Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

February 15 2024 - 4:20PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024 (Report No. 2)

Commission file number 000-28884

(Translation of registrant’s name into English)

Sgoola Industrial Zone, Petach Tikva, Israel

(Address of Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

ELTEK LTD.

EXPLANATORY NOTE

On February 12, 2024, Eltek Ltd., a company incorporated under the laws of Israel (the “Company”), entered into an underwriting agreement (the “Underwriting Agreement”) with ThinkEquity LLC, as

the representative of the several underwriters (the “Underwriter”) relating to the issuance and sale (the “Offering”) of 625,000 ordinary shares of the Company, at an offering price of $16.00 per share (the “Shares”).

The Offering closed on February 15, 2024. The gross proceeds from the Offering were $10,000,000 before deducting underwriting discounts and other offering expenses payable by the Company. The

Company intends to use the net proceeds from the Offering to strategically invest in the expansion of its production capabilities and for general corporate purposes, including working capital.

The Shares are being offered and sold by the Company pursuant to the Company’s effective registration statement on Form F-3 (Registration No. 333-266346) which was declared effective by the

Securities Exchange and Commission on August 5, 2022, the base prospectus included therein, as amended and supplemented by the prospectus supplement dated February 12, 2024.

The Underwriting Agreement contains customary representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company and the

Underwriter, including for liabilities under the Securities Act of 1933, as amended, other obligations of the parties and termination provisions. The foregoing description of the Underwriting Agreement is not complete and is qualified in its

entirety by reference to the full text of the Underwriting Agreement, a copy of which was filed as Exhibit 99.2 in a Report on Form 6-K filed on February 13, 2024, and is incorporated herein by reference.

Pursuant to the Underwriting Agreement, subject to certain exceptions, our officers, directors and certain stockholders have agreed not to sell or otherwise dispose of any of the Company’s

securities held by them for a period ending sixty (60) days after the Effective Date without first obtaining the written consent of ThinkEquity.

The legal opinion of Amit, Pollak, Matalon & Co. relating to the legality of the issuance and sale of the Shares is attached as Exhibit 5.1 to this Report on Form 6-K.

This Report on Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy the securities discussed herein, nor shall there be any offer, solicitation, or sale of the

securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state.

On February 15, 2024, the Company issued a press release announcing the closing of the offering. A copy of this press release is attached as Exhibit 99.1.

EXHIBIT INDEX

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

By: /s/ Ron Freund

Name: Ron Freund

Chief Financial Officer

|

Dated: February 15, 2024

Exhibit 5.1

Tel Aviv, February 15, 2024

Eltek Ltd.

20 Ben Zion Gellis Street

Sgoola Industrial Zone

Petah Tikva 4927920, Israel

Ladies and Gentlemen:

We have acted as Israeli counsel for Eltek Ltd., a company incorporated under the laws of the State of Israel (the “Company”), in connection with the offering by the Company of 625,000 ordinary shares of the Company (the “Shares”)

pursuant to a Registration Statement on Form F-3 (Registration No. 333-266346), which was initially filed with the Securities and Exchange Commission (the “Commission”) on July 27, 2022, under the Securities Act of 1933, as amended (the “Act”) and

declared effective on August 5, 2022, the prospectus included within the Registration Statement (the “Base Prospectus”), and the prospectus supplement dated February 12, 2024, filed with the Commission pursuant to Rule 424(b) of the rules and

regulations of the Act (together with the Base Prospectus, the “Prospectus”). As described in the Registration Statement and the Prospectus, the Shares are to be sold by the Company pursuant to an underwriting agreement (the “Underwriting Agreement”)

entered into by and between the Company and ThinkEquity, LLC, as Underwriter.

We have examined such corporate records, certificates and other documents, and such questions of law, as we have considered necessary or appropriate for the purposes of our opinion. In such

examination, we have assumed the genuineness of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as

certified, confirmed as photostatic copies and the authenticity of the originals of such latter documents. As to all questions of fact material to these opinions that have not been independently established, we have relied upon certificates or

comparable documents of officers and representatives of the Company.

On the basis of such examination, we are of the opinion that, upon payment of the consideration for the Shares provided for in the Underwriting Agreement, as approved by the

Company’s Board of Directors in its unanimous resolutions in writing, dated February 12, 2024, , the Shares will be validly issued, fully paid and non-assessable.

The opinion expressed herein is limited to Israeli law, and we do not express any opinion as to the laws of any other jurisdiction.

We consent to the filing of this opinion as an exhibit to the Prospectus and to the references to us under the headings “Legal Matters” and “Enforceability of Civil Liabilities”

therein. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

| |

Very truly yours,

/s/ Amit, Pollak, Matalon & Co.

Amit, Pollak, Matalon & Co., Advocates

|

Exhibit 99.1

Press Release

Eltek Announces Closing of $10 Million Public Offering.

Petach Tikva, Israel, February 15, 2024 - Eltek Ltd. (NASDAQ: ELTK), a global manufacturer and supplier of technologically advanced solutions in the field of printed circuit boards, announced today the closing of its previously announced public offering of 625,000 ordinary shares at a

public offering price of $16.00 per share, for gross proceeds of $10,000,000, before deducting underwriting discounts and offering expenses. All of the ordinary

shares are being sold by the Company.

ThinkEquity acted as sole book-running manager for the offering.

The Company intends to use the net proceeds from this offering to strategically invest in the expansion of its production capabilities

and for general corporate purposes including working capital.

The offering is being made pursuant to an effective shelf registration statement that has been filed with the U.S. Securities and

Exchange Commission (the “SEC”). The final prospectus supplement relating to the offering was filed with the SEC and is available on the SEC's website at http://www.sec.gov. Copies of the final prospectus supplement and the accompanying prospectus

relating to the offering may also be obtained from ThinkEquity, 17 State Street, 41st Floor, New York, New York 10004.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these

securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

About Eltek

Eltek – ”Innovation Across the Board”, is a global manufacturer and supplier of technologically advanced solutions in the field of

printed circuit boards (PCBs) and is an Israeli leading company in this industry. PCBs are the core circuitry of most electronic devices. Eltek specializes in the manufacture and supply of complex and high-quality PCBs, HDI, multilayered and

flex-rigid boards for the high-end market. Eltek is ITAR compliant and has AS-9100 and NADCAP electronics certifications. Its customers include leading companies in the defense, aerospace and medical industries in Israel, the United States, Europe

and Asia.

Eltek was founded in 1970. The Company’s headquarters, R&D, production and marketing center are located in Israel. Eltek also

operates through its subsidiary in North America and by agents and distributors in Europe, India, South Africa and South America.

For more information, visit Eltek's web site at www.nisteceltek.com

Forward Looking Statement

Some of the statements included in this press release may be forward-looking statements that involve a number of risks and uncertainties

including, but not limited to expected results in future quarters, the impact of the Coronavirus on the economy and our operations, the impact of the current war with Hamas, risks in product and technology development and rapid technological change,

product demand, the impact of competitive products and pricing, market acceptance, the sales cycle, changing economic conditions and other risk factors detailed in the Company’s Annual Report on Form 20-F and other filings with the United States

Securities and Exchange Commission. Any forward-looking statements set forth in this press release speak only as of the date of this press release. The information found on our website is not incorporated by reference into this press release and is

included for reference purposes only.

Investor Contact

Ron Freund

Chief Financial Officer

Investor-Contact@nisteceltek.com

+972-3-939-5023

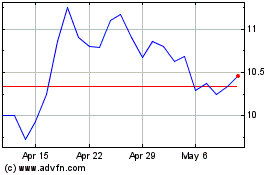

Eltek (NASDAQ:ELTK)

Historical Stock Chart

From Mar 2024 to Apr 2024

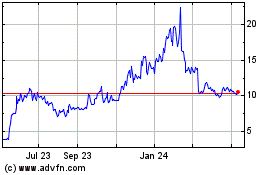

Eltek (NASDAQ:ELTK)

Historical Stock Chart

From Apr 2023 to Apr 2024