false

0001696558

0001696558

2024-02-08

2024-02-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 8, 2024

Jerash Holdings (US), Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38474 |

|

81-4701719 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 277 Fairfield Road, Suite 338, Fairfield, NJ |

|

07004 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (201) 285-7973

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

| Common stock, par value $0.001 per share |

|

JRSH |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2

of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On February 8, 2024, Jerash Holdings (US), Inc.

issued a press release to announce financial results for its fiscal year 2024 third quarter, ended December 31, 2023. The press release

is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

JERASH HOLDINGS (US), INC. |

| |

|

|

| February 8, 2024 |

By: |

/s/ Choi Lin Hung |

| |

|

Choi Lin Hung |

| |

|

Chairman of the Board of Directors,

Chief Executive Officer, President, and Treasurer |

2

Exhibit 99.1

Jerash Holdings Reports Fiscal 2024 Third Quarter

Financial Results

FAIRFIELD, N.J., February 8, 2024 – Jerash Holdings (US),

Inc. (“Jerash” or the “Company”) (NASDAQ: JRSH), which manufactures and exports custom, ready-made, sportswear

and outerwear for leading global brands, today announced financial results for its fiscal year 2024 third quarter, ended December 31,

2023.

Impact of Middle East Situation

The ongoing turmoil in the Middle East, including the attacks

on ships in the Red Sea is causing supply chain disruptions throughout the region and affecting many companies, including Jerash. Shipments

of raw materials to the Company have been delayed, which, in turn, had a transitory effect on operations and financial performance.

While the extent of the impact

on the region remains uncertain, the Company’s operations in Jordan are fully active, and exports from Jordan at both the

Aqaba and Haifa ports are open following a temporary shutdown at Haifa. Starting in December 2023, Jerash has been able to adopt an alternative

route through the Port of Jebel Ali in United Arab Emirates for raw material import. The Company is in close communication with its customers

and has put contingency plans in place that will enable it to fulfill customer orders.

Fiscal Year 2024 Third Quarter Results

“The ongoing tension in the region presented supply chain issues,

causing delays, but not cancellations, and curtailing production during the quarter,” said Sam Choi, Jerash’s chairman and

chief executive officer. “While revenue was significantly down compared with the prior year period, we achieved profitability for

the quarter and continued to make good progress attracting a fresh pipeline of orders from new customers representing established global

brands.

“We are excited about our growth opportunity in Europe, having

recently attracted another European-based high-end apparel brand for which we have begun to produce several trial orders. In addition,

Vans and Dickies, both VF Corporation brands, placed trial orders for both the U.S. and European markets. These are all positive indicators

for the future.

“While our new customers and the eventual shipment of delayed

orders bode well for Jerash’s longer term future performance, it would be imprudent at this time to provide formal guidance on what

to expect for the current quarter because of the ongoing geopolitical uncertainty. The Ministry of Foreign Affairs of Jordan has reassured

our team that the government is proactive in maintaining a safe and stable environment for businesses and providing protection export

sea routes. We are grateful that day-to-day life in Jordan remains normal. Our hearts go out to the innocent victims on all sides of the

crisis, and we pray for an expeditious resolution,” Choi added.

Revenue for the fiscal year 2024 third quarter was $27.5 million, compared

with $43.0 million in the same quarter last year, principally reflecting the supply chain interruptions, with fewer shipments being delivered

to some of the Company’s major customers in the U.S.

Gross profit for the fiscal year 2024 third quarter was $4.5 million,

compared with $5.8 million in the same quarter last year. Gross margin improved 270 basis points to 16.2 percent in the fiscal year 2024

third quarter, from 13.5 percent in the same quarter last year. The increase was primarily due to improved product mix, with a larger

proportion of shipments to the Company’s major U.S. customers that generate higher margins.

Operating expenses were reduced to $4.1 million in the fiscal year

2024 third quarter, from $4.5 million in the same quarter last year. Selling, general and administrative expenses also were lower, at

$3.8 million in the fiscal year 2024 third quarter, compared with $4.5 million in the same quarter last year. Stock-based compensation

expenses for the fiscal year 2024 third quarter were $243,000, compared with none in the same quarter last year.

Operating income totaled $376,000 in the fiscal year 2024 third quarter,

versus $1.3 million in the same quarter last year.

Total other expenses were $105,000 in the fiscal year 2024 third quarter,

compared with $111,000 in the same quarter last year.

Net income was $232,000 in the fiscal year 2024 third quarter, or $0.02

per diluted share, versus $891,000, or $0.07 per diluted share, in the same quarter last year.

Comprehensive income attributable to Jerash’s common stockholders

totaled $320,000 in the fiscal year 2024 third quarter, compared with $929,000 in the same quarter last year.

Balance Sheet, Cash Flow and Dividends

Cash totaled $19.6 million, and net working capital was $40.5 million

at December 31, 2023.

On February 5, 2024, Jerash approved a regular quarterly dividend of

$0.05 per share on its common stock, payable on February 23, 2024 to stockholders of record as of February 16, 2024.

Nine-Month Fiscal Year 2024 Results

Revenue for the first nine months of fiscal year 2024 was $95.6 million,

compared with $114.3 million in the same period last year.

Gross profit was $15.4 million for the first nine months of fiscal

year 2024, compared with $19.3 million for the same period last year. Gross margin for the first nine months of fiscal year 2024 was 16.1

percent, compared with 16.9 percent in the same period last year.

Operating expenses for the first nine months of fiscal year 2024 were

$13.0 million, slightly lower than the same period last year. Operating income was $2.4 million for the first nine months of fiscal year

2024, compared with $6.2 million for the same period last year.

Net income for the first nine months of fiscal year 2024 was $1.1 million,

or $0.09 per diluted share, compared with $4.4 million, or $0.35 per diluted share, in the same period last year.

Comprehensive income attributable to Jerash’s common stockholders

was $1.0 million in the first nine months of fiscal year 2024, compared with $4.1 million in the same period last year.

Conference Call

Jerash will host an investor conference call to discuss its fiscal

year 2024 third quarter results today, February 8, 2024, at 9:00 a.m. Eastern Time.

| Phone: | 888-506-0062

(domestic); 973-528-0011 (international) |

A live and archived webcast will be available online in the investor

relations section of Jerash’s website at www.jerashholdings.com. For those who are not able to listen to the live broadcast,

the call will be archived for approximately one year on the website.

About Jerash Holdings (US), Inc.

Jerash manufactures and exports custom, ready-made, sportswear and

outerwear for leading global brands and retailers, including VF Corporation (which owns brands such as The North Face, Timberland, and

Vans), New Balance, G-III (which licenses brands such as Calvin Klein, Tommy Hilfiger, DKNY, and Guess), American Eagle, and Skechers.

Jerash’s existing production facilities comprise six factory units and four warehouses, and Jerash currently employs approximately

5,000 people. Additional information is available at www.jerashholdings.com.

Forward-Looking Statements

This news release contains forward-looking statements that involve

risks and uncertainties, which may cause actual results to differ materially from the statements made. When used in this document, the

words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”,

“believe”, “estimate”, “expect”, “seek”, “potential,” “outlook” and similar

expressions are intended to identify forward-looking statements. Such statements, including, but not limited to, Jerash’s current views

with respect to future events and its financial forecasts, and expansion of the customer base among high-profile global brands, are subject

to such risks and uncertainties. Many factors could cause actual results to differ materially from the statements made, including those

risks described from time to time in filings made by Jerash with the U.S. Securities and Exchange Commission. These and other risks and

uncertainties are detailed in the Company’s filings with the U.S. Securities and Exchange Commission. Should one or more of these risks

or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary

materially from those described herein as intended, planned, anticipated or expected. Statements contained in this news release regarding

past trends or activities should not be taken as a representation that such trends or activities will continue in the future. Jerash does

not intend and does not assume any obligation to update these forward-looking statements, other than as required by law.

Contact:

PondelWilkinson Inc.

Judy Lin or Roger Pondel

310-279-5980

jlin@pondel.com

# # #

(tables below)

JERASH HOLDINGS (US), INC.,

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

AND COMPREHENSIVE INCOME

(UNAUDITED)

| | |

For the Three Months Ended

December 31, | | |

For the Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue, net | |

$ | 27,520,121 | | |

$ | 43,027,047 | | |

$ | 95,612,886 | | |

$ | 114,289,303 | |

| Cost of goods sold | |

| 23,057,845 | | |

| 37,230,421 | | |

| 80,211,039 | | |

| 94,952,523 | |

| Gross Profit | |

| 4,462,276 | | |

| 5,796,626 | | |

| 15,401,847 | | |

| 19,336,780 | |

| | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative expenses | |

| 3,843,029 | | |

| 4,469,967 | | |

| 12,318,535 | | |

| 12,796,749 | |

| Stock-based compensation expenses | |

| 243,448 | | |

| - | | |

| 727,698 | | |

| 294,822 | |

| Total Operating Expenses | |

| 4,086,477 | | |

| 4,469,967 | | |

| 13,046,233 | | |

| 13,091,571 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income from Operations | |

| 375,799 | | |

| 1,326,659 | | |

| 2,355,614 | | |

| 6,245,209 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other Income (Expenses): | |

| | | |

| | | |

| | | |

| | |

| Interest expenses | |

| (234,971 | ) | |

| (248,894 | ) | |

| (983,156 | ) | |

| (500,331 | ) |

| Other income, net | |

| 129,877 | | |

| 137,432 | | |

| 412,627 | | |

| 255,481 | |

| Total other expenses, net | |

| (105,094 | ) | |

| (111,462 | ) | |

| (570,529 | ) | |

| (244,850 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net income before provision for income taxes | |

| 270,705 | | |

| 1,215,197 | | |

| 1,785,085 | | |

| 6,000,359 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax expenses | |

| 38,535 | | |

| 324,379 | | |

| 688,856 | | |

| 1,596,407 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| 232,170 | | |

| 890,818 | | |

| 1,096,229 | | |

| 4,403,952 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net gain attributable to noncontrolling interest | |

| (11,457 | ) | |

| - | | |

| (13,373 | ) | |

| - | |

| Net income attributable to Jerash Holdings (US), Inc.’s Common Stockholders | |

$ | 220,713 | | |

$ | 890,818 | | |

$ | 1,082,856 | | |

$ | 4,403,952 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net income | |

$ | 232,170 | | |

$ | 890,818 | | |

$ | 1,096,229 | | |

$ | 4,403,952 | |

| Other Comprehensive Income (Loss): | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation gain (loss) | |

| 99,171 | | |

| 37,804 | | |

| (55,329 | ) | |

| (296,066 | ) |

| Total Comprehensive Income | |

| 331,341 | | |

| 928,622 | | |

| 1,040,900 | | |

| 4,107,886 | |

| Comprehensive gain attributable to noncontrolling interest | |

| (11,457 | ) | |

| - | | |

| (13,373 | ) | |

| - | |

| Comprehensive Income Attributable to Jerash Holdings (US), Inc.’s Common Stockholders | |

$ | 319,884 | | |

$ | 928,622 | | |

$ | 1,027,527 | | |

$ | 4,107,886 | |

| | |

| | | |

| | | |

| | | |

| | |

| Earnings Per Share Attributable to Common Stockholders: | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted | |

$ | 0.02 | | |

$ | 0.07 | | |

$ | 0.09 | | |

$ | 0.35 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted Average Number of Shares | |

| | | |

| | | |

| | | |

| | |

| Basic | |

| 12,294,840 | | |

| 12,412,922 | | |

| 12,294,840 | | |

| 12,414,546 | |

| Diluted | |

| 12,294,840 | | |

| 12,412,922 | | |

| 12,294,840 | | |

| 12,467,315 | |

| | |

| | | |

| | | |

| | | |

| | |

| Dividend per share | |

$ | 0.05 | | |

$ | 0.05 | | |

$ | 0.15 | | |

$ | 0.15 | |

JERASH HOLDINGS (US), INC.,

AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

December 31,

2023 | | |

March 31,

2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| Current Assets: | |

| | |

| |

| Cash | |

$ | 19,617,630 | | |

$ | 17,801,614 | |

| Accounts receivable, net | |

| 8,472,674 | | |

| 2,240,537 | |

| Bills receivable | |

| 152,188 | | |

| 87,573 | |

| Inventories | |

| 15,937,648 | | |

| 32,656,833 | |

| Prepaid expenses and other current assets | |

| 2,582,886 | | |

| 2,964,578 | |

| Advance to suppliers, net | |

| 2,644,108 | | |

| 1,533,091 | |

| Total Current Assets | |

| 49,407,134 | | |

| 57,284,226 | |

| | |

| | | |

| | |

| Restricted cash - non-current | |

| 1,608,784 | | |

| 1,609,989 | |

| Long-term deposits | |

| 782,697 | | |

| 841,628 | |

| Deferred tax assets, net | |

| 153,873 | | |

| 153,873 | |

| Property, plant and equipment, net | |

| 24,796,611 | | |

| 22,355,574 | |

| Goodwill | |

| 499,282 | | |

| 499,282 | |

| Right of use assets | |

| 541,612 | | |

| 974,761 | |

| Total Assets | |

$ | 77,789,993 | | |

$ | 83,719,333 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 2,401,586 | | |

$ | 5,782,570 | |

| Accrued expenses | |

| 2,898,142 | | |

| 2,930,533 | |

| Income tax payable - current | |

| 1,736,484 | | |

| 2,846,201 | |

| Other payables | |

| 1,619,636 | | |

| 1,477,243 | |

| Deferred revenue | |

| 905 | | |

| 928,393 | |

| Operating lease liabilities - current | |

| 280,363 | | |

| 481,502 | |

| Total Current Liabilities | |

| 8,937,116 | | |

| 14,446,442 | |

| | |

| | | |

| | |

| Operating lease liabilities - non-current | |

| 196,456 | | |

| 287,247 | |

| Income tax payable - non-current | |

| 417,450 | | |

| 751,410 | |

| Total Liabilities | |

| 9,551,022 | | |

| 15,485,099 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Preferred stock, $0.001 par value; 500,000 shares authorized; none issued and outstanding | |

$ | - | | |

$ | - | |

| Common stock, $0.001 par value; 30,000,000 shares authorized; 12,534,318 shares issued, 12,294,840 shares outstanding | |

| 12,534 | | |

| 12,534 | |

| Additional paid-in capital | |

| 23,658,744 | | |

| 22,931,046 | |

| Treasury stock, 239,478 shares | |

| (1,169,046 | ) | |

| (1,169,046 | ) |

| Statutory reserve | |

| 410,847 | | |

| 410,847 | |

| Retained earnings | |

| 45,410,712 | | |

| 46,172,082 | |

| Accumulated other comprehensive loss | |

| (178,558 | ) | |

| (123,229 | ) |

| Total Jerash Holdings (US), Inc.’ Stockholders’ Equity | |

| 68,145,233 | | |

| 68,234,234 | |

| | |

| | | |

| | |

| Noncontrolling interest | |

| 93,738 | | |

| - | |

| Total Equity | |

| 68,238,971 | | |

| 68,234,234 | |

| | |

| | | |

| | |

| Total Liabilities and Equity | |

$ | 77,789,993 | | |

$ | 83,719,333 | |

JERASH HOLDINGS (US), INC.,

AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

For the Nine Months Ended

December 31, | |

| | |

2023 | | |

2022 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | |

| | |

| |

| Net income | |

$ | 1,096,229 | | |

$ | 4,403,952 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,881,853 | | |

| 1,753,941 | |

| Stock-based compensation expenses | |

| 727,698 | | |

| 294,822 | |

| Bad debt recovery | |

| (187,762 | ) | |

| - | |

| Amortization of operating lease right-of-use assets | |

| 601,727 | | |

| 784,699 | |

| | |

| | | |

| | |

| Changes in operating assets: | |

| | | |

| | |

| Accounts receivable | |

| (6,044,375 | ) | |

| 5,503,123 | |

| Bills receivable | |

| (64,614 | ) | |

| - | |

| Inventories | |

| 16,719,185 | | |

| 1,591,135 | |

| Prepaid expenses and other current assets | |

| 350,324 | | |

| 424,867 | |

| Advance to suppliers | |

| (1,111,017 | ) | |

| (4,725,296 | ) |

| Changes in operating liabilities: | |

| | | |

| | |

| Accounts payable | |

| (3,380,984 | ) | |

| 1,108,112 | |

| Accrued expenses | |

| (32,390 | ) | |

| (266,092 | ) |

| Other payables | |

| 142,393 | | |

| (883,219 | ) |

| Deferred revenue | |

| (927,488 | ) | |

| 296,985 | |

| Operating lease liabilities | |

| (460,508 | ) | |

| (661,274 | ) |

| Income tax payable, net of recovery | |

| (1,443,317 | ) | |

| 232,632 | |

| Net cash provided by operating activities | |

| 7,866,954 | | |

| 9,858,387 | |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITIES | |

| | | |

| | |

| Purchases of property, plant, and equipment | |

| (824,305 | ) | |

| (587,613 | ) |

| Payments for construction of properties | |

| (3,158,501 | ) | |

| (3,414,172 | ) |

| Acquisition of Ever Winland | |

| - | | |

| (5,100,000 | ) |

| Acquisition of Kawkab Venus | |

| - | | |

| (2,200,000 | ) |

| Payment for long-term deposits | |

| (281,153 | ) | |

| (70,549 | ) |

| Net cash used in investing activities | |

| (4,263,959 | ) | |

| (11,372,334 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM FINANCING ACTIVITIES | |

| | | |

| | |

| Dividend payments | |

| (1,844,226 | ) | |

| (1,865,241 | ) |

| Investment of noncontrolling interest | |

| 31,365 | | |

| - | |

| Share repurchase | |

| - | | |

| (771,894 | ) |

| Repayment from short-term loan | |

| (4,937,633 | ) | |

| (1,756,360 | ) |

| Repayment to a related party | |

| - | | |

| (300,166 | ) |

| Proceeds from short-term loan | |

| 4,937,633 | | |

| 6,162,743 | |

| Net cash (used in) provided by financing activities | |

| (1,812,861 | ) | |

| 1,469,082 | |

| | |

| | | |

| | |

| EFFECT OF EXCHANGE RATE CHANGES ON CASH AND RESTRICTED CASH | |

| 24,677 | | |

| (296,261 | ) |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN CASH AND RESTRICTED CASH | |

| 1,814,811 | | |

| (341,126 | ) |

| | |

| | | |

| | |

| CASH, AND RESTRICTED CASH, BEGINNING OF THE PERIOD | |

| 19,411,603 | | |

| 26,583,488 | |

| | |

| | | |

| | |

| CASH, AND RESTRICTED CASH, END OF THE PERIOD | |

$ | 21,226,414 | | |

$ | 26,242,362 | |

| | |

| | | |

| | |

| CASH, AND RESTRICTED CASH, END OF THE PERIOD | |

| 21,226,414 | | |

| 26,242,362 | |

| LESS: NON-CURRENT RESTRICTED CASH | |

| 1,608,784 | | |

| 1,615,353 | |

| CASH, END OF THE PERIOD | |

$ | 19,617,630 | | |

$ | 24,627,009 | |

| | |

| | | |

| | |

| Supplemental disclosure information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 983,156 | | |

$ | 500,331 | |

| Income tax paid | |

$ | 2,163,732 | | |

$ | 1,354,754 | |

| | |

| | | |

| | |

| Non-cash investing and financing activities | |

| | | |

| | |

| Equipment obtained by utilizing long-term deposit | |

$ | 355,160 | | |

$ | 236,735 | |

| Acquisition of Kawkab Venus by utilizing long-term deposit | |

$ | - | | |

$ | 500,000 | |

| Right of use assets obtained in exchange for operating lease obligations | |

$ | 177,068 | | |

$ | 190,654 | |

6

v3.24.0.1

Cover

|

Feb. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 08, 2024

|

| Entity File Number |

001-38474

|

| Entity Registrant Name |

Jerash Holdings (US), Inc.

|

| Entity Central Index Key |

0001696558

|

| Entity Tax Identification Number |

81-4701719

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

277 Fairfield Road

|

| Entity Address, Address Line Two |

Suite 338

|

| Entity Address, City or Town |

Fairfield

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07004

|

| City Area Code |

201

|

| Local Phone Number |

285-7973

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.001 per share

|

| Trading Symbol |

JRSH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

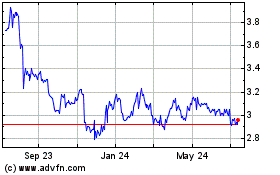

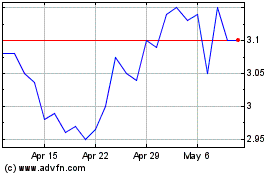

Jerash Holdings US (NASDAQ:JRSH)

Historical Stock Chart

From Apr 2024 to May 2024

Jerash Holdings US (NASDAQ:JRSH)

Historical Stock Chart

From May 2023 to May 2024