0000811532falseFebruary 15, 202400008115322024-02-152024-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2024

CEDAR FAIR, L.P.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 1-9444 | | 34-1560655 |

(State or other jurisdiction

of incorporation) | | (Commission File No.) | | (I.R.S. Employer

Identification No.) |

One Cedar Point Drive,

Sandusky, Ohio 44870-5259

(Address of principal executive offices) (Zip Code)

(419) 626-0830

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☒ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Depositary Units (Representing Limited Partner Interests) | FUN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 15, 2024, Cedar Fair, L.P. ("the Partnership") issued a news release disclosing its 2023 fiscal fourth-quarter results. A copy of the news release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise be subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

| | | | | |

| Exhibit No. | Description |

| |

| 104 | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | CEDAR FAIR, L.P. |

| | | By Cedar Fair Management, Inc., General Partner |

| | | |

| Date: | February 15, 2024 | By: | /s/ Brian C. Witherow |

| | | Brian C. Witherow

Executive Vice President and Chief Financial Officer |

NEWS RELEASE

CEDAR FAIR REPORTS RESULTS FOR 2023

•Strong performance over the second half of the year, including record fourth quarter attendance, validates the strength and resiliency of the Company’s business model

•Robust trends in long-lead indicators, including 2024 season pass sales, underscore the Company’s bright prospects for continued growth and value creation

•Board declares quarterly cash distribution of $0.30 per LP unit, payable March 20, 2024

SANDUSKY, Ohio (Feb. 15, 2024) -- Cedar Fair Entertainment Company (NYSE: FUN), a leader in regional amusement parks, water parks and immersive entertainment, today announced its 2023 fourth-quarter and full-year results, ended Dec. 31, 2023.

2023 Fourth-Quarter Highlights

•Net revenues totaled a record $371 million, an increase of 1%, or $5 million, compared with Q4-2022.

•The Company recorded a net loss of $10 million compared with net income of $12 million in Q4-2022. The decrease was due primarily to $17 million of transaction costs related to the proposed merger with Six Flags.

•Adjusted EBITDA(1) totaled $89 million, an increase of 1%, or $1 million, compared with Q4-2022.

•Attendance totaled a record 5.8 million guests, an increase of 9%, or 466,000 guests compared with Q4-2022. The increase in attendance was primarily attributable to increased season pass visits resulting from the strong start to the 2024 sales program.

•In-park per capita spending(2) was $58.61, a decrease of 7% compared with Q4-2022. The decrease was primarily due to a shift in attendance mix to lower-priced ticketing channels and higher attendance levels.

•Out-of-park revenues(2) were a record $43 million, an increase of 7%, or $3 million, compared with Q4-2022.

2023 Full-Year Highlights

•Net revenues totaled $1.80 billion compared with $1.82 billion in 2022.

•Net income was $125 million, a decrease of $183 million from 2022, primarily the result of a $155 million prior year gain recognized on the sale of the land at California’s Great America and $22 million of transaction costs in 2023 related to the proposed merger with Six Flags.

•Adjusted EBITDA was $528 million compared with $552 million in 2022.

•Attendance totaled 26.7 million guests compared with 26.9 million guests in 2022.

•In-park per capita spending was $61.05, a decline of 1% compared with 2022.

•Out-of-park revenues were a record $223 million, an increase of $10 million, or 5% compared with 2022.

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 2

Balance Sheet and Capital Allocation Highlights

•On Dec. 31, 2023, net debt(3) totaled $2.2 billion, calculated as total debt before debt issuance costs of $2.3 billion less cash and cash equivalents of $65 million.

•Cedar Fair’s Board of Directors today declared a cash distribution of $0.30 per limited partner (LP) unit, payable on March 20, 2024, to unitholders of record on March 6, 2024.

CEO Commentary

“With the return to more normal operating conditions in the back half of 2023, the strength and resiliency of Cedar Fair’s business model was on full display,” said Cedar Fair CEO Richard Zimmerman. “We remained nimble and successfully adapted to an evolving marketplace to offset the effects of anomalous macro-factors, including weather, on demand during the first half of the year. In the second half of the year, in addition to more normalized operating conditions, we made mid-year adjustments to our marketing and pricing strategies that successfully drove increased demand while our park teams effectively implemented cost-saving measures to expand operating margins.”

“In addition to our outstanding performance over the second half of the year and record fourth quarter results, I’m encouraged by the pace of our long-lead indicators heading into the 2024 season, particularly sales of season passes and related all-season, add-on products,” added Zimmerman. “With unit sales of season passes through January up approximately 20% versus last year, we expect season pass sales to serve as a tailwind for attendance and revenues all season long.”

Commenting on the proposed merger with Six Flags, Zimmerman concluded, “Since announcing the proposed merger transaction in early November, we have been pleased by the strong support we have heard from unitholders and others in the investor community. We look forward to completing our combination with Six Flags and delivering on the compelling value creation opportunities ahead, which we believe are greater than what either company can achieve independently. Cedar Fair and Six Flags continue to work constructively with the DOJ in its review of the merger and continue to expect it will be completed in the first half of 2024. We look forward to capitalizing on the opportunities ahead for the combined company.”

2023 Full-Year Results

Operating days in 2023 totaled 2,365 compared to 2,302 in 2022.

For the year ended Dec. 31, 2023, net revenues totaled $1.80 billion on attendance of 26.7 million guests, compared with net revenues of $1.82 billion on attendance of 26.9 million guests in 2022. The decrease in net revenues reflects the impact of a 1%, or 247,000, decline in attendance and a 1%, or $0.60, decrease in in-park per capita spending, offset in part by a 5%, or $10 million, increase in out-of-park revenues. The decline in attendance was attributable to a year-over-year decrease in season pass sales and lower demand during the first half of the year due to inclement weather. The decrease in in-park per capita spending was attributable to a decrease in

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 3

admissions spending, reflecting a mid-year reassessment of pricing strategy at several key parks, as well as the recovery of lower-priced attendance channels over the second half of the year. The decrease in admission spending was partially offset by higher levels of guest spending on food and beverage, as continued investments in food and beverage offerings led to increases in both the number of transactions per guest and the average transaction value. The increase in out-of-park revenues reflects the strong performance of the Company’s resort properties, highlighted by full-year operations of Castaway Bay Resort and Sawmill Creek Resort at Cedar Point following temporary closures for renovations during 2022.

Operating costs and expenses for 2023 totaled $1.32 billion compared with $1.29 billion for 2022. The approximate $27 million year-over-year increase was primarily attributable to $22 million of transaction costs related to the proposed merger with Six Flags, which are classified as SG&A expenses. Excluding the merger-related costs, operating costs and expenses for the year increased $5 million, or less than 1%, the result of a $14 million increase in SG&A expenses partially offset by a $4 million decrease in cost of goods sold and a $4 million decrease in operating expenses. The decrease in operating expenses was primarily due to cost savings initiatives resulting in a reduction in seasonal labor hours and less in-park entertainment costs. These cost-savings were somewhat offset by six incremental months of land lease costs at California's Great America, higher early-season maintenance wage costs at several parks, and increased insurance claims and related costs. Excluding the merger-related costs, the increase in SG&A expenses was primarily attributable to higher planned advertising costs in 2023.

Depreciation and amortization expense in 2023 totaled $158 million, up $5 million over the prior year, due to the reduction of the estimated useful lives of the long-lived assets at California's Great America following the sale-leaseback of the land at California's Great America. During 2023, the Company also reported a loss on impairment/retirement of fixed assets of approximately $18 million, compared with a $10 million loss in the prior year.

After the items noted above and a $155 million gain on the sale of the land at California's Great America in 2022, operating income for 2023 totaled $306 million, compared to operating income of $520 million for 2022.

Interest expense for 2023 totaled $142 million, a decrease of $10 million compared with 2022, the result of the repayment of the Company’s senior secured term loan facility and related termination of interest rate swap agreements during 2022. The reduction in interest expense was partially offset by interest on additional borrowings on the Company’s revolving credit facility in 2023. Prior to the termination of the Company’s interest rate swaps, the net effect of the swaps resulted in a $26 million net benefit to earnings for 2022. Finally, during 2023, Cedar Fair recognized a $6 million net benefit to earnings for foreign currency gains and losses compared with a $24 million net charge to earnings for 2022. Both amounts primarily represented the remeasurement of U.S.-dollar denominated notes to the functional currency of the Company’s Canadian entity.

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 4

Accounting for the items above, and after a $16 million decrease in the provision for taxes driven by the sale of the land at California’s Great America, net income for 2023 totaled $125 million, or $2.42 per diluted L.P. unit. This compares with net income of $308 million, or $5.45 per diluted LP unit, for 2022.

Adjusted EBITDA, which management believes is a meaningful measure of the Company’s park-level operating results, totaled $528 million in 2023, compared to Adjusted EBITDA of $552 million for 2022. The $24 million decrease in Adjusted EBITDA was primarily attributable to a decrease in net revenues driven by a decline in attendance caused by extreme weather during the first six months of 2023, and to a lesser extent by higher advertising, land lease and insurance related costs.

See the attached table for a reconciliation of net income to Adjusted EBITDA.

Balance Sheet and Liquidity Highlights

Deferred revenues on Dec. 31, 2023, including non-current deferred revenue, totaled $192 million, compared with $173 million of deferred revenues on Dec. 31, 2022. The $19 million increase was due to strong sales of advance purchase products, including season passes and related all-season add-on products.

As of Dec. 31, 2023, the Company had cash on hand of $65 million and $280 million available under its revolving credit facility, for total liquidity of $345 million. This compares to $381 million of total liquidity at the end of 2022. Net debt on Dec. 31, 2023, calculated as total debt of $2.3 billion (before debt issuance costs) less cash and cash equivalents of $65 million, was $2.2 billion.

Distribution and Unit Repurchases

Today the Company announced the Cedar Fair Board of Directors has approved a quarterly cash distribution of $0.30 per LP unit, to be paid on March 20, 2024, to unitholders of record on March 6, 2024.

During 2023, the Company repurchased approximately 1.7 million limited partnership units at a total cost of approximately $75 million – representing approximately 3% of its total units outstanding at the beginning of 2023.

Conference Call

As previously announced, the Company will host a conference call with analysts starting at 10 a.m. ET today, Feb. 15, 2024, to further discuss its recent financial performance. Participants on the call will include Cedar Fair President and CEO Richard Zimmerman, Executive Vice President and CFO Brian Witherow and Corporate Director of Investor Relations Michael Russell.

Investors and all other interested parties can access a live, listen-only audio webcast of the call on the Cedar Fair Investors website at https://ir.cedarfair.com under the tabs Investor Information / Events & Presentations / Upcoming Events. Those unable to listen to the live webcast can access a recorded version of the call on the Cedar Fair Investors website at https://ir.cedarfair.com under Investor Information / Events and Presentations / Past Events, shortly after the live call’s conclusion.

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 5

A digital recording of the conference call will be available for replay by phone starting at approximately 1 p.m. ET on Thursday, Feb. 15, 2024, until 11:59 p.m. ET, Thursday, Feb. 22, 2024. To access the phone replay, please dial (800) 770-2030 or (609) 800-9909, followed by Conference ID 3720518.

(1) Adjusted EBITDA is not a measurement computed in accordance with generally accepted accounting principles (GAAP). For additional information regarding Adjusted EBITDA, including how the Company defines and uses Adjusted EBITDA, see the attached reconciliation table and related footnotes.

(2) In-park per capita spending and out-of-park revenues are non-GAAP financial measures. See the attached reconciliation table and related footnote for the calculations of in-park per capita spending and out-of-park revenues. These metrics are used by management as major factors in significant operational decisions as they are primary drivers of financial and operational performance, measuring demand, pricing, and consumer behavior.

(3) Net debt is a non-GAAP financial measure. See the attached reconciliation table and related footnote for the calculation of net debt. Net debt is a meaningful measure used by the Company and investors to monitor leverage, and management believes it is meaningful for this purpose.

About Cedar Fair

Cedar Fair Entertainment Company (NYSE: FUN), one of the largest regional amusement-resort operators in the world, is a publicly traded partnership headquartered in Sandusky, Ohio. Focused on its mission to make people happy by providing fun, immersive, and memorable experiences, the Company owns and operates 13 properties, consisting of 11 amusement parks, four separately gated outdoor water parks, and resort accommodations totaling more than 2,300 rooms and more than 600 luxury RV sites. Cedar Fair’s parks are located in Ohio, California, North Carolina, South Carolina, Virginia, Pennsylvania, Minnesota, Missouri, Michigan, Texas and Toronto, Ontario.

Qualified Notice

This release is intended to be a qualified notice under Treasury Regulation Section 1.1446-4(b). Brokers and nominees should treat one hundred percent (100.0 percent) of Cedar Fair, L.P.’s distributions to non-U.S. investors as being attributable to income that is effectively connected with a United States trade or business. Accordingly, Cedar Fair’s distributions to non-U.S. investors are subject to federal income tax withholding at the highest applicable effective tax rate.

Forward-Looking Statements

Some of the statements contained in this news release that are not historical in nature constitute “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements as to the Company's expectations, beliefs, goals, and strategies regarding the future. All statements, other than statements of historical fact, included in this communication that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements. Words such as “anticipate,” “believe,” “create,” “expect,” “future,” “guidance,” “intend,” “plan,” “potential,” “seek,” “target,” “synergies,” “will,” “would,” similar expressions, and variations or negatives of these words identify forward-looking statements.

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 6

However, the absence of these words does not mean that the statements are not forward-looking. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about performance expectations and the consummation of the proposed transaction and the anticipated benefits thereof. These forward-looking statements may involve current plans, estimates, expectations, and ambitions that are subject to risks, uncertainties and assumptions that are difficult to predict, may be beyond our control and could cause actual results to differ materially from those described in such statements. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to be correct, that the Company's growth and operational strategies will achieve the target results, that the proposed transaction will close or that the Company will realize the anticipated benefits thereof. Important risk factors that may cause such a difference and could adversely affect attendance at our parks, our future financial performance, our growth strategies and/or the proposed transaction, and could cause actual results to differ materially from our expectations or otherwise to fluctuate or decrease, include, but are not limited to: general economic conditions; the impacts of public health concerns; adverse weather conditions; competition for consumer leisure time and spending; unanticipated construction delays; changes in the Company’s capital investment plans and projects; the expected timing and likelihood of completion of the proposed transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction and Six Flags stockholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the proposed transaction, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the outcome of any legal proceedings that may be instituted against Cedar Fair, Six Flags or their respective directors and others following announcement of the merger agreement and proposed transaction; the inability to consummate the transaction due to the failure to satisfy other conditions to complete the transaction; risks that the proposed transaction disrupts and/or harms current plans and operations of Cedar Fair or Six Flags, including that management’s time and attention will be diverted on transaction-related issues; the amount of the costs, fees, expenses and charges related to the transaction, including the possibility that the transaction may be more expensive to complete than anticipated; the ability of Cedar Fair and Six Flags to successfully integrate their businesses and to achieve anticipated synergies and value creation; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; legislative, regulatory and economic developments and changes in laws, regulations, and policies affecting Cedar Fair and Six Flags; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the proposed transaction that could affect Cedar Fair’s and/or Six

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 7

Flags’ financial performance and operating results; acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction; other factors discussed from time to time by the Company in its reports filed with the Securities and Exchange Commission (the “SEC”); and those risks that are described in the registration statement on Form S-4 and the accompanying proxy statement/prospectus. Additional information on risk factors that may affect the business and financial results of the Company can be found in the Company's Annual Report on Form 10-K and in the filings of the Company made from time to time with the SEC.

These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the registration statement on Form S-4 that was filed by CopperSteel HoldCo, Inc. (“HoldCo”) and subsequently declared effective by the SEC on January 31, 2024, in connection with the proposed transaction, which will contain a prospectus relating to the issuance of HoldCo securities in the proposed transaction and a proxy statement relating to the special meeting of the stockholders of Six Flags. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 are, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. The ability of Cedar Fair or Six Flags to achieve the goals for the proposed transaction may also be affected by our ability to manage the factors identified above. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and actual performance and outcomes may differ materially from those made in or suggested by the forward-looking statements contained in this press release. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether a result of new information, future events, information, circumstances or otherwise that arise after the publication of this document.

Important Information about the Transaction and Where to Find It

In connection with the mergers, Cedar Fair and Six Flags have caused HoldCo to file with the SEC a registration statement on Form S-4 that includes a proxy statement of Six Flags and a prospectus of HoldCo. The registration statement on Form S-4 has been declared effective by the SEC. The definitive proxy statement included in the registration statement on Form S-4 was mailed to stockholders of Six Flags on or about February 1, 2024. Cedar Fair, Six Flags and HoldCo may also file other documents with the SEC regarding the mergers. This communication is not a substitute for the registration statement, proxy statement/prospectus or any other document that Cedar Fair, Six Flags or HoldCo (as applicable) has filed or may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING AND/OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF CEDAR FAIR AND SIX FLAGS ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 8

PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus, as each may be amended from time to time, as well as other filings containing important information about Cedar Fair or Six Flags, without charge at the SEC’s Internet website (http://www.sec.gov). Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus and other documents filed with the SEC by Cedar Fair, Six Flags and HoldCo through the web site maintained by the SEC at www.sec.gov or by contacting the investor relations department of Cedar Fair or Six Flags at the following:

Cedar Fair Contacts:

Investor Contact: Michael Russell, 419.627.2233

Media Contact: Gary Rhodes, 704.249.6119

Alternate Media Contact: Andrew Siegel / Lucas Pers, Joele Frank, 212.355.4449

Six Flags Contact:

Evan Bertrand, 972.595.5180

Vice President, Investor Relations and Treasurer

investorrelations@sftp.com

The information included on, or accessible through, Cedar Fair’s or Six Flags’ website is not incorporated by reference into this communication.

Participants in the Solicitation

Cedar Fair, Six Flags, HoldCo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Six Flags stockholders in respect of the proposed transaction. Information regarding Cedar Fair’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Cedar Fair’s Form 10-K for the year ended December 31, 2022 filed with the SEC on February 17, 2023 and its proxy statement filed with the SEC on April 13, 2023, and subsequent statements of changes in beneficial ownership on file with the SEC (Form 4s filed on February 22, 2023, March 1, 2023, March 22, 2023, and January 4, 2024). Information regarding Six Flags’ directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Six Flags’ Form 10-K for the year ended January 1, 2023 filed with the SEC on March 7, 2023 and its proxy statement filed with the SEC on March 28, 2023, and subsequent statements of changes in beneficial ownership on file with the SEC (Form 4s filed on April 4, 2023, May 11, 2023, May 12, May 16, May 30, 2023, June 2, 2023, June 12, 2023, June 14, 2023, August 15, 2023, September 11, 2023, September 21, 2023, December 22, 2023 and December 26, 2023). Additional information regarding the participants in the proxy solicitations and a description

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 9

of their direct or indirect interests, by security holdings or otherwise, are contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

This news release and prior releases are available under the News tab at http://ir.cedarfair.com

-more-

(financial tables follow)

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 10

CEDAR FAIR, L.P.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Twelve months ended |

| | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net revenues: | | | | | | | |

| Admissions | $ | 194,727 | | | $ | 197,357 | | | $ | 894,728 | | | $ | 925,903 | |

| Food, merchandise and games | 120,695 | | | 115,795 | | | 613,969 | | | 602,603 | |

| Accommodations, extra-charge products and other | 55,701 | | | 52,842 | | | 289,971 | | | 288,877 | |

| 371,123 | | | 365,994 | | | 1,798,668 | | | 1,817,383 | |

| Costs and expenses: | | | | | | | |

| Cost of food, merchandise and games revenues | 30,745 | | | 31,188 | | | 159,830 | | | 164,246 | |

| Operating expenses | 188,931 | | | 188,592 | | | 860,154 | | | 864,304 | |

| Selling, general and administrative | 87,060 | | | 66,045 | | | 296,458 | | | 260,592 | |

| Depreciation and amortization | 30,284 | | | 26,833 | | | 157,995 | | | 153,274 | |

| Loss on impairment / retirement of fixed assets, net | 5,288 | | | 3,896 | | | 18,067 | | | 10,275 | |

| | | | | | | |

| Gain on sale of land | — | | | 1 | | | — | | | (155,250) | |

| | | | | | | |

| 342,308 | | | 316,555 | | | 1,492,504 | | | 1,297,441 | |

| Operating income | 28,815 | | | 49,439 | | | 306,164 | | | 519,942 | |

| Interest expense | 36,150 | | | 36,554 | | | 141,770 | | | 151,940 | |

| Net effect of swaps | — | | | — | | | — | | | (25,641) | |

| Loss on early debt extinguishment | — | | | — | | | — | | | 1,810 | |

| (Gain) loss on foreign currency | (3,912) | | | (452) | | | (5,525) | | | 23,784 | |

| Other income | (1,267) | | | (1,633) | | | (2,683) | | | (3,608) | |

| (Loss) income before taxes | (2,156) | | | 14,970 | | | 172,602 | | | 371,657 | |

| Provision for taxes | 7,797 | | | 2,615 | | | 48,043 | | | 63,989 | |

| Net (loss) income | (9,953) | | | 12,355 | | | 124,559 | | | 307,668 | |

| Net (loss) income allocated to general partner | — | | | — | | | 1 | | | 3 | |

| Net (loss) income allocated to limited partners | $ | (9,953) | | | $ | 12,355 | | | $ | 124,558 | | | $ | 307,665 | |

CEDAR FAIR, L.P.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Cash and cash equivalents | $ | 65,488 | | | $ | 101,189 | |

| Total assets | $ | 2,240,533 | | | $ | 2,235,897 | |

| Long-term debt, including current maturities: |

| | | |

| | | |

| Notes | $ | 2,275,451 | | | $ | 2,268,155 | |

| $ | 2,275,451 | | | $ | 2,268,155 | |

| Total partners' deficit | $ | (582,962) | | | $ | (591,602) | |

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 11

CEDAR FAIR, L.P.

RECONCILIATION OF ADJUSTED EBITDA

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Twelve months ended |

| December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net (loss) income | $ | (9,953) | | | $ | 12,355 | | | $ | 124,559 | | | $ | 307,668 | |

| Interest expense | 36,150 | | | 36,554 | | | 141,770 | | | 151,940 | |

| Interest income | (1,297) | | | (1,508) | | | (2,818) | | | (3,621) | |

| Provision for taxes | 7,797 | | | 2,615 | | | 48,043 | | | 63,989 | |

| Depreciation and amortization | 30,284 | | | 26,833 | | | 157,995 | | | 153,274 | |

| EBITDA | 62,981 | | | 76,849 | | | 469,549 | | | 673,250 | |

| Loss on early debt extinguishment | — | | | — | | | — | | | 1,810 | |

| Net effect of swaps | — | | | — | | | — | | | (25,641) | |

| Non-cash foreign currency (gain) loss | (3,920) | | | (361) | | | (5,594) | | | 23,856 | |

| Non-cash equity compensation expense | 6,770 | | | 5,502 | | | 22,611 | | | 20,589 | |

| Loss on impairment/retirement of fixed assets, net | 5,288 | | | 3,896 | | | 18,067 | | | 10,275 | |

| | | | | | | |

| Gain on sale of land | — | | | 1 | | | — | | | (155,250) | |

| | | | | | | |

| | | | | | | |

Costs related to proposed merger (1) | 17,275 | | | — | | | 22,287 | | | — | |

Other (2) | 468 | | | 1,944 | | | 752 | | | 3,064 | |

Adjusted EBITDA (3) | $ | 88,862 | | | $ | 87,831 | | | $ | 527,672 | | | $ | 551,953 | |

(1) Consists of third-party investment banking, consulting and legal costs related to the proposed merger with Six Flags. These costs are added back to net (loss) income to calculate Adjusted EBITDA as defined in the Company's current and prior credit agreements.

(2) Consists of certain costs as defined in the Company's current and prior credit agreements. These costs are added back to net (loss) income to calculate Adjusted EBITDA and have included certain legal expenses, severance and related benefits and contract termination costs. This balance also includes unrealized gains and losses on short-term investments.

(3) Adjusted EBITDA represents earnings before interest, taxes, depreciation, amortization, other non-cash items, and adjustments as defined in the Company's current and prior credit agreements. The Company believes Adjusted EBITDA is a meaningful measure as it is widely used by analysts, investors and comparable companies in the industry to evaluate operating performance on a consistent basis, as well as more easily compare the Company's results with those of other companies in the industry. Further, management believes Adjusted EBITDA is a meaningful measure of park-level operating profitability and uses it for measuring returns on capital investments, evaluating potential acquisitions, determining awards under incentive compensation plans, and calculating compliance with certain loan covenants. Adjusted EBITDA is provided as a supplemental measure of our operating results and is not intended to be a substitute for operating income, net income or cash flows from operating activities as defined under generally accepted accounting principles. In addition, Adjusted EBITDA may not be comparable to similarly titled measures of other companies.

CEDAR FAIR, L.P.

CALCULATION OF NET DEBT

(In thousands)

| | | | | |

| December 31, 2023 |

| Long-term debt, including current maturities | $ | 2,275,451 | |

| Plus: Debt issuance costs | 24,549 | |

| Less: Cash and cash equivalents | (65,488) | |

Net Debt (1) | $ | 2,234,512 | |

(1) Net Debt is a non-GAAP financial measure used by the Company and investors to monitor leverage. The measure may not be comparable to similarly titled measures of other companies.

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

CEDAR FAIR REPORTS RESULTS FOR 2023

Feb. 15, 2024

Page 12

CEDAR FAIR, L.P.

KEY OPERATIONAL MEASURES

(In thousands, except per capita and operating day amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Twelve months ended |

| December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Attendance | 5,776 | | | 5,309 | | | 26,665 | | | 26,912 | |

In-park per capita spending (1) | $ | 58.61 | | | $ | 63.33 | | | $ | 61.05 | | | $ | 61.65 | |

Out-of-park revenues (1) | $ | 42,531 | | | $ | 39,921 | | | $ | 223,263 | | | $ | 213,337 | |

| Operating days | 377 | | | 376 | | | 2,365 | | | 2,302 | |

(1) In-park per capita spending is calculated as revenues generated within the Company's amusement parks and separately gated outdoor water parks along with related parking revenues (in-park revenues), divided by total attendance. Out-of-park revenues are defined as revenues from resort, out-of-park food and retail locations, online transaction fees charged to customers, sponsorships and all other out-of-park operations. In-park revenues, in-park per capita spending and out-of-park revenues are non-GAAP measures. These metrics are used by management as major factors in significant operational decisions as they are primary drivers of the Company's financial and operational performance, measuring demand, pricing, and consumer behavior. A reconciliation of in-park revenues and out-of-park revenues to net revenues for the periods presented is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Twelve months ended |

| (In thousands) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| In-park revenues | $ | 338,549 | | | $ | 336,233 | | | $ | 1,627,906 | | | $ | 1,659,183 | |

| Out-of-park revenues | 42,531 | | | 39,921 | | | 223,263 | | | 213,337 | |

| Concessionaire remittance | (9,957) | | | (10,160) | | | (52,501) | | | (55,137) | |

| Net revenues | $ | 371,123 | | | $ | 365,994 | | | $ | 1,798,668 | | | $ | 1,817,383 | |

Cedar Fair Entertainment Company - One Cedar Point Drive, Sandusky, Ohio 44870 419.627.2233

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

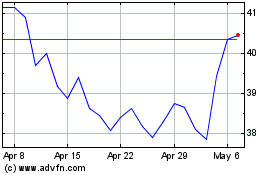

Cedar Fair (NYSE:FUN)

Historical Stock Chart

From Apr 2024 to May 2024

Cedar Fair (NYSE:FUN)

Historical Stock Chart

From May 2023 to May 2024