8-K0001365916FALSE00013659162024-01-022024-01-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

____________________

Date of report (Date of earliest event reported): February 7, 2024

Amyris, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34885 | 55-0856151 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 5885 Hollis Street, Suite 100, | Emeryville, | CA | 94608 |

| (Address of Principal Executive Offices) | (Zip Code) |

| | | | | | | | | | | |

| | (510) | 450-0761 | |

| | (Registrant’s telephone number, including area code) | |

| | | | | | | | |

| | | |

| | (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

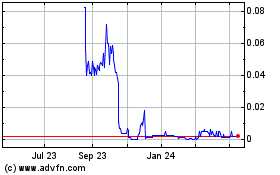

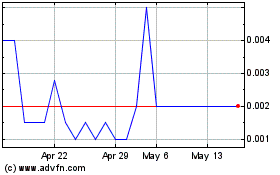

| Common Stock, $0.0001 par value per share | AMRSQ | N/A* |

* On September 8, 2023, Nasdaq filed a Form 25 with the Securities and Exchange Commission (the “SEC”) to delist our common stock from the Nasdaq Stock Market LLC. The delisting became effective on September 18, 2023. The deregistration of the shares of common stock under section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), became effective 90 days after the filing date of the Form 25, at which point the shares were deemed registered under Section 12(g) of the Exchange Act. Our common stock currently trades on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc. under the symbol “AMRSQ.”

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.03 Bankruptcy or Receivership

As previously reported, on August 9, 2023, Amyris, Inc. (the “Company”) and certain of its direct and indirect subsidiaries (collectively, the “Company Parties” or the “Debtors”) filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”), thereby commencing Chapter 11 cases for the Company Parties (the “Chapter 11 Cases”). Additional information about the Chapter 11 Cases, including access to Bankruptcy Court documents, is available online at cases.stretto.com/amyris/, a website administered by Stretto, Inc., a third-party bankruptcy claims and noticing agent. The information on this website is not incorporated by reference into, and does not constitute part of, this Form 8-K.

The Debtors filed with the Bankruptcy Court (i) on December 12, 2023, the Second Amended Joint Plan of Reorganization of Amyris, Inc. and Its Affiliated Debtors, as Modified (the “Second Amended Plan”) and the related Disclosure Statement; (ii) on January 9, 2024, a supplement to the Second Amended Plan (the “Initial Plan Supplement”); (iii) on January 22, 2024, a Third Amended Joint Plan of Reorganization of Amyris, Inc. and Its Affiliated Debtors (the “Third Amended Plan”); (iv) on January 22, 2024, a further supplement to the Third Amended Plan (the “Amended Plan Supplement”); (v) on January 23, 2024, a Third Amended Joint Plan of Reorganization of Amyris, Inc. and Its Affiliated Debtors, as Modified (the “Plan”); and (vi) on January 23, 2024, a further supplement to the Plan (the “Second Amended Plan Supplement” and, together with the Initial Plan Supplement, the Amended Plan Supplement, and the Second Amended Plan Supplement, the “Plan Supplement”). A copy of the Plan is attached as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On February 7, 2024, the Court entered an order (the “Confirmation Order”) confirming the Plan. The Plan is not yet effective. The Company expects that the effective date of the Plan will occur once all conditions precedent to the Plan have been satisfied or waived as set forth therein (the “Effective Date”). A copy of the Confirmation Order is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. Capitalized terms used without definition herein shall have the meanings assigned thereto in the Confirmation Order or Plan, as applicable. The documents contained in the Plan Supplement, as the same has been amended from time to time prior to confirmation of the Plan and may be further amended prior to the Effective Date or as otherwise set forth in the Plan or Confirmation Order, are integral to, and are considered part of, the Plan. It is also possible that technical amendments could be made to the Plan prior to the Effective Date.

Although the Company is targeting occurrence of the Effective Date as soon as reasonably practicable, the Company can make no assurances as to when, or ultimately if, the Plan will become effective.

The following is a summary of the material terms of the Plan. This summary describes only certain substantive provisions of the Plan and Confirmation Order, as applicable, and is not intended to be a complete description of the Plan or Confirmation. This summary is qualified in its entirety by reference to the full text of the Plan and the Confirmation Order.

Pursuant to the Plan and Confirmation Order, there will be a restructuring that provides for, among other things, (i) a reorganization of the Debtors’ remaining business and assets into a privately held company (referred to as “Reorganized Amyris”), and (ii) the treatment for certain classes of claims and interests as follows:

•Foris Prepetition Secured Claims. On the Effective Date, Holders of the Foris Prepetition Secured Claims will receive, at the option of the Foris Prepetition Secured Lenders, in each of their sole discretion, the Net Proceeds remaining after funding the payments required under the Plan (i) to satisfy Allowed Administrative Claims, Allowed Professional Fees, Allowed Priority Tax Claims and U.S. Trustee Fees (subject to the Plan Effective Date Funding), (ii) on account of the treatment of Classes 1, 2, 7, and 8, (iii) to provide the funding of the Estate Claims Settlement Cash Consideration, (iv) to provide the funding of the Third-Party Release Settlement Amounts, and (v) to provide the funding of the Lavvan Settlement Consideration, and the then remaining Foris Prepetition Secured Claims shall, at the option of the Foris Prepetition Secured Lenders, in each of their sole discretion, be rolled up (or assumed), converted, exchanged, refinanced or amended and restated, into: (x) the Exit First Lien Facility and/or (y) 100% of New Common Stock of Reorganized Amyris. Any remaining Foris Prepetition Secured Claims not rolled up, converted, exchanged, refinanced or amended and restated, into: (x) the Exit First Lien Facility and/or (y) 100% of New Common Stock of Reorganized Amyris shall neither receive nor retain any property under the Plan.

•DSM RealSweet Secured Claim. On the Effective Date, (i) if the DSM Term Sheet is implemented in full, then DSM will receive on account of the Allowed DSM RealSweet Secured Claim a $29.52 million promissory note issued by Reorganized Amyris and secured by the DSM Plan Promissory Note Pledge Agreement; and (ii) if the DSM Term Sheet is not implemented in full, then DSM will receive payment in cash on the Effective Date, or as soon as practical thereafter, in an amount equal to DSM’s Allowed DSM RealSweet Secured Claim

•Lavvan Secured Claim. On the Effective Date, in full and complete satisfaction of the Lavvan Secured Claim, Lavvan will receive the Lavvan Settlement Consideration in accordance with the Lavvan Settlement Agreement.

•Convertible Note Claims. On the Effective Date (or as soon as practicable thereafter), in full and complete satisfaction of the Convertible Note Claims, whether or not Class 7 votes to accept the Plan, each Holder of an Allowed Convertible Note Claim will receive from the Creditor Trust on account of such Allowed Convertible Note Claim, a Pro Rata distribution of the Creditor Trust Interests distributable to Class 7 based upon the Allowed Claims in Class 7 and Class 8.

•General Unsecured Claims. Holders of Allowed General Unsecured Claims will receive from the Creditor Trust on account of their Allowed General Unsecured Claims, in full and complete satisfaction of such Claims, on the Effective Date (or as soon as practicable thereafter), a Pro Rata distribution of the Creditor Trust Interests distributable to Class 8 based upon the Allowed Claims in Class 7 and Class 8.

•DSM Contract Claims. On the Effective Date, (i) if the DSM Term Sheet is implemented in full, then the DSM Contracts will be modified as set forth in the DSM Term Sheet, the DSM Contract Claims will be Allowed in the amount of $0, and DSM will neither receive nor retain any property under the Plan on account of the DSM Contract Claims except as provided for in the Amended DSM Contracts; or (ii) if the DSM Term Sheet is not implemented in full, then the DSM Contracts will be rejected and any Allowed DSM Contract Claims arising from such rejection will be treated as General Unsecured Claims for purposes of distributions under the Plan and DSM will be deemed to have voted its claims to reject the Plan and to have opted out of the Third-Party Release.

•DSM Other Secured Claims. On the Effective Date, DSM’s obligation to make earn-out payments to the Debtors under the DSM Agreements will be offset against the DSM Other Secured Claims, and DSM will neither receive nor retain any other property under the Plan on account of the DSM Other Secured Claims.

•Givaudan Contract Claims. On the Effective Date, (i) if the Givaudan Term Sheet is implemented in full, the Givaudan Contracts will be modified as set forth in the Amended Givaudan Contract and the Givaudan Contract Claims will be Allowed in the amount of $0 and Givaudan will neither receive nor retain any property under the Plan on account of the Givaudan Contract Claims except as otherwise provided in the Amended Givaudan Contract; or (ii) if the Givaudan Term Sheet is not implemented in full, then the Givaudan Contracts will be rejected and any Allowed Givaudan Contract Claims arising from such rejection will be treated as General Unsecured Claims for purposes of distributions under the Plan, and Givaudan will be deemed to have voted its claims to reject the Plan and to have opted out of the Third-Party Release.

•Intercompany Claims. Intercompany Claims will be, at the option of the Debtors or Reorganized Amyris, either: (i) Reinstated; (ii) adjusted, converted to equity, otherwise set off, settled, distributed, or contributed; or (iii) canceled, released, or discharged without any distribution on account of such Intercompany Claims.

•Section 510(b) Claims. Each Holder of an Allowed Section 510(b) Claim will neither receive nor retain any property under the Plan.

•Intercompany Interests. All Interests of the other Debtors (other than the Company) will remain issued and outstanding; except to the extent a Debtor other than the Company is dissolved, liquidated, and wound down under the Plan, in which case, the Interests of such Debtor will be canceled.

•Amyris Equity Interests. The Amyris Equity Interests will be extinguished and Holders of such Equity Interests will not receive any distribution on account of such Equity Interests.

The Plan and Confirmation Order contain other customary provisions including means for the Plan’s implementation, provisions regarding assumption and rejection of executory contracts and agreements, provisions governing the consensual Third-Party Release and Exculpation, provisions regarding the establishment of the Creditor Trust and appointment of the Plan Administrator. The Plan and Confirmation Order also incorporate certain settlements with key parties in interest, which have been summarized in part in the treatment of certain classes of claims above.

Holders of Convertible Notes, Holders of General Unsecured Claims, and Holders of Interests that did not opt out of the Third-Party Release, as set forth in the Confirmation Order, will receive their Pro Rata share of the Third Party Release Settlement Amount allocated to such Holder under the Plan.

As of February 5, 2024, the Company had no preferred shares issued or outstanding and 372,323,547 shares of common stock (the “Common Stock”) issued and outstanding. On the Effective Date, all of the existing shares of Common Stock (including shares of Common Stock issuable under equity awards granted under the Company’s equity incentive plans) will be canceled, released, and extinguished and will be of no further force or effect pursuant to the Plan.

Certain Information Regarding Assets and Liabilities of the Company Parties

In the Company’s most recent monthly operating report filed with the Bankruptcy Court on December 29, 2023, the Company reported total assets of approximately $813 million and total liabilities of approximately $1.3 billion as of November 30, 2023. This financial information has not been audited or reviewed by the Company’s

independent registered public accounting firm and may be subject to future reconciliation or adjustments. This information should not be viewed as indicative of future results.

The foregoing description of the Plan and the Confirmation Order is a summary thereof and does not purport to be complete, and is subject to, and is qualified in its entirety by reference to the full text of the Plan and Confirmation Order (attached hereto as Exhibits 2.1 and 99.1).

Item 2.05 Costs Associated with Exit or Disposal Activities.

On February 7, 2024, the Company announced the termination or separation of approximately 80 employees, effective February 7, 2024. The Company previously announced reductions in force in June 2023, August 2023 and December 2023. In connection with this February reduction in force, certain impacted employees will be provided severance benefits, including cash severance payments and reimbursement of medical insurance premiums. The Company expects to record a one-time charge of approximately $1.0 million related to the reduction in its workforce, consisting primarily of one-time severance payments upon termination of the employees. The Company expects that these charges will be incurred in the first quarter of 2024.

| | | | | |

| Item 3.03 | Material Modifications to the Rights of Security Holders. |

The disclosure under Item 1.03 of this Current Report is incorporated herein by reference.

Item 4.01 Changes in Registrant’s Certifying Accountant.

On February 9, 2024, Macias Gini & O’Connell LLP (“MGO”) informed the Company that MGO was resigning as the Company’s independent registered public accounting firm, effective immediately, in connection with the Chapter 11 Cases. There is no dispute between the Company and MGO.

MGO’s reports on the Company’s financial statements for the fiscal years ended December 31, 2022 and December 31, 2021 contained no adverse opinion or disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the Company’s fiscal years ended December 31, 2022 and December 31, 2021, and in the subsequent interim period through February 9, 2024, (i) there were no “disagreements” as that term is defined in the fourth paragraph of the Instructions to Item 304 of Regulation S-K (“Regulation S-K”) promulgated by the SEC pursuant to the Exchange Act, between the Company and MGO on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of MGO, would have caused MGO to make reference to the subject matter of the disagreement in their reports on the financial statements for such years, and (ii) there were no “reportable events” as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

The Company has provided MGO with a copy of the disclosures made in this Current Report on Form 8-K prior to its filing with the SEC and requested that MGO furnish the Company with a letter addressed to the SEC stating whether MGO agrees with the statements made herein. A copy of MGO’s letter dated February 9, 2024, is attached as Exhibit 16.1 hereto.

Deregistration of Securities

In conjunction with the effectiveness of the Plan and the cancellation of all of its outstanding shares of common stock, the Company intends to file post-effective amendments to each of its Registration Statements on Form S-1, Form S-3 and Form S-8 and promptly file a Form 15 with the Securities and Exchange Commission to deregister its securities under Section 12(g) of the Exchange Act, and suspend its reporting obligations under the Exchange Act.

Cautionary Statements Regarding Trading in the Company’s Securities

The Company’s securityholders are cautioned that trading in the Company’s Common Stock during the pendency of the Chapter 11 Cases is highly speculative and poses substantial risks. Trading prices for the Company’s Common Stock may bear little or no relationship to the actual recovery, if any, by holders thereof in the Company’s Chapter 11 Cases. Accordingly, the Company urges extreme caution with respect to existing and future investments in its Common Stock.

Cautionary Statements Regarding Forward-Looking Statements

This Current Report on Form 8-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Exchange Act. The words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “will,” “would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements contained in this Current Report on Form 8-K include, but are not limited to, statements regarding the process and potential outcomes of the Company’s Chapter 11 Cases. These statements are based on management’s current expectations, and actual results and future events may differ materially due to risks and uncertainties, including, without limitation, risks inherent in the bankruptcy process, including the outcome of the Chapter 11 Cases; the Company’s financial projections and cost estimates; the Company’s ability to raise additional funds during the Chapter 11 Cases; the Company’s ability to sell any of its assets; and the effect of the Chapter 11 Cases on the Company’s business prospects, financial results and business operations. The Company may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. These and other factors that may affect the Company’s future business prospects, results and operations are identified and described in more detail in the Company’s filings with the U.S. Securities and Exchange Commission, including the Company’s most recent Annual Report filed on Form 10-K and the subsequently filed Quarterly Report(s) on Form 10-Q. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this Form 8-K. Except as required by applicable law, the Company does not intend to update any of the forward-looking statements to conform these statements to actual results, later events or circumstances or to reflect the occurrence of unanticipated events.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit Number | Description |

| 2.1 | |

| 16.1 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | AMYRIS, INC. | |

| | | | |

| | | | |

| Date: February 9, 2024 | By: | /s/ Han Kieftenbeld | |

| | | Han Kieftenbeld | |

| | Interim Chief Executive Officer and Chief Financial Officer |

Exhibit 2.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| | | | | | | | |

In re:

AMYRIS, INC., et al.,

Debtors.1 | |

Chapter 11

Case No. 23-11131 (TMH)

Jointly Administered |

| | |

| THIRD AMENDED JOINT CHAPTER 11 PLAN OF REORGANIZATION OF AMYRIS, INC. AND ITS AFFILIATED DEBTORS, AS MODIFIED |

| | | | | |

PACHULSKI STANG ZIEHL & JONES LLP

Richard M. Pachulski (pro hac vice) Debra I. Grassgreen (pro hac vice) James E. O’Neill (DE Bar No. 4042) Jason H. Rosell (pro hac vice) Steven W. Golden (DE Bar No. 6807) 919 N. Market Street, 17th Floor P.O. Box 8705 Wilmington, DE 19899-8705 (Courier 19801) Telephone: (302) 652-4100 Facsimile: (302) 652-4400 rpachulski@pszjlaw.com dgrassgreen@pszjlaw.com joneill@pszjlaw.com jrosell@pszjlaw.com sgolden@pszjlaw.com

Counsel to the Debtors and Debtors in Possession | |

1 A complete list of each of the Debtors in these Chapter 11 Cases may be obtained on the website of the Debtors’ claims and noticing agent at https://cases.stretto.com/amyris. The location of Debtor Amyris Inc.’s principal place of business and the Debtors’ service address in these Chapter 11 Cases is 5885 Hollis Street, Suite 100, Emeryville, CA 94608.

4878-2047-7087.3 03703.004

TABLE OF CONTENTS

INTRODUCTION

Amyris, Inc. and the other above-captioned debtors and debtors in possession (collectively, the “Debtors”) propose this joint chapter 11 plan of reorganization (as amended, supplemented, or otherwise modified from time to time, this “Plan”) for the resolution of the outstanding Claims against, and Interests in, the Debtors. Capitalized terms used herein and not otherwise defined shall have the meanings ascribed to such terms in Article I.A of this Plan. Although proposed jointly for administrative purposes, the Plan constitutes a separate Plan for each Debtor. The Debtors are the proponents of the Plan within the meaning of section 1129 of the Bankruptcy Code. The classification of Claims and Interests set forth in Article III of this Plan shall be deemed to apply separately with respect to each Plan proposed by each Debtor, as applicable and set forth herein. The Plan does not contemplate substantive consolidation of any of the Debtors, other than for purposes of voting on and distributions under the Plan.

Reference is made, and Holders of Claims or Interests may refer, to the accompanying Disclosure Statement for a discussion on the Debtors’ history, businesses, assets, results of operations, historical financial information, valuation, projections, risk factors, a summary and analysis of the Plan, and certain related matters.

ALL HOLDERS OF CLAIMS AGAINST AND INTERESTS IN THE DEBTORS, TO THE EXTENT APPLICABLE, ARE ENCOURAGED TO READ THIS PLAN AND THE DISCLOSURE STATEMENT IN THEIR ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THIS PLAN. ALL HOLDERS OF CLAIMS AND INTERESTS SHOULD REVIEW THE SECURITIES LAW RESTRICTIONS AND NOTICES SET FORTH IN THIS PLAN (INCLUDING, WITHOUT LIMITATION, UNDER ARTICLE IV HEREOF) IN FULL.

THE ISSUANCE OF ANY SECURITIES REFERRED TO IN THIS PLAN SHALL NOT CONSTITUTE AN INVITATION OR OFFER TO SELL, OR THE SOLICITATION OF AN INVITATION OR OFFER TO BUY, ANY SECURITIES IN CONTRAVENTION OF APPLICABLE LAW IN ANY JURISDICTION. NO ACTION HAS BEEN TAKEN, NOR WILL BE TAKEN, IN ANY JURISDICTION THAT WOULD PERMIT A PUBLIC OFFERING OF ANY SECURITIES REFERRED TO IN THIS PLAN (OTHER THAN SECURITIES ISSUED PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE IN A DEEMED PUBLIC OFFERING) IN ANY JURISDICTION WHERE SUCH ACTION FOR THAT PURPOSE IS REQUIRED.

Article I.

DEFINED TERMS, RULES OF INTERPRETATION,

COMPUTATION OF TIME, AND GOVERNING LAW

A.Defined Terms.

As used in this Plan, capitalized terms have the meanings set forth below.

1.“Ad Hoc Cross-Holder Group” means the informal ad hoc group of certain holders of Convertible Notes and/or holders of Interests represented by ArentFox Schiff LLP, as primary counsel, Sterns Weaver Miller Weissler Alhadeff & Sitterson, P.A., as co-counsel, and Womble Bond Dickinson (US) LLP, as local counsel, as further described in the Verified Statement of the Ad Hoc Cross-Holder Group Pursuant to Bankruptcy Rule 2019 of the Federal Rules of Bankruptcy Procedure [Docket No. 397].

2.“Ad Hoc Cross-Holder Group Professionals” means ArentFox Schiff LLP, as primary counsel, Sterns Weaver Miller Weissler Alhadeff & Sitterson, P.A., as co-counsel, and Womble Bond Dickinson (US) LLP, as local counsel, each as retained by the Ad Hoc Group in connection with the Chapter 11 Cases.

3.“Ad Hoc Cross-Holder Group Acceptance Event” means each member of the Ad Hoc Cross-Holder Group has executed a joinder to the Plan Support Agreement.

4.“Ad Hoc Cross-Holder Group Restructuring Expenses” means, subject to the terms and conditions of the Plan, accrued and documented fees and expenses of the Ad Hoc Cross-Holder Group Professionals in connection with the Chapter 11 Cases in the aggregate amount not to exceed $450,000.00.

5.“Ad Hoc Group” means the informal ad hoc group of certain holders of Convertible Notes represented by Paul Hastings LLP, as primary counsel, and Blank Rome LLP, as local counsel, as further described in the Verified Statement of the Ad Hoc Noteholder Group Pursuant to Bankruptcy Rule 2019 [Docket No. 129] (as amended by the Amended Verified Statement of the Ad Hoc Noteholder Group Pursuant to Bankruptcy Rule 2019 [Docket No. 579] and the Second Amended Verified Statement of the Ad Hoc Noteholder Group Pursuant to Bankruptcy Rule 2019 [Docket No. 1078]).

6. “Ad Hoc Group Acceptance Event” means holders of at least 60% of the outstanding principal amount of the Convertible Notes have executed a joinder to the Plan Support Agreement.

7.“Ad Hoc Group Fee Reimbursement Letter” means those certain letter agreements, approved by the Order Authorizing the Debtors to Assume and/or Enter Into Reimbursement Agreements With Professionals for the Ad Hoc Noteholder Group [Docket No. 192], as amended in connection with the Ad Hoc Group Acceptance Event by agreement among the Debtors, the DIP Lenders, the Foris Prepetition Secured Lenders and the Ad Hoc Group Professionals to provide for the Ad Hoc Group Restructuring Expenses to be included in the Carve-Out under the Final DIP Order.

8.“Ad Hoc Group Professionals” means Paul Hastings LLP, as primary counsel, Blank Rome LLP, as local counsel, and Berkeley Research Group, LLC, as financial advisor, each as retained by the Ad Hoc Group in connection with the Chapter 11 Cases.

9.“Ad Hoc Group Restructuring Expenses” means, subject to the terms and conditions of the Ad Hoc Group Fee Reimbursement Letter, accrued, and not previously paid, documented fees and expenses of the Ad Hoc Group Professionals in connection with the Chapter 11 Cases in the aggregate amount not to exceed $1,700,000.00.

10.“Administrative Claim” means a Claim for costs and expenses of administration of the Chapter 11 Cases pursuant to sections 503(b), 507(a)(2), 507(b), or 1114(e)(2) of the Bankruptcy Code, including: (a) the actual and necessary costs and expenses incurred on or after the Petition Date and before the Effective Date of preserving the Estates and operating the Debtors’ businesses; (b) Allowed Professional Fee Claims; and (c) all fees and charges assessed against the Estates pursuant to section 1930 of chapter 123 of the Judicial Code.

11.“Administrative Claims Bar Date” means the deadline for Filing requests for payment of Administrative Claims, which shall be (a) thirty days after the Effective Date for Administrative Claims other than Professional Fee Claims and (b) forty-five days after the Effective Date for Professional Fee Claims.

12.“Administrative Claims Objection Bar Date” means the deadline for filing objections to requests for payment of Administrative Claims required to file a Proof of Claim form, which shall be the first Business Day that is 90 days following the Effective Date; provided that the Administrative Claims Objection Bar Date may be extended by the Bankruptcy Court after notice and a hearing.

13.“Affiliate” shall have the meaning of “affiliate” set forth in section 101(2) of the Bankruptcy Code. “Affiliated” has a correlative meaning.

14.“Agent” means any administrative agent, collateral agent, or similar Entity under the Foris Parties Facilities Documents, the DIP Facility Documents, or the Exit First Lien Facility Documents.

15.“Allowed” means, with respect to a Claim or Interest, any Claim or Interest (or portion thereof) against any Debtor (a) that has been listed by the Debtors in the Schedules as liquidated in amount and not “disputed” or “contingent,” and with respect to which no contrary proof of Claim or proof of Interest has been filed or an objection or request for estimation has been filed on or before the claims objection deadline or the expiration of such other applicable period fixed by the Bankruptcy Court, (b)

with respect to which a Proof of Claim or Proof of Interest has been filed and as to which no objection or request for estimation has been filed on or before the claims objection deadline or the expiration of such other applicable period fixed by the Bankruptcy Court, (c) as to which any objection has been filed on or before the claims objection deadline or the expiration of such other applicable period fixed by the Bankruptcy Court and such objection has been settled, waived, withdrawn or denied by a Final Order, or (d) that is Allowed (i) by a Final Order, or (ii) by a stipulation entered into between the Holder of such Claim or Interest and Reorganized Debtors on or after the Effective Date. For purposes of computing distributions under the Plan, a Claim or Interest that has been deemed “Allowed” shall not include interest, costs, fees or charges on such Claim or Interest from and after the Petition Date, except as provided in Bankruptcy Code section 506(b) or as otherwise expressly set forth in the Plan. Any Claim or Interest that has been or is hereafter categorized as contingent, unliquidated, or Disputed, and for which no Proof of Claim or Proof of Interest, as applicable, is or has been timely Filed, is not considered Allowed, as set forth in this Plan and the Confirmation Order. For the avoidance of doubt, a Proof of Claim Filed after the applicable Claims Bar Date shall not be Allowed for any purposes whatsoever absent entry of a Final Order allowing such late-Filed Claim. “Allow,” “Allowing,” and “Allowance” shall have correlative meanings.

16.“Amended DSM Contracts” means the DSM Contracts as amended and restated, modified, rejected and/or terminated materially consistent in all respects with the DSM Term Sheet.

17.“Amended Givaudan Contracts” means the Givaudan Contracts as amended and restated, modified, rejected and/or terminated materially consistent in all respects with the Givaudan Term Sheet.

18.“Amyris Equity Interests” means Interests in Parent.

19.“Approved Budget” has the meaning set forth in the DIP Facility Loan Agreement.

20.“Avoidance Actions” means any and all actual or potential avoidance, recovery, subordination, or other Causes of Action, or remedies that may be brought by or on behalf of the Debtors or their Estates or other authorized parties in interest under the Bankruptcy Code or applicable non-bankruptcy Law, including Causes of Action, or remedies arising under chapter 5 of the Bankruptcy Code or under similar or related local, state, federal, or foreign statutes or common Law, including fraudulent transfer Laws.

21.“Bankruptcy Code” means title 11 of the United States Code, 11 U.S.C. §§ 101-1532, as amended from time to time.

22.“Bankruptcy Court” means the United States Bankruptcy Court for the District of Delaware, presiding over the Chapter 11 Cases, or any other court having jurisdiction over the Chapter 11 Cases, including, to the extent of the withdrawal of reference under 28 U.S.C. § 157 and/or the General Order of the District Court pursuant to section 151 of the Judicial Code, the United States District Court for the District of Delaware.

23.“Bankruptcy Rules” means the Federal Rules of Bankruptcy Procedure promulgated under section 2075 of the Judicial Code and the general, local, and chambers rules of the Bankruptcy Court, each, as amended from time to time.

24.“Bar Date Order” means the Order (I) Establishing the Claims Bar Date, (II) Establishing the Governmental Bar Date, (III) Establishing the Rejection Damages Bar Date and the Amended Schedules Bar Date, (IV) Approving the Form of and Manner for Filing Proofs of Claim, Including Section 503(b)(9) Requests, and (V) Approving Notice of Bar Dates [Docket No. 528] (as amended, modified, or supplemented from time to time in accordance with the terms thereof).

25.“Bidding Procedures Order” means the Order (A) Approving Bid Procedures for the Sale of the Debtors' Brand Assets; (B) Approving Certain Bid Protections In Connection with the Debtors' Entry Into Any Potential Stalking Horse Agreements; (C) Scheduling the Auction and Sale Hearing; (D) Approving the Form and Manner of Notice Thereof; and (E) Granting Related Relief [Docket No. 553].

26.“Business Day” means any day other than a Saturday, Sunday, “legal holiday” (as defined in Bankruptcy Rule 9006(a)), or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in the State of Delaware.

27.“Cash” means cash in legal tender of the United States of America and cash equivalents, including bank deposits, checks, and other similar items.

28.“Causes of Action” means, collectively, any and all claims, interests, controversies, actions, proceedings, reimbursement claims, contribution claims, recoupment rights, debts, third-party claims, indemnity claims, damages, remedies, causes of action, demands, rights, suits, obligations, liabilities, accounts, judgments, defenses, offsets, powers, privileges, licenses, franchises, Liens, guaranties, Avoidance Actions, agreements, counterclaims, and cross-claims, of any kind or character whatsoever, whether known or unknown, foreseen or unforeseen, existing or hereinafter arising, contingent or non-contingent, matured or unmatured, suspected or unsuspected, liquidated or unliquidated, disputed or undisputed, asserted or unasserted, direct or indirect, assertable directly or derivatively, choate or inchoate, reduced to judgment or otherwise, secured or unsecured, whether arising before, on, or after the Petition Date, in tort, Law, equity, or otherwise pursuant to any theory of civil Law (whether local, state, or federal U.S. Law or non-U.S. Law). Causes of Action also include: (a) all rights of setoff, counterclaim, or recoupment and claims under contracts or for breaches of duties imposed by Law or in equity; (b) any claim (whether under local, state, federal U.S. Law or non-U.S. civil Law) based on or relating to, or in any manner arising from, in whole or in part, tort, breach of contract, breach of fiduciary duty, fraudulent transfer or fraudulent conveyance or voidable transaction Law, violation of local, state, or federal non-U.S. Law or breach of any duty imposed by Law or in equity, including securities Laws and negligence; (c) the right to object to or otherwise contest Claims or Interests and any Claim Objections; (d) claims pursuant to section 362 or chapter 5 of the Bankruptcy Code; and (e) such claims and defenses as fraud, mistake, duress, and usury, and any other defenses set forth in section 558 of the Bankruptcy Code.

29.“Chapter 11 Cases” means: (a) when used with reference to a particular Debtor, the case pending for that Debtor under chapter 11 of the Bankruptcy Code in the Bankruptcy Court; and (b) when used with reference to all the Debtors, the procedurally consolidated and jointly administered chapter 11 cases pending for the Debtors in the Bankruptcy Court.

30.“Claim” means any claim, as defined in section 101(5) of the Bankruptcy Code, against any of the Debtors.

31.“Claim Objection” means an objection to the allowance of a Claim as set forth in section 502 of the Bankruptcy Code, Bankruptcy Rule 3007, and/or any order of the Bankruptcy Court regarding omnibus claims objections.

32.“Claims Bar Date” means the applicable deadline by which Proofs of Claim must be Filed, as established by: (a) the Bar Date Order; (b) any Final Order of the Bankruptcy Court; or (c) the Plan.

33.“Claims Register” means the official register of Claims maintained by the Solicitation Agent or the clerk of the Bankruptcy Court.

34.“Class” means a class of Claims or Interests as set forth in Article III of the Plan pursuant to section 1122(a) of the Bankruptcy Code.

35.“Confirmation” means the Bankruptcy Court’s entry of the Confirmation Order on the docket of the Chapter 11 Cases within the meaning of Bankruptcy Rules 5003 and 9021.

36.“Confirmation Date” means the date upon which Confirmation occurs.

37.“Confirmation Hearing” means the hearing held by the Bankruptcy Court to consider Confirmation of the Plan, pursuant to Bankruptcy Rule 3020(b)(2) and sections 1128 and 1129 of the Bankruptcy Code, as such hearing may be continued from time to time.

38.“Confirmation Order” means the order entered by the Bankruptcy Court confirming the Plan pursuant to section 1129 of the Bankruptcy Code.

39.“Consenting Contract Counterparties” means each of DSM and Givaudan, provided said party executes the Plan Support Agreement or a joinder thereto.

40.“Consenting Convertible Noteholders” means each holder of Convertible Notes who executes the Plan Support Agreement.

41.“Consumer Brands” means Biossance®, JVN™, Rose Inc™, Pipette®, MenoLabs™, Stripes™, and 4U by Tia™. For the avoidance of doubt, the Consumer Brands shall not include any of the equity interests, assets or business with respect to Terasana®, EcoFabulous™, OLIKA™, Beauty Labs, Purecane™, and Onda Beauty.

42.“Consumer Brands Businesses” means the business, operations, and assets used in connection with the Consumer Brands (but excluding, as specifically set forth in the applicable asset purchase agreements, Estate Causes of Action, intercompany receivables, contracts unless assumed and assigned to the buyer (with cure payments made by the buyer), privileged books and records, and/or employees (unless timely offers are made to employees of such businesses on terms of employment at least the same as the current terms of employment), unless provided otherwise in the applicable asset purchase agreements).

43. “Consummation” means the occurrence of the Effective Date.

44.“Convertible Notes” means those certain convertible notes issued under that certain Indenture dated as of November 15, 2021 for 1.50% Convertible Senior Notes Due 2026 in an aggregate principal amount outstanding of approximately $690,000,000.

45.“Convertible Notes Claims” means any Claim against Parent arising under, derived from, based on, or related to the Convertible Notes or the Convertible Notes Documents.

46.“Convertible Notes Documents” means, collectively, the Indenture dated as of November 15, 2021, as amended from time to time, between Parent and the Convertible Notes Trustee, relating to the Convertible Notes and all other agreements, documents, and instruments delivered or entered into in connection therewith, as amended, supplemented, or modified from time to time.

47. “Convertible Notes Trustee” means U.S. Bank Trust Company, National Association, successor in interest to U.S. Bank National Association, solely in its capacity as trustee for the Convertible Notes.

48.“Convertible Notes Trustee Fees and Expenses” means subject to the occurrence of the Ad Hoc Group Acceptance Event, the reasonable and documented compensation, fees, expenses, and disbursements incurred by the Convertible Notes Trustee, including without limitation, attorneys’ and agents’ fees, expenses and disbursements, incurred by the Convertible Notes Trustee prior to the Effective Date, and, after the Effective Date, reasonable fees and expenses incurred in connection with distributions made pursuant to the Plan, in each case to the extent payable or reimbursable under any of the Convertible Notes Documents and in the aggregate amount not to exceed $250,000.00.

49.“Court-Ordered Cure Cost” has the meaning set forth in Article VI.D of the Plan.

50.“Creditor Trust” means a trust established on the Effective Date for the benefit of the Creditor Trust Beneficiaries in accordance with the Plan and the Creditor Trust Agreement.

51.“Creditor Trust Agreement” means the Creditor Trust Agreement, which shall be in form and substance acceptable to the Creditors’ Committee and the Ad Hoc Group, as may be amended, supplemented, restated, or otherwise modified from time to time, and substantially in the form to be included in the Plan Supplement. provided, however, for the avoidance of doubt, the Debtors, the DIP

Lender, and the Foris Prepetition Secured Lenders shall have consent rights over the Creditor Trust Agreement with respect to (i) access to books and records and personnel (which shall be at the sole cost and expense of the Creditor Trust); (ii) preservation of attorney client privilege and confidentiality; and (iii) such other terms and conditions that are not consistent with the terms hereof and the Plan Support Agreement.

52.“Creditor Trust Assets” means the assets to be held in the Creditor Trust composed of (i) the Creditor Trust Funding; (ii) the Estate Claims Settlement Consideration (including, without limitation, the Retained Estate Causes of Action); (iii) the Third-Party Release Settlement Amounts specified for distribution to qualifying holders of Allowed Claims in Classes 7 and 8; and (iv) any net proceeds of (i) – (ii) above; provided, however, that (a) Causes of Action of the Debtors and their Estates against any Released Parties and (b) any Designated Preference Actions shall not be Creditor Trust Assets.

53.“Creditor Trust Beneficiaries” means the holders of Allowed Class 7 and Class 8 Claims.

54.“Creditor Trust Expenses” means expenses (including, but not limited to, any taxes imposed on or payable by the Creditor Trust and professional fees) incurred by the Creditor Trust and any additional amount determined to be necessary or appropriate by the Creditor Trustee to adequately reserve for the operating expenses of the Creditor Trust.

55.“Creditor Trust Funding” means $2,000,000 in cash to be distributed to the Creditor Trust on the Effective Date to pay for Creditor Trust Expenses.

56.“Creditor Trust Interests” means interests in the Creditor Trust held by the Creditor Trust Beneficiaries.

57.“Creditor Trustee” means the trustee for the Creditor Trust, selected by the Creditors’ Committee and the Ad Hoc Group. The Creditor Trustee shall be identified in the Plan Supplement, and such person and any successor Creditor Trustee shall be a “U.S. person” as determined for U.S. federal income tax purposes.

58.“Creditor Trust Oversight Committee” means the committee appointed to manage and oversee the administration of the Creditor Trust.

59.“Creditors’ Committee” means the statutory committee of unsecured creditors appointed in the Chapter 11 Cases pursuant to section 1102 of the Bankruptcy Code by the U.S. Trustee pursuant to the United States Trustee’s Notice of Appointment of Committee of Unsecured Creditors [Docket No. 152] on August 27, 2023, as may be reconstituted from time to time.

60.“Creditors’ Committee Member” means each Entity that is a member of the Creditors’ Committee.

61.“Creditors’ Committee Professionals” means White & Case LLP, as primary counsel, Potter Anderson & Corroon LLP, as local counsel, FTI Consulting, Inc, as financial advisor, and Jefferies LLC, as investment banker, each as retained by the Creditors’ Committee in connection with the Chapter 11 Cases.

62.“Creditors’ Committee Professionals Expenses” means, subject to approval by the Bankruptcy Court, documented fees and expenses of the Creditors’ Committee Professionals in connection with the Chapter 11 Cases in the aggregate amount not to exceed $12,000,000.00.

63.“Cure” means all amounts, including an amount of $0.00, required to cure any monetary defaults under any Executory Contract or Unexpired Lease (or such lesser amount as may be agreed upon by the parties under an Executory Contract or Unexpired Lease) that is to be assumed by the Debtors pursuant to sections 365 or 1123 of the Bankruptcy Code.

64.“D&O Liability Insurance Policies” means all insurance policies (including any “tail policy”) covering any of the Debtors’ current or former directors’, managers’, officers’, and/or employees’ liability and all agreements, documents, or instruments relating thereto.

65.“Debt Documents” shall mean, collectively, the Foris Prepetition Secured Claims Documents, the DIP Facility Loan Agreement, the DSM Loan Agreement, and the Convertible Notes Documents, and any other agreements, instruments, pledge or security agreements, intercreditor agreements, guarantees, fee letters, control agreements, and other ancillary documents related thereto (including any security agreements, intellectual property security agreements, or notes), as amended, restated, supplemented, waived, and/or modified from time to time.

66.“Debtor Release” means the release given by the Debtors and the Estates to the Released Parties as set forth in Article IX.C of the Plan.

67.“Deferred Deadline” has the meaning set forth in Article VI.A of the Plan.

68.“Definitive Documents” means all agreements, instruments, pleadings, orders, forms, questionnaires, and other documents (including all exhibits, schedules, supplements, appendices, annexes, instructions, and attachments thereto) that are utilized to implement or effectuate, or that otherwise relate to, the Plan and the Restructuring Transactions, each of which shall be (except as otherwise set forth herein) in form and substance acceptable to the Debtors and the Foris Secured Parties, including, without limitation, (1) the New Organizational Documents; (2) the Lavvan Settlement Agreement; (3) the Exit First Lien Facility Documents; (4) new, amended, or amended and restated guarantees, security documents, and similar agreements, as applicable; (5) any and all documents required to implement, issue, and distribute the New Common Stock; (6) any other document(s) necessary to implement or consummate the Restructuring Transactions and the Exit First Lien Facility; (7) the Creditor Trust Agreement; (8) the Amended DSM Contracts and Amended Givaudan Contracts; (9) the DSM Plan Promissory Note and DSM Plan Promissory Note Pledge Agreement; (10) any other Plan Supplement; and (11) any and all opinions, certificates, filings, and other deliverables required to satisfy the conditions precedent to the effectiveness of the foregoing documents and agreements.

69.“Designated Preference Actions” means collectively Estate Causes of Action that are preference actions arising under Section 547 of the Bankruptcy Code that are so designated as Designated Preference Actions in the Plan Supplement.

70.“DIP Agent” means Euagore, LLC, in its capacity as administrative agent under the DIP Facility Loan Agreement, its successors, assigns, or any replacement agent appointed pursuant to the terms of the DIP Facility Loan Agreement.

71.“DIP Facility” means the $190 million debtor-in-possession credit facility provided to the Debtors on the terms and conditions set forth in the DIP Facility Loan Agreement and the DIP Orders.

72.“DIP Facility Claim” means a Claim arising under, relating to, derived from, based upon, or secured pursuant to the DIP Facility, including Claims for all principal amounts outstanding, interest, fees, expenses, costs, indemnification obligations, reimbursement obligations, and any other charges arising thereunder, in each case, with respect to the DIP Facility, including, for the avoidance of doubt, such Claims held by the DIP Lenders or the DIP Agent.

73.“DIP Facility Documents” means, collectively, the DIP Facility Loan Agreement and all other agreements, documents, and instruments delivered or entered into in connection therewith, including, but not limited to, any guarantee agreements, pledge and collateral agreements, intercreditor agreements, subordination agreements, fee letters, and other security documents.

74.“DIP Facility Loan Agreement” means that certain Senior Secured Super Priority Debtor In Possession Loan Agreement, dated as of August 9, 2023 (as may be amended, supplemented, or otherwise modified from time to time), by and among Amyris, Inc., Amyris Clean Beauty, Inc., and Aprinnova, LLC, in their capacity as borrowers; the other Debtors and certain non-Debtor subsidiaries, as guarantors; the DIP Lenders and the DIP Agent.

75.“DIP Lender(s)” means Euagore, LLC and other lenders from time to time party to the DIP Facility Loan Agreement.

76.“DIP Orders” means any orders entered in the Chapter 11 Cases approving the DIP Facility (whether interim or final) consistent with the DIP Facility Loan Agreement, including, for the avoidance of doubt, the interim order entered by the Bankruptcy Court on August 11, 2023 [Docket No. 54] and the Final DIP Order [Docket No. 558].

77.“Direct Claims” means any Cause of Action held by a Releasing Party against any of the Released Parties (excluding the Debtors) and their respective Related Parties, but only to the extent such claims arise from, relate to, or are connected with, directly or indirectly, in any manner whatsoever, the Debtors, including their respective assets, liabilities, operations, financings, contractual agreements, licenses, and including the governance thereof, and existing on or prior to the Effective Date (including prior to the Petition Date).

78.“Direct Claims Injunction” has the meaning set forth in Article IX.G.1 of the Plan.

79.“Direct Claims Injunction Parties” means (a) the Reorganized Debtors; (b) the Foris Secured Parties; and (c) the Related Parties of the foregoing parties.

80.“Direct Claims Threshold” means (a) with respect to holders of Direct Claims who are creditors of the Debtors, determined separately with respect to such creditors classified in Class 7 and Class 8, respectively, creditors who hold at least a majority in amount of the Claims asserted against the Debtors (such Claims measured as of the Record Date (as defined in the Solicitation Materials) on the same basis as such Claims are Allowed for voting purposes) do not elect to opt out of granting the Third-Party Release; and (b) with respect to holders of Direct Claims who are Holders of any Interests consisting of issued and outstanding shares of common stock of Parent, such Holders who hold at least a majority of the outstanding common stock of Parent (excluding for purposes of such calculation, any outstanding common stock of Parent held by any of the Direct Claims Injunction Parties) (such outstanding common stock of Parent measured as of the Distribution Record Date) do not elect to opt out of granting the Third-Party Release.

81.“Disbursing Agent” means, as applicable, the Entity or Entities selected by the Debtors, the Reorganized Debtors, Ad Hoc Group, Creditors’ Committee, or the Plan Administrator, as applicable, to make or to facilitate distributions, allocations, and/or issuances in accordance with, and pursuant to, the Plan. For the avoidance of doubt, (i) the Plan Administrator may serve as the Disbursing Agent; (ii) the DIP Agent shall not be a Disbursing Agent; and (iii) the Creditor Trust shall be the Disbursing Agent for distributions to holders of Allowed Claims in Classes 7 and 8.

82.“Disclosure Statement” means the disclosure statement relating to this Plan, as may be amended, supplemented, or modified from time to time, including all exhibits and schedules thereto, in each case, as may be amended, supplemented, or modified from time to time, that is prepared and distributed in accordance with the Bankruptcy Code, the Bankruptcy Rules, and any other applicable Law, to be approved pursuant to the Disclosure Statement Order.

83.“Disclosure Statement Order” means the order (and all exhibits thereto), entered by the Bankruptcy Court, approving the Disclosure Statement and the Solicitation Materials, and allowing solicitation of the Plan to commence.

84.“Disputed” means, as to a Claim or an Interest, any Claim or Interest (or portion thereof): (a) that is not Allowed; (b) that is not disallowed by the Plan, the Bankruptcy Code, or a Final Order, as applicable; and (c) with respect to which a party in interest has Filed a Proof of Claim or Proof of Interest or otherwise made a written request to a Debtor for payment, without any further notice to or action, order, or approval of the Bankruptcy Court.

85.“Distribution Date” means, except as otherwise set forth herein, (a) the date or dates determined by the Debtors, the Reorganized Debtors, the Plan Administrator, or the Creditor Trust, as applicable, on or after the Effective Date, with the first such date occurring on or as soon as is reasonably

practicable after the Effective Date, upon which the Disbursing Agent shall make distributions to Holders of Allowed Claims (as and if applicable) entitled to receive distributions under the Plan (except for Holders of Allowed General Unsecured Claims), (b) the date or dates determined by the Creditor Trustee, in its sole discretion, on or after the Effective Date, for distribution to the beneficiaries of the Creditor Trust, or (c) the date or dates determined by the Plan Administrator for distributions under the Plan as provided for in the Plan.

86.“Distribution Record Date” means the record date for purposes of determining which Holders of Allowed Claims against or Allowed Interests in the Debtors are eligible to receive distributions under the Plan, which date shall be the Solicitation Record Date, or such other date selected by the Debtors. The Distribution Record Date shall not apply to Securities of the Debtors deposited with DTC or another similar securities depository, the Holders of which may receive a distribution in accordance with Article VII of the Plan and, as applicable, the customary procedures of DTC or another similar securities depository.

87.“DSM” means DSM Finance B.V., DSM Nutritional Products Ltd., DSM Produtos Nutricionais Brasil S.A., DSM Food Specialties B.V., DSM IP Assets B.V., DSM International B.V., DSM Nutritional Products AG, DSM Nutritional Products Europe Ltd., and Firmenich S.A.

88.“DSM AP Stipulation” means the Order Approving Stipulation Granting Adequate Protection Relief to DSM-Firmenich AG [Docket No. 676] and the stipulation attached thereto.

89.“DSM Contract Claims” means any unsecured Claim against any of the Debtors arising prior to the Petition Date from any DSM Contract.

90.“DSM Contracts” means those contracts, licenses and agreements identified in the DSM Term Sheet, as each has been amended, modified, amended and restated, or otherwise modified from time to time, as well as all other contracts, agreements and licenses by and between DSM and the Debtors and the Debtors’ Affiliates (but excluding the DSM Loan Agreement).

91.“DSM Loan Agreement” means that certain Loan and Security Agreement by and among Parent and (as defined therein) the Subsidiary Guarantors and DSM Finance B.V. dated October 11, 2022 (as further amended, supplemented, amended and restated, or otherwise modified from time to time).

92.“DSM Other Secured Claim” means that certain Claim in the aggregate principal amount outstanding as of the Petition Date of $45,450,000 pursuant to the DSM Loan Agreement secured as described in the DSM AP Stipulation (including by a lien on Parent’s right to receive certain earn-out payments pursuant to Section 3.5 of the Asset Purchase Agreement, dated as of March 31, 2021, by and among, DSM Nutritional Products Ltd., as buyer and Parent as seller).

93.“DSM Plan Promissory Note” means the note to be provided to DSM pursuant to Section III.B. of the Plan, substantially in the form included as part of the Plan Supplement.

94.“DSM Plan Promissory Note Pledge Agreement” means the pledge agreement by which Reorganized Debtors’ obligations under the DSM Plan Promissory Note will be secured by certain interests, pursuant to Section III.B.4 of the Plan, substantially in the form included as part of the Plan Supplement.

95.“DSM RealSweet Secured Claims” means that certain claim in the aggregate principal amount outstanding as of the Petition Date of $29,518,925 pursuant to the DSM Loan Agreement, secured as described in the DSM AP Stipulation by a lien on Parent’s Interests in Amyris RealSweet LLC.

96.“DSM Term Sheet” means that certain DSM-Firmenich Restructuring Term Sheet, dated as of December 13, 2023, between Parent and its direct and indirect subsidiaries and DSM Nutritional Products Ltd., Firmenich S.A. and certain of their affiliates.

97.“DTC” means The Depository Trust Company, a New York corporation.

98.“Effective Date” means the first Business Day after the Confirmation Order is entered on which (a) all conditions precedent to the occurrence of the Effective Date set forth in Article X.A of the Plan have been satisfied or waived in accordance with Article X.C of the Plan and (b) the Plan is declared effective by the Debtors, in consultation with Foris, the Ad Hoc Group and the Creditors’ Committee.

99.“Entity” has the meaning set forth in section 101(15) of the Bankruptcy Code.

100.“Estate” means as to each Debtor, the estate created for such Debtor in its Chapter 11 Case pursuant to section 541 of the Bankruptcy Code upon the commencement of such Debtor’s Chapter 11 Case.

101.“Estate Causes of Action” means all Causes of Action that are assets of the Debtors’ Estates.

102.“Estate Claims Settlement” means that settlement and release of the Estate Causes of Action as provided for in Article IV.A and Article IX.C & F of the Plan in exchange for funding the payments required under the Plan; (i) to satisfy Allowed Administrative Claims, Allowed Professional Fees, Allowed Priority Tax Claims and U.S. Trustee Fees; and, (ii) the funding of the Estate Claims Settlement Consideration.

103.“Estate Claims Settlement Consideration” means the aggregate of the Estate Claims Settlement Cash Consideration and the Estate Claims Settlement Other Consideration.

104.“Estate Claims Settlement Cash Consideration” means $15,000,000 in cash which shall be distributed Pro Rata to Classes 7 and 8 by the Disbursing Agent, based upon the Allowed Claims in such Classes, and the Creditor Trust Funding, in each case whether or not Class 7 or Class 8 votes to accept the Plan.

105.“Estate Claims Settlement Other Consideration” means the Retained Estate Causes of Action which shall be transferred to the Creditor Trust on the Effective Date and the proceeds thereof, which proceeds shall be part of the Creditor Trust for distribution Pro Rata to Classes 7 and 8, based upon the Allowed Claims in such Classes, whether or not such Classes vote to accept the Plan.

106.“Exchange Act” means the Securities Exchange Act of 1934, as amended, together with the rules and regulations promulgated thereunder, as amended from time to time, or any similar federal, state, or local Law.2

107.“Excluded Parties” means John Melo and Eduardo Alvarez.

108.“Excluded Party Direct Claim” shall mean any Direct Claim against any Excluded Party.

109.“Exculpated Parties” means, collectively, and in each case in its capacity as such: (a) the Debtors; (b) the Creditors’ Committee; (c) Professionals for (a) and (b); (d) all officers and directors of any of the Debtors serving in such capacity on or after the Petition Date and before the Effective Date; and (e) persons who acted as agents for (a) and (b) and, in doing so, assumed fiduciary obligations of the principal.

110.“Executory Contract” means a contract to which one or more of the Debtors is a party and that is subject to assumption or rejection under section 365 or 1123 of the Bankruptcy Code.

111.“Exit First Lien Facility” means the first lien senior secured credit facility for the Exit First Lien Facility Amount, which shall be on the terms set forth in the Exit First Lien Facility Documents, and which shall mature five years after the Effective Date, or if any portion of the outstanding DIP Facility and/or Foris Prepetition Secured Loans is amended and restated or rolled-over into indebtedness of the Reorganized Debtors, up to ten years after the Effective Date.

112.“Exit First Lien Facility Agent” means the administrative agent and collateral agent under the Exit First Lien Facility, solely in their respective capacities as such.

113.“Exit First Lien Facility Amount” means an aggregate principal amount of up to $160,000,000, excluding any portion of the outstanding DIP Facility and/or Foris Prepetition Secured Loans that is amended and restated or rolled-over into indebtedness of the Reorganized Debtors with the specific identification and amount of the tranches of the Exit First Lien Facility to be specified in the Plan Supplement.

114.“Exit First Lien Facility Documents” means, collectively, the applicable credit agreements, collateral documents, mortgages, deeds of trust, Uniform Commercial Code statements, and other loan documents governing the Exit First Lien Facility, the material documents of which shall be included in the Plan Supplement.

115.“Exit First Lien Facility Lenders” means, collectively, the financial institutions and/or other entities that may from time from time become lenders under the Exit First Lien Facility, which parties shall be identified in the Plan Supplement; provided that the DIP Lender and the Foris Prepetition Secured Lenders shall provide jointly and severally a backstop commitment for a $160,000,000 exit facility as set forth in the Plan Support Agreement and exhibits and schedules thereto.

116.“Federal Judgment Rate” means the federal judgment rate in effect as of the Petition Date.

117.“File,” “Filed,” or “Filing” means file, filed, or filing with the Bankruptcy Court or its authorized designee in the Chapter 11 Cases.

118.“Final DIP Order” means the final order entered by the Bankruptcy Court on October 16, 2023 [Docket No. 558].

119.“Final Order” means, as applicable, an order or judgment of the Bankruptcy Court, or other court of competent jurisdiction with respect to the relevant subject matter, that has not been reversed, stayed, modified, or amended, and as to which the time to appeal, seek certiorari, or move for a new trial, re-argument, or rehearing has expired and as to which no appeal, petition for certiorari, or other proceeding for a new trial, re-argument, or rehearing has been timely taken; or as to which, any appeal that has been taken or any petition for certiorari that has been or may be filed has been withdrawn with prejudice, resolved by the highest court to which the order or judgment could be appealed or from which certiorari could be sought, or the new trial, re-argument, or rehearing has been denied, resulted in no stay pending appeal or modification of such order, or has otherwise been dismissed with prejudice; provided that the possibility that a motion under Rule 60 of the Federal Rules of Civil Procedure, or any analogous rule under the Bankruptcy Rules, may be filed with respect to such order will not preclude such order from being a Final Order.

120.“Foris” means Foris Ventures, LLC and any of its Affiliates.

121.“Foris 2018 Loan” means that certain Amended and Restated Loan and Security Agreement by and among Parent, as borrower, Amyris Clean Beauty, Inc., Amyris Fuels, LLC, and AB Technologies LLC, as guarantors, and Foris Ventures, LLC, as lender, dated as of October 28, 2019, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated, supplemented or otherwise modified from time to time.

122.“Foris Prepetition Secured Claims” means those certain secured claims in the approximate aggregate principal and interest amount outstanding of at least $312,100,000 as of the Petition Date pursuant to (i) the Foris 2018 Loan, (ii) Amended and Restated Loan and Security Agreement by and among Amyris, as borrower, the Subsidiary Guarantors, as guarantors, and Foris, as lender, dated as of September 27, 2022, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated, supplemented or otherwise modified from time to time, (iii) Bridge Loan and Security Agreement by and among Parent, as borrower, the Subsidiary Guarantors, as guarantors, and Perrara Ventures, LLC, as lender, dated as of March 10, 2023, as amended by that certain Omnibus Amendment Agreement, dated as of June 5, 2023, and as further amended, restated,

supplemented or otherwise modified from time to time, (iv) Loan and Security Agreement by and among Amyris, as borrower, the Subsidiary Guarantors, as guarantors, and Anesma Group, LLC, as lender, dated as of June 5, 2023, (v) Loan and Security Agreement by and among Parent, as borrower, the Subsidiary Guarantors, as guarantor, and Anjo Ventures, LLC, as lender, dated June 29, 2023, and (vi) Loan and Security Agreement by and among Parent, as borrower, the Subsidiary Guarantors, as guarantors, and Muirisc, LLC, and lender, dated as of August 2, 2023 (all of the foregoing as further amended, supplemented, amended and restated, or otherwise modified prior to the Petition Date).

123.“Foris Prepetition Secured Claims Documents” means all agreements, documents, and instruments delivered or entered into in connection with any Foris Prepetition Secured Claims, as amended, supplemented, or modified from time to time.

124.“Foris Prepetition Secured Lenders” means collectively, Foris Ventures, LLC, Perrara Ventures, LLC, Anesma Group, LLC, Anjo Ventures, LLC, and Muirisc, LLC.

125.“Foris Secured Parties” means Foris Ventures, LLC, Perrara Ventures, LLC, Anesma Group, LLC, Anjo Ventures, LLC, Muirisc, LLC, the DIP Lenders, and the DIP Agent.

126.“General Unsecured Claim” means any unsecured Claim against any of the Debtors, other than: (a) an Administrative Claim; (b) a Secured Claim, (c) a Priority Tax Claim; (d) an Other Priority Claim; (e) a Convertible Note Claim; or (e) a Section 510(b) Claim. For the avoidance of doubt, General Unsecured Claims include (i) unsecured Claims resulting from the rejection of Executory Contracts and Unexpired Leases, and (ii) unsecured Claims resulting from litigation against one or more of the Debtors.

127.“Givaudan” means Givaudan SA and its Affiliates.

128.“Givaudan Contracts” means those contracts, agreements and licenses identified in the Givaudan Term Sheet, as each has been amended, modified, amended and restated, rejected, or otherwise modified from time to time, including all other contracts, agreements and licenses by and between Givaudan and the Debtors and the Debtors’ Affiliates.

129.“Givaudan Term Sheet” means the Term Sheet entered into by and between Parent and Givaudan dated January 23, 2024.

130.“Governmental Unit” has the meaning set forth in section 101(27) of the Bankruptcy Code.

131.“Holder” means an Entity holding a Claim against or an Interest in any Debtor, as applicable.

132.“Impaired” means, with respect to a Class of Claims or Interests, a Class of Claims or Interests that is impaired within the meaning of section 1124 of the Bankruptcy Code.

133.“Intercompany Claim” means any Claim held by a Debtor or wholly-owned Affiliate of a Debtor against another Debtor or wholly-owned Affiliate of a Debtor.

134.“Intercompany Interest” means, other than an Amyris Equity Interest, any Interest in one Debtor held by another Debtor.

135.“Interests” means the legal interests, equitable interests, contractual interests, equity interests or ownership interests, or other rights of any entity in the Debtors, including all equity securities (as defined in section 101(15) of the Bankruptcy Code), capital stock, stock certificates, common stock, preferred stock, partnership interests, limited liability company or membership interests, rights, treasury stock, options, warrants, contingent warrants, convertible or exchangeable securities, investment securities, subscriptions or other agreements and contractual rights to acquire or obtain such an interest or share in the Debtors, partnership interests in the Debtors’ stock appreciation rights, conversion rights, repurchase rights, redemption rights, dividend rights, preemptive rights, subscription rights and liquidation

preferences, puts, calls, awards or commitments of any character whatsoever relating to any such equity, common stock, preferred stock, ownership interests or other shares of capital stock of the Debtors or obligating the Debtors to issue, transfer or sell any shares of capital stock whether or not certificated, transferable, voting or denominated “stock” or a similar security.

136.“Interim Compensation Order” means the Order Establishing Procedures for Interim Compensation and Reimbursement of Expenses for Professionals [Docket No. 279].

137.“Intrepid Engagement Letter” means that certain engagement letter between Parent and Intrepid Investment Bankers LLC, dated July 21, 2023, setting forth the terms of Parent’s engagement of Intrepid as approved pursuant to that certain Order (I) Authorizing the Retention and Employment of Intrepid Investment Bankers LLC as Investment Banker for the Debtors and Debtors in Possession, Pursuant to 11 U.S.C. §§ 327(A) and 328, Nunc Pro Tunc to the Petition Date; (II) Waiving Certain Requirements Imposed by Local Rule 2016-2; and (III) Granting Related Relief [Docket No. 280].

138.“IRS” means the United States Internal Revenue Service.

139.“Judicial Code” means title 28 of the United States Code, 28 U.S.C. §§ 1–4001, as amended from time to time.

140.“KEIP/KERP Order” means that certain Order (I) Approving Key Employee Incentive for Senior Leadership Employees and (II) Approving Key Employee Retention Plan for Non-Insider Employees [Docket No. 286].

141.“Lavvan” means Lavvan, Inc.

142.“Lavvan Claims” means in the aggregate: (i) the Claims arising under, related to or connected with, in any manner whatsoever, the Lavvan Documents; (ii) the Claims asserted by, or that could be asserted by, Lavvan in, connection, with, or related to, the Lavvan Proceedings; and (iii) any and all other Claims that Lavvan has, or may have, against the Debtors and its Affiliates as of the Effective Date.

143.“Lavvan Documents” means (i) the Research, Collaboration and License Agreement between Parent and Lavvan dated March 18, 2019; (ii) the Security Agreement between Parent and Lavvan dated May 2, 2019; (iii) the Subordination Agreement between Parent and Lavvan dated May 2, 2019; (iv) the Consent and Waiver, between Parent and Foris Ventures, LLC dated May 2, 2019; (v) the Escrow Agreement between Parent, Lavvan, and SciSafe Inc. dated May 20, 2019; (vi) the DIPA Co., Limited Liability Company Agreement between Parent and Lavvan dated May 2, 2019; (vii) the Intellectual Property Assignment between Parent and DIPA Co., LLC dated May 2, 2019; (viii) the License Agreement between Parent and DIPA Co., LLC dated May 2, 2019; (ix) the License Agreement between Lavvan and DIPA Co., LLC dated May 2, 2019; and (x) all other documents, agreements, contracts, licenses by and among Lavvan and the Debtors and their Affiliates, and the same have been amended, modified, amended and restated, or otherwise modified from time to time.

144.“Lavvan Proceedings” mean that certain arbitration proceeding pending in the ICC International Court of Arbitration and that certain Complaint filed in the United States District Court, Southern District of New York (Case 1:20-cv-07386-JPO) by Lavvan as plaintiff against Parent as defendant.

145.“Lavvan Proof of Claim” means Proof of Claim number 639 by Lavvan against Parent.

146.“Lavvan Secured Claim” means the Lavvan Claims.

147.“Lavvan Settlement” means the settlement, transactions and agreements among the Parent, the Foris Secured Parties, and Lavvan, and the consideration given or received, as applicable, by each, as set forth in, and subject to the terms and conditions of, the Lavvan Settlement Agreement.

148.“Lavvan Settlement Agreement” means that certain Settlement Agreement, to be executed by and among the Parent, the Foris Secured Parties, and Lavvan (together with all appendices, exhibits, and schedules thereto), which shall be in form and substance consistent with that certain Lavvan Settlement Term Sheet filed as Exhibit U to the Plan Supplement.

149.“Lavvan Settlement Consideration” means $15,140,000 in cash which shall be distributed by the Disbursing Agent on account of the Allowed Secured Claim on the Effective Date in accordance with the Plan and the Lavvan Settlement Agreement.

150.“Law” means any federal, state, local, or foreign law (including common law), statute, code, ordinance, rule, regulation, order, ruling, or judgment, in each case, that is validly adopted, promulgated, issued, or entered by a governmental authority of competent jurisdiction (including the Bankruptcy Court).

151.“Lien” has the meaning set forth in section 101(37) of the Bankruptcy Code.

152.“Net Cash Proceeds” means Net Proceeds that are paid in cash at closing of the sale of the Sold Assets.

153.“Net Proceeds” mean the cash proceeds from the sale of the Sold Assets less the “Sale Fee” (as defined in and payable under the Intrepid Engagement Letter).

154.“New Board” means the new board of directors of Reorganized Amyris or each of the Reorganized Debtors (if applicable and as the context requires).

155.“New Common Stock” means the common stock, common shares, ordinary shares, or other common Interest or unit, as applicable, of Reorganized Amyris.

156.“New Organizational Documents” means the form of the certificates or articles of incorporation, bylaws, shareholders’ agreement, or such other applicable formation documents, of each of the Reorganized Debtors.

157.“Other Assets” means all of the assets of the Debtors’ Estates excluding: (i) the Consumer Brands (and the proceeds of the sale thereof); (ii) the Estate Claims Settlement Consideration; and (iii) Third-Party Release Settlement Amounts.

158.“Other Assets Bidding Procedures” means the bidding procedures approved by order of the Bankruptcy Court governing the sale of the Other Assets, which shall be reasonably acceptable to the Committee and the Ad Hoc Group.

159.“Other Assets Sale Order” means the order of the Bankruptcy Court governing the sale of the Other Assets, which shall be reasonably acceptable to the Committee and the Ad Hoc Group.

160.“Other Assets Stalking Horse Credit Bid” means a credit bid for the Other Assets by the DIP Lenders and the Foris Prepetition Secured Lenders in accordance with the Other Assets Bidding Procedures and as further described in the Plan Support Agreement.

161.“Other Consenting Stakeholders” has the meaning ascribed to it in the Plan Support Agreement.

162.“Other Priority Claim” means any Claim, other than an Administrative Claim or a Priority Tax Claim, entitled to priority in right of payment under section 507(a) of the Bankruptcy Code.

163.“Other Secured Claim” means any Secured Claim other than: (a) the DIP Facility Claims; (b) the Foris Prepetition Secured Claims; and (c) the DSM RealSweet Secured Claims.

164.“Parent” means Debtor Amyris, Inc.

165.“Person” has the meaning set forth in section 101(41) of the Bankruptcy Code.

166.“Petition Date” means, as applicable, August 9, 2023, the date on which Parent and certain Debtors commenced their respective Chapter 11 Cases, or in the case of Clean Beauty 4U Holdings, LLC, Clean Beauty 4U LLC, and Clean Beauty Collaborative, Inc., August 21, 2023, the date on which those Debtors commenced their respective Chapter 11 Cases.

167.“Plan Administrator” means the person or entity selected by the Debtors, with the reasonable consent of the Foris Secured Parties, the Creditors’ Committee, and the Ad Hoc Group with respect to experience and qualifications, charged with overseeing the tasks outlined in the Plan not delegated to the Creditor Trust.