Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

February 13 2024 - 4:26PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE

14A

PROXY

STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE

ACT OF 1934

Filed

by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ | Preliminary

Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive

Proxy Statement |

| ☐ | Definitive

Additional Materials |

| ☒ | Soliciting

Material Pursuant to §240.14a-12 |

SILVERSUN

TECHNOLOGIES, INC.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☐ | Fee

paid previously with preliminary materials. |

| | |

| ☐ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

The

following is a transcript of an interview of Brad Jacobs conducted on the Inside the ICE House (NYSE) podcast and made available

on February 12, 2024. This transcript was prepared by a third party and has not been independently verified and may contain errors.

Inside

the ICE House (NYSE)

Podcast

| 1. | Josh

King: Connecticut where I lived from 2003 to 2009 is home to many of America’s most well-known corporations and the entrepreneurs

behind them. Ranked sixth in business environment for the economy inside the top 20 according to U.S. News & World Report,

the nutmeg state has long stood as a leader of industry. Of course, a lot of those well-known companies in Connecticut are listed here

at the New York Stock Exchange. Companies like Cigna (NYSE ticker symbol: CI), Stanley Black & Decker (SWK), Pitney Bowes (PBI) and

others headquartered in our nation’s fifth state. |

| 2. | In

May of this year, Connecticut governor Ned Lamont, six months after being re-elected to a second term joined us here inside the ICE House

for our 363rd episode. It’s a conversation that spanned many topics including his political journey to the governor’s

mansion in Hartford. The state’s business environment, and even UConn and Quinnipiac’s recent NCAA Division I titles in basketball

and hockey. He put it pretty bluntly to me in that episode. He said to me (I’m going to quote) “Connecticut’s got one

percent of the population, but all of the championships”. Recent college sports? Maybe. But, I believe that maybe beside the athletic

pursuits, Governor Lamont was referring to Connecticut’s businesses and entrepreneurs. |

| 3. | Few

business leaders, if any, have added more to the Connecticut economy and championed the region better than today’s guest, Brad

Jacobs. Brad has brought not just one or two companies to the state, but three in United Rentals (ticker symbol: URI), XPO Inc (ticker

symbol: XPO), and GXO Logistics (ticker symbol: GXO). Spanning a career of more than four decades, Brad has infused his home state with

thousands of jobs and opportunities for those living within a short drive of interstates 95, 91, and 84. In total Brad has created seven

flagship companies across different industries, delivering tens of billions of dollars to their shareholders. |

| 4. | I

often invoke the Intercontinental Exchange origin story into this show. How Jeff Sprecher saw around corners and saw an opaque energy

trading market where brokers would deal with one another on the phone and work inefficiently with a single counterparty, like Enron.

Jeff saw an analog process and worked to digitize it making prices transparent and bringing buyers and sellers together, and thus a $75-billion-market-cap

company was born from the original investment of a dollar. Well, Brad Jacob’s has a background in oil and energy trading, and what

he’s done in logistics has a real parallel with what Jeff did at ICE. Putting together disparate parts of an ecosystem through

M&A and integrations and magnifying the multiples for shareholders many times over. |

| 5. | So,

what sort of a mind is so wired into that kind of growth? On today’s episode, we’re going to go in depth on Brad’s

business journey from its inception in 1979 in the oil industry to his role today—spread throughout multiple corporations. In a

minute, our conversation with Brad Jacobs on the wide array of industries he’s touched, the passions that drive him outside the

office, and the lessons embedded in his new book, hot off the presses How to Make a Few Billion Dollars. Advice we can all use.

Unless maybe we’re Steve Schwarzman or Bill Ackman. It’s out now from Greenleaf Book Group Press. All this and more with

Brad Jacobs. |

| 6. | Brad

Jacobs is the chairman of XPO Inc, RXO Inc, and GXO Logistics. Those are, not surprisingly NYSE ticker symbols XPO, RXO, and GXO respectively.

Brad’s also the founder and former CEO of United Rentals. That’s ticker symbol URI. United Waste Systems which eventually

became part of Waste Management. That’s our ticker symbol WM. And, is the author of the newly released book How to Make a Few

Billion Dollars. Brad, thanks so much for joining us inside the ICE House. Welcome to the New York Stock Exchange. |

| 7. | Brad

Jacobs: It’s great to be here. |

| 8. | Josh

King: So, if our listeners couldn’t already tell by the ticker symbols I just rattled off, you’re quite the regular here

at 11 Wall Street. Your first bell ring came all the way back in 1997. If we’re not mistaken in just a few hours you’ll be

up again for the eleventh time ringing the bell. Does it ever get old? |

| 10. | Josh

King: Your employees must appreciate the recognition. |

| 11. | Brad

Jacobs: This will be my eleventh time. Every time is still spine tingling. It’s the center of capitalism. It’s just the

energy, the vibration here. So strong. |

| 12. | Josh

King: Paint a picture of the young Brad Jacobs the first time you were here. What did you think when you walked on to that floor? |

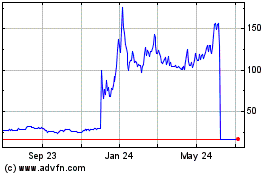

| 13. | Brad

Jacobs: Quite overwhelming, but it’s changed quite a bit. I mean the old New York Stock Exchange was kind of like Trading

Places, the movie with Eddie Murphy. There was a lot of people yelling and screaming at each other. Now, it’s very quiet. It’s

very electronic. It’s much more advanced. |

| 14. | Josh

King: Sort of like those GXO warehouses that you talk about. Used to be bustling with people running all over the place grabbing

boxes and forklifts. Now, they are models of efficiency. |

| 16. | Josh

King: You’re a New England guy like myself. You’re from Rhode Island and now Connecticut. Your career has taken you all

around the globe, but even in these frigid temperatures what keeps you back in New England. |

| 17. | Brad

Jacobs: I’m a New England boy. I was raised in Rhode Island. I went to school in Massachusetts, Vermont, Rhode Island. I’ve

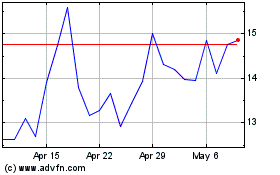

traveled a lot around the world, and I’ve done business in dozens and dozens of countries, but at the end of the day I’m

a Northeasterner. |

| 18. | Josh

King: I want to start with a thought experiment, as you might say. The kind of thing that you might undertake to officiate at your

daughter’s wedding for example or find a love vibe as you write about. We can all buy Renoir or a Picasso I suppose Brad if we

have enough money, but just so our listeners have a sense of who they’re listening to, tell me about the person who buys a piece

of modern art called Cluster by Lincoln Schatz. How a viewer appreciates it and about daydreaming and meditating. How that can

all lead to success looking at that piece. |

| 19. | Brad

Jacobs: You mentioned two things. You talked about my oldest daughter’s wedding that I opened the book with, and you talked

about the Lincoln Schatz Cluster video art. Let’s start with the video art. The video art when you walk into our house and

you come right in on the left-hand side of the wall are four television monitors next to each other. And, there’s a webcam. It’s

kind of the institutional memory of the house. So, all of our guests, all of our friends, all of our family who visits us, I get them

in front of the camera and it records them, and then it plays it back in segments of ten seconds a shot with four different at a time.

Two from recent and two from maybe 25 years ago. And, so it’s just a big montage where time is distorted, but space stays at the

constant. The camera has always been at the same angle, and so you may be looking up there and see someone from when they were fifteen

years old and from when they’re forty years old, or when they were literally a baby. I see my mom and dad. They’re long passed

away. |

| 20. | So,

it is something to do with business in the sense that it puts your mind—looking at that art piece—in a kind of transcendental

zone where you’re thinking differently. You’re looking at time just differently. You’re looking at it from a much larger

perspective, and it all blurs together. And, I find doing thought experiments like that, and that’s one of many, many different

ones, gets me into a certain groove. Gets me into a certain mindset to think in a way that is bigger and is better and is more creative,

and I really enjoy that. |

| 21. | An

example of that is my daughter’s wedding. My oldest daughter, Yasmina, was married must be now about seven or eight years ago in

a wonderful place in Mexico. And, we were very worried about security because Mexico is Mexico. We sent our security team down there.

We got there, and the guy said “No problems. Don’t worry about this”. Why should we not worry about this? The is place

owned by the brother of some big narco guy, and the word is out no criminals dare kidnap or harm or rob or anything at this place. So,

okay. Right away, we felt really safe. We had a beautiful wedding. It was a gorgeous location. |

| 22. | They

had asked me to officiate it. I’d never officiated a wedding before, so I was a little nervous about that thinking “Gee.

I don’t know if I can do it”. So, before I say “yes”, I went onto YouTube. I looked at a bunch of weddings, and

I realized you can do anything you want. There’s all different types. |

| 23. | What

I decided to do was to channel love. And, I had everyone in the group that was on the beach stand up and remember all the love that’s

ever existed in the universe from day one until now between any two beings, and feel that love. Really get in touch with that love. We

just did that silently for a good minute. Nice vibe. And, then I said “Now tune into all the love that’s in the universe

right this minute. Right this second. Anywhere between any two of the eight-billion people on the planet. Another good vibration going

for another minute. And, I said “Picture all the love that will ever happen in the universe from now all the way into the future”.

So, we had a really, really good love vibe going, and then I had everyone throw love. Take their hands and pantomime throwing love towards

my daughter and the groom, and then they channeled it into the ring. He put the ring on her finger. It was the most beautiful moment.

I really can’t even explain how everyone who was there, especially my daughter and my now son-in-law were just totally dripping

in love. It’s a fantastic way to start a marriage. |

| 24. | Josh

King: A love vibe—not the kind of officiating image you might expect from a CEO with a book How to Make a Few Billion Dollars.

I’ve heard you on the Odd Lots podcast. Also Invest Like the Best podcast. Of course, read the book. Those hosts

took a while to get to the book, but I want to get right to it—How to Make a Few Billion Dollars. Why’d you write

it? Who’d you write it for? And, for a person invests that kind of time preparing to officiate at their daughter’s wedding

or convinces their spouse to install that kind of a video and television projection like the Lincoln Schatz piece in your foyer, what

was the writing process like? |

| 25. | Brad

Jacobs: It was intense. It took a year, and a big chunk of that year. At the same time, I was doing my day job being chairman of

three different companies, and researching and then starting another company, QXO. So, it was quite a busy year for me last year. Why

did I write the book, and who did I write it for? I first wrote it for myself. I first didn’t even know if I was going to publish

the book. |

| 26. | I

thought “Now that I’ve stepped down as CEO, and I can step back a little bit. Go back in my career all the way back to 1979.

Because I’ve been a CEO for 45 years. It’s the only job I’ve ever had. And, all the companies I’ve run have done

really, really well. We’ve outperformed every possible index you think by a large amount. Why? Why did we create so much shareholder

value time and time and time again? What was the playbook? What were the things that we did right, and what were the things we could

have done even better and created even more alpha? |

| 27. | I

thought that was a worthwhile use of time. To contemplate what went right, and what could have been improved. And, the book wrote down

in an organized way the main things that I thought were idiosyncratic, that were specific to us, that were different than other companies.

Different than other businesses. And, as I wrote it I started realizing this could be interesting for other people. This is not just

a journal to read for myself. And, it turned into a book, and here we are. |

| 28. | Josh

King: United Rentals in 1997—the first of your enterprises to be listed here at the NYSE followed by XPO in 2012, GXO 2021,

RXO in 2022. Among the four does United Rentals stand out because it was the initial listing, or do any of the other three eclipse the

first? |

| 29. | Brad

Jacobs: United Rentals was great. When we started it, we all invested at $3.50 a share and today it’s over $550 a share, so

it’s been a huge return on investment for shareholders. Now, I can’t take all the credit for that because I haven’t

been CEO for quite a number of years, but the business has performed very, very well. And, at the end of the day that’s your report

card. Your report card in business for a New York Stock Exchange company is how much value did you create for shareholders because you’re

taking people’s money, other fiduciaries—people who are pension funds, people who are long-only funds, people who are hedge

funds, people who are endowments, retail investors. And, you have a very solemn duty to give them back a lot more money than they gave

you. And, God forbid you give them back less money than they gave you. So, United Rentals—I came to that in my head—it’s

like 150 bagger or something like that. |

| 30. | Josh

King: 150 bagger. Used to be a 100 bagger, now it’s 150. |

| 31. | Brad

Jacobs: So, United Rentals was certainly a success, and I feel very proud when I see all the decals on the equipment all around the

country. |

| 32. | Josh

King: What was the big idea behind United Rentals at the time because I do see the decals from time to time. I pass some of the locations.

I pass the equipment in the field, and we’d all love to have a scissor lift or boom lift located in the garage when we have to

decorate a Christmas tree. But, there were parts of it that you tried and failed and backed out of until you got to what the core business

was. |

| 33. | Brad

Jacobs: The main incentive to do equipment rental was I thought there was a long-term trend which turned out to be correct, that

customers would rent more equipment than they were doing already. At the time I got into it there was only about 15% rented. And, construction

equipment for the most part was purchased. But, so much of that 85% that was purchased was just sitting around getting rusty and dusty

and depreciating, and you had to pay to maintain it. It was actually costing money. |

| 34. | So,

I figured over time a lot more customers will see the economics of renting. Of course, that turned out to be the case. The rental penetration

has gone up way over half now. We rode that trend. |

| 35. | The

other thing that attracted me to the equipment rental business was at the time it was very fragmented. Hertz was the biggest guy, and

they were only a billion dollars after being in it for decades. Of course, we surpassed them in thirteen months by doing M&A. They

didn’t like that. We broke a billion dollars in a little over a year. |

| 36. | And,

there were many, many, many small and medium-sized companies. A few public companies which we ended up buying. But, it was mostly mom

and pop, or not really mom and pop—privately-owned entrepreneurs that were in the business. And, I thought “Gee. If we bought

a bunch of these and put them together, we could go to the manufacturers and say ‘Guys. We’re not a small company now. We’re

a big company. We’re your largest customer. We need a break on the price. And, we earn a break on the price because of our consistency

of long-term relationship buying’”. Lindstrom lowered their pricing roughly 20%. |

| 37. | Josh

King: So, some of those manufacturers I supposed with all the feedback that you’re giving them, you’re helping them build

a better scissor lift, a better boom lift as well. I mean you’ve contributed a lot to the advent of how these pieces are designed

and used out in the field. |

| 38. | Brad

Jacobs: No question about that. At the time there were about 25 or so—you mentioned aerial lifts—boom lifts. There were

a couple dozen of them. I went to all of them and said “Look, I’m going to consolidate this industry, and I’m going

to buy most of the equipment rental dealers out there, and I’m not going to work with 25 different vendors here. We’re going

to consolidate down to two. I’d like to consolidate to one, but I want to have two to keep each other honest. But, I want more

than that—we want to standardize the mechanics. We want to be an important customer to two, and the rest of you guys aren’t

going to really survive or you’re going to really shrink quite a bit”. |

| 39. | And,

two of them stepped up. What was then called Genie and Jail JLG. Today, they have the vast dominance of the market share because of United

Rentals. They bought into what my vision was. They signed up, and they really thrived as a result. Even with the discount, the volume

made up for that a lot. |

| 40. | Then

we went to Sir Anthony, actually Lord Bamford now. Before that he was Sir Anthony Bamford. When I knew him, he was just Anthony Bamford.

A British company, JCB. They came to the United States. Anthony wanted to break into the North American market because it’s much

bigger than the European market. He wanted to build a big plant down in Georgia and needed a customer. We said “Yes. We’ll

do that. Give us a good price that we can pass along some of those savings to our customers, and our shareholders will be happy, and

our vendors will be happy because we’re doing big volume and consolidating it”. He bought into that. We became I think his

biggest customers. |

| 41. | Josh

King: In theatres now is the work of another Brad, Bradley Cooper. Who wrote, directed, and starred in Maestro the bio pic

of the life of conductor Leonard Bernstein. A CEO Brad is a conductor of sorts, and you ought to know as a lover of music. You’re

a trained classical pianist. Back at Bennington College, what did Professor Bill Dixon teach you about jazz in the 1960s in his black

music course, and how does that inform getting a wide swath of employees to work together as a team? |

| 42. | Brad

Jacobs: I happened to watch Maestro over the holidays. It was a great movie. It reminded me a lot of my musical training.

I was first classically trained as you said. Which I think is important. You need to know structure. You need to know process. You need

to have certain discipline. You have to learn what’s called chops in music. But, I loved what Bill called “black music”.

He didn’t like the word “jazz”. He said “This is black music. It should be called black music”. That’s

fine. |

| 43. | And,

what I learned from Bill were a lot of things that applied to music were the same exact things that applied to life. Those were things

like how do you improvise in the moment? How do you get fully absorbed in this moment, right now? And, zone in on that, and zone out

everything else in the universe, so that the whole rest of the cosmos is going on without you. It’s just going, going, going but

you’re just zoned in on this moment with the person you’re with at this moment, and the place you’re at, at this moment

at this time in this space. That’s a great skill. This is way before the word mindfulness was invented and became very popular

in psychology and so forth. I would credit Bill Dixon with the real, original mindfulness. |

| 44. | Music

is a psychological thing where the first step is to get very in tuned with the present. Non-judgmentally. Accept it just the way it is

right now. You’re not trying to change it. You’re not trying to judge it. You’re trying to be in tune with it. And,

then the other thing I learned from him was how do you work with other people so that you become a super organism? In other words, it’s

not just me and you and a couple of other people jamming. It’s one. It’s us. It’s a team. It’s a group. It’s

a band. It’s a symphony. It’s one super organism like an ant colony or a beehive. That’s a very brilliant insight that

he had that applied to music but also applies to business. |

| 45. | In

business you want to be mindful when you’re with your team, or when you’re with a customer, or when you’re with a vendor,

or with your shareholder. You want to give them all your attention. You want to be fully present in the moment and make that a special

meeting, a special moment. Knowing that, that specific constellation of people will probably never happen again. Certainly not in that

space, going back to the Lincoln Schatz cluster art piece. That will never happen again, and you should really appreciate that, and be

very grateful for that. Say “How lucky I am that I happen to be right this minute with this person and that person”. That

creates a certain electric vibe. In the book I have a whole chapter on how to create an electric meeting. Part of it is being fully present

in the moment and giving non-judgmental concentration (that’s what I call it in the book) to the other people that you’re

with. |

| 46. | Bill

also taught me something very humbling which is—money ain’t everything. I talk about in the book one time he came to my apartment

about ten years after I had left Bennington, and he was doing a gig in the city, and I had been an oil guy and made some money, and had

this big beautiful apartment in Olympic Tower, and invited him over. I thought he was going to be really impressed. I thought he was

going to say “Wow. You really made it Brad”. We’re looking out down on New York, and he looks over to me and says “You

really screwed up. You could have been a really good musician. You could have made a serious contribution to music, and you’re

chasing this money stuff. Who cares? What are you doing? Why are you wasting your life chasing money?”. That was his message. It

was “I just don’t understand why you would go after money”. |

| 47. | I

happen to have a piece of art that hangs up in our office in Greenwich that has a quote by Friedrich Kunath that says “I can’t

afford to waste my time making money”. Making money is good. Making money is fine. It gives you all kinds of things you don’t

have if you don’t have it. But, there’s a lot of other things in life besides money. So, if you’re going to chase money—this

is something I learned from Bill. I took his lesson very carefully. If I’m going to chase money, I can’t just chase money.

I’ve got to enjoy the experience of chasing money. In the process of doing business with all the people I come into contact with

whether it’s someone’s company I’m going to buy, whether it’s a vendor whose equipment—whatever it is.

I have to enjoy that. I have to figure out a way that I process my daily experiences in a positive way. In an uplifting way, in a meaningful

way that gets me excited. |

| 48. | Josh

King: You think so intently sometimes about the math of what constitutes a life. If you do the actuarial calculations of how many

days you have left on this planet, you think maybe you have about five-thousand good days left. |

| 50. | Josh

King: And, you’ve got to make the most of every one of them. |

| 51. | Brad

Jacobs: Every day is so important. You have to work at it. You have to work at thinking about how you’re interacting with life.

Life is going to have ups and downs. Life is going to have positive stuff. Life is going to have negative stuff. That’s not going

to change. Life is going to have things that you’re really happy about, and life is going to have things that gee you really wish

that thing didn’t happen. You have to figure out a way to deal with both of those in a way that’s enriching and not get too

up when positive things happen. It’s good to be up, but not let your happiness be dependant on that. But, also you have to learn

how to not get too down when the inevitable messed up stuff is going to happen. |

| 52. | Josh

King: I want to stick a little bit on the time with Bill at Bennington College. Those of us who are aware of Bennington know it’s

a quirky little institution in Vermont. Your academic journey took you from Bennington to Brown, but you eventually decided to drop out

prior to getting your degree. Like you, Apple’s founder, the late Steve Jobs dropped out before eventually completing his degree

from Reed College. In 2005 Brad, Jobs gave the commencement at Stanford, and discussed his own reasons for leaving school. I want to

just take a listen to a little bit of that speech. |

| 53. | Steve

Jobs Audio: “And, 17 years later I did go to college, but I naively chose a college that was almost as expensive as Stanford.

And, all of my working-class parent’s savings were being spent on my college tuition. After six months, I couldn’t see the

value in it. I had no idea what I wanted to do with my life, and no idea how college was going to help me figure it out, and here I was

spending all the money my parents had saved their entire life. So, I decided to drop out and trust that it would all work out okay. It

was pretty scary at the time, but looking back it was one of the best decisions I ever made”. |

| 54. | Josh

King: Though the reasons for leaving might be different, there are quite a few examples of business leaders like Bill Gates and Mark

Zuckerberg who dropped out of college. What led you to step away from Brown and begin your entrepreneurial career without finishing your

degree. |

| 55. | Brad

Jacobs: I think on balance it’s better to go to school. I think the data shows very clearly that there’s a correlation

between finishing college and getting a better job and moving up in life. So, I don’t want to be a poster boy for not going to

school. I think education is very, very important. |

| 56. | In

my case, I was done. I was a good student. I had studied what I wanted to study. I had, more important than just learning stuff, I felt

I had learned how to study. I felt I had learned how to learn. And, that’s what the main thing you want to get from going to school

is the curiosity, and the discipline, and the love for solving the mysteries of life because there’s so many of them. Bennington

was a fantastic experience. We had the book launch last night at the Rainbow Room. It was fantastic. |

| 57. | Josh

King: Love that place. |

| 58. | Brad

Jacobs: Oh, it was just wonderful. We had 375 of my best friends, and it was just a really good vibe there. Very good people. One

of them was Laura Walker who is the president of Bennington College. And, we were chatting a little bit about the Bennington experience.

Bennington is still a cool school, and back in the 70s it was an ultra-cool school. Maybe the coolest school in the country. Only 600

kids. It was a privileged place because it was the most expensive college in the United States. I got a scholarship. I wouldn’t

have been able to go otherwise. But, it was $9,000. Of course, that’s 1970 dollars. Of course, that’s much higher in today’s

dollars. |

| 59. | What

was beautiful about it was because there were only 600 kids and so many people were applying for it, you had a lot of talented kids.

Everybody there had some special talent to them whether it was art or whether it was humanities or whether it was music or dance. People

were very serious about what were they were chasing. And, the student class size was very small. It averaged nine kids in a class, so

you got to know your professor. The professors were all practitioners. They weren’t just professors. They were people like Bill

who was a professional musician and teaching on the side. Or, Claude Fredericks who was a very profound author writing all the time,

and then teaching because it’s a nice thing to do. |

| 60. | And,

at some point my parents wanted me to go to Brown. My father went to Brown. My brother went to Brown medical school, and I was from Rhode

Island, and I kind of had to do the Brown thing. So, I gave into it. I did Brown. I couldn’t stand it. It’s a great school.

One of the best Ivy League schools in the world. It wasn’t for me because it had these large classes of 150 kids. People weren’t

really paying attention, and there wasn’t that interactivity with the teacher, and that just didn’t work for me. So, to answer

your question, I didn’t feel I was moving. I didn’t feel I was advancing. I didn’t feel I was progressing in life.

So, it was time to move on. |

| 61. | Josh

King: And, then you had that reunion of sorts with Professor Dixon in your apartment in New York. Before your success as an oil broker,

you were a 23-year-old in 1979 trying to figure out what might be next. You hadn’t had all this experience yet, and at the time

if our history is right, we had about fifty American diplomats held hostage in Tehran. I want to listen to then President Jimmy Carter

discuss the situation on Face the Nation of CBS News back then. |

| 62. | President

Jimmy Carter Audio: “What we’ve done since the very beginning is to try and protect the lives and safety of those hostages

from the original threats that they would be tried and executed. To build up on a worldwide basis support for our opposition, the condemnation

of Iran, and the calling on the Iranian government to protect those hostages and to release them. And, to have an adequate commitment

in our own nation’s military strength and otherwise to protect those hostages and to expedite their release”. |

| 63. | Josh

King: During Carter’s presidency, the crisis was driving up oil prices and had helped Exxon become the first American company

to report earnings in excess of a billion dollars. On a CBS News report at the time there was a graphic on one of those reports

that said “obscene profits”. How did those two words “obscene profits” influence you and your first venture into

the oil industry? |

| 64. | Brad

Jacobs: I remember very well because my goal was never to make a billion dollars. That wasn’t even in my mind. My goal was

to make $100,000. Interest rates were really high. Jimmy Carter brought this stagflation. |

| 65. | Josh

King: 19% or something like that. |

| 66. | Brad

Jacobs: Yeah. 18%, 19%. You could put it in a Bank of America CD which is what I did by the way. I figured, I’ll make $100,000.

I’ll put it in a Bank of America CD. I’ll make a little over a grand a month after taxes, and I’ll meditate and play

music and read and just have fun. Life will be fantastic. The only problem was I didn’t have a company. I didn’t have a business.

I didn’t have an industry. I had a business sense in my blood, but I didn’t know how I was going to apply that. |

| 67. | I

was watching the evening news and, on the screen, it was the first time that a company, Exxon (now ExxonMobil) made a billion dollars

profit in a quarter. And, the headline was “Obscene Profits”. And, I thought to myself “I could make some obscene profits.

$100,000 sounds like an obscene amount of money. Maybe I should get in the oil business”. And, it clicked right there. I got to

get in the oil business. |

| 68. | I

went to the library. There was no internet. And, I read every book I could find on what was then called the Seven Sisters, the big oil

companies. And, the history of the oil business. And, I tried to figure out what is upstream, what is downstream, what is processing,

what is shipping. Just how the whole thing worked. It was very, very fascinating. |

| 69. | I

found some other people who were doing oil brokering. And, oil brokering worked. I first wanted to do oil trading because I had read

an article where a man who ended up becoming my most important business mentor, Ludwig Jesselson, the chairman of Philipp Brothers. He

was featured in a big article I think in Business Week, and it described how they made money by knowing what’s going on

all around the globe. It had a photo of him with clocks from different time zones around the world, and the article explained that by

having a global network and collecting information of what’s going on (remember, before the internet) they could trade oil because

there was no way to have universal price discovery, but they would know what the real price and value was because they would know how

many buyers, how many sellers, how prices were changing, and how things were moving. I got that. I understood what that was. But, I didn’t

have enough money to go buy and sell big cargos of crude oil. Crude oil then was $20 to $50 million a cargo. Where was I going to get

that? I was 23-years old. |

| 70. | I

did run into people who were doing brokerage, and they explained to me how brokerage was like trading except instead of taking a position

you’re matching together a buyer and a seller and taking 5-cents or 10-cents a barrel as a commission. So, it’s $25,000–50,000

a pop. And, we started cranking out lots of those every day. Forget about saving $100,000. You can make $100,000 sometimes a week, and

then it mushroomed after that. |

| 71. | If

you had asked me back in those early days “When you’re 67-years old Brad, do you think you’ll still be in the business

world?”. I would have had a big belly laugh. I would have said “No way. I’m not going to waste my life making money.

I’m going to go out and do music and fun stuff and discover the purpose of life and the meaning of life and answer all the big

important questions that we want to answer”. But, one thing led to another, and I just started making a lot of money from one business

to another business. I just never stopped. I just kind of got on to this flow. |

| 72. | Josh

King: Get in this flow. One business to another business. The first two companies, Amerex Oil Associates and Hamilton Resources were

both in oil. Since then, you’ve ventured into waste management. We talked about it a little bit. Construction equipment rentals—we

talked about that. Truck brokerage and other industries. What is the alchemy of determining the next sector to target as you build your

next venture? Because you eventually have not gone off the track into answering the big questions of life or writing music and performing.

You’ve got into figuring out what the next thing is. So, how did it work for you after you saw the first “I want to get into

the oil business, and read all that stuff” to where we are now? |

| 73. | Brad

Jacobs: I’ve never abandoned music or trying to figure out the most important things in life, and how do you deal with life.

Those questions and those activities are very important to me, and I’ve never stopped doing that. But, I do it in my spare time,

and I multi-task while I’m doing business. I’m also thinking about meditation techniques, and I’m thinking about sound.

Those are all a part of my personality. |

| 74. | But,

after I got out of the oil business, the oil business was mainly an opportunity to have global organizations, whether it was brokerage

or trading, and use very rudimentary technology, but advanced for the time, to collect information about what’s going on, and then

capitalize on that. That was basically the basic edge that I had in the oil business for ten years. It was a great time to be in the

business. |

| 75. | After

that, if you look at my different companies, and just forget what industries they were, it’s the same business plan in every industry.

Every business plan whether it was waste, equipment rental, trucking, warehouse, truck brokerage, LTL—what did we do? We found

industries that had certain characteristics that we could capitalize on to create a lot of alpha. And, they were the same exact characteristics.

That’s the playbook, and of course I talk about that in How to Make a Few Billion Dollars. |

| 76. | Those

are things like the size of the industry. I’ve always gone to industries that have big swaths of GDP, big swaths of the economy

because if you’re going to create a large company, which I think you need to do. You need to scale up a company in order to create

significant alpha. You have to be in an industry that’s big enough. You’re not going to create a company that’s tens

of billions of dollars if the whole industry is tens of billions of dollars. You’re not going to get 100% market share. So, I looked

at the size of the industry. These were typically industries that were hundreds of billions of dollars. In some cases, depending how

you defined it, even trillions of dollars. |

| 77. | I

looked at industries that were growing. Just showing up on Monday every week there’s going to be a little more wind to our back,

and we’re going to grow a little bit more. We’re going to have a little price, a little volume. They’re good businesses.

They’re businesses that are genuine that there is a demand for. That there are customers who will wire money from their bank accounts

to yours if you do a good job and better than the competition. |

| 78. | I

looked at not just size, not just growth, but fragmentation. I tried to find industries that there were a lot of acquisition targets

where I could buy companies, and where I could buy companies at lower multiples of profit than I could reasonably assume we would trade

at as a public entity. |

| 79. | And,

then I looked at industries—I have a checklist. I go down the list and I say “Is this an industry where bigger is actually

better”? Most of the time bigger is better in most industries, but not always. I’ve looked at some industries where you become

big, and you’re more distant from the customer, and you lose sight of your cost and your customer service. Certain industries,

you’re better off having a small, local business, and that’s got an advantage over the big guy. But, that’s the exception.

But, I want to make sure any industry I go into that there are economies of scale. And, that we will have advantages to lower our cost

to serve, to elevate our level of service by being bigger. That’s another box I have to check. |

| 80. | And,

then I look at how can I apply technology. All of these companies—every single one that I’ve done, there’s been a big

element of using technology ahead of the other guy. Brokerage is a perfect example. I got into brokerage in 2011. The second guy I hired

was Mario Harik to be my CIO. He’s now CEO of XPO and doing an amazing job. And, the reason that the very second person I hired

was a technology guy was that was the vision. The vision was “Let’s take this industry of oil brokerage where people are

mainly talking on phones and automate it”. Now, fast-forward to today, the company we spun off that specializes in brokerage, RXO—97%

of their orders are either sourced or covered digitally, without human intervention. Eventually that will be close to 100% of everything.

That’s going to be all automated, so that vision was correct. We spotted the big trend. |

| 81. | That’s

the last thing I want to mention, which is there has to be a trend long-term that’s favorable. When I say long-term, let’s

call it ten years. That if you look at the industry and you say “What is this industry going to look like ten years from now”.

Your answer has to be “It’s going to be growing”. Today it’s an X-sized industry, in ten years it’s going

to be multiple-X-size. Are the margins going to get better, not worse? It’s not going to be disintermediated. It’s not going

to go into the metaverse. It’s not going to be done on a computer, it’s not going to be done in virtual land—it’s

still a real business. That’s my checklist. Many other things too, but those are the main things that I look for when I study an

industry. |

| 82. | Over

the last year I looked at over 500 companies, over dozens of industries, and I applied my checklist. Like, literally I have my checklist,

and I go over each industry, and I say “What’s the size? Is it big enough? What’s the growth rate? Does it grow fast

enough? Are there enough things to buy? Can you buy them at a lower multiple? When you integrate these things, will you have a better

company?”. I go down that same list I just went over, and then I found one that actually checked every single box. I said “Good.

I’m going to marry this industry. This is the girl I want to marry”. |

| 83. | Josh

King: And, we’re going to get to that future marriage in a couple of minutes, but I want to go to 2007 when you stepped down

from United Rentals in search of what the next big thing. That next big thing would not be until 2011 with XPO. But, you write about

this four-year gap between 2007 and 2011 with all the uncertainty that came with it. Within that span of course is the global financial

meltdown. What was that period of your life like prior to XPO, unsure of what the next big thing would be? |

| 84. | Brad

Jacobs: I forget if it’s 67 million years ago or 68 million years ago where there was this big meteor that crashed into the

earth, and at first obviously that was a bad thing because everything got burned up and killed, but it ended up being a tremendous growth

period after that for long periods of time. Fast-forward to today, we have this wonderful biodiversity that we’ve got. |

| 85. | That

was sort of for me that 67-million-years-ago event where I had been running a large company, and it was very successful, and then I wasn’t.

I’d stepped down, and I kind of was lost. It was the only time in my life that I was literally depressed. I was clinically depressed.

I’m a very sunny-side-of-the-mountain kind of guy, upbeat, glass half full generally. But, then I was not. I sunk into a serious

depression. I really lost my bearings which was the best thing that could have happened to me because I dealt with it, and I said “I’m

not going to go depressed for the rest of my life. I’m going to figure out a way to solve this. It’s a great problem to solve.

It’s a big problem, and it’s a problem that if I solve this, it’s fantastic because I can apply those skills to the

rest of my life activities”. |

| 86. | So,

I discovered lots of things to do. I discovered cognitive behavior therapy. I discovered The Beck Institute in Philadelphia. Aaron Beck

was alive then, and his daughter Judy Beck now runs that institute. And, I studied with them. I was fortunate and privileged to be on

their board of trustees for a while, board of directors for a while. And, I studied under Albert Ellis in New York here. Both of those

gentlemen have died a while ago. He also had tremendous insights into the human condition. How we think. How we as human beings think

so irrationally. We have so many cognitive biases. We have so many cognitive distortions. He identified a handful of them. Between Beck

and between Ellis, they identified probably about a dozen ways that is what you could call “stinking thinking” some people

say. You magnify problems way bigger than they really are. Exaggerate a crisis and catastrophize it and make it into this big, huge overwhelming

thing when it’s really not such a big deal. |

| 87. | Or,

you see things all or nothing thinking. It’s dichotomous. It’s black or white. Very few things are black and white. Most

things are gray. Or, most things you can change the color of them based on applying and processing. All kinds of self-downing thoughts.

We as human beings, we criticize ourselves all day long internally. We wear a mask. We don’t share that with everybody. We don’t

want to look weak. We don’t want to look vulnerable. We don’t want to look like we’re not perfect, but we’re

not perfect. And, we tend to amplify—almost everybody I know. There’re a few exceptions, but almost everybody I know if you

really get to know them, and confide with them, they have a lower self-worth than is actually true, and what other people think about

them. They may portray the opposite of that. They may seem so confident and almost even arrogant, but really when you probe, they don’t

like the way they look. They don’t like this defect. They don’t like the way they think. They feel they’re inferior

or defective in this way or that way. You have all this what I refer to as stinking thinking. |

| 88. | And,

through cognitive therapy, you pay attention to your, what they call automatic thoughts, and you identify them particularly when you’re

down. Why am I down? What thoughts did I just have that made me feel down? What caused that? So, you analyze your thoughts, and then

modify those thoughts to things that are either more true and accurate or if they are true and accurate, but they just aren’t good.

They’re true and they’re accurate. Reframe how you look at that. “Okay. Maybe I’m bald. I don’t want to

be bald”, or maybe “I’m chubby. I don’t want to be chubby”. Who cares? A lot of people are bald. A lot

of people are chubby. It’s not the end of the world. It doesn’t matter. It depends on the person. |

| 89. | So,

I learned a lot from cognitive therapy. How to pay attention to my thoughts, particularly the rotten ones, and how to deal with them.

They have a bunch of techniques, a bunch of tools. Like, when you have a problem that seems like a disaster, you say “Okay, look.

What’s the worst thing that could happen here. How am I going to cope with it?”. The second part is very important. What’s

the worst-case scenario, and how am I going to deal with it? When you do that with a problem in personal life or professional life, the

problem comes up to you and smacks you in the face. As Mike Tyson says “Everyone has a plan until you get smacked in the face”.

Then, you think “Okay. What’s the worst deal here, and how am I going to somehow make lemonade out of these lemons”? |

| 90. | Most

problems, if you go through that process, you’ll figure out a way to deal with it. You’ll also minimalize it. I studied NLP

(neuro-linguistic programming), and they have a technique where you visualize problems. You put it in an image, and then you minimize

them. You make them really, really tiny small. You can even take your finger and flick them away if you want. Tony Robbins uses a lot

of those techniques. I enjoyed learning those techniques. I never had the time to really study those, and find out masters of these little

techniques when I was a full-time CEO, and then I did have some time then, so I sought out a lot of those psychological gurus so to speak. |

| 91. | Josh

King: You write a lot about mergers and acquisitions. You have a whole chapter dedicated to it, and begin it by saying (I’m

going to quote you here) “Acquisitions are the best way I know of how to scale up fast and gain the advantages that come from a

large number of locations and greater market share”. Those first four years of XPO Brad, after that period that you did the introspection,

you did 17 acquisitions, but looked at about 2,000 prospects. Describe the process of determining how you sift through those thousands

of prospects, and arrive at the ones that make the most sense to bolt-on to the company? |

| 92. | Brad

Jacobs: I like to look at many, many, many acquisition opportunities at the same time. I want to have a plan A, B, C, and D. And,

I want to go aggressively at the same time on all fronts, so that I don’t feel any pressure to do any one specific deal. If I’m

only going to look at one deal at a time, I kind of fall in love with it, and I might lose my discipline. I might pay up too much, God

forbid because that’s a terrible thing. Or, I want to pay a fair price, but overpaying for an acquisition is a bad thing because

that’s on your balance sheet forever. That’s your IC in ROIC, and in business it’s all about ROIC. Of all the metrics

there are, return on invested capital is the mother of all metrics to measure how you’re doing as a business. So, the purchase

price is very, very important. |

| 93. | I

like to look at many, many companies, and I learn from every single one I look at. Every single company I’ve ever approached to

buy, and it’s thousands of them, it’s like getting a Harvard MBA. You can’t get this in business school. You just can’t

get it. It’s real-world insights into how you make money. I always ask these entrepreneurs, and I fall in love with these entrepreneurs

or these CEOs of companies. I just fall in love with them. |

| 94. | I’m

so impressed with entrepreneurs who’ve grown companies from small to big, and created value by doing that. And, I just want to

know “What are your secrets? How did you do this? Give me the whole story? Give me the history”. Of course, I relate to them

because I have a similar background to them. I want them to tell me all the great stuff that’s happened, and tell me all the crazy

stuff that happened because we all know a lot of crazy stuff happens when you’re in the business world and doing big stuff. All

kinds of stuff come out of left field, and I want to know all that. I really want to understand that. And, even if I don’t end

up buying the company because most companies I don’t end up buying, I benefit from that experience dramatically. I learn something

new every time I hear an entrepreneur, a successful leader. How they grew that business and what they value and what emphasis do they

put on. |

| 95. | Josh

King: Intercontinental Exchange (ICE) just completed its most recent acquisition. $11.9 billion for Black Knight in September, and

a priority since closing as it always is with us is integrating their employees into the ICE community. Through your experiences, how

do you ensure a smooth transition of people when making an acquisition? You’ve said some of your worst deals were with people that

you didn’t quite click with across the marketing table. |

| 96. | Brad

Jacobs: I’ll never do a deal with someone I don’t like because I’ve learned the hard way. When you’re in

the dating process of a deal, if it is going smoothly and there’s mutual respect and everyone is being constructive and trying

to figure out ways to find ways to meet in the middle and to understand the other side’s position. Understand what’s important

to the other side, and try and work around that. Much more often than not, it turns out to be a really good deal. There’s a correlation

to that. |

| 97. | I

find just the opposite as well. The converse. In other words when the dating process/the negotiation process has been rough, and disrespectful,

and just full of drama, there is a high correlation that later on that marriage/that acquisition is also not so great. There is a reason,

and I haven’t fully understood yet, but I do understand this: regardless of why, certainly there’s a correlation between

those difficult negotiated deals—deals that were negotiated in a difficult environment. A lot of times they don’t work out

later. |

| 98. | First

of all, I’m making a lot of these guys rich, so I like to have a little bit of respect because I am giving them millions of dollars.

And, I want to show them respect. I find that in a relationship, in business or in personal life for that matter, the most important

thing is mutual respect. Both parties have to respect the other, have to listen to the other, have to try to understand with empathy

what they value, what’s important. Both parties have to be committed to developing and culturing and nurturing a relationship.

And, if you have that basic framework, that intentionality and that mutual respect, you can get a lot done. |

| 99. | Josh

King: Talking about respect, that 2018 short report didn’t show you a lot of respect writing about XPO. XPO’s stock was

under attack, and the culprit as you put it was a capital management firm that specializes in hit jobs. The stock price went into freefall.

It went down 26% in a day. Disaster seemed at hand. How were you able to fight back in a way using the falling stock price to your advantage? |

| 100. | Brad

Jacobs: We bought back $2 billion of our stock because the stock had come down because of this crazy report, and it wasn’t

for fundamental reasons. Nothing changed in the business. The business was the same business it was when it was 26% higher the day before.

It came down just because of this weird thing out there. So, when that happens, when something is cheap, buy. It certainly was on sale,

and we ended up buying quite a large part of the company back, and so did some of our shareholders. Orbis bought a fortune of the stock,

ended up quadrupling their money. They made huge amounts of money. |

| 101. | There

is a hedge fund here called Spruce House that also bought I think almost a billion dollars of stock. Something in that neighborhood.

It was so gratifying a couple of years later when I got a letter over email from Spruce House saying “We’ve liquidated our

position. It’s been a tremendous ride. I want you to know we made $500 million on this trade. Not only did we, the owners make

20% of that, ($100 million), God bless them. God bless America. But, that other $400 million went to pension plans who had invested in

their hedge fund. To endowments of schools, to retirement funds of people— |

| 102. | Josh

King: Police, teachers. |

| 103. | Brad

Jacobs: Yeah. Everybody, just regular normal people. That’s a lot of money to be spreading around. That’s a lot of love

to be spreading around. |

| 104. | Josh

King: A lot of love. |

| 105. | Brad

Jacobs: I was very happy about that. |

| 106. | Josh

King: Hats off to Spruce House and everyone who saw the wisdom in getting in at that point. So, after that XPO under your leadership

has received so many accolades. The stock was named the seventh best performer in the Fortune 500 over the last decade. The company was

named the fastest growing in the Fortune 500. Forbes in 2017 and 2020 named XPO to one of America’s best large employers. That’s

a lot of success for one enterprise, yet Brad in 2021 and 2022 you decided to spin it out, spinning off GXO Logistics and RXO. Multiples,

multiples, multiples. What made it the right time to make this move and spin off these two companies from XPO Inc.? |

| 107. | Brad

Jacobs: It was very simple. We were trading at about 7.5x, sometimes 8x EBITDA. Our competitors were trading in the teens. So, we

dealt with that honestly and brutally. Why? We called all of our top-20 shareholders and said “What are we doing wrong here? We

have a great company. We have a great contract logistics business. The only pure play in the world. It’s the largest pure play.

It’s not the only one, but it’s the largest pure play. And it dominates e-commerce. It’s a tremendous organization.

We have a fantastic brokerage firm. It’s growing 3x the rate of the industry. We have a wonderful LTL business that we’ve

improved quite a bit since we bought it from Conway. Why are we getting this lousy multiple?”. |

| 108. | There

were two things that came back. One was people said “You have too much debt. You have like 4x leverage and that’s too much”.

We said “Okay”. I mean I always liked some amount of leverage because it juiced the returns for the common shareholders,

but there’s a limit. If you’re a private-equity-owned company, 4x leverage may be too low, but as a publicly traded company,

there were a lot of investors that said “We can only have so much. We look at it as risk. That if suddenly we go into geopolitical

event that causes a recession or a market downturn, that’s just too much leverage. We said “Okay. We need to bring down our

leverage”. |

| 109. | The

second thing they told us was “You’re too complicated. You’ve got a warehouse business. You have a trucking business.

You have an asset-trucking business. You have a non-asset trucking business. It’s just too complicated”. You have people

who want to invest in the industrial play, and they would want to buy your LTL stock, but they don’t want your warehouse stock.

They don’t want your consumer-base stock. And, people want to play in e-fulfillment debt. They want your warehouse business, your

supply chain business, but they don’t want the other stuff. So, we said okay. |

| 110. | People said “Why don’t you just sell this stuff

off”? I said “I don’t want to sell it because I think there’s a lot of value still we can create”. And,

we had a couple of banks come in, and they said “You ought to do spins”. I said “I’ve never done a spin, so let’s

get educated”. I brought Wachtell in. They’ve done a lot of spins, and they gave us all kinds of memos to read. We read them

all and studied them. We had some tutorials. We said “Okay. I get this. It’s going to be a lot of work. It’s going

to be a year’s worth of work, and it’s going to be a big distraction from running the business, but if we segregate the company

out into these pure plays, we’re probably going to get a much bigger multiple, particularly if we make them investment grade”.

We made two out of three investment grade, and the other one is lightly-leveraged, but not too much. A little over two times. |

| 111. | Fast-forward to today where we have completed those spins.

We trade in the low teens. So, we’ve improved the EBITDA, and we’ve improved the multiple we get on that EBITDA. And, in

the market that’s the two big things. What’s your profit and what multiple are you going to get on that profit? So, the spins

while are counter-intuitive for most CEOs because most CEOs are trying to grow the company, and go up the ranks of the Fortune 500 in

terms of the size, that was never really at all a factor us. |

| 112. | The main factor for us—the only factor for us, for

our investors was how do we get the share price up. How do we increase shareholder value? How do we make our investors a lot of money?

For that is a wonderful, satisfying feeling. There’s no greater feeling that I can think of, of when your stock doubles or triples

over a short period time, and you go and visit your top-20 shareholders, and people are standing up applauding you. It’s a great

feeling. It’s very, very gratifying that people had confidence in you, people believed in you, and you delivered. And, you delivered

in spades. So, that’s just a really great feeling. The spins were a way for us to deliver the value that we weren’t delivering. |

| 113. | Josh King: Well, keep creating as many spins as you

want just as long as they keep listed here at the New York Stock Exchange. We’ll have as many XOs as you can possibly muster. |

| 114. | Brad Jacobs: New York Stock Exchange has been very,

very kind to me. And, I’ve been up on that podium eleven times, and every single time is just a thrill. |

| 115. | Josh King: Before the break, Brad Jacobs and I were

discussing his rise in business from Amerex Oil to XPO Inc, and his new book How to Make a Few Billion Dollars out now from Greenleaf

Book Group Press. Brad, I think a lot about trash when I’m at our place upstate. One of my favorite past times is separating paper

from plastic from metal, and preparing everything in neat bags for the recycling before I head to the transfer station. But, that’s

not how it really works in the big city. Let’s start this half of the show off with a little digression into garbage. What neat

and tidy way did you see to make a few billion dollars in the messy business of waste management? |

| 116. | Brad Jacobs: The oil business I had a great run in

for a decade, but it was ending. I could see the trend ending because Bear Sterns and Morgan Stanley and some of the other banks got

into oil trading competing for much lower margins than we were. The Japanese sogo shosha are the big trading houses—the Mitsubishis,

the Marubenis, the Sojitz. They were getting into it again, so suddenly there were a lot of competitors willing to do business for much,

much lower margins. Okay, well I needed to find another industry. This was a great run. We did well, but it’s time to find something

else. |

| 117. | And, I read a research report. I had an account. It was called

the CMA account from Merrill Lynch. And, it was a report by a guy who ended up covering me, Bill Genco. And, it talked about how the

two big industry leaders in waste management, one called Waste Management, and the other one then called Browning-Ferris Industries (BFI)

were making about a half-a-billion dollars a year. And, I turned my then girlfriend now wife, and said “How hard can it be to pick

up someone’s trash, bury it in a hole, and send out an invoice”? Compared to all the very sophisticated things we’re

doing in oil trading which was a very complicated and difficult global business. I said “I’m pretty sure we could learn that

business pretty quickly and do it. If they’re making that kind of money, we could probably figure out a way to make that kind of

money too”. |

| 118. | So, I came to the United States, and I interviewed about

a hundred people from the leading waste management companies, and I asked everyone on the interview “If you were coming into this

industry and wanted to capitalize it at a few million dollars upfront, what would you do to make a lot of money? What would be your best

idea to make a big business plan”? As a result of all of those interviews, I came up with a business plan. |

| 119. | The business plan was not to go head-to-head with the big

guys in the urban areas or even the sub-urban areas, but go into the tertiary markets in the upper peninsula of Michigan or to the Appalachia

in West Virginia and Kentucky or rural Mississippi. Buy up all the landfill capacity we could get, and then go to the collection companies

that were hauling to those landfills, and buy as many of those up as possible, so we’d consolidate it and integrate it, and grow

the margins. And, we certainly did grow the margins, and we compounded our earnings at 55%, and not surprisingly we compounded our stock

price by 55% annually as well. So, it was a big hit. |

| 120. | Josh King: Now, fast-forward from then to where we

are today. GXO Logistics and RXO were company six and seven for you. Your eighth venture is QXO a building products distribution company.

Can you give our listeners an overview of what you’re trying to do and accomplish, and the problems you’re trying to solve

with the creation of QXO? |

| 121. | Brad Jacobs: I love this industry—building products

distribution. The reason I love this industry is it’s nearly identical in the characteristics of the other industries that I’ve

made a lot of money in, and it’s large. It’s $800 billion in size just in Western Europe and North America. It’s growing.

It’s growing at 7% annually. That’s a wonderful thing. You can make a lot of money in something that’s growing 7% annually

even before acquisitions, even before improving margins, even before applying best practices. If you’re just an average company,

just an average company, and the industry is growing at 7%. You can create some alpha there, but you can do all those extra things too. |

| 122. | It’s fragmented. It’s $800 billion. The biggest

guy is $30 billion, $40 billion. There’s no big company with huge market share in this space. Lots of opportunities to do acquisitions.

There’re 7,000 distributors here in the United States or North America if you include Canada. There’s 13,000 in Europe. There’re

20,000 relatively small companies out there competing. It reminds me of equipment rental quite a bit. It reminds me of the waste industry

quite a bit. It was very, very fragmented when I got into it. It wasn’t when I finished, but it was when I started. It’s

an industry where bigger is definitely better. When you look down the P&L, one of the biggest costs is procurement. You’re

buying stuff wholesale, and you’re selling it retail. I’m simplifying the business, but at the core that’s a big part

of the business. |

| 123. | Josh King: We’re talking windows, we’re

talking doors. |

| 124. | Brad Jacobs: Lumber—anything that goes in a

house. Anything that goes in a commercial building. Anything that goes in infrastructure around the country. These are building products

that are not going into the internet. They aren’t going to be done in the metaverse. Ten or twenty years from now, I think it’s

a safe bet that you and I are going to go home to a real house with a real bed with a real bathroom with a real shower with a real kitchen

and that’s reality of what’s going to be. There might be other realities going on virtual, but that reality is still going

to be there. |

| 125. | Again, one of the important things that I had on my checklist

that I have to check for. There’s an opportunity to use technology to improve it because this industry there’s maybe a handful

of companies that are actually doing some pretty cool stuff with technology, although they have a long way to go. But, still they’ve

made a really good beginning. |

| 126. | The vast majority of companies are not using technology for

pricing, for procurement, for warehouse management, for inventory management, for e-commerce, for connections with the customer. They’re

not doing route planning. They’re just not really using technology. They’re doing it all old-fashioned kind of like the way

the transportation industry was 15 years ago. Kind of like the way garbage business was thirty years ago. So, a big opportunity to be

tech forward and to apply technology to improve it. |

| 127. | So, it’s an industry that attracts me a lot because

I feel very familiar with it. I feel very familiar with it because of its characteristics, its traits. I also feel very familiar with

it because a lot of the customers are similar customers to who I’ve had over the years. A lot of these same customers are LTL customers

at XPO. A lot of these customers are United Rentals’ customers, except instead of renting, they’re buying here. I feel at

home in this industry. |

| 128. | Josh King: You titled a sub-chapter in your book AI

is the Mothership of the Future. When we had one of the people that you talked about earlier, CEO Malcolm Wilson on for episode 314

of Inside the ICE House back in 2022, I asked Malcolm how he’s deploying artificial intelligence within GXO. I want to hear

a little bit of his answer. |

| 129. | Malcolm Wilson Audio: “In the actual warehouse

it’s just a huge variety of tech. Pretty cool tech that we’re using, and mainly I have to say it’s kind of the collaborative

robots. It’s close-to-person robots. It’s robotic arms. These machines do the different workstreams that we’re asking

and putting in. It can be de-consolidating. It can be packing. All kind of manner of different activities, but they do it very accurately,

very efficiently, and it’s one of the ways in which we’re able to move relatively big volumes through the warehouse very

productively”. |

| 130. | Josh King: Malcolm mentions using robots in the collaborative

approach alongside the human employee. Is that the type of artificial intelligence you see being implemented throughout your companies,

and how has its presence impacted your current and future pursuits at QXO? |

| 131. | Brad Jacobs: Technology is on two levels—software

and hardware. A lot of what Malcolm was talking about there is the hardware. It’s robots. We call them co-bots. They’re collaborative

robots that are doing picking and packing or assisting the pickers to do picking and packing. |

| 132. | There’s also including in the warehouse business a

WMS system, a warehouse management system that uses AI to do inventory management, and to figure out using predictive analytics what’s

the right volumes to be storing here for the customers. You’re saving the customer money. They’re not storing too much of

stuff and tying up working capital, but they’re storing enough so they can fulfill their customer’s demands in a timely way.

So, there is both components there, but when I was hearing Malcolm’s voice that you just played, first of all it’s heartwarming.

I love Malcolm. |

| 133. | Josh King: We all love Malcolm. |

| 134. | Brad Jacobs: I saw him last night at the book signing.

It was great to see him. And, you hear his south English accent. Is it south or north? I don’t know. A strong English accent. It

just illustrates so clearly. The three guys I had succeed me when we divided the company up—Malcolm running GXO, the warehouse

business. Mario running LTL, and Drew running RXO, the brokerage business. |

| 135. | On a superficial level these guys couldn’t be more

different. You heard Malcolm’s accent. Drew comes from South Carolina and sounds like he’s from South Carolina. You have

to translate some of the words sometimes. Deep southern accent. Mario has this charming Lebanese accent, that’s sort of French.

It’s just really a beautiful accent. They’re all different heights. Drew is like six foot three or something like that. Mario

is short. And, their backgrounds and education levels—Drew is always proud about how he went to a school that wasn’t high-ranked

even though he did very well. Mario went to MIT and got a master’s degree in machine learning or something like that. |

| 136. | They’re all very different demographics. Very, very

different demographics. However, at core these guys are identical. These are exactly the kind of people I like to hire. These are the

guys who have the traits that I look for when I’m putting together what’s very, very important—a superstar team. A

team of A+ players. For me that’s the most important element for how to make a few billion dollars, to go back to the book. It’s

to get a team of superstars. |

| 137. | And, as I write in the book, that means they have to have

four traits that that they have to score an A+ on. They’ve got to be super smart. They’ve got to be completely honest. And,

when I say completely honest—completely honest. They’ve got to be hard working. Fire in the belly. Hair on fire. Really want

to work. Really passionate. Real strong desire to win, but win fairly. Competitive, but a sense of pride about how they win. And—and

this fourth one is equally important to the other three—if you have the other three but not this fourth one, it’s a no go.

They’ve got to be collegial. They’ve got to be collaborative. They’ve got to play well in the sandbox. They’ve

got to get along with each other. |

| 138. | You’ve got to create a team, going back to what we

talked about at the top of the hour. We talked about creating a super organism. Just like an ant colony, or a beehive, or a human body.

Where it’s all one organism that’s made up of micro-organisms, but it becomes one super organism that takes on the world

to win and succeed. And, for that you have to collegial people. They can’t just be smart. They can’t just be honest. They

can’t just have a high work ethic. They’ve got to work together as a team. We always say over and over again the cliché

“Teamwork makes the dream work”. We repeat it pretty much every day. Sometimes multiple times a day. If you can get a team

of people who are really smart, really hardworking, really honest, and they all get along with each other. They respect each other. They

love each other. They really look forward to working with each other every day. Man, that’s how you make billions of dollars. |

| 139. | Josh King: With Malcolm, Mario, and Drew you talked

about the positive attributes needed to build the team, but as we begin to wrap up there are a couple of specific lessons in your book

I wanted to discuss. One of which deals with effective leadership. Not what makes someone great necessarily, but obstacles to their success.

What are the three impediments to effective leadership that you write about, and how could they get heads of industry back when they

are trying to achieve their goals? |

| 140. | Brad Jacobs: They all boil down to one effectively.

At root it’s taking yourself to seriously and getting arrogant. This is the worst thing that can happen to a business leader. Even

if they’ve had a great run for ten, twenty, thirty years, or however many years. If they start thinking that they’re invincible.

If they start thinking that they’re the cat’s meow, they’re not. I’m not. No other CEO I know is. We all have

things that are great, and we all have things we need to work on. If you start blinding yourself to that balanced view of yourself, you

will fail. You will fail to detect threats to the business. You will take yourself to seriously. |

| 141. | I’ve seen this so many times in so many industries

where a company is doing well. They get arrogant. They think they’re entitled to be at the top of the mountain forever, and they

get a little fat, old, and dumb and they let someone who is hungrier come in and chip away at them, and they suddenly are taking market

share and taking a rug out from under them, and suddenly they’re not king of the mountain anymore. Some new upstarts come in whose

got more fire in the belly than they have and has found a new way to approach the market. So, arrogance—hubris is the enemy of

success in business. You can say that in life too. In relationships. What’s worse than a relationship with someone who is selfish? |

| 142. | Josh King: A lot of books feature three to four blurb

paragraphs at the back-cover jacket. How to Make a Few Billion Dollars has, and I counted them Brad, 36 one-sentence blurbs including

one from NYSE’s president Lynn Martin, and a lot of CEOs who are listed here at the NYSE. Before you even get to the title page,

you’ve made a lot of investors a lot of money over the years. Is this the chorus of the Brad Jacobs’ admiration society? |

| 143. | Brad Jacobs: I’m admirers of them. All the people

that I asked to endorse the book were people who I admire. I admire Fred Smith. I think Fred Smith, the chairman of FedEx is the most

consequential person in the transportation industry since Henry Ford. There’s nobody that’s had a bigger idea than Fred,

and then actually materialized it and created this global behemoth. FedEx is just amazing. |

| 144. | Mike Moritz—way above my level in every way you can

possibly measure. This is the guy who ran Sequoia Capital for a number of years now. He’s senior advisor to Sequoia Heritage which

runs the money of Sequoia Partners and plus other institutional investors. He’s the master of taking small amounts of money and

turning it into gargantuan amounts of money. I mean, he put in something like $10 or $12 million into Google, and it became worth $10

or $15 billion. He got into PayPal. He got into Sun Microsystems. He got into Netscape. The people who endorsed my book are people who