0000852772false00008527722024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) February 13, 2024

DENNY’S CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 0-18051 | 13-3487402 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

203 East Main Street

Spartanburg, South Carolina 29319-0001

(Address of principal executive offices)

(Zip Code)

(864) 597-8000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

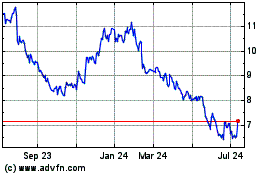

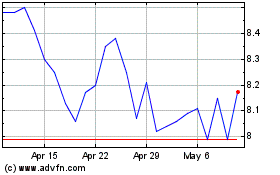

| $.01 Par Value, Common Stock | | DENN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 13, 2024, Denny's Corporation (the "Company") issued a press release announcing financial results for the fourth quarter and year ended December 27, 2023. A copy of the press release is attached as Exhibit 99.1 hereto and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The management of the Company will conduct meetings with members of the investment community during February and March 2024. A copy of the investor presentation to be used during these meetings is attached to this Current Report on Form 8-K as Exhibit 99.2 and is also available at the Company's investor relations website at investor.dennys.com.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. The information in this Item 7.01 of this Current Report on Form 8-K shall not be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

See the Exhibit Index below, which is incorporated by reference herein.

EXHIBIT INDEX

| | | | | |

Exhibit

number | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Denny's Corporation |

| | |

| | |

| Date: February 13, 2024 | /s/ Robert P. Verostek |

| | Robert P. Verostek |

| | Executive Vice President and |

| | Chief Financial Officer |

DENNY’S CORPORATION REPORTS RESULTS FOR FOURTH QUARTER AND FULL YEAR 2023

SPARTANBURG, S.C., February 13, 2024 - Denny’s Corporation (the "Company") (NASDAQ: DENN), owner and operator of Denny's Inc. ("Denny's") and Keke's Inc. ("Keke's") today reported results for its fourth quarter and full year ended December 27, 2023 and provided a business update on the Company’s operations.

Kelli Valade, Chief Executive Officer, stated, "We were pleased to close out 2023 with solid Denny’s domestic system-wide same-restaurant sales** of 1.3% in the fourth quarter, reflecting sequential improvement throughout the quarter, while also achieving results above the high-end of our previously guided range for the full year. We enter 2024 with growing momentum by focusing on our key strategic levers: a best-in-class breakfast with craveable items, an unbeatable value proposition, and convenience in the form of off-premises options.”

Fourth Quarter 2023 Highlights

•Total operating revenue was $115.4 million compared to $120.8 million in the prior year quarter.

•Denny's domestic system-wide same-restaurant sales** were 1.3% compared to the equivalent fiscal period in 2022, including 1.5% at domestic franchised restaurants and (1.2)% at company restaurants.

•Opened nine franchised restaurants, including one international Denny's location and two Keke's locations.

•Completed five Denny's franchised restaurant remodels.

•Operating income was $7.7 million compared to $17.6 million in the prior year quarter.

•Franchise Operating Margin* was $31.5 million, or 51.4% of franchise and license revenue, and Company Restaurant Operating Margin* was $5.4 million, or 10.0% of company restaurant sales.

•Net income was $2.9 million, or $0.05 per diluted share.

•Adjusted Net Income* and Adjusted Net Income Per Share* were $7.8 million and $0.14, respectively.

•Adjusted EBITDA* was $18.6 million.

•Cash provided by (used in) operating, investing, and financing activities was $21.4 million, ($4.5) million, and ($12.9) million, respectively.

•Adjusted Free Cash Flow* was $7.4 million.

•Repurchased $16.2 million of common stock.

Full Year 2023 Highlights

•Total operating revenue was $463.9 million compared to $456.4 million in the prior year.

•Denny's domestic system-wide same-restaurant sales** were 3.6% compared to the equivalent fiscal period in 2022, including 3.6% at domestic franchised restaurants and 2.7% at company restaurants.

•Opened 32 franchised restaurants, including 11 international Denny's locations and 4 Keke's locations.

•Completed 22 Denny's remodels including 21 franchised restaurants.

•Operating income was $52.8 million compared to $60.6 million in the prior year.

•Franchise Operating Margin* was $125.9 million, or 50.7% of franchise and license revenue, and Company Restaurant Operating Margin* was $27.9 million, or 13.0% of company restaurant sales.

•Net income was $19.9 million, or $0.35 per diluted share.

•Adjusted Net Income* and Adjusted Net Income Per Share* were $32.9 million and $0.59, respectively.

•Adjusted EBITDA* was $81.5 million.

•Cash provided by (used in) operating, investing, and financing activities was $72.1 million, ($7.6) million, and ($63.2) million, respectively.

•Adjusted Free Cash Flow* was $44.7 million.

•Repurchased $52.1 million of common stock.

Fourth Quarter 2023 Results

Total operating revenue was $115.4 million compared to $120.8 million in the prior year quarter.

Franchise and license revenue was $61.3 million compared to $66.5 million in the prior year quarter. This change was primarily driven by a $5.3 million decrease in initial and other fees associated with the sale of kitchen equipment in the prior year quarter.

Company restaurant sales were $54.0 million compared to $54.4 million in the prior year quarter.

Franchise Operating Margin* was $31.5 million, or 51.4% of franchise and license revenue, compared to $31.6 million, or 47.6%, in the prior year quarter. The favorable change in margin rate resulted from the completion of our kitchen modernization rollout during 2023.

Company Restaurant Operating Margin* was $5.4 million, or 10.0% of company restaurant sales, compared to $6.8 million, or 12.6%, in the prior year quarter. This margin change was primarily due to $1.8 million in legal costs in the current quarter partially offset by improvements in product costs compared to the prior year quarter.

Total general and administrative expenses were $19.3 million, compared to $17.0 million in the prior year quarter. This change was primarily due to increases in corporate administration expense, deferred compensation valuation adjustments and performance-based incentive compensation, partially offset by a reduction in stock-based compensation.

The provision for income taxes was $1.7 million, reflecting an effective tax rate of 36.9% for the quarter. Approximately $2.7 million in cash taxes were paid during the quarter.

Net income was $2.9 million, or $0.05 per diluted share, compared to $12.8 million, or $0.22 per diluted share, in the prior year quarter. This change in net income was primarily due to a $6.7 million impairment loss in the current quarter and $2.3 million of gains related to dedesignated interest rate swap valuation adjustments in the prior year quarter. Adjusted Net Income* per share was $0.14 compared to $0.18 in the prior year quarter.

The Company ended the quarter with $266.0 million of total debt outstanding, including $255.5 million of borrowings under its credit facility.

Adjusted Free Cash Flow* and Capital Allocation

Adjusted Free Cash Flow* in the quarter was $7.4 million after investing $4.5 million in cash capital expenditures, including facilities maintenance.

During the quarter, the Company allocated $16.2 million to share repurchases resulting in approximately $100.4 million remaining under its existing repurchase authorization.

Business Outlook

The following full year 2024 expectations reflect management's expectations that the current consumer and economic environment will not change materially.

•Denny's domestic system-wide same-restaurant sales** between 0% and 3%

•Consolidated restaurant openings of 40 to 50, including 12 to 16 new Keke's restaurants , with a consolidated net decline of 10 to 20.

•Commodity inflation between 0% and 2%.

•Labor inflation between 4% and 5%.

•Total general and administrative expenses between $83 million and $86 million , including approximately $12 million related to share-based compensation expense which does not impact Adjusted EBITDA*.

•Adjusted EBITDA* between $85 million and $89 million.

* Please refer to the Reconciliation of Net Income and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the Reconciliation of Operating Income to Non-GAAP Financial Measures included in the tables below. The Company is not able to reconcile the forward-looking non-GAAP estimate set forth above to its most directly comparable U.S. generally accepted accounting principles (GAAP) estimates without unreasonable efforts because it is unable to predict, forecast or determine the probable significance of the items impacting these estimates, including gains, losses and other charges, with a reasonable degree of accuracy. Accordingly, the most directly comparable forward-looking GAAP estimate is not provided.

** Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company's results as reported under GAAP.

Conference Call and Webcast Information

The Company will provide further commentary on the results for the fourth quarter ended December 27, 2023 on its quarterly investor conference call today, Tuesday, February 13, 2024 at 4:30 p.m. Eastern Time. Interested parties are invited to listen to a live broadcast of the conference call accessible through the Company's investor relations website at investor.dennys.com.

About Denny's Corporation

Denny’s Corporation is one of America’s largest full-service restaurant chains based on number of restaurants. As of December 27, 2023, the Company consisted of 1,631 restaurants, 1,558 of which were franchised and licensed restaurants and 73 of which were company operated.

Denny's Corporation consists of the Denny’s brand and the Keke’s brand. As of December 27, 2023, the Denny's brand consisted of 1,573 global restaurants, 1,508 of which were franchised and licensed restaurants and 65 of which were company operated. As of December 27, 2023, the Keke's brand consisted of 58 restaurants, 50 of which were franchised restaurants and 8 of which were company operated.

For further information on Denny's Corporation, including news releases, links to SEC filings, and other financial information, please visit investor.dennys.com.

Cautionary Language Regarding Forward-Looking Statements

The Company urges caution in considering its current trends and any outlook on earnings disclosed in this press release. In addition, certain matters discussed in this release may constitute forward-looking statements. These forward-looking statements, which reflect management's best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, "will", and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date of this release or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: economic, public health and political conditions that impact consumer confidence and spending, commodity and labor inflation; the ability to effectively staff restaurants and support personnel; the Company's ability to maintain adequate levels of liquidity for its cash needs, including debt obligations, payment of dividends, planned share repurchases and capital expenditures as well as the ability of its customers, suppliers, franchisees and lenders to access sources of liquidity to provide for their own cash needs; competitive pressures from within the restaurant industry; the Company's ability to integrate and derive the expected benefits from its acquisition of Keke's Breakfast Cafe; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment and geopolitical events (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 28, 2022 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K).

Investor Contact: 877-784-7167

Media Contact: 864-597-8005

| | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

| Consolidated Balance Sheets |

| (Unaudited) |

| | | | | | |

| ($ in thousands) | 12/27/23 | | 12/28/22 |

| Assets | | | |

| Current assets | | | |

| | Cash and cash equivalents | $ | 4,893 | | | $ | 3,523 | |

| | Investments | 1,281 | | | 1,746 | |

| | Receivables, net | 21,391 | | | 25,576 | |

| | Inventories | 2,175 | | | 5,538 | |

| | Assets held for sale | 1,455 | | | 1,403 | |

| | Prepaid and other current assets | 12,855 | | | 12,529 | |

| | | Total current assets | 44,050 | | | 50,315 | |

| Property, net | 93,494 | | | 94,469 | |

| Finance lease right-of-use assets, net | 6,098 | | | 6,499 | |

| Operating lease right-of-use assets, net | 116,795 | | | 126,065 | |

| Goodwill | 65,908 | | | 72,740 | |

| Intangible assets, net | 93,428 | | | 95,034 | |

| Deferred financing costs, net | 1,702 | | | 2,337 | |

| | | | |

| Other noncurrent assets | 43,343 | | | 50,876 | |

| | | Total assets | $ | 464,818 | | | $ | 498,335 | |

| | | | | | |

| Liabilities | | | |

| Current liabilities | | | |

| | | | | |

| | Current finance lease liabilities | $ | 1,383 | | | $ | 1,683 | |

| | Current operating lease liabilities | 14,779 | | | 15,310 | |

| | Accounts payable | 24,070 | | | 19,896 | |

| | Other current liabilities | 63,068 | | | 56,762 | |

| | | Total current liabilities | 103,300 | | | 93,651 | |

| Long-term liabilities | | | |

| | Long-term debt | 255,500 | | | 261,500 | |

| | Noncurrent finance lease liabilities | 9,150 | | | 9,555 | |

| | Noncurrent operating lease liabilities | 114,451 | | | 123,404 | |

| | Liability for insurance claims, less current portion | 6,929 | | | 7,324 | |

| | Deferred income taxes, net | 6,582 | | | 7,419 | |

| | Other noncurrent liabilities | 31,592 | | | 32,598 | |

| | | Total long-term liabilities | 424,204 | | | 441,800 | |

| | | Total liabilities | 527,504 | | | 535,451 | |

| | | | | | |

| Shareholders' deficit | | | |

| | Common stock | 529 | | | 650 | |

| | Paid-in capital | 6,688 | | | 142,136 | |

| | Deficit | (21,784) | | | (41,729) | |

| | Accumulated other comprehensive loss, net | (41,659) | | | (42,697) | |

| | Treasury stock | (6,460) | | | (95,476) | |

| | | Total shareholders' deficit | (62,686) | | | (37,116) | |

| | | Total liabilities and shareholders' deficit | $ | 464,818 | | | $ | 498,335 | |

| | | | | | |

| Debt Balances |

| Credit facility revolver due 2026 | $ | 255,500 | | | $ | 261,500 | |

| Finance lease liabilities | 10,533 | | | 11,238 | |

| | Total debt | $ | 266,033 | | | $ | 272,738 | |

| | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

Condensed Consolidated Statements of Income |

| (Unaudited) |

| | | | | |

| | | Quarter Ended |

| ($ in thousands, except per share amounts) | 12/27/23 | | 12/28/22 |

| Revenue: | | | |

| Company restaurant sales | $ | 54,046 | | | $ | 54,399 | |

| Franchise and license revenue | 61,307 | | | 66,450 | |

| | Total operating revenue | 115,353 | | | 120,849 | |

| Costs of company restaurant sales, excluding depreciation and amortization | 48,646 | | | 47,554 | |

| Costs of franchise and license revenue, excluding depreciation and amortization | 29,795 | | | 34,814 | |

| General and administrative expenses | 19,255 | | | 16,985 | |

| Depreciation and amortization | 3,507 | | | 3,810 | |

| Goodwill impairment charges | 6,363 | | | — | |

| Operating (gains), losses and other charges, net | 63 | | | 46 | |

| | Total operating costs and expenses, net | 107,629 | | | 103,209 | |

| Operating income | 7,724 | | | 17,640 | |

| Interest expense, net | 4,309 | | | 4,240 | |

| Other nonoperating income, net | (1,182) | | | (2,714) | |

| Income before income taxes | 4,597 | | | 16,114 | |

| Provision for income taxes | 1,695 | | | 3,343 | |

| Net income | $ | 2,902 | | | $ | 12,771 | |

| | | | | |

| Net income per share - basic | $ | 0.05 | | | $ | 0.22 | |

| Net income per share - diluted | $ | 0.05 | | | $ | 0.22 | |

| | | | | |

| Basic weighted average shares outstanding | 53,648 | | | 58,406 | |

| Diluted weighted average shares outstanding | 53,893 | | | 58,480 | |

| | | | | |

| Comprehensive income (loss) | $ | (10,997) | | | $ | 13,377 | |

| | | |

| General and Administrative Expenses | |

| Corporate administrative expenses | $ | 16,420 | | | $ | 13,812 | |

| Share-based compensation | 403 | | | 1,933 | |

| Incentive compensation | 1,305 | | | 866 | |

| Deferred compensation valuation adjustments | 1,127 | | | 374 | |

| | Total general and administrative expenses | $ | 19,255 | | | $ | 16,985 | |

| | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

Condensed Consolidated Statements of Income |

| (Unaudited) |

| | | | | |

| | | Fiscal Year Ended |

| ($ in thousands, except per share amounts) | 12/27/23 | | 12/28/22 |

| Revenue: | | | |

| Company restaurant sales | $ | 215,532 | | | $ | 199,753 | |

| Franchise and license revenue | 248,390 | | | 256,676 | |

| | Total operating revenue | 463,922 | | | 456,429 | |

| Costs of company restaurant sales, excluding depreciation and amortization | 187,599 | | | 179,458 | |

| Costs of franchise and license revenue, excluding depreciation and amortization | 122,452 | | | 135,327 | |

| General and administrative expenses | 77,770 | | | 67,173 | |

| Depreciation and amortization | 14,385 | | | 14,862 | |

| Goodwill impairment charges | 6,363 | | | — | |

| Operating (gains), losses and other charges, net | 2,530 | | | (1,005) | |

| | Total operating costs and expenses, net | 411,099 | | | 395,815 | |

| Operating income | 52,823 | | | 60,614 | |

| Interest expense, net | 17,597 | | | 13,769 | |

| Other nonoperating expense (income), net | 8,288 | | | (52,585) | |

| Income before income taxes | 26,938 | | | 99,430 | |

| Provision for income taxes | 6,993 | | | 24,718 | |

| Net income | $ | 19,945 | | | $ | 74,712 | |

| | | | | |

| Net income per share - basic | $ | 0.36 | | | $ | 1.23 | |

| Net income per share - diluted | $ | 0.35 | | | $ | 1.23 | |

| | | | | |

| Basic weighted average shares outstanding | 55,984 | | | 60,771 | |

| Diluted weighted average shares outstanding | 56,196 | | | 60,879 | |

| | | | | |

| Comprehensive income | $ | 20,983 | | | $ | 86,485 | |

| | | |

| General and Administrative Expenses | |

| Corporate administrative expenses | $ | 60,339 | | | $ | 52,115 | |

| Share-based compensation | 8,880 | | | 11,400 | |

| Incentive compensation | 6,640 | | | 5,811 | |

| Deferred compensation valuation adjustments | 1,911 | | | (2,153) | |

| | Total general and administrative expenses | $ | 77,770 | | | $ | 67,173 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

| Reconciliation of Net Income and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures |

| (Unaudited) |

The Company believes that, in addition to GAAP measures, certain non-GAAP financial measures are appropriate indicators to assist in the evaluation of operating performance and liquidity on a period-to-period basis. The Company uses Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. Adjusted EBITDA is also used in the calculation of financial covenant ratios in accordance with the Company’s credit facility. Adjusted Free Cash Flow is also used as a non-GAAP liquidity measure by Management to assess the Company’s ability to generate cash and plan for future operating and capital actions. Management believes that the presentation of Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income Per Share and Adjusted Free Cash Flow provide useful information to investors and analysts about the Company’s operating results, financial condition or cash flows. However, each of these non-GAAP financial measures should be considered as a supplement to, not a substitute for, operating income, net income, net income per share, net cash provided by operating activities, or other financial performance and liquidity measures prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Fiscal Year Ended |

| ($ in thousands) | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 |

| Net income | $ | 2,902 | | | $ | 12,771 | | | $ | 19,945 | | | $ | 74,712 | |

| Provision for income taxes | 1,695 | | | 3,343 | | | 6,993 | | | 24,718 | |

| Goodwill impairment charges | 6,363 | | | — | | | 6,363 | | | — | |

Operating (gains), losses and other charges, net | 63 | | | 46 | | | 2,530 | | | (1,005) | |

| Other nonoperating (income) expense, net | (1,182) | | | (2,714) | | | 8,288 | | | (52,585) | |

| Share-based compensation expense | 403 | | | 1,933 | | | 8,880 | | | 11,400 | |

| Deferred compensation plan valuation adjustments | 1,127 | | | 374 | | | 1,911 | | | (2,153) | |

| Interest expense, net | 4,309 | | | 4,240 | | | 17,597 | | | 13,769 | |

| Depreciation and amortization | 3,507 | | | 3,810 | | | 14,385 | | | 14,862 | |

Cash payments for restructuring charges and exit costs | (626) | | | (402) | | | (2,291) | | | (1,067) | |

Cash payments for share-based compensation | — | | | — | | | (3,131) | | | (5,147) | |

| Adjusted EBITDA | $ | 18,561 | | | $ | 23,401 | | | $ | 81,470 | | | $ | 77,504 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

Reconciliation of Net Income and Net Cash Provided by Operating Activities

to Non-GAAP Financial Measures (Continued) |

| (Unaudited) |

| Quarter Ended | | Fiscal Year Ended |

| ($ in thousands) | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 |

| Net cash provided by operating activities | $ | 21,357 | | | $ | 14,502 | | | $ | 72,125 | | | $ | 39,452 | |

| Capital expenditures | (4,479) | | | (1,698) | | | (9,978) | | | (11,844) | |

Acquisition of real estate and restaurant(1) | — | | | — | | | (1,227) | | | (750) | |

| Cash payments for restructuring charges and exit costs | (626) | | | (402) | | | (2,291) | | | (1,067) | |

| Cash payments for share-based compensation | — | | | — | | | (3,131) | | | (5,147) | |

| Deferred compensation plan valuation adjustments | 1,127 | | | 374 | | | 1,911 | | | (2,153) | |

| Other nonoperating expense (income), net | (1,182) | | | (2,714) | | | 8,288 | | | (52,585) | |

| Gains (losses) on investments | 26 | | | (16) | | | 85 | | | (305) | |

| Gains (losses) on early termination of debt and leases | (17) | | | 8 | | | (17) | | | 37 | |

| Amortization of deferred financing costs | (159) | | | (159) | | | (635) | | | (634) | |

| Gains (losses) and amortization on interest rate swap derivatives, net | (121) | | | 2,311 | | | (10,959) | | | 54,989 | |

| Interest expense, net | 4,309 | | | 4,240 | | | 17,597 | | | 13,769 | |

Cash interest expense, net (2) | (4,028) | | | (3,925) | | | (16,420) | | | (14,923) | |

| Deferred income tax benefit (expense) | 2,072 | | | 937 | | | 1,703 | | | (14,732) | |

| Increase in tax valuation allowance | (205) | | | (546) | | | (205) | | | (546) | |

| Provision for income taxes | 1,695 | | | 3,343 | | | 6,993 | | | 24,718 | |

| Income taxes paid, net | (2,664) | | | (3,135) | | | (9,195) | | | (9,296) | |

| Changes in operating assets and liabilities, excluding acquisitions and dispositions | | | | | | | |

| Receivables | 4,331 | | | 1,104 | | | (3,904) | | | 5,892 | |

| Inventories | (178) | | | (3,406) | | | (3,362) | | | 460 | |

| Other current assets | 1,037 | | | 2,821 | | | 325 | | | 1,138 | |

| Other noncurrent assets | 1,607 | | | 5,318 | | | 2,509 | | | 2,129 | |

| Operating lease assets and liabilities | 149 | | | 136 | | | 628 | | | 696 | |

| Accounts payable | (11,111) | | | (7,033) | | | (4,032) | | | (3,918) | |

| Other accrued liabilities | (4,675) | | | 5,315 | | | (3,356) | | | 8,798 | |

| Other noncurrent liabilities | (875) | | | (2,732) | | | 1,198 | | | 6,513 | |

| Adjusted Free Cash Flow | $ | 7,390 | | | $ | 14,643 | | | $ | 44,650 | | | $ | 40,691 | |

| | | | | | | |

| | | | | |

| (1) | For the year-to-date period ended December 27, 2023, amount includes cash paid for the acquisition of a piece of real estate. For the year-to-date period ended December 28, 2022, amount includes cash paid for the acquisition of a Denny's franchise restaurant and excludes cash paid for the acquisition of Keke's. |

| (2) | Includes cash interest income, net for the quarter and year-to-date period ended December 27, 2023, and cash receipts of $0.2 million for dedesignated interest rate swap derivatives for the year-to-date period ended December 27, 2023. Includes cash interest expense (income), net and cash (receipts) payments of $(0.1) million and $1.8 million for dedesignated interest rate swap derivatives for the quarter and year-to-date period ended December 28, 2022, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

Reconciliation of Net Income and Net Cash Provided by Operating Activities

to Non-GAAP Financial Measures (Continued) |

| (Unaudited) |

| Quarter Ended | | Fiscal Year Ended |

| ($ in thousands, except per share amounts) | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 |

| Adjusted EBITDA | $ | 18,561 | | | $ | 23,401 | | | $ | 81,470 | | | $ | 77,504 | |

Cash interest expense, net (1) | (4,028) | | | (3,925) | | | (16,420) | | | (14,923) | |

| Cash paid for income taxes, net | (2,664) | | | (3,135) | | | (9,195) | | | (9,296) | |

Cash paid for capital expenditures (2) | (4,479) | | | (1,698) | | | (11,205) | | | (12,594) | |

| Adjusted Free Cash Flow | $ | 7,390 | | | $ | 14,643 | | | $ | 44,650 | | | $ | 40,691 | |

| | | | | | | |

| Net income | $ | 2,902 | | | $ | 12,771 | | | $ | 19,945 | | | $ | 74,712 | |

| (Gains) losses and amortization on interest rate swap derivatives, net | 121 | | | (2,311) | | | 10,959 | | | (54,989) | |

| Gains on sales of assets and other charges, net | (88) | | | (67) | | | (2,220) | | | (3,378) | |

Impairment charges (3) | 6,737 | | | — | | | 8,577 | | | 963 | |

Tax effect (4) | (1,872) | | | 152 | | | (4,329) | | | 14,294 | |

| Adjusted Net Income | $ | 7,800 | | | $ | 10,545 | | | $ | 32,932 | | | $ | 31,602 | |

| | | | | | | |

| Diluted weighted average shares outstanding | 53,893 | | | 58,480 | | | 56,196 | | | 60,879 | |

| | | | | | | |

| Net Income Per Share - Diluted | $ | 0.05 | | | $ | 0.22 | | | $ | 0.35 | | | $ | 1.23 | |

| Adjustments Per Share | 0.09 | | | (0.04) | | | 0.24 | | | (0.71) | |

| Adjusted Net Income Per Share | $ | 0.14 | | | $ | 0.18 | | | $ | 0.59 | | | $ | 0.52 | |

| | | | | | | |

| | | | | |

| (1) | Includes cash interest income, net for the quarter and year-to-date period ended December 27, 2023, and cash receipts of $0.2 million for dedesignated interest rate swap derivatives for the year-to-date period ended December 27, 2023. Includes cash interest expense (income), net and cash (receipts) payments of $(0.1) million and $1.8 million for dedesignated interest rate swap derivatives for the quarter and year-to-date period ended December 28, 2022, respectively. |

| (2) | For the year-to-date period ended December 27, 2023, amount includes cash paid for capital expenditures and the acquisition of a piece of real estate. For the year-to-date period ended December 28, 2022, amount includes cash paid for capital expenditures and the acquisition of a Denny's franchise restaurant, and excludes cash paid for the acquisition of Keke's. |

| (3) | Impairment charges include goodwill impairment charges of $6.4 million for the quarter and year-to-date period ended December 27, 2023. |

| (4) | Tax adjustments for the quarter and year-to-date period ended December 27, 2023 reflect effective tax rates of 27.7% and 25.0%, respectively. Tax adjustments for the quarter and year-to-date period ended December 28, 2022 reflect effective tax rates of 6.4% and 24.9%, respectively. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

| Reconciliation of Operating Income to Non-GAAP Financial Measures |

| (Unaudited) |

The Company believes that, in addition to GAAP measures, certain other non-GAAP financial measures are appropriate indicators to assist in the evaluation of restaurant-level operating efficiency and performance of ongoing restaurant-level operations. The Company uses Restaurant-level Operating Margin, Company Restaurant Operating Margin and Franchise Operating Margin internally as performance measures for planning purposes, including the preparation of annual operating budgets, and these three non-GAAP measures are used to evaluate operating effectiveness.

The Company defines Restaurant-level Operating Margin as operating income excluding the following three items: general and administrative expenses, depreciation and amortization, and operating (gains), losses and other charges, net. Restaurant-level Operating Margin is presented as a percent of total operating revenue. The Company excludes general and administrative expenses, which include primarily non-restaurant-level costs associated with support of company and franchised restaurants and other activities at their corporate office. The Company excludes depreciation and amortization expense, substantially all of which is related to company restaurant-level assets, because such expenses represent historical sunk costs which do not reflect current cash outlays for the restaurants. The Company excludes special items, included within operating (gains), losses and other charges, net, to provide investors with a clearer perspective of its ongoing operating performance and a more relevant comparison to prior period results.

Restaurant-level Operating Margin is the total of Company Restaurant Operating Margin and Franchise Operating Margin. The Company defines Company Restaurant Operating Margin as company restaurant sales less costs of company restaurant sales (which include product costs, company restaurant level payroll and benefits, occupancy costs, and other operating costs including utilities, repairs and maintenance, marketing and other expenses) and presents it as a percent of company restaurant sales. The Company defines Franchise Operating Margin as franchise and license revenue (which includes franchise royalties and other non-food and beverage revenue streams such as initial franchise and other fees, advertising revenue and occupancy revenue) less costs of franchise and license revenue and presents it as a percent of franchise and license revenue.

These non-GAAP financial measures provide a meaningful comparison between periods and enable investors to focus on the performance of restaurant-level operations by excluding revenues and costs unrelated to food and beverage sales in addition to corporate general and administrative expense, depreciation and amortization, and operating (gains), losses and other charges, net. However, each of these non-GAAP financial measures should be considered as a supplement to, not a substitute for, operating income, net income or other financial performance measures prepared in accordance with GAAP. Restaurant-level Operating Margin, Company Restaurant Operating Margin and Franchise Operating Margin do not accrue directly to the benefit of shareholders because of the aforementioned excluded items and are not indicative of the overall results for the Company.

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | Fiscal Year Ended |

| ($ in thousands) | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 |

| Operating income | $ | 7,724 | | | $ | 17,640 | | | $ | 52,823 | | | $ | 60,614 | |

| General and administrative expenses | 19,255 | | | 16,985 | | | 77,770 | | | 67,173 | |

| Depreciation and amortization | 3,507 | | | 3,810 | | | 14,385 | | | 14,862 | |

| Goodwill impairment charges | 6,363 | | | — | | | 6,363 | | | — | |

| Operating (gains), losses and other charges, net | 63 | | | 46 | | | 2,530 | | | (1,005) | |

| Restaurant-level Operating Margin | $ | 36,912 | | | $ | 38,481 | | | $ | 153,871 | | | $ | 141,644 | |

| | | | | | | |

| Restaurant-level Operating Margin consists of: | | | | | | | |

Company Restaurant Operating Margin (1) | $ | 5,400 | | | $ | 6,845 | | | $ | 27,933 | | | $ | 20,295 | |

Franchise Operating Margin (2) | 31,512 | | | 31,636 | | | 125,938 | | | 121,349 | |

| Restaurant-level Operating Margin | $ | 36,912 | | | $ | 38,481 | | | $ | 153,871 | | | $ | 141,644 | |

| | | | | |

| (1) | Company Restaurant Operating Margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of franchise and license revenue, excluding depreciation and amortization; less franchise and license revenue. |

| (2) | Franchise Operating Margin is calculated as operating income plus general and administrative expenses; depreciation and amortization; operating (gains), losses and other charges, net; and costs of company restaurant sales, excluding depreciation and amortization; less company restaurant sales. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

| Operating Margins |

| (Unaudited) |

| | | | | | |

| | | | Quarter Ended |

| ($ in thousands) | 12/27/23 | | 12/28/22 |

Company restaurant operations: (1) | | | | | |

| Company restaurant sales | $ | 54,046 | | 100.0 | % | | $ | 54,399 | | 100.0 | % |

| Costs of company restaurant sales, excluding depreciation and amortization: | | | | | |

| | Product costs | 13,993 | | 25.9 | % | | 14,743 | | 27.1 | % |

| | Payroll and benefits | 20,184 | | 37.3 | % | | 20,814 | | 38.3 | % |

| | Occupancy | 4,699 | | 8.7 | % | | 3,838 | | 7.1 | % |

| | Other operating costs: | | | | | |

| | | Utilities | 1,811 | | 3.4 | % | | 2,062 | | 3.8 | % |

| | | Repairs and maintenance | 994 | | 1.8 | % | | 1,071 | | 2.0 | % |

| | | Marketing | 1,396 | | 2.6 | % | | 1,417 | | 2.6 | % |

| | | Legal settlements | 1,827 | | 3.4 | % | | 1 | | 0.0 | % |

| | | Other direct costs | 3,742 | | 6.9 | % | | 3,608 | | 6.6 | % |

| Total costs of company restaurant sales, excluding depreciation and amortization | $ | 48,646 | | 90.0 | % | | $ | 47,554 | | 87.4 | % |

| Company restaurant operating margin (non-GAAP) (2) | $ | 5,400 | | 10.0 | % | | $ | 6,845 | | 12.6 | % |

| | | | | | | | |

Franchise operations: (3) | | | | | |

| Franchise and license revenue: | | | | | |

| Royalties | $ | 30,025 | | 49.0 | % | | $ | 29,615 | | 44.6 | % |

| Advertising revenue | 19,676 | | 32.1 | % | | 19,284 | | 29.0 | % |

| Initial and other fees | 2,888 | | 4.7 | % | | 8,227 | | 12.4 | % |

| Occupancy revenue | 8,718 | | 14.2 | % | | 9,324 | | 14.0 | % |

| Total franchise and license revenue | $ | 61,307 | | 100.0 | % | | $ | 66,450 | | 100.0 | % |

| | | | | | | | |

| Costs of franchise and license revenue, excluding depreciation and amortization: | | | | | |

| Advertising costs | $ | 19,676 | | 32.1 | % | | $ | 19,284 | | 29.0 | % |

| Occupancy costs | 5,307 | | 8.7 | % | | 5,739 | | 8.6 | % |

| Other direct costs | 4,812 | | 7.8 | % | | 9,791 | | 14.7 | % |

| Total costs of franchise and license revenue, excluding depreciation and amortization | $ | 29,795 | | 48.6 | % | | $ | 34,814 | | 52.4 | % |

| Franchise operating margin (non-GAAP) (2) | $ | 31,512 | | 51.4 | % | | $ | 31,636 | | 47.6 | % |

| | | | | | | | |

Total operating revenue (4) | $ | 115,353 | | 100.0 | % | | $ | 120,849 | | 100.0 | % |

Total costs of operating revenue (4) | 78,441 | | 68.0 | % | | 82,368 | | 68.2 | % |

Restaurant-level operating margin (non-GAAP) (4)(2) | $ | 36,912 | | 32.0 | % | | $ | 38,481 | | 31.8 | % |

| | | | | | | | |

Other operating expenses: (4)(2) | | | | | |

| General and administrative expenses | $ | 19,255 | | 16.7 | % | | $ | 16,985 | | 14.1 | % |

| Depreciation and amortization | 3,507 | | 3.0 | % | | 3,810 | | 3.2 | % |

| Goodwill impairment charges | 6,363 | | 5.5 | % | | — | | — | % |

| Operating losses and other charges, net | 63 | | 0.1 | % | | 46 | | 0.0 | % |

| Total other operating expenses | $ | 29,188 | | 25.3 | % | | $ | 20,841 | | 17.2 | % |

| | | | | | | | |

Operating income (4) | $ | 7,724 | | 6.7 | % | | $ | 17,640 | | 14.6 | % |

| | | | | | | | |

| (1) | As a percentage of company restaurant sales. |

| (2) | Other operating expenses such as general and administrative expenses and depreciation and amortization relate to both company and franchise operations and are not allocated to costs of company restaurant sales and costs of franchise and license revenue. As such, operating margin is considered a non-GAAP financial measure. Operating margins should be considered as a supplement to, not as a substitute for, operating income, net income or other financial measures prepared in accordance with GAAP. |

| (3) | As a percentage of franchise and license revenue. |

| (4) | As a percentage of total operating revenue. |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

| Operating Margins |

| (Unaudited) |

| | | | | | |

| | | | Fiscal Year Ended |

| ($ in thousands) | 12/27/23 | | 12/28/22 |

Company restaurant operations: (1) | | | | | |

| Company restaurant sales | $ | 215,532 | | 100.0 | % | | $ | 199,753 | | 100.0 | % |

| Costs of company restaurant sales, excluding depreciation and amortization: | | | | | |

| | Product costs | 55,789 | | 25.9 | % | | 53,617 | | 26.8 | % |

| | Payroll and benefits | 80,666 | | 37.4 | % | | 76,412 | | 38.3 | % |

| | Occupancy | 17,080 | | 7.9 | % | | 15,154 | | 7.6 | % |

| | Other operating costs: | | | | | |

| | | Utilities | 7,848 | | 3.6 | % | | 7,273 | | 3.6 | % |

| | | Repairs and maintenance | 3,661 | | 1.7 | % | | 3,874 | | 1.9 | % |

| | | Marketing | 5,603 | | 2.6 | % | | 5,294 | | 2.7 | % |

| | | Legal settlements | 2,302 | | 1.1 | % | | 4,224 | | 2.1 | % |

| | | Other direct costs | 14,650 | | 6.8 | % | | 13,610 | | 6.8 | % |

| Total costs of company restaurant sales, excluding depreciation and amortization | $ | 187,599 | | 87.0 | % | | $ | 179,458 | | 89.8 | % |

| Company restaurant operating margin (non-GAAP) (2) | $ | 27,933 | | 13.0 | % | | $ | 20,295 | | 10.2 | % |

| | | | | | | | |

Franchise operations: (3) | | | | | |

| Franchise and license revenue: | | | | | |

| Royalties | $ | 120,131 | | 48.4 | % | | $ | 113,891 | | 44.4 | % |

| Advertising revenue | 78,494 | | 31.6 | % | | 75,926 | | 29.6 | % |

| Initial and other fees | 13,882 | | 5.6 | % | | 28,262 | | 11.0 | % |

| Occupancy revenue | 35,883 | | 14.4 | % | | 38,597 | | 15.0 | % |

| Total franchise and license revenue | $ | 248,390 | | 100.0 | % | | $ | 256,676 | | 100.0 | % |

| | | | | | | | |

| Costs of franchise and license revenue, excluding depreciation and amortization: | | | | | |

| Advertising costs | $ | 78,494 | | 31.6 | % | | $ | 75,926 | | 29.6 | % |

| Occupancy costs | 22,160 | | 8.9 | % | | 24,090 | | 9.4 | % |

| Other direct costs | 21,798 | | 8.8 | % | | 35,311 | | 13.8 | % |

| Total costs of franchise and license revenue, excluding depreciation and amortization | $ | 122,452 | | 49.3 | % | | $ | 135,327 | | 52.7 | % |

| Franchise operating margin (non-GAAP) (2) | $ | 125,938 | | 50.7 | % | | $ | 121,349 | | 47.3 | % |

| | | | | | | | |

Total operating revenue (4) | $ | 463,922 | | 100.0 | % | | $ | 456,429 | | 100.0 | % |

Total costs of operating revenue (4) | 310,051 | | 66.8 | % | | 314,785 | | 69.0 | % |

Restaurant-level operating margin (non-GAAP) (4)(2) | $ | 153,871 | | 33.2 | % | | $ | 141,644 | | 31.0 | % |

| | | | | | | | |

Other operating expenses: (4)(2) | | | | | |

| General and administrative expenses | $ | 77,770 | | 16.8 | % | | $ | 67,173 | | 14.7 | % |

| Depreciation and amortization | 14,385 | | 3.1 | % | | 14,862 | | 3.3 | % |

| Goodwill impairment charges | 6,363 | | 1.4 | % | | — | | — | % |

| Operating (gains), losses and other charges, net | 2,530 | | 0.5 | % | | (1,005) | | (0.2) | % |

| Total other operating expenses | $ | 101,048 | | 21.8 | % | | $ | 81,030 | | 17.8 | % |

| | | | | | | | |

Operating income (4) | $ | 52,823 | | 11.4 | % | | $ | 60,614 | | 13.3 | % |

| | | | | | | | |

| (1) | As a percentage of company restaurant sales. |

| (2) | Other operating expenses such as general and administrative expenses and depreciation and amortization relate to both company and franchise operations and are not allocated to costs of company restaurant sales and costs of franchise and license revenue. As such, operating margin is considered a non-GAAP financial measure. Operating margin should be considered as a supplement to, not as a substitute for, operating income, net income or other financial measures prepared in accordance with GAAP. |

| (3) | As a percentage of franchise and license revenue. |

| (4) | As a percentage of total operating revenue. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DENNY’S CORPORATION |

| Statistical Data |

| (Unaudited) |

| | | | | | | | | | | | | | | | | |

| | | Denny's | | Keke's (2) |

Changes in Same-Restaurant Sales (1) | Quarter Ended | | Fiscal Year Ended | | Quarter Ended | | Fiscal Year Ended |

| (Increase vs. prior year) | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 | | 12/27/23 | | 12/28/22 |

| Company Restaurants | (1.2)% | | 6.0% | | 2.7% | | 10.4% | | 0.7% | | N/A | | (1.1)% | | N/A |

| Domestic Franchise Restaurants | 1.5% | | 1.7% | | 3.6% | | 6.0% | | (3.8)% | | N/A | | (4.4)% | | N/A |

| Domestic System-wide Restaurants | 1.3% | | 2.0% | | 3.6% | | 6.3% | | (3.1)% | | N/A | | (3.9)% | | N/A |

| | | | | | | | | | | | | | | | | |

| Average Unit Sales | | | | | | | |

| ($ in thousands) | | | | | | | | | | | | | | | |

| Company Restaurants | $770 | | $776 | | $3,073 | | $2,985 | | $429 | | $438 | | $1,796 | | $772 |

| Franchised Restaurants | $467 | | $448 | | $1,843 | | $1,729 | | $432 | | $453 | | $1,828 | | $802 |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| (1) | Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company's results as reported under GAAP. |

| (2) | Effective July 20, 2022, the Company acquired Keke's, as such data for the quarter and year-to-date period ended December 28, 2022 only represent post-acquisition results. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restaurant Unit Activity | Denny's | | Keke's |

| | | | | Franchised | | | | | | Franchised | | |

| | | Company | | & Licensed | | Total | | Company | | & Licensed | | Total |

| Ending Units September 27, 2023 | 66 | | | 1,522 | | | 1,588 | | | 8 | | | 48 | | | 56 | |

| Units Opened | — | | | 7 | | | 7 | | | — | | | 2 | | | 2 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Units Closed | (1) | | | (21) | | | (22) | | | — | | | — | | | — | |

| | Net Change | (1) | | | (14) | | | (15) | | | — | | | 2 | | | 2 | |

| Ending Units December 27, 2023 | 65 | | | 1,508 | | | 1,573 | | | 8 | | | 50 | | | 58 | |

| | | | | | | | | | | | | |

| Equivalent Units | | | | | | | | | | | |

| Fourth Quarter 2023 | 65 | | | 1,512 | | | 1,577 | | | 8 | | | 50 | | | 58 | |

| Fourth Quarter 2022 | 65 | | | 1,543 | | | 1,608 | | | 8 | | | 46 | | | 54 | |

| | Net Change | — | | | (31) | | | (31) | | | — | | | 4 | | | 4 | |

| | | | | | | | | | | | | |

| | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | |

| Ending Units December 28, 2022 | 66 | | | 1,536 | | | 1,602 | | | 8 | | | 46 | | | 54 | |

| Units Opened | — | | | 28 | | | 28 | | | — | | | 4 | | | 4 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Units Closed | (1) | | | (56) | | | (57) | | | — | | | — | | | — | |

| | Net Change | (1) | | | (28) | | | (29) | | | — | | | 4 | | | 4 | |

| Ending Units December 27, 2023 | 65 | | | 1,508 | | | 1,573 | | | 8 | | | 50 | | | 58 | |

| | | | | | | | | | | | | |

| Equivalent Units | | | | | | | | | | | |

| Year-to-Date 2023 | 65 | | | 1,522 | | | 1,587 | | | 8 | | | 48 | | | 56 | |

| Year-to-Date 2022 | 65 | | | 1,561 | | | 1,626 | | | 4 | | | 20 | | | 24 | |

| | Net Change | — | | | (39) | | | (39) | | | 4 | | | 28 | | | 32 | |

| |

D E N N Y ’ S C O R P O R AT I O N INVESTOR PRESENTATION F E B R U A R Y T H R O U G H M A R C H 2 0 2 4

FORWARD-LOOKING STATEMENTS AND NON-GAAP FINANCIAL MEASURES The Company urges caution in considering its current trends and any outlook on earnings disclosed either in this presentation or in its press releases. In addition, certain matters discussed in either this presentation or related press releases may constitute forward- looking statements. These forward-looking statements, which reflect management's best judgment based on factors currently known, are intended to speak only as of the date such statements are made and involve risks, uncertainties, and other factors that may cause the actual performance of Denny’s Corporation, its subsidiaries, and underlying restaurants to be materially different from the performance indicated or implied by such statements. Words such as “expect”, “anticipate”, “believe”, “intend”, “plan”, “hope”, "will", and variations of such words and similar expressions are intended to identify such forward-looking statements. Except as may be required by law, the Company expressly disclaims any obligation to update these forward-looking statements to reflect events or circumstances after the date this presentation was published or to reflect the occurrence of unanticipated events. Factors that could cause actual performance to differ materially from the performance indicated by these forward-looking statements include, among others: economic, public health and political conditions that impact consumer confidence and spending; commodity and labor inflation; the ability to effectively staff restaurants and support personnel; the Company's ability to maintain adequate levels of liquidity for its cash needs, including debt obligations, payment of dividends, planned share repurchases and capital expenditures as well as the ability of its customers, suppliers, franchisees and lenders to access sources of liquidity to provide for their own cash needs; competitive pressures from within the restaurant industry; the Company's ability to integrate and derive the expected benefits from its acquisition of Keke's Breakfast Cafe; the level of success of the Company’s operating initiatives and advertising and promotional efforts; adverse publicity; health concerns arising from food-related pandemics, outbreaks of flu viruses or other diseases; changes in business strategy or development plans; terms and availability of capital; regional weather conditions; overall changes in the general economy (including with regard to energy costs), particularly at the retail level; political environment and geopolitical events (including acts of war and terrorism); and other factors from time to time set forth in the Company’s SEC reports and other filings, including but not limited to the discussion in Management’s Discussion and Analysis and the risks identified in Item 1A. Risk Factors contained in the Company’s Annual Report on Form 10-K for the year ended December 28, 2022 (and in the Company’s subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K). The presentation includes references to the Company’s non-GAAP financials measures. All such measures are designated by an asterisk (*). The Company believes that, in addition to U.S. generally accepted accounting principles (GAAP) measures, certain non-GAAP financial measures are appropriate indicators to assist in the evaluation of operating performance and liquidity on a period-to-period basis. The Company uses Adjusted EBITDA, Adjusted Free Cash Flow, Adjusted Net Income and Adjusted Net Income Per Share internally as performance measures for planning purposes, including the preparation of annual operating budgets, and for compensation purposes, including incentive compensation for certain employees. Adjusted EBITDA is also used in the calculation of financial covenant ratios in accordance with the Company’s credit facility. Adjusted Free Cash Flow is also used as a non-GAAP liquidity measure by Management to assess the Company’s ability to generate cash and plan for future operating and capital actions. Management believes that the presentation of Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income Per Share and Adjusted Free Cash Flow provide useful information to investors and analysts about the Company’s operating results, financial condition or cash flows. However, each of these non-GAAP financial measures should be considered as a supplement to, not a substitute for, operating income, net income, net income per share, net cash provided by (used in) operating activities, or other financial performance and liquidity measures prepared in accordance with U.S. generally accepted accounting principles. See Appendix for non-GAAP reconciliations to the following GAAP measures: $ Millions (except per share amounts) 2018 2019 2020 2021 2022 2023 Operating Income $73.6 $165.0 $6.7 $104.1 $60.6 $52.8 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 Net Income (Loss) per Share $0.67 $1.90 ($0.08) $1.19 $1.23 $0.35 Cash Provided By (Used In): Operating Activities $73.7 $43.3 ($3.1) $76.2 $39.5 $72.1 Investing Activities ($32.0) $105.0 $4.7 $29.0 ($86.6) ($7.6) Financing Activities ($41.6) ($150.0) ($1.0) ($78.5) $20.0 ($63.2) 2

Q4 2023 HIGHLIGHTS 𝟏 Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non- consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures. 3 $115.4M $18.6M Adjusted EBITDA* Adjusted Free Cash Flow* $7.4M Share Repurchases $16.2M 1.8M Shares Repurchased Total Debt to Adjusted EBITDA* Leverage Ratio 3.26x Denny’s Domestic System-Wide Same- Restaurant Sales 1 1.3% Versus 2022 Total Operating Revenue Adjusted Net Income* $7.8M Portfolio Seven New Openings Including One International Opening Two New Openings

DENNY’S INC.

D E N N Y ’ S D O M E S T I C A V E R A G E W E E K LY S A L E S 3 & S A M E - R E S TA U R A N T S A L E S 1 $4.0 $4.0 $3.8 $4.1 $4.2 $8.4 $8.0 $7.9 $8.8 $8.1 $7.0 $7.2 $7.0 $6.5 $6.1 $6.5 $6.5 $6.2 $6.0 $6.6 $0.4 $1.1 $1.0 $1.0 $0.9 $0.9 $0.9 $1.1 $1.1 $1.0 $1.0 $1.1 $28.7 $30.1 $29.7 $30.0 $26.5 $6.4 $14.4 $15.4 $17.3 $25.3 $26.2 $27.0 $25.2 $28.3 $28.1 $28.9 $29.1 $30.3 $29.6 $30.0 $32.7 $34.0 $33.6 $34.1 $30.8 $14.9 $22.4 $23.3 $26.6 $34.5 $34.3 $35.2 $33.1 $35.7 $35.1 $36.5 $36.7 $37.5 $36.5 $37.7 1% 4% 1% 2% -6% -57% -34% -33% -20% -1% 0% 1% -2% 2% 2% 3% 8% 3% 2% 1% -70% -50% -30% -10% 10% 30% $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 Q1 '19 Q2 '19 Q3 '19 Q4 '19 Q1 '20 Q2 '20 Q3 '20 Q4 '20 Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 D om es tic S ys te m -W id e S am e- R es ta ur an t S al es 1 A ve ra ge W ee kl y S al es ( $0 00 s) 3 Denny's Off-Premise Sales Virtual Brands Off-Premise Sales Denny's On-Premise Sales Denny's Total Sales Denny's Domestic System-Wide Same-Restaurant Sales 𝟏 Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. 𝟐 2021 and 2022 Denny’s domestic system-wide same-restaurant sales 1 are versus 2019. 𝟑 Domestic average weekly sales reflect sales for company and franchised restaurants on Denny’s proprietary point of sale (POS) system. Denny’s Q4 ‘23 Domestic Average Weekly Sales Outperformed Q4 ‘22 by 3.2% 2 5

DENNY’S OFF-PREMISE SALES 52% 47% 46% 44% 42% 43% 44% 42% 41% 43% 41% 40% 43% 50% 52% 53% 56% 55% 54% 56% 57% 56% 56% 58% 5% 3% 3% 2% 2% 2% 2% 1% 1% 1% 2% 2% 0% 20% 40% 60% 80% 100% Q1 '21 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Q3 '23 Q4 '23 Domestic Off-Premise Sales By Channel Delivery - Online Dispatch Delivery - 3rd Party (Includes Virtual Brands) Carry Out 𝟏 Data for the Fiscal Fourth Quarter 2023. The Bu r ger Den i s cu r ren t l y a c t i ve i n o v er 1 , 200 domes t i c l o ca t ions . The Me l t down i s cu r r en t l y a c t i ve i n o v e r 1 , 100 domes t i c l o c a t ions . 68% 53% 25% 37%32% 47% 75% 63% 0% 20% 40% 60% 80% Dine In Off-Premise The Burger Den The Meltdown Sales Mix by Daypart1 Breakfast & Lunch Dinner & Late-Night 60% 64% 69% 69% 40% 36% 31% 31% 0% 20% 40% 60% 80% Dine In Off-Premise The Burger Den The Meltdown Sales Mix Weekday vs. Weekend1 Weekday Weekend Off-Premise Sales Over-Index At the Dinner & Late-Night Dayparts, Which Are More Popular With Younger Generations and More Diverse Guests. 6

7𝟏 Data through Fiscal December ended December 27, 2023. Total of 1,407 Restaurants in the U.S. with Strongest Presence in California, Texas, Florida, and Arizona 1 Top 10 U .S . Mar ke t s 1 DMA Number of Restaurants Los Angeles 171 Houston 66 Phoenix 66 Dallas/Ft. Worth 53 Sacramento/Stockton 44 Orlando/Daytona 40 San Francisco/Oakland 39 San Diego 37 Miami/Ft. Lauderdale 34 Las Vegas 34 % of Domestic System 42% DENNY’S DOMESTIC FOOTPRINT 3 25 2 6 5 5 1 6

8 I n t e rna t i ona l Foo tp r i n t 1 Country Number of Restaurants United States 1,407 Canada 86 Puerto Rico 16 Mexico 15 Philippines 15 New Zealand 7 Honduras 6 United Arab Emirates 5 Guatemala 4 Costa Rica 3 El Salvador 3 Guam 2 Indonesia 2 Curaçao 1 United Kingdom 1 Total System 1,573 International Presence of 166 Restaurants in 14 Countries and U.S. Territories Grown by ~91% Since Year End 2010 1 𝟏 Data through Fiscal December ended December 27, 2023. DENNY’S INTERNATIONAL FOOTPRINT

9 Well Diversified, Experienced, and Energetic Group of 208 Franchisees 1 • 32 franchisees with more than 10 restaurants each collectively comprise approximately 65% of the franchise system. • Approximately 20% of our franchisees operate multiple concepts1 providing a well-rounded perspective within the industry. Ownership o f 1 ,508 Franchisee Res taurants 1 Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 79 38% 79 5% 2–5 68 33% 215 14% 6–10 29 14% 227 15% 11–20 16 8% 224 15% 21–35 8 4% 230 15% >35 8 4% 533 35% Total 208 100% 1,508 100% 𝟏 Data through Fiscal December ended December 27, 2023. DENNY'S STRONG PARTNERSHIP WITH FRANCHISEES

KEKE’S

KEKE’S FOOTPRINT AND PERFORMANCE 11 63 3 3 1 Total of 58 Restaurants Across Florida with Heavy Concentrations in the Orlando and Tampa Areas1 𝟏 Data through Fiscal December ended December 27, 2023. 𝟐 Keke’s data is annualized based on the reported Average Unit Volumes following acquisition. Ownership of 50 Franchisee Restaurants 1 Number of Franchised Units Number of Franchisees Franchisees as % of Total Total Franchised Units Franchised Units as % of Total 1 9 47% 9 18% 2–5 8 42% 26 52% 6–10 2 11% 15 30% Total 19 100% 50 100% 8 Company and 50 Franchised Restaurants $1.6 $1.2 $1.9 $1.8 $1.8 $0.0 $1.0 $2.0 $3.0 2019 2020 2021 2022 2023 $M s Keke’s System Restaurant AUVs 23 19 2

DENNY’S CORPORATION

HISTORY OF CONSISTENTLY RETURNING CAPITAL TO SHAREHOLDERS $50 $25 $25 $3.9 $21.6 $22.2 $24.7 $36.0 $105.8 $58.7 $82.9 $67.9 $96.2 $34.2 $30.6 $64.9 $52.1 Q4 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 ASR Total Share Repurchases In $ Millions• During Q4 2023, we allocated approximately $16.2 million to share repurchases2. • Since late 20101, we have repurchased over 67 million shares at an average of $10.40 per share resulting in a 48% net reduction in our share count. • Approximately $100 million remaining under existing repurchase authorization2. 𝟏 Data from November 2010 through Fiscal December ended December 27, 2023. 𝟐 Data through Fiscal December ended December 27, 2023. Includes 1% excise tax on the value of corporate share repurchases (net of issuance). Average Price of $10.40 Multi-year share repurchase program suspended from February 2020 through August 2021 Over $700 Million Allocated Towards Share Repurchases Since We Started Returning Capital to Shareholders in late 2010 1 13

SOLID BALANCE SHEET WITH FLEXIBILITY $198.1 $170.0 $153.0 $140.0 $195.0 $218.5 $259.0 $286.5 $240.0 $210.0 $170.0 $261.5 $255.5 $22.5 $20.1 $20.1 $18.8 $20.7 $27.1 $30.2 $30.6 $16.5 $15.4 $12.7 $11.2 $10.5 2.7x 2.4x 2.2x 1.9x 2.5x 2.5x 2.8x 3.0x 2.7x 2.1x 3.4x 3.3x 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 $0.0 $100.0 $200.0 $300.0 $400.0 $500.0 $600.0 To ta l D eb t ($ M ill io ns ) Finance Leases Credit Facility Total Debt / Adjusted EBITDA* 2 Disciplined Focus on Debt Leverage with Financial Flexibility to Make Brand Investments & Return Capital to Shareholders Target Total Debt / Adjusted EBITDA* Leverage Ratio Range of 2.5x to 3.5x 1 Total Debt / Adjusted EBITDA* leverage ratio was waived starting in Q2 ’20 through Q1 ‘21. 2 Increased borrowings under the credit facility in 2022 are primarily due to the Keke’s acquisition. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures 14 Debt amendments provided temporary covenant relief 1

OUR CRAVE STRATEGIES C rea te Lead ing Edge So lu t ions Wi th Technology & Innova t ion Robust New Res taurant G row th as the Franchisor o f Cho ice Assemble Bes t In Class Peop le and Teams Through Cu l tu re, Too ls & Sys tems Va l ida te & Op t imize the Bus iness Mode l to Max imize Res taurant Margins E l eva te Pro f i tab le Tra f f ic Through the Gues t Exper ience & Un iquely Craveable Food 15

APPENDIX

17 $2.3 $2.5 $1.8 $2.7 $3.0 $3.1 $0.0 $1.0 $2.0 $3.0 2018 2019 2020 2021 2022 2023 $M s Denny’s Company Restaurant AUVs $1.6 $1.7 $1.2 $1.6 $1.7 $1.8 $0.0 $1.0 $2.0 $3.0 2018 2019 2020 2021 2022 2023 $M s Denny’s Franchise Restaurants AUVs History of Steady Growth in Franchised and Company Average Unit Volumes1 Refranchising Strategy Benefited AUVs at Both Franchised and Company Restaurants in 2019 DENNY’S FRANCHISED AND COMPANY RESTAURANT SALES 1% 2% -18% -1% 1% 4% -40% -30% -20% -10% 0% 10% 2018 2019 2020 2021 2022 2023 Denny’s Domestic Franchised Same-Restaurant Sales 2,3 1 Excluding pandemic-impacted years 𝟐 Same-restaurant sales include sales at company restaurants and non-consolidated franchised and licensed restaurants that were open during the comparable periods noted. Total operating revenue is limited to company restaurant sales and royalties, advertising revenue, initial and other fees and occupancy revenue from non-consolidated franchised and licensed restaurants. Accordingly, domestic franchise same-restaurant sales and domestic system-wide same-restaurant sales should be considered as a supplement to, not a substitute for, the Company’s results as reported under GAAP. 𝟑 2021 and 2022 Denny’s domestic system-wide same-restaurant sales 1 are versus 2019. 2% 2% -23% -1% 7% 3% -40% -30% -20% -10% 0% 10% 2018 2019 2020 2021 2022 2023 Denny’s Company Same-Restaurant Sales 2,3 -31% -20 -40% -37% -4 5-20 -40%

18 Over $500 Million in Adjusted Free Cash Flow* Generated Over Last 13 Fiscal Years Adjusted Free Cash Flow* Impacted by ~$21 Million of Real Estate Acquisitions Between 2019 and 2021 ¹ Includes cash interest expense, net and cash payments of approximately $1.9 million, $3.3 million, $1.8 million and $0.2 million for dedesignated interest rate swap derivatives for full year 2020, 2021, 2022 and 2023, respectively. * See Appendix for reconciliation of Net Income (Loss) and Net Cash Provided by Operating Activities to Non-GAAP Financial Measures, as well as the reconciliation of Operating Income (Loss) to Non-GAAP Financial Measures. ~$11 ~$10 $17 $12 $9 $8 $8 $11 $15 $20 $18 $18 $17 $15 $16 $1 $2 $3 $4 $5 $3 $6 $3 $24 $0 $10 $9 $9 $16 $16 $21 $22 $33 $34 $31 $32 $25 $18 $13 $11 $82 $79 $78 $83 $89 $100 $103 $105 $97 $27 $86 $78 $81 $48 $49 $45 $49 $42 $52 $51 $50 $30 $2 $41 $41 $45 $0 $20 $40 $60 $80 $100 $120 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 $ M ill io ns Real Estate Acquisitions Cash Interest Cash Taxes Cash Capital Adjusted EBITDA* Adjusted Free Cash Flow* Cash capital expenditures include real estate acquisitions through like- kind exchange transactions 1 ADJUSTED FREE CASH FLOW*

19 Robert P. Verostek, Executive Vice President, Chief Financial Officer. Joined Denny’s in 1999 and served in numerous leadership positions across the Finance and Accounting teams. Named Vice President of Financial Planning and Analysis in 2012 and Chief Financial Officer in 2020. Prior experience includes various accounting roles for Insignia Financial Group. Kelli F. Valade, President and Chief Executive Officer of Denny’s Corporation. Prior to joining Denny's in June 2022, served as CEO of Red Lobster, CEO of Black Box Intelligence, and held various management positions at Chili’s including Brand President, Chief Operating Officer and Senior Vice President of Human Resources. Jay C. Gilmore, Senior Vice President, Chief Accounting Officer and Corporate Controller. Joined Denny’s in 1999 as Director of Accounting and Assistant Corporate Controller and was named Senior Vice President, Chief Accounting Officer and Corporate Controller in 2021. Prior experience includes serving as a Senior Manager with KPMG LLP. Gail S. Myers, Executive Vice President, Chief Legal & Administrative Officer and Corporate Secretary. Prior to joining Denny’s in 2020, served as Executive Vice President, General Counsel, Secretary and Chief Compliance Officer for American Tire Distributors, Inc., Senior Vice President, Deputy General Counsel and Chief Compliance Counsel at U.S. Foods and Senior Vice President, General Counsel and Secretary at Snyder's-Lance, Inc. David P. Schmidt, President of Keke’s Breakfast Café. Prior to joining Keke’s in September 2022, served as CFO of Red Lobster and worked for Bloomin’ Brands where he held various leadership roles throughout his tenure including Group Vice President and CFO of Bloomin’ Brand’s Casual Dining. Stephen C. Dunn, Executive Vice President, Chief Global Development Officer. Prior to joining Denny’s in 2004, held executive-level positions with Church's Chicken, El Pollo Loco, Mr. Gatti's, and TCBY. Earned the distinction of Certified Franchise Executive by the International Franchise Association Educational Foundation. Served as an Infantry Officer in the United States Army. EXPERIENCED AND COMMITTED LEADERSHIP TEAM Pankaj Patra, Executive Vice President, Chief Digital and Technology Officer. Prior to joining Denny’s in 2023, served as Chief Information Officer and Senior Vice President at Brinker International, Inc. and brings 25 years of experience as an innovative enterprise technology architect, digital strategist and information technology leader.

20 1 Includes 53 operating weeks. $ Millions 2018 2019 20201 2021 2022 2023 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 Provision for (Benefit from) Income Taxes 8.6 31.8 (2.0) 26.0 24.7 7.0 Goodwill Impairment Charges 6.4 Operating (Gains) Losses and Other Charges, Net 2.6 (91.2) 1.8 (46.1) (1.0) 2.5 Other Nonoperating Expense (Income), Net 0.6 (2.8) (4.2) (15.2) (52.6) 8.3 Share‐Based Compensation Expense 6.0 6.7 7.9 13.6 11.4 8.9 Deferred Compensation Plan Valuation Adjustments (1.0) 2.6 1.6 2.1 (2.2) 1.9 Interest Expense, Net 20.7 18.5 18.0 15.1 13.8 17.6 Depreciation and Amortization 27.0 19.8 16.2 15.4 14.9 14.4 Cash Payments for Restructuring Charges and Exit Costs (1.1) (2.6) (3.0) (1.8) (1.1) (2.3) Cash Payments for Share‐Based Compensation (1.9) (3.6) (4.6) (1.8) (5.1) (3.1) Adjusted EBITDA $105.3 $96.8 $26.6 $85.6 $77.5 $81.5 Adjusted EBITDA Margin % 16.7% 17.9% 9.2% 21.5% 17.0% 17.6% RECONCILIATION OF NET INCOME (LOSS) TO NON-GAAP FINANCIAL MEASURES

21 $ Millions 2018 2019 20201 2021 2022 2023 Net Cash Provided By (Used In) Operating Activities $73.7 $43.3 ($3.1) $76.2 $39.5 $72.1 Capital Expenditures (22.0) (14.0) (7.0) (7.4) (11.8) (10.0) Acquisition of Real Estate and Restaurants2 (10.4) (11.3) - (10.4) (0.8) (1.2) Cash Payments for Restructuring Charges and Exit Costs (1.1) (2.6) (3.0) (1.8) (1.1) (2.3) Cash Payments for Share‐Based Compensation (1.9) (3.6) (4.6) (1.8) (5.1) (3.1) Deferred Compensation Plan Valuation Adjustments (1.0) 2.6 1.6 2.1 (2.2) 1.9 Other Nonoperating Expense (Income), Net 0.6 (2.8) (4.2) (15.2) (52.6) 8.3 Gains (Losses) on Investments 0.0 0.2 0.1 (0.0) (0.3) 0.1 Gains (Losses) on Early Termination of Debt and Leases 0.2 0.0 (0.2) 0.5 0.0 (0.0) Amortization of Deferred Financing Costs (0.6) (0.6) (0.9) (1.1) (0.6) (0.6) Gains (Losses) and Amortization on Interest Rate Swap Derivatives, Net - - 2.2 12.6 55.0 (11.0) Interest Expense, Net 20.7 18.5 18.0 15.1 13.8 17.6 Cash Interest Expense, Net3 (19.6) (17.6) (18.0) (17.2) (14.9) (16.4) Deferred Income Tax (Expense) Benefit (6.2) (16.0) (4.0) (14.1) (14.7) 1.7 Decrease (Increase) in Tax Valuation Allowance (0.1) 2.9 3.0 5.0 (0.5) (0.2) Provision for (Benefit from) Income Taxes 8.6 31.8 (2.0) 26.0 24.7 7.0 Income Taxes Paid, Net (3.3) (24.1) (0.0) (9.9) (9.3) (9.2) Changes in Operating Assets and Liabilities Receivables 4.7 2.0 (6.4) (1.4) 5.9 (3.9) Inventories (0.1) (1.7) (0.1) 3.9 0.5 (3.4) Other Current assets (0.9) 4.1 3.9 (7.5) 1.1 0.3 Other Noncurrent Assets (0.0) 4.6 1.8 1.9 2.1 2.5 Operating Lease Assets and Liabilities - 0.6 (0.8) 1.5 0.7 0.6 Accounts Payable 5.1 5.2 10.7 (6.6) (3.9) (4.0) Other Accrued Liabilities (0.8) 10.0 9.1 (15.5) 8.8 (3.4) Other Noncurrent Liabilities 4.4 (1.9) 5.5 5.5 6.5 1.2 Adjusted Free Cash Flow $50.0 $29.8 $1.6 $40.8 $40.7 $44.7 ¹ Includes 53 operating weeks. 2 For 2022, amounts include cash paid for the acquisition of a Denny's franchise restaurant and exclude capital paid for the acquisition of Keke's. For the year-to-date period ended December 27, 2023, amounts include cash paid for the acquisition of a piece of real estate. 3 Includes cash interest expense (income), net and cash payments (receipts) of approximately $1.9 million, $3.3 million, $1.8 million and $0.2 million for dedesignated interest rate swap derivatives for full year 2020, 2021, 2022 and 2023, respectively. RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO NON- GAAP FINANCIAL MEASURES

22 $ Millions (except per share amounts) 2018 2019 20201 2021 2022 2023 Adjusted EBITDA $105.3 $96.8 $26.6 $85.6 $77.5 $81.5 Adjusted EBITDA Margin % 16.7% 17.9% 9.2% 21.5% 17.0% 17.6% Cash Interest Expense, Net2 (19.6) (17.6) (18.0) (17.2) (14.9) (16.4) Cash Paid for Income Taxes, Net (3.3) (24.1) (0.0) (9.9) (9.3) (9.2) Cash Paid for Capital Expenditures and Acquisition of Restaurants and Real Estate3 (32.4) (25.3) (7.0) (17.7) (12.6) (11.2) Adjusted Free Cash Flow $50.0 $29.8 $1.6 $40.8 $40.7 $44.7 Net Income (Loss) $43.7 $117.4 ($5.1) $78.1 $74.7 $19.9 (Gains) Losses and Amort. on Interest Rate Swap Derivatives, Net - - (2.2) (12.6) (55.0) 11.0 Gains on Sales of Assets and Other, Net (0.5) (93.6) (4.7) (47.8) (3.4) (2.2) Impairment Charges4 1.6 - 4.1 0.4 1.0 8.6 Tax Effect5 (0.2) 24.1 0.7 15.0 14.3 (4.3) Adjusted Net Income (Loss) $44.6 $47.9 ($7.2) $33.1 $31.6 $32.9 Diluted Net Income (Loss) Per Share $0.67 $1.90 ($0.08) $1.19 $1.23 $0.35 Adjustments Per Share $0.01 ($1.13) ($0.04) ($0.69) ($0.71) $0.24 Adjusted Net Income (Loss) Per Share $0.68 $0.77 ($0.12) $0.50 $0.52 $0.59 Diluted Weighted Average Shares Outstanding (000’s) 65,562 61,833 60,812 65,573 60,879 56,196 1 Includes 53 operating weeks. 2 Includes cash interest expense (income), net and cash (receipts) payments of approximately $1.9 million, $3.3 million, $1.8 million and $0.2 million for dedesignated interest rate swap derivatives for full year 2020, 2021, 2022 and 2023, respectively. 3 For 2022, amount includes cash paid for capital expenditures and the acquisition of a Denny's franchise restaurant, and excludes capital paid for the acquisition of Keke's. For the year-to-date period ended December 27, 2023, amounts include cash paid for capital expenditures and the acquisition of a piece of real estate. 4 Impairment charges include goodwill impairment charges of $6.4 million for full year 2023.. 5 Tax adjustments for full year 2018 use full year effective tax rates of 16.4%. Tax adjustments for the gains on sales of assets and other, net in 2019 are calculated using an effective rate of 25.7%. Tax adjustments for full year 2020, 2021, 2022 and 2023 reflect an effective tax rate of 25.6%, 25.0%, 24.9%, and 25.0%, respectively. RECONCILIATION OF NET INCOME (LOSS) AND NET CASH PROVIDED BY OPERATING ACTIVITIES TO NON-GAAP FINANCIAL MEASURES