As filed with the Securities and Exchange Commission on February 14, 2024

Registration No. 333-254509

Registration No. 333-218570

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

FORM S-3 REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EVOLVE TRANSITION INFRASTRUCTURE LP

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of

incorporation or organization)

11-3742489

(I.R.S. Employer

Identification Number)

1360 Post Oak Blvd, Suite 2400

Houston, Texas 77056

Telephone: (713) 783-8000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive office)

Charles C. Ward

Interim Chief Executive Officer, Chief Financial Officer and Secretary

Evolve Transition Infrastructure GP LLC

1360 Post Oak Blvd, Suite 2400

Houston, Texas 77056

Telephone: (713) 783-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Philip Haines, Esq.

Hunton Andrews Kurth LLP

600 Travis St., Suite 4200

Houston, Texas 77002

(713) 220-4200

Approximate date of commencement of proposed sale to the public: Not applicable.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or

additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | |

Large accelerated filer ☐ | Accelerated filer ☐ |

Non-accelerated filer ☒ | Smaller reporting company ☒ |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act ☐

EXPLANATORY NOTE — DEREGISTRATION OF SECURITIES

This Post-Effective Amendment No. 1 relates to the following Registration Statements on Form S-3 (collectively, the “Registration Statements”), originally filed by Evolve Transition Infrastructure LP, a Delaware limited partnership (the “Partnership”), with the Securities and Exchange Commission:

•Registration Statement No. 333-254509 on Form S-3, filed on March 19, 2021, registering the common units representing limited partner interests in the Partnership (“Common Units”) in an amount up to $100,000,000 in aggregate initial offering price; and

•Registration Statement No. 333-218570 on Form S-3, filed on June 7, 2017, registering an aggregate of 184,697 Common Units that the Partnership had issued to the selling unitholders named in that prospectus (the “Selling Unitholders”), which were acquired by the Selling Unitholders in connection with a private placement of the Common Units.

On January 8, 2024, Evolve Transition Infrastructure GP LLC, a Delaware limited liability company and the sole general partner of the Partnership (the “General Partner”), elected to exercise the limited call right (the “Limited Call Right”) provided for in Section 15.1 of the Third Amended and Restated Agreement of Limited Partnership of the Partnership, as amended (the “Partnership Agreement”), to purchase all of the outstanding common units representing limited partner interests in the Partnership (“Common Units”) not already owned by the General Partner or its controlled affiliates for a cash purchase price, determined pursuant to the contractual formula set forth in Section 15.1(b) of the Partnership Agreement, of $1.389285 per Common Unit.

As a result of the General Partner’s election to exercise the Limited Call Right, the Partnership terminated all offerings of securities pursuant to the Registration Statements. The exercise of the Limited Call Right will be completed on February 16, 2024 (the “Purchase Date”). After the Purchase Date, the General Partner and its affiliates will beneficially own, directly or indirectly, all of the Common Units, and there is no longer a public market for the Common Units. In accordance with undertakings made by the Partnership in the Registration Statements to remove from registration, by means of a post-effective amendment, any of the securities that had been registered for issuance that remain unsold at the termination of such offering, the Partnership hereby removes from registration all of such securities of the Partnership registered but unsold under the Registration Statements.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended (the “Securities Act”), the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused these Post-Effective Amendments to the Registration Statements to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Houston, State of Texas, on February 14, 2024.*

| | | | | | | | |

| | |

| EVOLVE TRANSITION INFRASTRUCTURE LP |

| |

| By: | | Evolve Transition Infrastructure GP LLC, its general partner |

| |

| By: | | /s/ Charles C. Ward |

| Name: | | Charles C. Ward |

| Title: | | Interim Chief Executive Officer, Chief Financial Officer and Secretary |

* Pursuant to Rule 478 of the Securities Act, no other person is required to sign these Post-Effective Amendments to the Registration Statements.

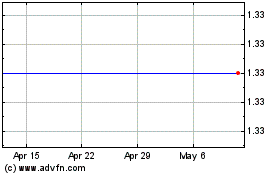

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

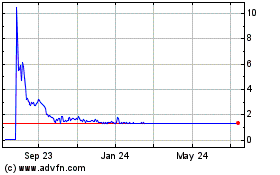

Evolve Transition Infras... (AMEX:SNMP)

Historical Stock Chart

From Apr 2023 to Apr 2024