false

0001038277

0001038277

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

INTERNATIONAL ISOTOPES INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Texas

|

0-22923

|

74-2763837

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

4137 Commerce Circle

Idaho Falls, Idaho

|

|

83401

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

208-524-5300

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On February 8, 2024, International Isotopes Inc. (“INIS”) and its wholly-owned subsidiary International Isotopes Fluorine Products, Inc. (together with INIS, the “Company”) entered into an Asset Purchase Agreement (the “APA”) with American Fuel Resources, LLC (“AFR”), pursuant to which the Company agreed to sell to AFR all the assets and certain specified liabilities of the Company’s depleted uranium deconversion and fluorine extraction plant (the “DUF6 Plant”), subject to the terms and conditions set forth in the APA (the “Transaction”). The Company expects to close the Transaction in approximately 12 to 24 months, subject to satisfaction of certain closing conditions (the “Closing”).

The purchase price to be paid by AFR in the Acquisition will consist of (i) $50,000 to be paid withing five business days of execution of the APA (the “Prepayment”), and (ii) $12,500,000 paid at the Closing, less the Prepayment. The APA contains customary representations and warranties, covenants and indemnification provisions for a transaction of this nature. Closing of the Transaction is also subject to certain closing conditions, including (i) transfer of the U.S. Nuclear Regulatory Commission (NRC) license related to the DUF6 Plant (the “NRC License Transfer”) and (ii) transfer of Purchased Assets (as defined in the APA), which includes licenses, patents, agreements, and other records of the DUF6 Plant.

The APA may be terminated, among other things, (i) upon mutual written consent by the parties to the APA, (ii) by either party upon material breach of the APA by the other party, subject to applicable cure periods, and (iii) by AFR if there is reason to believe that the NRC License Transfer will not be completed by March 31, 2026.

The foregoing summary of the APA does not purport to be complete and is subject to and is qualified in its entirety by the terms of the APA, which is attached hereto as Exhibit 10.1, and incorporated herein by reference.

Item 7.01. Regulation FD.

On February 8, 2024, the Company issued a press release relating to the Transaction. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in this Item 7.01 and Exhibit 99.1 furnished hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

10.1*#

|

|

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL).

|

* Certain portions of the exhibit have been omitted pursuant to Rule 601(b)(10) of Regulation S-K. The omitted information is not material and is the type of information that the registrant treats as private or confidential.

# Certain exhibits and schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company agrees to furnish supplementally to the Securities and Exchange Commission a copy of any omitted exhibits or schedules upon request.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

INTERNATIONAL ISOTOPES INC.

|

|

| |

|

|

|

|

Date: February 8, 2024

|

By:

|

/s/ Shahe Bagerdjian

|

|

| |

|

Shahe Bagerdjian

Chief Executive Officer

|

|

Exhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION, IDENTIFIED BY BRACKETED ASTERISKS “[***]”, HAS BEEN OMITTED FROM THIS EXHIBIT BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED.

ASSET PURCHASE AGREEMENT

This ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of February 8, 2024 (the “Effective Date”), is by and among AMERICAN FUEL RESOURCES, LLC, a Washington limited liability company, including any of its Affiliates, (“Buyer”), and INTERNATIONAL ISOTOPES, INC., a Texas corporation (“INIS”) and INTERNATIONAL ISOTOPES FLUORINE PRODUCTS, INC., an Idaho corporation (“IIFP”) (INIS and IIFP jointly the “Seller”). The Buyer and Seller individually a “Party” and collectively the “Parties.”

RECITALS:

Seller owns tangible and intangible assets relating to the permitting, development, financing, construction, and operation, including registered patents and a U.S. Nuclear Regulatory Commission (“NRC”) license, of a depleted uranium deconversion and fluorine extraction plant to be located in Hobbs, NM. [***] Seller has owned the tangible and intangible assets for several years but has not pursued construction of the plant. Seller is interested in selling all of its assets in the depleted uranium deconversion and fluorine extraction plant (the “Purchased Assets”) to Buyer.

Buyer is in the development stage of, and intends to own, construct, and operate, a depleted uranium deconversion and fluorine extraction plant (“DUF6 Plant”). Buyer desires to purchase the Purchased Assets for use in its DUF6 Plant.

The Parties understand that the sale and purchase of the Purchased Assets will not be consummated in the immediate future, but rather in stages, with an initial payment, potential payments for extension of Closing, and a payment at Closing (“Closing” is defined as the transfer of the Purchased Assets to Buyer as described in this Agreement). Buyer and Seller, however, believe it is beneficial for both of them to enter into this Agreement for the sale and purchase of the Purchased Assets at this time.

The Parties, intending to be bound by terms and conditions of this Agreement, agree as follows:

ARTICLE 1 RECITALS AND DEFINITIONS

1.01 Recitals. The foregoing Recitals are restated and incorporated into this Agreement.

1.02 Definitions. Capitalized terms used in this Agreement and not otherwise defined have the meaning ascribed to such terms in Exhibit A to this Agreement, and the definitional and interpretive provisions set forth in Section 9.20 will apply in all respects to this Agreement including the Exhibits and Schedules.

ARTICLE 2 PURCHASE AND SALE

2.01 Purchase and Sale. Upon the terms and subject to the conditions of this Agreement, Buyer agrees to purchase from Seller and Seller agrees to sell, convey, transfer, assign and deliver, or cause to be sold, conveyed, transferred, assigned and delivered, to Buyer the entire right, title and interest of Seller in, to and under the Purchased Assets, in each case free and clear of all Liens. The Purchased Assets more specifically include:

(a) the assets described on Schedule A; and

(b) all information that Seller has in its possession that relates to or arises from the permitting, development, financing, construction, and operation of a depleted uranium (DU) deconversion and fluorine extraction process (FEP) plant Seller had previously planned to be located in Hobbs, NM. Information includes, but is not limited to, intellectual property, trade secrets, technical data, financial data, and business planning strategies. Information may be contained in any form such as books, ledgers, records, files, lists, and papers, whether in hard copy or computer or other electronic format, used in, held for use, or relating to the Purchased Assets, including all user manuals and product documentation (“Books and Records”).

(c) For clarity, Schedule A is not intended to list each asset to be transferred but is intended to demonstrate the Parties’ intent that Buyer is purchasing all of Seller’s assets related and limited to the depleted uranium deconversion and fluorine extraction process plant, including all information in Seller’s possession, relating to and arising out of Seller’s previously planned depleted uranium deconversion and fluorine extraction process plant. Therefore, if an asset is not specifically stated on Schedule A, but is in the possession of the Seller and otherwise reasonably necessary or beneficial for Buyer to own or use so that Buyer may develop, finance, construct, own and operate the DUF6 Plant effectively, that asset is deemed to have been included on Schedule A.

2.02 Excluded Assets. All tangible and intangible assets of the Seller that are not Purchased Assets are “Excluded Assets”.

2.03 Assumed Liabilities. Upon the terms and subject to the conditions of this Agreement, Buyer agrees, effective at the time of the Closing, to assume only the following liabilities (the “Assumed Liabilities”): (a) all liabilities or obligations, including Taxes, arising out of or relating to the ownership of the Purchased Assets after Closing (but excluding any of the foregoing to the extent arising from the acts or omissions of Seller prior to Closing), and (b) any Taxes for which Buyer is responsible pursuant to Section 5.06.

2.04 Excluded Liabilities. Buyer is assuming only the Assumed Liabilities and is not assuming any Excluded Liabilities, which will remain liabilities and obligations of Seller.

2.05 Assignment of Permits, Patents, and Rights. This Agreement does not constitute an agreement to sell, assign, transfer, convey or deliver any intended Purchased Asset or any claim or right or any benefit arising or resulting from the Purchased Asset if such attempted sale, assignment, transfer, conveyance or delivery, without the authorization, approval or consent of a Governmental Authority or other third party (collectively, the “Required Consents”), would (a) constitute a breach or other contravention of any Governmental Authority, procedure, rule or regulation related to such intended Purchased Asset; (b) be void or voidable; or (c) in any way adversely affect the rights of Buyer as of the execution of this Agreement. If any Required Consent is not obtained prior to the Closing and the Closing nonetheless occurs, Seller and Buyer will use commercially reasonable efforts to obtain such Required Consent as promptly as practicable thereafter. Upon receipt of any Required Consent, Seller will promptly assign, transfer, convey and deliver such Purchased Asset to Buyer for no additional consideration. Seller will not be required to make any payment to any 3rd party to obtain such 3rd party’s consent to assignment of any Purchased Asset.

2.06 Aggregate Purchase Price; Allocation; Withholding.

(a) The Buyer will pay Seller the following amounts for the Purchased Assets as set forth in Sections 2.06(a)(i) and (ii) and Section 2.07(d) (“Purchase Price”):

(i) Prepayment: Fifty Thousand US Dollars ($50,000) payable upon execution of this Agreement (the “Prepayment”). Specifically, within five (5) Business Days after the Effective Date, Buyer will deliver the initial Prepayment by wire transfer to the account designated by Seller and set forth on Schedule 2.06(a) (the “Designated Account”).

Buyer acknowledges and agrees that certain Seller patents included in the Purchased Assets shall have expired before or near the Outside Date, and therefore the non-refundable amounts in 2.06(a)(i), 2.07(d) and 3.09 represent a negotiated fair and equitable payment by Buyer to have Seller maintain and hold the remaining life of said patents along with the rest of the Purchased Assets for Buyer, until the later of the Closing or the Outside Date, and with respect to §3.09, beyond the Closing or the Outside Date.

Seller acknowledges and agrees that Buyer’s non-refundable, at-risk Prepayment together with Buyer’s payment of Seller’s costs pursuant to Section 3.09 and any non-refundable, at-risk NRC Extension Fees (defined in Section 2.07(d)) paid to Seller represent a negotiated fair and equitable payment to Seller for maintaining and holding the Purchased Assets for Buyer until the later of the Closing or the Outside Date. And, further, Buyer is relying on Seller to consummate the transactions and complete the Closing in accordance with the terms of this Agreement and that Seller shall not use the Purchased Assets or offer the Purchased Assets for sale to a third party for the duration of this Agreement.

(ii) Closing Payment: Twelve Million Five Hundred Thousand US Dollars ($12,500,000), as provided for in Section 2.07, less the total amount of Prepayment (the “Closing Payment”). For the avoidance of doubt, NRC Extension Fees paid to Seller shall not be credited to Buyer against the Closing Payment. For example: if Buyer has paid Seller $50,000 in Prepayment and $60,000 in NRC Extension Fees, Buyer will pay Seller $12,450,000 at Closing (with the $60,000 not being counted). Payment will be made as provided for in Section 2.07.

| |

(b)

|

The Purchase Price (plus Assumed Liabilities, to the extent properly considered under Section 1060 of the Code) will be allocated among the Purchased Assets in accordance with Section 1060 of the Code and the methodology set forth on Schedule 2.06(c) (the “Purchase Price Allocation”). Buyer will deliver such Purchase Price Allocation to Seller within sixty (60) days after the Closing Date for Seller’s review and comment. Seller will be solely responsible for allocating the Purchase Price appropriately between INIS and IIFP and will advise Buyer of the allocation between the two companies. Seller will indemnify and hold Buyer harmless from any liability that may arise out of an inaccurate allocation between INIS and IIFP. Buyer will incorporate all reasonable comments on such Purchase Price Allocation provided by Seller. Buyer and Seller agree to use such Purchase Price Allocation for all tax reporting purposes, including, but not limited to, preparation of IRS Form 8594 for its respective federal income tax returns, and not to assert any other allocation or take any position in any tax return or filing, or any examination, audit, or administrative or judicial proceeding relating to any tax return or filing, that is inconsistent with the Purchase Price Allocation unless otherwise required by Applicable Law.

|

(c) Notwithstanding anything in this Agreement to the contrary, Buyer will be entitled to deduct and withhold from any amounts otherwise payable pursuant to this Agreement such amounts of Taxes, if any, as Buyer is required to deduct and withhold under any Applicable Law. Any amounts so deducted and withheld and paid over to or deposited with the appropriate Governmental Authority will be treated for all purposes of this Agreement as having been paid to Seller. Buyer will notify (to the extent reasonably practicable) Seller of any amounts that it intends to deduct and withhold at least three (3) Business Days prior to the scheduled date of such payment, and Buyer will work in good faith with Seller to minimize any such withheld amounts.

2.07 Closing. The closing of the purchase and sale of the Purchased Assets and the assumption of the Assumed Liabilities (the “Closing”) will proceed as follows:

(a) On or before April 1, 2024, Seller and Buyer will contact the NRC to commence transfer of the NRC Material License SUB-1011 from IIFP to Buyer or Buyer’s assignee, provided that such transfer is nonbinding and reversible in the event of termination of the Agreement. The binding and complete transfer of all of Seller’s interest in the NRC Material License SUB-1011 to Buyer or Buyer’s assignee is the “NRC License Transfer.” The initial date for the NRC License Transfer will be scheduled for April 1, 2025 (the “NRC Notice Date”).

(b) Ten (10) Business Days prior to the NRC Notice Date or an extension of the NRC Notice Date, the Parties will contact the NRC to confirm that the NRC License Transfer will occur on the NRC Notice Date and that such transfer is scheduled to occur without further qualification or condition. Within two (2) Business Days of the NRC Notice Date and after Buyer has received the requisite confirmation (stated above) from the NRC, Buyer will deliver the Closing Payment by wire transfer to the Seller’s Designated Account. Seller will retain the entire amount of the Closing Payment in the Designated Account, without any distribution of the amount, until after the following occur: 1) Closing; and 2) all Required Consents pursuant to Section 2.05 have been received and all Purchased Assets have been fully and completely transferred to Buyer or Buyer’s assignee, except the hardcopy Books and Records which Buyer will retrieve from Seller within three (3) weeks after Closing. Further, in regards to the Closing Payment, Buyer’s sole responsibility is to transfer the Closing Payment into the Designated Account as directed by Seller. Seller will be solely responsible for correctly distributing the Closing Payment (and the remainder of the Purchase Price payments) between INIS and IIFP. Seller will indemnify and hold Buyer harmless from any liability that may arise out of an incorrect distribution between INIS and IIFP of any payment received from Buyer under this Agreement.

(c) Closing will occur on the NRC Notice Date on which the NRC License Transfer occurs (the “Closing Date”), provided that all of the conditions set forth in Article 6 have been satisfied or waived (other than any such condition that by its terms cannot be satisfied until the Closing Date, which condition will be required to be so satisfied or waived on the Closing Date). The Closing may be accomplished by the exchange of signatures by overnight mail or by scanned and emailed signatures or by electronic signatures, as Buyer and Seller may deem appropriate.

(d) NRC Notice Date Extension, NRC Extension Fees. Buyer has the unilateral right to advise the NRC or request that Seller advise the NRC to extend the NRC Notice Date as often as Buyer deems necessary, and if requested by Buyer to so advise the NRC, Seller agrees to promptly do so; provided that (i) any new date shall not exceed March 31, 2026; and, (ii) Buyer shall pay the Seller a recurring payment beginning April 2, 2025, of Ten Thousand US Dollars ($10,000 USD) for each month of any such extension of the NRC Notice Date (the “NRC Extension Fees”). For avoidance of doubt, the NRC Extension Fees are nonrefundable payments made from Buyer to Seller, in the event this Agreement is earlier terminated as permitted, or if Closing does not occur by the Outside Date. In the event of Closing, NRC Extension Fees shall not be applied to the Purchase Price. Seller or Buyer may terminate this Agreement in accordance with Section 7.01(e) if the Parties do not complete the NRC License Transfer before March 31, 2026 (the “Outside Date”). Any Purchased Assets previously provided to Buyer will be promptly returned to Seller at Buyer’s cost and neither Party will have any further liability to the other Party.

| |

2.08

|

Buyer’s Additional Deliveries. At Closing, Buyer will deliver to Seller the following:

|

(a) the Bill of Sale and any Related Agreements duly executed by Buyer; and

(b) a certificate of a duly authorized officer of Buyer, dated as of the Closing Date, in form and substance reasonably satisfactory to Seller, certifying to the Buyer Transaction Approvals.

| |

2.09

|

Seller’s Deliveries. At Closing, Seller will deliver or cause to be delivered to Buyer all of the following:

|

(a) the Bill of Sale duly executed by Seller;

| |

(b)

|

ownership of the Books and Records;

|

(c) a certificate of a duly authorized officer for each company that is the Seller, dated as of the Closing Date, in form and substance reasonably satisfactory to Buyer, certifying to the Seller Transaction Approvals;

| |

(d)

|

duly executed IRS Form W-9;

|

(e) a certificate of existence or good standing with respect to INIS issued by the Secretary of State of Texas of recent date and a certificate of existence or good standing with respect to IIFP issued by the Secretary of State of Idaho of recent date; and

(f) such other Related Agreements in the form and substance satisfactory to Buyer as Buyer may reasonably request or as may be otherwise necessary to evidence and complete the sale, assignment, transfer, conveyance, and delivery of the Purchased Assets to Buyer.

In addition to the above deliveries, Seller will take all steps and actions as Buyer may reasonably request or as may otherwise be necessary to put Buyer in actual possession or control of the Purchased Assets and vest with Buyer sole and complete ownership of the Purchased Assets.

ARTICLE 3 REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants to Buyer as of the Effective Date and as of the Closing Date that:

3.01 Corporate Existence and Power. INIS is a corporation duly organized, validly existing and in good standing under the laws of the State of Texas and has all corporate powers and all governmental licenses, authorizations, permits, consents, and approvals required to own, lease and operate its assets and carry on its business as now conducted.

3.02 Corporate Existence and Power. IIFP is a corporation duly organized, validly existing and in good standing under the laws of the State of Idaho and has all corporate powers and all governmental licenses, authorizations, permits, consents, and approvals required to own, lease and operate its assets and carry on its business as now conducted.

3.03 Corporate Authorization. The execution, delivery and performance by Seller of this Agreement and the Related Agreements to which it is a party and the consummation of the transactions contemplated in this Agreement are within Seller’s corporate powers and have been duly authorized by all necessary corporate action on the part of Seller (“Seller Transaction Approvals”). This Agreement and each of the Related Agreements to be executed and delivered by Seller constitute or will constitute (as applicable) the legal, valid, and binding obligation of Seller, enforceable against Seller in accordance with their respective terms.

3.04 Non-Contravention. The execution, delivery and performance by Seller of this Agreement and the consummation of the transactions contemplated in this Agreement do not and will not (a) violate the Organizational Documents of Seller, (b) violate any Applicable Law, or (c) conflict with, result in a breach of, constitute (with or without due notice or lapse of time or both) a default under, result in the acceleration of obligations under, create in any Person the right to terminate, modify or cancel, or require any notice, consent or waiver under, any contract or instrument to which Seller is a party and to which the Purchased Assets are subject, or (d) result in the creation or imposition of any Lien on any Purchased Asset.

3.05 No Undisclosed Liabilities. Except as set forth elsewhere in this Agreement, there are no liabilities of Seller’s Knowledge related to the Purchased Assets of any kind whatsoever, absolute or contingent, liquidated or unliquidated, due or to become due and accrued or unaccrued, and there is no Seller’s Knowledge regarding an existing condition, situation or set of circumstances which would reasonably be expected to result in such a liability.

3.06 Litigation. There is no Action pending against, or to Seller’s Knowledge, threatened against or involving Seller which questions the validity of this Agreement or seeks to prohibit or enjoin or otherwise challenge the transactions contemplated in this Agreement, and, to Seller’s Knowledge, there is no basis for any such Action.

3.07 Compliance with Laws. Seller is conducting, and has at all times conducted, the activities with respect to the Purchased Assets in all material respects in accordance with all Applicable Laws and Permits and, (x) to Seller’s Knowledge, Seller is not under investigation with respect to, and (y) Seller has not been threatened in writing to be charged with or given written notice of any violation of, any Applicable Law relating to the Purchased Assets.

3.08 Properties and Assets. Except as set forth in Schedule 3.08 (Shareholder Liens), which Seller shall have removed prior to Closing, to the best of Seller’s Knowledge, Seller is the true and lawful owner of, and has good and valid title to, or in the case of leased assets and properties a valid leasehold interest in, all of the Purchased Assets, in each case free and clear of all Liens. There has not been any material adverse change in the Purchased Assets to Seller’s Knowledge. All Taxes and other charges required to maintain the Purchased Assets have been paid. Except for this Agreement, Seller is not a party to any Contract granting any Person or recognizing with respect to any Person any ownership or vesting right in, or any right of first refusal, right of first offer or other preferential right to purchase, any of the Purchased Assets or any portion of or interest in the Purchased Assets.

3.09 Permits. Within ninety (90) days of the Effective Date, Seller will complete Schedule 3.09 and list each Permit, including the NRC Material License SUB-1011, together with the name of the Governmental Authority issuing such Permit. Seller will deliver to Buyer on or before the Closing Date a true, correct, and complete copy of each Permit and will transfer its entire ownership rights to Buyer in all the Permits, including the NRC Material License SUB-1011. The NRC will charge for its evaluation and decision regarding the transfer (“NRC Costs”). Any NRC Costs incurred by Seller in its efforts to transfer the NRC Material License SUB-1011 to Buyer will be either paid directly by Buyer or Buyer will reimburse Seller for its costs upon receipt of an invoice from Seller demonstrating such costs. As of the Effective Date and the Closing Date, Seller represents and warrants to Buyer that the Permits are, and will be, valid and in full force and effect, and Seller is not, and will not be, in default under the Permits, and to Seller’s Knowledge no condition exists, or will exist, that with notice or lapse of time or both would constitute a default under the Permits.

3.10 Patents. Seller will complete Schedule 3.10 and list all active patents that Seller has in its possession that relate to the DUF6 Plant (the “Patents”). Seller will deliver to Buyer on or before the Closing Date all active Patents. Seller will take all steps necessary to ensure that the active Patents will be fully and completely transferred to Buyer in compliance with federal and any applicable state law, including paying any maintenance fees, annuities, and the like due or payable on the Patents until the Closing. If prior to the Closing Date, it is determined that this Agreement must be amended to ensure such compliance (e.g., include notarized signatures), the Parties will amend this Agreement accordingly. As of the Effective Date and the Closing Date, Seller represents and warrants to Buyer that the active Patents to the best of Seller’s knowledge, are, and will be, valid and in full force and effect, and Seller is not, and will not be, in default under the Patents, and to Seller’s Knowledge, no condition exists, or will exist, that with notice or lapse of time or both would constitute a default under the Patents.

3.11 Finders’ Fees. There is no investment banker, broker, finder or other intermediary who has been retained by or is authorized to act on behalf of Seller who might be entitled to any fee or commission in connection with the transactions contemplated by this Agreement.

3.12 Full Disclosure. No representation, warranty, or statement by Seller in this Agreement or any certificate or other document furnished or to be furnished to Buyer pursuant to this Agreement contains any untrue statement of a material fact or omits to state a material fact necessary to make each such representation, warranty, or statement in this Agreement accurate in all material respects.

ARTICLE 4 REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller as of the Effective Date and as of the Closing Date that:

4.01 Existence and Power. Buyer is a limited liability company duly organized and in good standing under the laws of Washington and has all limited liability company powers and all governmental licenses, authorizations, permits, consents, and approvals required to carry on its business as now conducted.

4.02 Authorization. The execution, delivery and performance by Buyer of this Agreement and the Related Agreements to which it is a party and the consummation of the transactions contemplated in this Agreement are within the limited liability company powers of Buyer and have been duly authorized by all necessary limited liability company action on the part of Buyer (“Buyer Transaction Approvals”). This Agreement and each of the Related Agreements to which it is a party constitutes or will constitute (as applicable) the legal, valid, and binding obligation of Buyer, enforceable against Buyer in accordance with their respective terms.

4.03 Non-Contravention. The execution, delivery and performance by Buyer of this Agreement and the consummation of the transactions contemplated in this Agreement do not and will not (a) violate the Organizational Documents of Buyer, (b) violate any Applicable Law, or (c) conflict with, result in a breach of, constitute (with or without due notice or lapse of time or both) a default under, result in the acceleration of obligations under, create in any Person the right to terminate, modify or cancel, or require any notice, consent or waiver under, any contract or instrument to which Buyer is a party or by which Buyer is bound or to which Buyer’s assets are subject.

4.04 Finders’ Fees. There is no investment banker, broker, finder or other intermediary who has been retained by or is authorized to act on behalf of Buyer who might be entitled to any fee or commission in connection with the transactions contemplated by this Agreement.

4.05 Full Disclosure. No representation or warranty by Buyer in this Agreement and no statement contained in any certificate or other document furnished or to be furnished to Seller pursuant to this Agreement contains any untrue statement of a material fact or omits to state a material fact necessary to make each such representation, warranty, or statement in this Agreement accurate in all material respects.

4.06 Operations. Buyer represents and warrants that at all times, prior to Closing, when Seller may be liable, the use of the Purchased Assets shall be strictly consistent with all Permits, rules, regulations, and applicable law.

ARTICLE 5 COVENANTS OF SELLER AND BUYER

5.01 Confidentiality. At and after the Closing Date, Seller and its Affiliates and Representatives will keep confidential and not disclose to any other Person or use for his, her or its own benefit or the benefit of any other Person any Confidential Information. Notwithstanding the foregoing, if Seller or any of its Affiliates or, as applicable, Representatives (collectively, the “Disclosing Party”) is requested or required by Applicable Law to disclose any Confidential Information, the Disclosing Party will provide Buyer with notice of such request or requirement as promptly as practicable (unless prohibited by Applicable Law) so that Buyer may, at its own expense, seek a protective order or other appropriate remedy and/or waive compliance with the foregoing provisions of this Section 5.01. The Disclosing Party will cooperate reasonably with Buyer in connection with the Buyer’s efforts to seek such an order or remedy. If the Buyer does not obtain such an order or other remedy or waives compliance with the provisions of this Section 5.01, the Disclosing Party will furnish only that portion of the applicable Confidential Information that is legally required and will exercise reasonable efforts to obtain assurance that confidential treatment will be accorded such disclosed information. For clarity, in the event this transaction does not close by the Outside Date, no confidentiality obligations shall impede Seller’s future disposition of the Purchased Assets, such as Seller’s future use, licensing, or sale of the same (while at the same time Seller shall not disclosure any Buyer Confidential Information).

From the Effective Date of this Agreement to the Closing Date, the Parties are bound by the terms of their Confidentiality Agreement, dated February 8, 2024, attached as Exhibit B, which is incorporated into by reference and made a part of this Agreement as if set forth in full.

5.02 Good Faith and Reasonable Efforts. As material conditions of this Agreement, both Parties must act in good faith, and use all reasonable efforts to close the transaction contemplated herein. Nothing contained in this Section 5.02 shall be interpreted to require Buyer to engage in (pursue or defend) litigation, arbitration, or any other form of adversarial proceeding. Prior to Closing, Seller may be required to engage in (pursue or defend) litigation, arbitration, or other form of adversarial proceeding only with respect to the removal of Shareholder Liens if necessary to transfer the Purchased Assets in accordance with the terms of this Agreement.

5.03 Remedies and Enforcement. Seller acknowledges and agrees that (i) strict enforcement of the terms of Section 5.01 is necessary for the purpose of ensuring the preservation, protection and continuity of the Purchased Assets, (ii) Buyer would be irreparably harmed by any breach of Section 5.01 and that monetary damages, even if available, alone would not be an adequate remedy for any such breach; (ii) in the event of any breach or threatened breach of any provision of Section 5.01, Buyer will be entitled, in addition to all other equitable remedies that it may have existing in its favor, to obtain injunctive or other equitable relief (including a temporary restraining order, a preliminary injunction and a final injunction) to prevent any such breach or threatened breach and to enforce such provisions specifically, without the necessity of posting a bond or other security or of proving actual damages; and (iii) the prevailing Party in any action commenced to enforce Section 5.01 (whether through a monetary judgment, injunctive relief or otherwise) will be entitled to recover reasonable attorneys’ fees and court costs incurred in connection with such action.

5.04 Further Assurances. At any time and from time to time after the Closing, at the request of either Party, and without further consideration, the other Party will execute and deliver such other instruments of sale, transfer, conveyance, assumption, and assignment and take such actions as such requesting Party may reasonably request to more effectively carry out the transactions contemplated by this Agreement.

5.05 Public Announcements. Neither Party will issue any press release or make any public statement with respect to this Agreement, or the transactions contemplated in this Agreement, without the prior written consent of the other Party, which consent will not be unreasonably withheld, delayed or conditioned. Notwithstanding the requirements of this Section 5.05, Buyer understands and agrees that Seller may be required to publicly report any transactions determined by the Seller’s counsel to be material in nature.

5.06 Straddle Period Apportionment. With respect to any Straddle Period, all excise, property and other similar ad valorem taxes pertaining to the Purchased Assets will be prorated on the basis of the number of days of the relevant Tax year or period which have elapsed through the Closing Date, determined without reference to any change of ownership occasioned by the consummation of the transactions contemplated in this Agreement. Seller will be responsible for that portion of such amounts relating to the period ending on or before the Closing Date and Buyer will be responsible for that portion of such amounts relating to the period following the Closing Date.

5.07 Lea County and the State of New Mexico Assets. Seller has previously negotiated certain assets with the State of New Mexico and also with Lea County, New Mexico related to the DUF6 Plant (“New Mexico Assets”). It is Seller’s intent to transfer, sell, convey, and deliver all of its New Mexico Assets as part of the Purchased Assets under this Agreement. The Parties acknowledge, however, that as of the Effective Date, it is unknown whether Seller has the legal authority to transfer all of its New Mexico Assets and that a legal opinion is pending from Lea County, NM regarding certain asset transfers. If it is determined, prior to Closing, that all or some of Seller’s New Mexico Assets may be transferred, sold, or assigned to Buyer, those New Mexico Assets will be included as Purchased Assets, and Seller’s obligations under this Agreement will apply to those New Mexico Assets. If it is determined that none of the New Mexico Assets may be transferred to Buyer or if certain New Mexico Assets cannot be transferred, sold, or assigned to Buyer, the Parties agree to revise Schedule A prior to Closing to reflect only those New Mexico Assets that will be transferred in accordance with this Agreement. Buyer acknowledges that Buyer will have benefited from Seller’s prior efforts with the State of New Mexico and with Lea County, NM even if all New Mexico Assets are not transferred under this Agreement, and for that reason nothing in this Section 5.07 will affect the Purchase Price.

5.08 Condition of Assets. Notwithstanding anything to the contrary in this Agreement, Buyer acknowledges that Seller does not warrant the condition of the Purchased Assets, and that the Purchased Assets are offered on an as-is basis. Seller offers no further warranty or covenant as to utility or validity of the same. Buyer further acknowledges that it has had amply time and opportunity prior to the execution of this Agreement to conduct its own evaluation of the condition, utility, and commercial viability of the Purchased Assets.

ARTICLE 6 CONDITIONS TO CLOSING

6.01 Conditions to Buyer’s Obligations. Buyer’s obligations to consummate the transactions contemplated by this Agreement will be subject to the fulfillment, at or prior to Closing, of each of the following conditions:

(a) The representations and warranties of Seller set forth in this Agreement shall be true and correct in all material respects on and as of the Closing Date with the same force and effect as though made on and as of that date (except for such representations and warranties that are made as of a specific date, which representations and warranties shall be true and correct as of such date).

(b) All of the agreements and covenants of Seller to be performed or complied with at or prior to the Closing pursuant to this Agreement have been duly performed or complied with in all material respects.

(c) Buyer has received a certificate, dated the Closing Date and signed by a duly authorized officer of Seller, that each of the conditions set forth in Section 6.01(a), Section 6.01(b), Section 6.01(d), and Section 6.01(e) have been satisfied.

| |

(d)

|

Buyer has received all deliveries of Seller provided for in Section 2.09.

|

(e) From the date of this Agreement, no Material Adverse Effect has occurred, nor has any event or events occurred that, individually or in the aggregate, with or without the lapse of time, could reasonably be expected to result in a Material Adverse Effect.

(f) Buyer is satisfied in its sole discretion with its due diligence review of the Purchased Assets including the status, content, completeness, functionality, appropriateness, validity and value of the Purchased Asset.

(g) Any schedules or exhibits referred to but not attached to this Agreement on the Effective Date have been delivered to Buyer in form satisfactory to Buyer.

(h) The NRC shall have consented to the NRC License Transfer.

(i) All Shareholder Liens against the Purchased Assets, as set forth in Schedule 3.08 related to the Purchased Assets shall be removed.

6.02 Conditions to Seller’s Obligations. Seller’s obligations to consummate the transactions contemplated by this Agreement will be subject to the fulfillment, at or prior to the Closing, of each of the following conditions:

(a) The representations and warranties of Buyer set forth in this Agreement shall be true and correct in all material respects on and as of the Closing Date with the same force and effect as though made on and as of that date (except for such representations and warranties that are made as of a specific date, which representations and warranties shall be true and correct as of such date).

(b) All of the agreements and covenants of Buyer to be performed or complied with at or prior to the Closing pursuant to this Agreement have been duly performed or complied with in all material respects.

(c) Buyer has made all payments specified in Section 2.06 and 2.07 and all other deliveries of Buyer provided for in Section 2.08.

(d) Any schedules or exhibits referred to but not attached to this Agreement on the Effective Date have been delivered to Seller in form satisfactory to Seller.

ARTICLE 7 TERMINATION

7.01 Termination. This Agreement may be terminated at any time in the following circumstances:

(a) by the mutual written consent of Seller and Buyer.

(b) prior to Closing, by Buyer, if there has been a material breach by Seller of any covenant, representation or other agreement or term of this Agreement that has prevented the satisfaction of any condition to Buyer’s obligations at Closing and such breach has not been waived by Buyer or cured by Seller within seven (7) Business Days after written notice has been delivered to Seller.

(c) prior to Closing, by Buyer, after consultation with the Seller, if the Buyer has factual information to reasonably believe that the NRC License Transfer will not be completed by the Outside Date.

(d) by Seller, if there has been a material breach by Buyer of any covenant, representation or other agreement or term of this Agreement that has prevented the satisfaction of any condition to Seller’s obligations at Closing and such breach has not been waived by Seller or cured by Buyer within seven (7) Business Days after written notice has been delivered to Buyer.

(e) prior to Closing, by Buyer or Seller, provided Buyer has paid any applicable NRC Extension Fees, if the NRC License Transfer has not occurred by an NRC Notice Date and Buyer has not requested an extension of that NRC Notice Date in accordance with Section 2.07(d) or the Outside Date; provided, however, that the right to terminate this Agreement pursuant to this Section 7.01(e) will not be available to a Party who has breached any provision of this Agreement and that breach has caused, or has resulted in, the failure of the NRC License Transfer to occur on or before the NRC Notice Date, or (if Buyer has paid the NRC Extension Fees) the Outside Date.

(f) prior to Closing, by Seller if the Buyer, with no fault attributable to the Seller, has not contacted the NRC to commence transfer of the NRC Material License SUB-1011 from IIFP to Buyer or Buyer’s assignee by the earlier of (i) three (3) months from the Effective date or (ii) June 1st, 2024.

7.02 Effect of Termination. Upon any termination of this Agreement under Section 7.01 by Buyer or Seller, written notice will be given to the other Party specifying the provision pursuant to which such termination is made, and this Agreement will terminate and be of no further force or effect, except for certain clauses which by their nature or intended operation shall survive as described in §8.01. There will be no liability on the part of either Party to the other Party except that any Party whose breach or violation of the terms of this Agreement resulted in termination of this Agreement will be liable for damages incurred by the other Party and the Agreement will remain in effect to the extent necessary for the aggrieved Party to pursue recovery of such damages. Notwithstanding anything to the contrary, Buyer will promptly return any previously provided Purchased Assets to Seller in the same condition as originally provided, including but not limited to: (i) the prompt processing, execution and filing all documentation related to any Purchased Asset, in favor of Seller; and (ii) the immediate payment of any amounts outstanding pursuant to this Agreement.

7.03 Covenant in Case of Termination. If any Party terminates this Agreement, Buyer shall immediately cease the use of all Purchased Assets including all intellectual property or derivative assets associated therewith.

ARTICLE 8 SURVIVAL; INDEMNIFICATION

8.01 Survival. The provisions of this Agreement that by their context are intended to survive the performance of the terms and conditions of this Agreement will so survive the completion of performance or termination of this Agreement.

8.02 Indemnification.

(a) Effective at and after the Closing, Seller will indemnify, defend and hold harmless Buyer and its Affiliates, directors, managers, officers, employees, agents, Representatives, successors and assignees (collectively, the “Buyer Indemnitees”) from and against, and reimburse the Buyer Indemnitees for, any and all damage, loss, liability and expense (including reasonable expenses of investigation and reasonable attorneys’ fees and expenses in connection with any action, suit or proceeding whether involving a Third-Party Claim or a claim solely between the Parties) (collectively, “Damages”) incurred or suffered by the Buyer Indemnitees based upon, arising out of, with respect to, or by reason of:

(i) any breach of, or inaccuracy in, any representation or warranty made by Seller in this Agreement, any Related Agreement, or any document or certificate required to be furnished by Seller pursuant to this Agreement;

(ii) any failure to perform or other breach of covenant or agreement made or to be performed by Seller pursuant to this Agreement or any Related Agreement;

(iii) any Excluded Asset or any Excluded Liability; or

(iv) the assertion of any claim or the commencement of any suit, action or proceeding by any third party (“Third-Party Claim”) arising from or relating to the ownership of the Purchased Assets prior to the Closing Date.

(b) Effective at and after the Closing, Buyer will indemnify, defend and hold harmless Seller and its Affiliates, directors, officers, employees, agents, successors and assignees (collectively, the “Seller Indemnitees”) from and against, and reimburse Seller Indemnitees for, any and all Damages incurred or suffered by Seller Indemnitees based upon, arising out of, with respect to, or by reason of:

(i) any breach of, or inaccuracy in, any representation or warranty made by Buyer in this Agreement, any Related Agreement, or any document or certificate required to be furnished by Buyer pursuant to this Agreement;

(ii) any failure to perform or other breach of covenant or agreement made or to be performed by Buyer pursuant to this Agreement or any Related Agreement;

(iii) any Assumed Liability; or

(iv) the ownership of the Purchased Assets after the Closing Date, except to the extent covered by the indemnification provided in Section 8.02(a).

(c) For purposes of this Article 8, any inaccuracy in or breach of any representation or warranty, and the calculation of any Damages, will be determined without regard to any materiality, Material Adverse Effect or other similar qualification contained in or otherwise applicable to such representation or warranty.

8.03 Third-Party Claim Procedures. Promptly upon receipt of notice of a Third-Party Claim that may give rise to a claim for indemnification, Buyer will give written notice to Seller. If Seller provides Buyer with an agreement in writing, in form satisfactory to Buyer’s counsel, to defend such claim, Seller may, at its sole expense, undertake the defense against such claim and may contest or settle such claim on such terms, at such time and in such manner as Seller in its sole discretion elects and Buyer will execute such documents and take such steps as may be reasonably necessary in the opinion of Seller’s counsel to enable Seller to conduct the defense of such claims. In any and all events, each of the Parties will have access to the records and files of the other Party relating to any such claim as may be reasonably necessary to effectively defend or participate in the defense.

8.04 Tax Treatment of Indemnification Payments. Except to the extent otherwise required by Applicable Law, all indemnification payments made pursuant to this Article 8, will be treated by the Parties as an adjustment to the Purchase Price for Tax purposes.

ARTICLE 9 MISCELLANEOUS

9.01 Notices. All notices, requests and other communications to a Party will be in writing (including electronic mail (“E-mail”) transmission, so long as a receipt of such E-mail is requested and received) and given,

If to Buyer:

American Fuel Resources, LLC

[ADDRESS]

Attn:

E-mail:

If to Seller:

International Isotopes

4137 Commerce Circle

Idaho Falls, ID 83406

Attn:

E-mail:

or such other address or E-mail as such Party may specify. All such notices, requests and other communications will be deemed received on the date of receipt by the recipient if received prior to 5:00 p.m. in the place of receipt and such day is a Business Day in the place of receipt. Otherwise, any such notice, request or communication will be deemed not to have been received until the next succeeding Business Day in the place of receipt.

9.02 Amendments and Waivers. Any provision of this Agreement may be amended or waived if, but only if, such amendment or waiver is in writing and is signed, in the case of an amendment, by an authorized representative of each of Seller and Buyer, or in the case of a waiver, by the Party against whom the waiver is to be effective. A failure to exercise or enforce or a delay in exercising or enforcing or the partial exercise or enforcement of any right, remedy, power or privilege under this Agreement by either Party will not in any way preclude or operate as a waiver of any further exercise or enforcement or the exercise or enforcement of any other right, remedy, power or privilege under this Agreement or as provided by law.

9.03 Expenses. Except as otherwise expressly provided in this Agreement, all costs and expenses, including fees and disbursements of counsel, financial advisors and accountants, incurred in connection with this Agreement will be paid by the Party incurring such cost or expense.

9.04 Interest. Any outstanding payments from one Party to the other Party will accrue interest at the per annum rate equal to the lesser of (x) the maximum rate permitted by applicable law; or (y) the Prime Rate plus two percent (2%) per annum in effect on the payment due date. The “U.S. Prime Rate” is published in The Wall Street Journal. Should The Wall Street Journal cease publication of the Prime Rate, the Parties will negotiate in good faith to reach agreement upon a new base rate which reasonably can be expected to produce the same result.

9.05 Successors and Assigns.

(a) The provisions of this Agreement will be binding upon and inure to the benefit of the Parties and their respective successors and assigns.

(b) Seller may not assign, delegate, or otherwise transfer any of its rights or obligations under this Agreement without the consent of Buyer, which consent will not be unreasonably delayed or withheld.

(c) The Parties understand and agree that Buyer may enter into an agreement with one or more entities for the purpose of jointly developing, financing, constructing, and operating the DUF6 Plant or Buyer may transfer its rights and obligations under this Agreement to an Affiliate of Buyer. It may be necessary for Buyer to assign this Agreement under those circumstances. Therefore, Buyer may assign all of its rights and obligations under this Agreement without Seller’s consent, provided that under no arrangement that all of the rights and obligations (including the payments, potential return or deletion of Purchased Assets, and liquidated damages) and consideration to be paid to the Seller, will be negatively impacted. If Buyer intends to assign this Agreement, Buyer will notify Seller and will facilitate an amendment to this Agreement to recognize any additional or new parties to the Agreement.

9.06 Governing Law and Jurisdiction. This Agreement will be governed by and construed in accordance with the laws of the State of Idaho, without reference to choice of law doctrine, and each Party irrevocably submits to and accepts, generally and unconditionally, the non-exclusive jurisdiction of the courts of the State of Idaho and the United States District Court located in Boise, Idaho with respect to any legal action or proceedings which may be brought at any time relating in any way to this Agreement. Should Idaho law prevent the Seller from retaining the Prepayment, and retaining NRC Extension Fees (if any), or prevent the Seller or Buyer from enforcing or recovering Liquidated Damages, then New York State law shall apply to those specific subjects only.

9.07 WAIVER OF JURY TRIAL. EACH OF THE PARTIES IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED IN THIS AGREEMENT.

9.08 Counterparts; Third Party Beneficiaries. This Agreement may be signed in any number of counterparts, each of which will be an original, with the same effect as if the signatures were on the same instrument. A signed copy of this Agreement delivered by facsimile, E-mail or other means of electronic transmission has the same legal effect as delivery of an original signed copy of this Agreement. Except as set forth in Section 8.02, no provision of this Agreement is intended to confer any rights, benefits, remedies, obligations, or liabilities upon any Person other than the Parties and their respective successors and assigns.

9.09 Entire Agreement. This Agreement (including all Exhibits and Schedules) and the Related Agreements constitute the entire agreement between the Parties with respect to the subject matter of this Agreement and supersede all prior agreements and understandings, both oral and written, between the Parties with respect to the subject matter of this Agreement.

9.10 Headings. The headings in this Agreement are for reference only and do not affect the interpretation of this Agreement.

9.11 Severability. Any provision of this Agreement that is illegal, void, or unenforceable, will be ineffective to the extent only of such illegality, voidness, or unenforceability, without invalidating the remaining provisions of this Agreement.

9.12 No Joint Venture. Nothing in this Agreement will create or be construed as creating a partnership or joint venture between the Parties.

9.13 Parties’ Intent. The Parties acknowledge and agree that from the Effective Date of this Agreement, Buyer will expend significant resources and a substantial amount of time to consummate the transactions contemplated in this Agreement. Buyer is relying on Seller’s commitment to transfer and convey the Purchased Assets as set forth in this Agreement and that failure to do so will constitute a material breach by Seller and that Buyer may pursue all remedies under this Agreement and as provided by Applicable Law against Seller. The Parties also acknowledge and agree that Seller is relying on Buyer to advance the development, financing, construction, and operation of the DUF6 Plant in a timely manner and that Buyer must use commercially reasonable efforts in an attempt to accomplish this objective.

9.14 Buyer Joint and Several Liability. The Parties acknowledge and agree that AFR and its Affiliates are closely related, and in the event of an alleged or actual breach, it may be difficult for Seller to establish which entity was at fault. Therefore, AFR and its Affiliates have joint and several liability as Buyer for all obligations and responsibilities arising out of this Agreement. In the event of an alleged or actual breach by Buyer, Seller may pursue recourse and receive remedies against either AFR or its Affiliates or a combination thereof without having to establish which company was at fault.

9.15 Seller Joint and Several Liability. The Parties acknowledge and agree that INIS and IIFP are closely related, and in the event of an alleged or actual breach, it may be difficult for Buyer to establish which company was at fault. Therefore, INIS and IIFP have joint and several liability as Seller for all obligations and responsibilities arising out of this Agreement. In the event of an alleged or actual breach by Seller, Buyer may pursue recourse and receive remedies against either INIS or IIFP or both without having to establish which company was at fault.

9.16 Specific Performance. The Parties agree that irreparable damage would occur if any provision of this Agreement was not performed in accordance with its terms and that the Parties will be entitled to obtain injunctive or other equitable relief (including a temporary restraining order, a preliminary injunction and a final injunction) to prevent any actual or threatened breach of this Agreement or to enforce specifically the performance of the terms and provisions in courts described in Section 9.06. The Parties further agree that they will not oppose the granting of an injunction, specific performance, or other equitable relief on the basis that the other Party has an adequate remedy at law or an award of specific performance is not an appropriate remedy for any reason at law or in equity.

9.17 Liquidated Damages – Buyer. The Parties acknowledge that as of the Effective Date of this Agreement both the Seller and the Buyer have a complete electronic copy of the Books and Records as defined in Section 2.01(b) (the “Electronic Copy”). Notwithstanding anything to the contrary in this Agreement, in the event of a termination as set forth in Article 7 (or anywhere else in this Agreement), within one (1) month of termination, Buyer will certify to Seller that it has destroyed its Electronic Copy. In the case of post-termination use or disclosure of any of the Purchased Assets by Buyer (including any third party receiving any disclosure), in whole or part, unauthorized by Seller, Buyer shall pay to Seller, in addition to any consideration already paid or due under this Agreement, damages of Five Million US Dollars ($5,000,000), which the Parties each hereby acknowledge represents a negotiated fair and equitable payment to Seller for damages and losses related to the unauthorized use or disclosure of any Purchased Assets.

9.18 Liquidated Damages – Seller. Notwithstanding anything to the contrary in this Agreement, within one (1) month of Closing, provided that, Seller has received the Closing Payment in full, Buyer will certify to Seller that it has received all Purchased Assets, and Seller will then certify to Buyer that it has destroyed its Electronic Copy and that it is no longer in possession of any hardcopy Books and Records except for those documents or Electronic Copy which the Seller reasonably believes are required to be maintained for purposes of audits or compliance or legal records. In the case of post-Closing Seller commercial use or Seller disclosure in contravention of any applicable confidentiality obligations of any of the Purchased Assets or Confidential Information, respectively, by Seller (including any third party receiving any unpermitted disclosure from Seller), in whole or part, unauthorized by Buyer, Seller shall pay to Buyer damages of Five Million US Dollars ($5,000,000), which the Parties each hereby acknowledge represents a negotiated fair and equitable payment to Buyer for damages and losses related to the unauthorized use or disclosure of any Purchased Assets.

9.19 Attorneys’ Fees. In the event of any litigation or other action at law or suit in equity to enforce this Agreement or the rights of any Party, the prevailing Party in such litigation, action or suit will be entitled to receive from the other Party its reasonable attorneys’ fees and other reasonable costs and expenses of litigation or other action.

9.20 Definitional and Interpretive Provisions. References to Articles, Sections, Exhibits and Schedules are to Articles, Sections, Exhibits and Schedules of this Agreement unless otherwise specified. All Exhibits and Schedules referred to in this Agreement are incorporated in and made a part of this Agreement as if set forth in full. Any capitalized terms used in any Exhibit or Schedule but not otherwise defined, will have the meaning as defined in this Agreement. Any singular term in this Agreement is deemed to include the plural, and any plural term the singular. Whenever the words “include,” “includes” or “including” are used in this Agreement, they are deemed to be followed by the words “without limitation,” whether or not they are in fact followed by those words or words of like import. A reference to any statute is deemed to refer to such statute as amended from time to time and to any related rules or regulations. References to any agreement are to that agreement as amended, modified, or supplemented from time to time. References to any Person include the successors and permitted assigns of that Person. References from or through any date mean, unless otherwise specified, from and including such date or through and including such date, respectively.

[Remainder of this page intentionally left blank. Signature pages, Exhibits and Schedules to follow]

Acknowledged, accepted, and agreed to by the following Parties:

SELLER:

INTERNATIONAL ISOTOPES, INC.,

A Texas corporation

| By: |

/s/ Shahe Bagerdjian |

|

Name: Shahe Bagerdjian

Title: CEO

|

INTERNATIONAL ISOTOPES FLUORINE PRODUCTS, INC.,

An Idaho corporation

| By: |

/s/ Shahe Bagerdjian |

|

Name: Shahe Bagerdjian

Title: CEO

|

BUYER: AMERICAN FUEL RESOURCES, LLC

A Washington limited liability company

| By: |

/s/ Eric K. Rockett |

|

Name: Eric K. Rockett

Title: President

|

SCHEDULE A

Seller’s Assets in the DUF6 Plant include:

All information that Seller has in its possession that relates to the Permitting, development, financing, construction, and operation of a depleted uranium deconversion (DU) and fluorine extraction process (FEP) plant that Seller had intended to be located in Hobbs, NM. Information includes, but is not limited to, intellectual property, trade secrets, technical data, financial data, and business planning strategies. Information may be contained in any form accessible to Seller, such as books, ledgers, papers, and electronic format and includes, but is not limited to, the following:

| |

1.

|

U.S. Nuclear Regulatory Commission Material License SUB-1011, and amendments, including all license application documentation, reports, correspondence, and responses to requests for additional information.

|

| |

2.

|

All documentation acquired by International Isotopes Inc. (INIS) from General Dynamics and its successors for the Sequoya Fuels Conversion plant (DUF6-DUF4). Files include plant design, operating procedures, component specifications, and operating records.

|

| |

3.

|

All safety analysis, preliminary plant design, drawings, and vendor information developed by INIS to support plant construction, cost estimates, and selection of a design and build contractor.

|

| |

4.

|

Project Participation Agreement completed between INIS and Lea County for the transfer or purchase of the 640-acre site in Hobbs, New Mexico.

|

| |

5.

|

The Air Permit obtained by INIS from the State of New Mexico for the DU-FEP project.

|

| |

6.

|

The Industrial Revenue Bond granted to INIS for the purchase of capital equipment for the DU-FEP project.

|

| |

7.

|

All active patents currently owned by INIS for the FEP process:

|

| |

a.

|

7,638,659 Processes for producing chlorofluorocarbon compounds using inorganic fluoride;

|

| |

b.

|

7,745,673 Processes for producing hydrohalocarbon compounds using silicon tetrafluoride; and

|

| |

c.

|

7,776,302 Fluorine Extraction systems and associated processes.

|

| |

8.

|

The associated indexed documents currently stored at Seller’s facility.

|

| |

9.

|

All other files, records, correspondence, and documents contained in the INIS files identified as the “Hobbs Fluorine Extraction Process Project.”

|

EXHIBIT A

ADDITIONAL DEFINITIONS

In this Agreement, the following terms have the meanings set forth in this Exhibit A and are equally applicable to both the singular and plural forms:

“Action” means any action, claim, litigation, complaint, investigation, petition, suit, arbitration, or other proceeding, whether civil or criminal, at law or in equity, before any Governmental Authority.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under common Control with such other Person.

“Applicable Law” means, with respect to any Person, any transnational, domestic or foreign federal, state or local law (statutory, common or otherwise), constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, judgment, decree, ruling or other similar requirement enacted, adopted, promulgated or applied by a Governmental Authority that is binding upon or applicable to such Person or such Person’s properties or assets, including all laws and regulations relating to the environment, health, safety, natural resources or hazardous materials, in each case as amended unless expressly specified otherwise.

“Bill of Sale” means a document that details in writing, in accordance with Idaho law, the sale and transfer of assets and serves as legal evidence that the Seller has transferred all ownership rights in the Purchased Assets to Buyer.

“Business Day” means a day, other than Saturday, Sunday, or other day on which commercial banks in New York, NY, are authorized or required by Applicable Law to close.

“Code” means the Internal Revenue Code of 1986, as amended, and the Treasury Regulations.

“Confidential Information” means all Trade Secrets, information, data, know-how, systems and procedures of a technical, sensitive or confidential nature in any form relating to the Purchased Assets, including to the extent applicable to the Purchased Assets all business and marketing plans, marketing and financial information, pricing, profit margin, cost and sales information, operations information, forms, contracts, bids, agreements, legal matters, unpublished written materials, names and addresses of customers and prospective customers, information about employees, suppliers and other companies with which Seller has had a commercial relationship, plans, methods, concepts, technical information, Seller’s information and materials relating to future plans, including marketing strategies, new research, pending projects and proposals, proprietary production processes, research and development strategies and similar items, and any other information or material related to the Purchased Assets that gives Seller an advantage with respect to its competitors by virtue of not being known by those competitors.

“Contract” means any agreement, contract, lease, license, promissory note, conditional sales contract, invoice, purchase order, indenture, mortgage, deed of trust or other commitment, undertaking, instrument or arrangement of any kind, whether written or oral, other than this Agreement.

“Control” when used with respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise, and the terms “controlling” and “controlled” have correlative meanings.

“Dollars” or “$” means the lawful currency of the United States.

“Excluded Liabilities” means any and all liabilities or obligations of Seller of whatever nature, whether presently in existence or arising after the Effective Date, and whether known or unknown, absolute or contingent, liquidated or unliquidated, due or to become due and accrued or unaccrued, and whether claims are asserted before or after the Closing, other than the Assumed Liabilities.

“Governmental Authority” means any transnational, domestic or foreign federal, state, or local governmental, regulatory, or administrative authority, department, court, agency or official, including any political subdivision of the foregoing.

“Lien” means, with respect to any property or asset, any mortgage, deed of trust, lien (statutory or otherwise), pledge, charge, option, conditional sale agreement, right of first refusal or right of first offer, security interest, equitable interest, restriction on transfer or encroachment, encumbrance, or other adverse claim of any kind in respect of such property or asset, including any right or claim of third parties, whether perfected or not perfected, voluntarily incurred or arising by operation of law.

“Material Adverse Effect” means a change, event, circumstance, or development with respect to or on the condition (financial or otherwise) of the Purchased Assets which is or can reasonably be expected to be material and adverse.

“Organizational Documents” means, with respect to a Person, as applicable, (a) such Person’s certificate or articles of formation, organization, or incorporation, (b) agreements, instruments and certificates defining the rights and preferences of holders of such Person’s capital stock or membership interests, and (c) such Person’s bylaws or limited liability company operating agreement, in each case as amended.

“Permits” mean all permits and licenses (including the NRC Material License SUB-1011 and amendments), authorizations, consents, approvals, clearances, registrations, certificates, franchises, or similar rights obtained or required to be obtained from any Governmental Authority affecting, or relating in any way to, the Purchased Assets.

“Person” means an individual, corporation, partnership, limited liability company, association, trust or other entity or organization, including a Governmental Authority.

“Related Agreements” means the Bill of Sale and any other document or instrument delivered by the Parties in connection with the transactions contemplated in this Agreement that are either necessary, or help, to facilitate the completion and transfer of all rights and ownership in the Purchased Assets from Seller to Buyer.

“Representative” means, with respect to any Person, such Person’s directors, managers, members, officers, employees, independent contractors, counsel, financial advisors, accountants, agents, and other authorized representatives, as applicable.

“Seller’s Knowledge” means the actual knowledge of the Representatives of INIS and IIFP.

“Shareholder Liens” means the Liens against certain Purchased Assets, as set forth in Schedule 3.08 as recorded in their respective UCC filings shown in the Schedule.

“Straddle Period” means any Tax period that includes, but does not begin or end on, the Closing Date.

“Tax” means (a) all taxes, including without limitation, all net income, gross income, gross receipts, capital, windfall profit, severance, real property, personal property, production, sales, use, license, excise, franchise, employment, payroll, withholding, social security charges, escheat, unclaimed property, alternative or add-on minimum, ad valorem, value-added, transfer, stamp or environmental taxes or any other tax, custom, duty, governmental fee or other like assessment or charge of any kind whatsoever in nature of taxes imposed or collected by any Governmental Authority, and any interest, penalties, assessments or additions to tax resulting from, attributable to or incurred in connection with any tax or any contest or dispute , or (b) liability for the payment of any amounts of the type described in (a) as a result of being party to any agreement or any express or implied obligation to indemnify any other Person.

“Trade Secrets” means confidential information, ideas, research and development, compositions, know-how, developments, concepts, methods, processes, formulae, technology, technical data, designs, specifications, algorithms, models, reports, data, databases, customer lists, supplier lists, mailing lists, pricing and cost information, business plans, marketing plans, business proposals, marketing proposals and other proprietary information which may qualify as a trade secret under the Uniform Trade Secrets Act. Trade Secrets fall within the legal definition of intellectual property, and certain Trade Secrets of Seller form a part of the Purchased Assets.

“Treasury Regulations” means the final or temporary regulations that have been issued by the United States Department of Treasury pursuant to its authority under the Code and any successor regulations.

Exhibit 99.1

FOR IMMEDIATE RELEASE:

February 8, 2024

INTERNATIONAL ISOTOPES TO DIVEST DEPLETED URANIUM DECONVERSION ASSETS TO AMERICAN FUEL RESOURCES FOR $12,500,000 CASH.

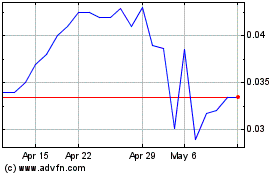

IDAHO FALLS, IDAHO, February 8,2024. International Isotopes Inc. (OTCQB: INIS) (“International Isotopes,” “INIS” or the “Company”) is pleased to announce that it has entered into a definitive agreement to sell all of its assets related to its depleted uranium deconversion and fluorine processing venture (“DUF6 Assets”) to American Fuel Resources, LLC (“AFR”) for $12,500,000 cash at closing. AFR is a leading trader of nuclear fuel components (U3O8, UF6) and services (conversion and SWU).

Shahe Bagerdjian, President & CEO of INIS commented, “We are happy to have found a great home with AFR for our DUF6 assets. We believe AFR is well positioned to bring the deconversion facility into operation. For INIS, this is a pivotal time to focus on the growth of our medical device and theranostics business lines and this deal will strengthen our balance sheet to do just that.”

Under the terms of the transaction, AFR will pay INIS a $50,000 prepayment at signing and the remaining $12,450,000 at closing. The parties expect closing to occur in 12 to 24 months, in order to properly transfer all related licenses, patents, agreements, and obtain NRC approval. Closing is contingent on various conditions being met, including approvals and agreements by the U.S. Nuclear Regulatory Commission and other third parties.

Additional information about the transaction with AFR will be provided in a Current Report on Form 8-K to be filed by the Company with the SEC.

About International Isotopes Inc.

International Isotopes Inc. (INIS), established in 1995, with its headquarters in Idaho Falls, ID, USA, manufactures a wide range of radioisotope-focused products. INIS manufactures and supplies generic sodium iodide I-131 radiopharmaceutical drug product for hyperthyroidism and thyroid cancer. INIS manufactures and distributes a complete line of calibration and reference standards for nuclear pharmacies and SPECT/PET imaging systems as well as industrial calibration standards. The Company also manufactures Cobalt-60 sealed source products and provides contract manufacturing of various drug products as well as radioisotope API supply for 3rd party theranostics clients. The Company recently purchased the Swirler® and Tru-Fit™ Mouthpiece assets, medical devices for radioaerosol applications, from AMICI, Inc.

International Isotopes Inc. Safe Harbor Statement