UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Filed

by the Registrant ☐

Filed

by a Party other than the Registrant ☒

Check

the appropriate box:

☐ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☐ Definitive

Additional Materials

☒ Soliciting

Material Under Rule 14a-12

PARKS!

AMERICA, INC.

(Name

of Registrant as Specified in Its Charter)

FOCUSED

COMPOUNDING FUND, LP

ANDREW KUHN

GEOFF GANNON

JAMES FORD

(Name

of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

☒ No

fee required

☐ Fee

paid previously with preliminary materials

☐ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

_____________________________________________________________________________________

Focused

Compounding Fund, LP today published an episode on its investing podcast addressing the Parks! America, Inc. Special Meeting and made

additional social media posts regarding the Special Meeting. The transcript of such episode, links to the podcast, and social media posts

are below:

Parks!

America: Failures in Capital Allocation, Corporate Governance, and Business Basics

[00:00:00]

Andrew Kuhn: Alrighty, we are going to get started here today. We’re going to save our normal intro for the podcast because

we’re going to be talking about a different topic here today, and that is our investment in Parks America, Inc. The ticker is PRKA.

We’re going to be talking about some things related to our recent proxy contest with the company. Full disclosure, go read the

SEC filings. We are currently in a proxy fight with Parks America. So go read the filings, go to our website, prkaproxyfight.com. There’s

disclosures on the website, but I just wanted to get that out of the way.

So,

Geoff, this is the first time I think that we’ve ever publicly spoken about our investment in Parks America. We do own 38 and a

half percent of the company. We are the largest shareholder in the business. We originally built the stake back in 2020. We launched

our fund in 2020, so this was an early investment for us.

Want

to go back to the beginning on how this came to be and kind of take people through our timeline with the company up to the present. You

were familiar with this business for some time, right? And it’s a company that you had followed for some years, so maybe take us

back to 2020. What was appealing to you about the company, and then we’ll work our way to getting to the present in 2024.

[00:01:31]

Geoff Gannon: Sure. So, I knew about the company only in having read 10k’s. It’s an SEC filing company at pink sheets,

and I would have read some write-ups. The most memorable one was probably a write-up that Dave Waters did at his blog before he was,

or I think before he was running alluvial capital, which was years before. And so, I was aware of the company just because it was profitable

and small in the tens of millions of dollars market cap and profitable, which is unusual. There’s not a lot of companies like that.

So,

I would have known about any company like that. And we launched the fund. And we would have known in summer and fall of 2019 that we

were going to launch a fund. And so, in January, we did launch the fund, you know, January first start date, we would have raised money

before then. And we went and visited the parks there at that time, there were two parks, one in Missouri, one in Georgia, they’re

now three parks that this company owns. And these are drive-thru animal safaris, and we visited them. And we bought in January, there’s

an SEC filing that covers all this, but we bought from three different people blocks of stock of, you know, like 5%, or something, you

know, it ended up that we bought about 17 % of the stock. So, it in blocks that were meaningful, but not one of the largest shareholders

or something from people who were holders of the stock who had gotten it in various ways. And then during COVID, we bought a very small

amount of the stock when it dropped.

So,

the purchases were done in around 26 cents, I guess, around January. And then COVID would have happened a few months later when we bought

in the open market, probably around 14 cents, a tiny amount. Since then, we had never bought until December of last year, 2023, which

is when we bought the other 21 or whatever percent. And that was from the former CEO, chairman of the company.

[00:03:32]

Andrew Kuhn: This company, I mean, and we, one of the investors that we did buy from, he was trying to do activism with the company.

So, this has always been sort of part of the company’s history in a weird, interesting way. Probably because the economics of the

business -- The Georgia park are so great, right? And it can be so great. It’s a very high return on capital business. The operating

leverage at the company is great. It’s a regional company, and you could define it as having a moat around it. I mean, it kind

of fits within what you would think would be a pretty great business. But, you know, prior to our recent purchase, insiders always own

more than 50% of the company, right?

[00:04:28]

Geoff Gannon: At the time of our purchase, they did. They had bought a lot in the open market. One of the people on the board bought

a lot in the open market over time. The other issue with why there’s activism stuff is the company didn’t have annual meetings.

Although SEC filing stuff and it’s a Nevada corporation that hadn’t had an annual meeting about 10 years when we bought into

it. There’s a whole history with the company about what it was involved with before and stuff. And that’s why it has a lot

of shareholders from that. And so, I think some of that is that those things would be resolved if there had been annual meetings, and

there would have been questions about that, and they would have dealt with those things and stuff and not had the activists they had

at the time. But yeah, that was a factor, I’m sure.

[00:04:57]

Andrew Kuhn: So, we go through, you know, 2020, 2021, we’re not involved, or on the board or anything. We are the third largest

shareholder, right? We had met with all of, like we met with Dale, who owned 21%, who was the chairman and the CEO. We met with Chuck,

and I believe it was 2020 in Ohio, he owned North, I mean, high twenties and has bought more over time. And now owns 30 % of the business.

We were never involved in management or anything. I mean, it was a very cordial, open relationship and, you know, we would speak with

them every now and then, I would say, but really nothing really ever came out of it. 2022, very similar, except for in... the summer

of 2022, we got a call from Dale at one point, basically telling us that there was stuff going on at the board level. And he had called

us actually telling us to call a special election because they were trying to push him out of the company. Do you wanna explain that,

Geoff, for people listening?

[00:06:20]

Geoff Gannon: Yeah. So, at the time, Dale was the CEO of the company. He was around 80 years old or something. And he was not the

largest shareholder. He was the second largest shareholder at that point. There was another person on another director who owned more

of the stock. The CFO also owned a small amount of stock, a little less than 2%. And as we said, the company doesn’t have annual

meetings. It says it’s going to have any annual meeting this year, but it has historically had annual meeting. So, the only way

that you would have people being replaced and debating these things and whatever would be a special election, it’s in the company’s

bylaws that anyone who’s a 10% holder of the stock can do that. So obviously there are three holders of 10% or more of the stock

at that time. Two of them are on the board. They’re the two largest holders. And then there was us. And so, that was basically

what was happening is what you described. We don’t know that much because we’re not on the board, we never were and we only

know what people told us. But yeah, they had brought in two new directors to fill vacancies that the company had. Obviously, because

the company doesn’t have annual meetings, the number of directors is set by how many they elected a long time ago, and then they

fill vacancies or they leave the vacancies open, but they don’t raise and lower the number of directors officially because that’s

something you do at an annual meeting. So, they would have had

vacancies that they filled and they seemed to fill it with people who it was likely that to us that you know they were probably gonna

get rid of Dale and stuff and that is what happened.

But

he agreed to go so we did not call a special election. He stayed on his interim CEO and stuff. stuff. Um, and that’s when they

brought in a new CEO at that time, who was one of the new directors who had been brought in to fill the vacancies.

[00:08:06]

Andrew Kuhn: And who was that?

[00:08:08]

Geoff Gannon: That’s Lisa Brady.

[00:08:10]

Andrew Kuhn: Yeah. So that was Lisa. So, she was on the board and, yes, she was the one that ultimately became the CEO. I mean, it’s,

we would speculate. I guess from the outside looking in, it seemed like Chuck had brought in people to the board.

[00:08:26]

Geoff Gannon: Someone had, yeah.

[00:08:27]

Andrew Kuhn: That okay, someone had that were friendly or whatever and it was obvious that that Dale basically was outnumbered in,

you know who would want him on the board or who wouldn’t want him on the board. Yeah, so he called me basically out of the blue

saying they’re trying to throw me out I want you guys to call a special election, you know blah blah blah. We spoke to Chuck. We

set up a time to speak with him and ironically, Lisa was on the call, which was sort of a tip off of what was going on. And look, I basically

said, from my memory, you and Dale oppose each other, it seems.

These

are things that need to be voted on. You guys need to have an annual meeting. That’s always been something that we’ve been

trying to push the company to do, right? These are things that come up over time. You guys don’t don’t have annual meetings.

You guys need to vote on certain things.

[00:09:19]

Geoff Gannon: Well, because those two together at that time, ‘cause Chuck had bought more stock in the open market over time.

And Dale bought a little bit because of some technical thing. So, they had added up to over 50%, and certainly with the CFO Todd on the

board, it added up to over 50%. Of course, you still are supposed to have annual meetings, but if they have that, then obviously no election

is going to be different than what the board decides or the board’s unanimous on those things.

But

like you said, someone contacted us to say, “Look, we’re not in agreement here.” And so, we said then it has to go

to an election and stuff and they have to be elected new board if you’re not in agreement on that. But then they worked it out.

They worked out that Dale would leave, that they’re being interim period and all that kind of stuff. And people can see that in

the filings.

[00:10:06]

Andrew Kuhn: Yeah. So, take us through the beginning of 2023. So, Lisa comes on really at the end of 2022. I think it was November

14th. She’s with the company and then very early on in her time with the business, the Georgia Park, which is the most successful

park at the company. You could say probably the only successful park at the company. Unfortunately, gets hit by a tornado.

[00:10:31]

Geoff Gannon: Mm -hmm, hit by a tornado. And so that changes everything, obviously. That means it’s during a busy season for

them, so they miss out on that. It’s a highly seasonal business. And then there’s also stuff that they have to replace and

all that. And so, it’s a big deal, yeah.

[00:10:45]

Andrew Kuhn: Fast forward through the year. I mean, they did open up the park, I believe, within, I don’t know, two weeks or

something like that a month. I mean, you have to give credit to that. I mean, it seems like they did a lot of work there and Lisa did

lead them through that process. And, you know, towards the end of the year, we end up, you know, being able to buy Dale’s stock.

Yeah, in December, we buy his stock. The first thing that we do is we reach out to the company, right? And do you want to explain what

we did from there before we went public with this?

[00:11:19]

Geoff Gannon: Well, I mean, so, so we made an offer to the company for a board, which would be consist of three representatives from

Focused Compounding and two from them. It’s the smallest board you can have basically while having a majority.

And

we would later make other offers, one offer to start talking about things, and one offer that was more of a firm offer about something.

So, in this process, there were offers made by us sometimes. Some of those we said would be private, and so I’m not gonna say what

was in some of those, but the first one wasn’t, and that’s what it was.

And

generally, we don’t really hear back from the company. Right, so people see there’s open letters from us. Those are usually

public things that we do at the point at which we said to talk to us by such and such a date, that date passes, and so then... usually

we do a letter. And then that’s when the company responds. That’s not entirely the case because we have received things from

a lawyer at times.

And

one time, and I think the company kind of talked about this, you talked on a phone call with the CEO and CFO for, I don’t know,

was it 15 minutes or something? And was that in December?

[00:12:30]

Andrew Kuhn: I think it was less than 30 minutes. Yeah.

[00:12:33]

Geoff Gannon: Okay. Yeah. And from what I can tell from that call and what the two have said, what the company said and what we’ve

said and stuff, like there was no progress on any sort of talks that didn’t really get to the heart of anything to actually discuss

issues that would be resolved.

So,

there’s basically no communication between us and the company that has to do with actually settling or anything like that, except

that we have made offers, but you know, they don’t really acknowledge them one way or the other.

[00:13:02]

Andrew Kuhn: Yeah, I mean in their public letters. They always say that they’re open to constructive dialogue and talking with

us. I will say we’ve given them a few olive branches, and they’ve given us absolutely nothing. Right.

[00:13:13]

Geoff Gannon: Well, I don’t know if they’re olive branches, but we’ve made offers, and they’ve never made

offers to us. That’s true.

[00:13:20]

Andrew Kuhn: Yeah. So, we announced that we want to call a special meeting to replace the entire board. We put forward a three-person

slate, which we acknowledge in our letter. Sure, it’s fast and messy, in the short term, but we felt like it’s what was needed,

to start this entire process. Right? And then maybe take us through what happens from there.

[00:13:44]

Geoff Gannon: Oh, well, a lot of stuff happened then, but I mean, the only important things to talk about with that is that they

then said that they’re going to do an annual meeting after that. And then they’ve responded with a lawyer to us to say not

to have a special election stuff. And so that’s why you see the next letter from us on that topic. But because we had said some

things in a letter that was an open letter about like earnings calls and annual meetings and things like that.

And

so, they did come out with something that, while not directly talking about the fact we had said those things, I don’t think they

mentioned Focused Compounding in that release. Yeah, but it kind of responded to those things in the sense that they adopted that stuff.

They said we’re gonna do an investor day at one of the parks, which was one of the things that we talked about doing an annual

meeting at one of the parks. So, they’re gonna do an investor day, and they’re gonna do an annual meeting that same day virtually

and that’ll be in June.

So

that’ll be the first annual meeting in a while. And then they also said that they’ll do quarterly earnings calls, which was

one of the other. The Q&A was one of the other things that we mentioned in it.

[00:14:46]

Andrew Kuhn: Do you want to take us through like your thoughts on the company on where they currently stand here today? I mean, the

biggest thing with the business is they really took a perfectly flat organization when we first invested in it, added a bunch of layers,

SG&A as a percentage of revenue went through the roof. I mean, the actual business itself has declined substantially since 2020.

I mean, yes, they had the COVID bump, and that was fine. But if you look at the way that they manage expenses through it, I mean, the

way they manage expenses on the back end of it, I mean, it’s been absolutely horrible.

So

maybe let’s talk about like the business itself on worries that you have. And, you know, especially from their perspective of sinking

more capital into the company, Missouri as we put in one of our letters has been basically a disaster investment. They bought it in 2008,

and the park has done nothing but burn capital. But more importantly than that as well, the opportunity costs of the capital that they’ve

put into it has been a huge dud.

They

want to continue to sink more and more money into Missouri. I mean, I just feel like their version of managing the company is, all right,

let’s grow sales a little bit. We’ll continue to plow more money into marketing and we’ll, you know, kind of grow from

there. I just feel like they don’t think about capital allocation the way that they should, which is that every single park needs

to earn its own keep. Every single CapEx investment that you make, there has to be some sort of justifiable return on investment in that

math. I mean, let’s just talk about the company. I mean, what are your thoughts on like the actual business itself, where we sit

here today?

I

mean, Aggieland, they bought a park in Texas right outside of College Station in 2020. They paid $7.1 million for this park, and it’s

done nothing but burn cash. I mean, we could get into like the actual management, I don’t even know if they have a general manager

at the park. I think they have an assistant general manager.

I

mean, these are businesses where you need a general manager at each park thinking about how are we going to, you know, increase the EBITDA,

increase the cash flow and grow the business. I mean, you could even make the case. I don’t even know if people in the surrounding

areas even know that Aggieland even exists. Yeah, let’s talk about, you know, the actual financial condition of the company and

why we’re actually really concerned about it.

[00:17:15]

Geoff Gannon: So, there are two things here. One is just the way the companies run versus what people might be imagining in terms

of an organization. And two is that things that have changed from when we first bought the stock and wrote the letter to the board and

everything and then things that happen later. Obviously, we were in the stock a few years before Lisa was added to the board and then

became the CEO and you know Dale stopped being the CEO and CapEx went up a lot, advertising went up a lot, headcount went up a bit. We

were actually bought the stock a little before Aggieland obviously. So, there’s the change in things from there and then there’s

how it’s run and all that. So, I guess to explain things we have to start with how the company’s run and everything.

So,

corporate people are all remote you know, there is no corporate office at the company really, so you have these three parks and there

are people at each of the parks and in some cases, they’re not very senior people. In some cases, there may be very senior people

at other places. It’s a little complicated. They re-hired someone said they’re not an executive so that like when you said

the GM with Aggieland, possibly that is what his title is now. The company didn’t really say, but since they said he wasn’t

an executive, I assume they’ll say that that’s what he is.

[00:18:36]

Andrew Kuhn: So, Mike Newman lives in Georgia and is supposedly the general manager of a park in Texas, right?

[00:18:42]

Geoff Gannon: We don’t, I don’t know that. I’m saying where I’m guessing that that’s what the company

will say because they he used to be an executive with the company, they fired him and then they hired him back and it now says he’s

not an executive I can’t really think what else that is other than that, but it might not be I don’t know. But if you asked

who runs the park, I think that’s who they would say. He’s remote, you know, he’s he doesn’t live in the state

that he’s running the park in if that’s true. So, there’s not a there isn’t a general manager in the state sense

in which we mean that in most of the hospitality industries and amusement things and whether we’re talking movie theaters, hotels,

amusement parks, whatever, things that are somewhat comparable, restaurants, things that are somewhat comparable to these in terms of

size of the unit economics that they do several million dollars in sales, a few million dollars in EBITDA is what you’re aiming

for, those kinds of things usually have someone who would have profit and loss responsibility and be on site. And I think that that has

historically not been the case of this company. Now, we are not on the board. So, we don’t know and can’t know exactly what

they say. But if you read the filings and what we know about the company, I don’t think that that’s the case.

Sometimes

there are people on site. I don’t think that they have a lot of autonomy or paid particularly well or incentivized to do as you

would say a Walmart manager or something. Where a lot of it is bonus, you have to be there, you have a lot of responsibility for that

particular location. It’s more mixed. We know somewhat the history of the company that they had someone running Missouri who was

actually a corporate person who was officially doing the Missouri stuff for a little while.

At

some point they had Vice President Safari Operations. You can track a little bit what they’ve done, but I think in general it’s

fair to say there’s not, and when they do have titles of GM’s because you can see job listings however, these are seemed

to be at salary levels that are like a third to half of what a GM in the industry normally means and the job description doesn’t

fit what a general manager would mean in terms of profit and loss responsibility for the site.

As

a business manager, this seems more like a zoo director or something like that. So that’s the basic issue that we have in terms

of the way in which the company is managing its properties is that it has bought these properties and then it hasn’t managed them.

Long ago, here’s part of the issue, right? So, you have the CEO, the previous CEO. Dale, not the current CEO, Lisa. The current

CFO and all that they at one time had a CEO. These people were hired originally to be part-time, you can see in their contracts and stuff.

Now they put in a lot more time than that, but it was designed to be run remotely with a small number of properties.

Basically

Georgia, when this company originally was doing all this, and not built out to have people running each of the parks with responsibility

for that. And so that is overall the big concern that we have and it’s what you can see in their results. They made a great deal

to buy Georgia and Georgia improved year by year. It didn’t; it wasn’t a hockey stick sort of thing but improved

year by year for a long period of time, which resulted in better and better earnings. Other than that, capital allocation and management

of other locations has been very bad. The results have been very bad. Whether they, that’s their fault or not.

We

can debate that, but there’s no doubt that it has gone very badly, everything outside of Georgia. The Georgia more than makes up

all the earnings of the company cumulatively, right? So, a possible reason for that is that there actually isn’t people with responsibility

at each of the parks, running them each separately, the way that you would if you were one location operation, as many in this industry

are, right? Or if you were running it similar to how publicly traded restaurant companies, movie theater companies, hotels, whatever

that I’m comping it against run, which is with general managers, you know, and those people often make $100,000-150,000 a year,

have bonus opportunities of $100,000-150,000 a year or something like that. And this company has three parks. So, you would expect something

like that. But that is not the case, especially because they’re so distant from each other, there’s no way to really manage

them all. In terms of, I mean, the driving things and all of it, obviously, they’re not right in metro areas, you have to drive,

even if you were to fly to places and stuff, it’s impossible to manage them without having someone located close to each one in

charge of it, and they don’t have that, really.

I

don’t, since we’re on the board stuff. We don’t see an org chart. Someone is officially at each of these places, but

certainly, it doesn’t resemble in any way the way that other companies in these industries run attractions.

[00:23:45]

Andrew Kuhn: And why do you think that is so important? I mean, I think it’s obvious, but it’d be great to hear from

your own voice why you think it’s so important and how that’s typically, that’s how it goes in this industry where

you have a general manager that’s on-site, it’s their own business line. They report to whomever, but they’re responsible

for the profit and loss of the business and that’s, you know, what they focus on day in and day out.

[00:24:10]

Geoff Gannon: Well, there’s so many different things about that. We’ll take Aggieland ‘cause there’s something

we do know. Aggieland doesn’t have potable water as far as I know it. They bought the park four years ago, and it still does not

have water that you can drink. There’s water for animals and stuff in there. There’s water on-site. But it is what you have

for like an agricultural operation is not what you would ever have for an amusement and so, why is that? I’m sure there’s

good reasons why it is, but the truth is that if someone was a general manager there, where that was their job, after four years, they

would have fixed the problem, or they’d be fired because they try to fix the problem because they’d otherwise be sure that

they would be fired.

You

can’t really pass the buck along with that where you have someone in charge of it. You know, and that’s why if you go to

a Walmart or whatever, there’ll be a functioning bathroom because there’s a manager there, make sure that if it was corporate’s

job to make sure there were functioning bathrooms at every one, I’m sure a lot wouldn’t be in good order all the time. But

there’s no way it’s one person’s job to do it to avoid that kind of thing. And that’s what would happen. Now

they have to come up with a creative solution of how to do that. And I’m sure there’s lots of complications, but it wouldn’t

take four years. And no other businesses take four years to do this. And the only reason why that happens is ‘cause you don’t

have someone there. There’s lots of other examples.

I

mean, we don’t have good data, so we don’t know. We strongly suspect their group business is extremely low, at least outside

of Georgia. Group business is something that probably a GM brings in. So, in this industry, it’s not unusual to have a third of

your revenue or something probably come from group business. At least like regional theme park type stuff, that would be possible. And

certainly, these attractions in other places in the country, we’ve been to a bunch them, have a lot of group business. It would

be very hard for someone across the country to have roots in the community to bring that in, to be doing that all the time, to build

up that base year after year. But you know, even Aggieland, Missouri is like, we’re getting close to what 15 years or something

with Missouri. So, -

[00:26:16]

Andrew Kuhn: I think it’s over 15. Yeah.

[00:26:18]

Geoff Gannon: Okay. So, but even Aggieland, we’re talking about this is his fourth year basically, and it sort of had a season

when they were buying it. So, it was not brand new at the time they were buying it had been finished. So, you know, if there’s

an owner-operator or someone is thinking like an owner on-site there, they’re going to help bring in group business, among other

things that they’ll try to do. And it’s not nothing because if you’ve looked at the sales at some of these things,

you know, if you could bring in over a period of years, group business more in line with what other parks have in the industry and in

the broader entertainment industry away from home, it’s the difference between EBITDA positive and EBITDA negative on these sorts

of things. It’s certainly a difference of GM would pay for themselves in terms of being able to bring those things in. And that’s

the sort of thing that you would be doing all the time. And it’s the sort of thing that’s really hard, I think, for a corporate

to do from the other side of the country working remotely. I don’t know how you work with schools and camps and churches and all sorts of other things when you’re in a state far away from that and everything. And also, when you don’t have a background

in that.

Obviously,

many of the people on the board and CEO and all those sorts of people that are there now did not run a park. That was not true originally

when we bought into the stock. Dale was at retirement age when we bought in, but much earlier in his career had run things that are actually

quite a bit bigger than what this company owns. And so had park-level experience of running things quite a lot more than there is now

at the company. But he was remote.

[00:28:06]

Andrew Kuhn: He was remote, and he was, I think, a part-time CEO. I think that’s actually what his contract had said.

[00:28:10]

Geoff Gannon: And he was at retirement age. But if he had been half that age and stuff, I’m sure that it would have been different.

But we knew that when we bought in, no doubt.

[00:28:18]

Andrew Kuhn: Yeah. Mm-hmm. They hired an operator, Mark Whitfield, who has since been fired; he’s not at the company anymore.

But I do remember reading the filings when they announced it. And I believe it was at the end of 2020, or thereabouts. And they announced

that he was moving to College Station. And I had thought, oh, okay, great, they just paid $7.1 million on this park, Aggieland.

They

are hiring an individual that has theme park and attraction experience. He worked in the Wisconsin Dells at a water park. They’re

moving him to college station. This seems great. This makes sense. But then it just, he was the VP of Safari Operations. I mean, he was

not the general manager of that park. He was worried about Missouri, Texas, and I believe Georgia.

[00:29:11]

Geoff Gannon: Right. My memory is I don’t have the numbers in front of me in terms of what he was paid and stuff. But my memory

is that the base pay was a salary that would be in line with what we’re talking about from a high end of a GM type job. So, whether

it was over $150,000 around $150,000 or something I think guaranteed was a bit lower than that actually but then there was but discretionary

so there are bonuses at the company. But, as far as I can tell from the filings and stuff, we’re talking about all often $20,000

bonuses or something in that neighborhood in the zero to $20 range, paid for at the discretion of like the board, I guess, with the input

of probably CEO and stuff.

It

doesn’t seem to be tied to anything that they explained. It’s quite small versus the salaries of people involved. So even

not only what you’re talking about VP of Safari operations, so presumably, I guess that means he was responsible for overseeing

Aggieland, but also equally Missouri, like in terms of overseeing someone who’s working at each of those places and making decisions

and working with the CEO to do that, right? So, it’s difficult to know with that where the responsibility is, right? What decisions

could the vice president of safari operations make without the CEO? What could they make without the people on site? If that didn’t

matter, then does that mean they have to make a lot of site visits and to be traveling a lot between things.

These

places are not close -- Aggieland, so, the three locations are -- you’ve got one that’s in Georgia and in terms of what people

know of those states and stuff It’s not too far the nearest thing that they would know is Atlanta. It’s quite a way away

from Atlanta, but that’s the only city they’ll know that’s closer to it. You’ve got the one in Missouri, and

then you’ve got Aggieland. We’re talking about but Aggieland always say that means it’s by Texas A&M, meaning College

Station, and it’s the College Station, Bryan metropolitan area, it’s near the, so, you have two cities of pretty similar

size and stuff that are both reasonably close to it. That is nowhere near where say, I live, which is much closer to Missouri, though

still quite a ways away in the northernmost part of the state. We’re talking about things that are quite aways far south in the

middle part of Texas.

So,

these are not things that are easy to get back and forth between and we’re basically talking about traversing half the country

going between these places those three sites.

[00:31:37]

Andrew Kuhn: What are your thoughts on Missouri in general? So, it’s 200 the Missouri Park 225 acres. They have 650 animals

there. It’s lost money throughout the entire ownership under PRKA.

[00:31:51]

Geoff Gannon: Cumulatively, yeah, it’s made money and yeah.

[00:31:54]

Andrew Kuhn: They’re continuing to put more capital into it. Do you have any general thoughts on Missouri? I don’t know

how long you need to run this as a pilot to see if it makes sense to continue on with it, but. –

[00:32:05]

Geoff Gannon: Well, we don’t have any evidence that they’ve ever run it with someone incentivized on site. The closest

they came is they had their former who he died by the former chief operating officer who was really trying to turn Missouri

around and then like we said, we don’t know but it apparently was part of the job of a Vice President of Safari Operations at one

time. But that would have been the smaller park and not the newer one and stuff. So, I don’t know how much attention it got but

I don’t know that that we have a very good feel for what it would do under good management. I don’t think it’s been

seriously managed for 15 years to be completely honest on site. So, I think it’s been managed remotely without a lot being done

about it for the better part of that.

And

we can see that because there did a marketing thing and a pricing thing that both show up if you read carefully kind of the if you’re

looking for like the price elasticity and stuff to see the responsiveness of admissions to price and stuff. You have to really read between

the lines but there was a couple times where attendance they don’t disclose attendance and stuff but they disclose changes and

some things so you can figure it out. Attendance really moved in reaction to a couple things and I think that that was sort of experimental

type stuff that might have been tried earlier if someone had been there the whole time you know to see that. That’s one thing I

don’t know, but the pricing could be very different, that if you adopted different prices, it could be more effective in changing

attendance at say a Missouri than at a Georgia or something.

Then,

if your prices are more similar and sorts of things about how you try to drive that. So that’s, again, something that in a local

area, people might know better. We’ve seen many parks around the country, and many of them do – to start – price, basically,

I think they just look at what other parks around the country are priced at and just assume that they should price at the same level.

But

over time, I think that they learn it makes a lot of sense to price differently depending on where you are and what kind of demographics

you draw, obviously. And so, if you’re in a place with lower income and drawing people more locally, as opposed to higher income

and drawing people from far away and stuff, then you might want to adopt different kinds of pricing, and there’s not a lot of dynamic

pricing and stuff in the industry, but obviously that’s the thing that’s normally done in adjacent industries in terms of

entertainment stuff is a lot of dynamic pricing based on time of the year and stuff, yeah. So, Missouri, they bought for like 2 million,

put in 500,000 immediately. This is like 15 years ago; I think we talked about that and something that we talked about with Jacob McDonough

we talked about.

[00:34:41]

Andrew Kuhn: Yeah.

[00:34:42]

Geoff Gannon: Him being a nominee for director at the annual meeting in June, and in that, we talked about how much has been spent

at Missouri and cumulatively it’s quite a bit because there’s cumulative losses.

Like

you said, there’s been a few years where they generate some positive EBITDA but cumulatively obviously there’s been a lot

more going in CapEx and stuff over time. So, although the purchase price was small, you’re closer to three times that in terms

of all-in purchase price plus your CapEx plus your cumulative losses. Get a little benefit from that in taxes. Presumably, George has

paid less taxes over time because both Aggieland and Missouri have generated some tax losses for federal purposes, I would assume.

[00:35:31]

Andrew Kuhn: Yeah. So, obviously, they have a horrible record with Missouri, and Aggieland is off to basically even a more horrible

start than what Missouri has.

[00:35:43]

Geoff Gannon: Well, Aggieland hasn’t started yet. Yeah. I mean, Aggieland is not better off than it was four years ago. People

can see that. They can see what inflation is and stuff. They can tell that nothing ever happened with Aggieland. And the advantage of

Missouri or disadvantage or whatever versus Aggieland is, look, Missouri, the way the industry works, right, with these sites, there’s

many things that we talk about, whether we talk about movie theater things, whether we talk about theme parks, whatever, these things

you could comp them against, they tend to have high fixed costs.

And

then you have, you know, theoretically, let’s say, say that someplace has attendance of 140,000 or something, right? Well, if that

goes up to 100, let’s say that goes up to 141,400 something, like it’s like a 1% gain, right, in attendance, that doesn’t

really change your expenses. So that’s basically pure profit. Now, yes, if your attendance jumped 50%, then yeah, there’s

a lot more expenses that have to happen, but over small increases, you, it’s, it’s basically profit in attend, in attendance

gains, right? Either from raising prices and having the same level of attendance or just having more attendance or whatever, the revenue

maximizing of it.

So,

Missouri has a small nut to cover basically. It isn’t actually that expensive. I mean, they put some CapEx into it recently

that way, but it’s not a particularly large park. It’s been established for a long time and it doesn’t require a

very high level of attendance to make some money. Now, at book value, I think, you know, and book value may not be the best

estimate, liquidation value could be quite different from book value. But if we say book value is around 3.3 million, do you remember 3 point? Yeah.

[00:37:24]

Andrew Kuhn: 3.4.

[00:37:25]

Geoff Gannon: 3.4 million. So, you know, if you could do 400 something thousand in EBITDA, 400, 500,000 EBITDA, then you could justify

the location potentially, depending on how low CapEx is. Certainly, if you could do, say, 400,000 free cash flow, you could, instead,

you’d say, oh, I’d rather have $400,000 a year in free cash flow after tax than to have $3.4 million, and that’s really

what the question is. So, the answer is, I don’t know. I don’t think that it’s ever had management that’s been

highly incentivized and right there and everything to do it.

So,

we don’t know how much it’s a management issue and how much it’s a location issue. We’ve been there so we could

guess how much it’s a location issue. I don’t know people who, I’m very unsure that people running it have a good feel

for what the local areas like and stuff to be completely honest. But that’s just based on little things about who we’ve talked

to and what they’ve said.

[00:38:18]

Andrew Kuhn: What do you think are like the potential, gross margins in this business? Like that’s something like through COVID.

We saw what was possible. They did have 90% gross margins even before COVID, right? And you look at other businesses in the theme park

industry, I mean, margins, this could be a 90% gross margin business. SG&A as a percentage of revenue, should be a lot lower than

what it is. I mean, why do you think gross margins aren’t as good as they could be and SG&A is a percentage of revenue? Like,

why do you think that’s so high?

[00:38:50]

Geoff Gannon: Well, I mean, I think that this gets to the second part, which is what’s changed at the company, right? So, there’s

two things. I mean, the things you said are true. Margins are not a very important concept, I think, in this industry or others like

if people can look at Six Flags, SeaWorld, whatever, they can look at the smallest parks to the largest parks and all that. You’re

going to see a lot of the same things in terms of there’s a break-even point and after that break-even point it’s highly

profitable to add additional attendance or to add price and a lot of it drops the bottom line. So yes, there’s publicly traded

things that peers that people would find for it that are 90% gross margins 30% operating margins or whatever. And those are a mix, not

as serious a mix as you have here but those are a mix of good and bad the truth is that their best parks at these places do better than

that that.

That’s

assuming corporate costs and they have some parks that aren’t so great at all those places. Here you have two parks that contribute

nothing and account for what? Seventy-seven, you know, 65 to 80% of the assets, depending on how you measure it, probably. So, let’s

say 70 or 80% of the assets often aren’t that don’t earn anything. And the rest earns it all is from Georgia. They break

out the segment so you can see that Georgia’s had what? 30%, depending on how you define operating margins and stuff, segment margins

of 30% at times to, I don’t know, close to 60 or something probably. You know, so yeah, it’s very, very high. What’s

changed, though, is where we get into the issues of why would we do what we’re doing, right? So, two things, one is obviously see

some potential for improvement of things, right? But two is we probably would have a more negative view than most outsiders looking at

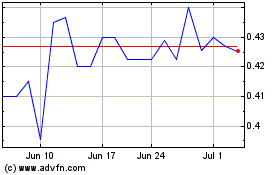

the company, right? So, the stock has done what it’s done. We bought in obviously at 26 cents or so, bought some additional cheaper,

bought more stock at 25 cents, people can see that. And then the stock in the meantime went up to, I don’t know, 90 cents at the

peak and has been in between those prices at many times in between and that peak would have probably been during COVID or in the afterglow

of the COVID reported earnings or whatever.

What’s

changed is obviously higher expenses, like in terms of administrative expenses and fixed expenses for things. Higher advertising spending,

higher CapEx. So, at the same level of attendance, for instance, and pricing and all that, you now have much, much lower profitability,

right? And that’s disguised to some extent because they’re in a better financial place because of COVID. You could see that

if it wasn’t for COVID happening, if they’d adopted it, these things without COVID, which they probably wouldn’t do

‘cause they wouldn’t feel as comfortable doing it. They’d be in a really bad place in terms of cash and everything.

So, I think this year’s capital budget, do you remember it’s 1.3 million? Is that what they said? 1point? Yeah, okay.

[00:42:01]

Andrew Kuhn: 1.4.

[00:42:03]

Geoff Gannon: 1.4 million. So that’s the CapEx. Before we bought in a $600,000 a year would have been heavy, really heavy for

CapEx, and most years would have been quite a bit lower than that, and that number that we just said is pretty in line with the kind

of CapEx we’ve seen in the last couple years and projecting the next year. The same thing you see with ad spending.

Well, before we bought in, you probably had ad spending, I’m going to guess a little south of $700,000. I don’t remember

what they disclosed and stuff at the time. It probably would have been around there.

This

is both advertising and marketing. Last year, did they do 1.2 and this year 1.1 million, do you remember? It’s along those lines,

right? And so, remember, there’s been a lot of inflation, everything. So, I, they don’t disclose attendance, but like, these

are heavy increases in CapEx and advertising, which probably are not associated with increases in attendance on a go-forward basis. If

headcount and stuff you could justify on the basis or any of these things, you could just on the basis of it’s tied to what we

were peaking at Georgia during COVID. This is what we need if we’re going to sustain a high level, right? That could be the logic

of why they’re doing that.

But

it’s not like you’re really serving a lot more people than you used to. Now, you may be at Missouri and Aggieland simply

because you own Aggieland and when we bought in the stock, there was no Aggieland, but obviously neither Aggieland nor Missouri contribute

anything in terms of earnings. So generally, you just have higher corporate costs, which some of that is presumably one-time expenses

and stuff. They’ll have one-time expenses this year. They had them last year. They’ve had them every year to some extent.

It’s a very small company, so individual little events can add up to a lot. So, it’s hard to peel all that out. But it’s,

it’s higher than it used to be, right? A bit higher. Advertising is way higher. Advertising is like 50% higher. And CapEx is probably

coming in at double or more sustainably. Advertising is at 1.5 times or more sustainably. And it’s not clear to us that either

of those things contribute in terms of driving any revenue.

There’s

no marketing person at the company. So, we, I think at some point we have a, people will be able to see the plan that we talked about.

That’s like written out. It will be in some form that they can see. Okay. So, we’ll mention in that that we’d fire

the ad agency, right? You can see in their proxy thing that their ad agency was referred by one of their, they referred to the ad agency

by a director who gets a fee for doing that.

We

would pick another ad agency. As far as I know, there’s never been any chief marketing officer at the company or anyone in charge

of that. It’s a question I asked everybody we talked to at the company in 2020. You know, CFO, CEO, etc., who knows the most about

marketing and stuff of that. And, you know, there just isn’t someone who has that responsibility and that background. So, it may

not sound like a big deal.

Okay,

they took advertising from 700,000 to 1.2 million 1.1 million whatever, without really getting a bump up in attendance from doing it.

But I don’t know that all that isn’t wasted. I just don’t know because I don’t think they know. I don’t

think they measure that and have a good feel for that. Because it again is the same thing with the accountability that we have with the

parks. Each park doesn’t have a GM doing it.

If

you don’t have someone in charge of advertising to us, it certainly looks like advertising just seems to always come in about 10%

of the previous years -- you know, like they said it at like 10% of last year’s revenue or something, it seems like not a very

thought-through thing. And it’s I’m not for a lot of advertising or against a lot of advertising. But it has to have a good

return on investment, and I don’t think that they have an idea what their spend is that way. How effective it is.

[00:46:05]

Andrew Kuhn: Do you think if you had to guess like the breakdown would be most of that advertising is going to Georgia? Do you think

it also goes towards Aggieland and Missouri? I mean, we put in our plan-

[00:46:18]

Geoff Gannon: Respectfully, and we think it’s we think it’s Georgia, which I don’t think makes the most sense,

but-

[00:46:23]

Andrew Kuhn: Because there’s just 20 years of built-up awareness of that park.

[00:46:28]

Geoff Gannon: Yeah, and we don’t know that it is all Georgia, but there’s different ways of advertising and why you would

do it. The issue, so Georgia, for instance, doesn’t have low awareness, but you can, if you have something new, which is like the

CapEx that they’re doing and stuff, you can obviously advertise on that base and try to increase the frequency of people have been

there before and everything, remind people, activate, reactivate, you know, customers that you have before, whatever terms the ad agency

will use for that.

But

that is different than advertising or other things besides just advertising, marketing and all sorts of different ways and promotions

that would drive additional awareness. Awareness in some place like Aggieland. Also, there’s just, I don’t want to get into

all the things, but like we could see because of the way that they’re advertising what their spend is and by monitoring things,

whether it’s social media accounts or the websites or whatever, they were seem to have been advertising even in the midst of COVID

at a time when their park was jammed full of people and that like the responsiveness of advertising does not seem appropriate.

I

don’t know why it is the way it is, but it does not seem that they flexibly manage their advertising spend in terms of what they’re

doing around the year and around whether they have weak or strong traffic the way that they should be. But that’s not a surprise

if there’s not someone with an advertising background who has a job to manage that for them.

[00:47:56]

Andrew Kuhn: Yeah, I remember it would drive us sort of crazy back during 2020 when we’d see on Facebook that, you know, like

it’d be like two or three o’clock and they would post something that they were closing the park to new people coming because

we’re at maximum capacity. So, people in the comments would be complaining like, oh, we’ve been driving for two hours and

now we can’t come. And, you know, we were just like, if you’re going to have to push people away, that tells you that you

should probably raise your price or do some sort of dynamic pricing. And to your point about not having an advertising person at the

company that’s thinking through these things, it was just pretty obvious to us that this company is very, at least at that point,

and even now with advertising, it almost seems like it’s just not incredibly focused. It’s just another example of that.

[00:48:46]

Geoff Gannon: Well, I think there’s not accountability because there not monitoring of people that have those specific responsibilities.

There’s a board and they do stuff and there’s a lot of them and they may be very involved, but they’d be very involved

as a group. We have no idea. And that’s different than what we’re talking about.

So,

there isn’t siloed responsibilities for particular areas of where you could have measurable results. You can measure results in

marketing and you should and you should measure results in terms of expense control and stuff at each of the parks. But if you have someone

who’s doing several different parks or who is doing several different parks and only gets to do some of the things because they’re

working hand-in-hand with someone else at the company and some of the decisions are theirs and some are the other persons, it’s

not as easy to have the responsibility handled that way to know if they’re doing a good job or not. So, the overall company can

look at it and say, “Look, George has done so well over a long period of time. Look at our stock price, look at our performance,

whatever. It’s okay. Everything’s going fine.” Because cumulatively, even if we make mostly bad decisions, we haven’t

watered it down too much yet, with the fact that so much of the earnings and stuff until recently came from Georgia and was so large

compared to the rest.

So,

it doesn’t eat you wouldn’t even have to face up to the fact that you misallocated three quarters of the balance sheet because

the other quarter is so good. See if one, if you’ve got a park that’s delivering say a 40 % return equity or something if

you really stripped everything out. Then it can make the everything look like it’s giving you a 10% and you could say that’s

fine for this year. And not have really face up that three quarters is performing really badly one quarter is performing well, but it

was performing well before you change things up, you know.

[00:50:36]

Andrew Kuhn: Let’s talk about employee count and how this tie in maybe to having the right GMs at the park that are incentivized

to be paid in a bonus based on you know park level EBITDA record growth. So, I mean just kind of looking at this eyeballing Georgia and

I’ll read across from 2014 full-time employees. And then they also have part-time /seasonal. I just think it’s interesting

to bring up, uh, 2014 Georgia, 15 full-time employees, 14 full-time employees, 14 full-time employees, then 2017, 14 full-time employees,

2018, 14, 2019, 17, 2020, 18, 2021, 27, 2022, 25, 2023, 25. Now looking at Missouri, Missouri’s full-time employee headcount since

2014 was always six full-time employees. And then 2019, it was eight, nine, 14, 12, and now they’re at 11 in 2023. Texas, they

only have since 2020, I’ll just read across, 12, 14, 14, 13. Why do you think employee headcount has exploded in Georgia and Missouri?

We’ll leave Texas out of this because if it’s a newer park and we don’t have longer-term data, why do you think Georgia

and Missouri full-time employee headcount has gone up?

[00:51:58]

Geoff Gannon: There’s different theories. The most logical one in general of why this could happen is that there is no general

manager, right? So, what would happen then is that if someone needs more people, then the answer is we need more people, we have to hire

additional people. What you were talking about in terms of bonuses and things and stuff that we’ve talked about doing, it’s

not something that the company does. And so, keeping down headcount by paying people more that are there is sometimes a better long-term

solution in keeping down expenses, even though it means higher wages for the people there. When inflation hit and stuff, it would have

meant that labor markets were tight and they hire people at the very lowest pay levels generally compared to the area.

These

are fairly low in terms of the, for hourly wages. So, when the market is very, very tight, inflation is happening, it would become harder

to get quality people and the only thing you could do is throw more people at it to get the same amount of work done. So, I mean, that’s,

it’s not unique to them. In any gold rush things that we’ve seen with tech things or whatever, you saw that there were companies

that couldn’t control their head count because they just were proving hiring for anyone to the level that they needed it.

But

then when they tell them to rein it in, then, you know, that it adjusts that fact. But when there’s no discipline on expense control,

then that’s what would happen because obviously, there are issues, I don’t want to blame anyone who made decisions to request

more people, because I think that that’s probably the only realistic thing to do when you don’t have someone who is focused

on the P/L there, and who’s incentivized with bonuses and stuff.

It

is much harder to come up with solutions that keep headcount similar but come up with more productive ways to do things so that everyone

makes more money and you need fewer people working at the place. That’s harder to do and very cost-disciplined places come up with

ways to do that but your average company when they just face more work needed hire more people, more entry-level people immediately.

That’s kind of what they do.

[00:54:17]

Andrew Kuhn: And we want to be very clear with everybody listening here. The general managers and the employees are the most important

people at the company, full stop. I mean, the CEO, CFO, people on the board, I mean, it’s the general managers that are the most

important people at this company and their employees, right? So, getting the incentives right from that perspective with them is something

that’s crucial.

[00:54:52]

Geoff Gannon: Yeah, I mean, you can see how much pay has gone up to other things that corporate and stuff if the same amount was

reinvested in that amount of higher payout parks the individual parks you have a different result. So yeah, I mean, the parks are the

revenue-generating part of it. They’re also the places best handled to the expense control. It’s very hard to blame people

a corporate, for too much increase in headcount at states way away from them that they can’t be visiting all the time. That’s,

you know, it’s just an issue of what they’re responsible for and what they can be on top of. It’s not reasonable to

manage headcount at individual locations from a distance and stuff. So, it’s one of these situations where it’s a bad outcome,

but I wouldn’t blame it on individual people. I blame it on the fact that there aren’t lines of responsibility drawn up that

would have someone responsible for making sure that doesn’t happen. Basically, no one is responsible for making sure that doesn’t

happen. And so, it happened. You know, and it’s, we’ve talked about in some of the other podcasts we’ve done, right?

It’s systems and processes that you have for these things. And each individual decision might make sense. It probably made sense

at each point that you thought you should hire more people and stuff.

But

put aside the Georgia thing for a second, which is a big increase. But theoretically, if you thought COVID would, that that would be

lasting in some way, which is not proven to be as much as maybe the company thought, the patterns of behavior would revert that they

maybe they thought wouldn’t revert quite as much the pre-COVID level.

It

doesn’t make as much sense at Aggieland and Missouri, right? Like when you consider what inflation is and look at their prices

and stuff over time, again, they don’t disclose attendance, but I would just encourage people to look and try to figure out what

could I guess attendance has changed and what do I guess headcount has changed.

That’s

alarming. You don’t want to do that. If the place is already not making money, increasing headcount faster than attendance on a

percentage basis, there’s no doubt that all these parks did that, is not a good idea. And it’s a really bad idea at the parks

that can’t afford it. At least at Georgia, they could say, well, we’re making a lot of money at Georgia, it may not be the

most efficient thing to do, but we’re paying for ourselves here. Georgia subsidizing the losses at Aggieland and Missouri, so you’re

hiring people you can’t afford at those places, and not really to drive more attendance. So, you know, it’s, it’s not

good, but that’s, it’s something that would happen if you don’t have people managing each location that way. It’s

very logical. I mean, in all the industries we mentioned, I think headcount would rise too much at locations that don’t have GMs

there and stuff. It’s a very natural thing for people to do in trying to manage from a distance.

[00:57:32]

Andrew Kuhn: So, part of our plan on PRKAproxyfight.com, which everyone can see, is obviously it starts with the operations. And

a huge part of fixing operations is, you know, decentralizing management, but more importantly, putting the right general managers in

place and getting the incentives right with the general managers and employees, right? So, we just hit on that. Very important.

We

want to hire a new ad agency. They have a $1.1 million dollar budget. We want to switch to, you know, more digital and social media,

stuff, but really, you know, hone that in and have a better idea about, you know, what the spend would be with that. Go look at all of

their social media. Okay. I mean, pull up your Instagram and do it. I don’t really need to say much more about that. You want to

see what a good social-

[00:58:21]

Geoff Gannon: Other people, yeah.

[00:58:23]

Andrew Kuhn: I’ll give you a good one. Go to Instagram, type in Out of Africa. And you’ll see a really good social

media account. This isn’t rocket science. These are animals. The animals are the product. This is built for Tik Tock and

virality and everything. I mean, my own personal opinion is it looks like it was done on clip art on, you know, what they currently have. So, something

that we really need to think about. And, you know, that’s very important in this industry, obviously. So go to Out of Africa and

look at what they have done. I mean, it’s, it’s a really top-notch account.

And

I can give a great example, right? When we went to Out of Africa, Geoff, you remember we were there and I’m like, oh yeah, there’s

Cypress the bear. I’ve seen this bear many times on Instagram. So, it was very cool to see it in person. They almost create characters

out of these animals that they have. And then you want to go see the animal in person.

[00:59:13]

Geoff Gannon: Yeah, I mean, a lot of things are talked about are just to bring you up to the standards of what operations which only

have one location or only have a couple locations around the country. So, for people to understand the industry, right, because these

are drive-thru animal safaris, they might think, are these the only ones? Is Georgia the biggest one in the country? What is this, you

know?

Four

years ago, I guess we were learning about the industry. We put together over a hundred just in basically the southern United States,

so excluding the west, like California, the Pacific Coast, and the north, and that had been opened for a couple years at least, you know,

you had to be open for a few years. So just to like benchmark what are the prices of these, what does it look like, whatever to get a

feel for the industry. Because there’s all these things that cite how many there are and everything, but some are real operations

that last a long time, some aren’t. So how do we get all the statistics on it. About a hundred. I visit, I live in far north of

Texas now and visit Southeastern Oklahoma quite a bit, couple out two-and-a-half-hour drive probably. There are three safari parks that

I pass on the way there. I’ve been to them and stuff and so, obviously that’s because of the tourist flows right, because

people do go from Dallas Forth Worth out there for camping and hunting and fishing and all outdoors things over there. There’s

a state park and stuff, but it gives you an idea that there’s a ton of these parks. And many of the things that we’re talking

about are simply to get up to the level of the top quartile, quintile, whatever. And this isn’t that -- even a lot of their, the

most that they did in improving marketing stuff, I think, was honestly after they acquired Aggieland and just adopted some of the things

which the previous people who created Aggieland had adopted who are not experts in the industry or anything. But just invested in trying

to do some smart stuff about design of what logo should look like and messaging and positioning of the brand and stuff that you would

do with a website and with stuff and whatever. And there’s not a lot of that of this company, obviously, but not a surprise because

there’s not people with the marketing background and there’s no position dedicated to marketing. So why would there be right?

[01:01:31]

Andrew Kuhn: Improve capital allocation. Let’s talk about that. So, we’ve talked a lot about, you know, the Missouri

park, and we’ve talked about Aggieland, the Texas park, both have not done anything that has really moved the needle at all from

the perspective of EBITDA, cash flow, free cash flow, whatever metric you want to use. The first thing that we will do is obtain an appraisal

and liquidation analysis for both parks, right? That’s something that we want to get more familiar with. But at the board level,

something that’s super important is going to be the framework that we’re going to have throughout the company, right? And

this is going to be on any sort of capital outlay that we ever do. And then of course, at the board level, when we meet, just talking

about if a park should stay open, if it’s, you know, on track to be successful, how are we gonna get there? What’s the pathway

forward? Or should we consider other alternatives with that source of capital? Every park needs to earn its keep on a return investment

basis. At the board level, the framework will be, is this park earning a 10% return on capital? If you’re going to put $7 million

in this park or $7.1 million, is there a pathway forward or is this park earning at least 7 to $800,000 in cash flow, EBITDA, free cash

flow, whatever metric we decide on to basically justify its existence, right? We’ll be very active in that from that perspective.

And, you know, the first thing that we’re going to do is get an appraisal or liquidation analysis for both Missouri and Texas and

think long and hard about if it makes sense to keep Missouri open. Is there an actual pathway forward to getting generating a great return?

Is there a pathway forward to getting a great return from Aggieland? And then, you know, making the decision from there.

Missouri,

personally, I’m a little bit more hesitant towards because the park has been open forever. Now they did just cut prices and the

park somewhat has done it a little bit better. But my personal perspective is we’re not doing something here that’s just

going to make an executive salary. We want to do stuff that’s really going to move the needle and put the company on the path forward

to just be able to do much bigger and better things. Aggieland is a park which we wrote about in our letter, which investors have read

in 2020. There’s potential at Aggieland, right? We’ve been to, I don’t know, 15, 20 different parks in the industry.

We’ve seen what other parks look like. Aggieland is definitely a state-of-the-art park from an asset perspective. We just still

feel like nobody knows that it even exists in the surrounding areas.

[01:04:10]

Geoff Gannon: The things we said in the letter are true, but that was four years ago, and it’s in the same position that

it was four years ago, you know. What I’d say is the same thing with the capital allocation stuff that I said about the water, which

is like that only with this company owning it would Aggieland consider it would four years later not have potable water. It’s the

same issue with Missouri and Aggieland here with capital allocation. I don’t want to come out saying that we’re in favor

of closing things or that we’re not in favor of it. It’s very hard to do and we don’t know what kind of money can be

got back out from it and how easily because those book values are not necessarily very representative of the values that you would have

after all costs and things and a lot of time has passed when we’re talking about land animals any of these things the values are

probably quite different from the book value. So, you need that appraisal stuff but what would have happened with Missouri, it’s

been 15 years, it either would be a successful park or it would be closed. I don’t know which, but no one other than this company

would have kept it running for 15 years with and not made it successful. If it had been bought by anyone who didn’t have a lot

of resources, they would have been forced to do that or they would have been forced to rely on a lender or something so that the only

way they could make it is to keep it operating would be to make it a financial success.

This

is the one case where someone is cross subsidizing losses from a they’re taking a very successful park and they’re using

that to pay for other things and that’s covering up the fact that there’s not success at the other parks even to the level

that would be required by any owner. So, if the previous owners had kept it and stuff, they either would have to make it a success or

they would have defaulted on a loan or something like that, what would have happened. That’s what would happen with anyone. And

that’s disguised by what’s happening here with this company. And so, it’s really enabling losses and enabling a lack

of success at these parks simply because it’s using Georgia for that. But that doesn’t mean the outcome has to be closing

it down, but it will be one of them. It will be either be success or closing it down. And the status quo is this is the only case in

which someone would allow something to go on for years without being successful and yet keep funding it. So, it’ll be different

one way or the other.

[01:06:30]

Andrew Kuhn: I mean, they’re continuing to sink capital into it. I mean, especially Missouri, right? So, the budget for 2024

is $1.4 million. We put in our plan that cuts to CapEx will be likely this year if we’re in and the shareholders vote us in, and

all future spending will be determined by a projected ROI. I mean, it’s the framework, right? That every park, every dollar that’s

invested, there needs to be some sort of pathway forward to generating some type of return on that dollar.

[01:07:05]

Geoff Gannon: So, it varies a little bit depending on the project, but as a general rule, you know, if you want your stock to go

up over time. It’s gonna have to have a better return on the company’s projects that it engages in then you would get in

the stock market. Stock markets usually maybe high single digits but its single digits is not double. So, what you need is a 10% or higher

return in terms of free cash flow for your equity. There’s taxes and things but in general while there’s some variance, it’s

going to mean higher than 15% EBITDA. So, people like to use that number EBITDA, it’s easier for them to figure out the IRR and

to do projections. So, you know, CAPEX that can generate a 15% increase in EBITDA relative to the expense that it has there.

So,

you know, a $1 million project that generates $150,000 in EBITDA is a defensible use of capital. But one that generates half of that

and stuff are not, and would have to stop. And so, obviously, immediately, with Aggieland and certainly Missouri, no matter what the

decision is about those, that would stop is that no more money would be put into it. It would have to generate the funds internally for

whatever was being done, which means it would have to be turned around quickly to keep getting any capital if there would be no situation

or which more capital would be put into it from the outside without better results. It would have to be internal improvements operational

improvements to generate that.

And

similarly, where we talk about ad spending and capital spending look, the annual meeting is in June their busy season starts months ahead

of that, and I, this is years not gonna look good I mean, there’s nothing we can do to turn off the spigot either in terms of ad

spending or CapEx fast enough considering when they probably would spend it. We don’t know because we don’t know exactly

when they spend it but, you would do the CapEx outside of your busy season and you would need to add spending probably close to when

you expect the attendance. So, what we’d be talking about there really is, I don’t know what they’ll be long-term,

but initially they’d be frozen. I mean, the attempt would be to freeze everything possible because we don’t think that there

were any calculations done on any of this.

We

did say that we’d definitely get rid of the current ad agency, I know that for a fact, but I don’t know about some of the

other things, how far along in CapEx, they canceled a project which cost a write-down of a bunch of money and stuff. So sometimes you

would go through with a project just because it’s already committed and it would be too expensive not to. But the basic idea is

it would be frozen pretty fast and then reassessed. And so that should see a big drop initially, but that might be more in 2025 than

2024. It could be too late by the time that we get in and stuff in 2024 to make a big difference. And in terms of cash, basically those

are your two big areas, the company, the last two years had negative free cash flow, had not had negative free cash flow in at least

a decade or something before then. And it’s really without cuts in CapEx and ad spending, you’re running

similar risks of being free cash flow negative or very neutral. That’s where you would immediately get cash benefits from cutting

things would be those two areas. So especially on a cash flow basis. Those would be places where you could really help a lot and quickly.

I just don’t know, given how late the annual meeting is, that people will see that result in 2024.

[01:10:39]

Andrew Kuhn: Cashflow from operations has been declining, CapEx has gone up a huge amount since even pre-COVID. And then obviously

revenues declining on the back of the COVID boom as well. I mean, it’s not, yes -- they got hit by a tornado and obviously that

set back the company last year. However, they have not slowed down the amount of capital that they’ve continued to put into these

parks and what they’re spending money on. And I would say the financial profile, right? If you want to use a technical term of

the company, since really, we invested has gone downhill tremendously.

[01:11:17]

Geoff Gannon: It’s a huge pivot about, you know, it’s not all attributable to, it’s not like it was the second

that they changed CEOs or something. It was already, you could see some things in the works before then, which presumably were a response

more to COVID and maybe could have been stopped faster. But there’s a huge pivot about halfway through our ownership in the company

that you can see in terms of financial results, no doubt about that. You can see the year before the tornado and stuff already that on

a cash basis, there’s been a huge decline and stuff, but the, I don’t know the current management and I don’t know

about the board and stuff, but you know, you can read what things they say. The, they don’t talk a lot about things like free cash

flow and return on capital. They talk about inorganic expansion. They talk about growth. They talk about, I mean, I think they probably

care about what earnings they report and stuff but I don’t know that a lot of time is spent thinking about the fact that there

was negative free cash on how concerning that is.

And