UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

| ☐ |

Definitive Proxy Statement

|

| |

|

| ☒ |

Definitive Additional Materials

|

| |

|

| ☐ |

Soliciting Material Pursuant to Section 240.14a-12

|

EARGO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

|

| |

|

| |

|

| ☒ |

No fee required

|

| |

|

| ☐ |

Fee paid previously with preliminary materials

|

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

On January 16, 2024, Eargo, Inc. (the “Company” or “Eargo”) filed its definitive proxy statement on

Schedule 14A (the “Proxy Statement”), as such may be supplemented from time to time, with the Securities and Exchange Commission (the “SEC”)

with respect to the special meeting of Eargo’s stockholders scheduled to be held on February 13, 2024 (the “Special Meeting”). The Special Meeting will be held virtually on February 13, 2024

at 11:00 a.m. Pacific Time to act on the proposal to adopt the Merger Agreement, as disclosed in the Proxy Statement. This Schedule 14A (the “Schedule”) is being filed to update and supplement

the Proxy Statement. The information contained in this Schedule should be read in conjunction with the Proxy Statement, which should be read in its entirety.

Litigation Relating to the Merger.

As of the date of this Schedule, one lawsuit relating to the Merger (the “Lawsuit”) has been filed: Kim v.

Eargo, Inc., et al., Case No. 5:24-cv-00357, which was filed in the United States District Court for the Northern District of California on January 22, 2024. This lawsuit was filed by a purported

stockholder of the Company as an individual action and alleges that the Company’s Proxy Statement omitted material information in violation of Sections 14(a) and 20(a) of the Securities Exchange Act of 1934, as amended, and certain rules promulgated

thereunder, rendering the Proxy Statement false and misleading. The Lawsuit names as defendants the Company and its directors and seeks, among other relief, an order enjoining the completion of the Merger. There can be no assurance regarding the

ultimate outcome of the Lawsuit.

As of the date of this Schedule, multiple purported stockholders of the Company have also delivered demand letters to the Company (collectively, the “Demand Letters”)

alleging that the disclosures contained in the Proxy Statement are deficient and requesting that the Company supplement such disclosures prior to the Special Meeting in connection with the Merger, which is scheduled to be held on February 13, 2024, as

disclosed in the Proxy Statement. The Demand Letters also threaten the Company with lawsuits in the event that the purported deficiencies in the Proxy Statement are not addressed.

It is possible that additional, similar complaints may be filed, that the Lawsuit described above may be amended, or that additional demand letters will be received by the Company. If this occurs, the Company does not

intend to announce the filing or receipt of each additional, similar complaint or demand letter or any amended complaint unless required by law.

The Company believes that the claims asserted in the Lawsuit and the Demand Letters are without merit. However, in order to moot the unmeritorious disclosure claims, alleviate the costs, risks and uncertainties inherent in

litigation and provide additional information to its stockholders, the Company has determined to voluntarily supplement the Proxy Statement as described in this Schedule. Nothing in this Schedule shall be deemed an admission of the legal necessity or

materiality under applicable laws of any of the disclosures set forth herein. To the contrary, the Company specifically denies all allegations set forth in the Lawsuit and the Demand Letters that any additional disclosure in the Proxy Statement was or

is required.

Supplemental Disclosures.

The following disclosures supplement the disclosures contained in the Proxy Statement and should be read in conjunction with the disclosures contained in the Proxy Statement, which should be read in its entirety. To the

extent the information set forth herein differs from or updates information contained in the Proxy Statement, the information set forth herein shall supersede or supplement the information in the Proxy Statement. All page references are to pages in the

Proxy Statement, and terms used below, unless otherwise defined, have the meanings set forth in the Proxy Statement.

(a) In the section of the Proxy Statement titled “Background of the Merger,” the disclosure in the sixth paragraph of page 21 is amended by adding the following sentence to the end of such paragraph:

Such confidentiality restrictions terminated on December 31, 2023.

(b) In the section of the Proxy Statement titled “Background of the Merger,” the disclosure in the seventh paragraph of page 21 is amended by adding the following sentence to the end of said paragraph:

As the PSC Stockholder was already bound by confidentiality obligations in favor of Eargo pursuant to an investor rights agreement entered into at the time of its acquisition of Notes pursuant to the Note Purchase

Agreement, Eargo did not enter into any separate or additional confidentiality agreement with the PSC Stockholder.

(c) In the section of the Proxy Statement titled “Background of the Merger,” page 24 is amended by adding the following sentence at the end of the Background of the Merger Section:

At the time of the execution of the Merger Agreement, neither the PSC Stockholder nor any of its representatives had discussed any post-closing employment or equity participation for Eargo management.

(d) In the section of the Proxy Statement titled “Special Factors - Opinion of the Special Committee’s Financial Advisor,” the disclosure in the second paragraph of page 32 is amended by replacing the paragraph with the

following (new text is underlined and bold, and deleted text is crossed through):

Based on the analysis of the relevant metrics described above and on professional judgments made by Perella Weinberg, Perella Weinberg selected and applied a range of multiples of 0.6x to 1.4x

and 0.0x to 1.1x to the 2024E Revenue of the Company using the Company Forecasts for the with-insurance case and the without-insurance case, respectively. From this analysis, Perella Weinberg derived a range of implied enterprise values for

the Company. To calculatePerella Weinberg calculated the implied equity value from theas implied enterprise value, Perella

Weinberg added plus cash and cash equivalents and subtracted, which was $46 million, and less debt, which was $0, in each case as of September 30, 2023, and as provided by the Company. Perella Weinberg then calculated implied equity values per share by dividing the implied equity values by the applicable number of fully

diluted shares of approximately 20.8 million to 21.8 million (based upon the number of issued and outstanding shares as provided by the Company, and using the treasury stock method for dilutive shares).

The resulting range of implied equity values per share for the Company Common Stock derived from these calculations was $3.77 to $5.69 for the with-insurance case, and $2.21 to $3.73 for the without-insurance case, in each case as compared to the

Merger Consideration of $2.55 per share in the proposed Merger.

(e) In the section of the Proxy Statement titled “Special Factors - Opinion of the Special Committee’s Financial Advisor,” the disclosure in the seventh paragraph of page 32 is amended by replacing the paragraph with the

following (new text is underlined and bold, and deleted text is crossed through):

Perella Weinberg then calculated the implied equity values per share of the Company from the range of implied enterprise values, using the same enterprise value to equity value calculations set forth above in the analysis

of the Selected Public Companies, and a number of fully diluted shares that includedequal to the sum of the fully diluted shares of approximately 20.8 million (based upon the number of issued and

outstanding shares as provided by the Company, and using the treasury stock method for dilutive shares) and the additional shares issued in connection with the assumed equity financing in the with-insurance case of approximately 48.9

million. Perella Weinberg derived a range of implied equity values per share of $1.95 to $2.66 for the with-insurance case, as compared to the Merger Consideration of $2.55 per share in the proposed Merger. Perella Weinberg derived an implied equity

value per share for the without-insurance case of $0.00, on account of the present value of the cash flows during the forecast period being negative through calendar year 2028, and the forecasted cash flows being expected

to remain negative thereafter.

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this Schedule, and the documents to which we refer you in this Schedule, as well as information included in oral statements or other written statements made or to be made by us, contain

forward-looking statements. All statements other than statements of historical fact contained in this Schedule, and the documents to which we refer you in this Schedule, as well as information included in oral statements or other written statements

made or to be made by us, are forward-looking statements, including statements regarding the expected consummation of the proposed transaction or the anticipated timing thereof. Words such as “approximately,” “anticipate,” “assume,” “believe,”

“contemplate,” “continue,” “could,” “estimate,” “expect,” “future,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will” and similar terms and phrases are intended to identify forward-looking statements but

are not the exclusive means of identifying these statements. Forward-looking statements are based on a number of assumptions about future events and are subject to risks and uncertainties that may cause actual results to differ materially from those

that we are expecting, including, among others, the risks associated with proposed transaction generally, such as the failure to consummate or delay in consummating the merger for any reason; the risk that a condition to closing of the merger may not

be satisfied; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the outcome of any legal proceedings that may be instituted following announcement of the merger; failure to

retain key management and employees of the Company; unfavorable reaction to the merger by customers, competitors, suppliers and employees; the risk of litigation and/or regulatory actions related to the proposed transaction or unfavorable results

from currently pending litigation and proceedings or litigation and proceedings that could arise in the future; the ability to meet expectations regarding the timing and completion of the proposed transaction; the risk that any announcements relating

to the proposed transaction could have adverse effects on the market price of the Company’s common stock; risks related to disruption of management’s attention from the Company’s ongoing business operations due to the proposed transaction;

significant transaction costs and other risks that are described in greater detail in the sections titled “Risk Factors” contained in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q and in our other filings with the SEC. Any

forward-looking statements in this Schedule, and the documents to which we refer you in this Schedule, as well as information included in oral statements or other written statements made or to be made by us, are made pursuant to the Private

Securities Litigation Reform Act of 1995, as amended, are based on current expectations, forecasts and assumptions, and speak only as of the date they are made. Except as required by law, we undertake no obligation to publicly update any

forward-looking statements, whether as a result of new information, future events or otherwise. The factors described above cannot be controlled by the Company.

Additional Information and Where to Find It

In connection with the proposed transaction, the Company filed with the SEC and furnished to the Company’s stockholders a proxy statement, and the parties jointly filed a Rule 13e-3 Transaction

Statement on Schedule 13e-3 (the “Schedule 13E-3”) and other relevant documents. This communication is not intended to and does not constitute an offer to sell or the solicitation of an

offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in

contravention of applicable law. Stockholders of the Company are urged to read the proxy statement and Schedule 13E-3 and any other documents filed with the SEC in connection with the proposed transaction or incorporated by reference in the proxy

statement and Schedule 13E-3 because they contain important information about the Company, the proposed transaction and related matters. Investors are able to obtain a free copy of proxy statement, the Schedule 13E-3 and other related documents filed

by the Company with the SEC at the SEC’s website at http://www.sec.gov. In addition, investors may obtain a free copy of the Company’s filings with the SEC from the Investor Relations section of the Company’s Web site at https://ir.eargo.com/ or by

directing a request to the Secretary of the Company, 2665 North First Street, Suite 300, San Jose, California 95134.

Participants in the Solicitation

The Company and its directors, executive officers and certain other members of management and employees of the Company may be deemed to be “participants” in the solicitation of proxies from the

stockholders of the Company in connection with the proposed transaction. Information regarding the interests of the persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders of the Company in

connection with the proposed transaction, which may be different than those of the Company’s stockholders generally, will be set forth in the proxy statement for the proposed merger transaction and the other relevant documents to be filed with the

SEC. Stockholders can find information about the Company and its directors and executive officers and their ownership of the Company’s common stock in the Company’s proxy statement on Schedule 14A for the Company’s June 7, 2023 annual meeting, which

was filed with the SEC on April 24, 2023, in Forms 4 of directors and executive officers filed with the SEC subsequent to that date, and in the Company’s proxy statement on Schedule 14A for the Company’s February 13, 2024 Special Meeting, which was

filed with the SEC on January 16, 2024.

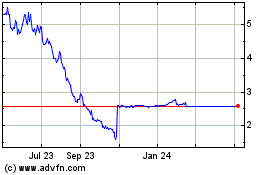

Eargo (NASDAQ:EAR)

Historical Stock Chart

From Apr 2024 to May 2024

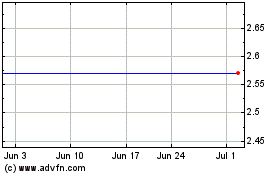

Eargo (NASDAQ:EAR)

Historical Stock Chart

From May 2023 to May 2024