0001364954false00013649542024-02-022024-02-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 2, 2024

Chegg, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36180 | | 20-3237489 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | |

| 3990 Freedom Circle | | |

| Santa Clara, | California | | 95054 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 855-5700

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

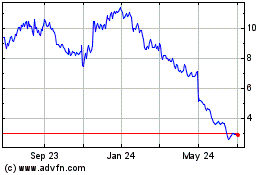

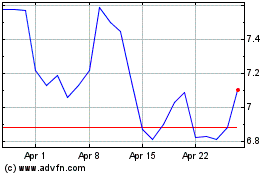

| Common stock, $0.001 par value per share | CHGG | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 5, 2024, Chegg, Inc. (“Chegg”) issued a press release announcing its financial results for the quarter and year ended December 31, 2023. A copy of the press release is attached as Exhibit 99.01 to this Current Report on Form 8-K.

The information contained in this Item 2.02, including the press release attached as Exhibit 99.01 to this Current Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the accompanying Exhibit 99.01 shall not be incorporated by reference into any registration statement or other document filed by Chegg with the Securities and Exchange Commission (“SEC”), whether made before or after the date of this Current Report on Form 8-K, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

On February 2, 2024, the Board of Directors of Chegg, Inc. (the “Company”) appointed David Longo, 56, as the Company’s Chief Financial Officer, Principal Financial Officer, and Treasurer, effective February 21, 2024, to serve until his successor is duly elected and qualified or until the earlier of his death, resignation or removal. Mr. Longo is replacing Andrew Brown, who notified the Company of his retirement in October 2023, as previously disclosed in the Company's Current Report on Form 8-K filed with the Securities and Exchange Commission on October 30, 2023.

Mr. Longo has served as the Company’s Vice President, Chief Accounting Officer, Corporate Controller, Assistant Treasurer, and Principal Accounting Officer since December 2021. Prior to joining the Company, Mr. Longo served as Chief Accounting Officer at Spire Global, Inc., a data and analytics company, from October 2021 to December 2021; as Chief Accounting Officer at Shutterfly, Inc., a digital retailer and manufacturer of high-quality personalized products and services, from August 2020 to October 2021; as Senior Vice President, Controller at CBS Interactive, Inc., a division of CBS Inc., an online content network for information and entertainment, from October 2017 to July 2020 and as Vice President, Controller of CBS Interactive, Inc. from February 2013 to October 2017. Mr. Longo holds a B.S. in business administration, with a concentration in accounting, from Boston University and is a licensed CPA.

There are no family relationships between Mr. Longo and any of the Company’s directors or executive officers. There are no arrangements or understandings between Mr. Longo and any other persons pursuant to which Mr. Longo was appointed as the Company’s Chief Financial Officer, Principal Financial Officer, and Treasurer. Mr. Longo does not have a direct or indirect material interest in any transaction or any currently proposed transaction reportable under Item 404(a) of Regulation S-K.

As part of Mr. Longo’s appointment as the Company's Chief Financial Officer, Principal Financial Officer, and Treasurer, he will receive an annual base salary of $680,000, effective as of February 21, 2024, and a grant of restricted stock units ("RSU") with a value of $1.9 million on March 12, 2024 (the “Award”) as set forth in his Promotion Letter. Each RSU represents a contingent right to receive one share of common stock of the Company upon vesting. The Award shall vest with respect to 100% of the shares subject to the RSU on March 12, 2025 (the “Vesting Date”), subject to Mr. Longo’s continued service with the Company up and through the Vesting Date. Such RSU grant shall be made pursuant to the Company’s 2023 Equity Incentive Plan and on the Company’s Form of Notice of Global Restricted Stock Unit Award Agreement and Global Restricted Stock Unit Agreement, each as previously filed with the Securities and Exchange Commission (the “SEC”) as Exhibit 99.1 to the Company’s Registration Statement on Form S-8 filed with the SEC on June 7, 2023.

The foregoing description of the Promotion Letter is qualified in its entirety by reference to the full text of the Promotion Letter, which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

On February 5, 2024, Chegg issued a press release announcing the appointment of Mr. Longo as the Company's Chief Financial Officer. A copy of the press release is attached as Exhibit 99.02 to this Current Report on Form 8-K and incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this Current Report, including statements regarding Mr. Longo’s role,

responsibilities, compensation, and equity grant are forward-looking statements. The words “will,” “plans,” “expects” and similar expressions are intended to identify these forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including the effective date of Mr. Longo's appointment and the timing of Mr. Longo’s RSU award. In addition, new risks may emerge from time to time and it is not possible for the Company to predict all risks, nor can it assess the impact of all factors on its business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward‑looking statements made. In light of these risks, uncertainties and assumptions, the future events discussed in this Current Report on Form 8‑K may not occur and actual future results may be materially different from those anticipated or implied in the forward‑looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| |

| CHEGG, INC. |

| |

| By: /s/ Andrew Brown |

| Andrew Brown |

| Chief Financial Officer |

Date: February 5, 2024

Chegg Reports 2023 Fourth Quarter and Full Year Financial Results

Chegg announces appointment of new Chief Financial Officer, David Longo, effective February 21, 2024

SANTA CLARA, Calif., February 5, 2024 /BUSINESS WIRE/ -- Chegg, Inc. (NYSE:CHGG), the leading student-first connected learning platform, today reported financial results for the three and twelve months ended December 31, 2023.

“It’s an exciting time at Chegg and I am proud of the team, and how they have navigated through last year, as we completely reinvented the company by leveraging the advancements in artificial intelligence,” said Dan Rosensweig, CEO and President of Chegg, Inc. “The process of embedding AI into every facet of Chegg’s platform is ongoing and iterative, as we build a truly personalized learning assistant.”

Q4 2023 Highlights:

•Total Net Revenues of $188.0 million, a decrease of 8% year-over-year

•Subscription Services Revenues of $166.3 million, or 88% of total net revenues, a decrease of 6% year-over-year

•Gross Margin of 76%

•Non-GAAP Gross Margin of 78%

•Net Income was $9.7 million

•Non-GAAP Net Income was $42.7 million

•Adjusted EBITDA was $66.2 million

•4.6 million Subscription Services subscribers, a decrease of 9% year-over-year

Full Year 2023 Highlights:

•Total Net Revenues of $716.3 million, a decrease of 7% year-over-year

•Subscription Services Revenues of $640.5 million, or 89% of total net revenues, a decrease of 5% year-over-year

•Gross Margin of 68% driven lower by a one-time content and related assets charge of $38.2 million

•Non-GAAP Gross Margin of 76%

•Net Income was $18.2 million

•Non-GAAP Net Income was $141.8 million

•Adjusted EBITDA was $222.4 million

•7.7 million Subscription Services subscribers, a decrease of 6% year-over-year

Total net revenues include revenues from Subscription Services and Skills and Other. Subscription Services includes revenues from our Chegg Study Pack, Chegg Study, Chegg Writing, Chegg Math, and Busuu offerings. Skills and Other includes revenues from Chegg Skills, Advertising, and any other revenues not included in Subscription Services.

For more information about non-GAAP net income and adjusted EBITDA, and a reconciliation of non-GAAP net income to net income, and adjusted EBITDA to net income, see the sections of this press release titled “Use of Non-GAAP Measures,” “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” and “Reconciliation of GAAP to Non-GAAP Financial Measures.”

Business Outlook:

First Quarter 2024

•Total Net Revenues in the range of $173 million to $175 million

•Subscription Services Revenues in the range of $155 million to $157 million

•Gross Margin between 73% and 74%

•Adjusted EBITDA in the range of $43 million to $45 million

For more information about the use of forward-looking non-GAAP measures, a reconciliation of forward-looking net loss to EBITDA and adjusted EBITDA for the first quarter 2024, see the below sections of the press release titled “Use of Non-GAAP Measures,” and “Reconciliation of Forward-Looking Net Loss to EBITDA and Adjusted EBITDA.”

An updated investor presentation and an investor data sheet can be found on Chegg’s Investor Relations website http://investor.chegg.com.

Prepared Remarks - Dan Rosensweig, CEO Chegg, Inc.

Thank you, Tracey, and welcome everyone to our 2023 Q4 earnings call. To start, I am pleased to announce the appointment of David Longo as our new Chief Financial Officer, effective February 21st, as Andy announced on the last call that he will be retiring. David has been our Chief Accounting Officer and Corporate Controller since coming to Chegg in 2021 and we look forward to his continued leadership in this new role. He is joining us on this call today, so welcome, David.

Now, back to the business at hand. Chegg had a good quarter and exceeded our expectations. The last few years we have seen real challenges as we navigate the post-COVID world. Despite those challenges, it’s actually an exciting time at Chegg and I am proud of the team, and how they are navigating the complete reinvention of our company, leveraging the advancements in artificial intelligence and making it core to everything we do. In less than a year, we redesigned our entire user experience, developed our own large language models, launched automated answering, built proprietary algorithms to optimize the quality and accuracy of our exclusive content, and we began to compete more aggressively for new customers around the world. While early, our packaging, pricing, and product strategy are yielding encouraging results for both students and our business.

The process of embedding AI into every facet of Chegg’s platform is ongoing and iterative as we build a truly personalized learning assistant; a service that anticipates the students’ needs, adapts to their strengths and weaknesses, and supports them academically, professionally, and personally. There are numerous ways we intend to aggressively market our new product experience because the data tells us that, once a student tries us, they love us. Internationally, we focused our biggest effort on testing promotional pricing to convert the millions of students who have entered the funnel but did not yet subscribe. Additionally, we are building sharing into our service to increase word of mouth, expanding our presence on TikTok, and enhancing our SEO with increased questions from automated answers. Our business model benefits from more students asking more questions - as we index those questions in to search and other platforms - to drive even more customers.

Let me provide a little context. Since introducing automated answers in late December, we’ve seen a significant increase in the number of students asking new questions, as well as the number of questions per student. This is because our new automated service is delivering quality and accuracy almost immediately, which is a huge benefit to students. By building our own language models, along with our algorithms to check for quality, students can feel confident in what they are learning on Chegg and get support in real time. The impact has been immediate and significant. In January Chegg’s automated answers delivered more than 2.2 million solutions to students, which is 3 times the number of new questions asked and answered this time last year.

Importantly – as we scale – to ensure we meet our standards of accuracy and quality; we expect to launch the rest of our proprietary models by the end of Q1. These models are being trained on Chegg’s data and we are leveraging our 150 thousand subject matter experts to optimize our solutions for learning. In education, students cannot afford the illusion of accuracy to learn, they need it to be correct, immediate, and personalized. We believe this is what Chegg can uniquely do for students, and it’s a huge competitive advantage over generic AI models.

The overall benefit of our new service to students is enormous and there are also significant benefits to Chegg. As the hype of AI dies down, leaders in their verticals like Chegg are taking control of their own destiny by building their own models which allows for higher quality and lower cost. As an example, the cost to answer a new question using our own AI models is already more than 75% less expensive and we believe it will continue to decline over time. This means we will be able to serve more students at a lower cost per student, faster, and in more subjects and languages.

We are confident in the value of our new product and because of that confidence, and to be more competitive, we began testing promotional pricing in international markets in the middle of last year. We believed that if we could introduce our offering to more global learners, they would find the value and benefit of Chegg and continue to choose us and stay with us. In Q4, we saw year-over-year new customer growth outside of the U. S. for the first time in 2 years. And just as important for our business model, more of these users are taking the Chegg Study Pack, which is our higher priced subscription, and remaining paying customers for longer periods of time. We developed this pricing and packaging to be revenue neutral this year, while we expand new account growth substantially. While it is still early, we are seeing encouraging results. Given the success of what we’ve seen internationally, we are now testing promotional pricing for new accounts in the U.S. which began in mid-January.

As we have said, online learning support and skills-based learning are a huge market, and they are only getting bigger. AI is still in its infancy and our product roadmap is ambitious and exciting. Throughout 2024, we are introducing more AI-driven capabilities, such as conversational chat, which continues to layer in personalization and interactivity for our learners. We also plan to integrate personalized learning tools such as practice questions, flashcards, and study guides to our conversational learning experience. Looking beyond 2024, as AI automated translation gets better and cheaper, we plan to expand the localization of our offerings to non-English speaking users.

We also plan to build out more AI capabilities within Chegg Skills and integrate pathways for students with assessments and other tools. We are already seeing a reduction in the time it takes to launch new Skills programs by approximately 40%, which allows us to offer new courses at greater speeds and will significantly reduce our costs. And the importance of skills-based training has never been more critical. In fact, half of recent graduates are questioning how prepared they are to enter the workforce given the disruption of artificial intelligence. And employers agree, as 79% say that workers need more training to work with AI more effectively. So, the opportunity for Chegg Skills has never been greater or more important.

There are number of exciting opportunities ahead of us and in 2024 we remain focused on the following priorities;

•Returning to new account growth globally;

•Maintaining strong margins and cash flow;

•Rolling out the next phase of Chegg’s enhanced AI services;

•And leveraging our momentum in Skills for continued growth.

Every decade or so the pace of technological innovation accelerates, and new growth opportunities open up. The history of the internet has shown us that vertical players who know their customer, have reach, proprietary content, and can provide a personalized user experience will win and win big. Given the strength of our brand, with over 90% of our customers reporting they are satisfied with Chegg’s service, we believe we are well positioned to do just that in our sector.

Before I turn it over to Andy, I want to again thank him for all he has done for Chegg during his 12-and-a-half-year tenure. Under his guidance Chegg grew from a physical textbook rental business to a global, online, learning platform. When Andy took the job, Chegg was in debt, unprofitable, and we had a single business model – renting textbooks. Andy guided us through our transition to a fully digital business and, in doing so, grew our digital revenue from $0 to over $700 million annually. In his final full year as our CFO, Chegg generated $222 million in adjusted EBITDA and $173 million in free cash flow. Thank you isn’t enough to acknowledge the impact Andy has had on this company and on me personally. Andy, you leave quite the legacy at Chegg, and you will truly be missed. With that, I will turn it over to you, my friend.

Prepared Remarks - Andy Brown, CFO Chegg, Inc.

Thanks, Dan, for those kind words, but more importantly congratulations David, on a well-deserved promotion and I look forward to working with you as you transition into your new role over the next few weeks.

Today, I will discuss our financial performance for the fourth quarter and full year 2023, as well as our outlook for the first quarter of 2024.

As Dan mentioned, we ended the year on a positive note, with total revenue, adjusted EBITDA and free cash flow all coming in above the high end of our expectations. While the year had its challenges, we executed well on our plan to reinvent the way we help students navigate their learning experience by leveraging AI, and we continued to see strong profitability and cash flows. This, along with the strength of our balance sheet, gave us the confidence to extinguish a significant amount of our debt at a discount and repurchase shares, which we believe have, and will continue to, enhance shareholder value.

Looking more specifically at our 2023 performance, total revenue was $716 million, with Subscription Services declining 5% to $641 million. Total subscribers were 7.7 million, of which international subscribers were 2.0 million. Since 2021, international has increased from 11% of total revenue to 14% in 2023, or $100 million, and over time, we expect international to be even more significant. Skills and Other revenue of $76 million declined 20% year-over-year. While Skills grew 55%, this was offset by the impact from exiting the textbook business in 2022. We continued to take a prudent approach with expense management, and we were very pleased that we were able to deliver adjusted EBITDA margin of 31% or $222 million, and free cash flow margin of 24% or $173 million, which represented 78% of adjusted EBITDA. We expect interest income to contribute less in 2024 from a combination of lower interest rates and a lower cash balance, as a result of the aforementioned repurchases.

Looking at Q4, total revenue came in above the high end of our guidance at $188 million, which drove better than expected adjusted EBITDA of $66 million. Subscription Services revenue of $166 million declined 6% year over year, driven by a decline in subscribers, which was partially offset by the Chegg Study Pack take rate and a continued increase in retention. Skills and Other revenue of $22 million declined 22%, as growth in skills was offset by the impact of exiting the textbook business.

Looking at the balance sheet, we ended the year with cash and investments of $580 million and net debt of $20 million. This is the result of repurchasing $597 million of outstanding convertible notes during the year at a $92 million discount to par, and initiating an accelerated share repurchase or ASR in Q4 of $150 million, which reduces our outstanding shares by approximately 12%. We believe this prudent capital management will enhance shareholder value. We exited the year with 103 million shares outstanding, including the majority of the benefit from our most recent ASR. This represents a 19% reduction in shares outstanding versus 2022. We believe our company is undervalued, as such we will continue to look for opportunities to return value to our shareholders.

Our business is somewhat unique given our subscription model and the lifecycle of a student. While we are seeing encouraging signs in the business, it is too early to predict when we will return to revenue and margin growth. The green shoots in engagement, acquisitions, and retention will take time to build our renewal base before we see a positive impact on total subscribers and revenue. In the meantime, we will continue to be prudent with expense management and prioritization, while we continue to drive strong profitability and cash flows.

With respect to Q1 guidance we expect:

•Total revenue between $173 and $175 million, with Subscription Services revenue between $155 and $157 million;

•Gross margin to be in the range of 73 and 74 percent;

•And adjusted EBITDA between $43 and $45 million.

In closing, I am proud of what we have accomplished during my 12.5 years at Chegg. This is, by a large measure, the best company I have worked for during my career. The mission, the culture and especially the team, are second to none. I want to thank everyone who was with me on this journey. In particular, a special thanks to Dan, for your leadership, mentorship, and especially the friendship we have developed. It means more than words can say. Thank you. I can also say with confidence that the future is bright for Chegg, and as a long-term shareholder, I look forward to seeing the many future successes the team accomplishes.

With that, I’ll turn the call over to the operator for your questions.

Conference Call and Webcast Information

To access the call, please dial 1-877-407-4018, or outside the U.S. +1-201-689-8471, five minutes prior to 1:30 p.m. Pacific Time (or 4:30 p.m. Eastern Time). A live webcast of the call will also be available at http://investor.chegg.com under the Events & Presentations menu. An audio replay will be available beginning at 4:30 p.m. Pacific Time (or 7:30 p.m. Eastern Time) on February 5, 2024, until 8:59 p.m. Pacific Time (or 11:59 p.m. Eastern Time) on February 12, 2024, by calling 1-844-512-2921, or outside the U.S. +1-412-317-6671, with Conference ID 13743807. An audio archive of the call will also be available at http://investor.chegg.com.

Use of Investor Relations Website for Regulation FD Purposes

Chegg also uses its media center website, http://www.chegg.com/press, as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor http://www.chegg.com/press, in addition to following press releases, Securities and Exchange Commission filings and public conference calls and webcasts.

About Chegg

Millions of people all around the world learn with Chegg. No matter your goal, level or style, Chegg helps you learn with confidence. We provide 24/7 on-demand support and our personalized learning assistant leverages the power of artificial intelligence (AI), more than a hundred million pieces of proprietary content, as well as, a decade of learning insights. Our platform also helps learners build essential life and job skills to accelerate their path from learning to earning, and we work with companies to offer learning programs for their employees. Chegg is a publicly held company and trades on the NYSE under the symbol CHGG. For more information, visit www.chegg.com.

Investor Relations Contact: Tracey Ford IR@chegg.com

Media Contact: Heather Hatlo Porter press@chegg.com

Use of Non-GAAP Measures

To supplement Chegg’s financial results presented in accordance with generally accepted accounting principles in the United States (GAAP), this press release and the accompanying tables and the related earnings conference call contain non-GAAP financial measures, including adjusted EBITDA, non-GAAP cost of revenues, non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP income from operations, non-GAAP net income, non-GAAP weighted average shares, non-GAAP net income per share, and free cash flow. For reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures, please see the section of the accompanying tables titled, “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Reconciliation of GAAP to Non-GAAP Financial Measures,” “Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow,” and “Reconciliation of Forward-Looking Net Loss to EBITDA and Adjusted EBITDA.”

The presentation of these non-GAAP financial measures is not intended to be considered in isolation from, as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and may be different from non-GAAP financial measures used by other companies. Chegg defines (1) adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, or EBITDA, adjusted for print textbook depreciation expense and to exclude share-based compensation expense, other income (expense), net, acquisition-related compensation costs, content and related assets charge, restructuring charges, loss contingency, transitional logistic charges, and impairment of lease related assets; (2) non-GAAP cost of revenues as cost of revenues excluding content and related assets charge, amortization of intangible assets, share-based compensation expense, acquisition-related compensation costs, restructuring charges, and transitional logistic charges; (3) non-GAAP gross profit as gross profit excluding content and related assets charge, amortization of intangible assets, share-based compensation expense, acquisition-related compensation costs, restructuring charges, and transitional logistic charges; (4) non-GAAP gross margin is defined as non-GAAP gross profit divided by net revenues, (5) non-GAAP operating expenses as operating expenses excluding share-based compensation expense, amortization of intangible assets, acquisition-related compensation costs, content and related assets charge, restructuring charges, loss contingency, and impairment of lease related assets; (6) non-GAAP income from operations as income (loss) from operations excluding share-based compensation expense, amortization of intangible assets, acquisition-related compensation costs, content and related assets charge, restructuring charges, loss contingency, transitional logistic charges, and impairment of lease related assets; (7) non-GAAP net income as net income excluding share-based compensation expense, amortization of intangible assets, acquisition-related compensation costs, amortization of debt issuance costs, income tax effect of non-GAAP adjustments, the gain on early extinguishment of debt, content and related assets charge, restructuring charges, loss contingency, transitional logistic charges, realized loss on sale of investments, the tax benefit related to release of valuation allowance, and impairment of lease related assets; (8) non-GAAP weighted average shares outstanding as weighted average shares outstanding adjusted for the effect of outstanding stock plan activity and shares related to our convertible senior notes, to the extent such shares are not already included in our weighted average shares outstanding; (9) non-GAAP net income per share is defined as non-GAAP net income divided by non-GAAP weighted average shares outstanding; and (10) free cash flow as net cash provided by operating activities adjusted for purchases of property and equipment, purchases of textbooks and proceeds from disposition of textbooks. To the extent additional significant non-recurring items arise in the future, Chegg may consider whether to exclude such items in calculating the non-GAAP financial measures it uses.

Chegg believes that these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding Chegg’s performance by excluding items that may not be indicative of Chegg’s core business, operating results or future outlook. Chegg management uses these non-GAAP financial measures in assessing Chegg’s operating results, as well as when planning, forecasting and analyzing future periods and believes that such measures enhance investors’ overall understanding of our current financial performance. These non-GAAP financial measures also facilitate comparisons of Chegg’s performance to prior periods.

As presented in the “Reconciliation of Net Income to EBITDA and Adjusted EBITDA,” “Reconciliation of GAAP to Non-GAAP Financial Measures,” “Reconciliation of Forward-Looking Net Loss to EBITDA and Adjusted EBITDA,” and “Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow,” tables below, each of the non-GAAP financial measures excludes one or more of the following items:

Share-based compensation expense

Share-based compensation expense is a non-cash expense that varies in amount from period to period and is dependent on market forces that are often beyond Chegg's control. As a result, management excludes this item from Chegg's internal

operating forecasts and models. Management believes that non-GAAP measures adjusted for share-based compensation expense provide investors with a basis to measure Chegg's core performance against the performance of other companies without the variability created by share-based compensation as a result of the variety of equity awards used by other companies and the varying methodologies and assumptions used.

Amortization of intangible assets

Chegg amortizes intangible assets, including those that contribute to generating revenues, that it acquires in conjunction with acquisitions, which results in non‑cash expenses that may not otherwise have been incurred. Chegg believes excluding the expense associated with intangible assets from non-GAAP measures allows for a more accurate assessment of its ongoing operations and provides investors with a better comparison of period-over-period operating results. No corresponding adjustments have been made related to revenues generated from acquired intangible assets.

Acquisition-related compensation costs

Acquisition-related compensation costs include compensation expense resulting from the employment retention of certain key employees established in accordance with the terms of the acquisitions. In most cases, these acquisition-related compensation costs are not factored into management's evaluation of potential acquisitions or Chegg's performance after completion of acquisitions, because they are not related to Chegg's core operating performance. In addition, the frequency and amount of such charges can vary significantly based on the size and timing of acquisitions and the maturities of the businesses being acquired. Excluding acquisition-related compensation costs from non-GAAP measures provides investors with a basis to compare Chegg’s results against those of other companies without the variability caused by purchase accounting.

Content and related assets charge

As part of the design and build of our new generative AI experience, in August 2023, we streamlined our product experiences. As a result, we elected to abandon certain content and software assets that did not align with our AI strategy. The content and related assets charge represents a one-time charge consisting primarily of accelerated depreciation of certain content and software assets of $34.2 million, the impairment of our indefinite-lived intangible asset of $3.6 million, the impairment of certain in progress software assets of $2.6 million and other costs associated with abandoning these content and software assets of $1.4 million. The one-time expense is excluded from non-GAAP financial measures because it is the result of a discrete event that is not considered core-operating activities. Chegg believes that it is appropriate to exclude the content and related assets charge from non-GAAP financial measures because it enables the comparison of period-over-period operating results.

Amortization of debt issuance costs

The difference between the effective interest expense and the contractual interest expense are excluded from management's assessment of our operating performance because management believes that these non-cash expenses are not indicative of ongoing operating performance. Chegg believes that the exclusion of the non-cash interest expense provides investors with a better comparison of period-over-period operating results.

Restructuring charges

Restructuring charges represent expenses incurred in conjunction with a reduction in workforce to better position us to execute against our AI strategy and to create long-term, sustainable value for its students and investors. Chegg believes that it is appropriate to exclude them from non-GAAP financial measures because it is the result of an event that is not considered a core-operating activity and we believe its exclusion provides investors with a better comparison of period-over-period operating results.

Loss contingency

The loss contingency represents a one-time accrual in connection with a demand for repayment of certain investment proceeds received in our capacity as an investor in TAPD, Inc. (more commonly known as “Frank”). The loss contingency is excluded from non-GAAP financial measures because they are the result of discrete events that are not considered core-operating activities. Chegg believes that it is appropriate to exclude the loss contingency from non-GAAP financial measures because it enables the comparison of period-over-period operating results.

Gain on early extinguishment of debt

The difference between the carrying amount of early extinguished debt and the reacquisition price is excluded from management's assessment of our operating performance because management believes that these non-cash gains are not indicative of ongoing operating performance. Chegg believes that the exclusion of the gain on early extinguishment of debt provides investors with a better comparison of period-over-period operating results.

Income tax effect of non-GAAP adjustments

In the periods following the release of our U.S. valuation allowance, we utilize a non-GAAP effective tax rate of 24% for evaluating our operating results, which is based on our current mid-term projections. This non-GAAP tax rate could change for various reasons including, but not limited to, significant changes resulting from tax legislation, changes to our corporate structure and other significant events. Chegg believes that the inclusion of a non-GAAP provision for income tax adjustments provides investors with a better comparison of period-over-period operating results.

Tax benefit related to release of valuation allowance

The tax benefit related to the release of the valuation allowance on our U.S. and non-California state deferred tax assets is a result of our expectation that it is more likely than not that our operations will continue to be profitable. Chegg believes that it is appropriate to exclude this from non-GAAP financial measures because it is the result of an event that is not considered a core-operating activity and we believe its exclusion provides investors with a better comparison of period-over-period operating results.

Transitional logistics charges

The transitional logistics charges represent incremental expenses incurred as we transition our print textbooks to a new third party logistics provider. Chegg believes that it is appropriate to exclude them from non-GAAP financial measures because it is the result of an event that is not considered a core-operating activity and we believe its exclusion provides investors with a better comparison of period-over-period operating results.

Realized loss on sale of investments

The realized loss on sale of investments represents the one-time sale of certain investments primarily to align with our updated investment policy. Chegg believes that it is appropriate to exclude this from non-GAAP financial measures because it is the result of an event that is not considered a core-operating activity and we believe its exclusion provides investors with a better comparison of period-over-period operating results.

Impairment of lease related assets

The impairment of lease related assets represents a non-cash impairment charge recorded on the ROU asset and leasehold improvements associated with the closure of certain corporate offices. The impairment of lease related assets is a one-time event that is not considered a core-operating activity and we believe its exclusion provides investors with a better comparison of period-over-period operating results.

Effect of shares for stock plan activity

The effect of shares for stock plan activity represents the dilutive impact of outstanding stock options, RSUs, and PSUs calculated under the treasury stock method.

Effect of shares related to convertible senior notes

The effect of shares related to convertible senior notes represents the dilutive impact of our convertible senior notes, to the extent such shares are not already included in our weighted average shares outstanding as they were antidilutive on a GAAP basis.

Free cash flow

Free cash flow represents net cash provided by operating activities adjusted for purchases of property and equipment and purchases of textbooks and including proceeds from the disposition of textbooks. Chegg considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after the purchases of property and equipment and textbooks, which can then be used to, among other things, invest in Chegg's business and make strategic acquisitions. A limitation of the utility of free cash flow as a measure of financial performance is that it does not represent the total increase or decrease in Chegg's cash balance for the period.

Forward-Looking Statements

This press release contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, which include, without limitation, statements regarding our future growth and the future of learning, the impact of artificial intelligence (AI) technology on our financial condition and results of operations, our ability to leverage AI and make it the core of everything we do, our proprietary algorithms optimizing the quality and accuracy of our exclusive content, our ability to compete more aggressively for new customers around the world, the results for students and our business of our packaging, pricing, and product strategy, our embedding of AI into every facet of our platform, our ability to build a truly personalized learning assistant (including a service that anticipates student needs, adapts to their strengths and weaknesses, and supports them academically, professionally, and personally), the ways we intend to aggressively market our new product experience, our ability to use international promotional pricing to convert the millions of students who have entered the funnel but did not yet subscribe to our service, our building of sharing into our service to increase word of mouth, expanding our presence on TikTok, enhancing our search engine optimization with increased questions from automated answers, our business model benefiting from more students asking more questions, as we index those questions into search and other platforms, to drive even more customers, trends of a significant increase in the number of students asking new questions and the number of questions per student since introducing automated answers in late December 2023, our automated service's delivery of quality and accuracy almost immediately and the related benefits to students, our ability to build our own language models along with algorithms to check for quality, our ability to meet our standards of accuracy and quality, the timeline for the availability of our new offerings, capabilities and experiences, expectations to launch the rest of our proprietary models by the end of the first quarter of 2024, our belief that we can uniquely provide students correct, immediate, and personalized content and the related huge competitive advantage over generic AI models, the enormous overall benefit of our new service to students and the significant benefits to Chegg, our view that, as the hype of AI dies down, leaders in their verticals like us are taking control of their own destiny by building their own models which allow for higher quality and lower cost, our belief that the cost to answer a new question using our own AI models will continue to decline over time, our ability to serve more students at a lower cost per student, faster, and in more subjects and languages, our confidence in the value of our new product, our belief that, if we could introduce our offering to more global learners, they would find the value and benefit of Chegg and continue to stay with us, our international pricing and packaging being revenue neutral this year while we expand new account growth substantially, online learning support and skills-based learning being a huge market and their continued global growth, our introduction throughout 2024 of more AI-driven capabilities, such as conversational chat, which continues to layer in personalization and interactivity for our learners, our plans to integrate personalized learning tools such as practice questions, flashcards, and study guides to our conversational learning experience, our plans beyond 2024, as AI automated translation gets better and cheaper, to expand the localization of our offerings to non-English speaking users, our plan to build out more AI capabilities within Chegg Skills and integrate pathways for students with assessments and other tools, the reduction of the time it takes to launch a new Skills program allowing us to offer new courses at greater speeds and significantly reducing our costs in the future, the opportunity for Chegg Skills never having been greater or more important, our priorities in 2024 (including returning to new account growth globally, maintaining strong margins and cash flow, rolling out the next phase of Chegg's enhanced AI services, and leveraging our momentum in Skills for continued growth), our belief that vertical players who know their customer, have reach and proprietary content, and can provide a personalized user experience will win and win big, our belief that Chegg will win and win big in our sector given the strength of our brand and customer satisfaction, our belief that our securities repurchases will continue to enhance shareholder value, expectations that international revenue will become even more significant over time, expectations that interest income will contribute less in 2024 from a combination of lower interest rates and a lower cash balance as a result of securities repurchases, our intention to look for ways to continue to return value to shareholders as we continue to see our company as undervalued, our belief that green shoots in engagement, acquisitions, and retention will have to build our renewal base before we can see a positive impact on total subscribers and revenue, our reallocation of resources to fund our AI investments and marketing channels to promote our new experience, expectations regarding Chegg's execution against its strategic and financial objectives and guidance, our financial guidance, as well as those included in the investor presentation referenced above, those included in the “Prepared Remarks” sections above, and all statements about Chegg’s outlook under “Business Outlook.” The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “project,” “endeavor,” “will,” “should,” “future,” “transition,” “outlook” and similar expressions, as they relate to Chegg, are intended to identify forward-looking statements. These statements are not guarantees of future performance, and are based on

management’s expectations as of the date of this press release and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to differ materially from any future results, performance or achievements. Important factors that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include the following: the effects of AI technology on Chegg’s business and the economy generally; Chegg’s ability to attract new, and retain existing, students, to increase student engagement, and to increase monetization; Chegg’s brand and reputation; changes in employment and wages and the uncertainty surrounding the evolving educational landscape, enrollment and student behavior; Chegg’s ability to expand internationally; changes in search engine methodologies that modify Chegg’s search result page rankings, resulting in decreased student engagement on Chegg’s website; the success of Chegg’s new product offerings, including the new Chegg generative AI experience and personal learning assistant; competition in aspects of Chegg’s business, and Chegg's expectation that such competition will increase; Chegg’s ability to innovate in response to technological and market developments, including artificial intelligence; Chegg’s ability to maintain its services and systems without interruption, including as a result of technical issues, cybersecurity threats, or cyber-attacks; third-party payment processing risks; adoption of government regulation of education unfavorable to Chegg; the rate of adoption of Chegg’s offerings; mobile app stores and mobile operating systems making Chegg’s apps and mobile website available to students and to grow Chegg’s user base and increase their engagement; colleges and governments restricting online access or access to Chegg’s services; Chegg’s ability to strategically take advantage of new opportunities; competitive developments, including pricing pressures and other services targeting students; Chegg’s ability to build and expand its services offerings; Chegg’s ability to integrate acquired businesses and assets; the impact of seasonality and student behavior on the business; the outcome of any current litigation and investigations; Chegg’s ability to effectively control operating costs; regulatory changes, in particular concerning privacy, marketing, and education; changes in the education market, including as a result of AI technology and COVID-19; and general economic, political and industry conditions, including inflation, recession and war. All information provided in this release and in the conference call is as of the date hereof, and Chegg undertakes no duty to update this information except as required by law. These and other important risk factors are described more fully in documents filed with the Securities and Exchange Commission, including Chegg's Annual Report on Form 10-K for the year ended December 31, 2022 filed with the Securities and Exchange Commission on February 21, 2023 and Chegg's Annual Report on Form 10-K for the year ended December 31, 2023 to be filed with the Securities and Exchange Commission, and could cause actual results to differ materially from expectations.

CHEGG, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except for number of shares and par value)

(unaudited)

| | | | | | | | | | | |

| December 31, |

| | 2023 | | 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 135,757 | | | $ | 473,677 | |

| Short-term investments | 194,257 | | | 583,973 | |

Accounts receivable, net of allowance of $376 and $394 at December 31, 2023 and December 31, 2022, respectively | 31,404 | | | 23,515 | |

| Prepaid expenses | 20,980 | | | 28,481 | |

| Other current assets | 32,437 | | | 34,754 | |

| Total current assets | 414,835 | | | 1,144,400 | |

| Long-term investments | 249,547 | | | 216,233 | |

| | | |

| Property and equipment, net | 183,073 | | | 204,383 | |

| Goodwill | 631,995 | | | 615,093 | |

| Intangible assets, net | 52,430 | | | 78,333 | |

| Right of use assets | 25,130 | | | 18,838 | |

| Deferred tax assets | 141,843 | | | 167,524 | |

| Other assets | 28,382 | | | 20,612 | |

| Total assets | $ | 1,727,235 | | | $ | 2,465,416 | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 28,184 | | | $ | 12,367 | |

| Deferred revenue | 55,336 | | | 56,273 | |

| Accrued liabilities | 77,863 | | | 70,234 | |

| Current portion of convertible senior notes, net | 357,079 | | | — | |

| Total current liabilities | 518,462 | | | 138,874 | |

| Long-term liabilities | | | |

| Convertible senior notes, net | 242,758 | | | 1,188,593 | |

| Long-term operating lease liabilities | 18,063 | | | 13,375 | |

| Other long-term liabilities | 3,334 | | | 7,985 | |

| Total long-term liabilities | 264,155 | | | 1,209,953 | |

| Total liabilities | 782,617 | | | 1,348,827 | |

| Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value – 10,000,000 shares authorized, no shares issued and outstanding at December 31, 2023 and December 31, 2022 | — | | | — | |

Common stock, $0.001 par value – 400,000,000 shares authorized; 102,823,700 and 126,473,827 shares issued and outstanding at December 31, 2023 and December 31, 2022, respectively | 103 | | | 126 | |

| Additional paid-in capital | 1,031,627 | | | 1,244,504 | |

| Accumulated other comprehensive loss | (34,739) | | | (57,488) | |

| Accumulated deficit | (52,373) | | | (70,553) | |

| Total stockholders’ equity | 944,618 | | | 1,116,589 | |

| Total liabilities and stockholders’ equity | $ | 1,727,235 | | | $ | 2,465,416 | |

CHEGG, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net revenues | $ | 187,987 | | | $ | 205,193 | | | $ | 716,295 | | | $ | 766,897 | |

Cost of revenues(1) | 45,804 | | | 51,424 | | | 225,941 | | | 197,396 | |

| Gross profit | 142,183 | | | 153,769 | | | 490,354 | | | 569,501 | |

| Operating expenses: | | | | | | | |

Research and development(1) | 45,724 | | | 46,316 | | | 191,705 | | | 196,637 | |

Sales and marketing(1) | 29,746 | | | 38,080 | | | 126,591 | | | 147,660 | |

General and administrative(1) | 53,426 | | | 61,700 | | | 239,783 | | | 216,247 | |

| | | | | | | |

| Total operating expenses | 128,896 | | | 146,096 | | | 558,079 | | | 560,544 | |

| Income (loss) from operations | 13,287 | | | 7,673 | | | (67,725) | | | 8,957 | |

| Interest expense, net and other income (expense), net | | | | | | | |

| Interest expense, net | (658) | | | (1,302) | | | (3,773) | | | (6,040) | |

| Other income (expense), net | 5,139 | | | (4,218) | | | 121,810 | | | 101,029 | |

| Total interest expense, net and other income (expense), net | 4,481 | | | (5,520) | | | 118,037 | | | 94,989 | |

| Income before (provision for) benefit from income taxes | 17,768 | | | 2,153 | | | 50,312 | | | 103,946 | |

| (Provision for) benefit from income taxes | (8,103) | | | (295) | | | (32,132) | | | 162,692 | |

| Net income | $ | 9,665 | | | $ | 1,858 | | | $ | 18,180 | | | $ | 266,638 | |

Net income (loss) per share | | | | | | | |

| Basic | $ | 0.09 | | | $ | 0.01 | | | $ | 0.16 | | | $ | 2.09 | |

| Diluted | $ | 0.09 | | | $ | 0.01 | | | $ | (0.34) | | | $ | 1.34 | |

Weighted average shares used to compute net income (loss) per share | | | | | | | |

| Basic | 109,093 | | | 125,750 | | | 116,504 | | | 127,557 | |

| Diluted | 118,902 | | | 127,518 | | | 128,569 | | | 149,859 | |

| | | | | | | |

(1) Includes share-based compensation expense as follows: | | | | | | | |

| Cost of revenues | $ | 571 | | | $ | 539 | | | $ | 2,256 | | | $ | 2,484 | |

| Research and development | 10,194 | | | 10,381 | | | 44,103 | | | 41,335 | |

| Sales and marketing | 2,408 | | | 2,681 | | | 9,524 | | | 13,857 | |

| General and administrative | 18,733 | | | 21,514 | | | 77,619 | | | 75,780 | |

| Total share-based compensation expense | $ | 31,906 | | | $ | 35,115 | | | $ | 133,502 | | | $ | 133,456 | |

| | | | | | | |

| | | | | | | |

CHEGG, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited) | | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2023 | | 2022 | | 2021 |

| Cash flows from operating activities | | | | | |

| Net income (loss) | $ | 18,180 | | | $ | 266,638 | | | $ | (1,458) | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | |

| Share-based compensation expense | 133,502 | | | 133,456 | | | 108,846 | |

| Other depreciation and amortization expense | 129,718 | | | 89,997 | | | 63,274 | |

| Deferred tax assets | 26,575 | | | (168,679) | | | (1,104) | |

| (Gain)/loss on early extinguishments of debt | (85,926) | | | (93,519) | | | 78,152 | |

| Loss contingency accrual | 7,000 | | | — | | | — | |

| Impairment of intangible asset | 3,600 | | | — | | | — | |

| Loss from write-offs of property and equipment | 4,137 | | | 3,549 | | | 2,115 | |

| Amortization of debt issuance costs | 3,156 | | | 5,166 | | | 5,922 | |

| Operating lease expense, net of accretion | 6,079 | | | 6,327 | | | 5,994 | |

| Realized loss on sale of investments | 2,106 | | | 9,675 | | | 178 | |

| (Gain)/loss on textbook library, net | — | | | (4,976) | | | 10,956 | |

| Print textbook depreciation expense | — | | | 1,610 | | | 10,859 | |

| Gain on foreign currency remeasurement of purchase consideration | — | | | (4,628) | | | — | |

| Impairment on lease related assets | — | | | 5,225 | | | — | |

| Gain on sale of strategic equity investments | — | | | — | | | (12,496) | |

| Loss on change in fair value of derivative instruments, net | — | | | — | | | 7,148 | |

| Other non-cash items | (1,228) | | | 378 | | | (47) | |

| Change in assets and liabilities, net of effect of acquisition of businesses: | | | | | |

| Accounts receivable | (7,799) | | | (3,752) | | | (5,004) | |

| Prepaid expenses and other current assets | 3,476 | | | 17,191 | | | (21,854) | |

| Other assets | 10,829 | | | 14,563 | | | 16,387 | |

| Accounts payable | 13,057 | | | (4,144) | | | 3,241 | |

| Deferred revenue | (1,585) | | | 7,538 | | | 2,523 | |

| Accrued liabilities | (7,342) | | | (20,111) | | | 5,199 | |

| Other liabilities | (11,337) | | | (5,768) | | | (5,607) | |

| Net cash provided by operating activities | 246,198 | | | 255,736 | | | 273,224 | |

| Cash flows from investing activities | | | | | |

| Purchases of property and equipment | (83,052) | | | (103,092) | | | (94,180) | |

| Purchases of textbooks | — | | | (3,815) | | | (10,931) | |

| Proceeds from disposition of textbooks | 9,787 | | | 6,003 | | | 8,714 | |

| Purchases of investments | (637,939) | | | (730,509) | | | (1,688,384) | |

| Proceeds from sale of investments | 394,533 | | | 458,489 | | | 206,041 | |

| Maturities of investments | 597,197 | | | 884,940 | | | 1,204,787 | |

| Proceeds from sale of strategic equity investments | — | | | — | | | 16,076 | |

| Acquisition of businesses, net of cash acquired | — | | | (401,125) | | | (7,891) | |

| Purchases of strategic equity investments | (11,853) | | | (6,000) | | | — | |

| Net cash provided by (used in) investing activities | 268,673 | | | 104,891 | | | (365,768) | |

| Cash flows from financing activities | | | | | |

| Proceeds from common stock issued under stock plans, net | 4,165 | | | 6,477 | | | 8,887 | |

| Payment of taxes related to the net share settlement of equity awards | (16,440) | | | (26,549) | | | (94,423) | |

| Proceeds from equity offering, net of offering costs | — | | | — | | | 1,091,466 | |

| Repayment of convertible senior notes | (505,986) | | | (401,203) | | | (300,762) | |

| Proceeds from exercise of convertible senior notes capped call | 297 | | | — | | | 69,005 | |

| Payment of escrow related to acquisition | — | | | — | | | (7,451) | |

| Repurchase of common stock | (334,806) | | | (323,528) | | | (300,000) | |

| Net cash (used in) provided by financing activities | (852,770) | | | (744,803) | | | 466,722 | |

| Effect of exchange rate changes | 21 | | | 4,137 | | | — | |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (337,878) | | | (380,039) | | | 374,178 | |

| Cash, cash equivalents and restricted cash, beginning of period | 475,854 | | | 855,893 | | | 481,715 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 137,976 | | | $ | 475,854 | | | $ | 855,893 | |

| | | | | | | | | | | | | | | | | |

| | Years Ended December 31, |

| | 2023 | | 2022 | | 2021 |

| Supplemental cash flow data: | | | | | |

| Cash paid during the period for: | | | | | |

| Interest | $ | 741 | | | $ | 875 | | | $ | 1,053 | |

| Income taxes, net of refunds | $ | 11,074 | | | $ | 6,841 | | | $ | 7,388 | |

| Cash paid for amounts included in the measurement of lease liabilities: | | | | | |

| Operating cash flows from operating leases | $ | 9,042 | | | $ | 8,863 | | | $ | 7,772 | |

| Right of use assets obtained in exchange for lease obligations: | | | | | |

| Operating leases | $ | 12,407 | | | $ | 10,232 | | | $ | — | |

| Non-cash investing and financing activities: | | | | | |

| Accrued purchases of long-lived assets | $ | 9,650 | | | $ | 4,927 | | | $ | 2,982 | |

| | | | | |

| Issuance of common stock related to repayment of convertible senior notes | $ | — | | | $ | — | | | $ | 235,521 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 | | 2021 |

| Reconciliation of cash, cash equivalents and restricted cash: | | | | | |

| Cash and cash equivalents | $ | 135,757 | | | $ | 473,677 | | | $ | 854,078 | |

| Restricted cash included in other current assets | — | | | 63 | | | — | |

| Restricted cash included in other assets | 2,219 | | | 2,114 | | | 1,815 | |

| Total cash, cash equivalents and restricted cash | $ | 137,976 | | | $ | 475,854 | | | $ | 855,893 | |

CHEGG, INC.

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 9,665 | | | $ | 1,858 | | | $ | 18,180 | | | $ | 266,638 | |

| Interest expense, net | 658 | | | 1,302 | | | 3,773 | | | 6,040 | |

| Provision for (benefit from) income taxes | 8,103 | | | 295 | | | 32,132 | | | (162,692) | |

| Print textbook depreciation expense | — | | | — | | | — | | | 1,610 | |

Other depreciation and amortization expense(1) | 20,773 | | | 25,702 | | | 129,718 | | | 89,997 | |

| EBITDA | 39,199 | | | 29,157 | | | 183,803 | | | 201,593 | |

| Print textbook depreciation expense | — | | | — | | | — | | | (1,610) | |

| Share-based compensation expense | 31,906 | | | 35,115 | | | 133,502 | | | 133,456 | |

| Other (income) expense, net | (5,139) | | | 4,218 | | | (121,810) | | | (101,029) | |

| Acquisition-related compensation costs | 204 | | | 3,438 | | | 6,290 | | | 14,427 | |

Content and related assets charge(1) | — | | | — | | | 7,647 | | | — | |

| Restructuring charges | — | | | — | | | 5,704 | | | — | |

| Loss contingency | — | | | — | | | 7,000 | | | — | |

| Transitional logistics charges | — | | | 266 | | | 253 | | | 2,463 | |

| Impairment of lease related assets | — | | | 1,814 | | | — | | | 5,225 | |

| Adjusted EBITDA | $ | 66,170 | | | $ | 74,008 | | | $ | 222,389 | | | $ | 254,525 | |

(1) The total content and related assets charge during the year ended December 31, 2023 is $41.8 million consisting of $34.2 million of accelerated depreciation included within other depreciation and amortization expense and $7.6 million of the remaining associated charges included within content and related assets charge.

CHEGG, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in thousands, except percentages and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cost of revenues | $ | 45,804 | | | $ | 51,424 | | | $ | 225,941 | | | $ | 197,396 | |

| Content and related assets charge | — | | | — | | | (38,242) | | | — | |

| Amortization of intangible assets | (3,111) | | | (3,290) | | | (12,970) | | | (14,402) | |

| Share-based compensation expense | (571) | | | (539) | | | (2,256) | | | (2,484) | |

| Acquisition-related compensation costs | (4) | | | (6) | | | (21) | | | (35) | |

| Restructuring charges | — | | | — | | | (12) | | | — | |

| Transitional logistics charges | — | | | (266) | | | (253) | | | (2,463) | |

| Non-GAAP cost of revenues | $ | 42,118 | | | $ | 47,323 | | | $ | 172,187 | | | $ | 178,012 | |

| | | | | | | |

| Gross profit | $ | 142,183 | | | $ | 153,769 | | | $ | 490,354 | | | $ | 569,501 | |

| Content and related assets charge | — | | | — | | | 38,242 | | | — | |

| Amortization of intangible assets | 3,111 | | | 3,290 | | | 12,970 | | | 14,402 | |

| Share-based compensation expense | 571 | | | 539 | | | 2,256 | | | 2,484 | |

| Acquisition-related compensation costs | 4 | | | 6 | | | 21 | | | 35 | |

| Restructuring charges | — | | | — | | | 12 | | | — | |

| Transitional logistics charges | — | | | 266 | | | 253 | | | 2,463 | |

| Non-GAAP gross profit | $ | 145,869 | | | $ | 157,870 | | | $ | 544,108 | | | $ | 588,885 | |

| | | | | | | |

| Gross margin % | 76 | % | | 75 | % | | 68 | % | | 74 | % |

| Non-GAAP gross margin % | 78 | % | | 77 | % | | 76 | % | | 77 | % |

| | | | | | | |

| Operating expenses | $ | 128,896 | | | $ | 146,096 | | | $ | 558,079 | | | $ | 560,544 | |

| Share-based compensation expense | (31,335) | | | (34,576) | | | (131,246) | | | (130,972) | |

| Amortization of intangible assets | (2,594) | | | (2,839) | | | (11,417) | | | (11,470) | |

| Acquisition-related compensation costs | (200) | | | (3,432) | | | (6,269) | | | (14,392) | |

| Content and related assets charge | — | | | — | | | (3,600) | | | — | |

| Restructuring charges | — | | | — | | | (5,692) | | | — | |

| Loss contingency | — | | | — | | | (7,000) | | | — | |

| Impairment of lease related assets | — | | | (1,814) | | | — | | | (5,225) | |

| Non-GAAP operating expenses | $ | 94,767 | | | $ | 103,435 | | | $ | 392,855 | | | $ | 398,485 | |

| | | | | | | |

| Income (loss) from operations | $ | 13,287 | | | $ | 7,673 | | | $ | (67,725) | | | $ | 8,957 | |

| Share-based compensation expense | 31,906 | | | 35,115 | | | 133,502 | | | 133,456 | |

| Amortization of intangible assets | 5,705 | | | 6,129 | | | 24,387 | | | 25,872 | |

| Acquisition-related compensation costs | 204 | | | 3,438 | | | 6,290 | | | 14,427 | |

| Content and related assets charge | — | | | — | | | 41,842 | | | — | |

| Transitional logistics charges | — | | | 266 | | | 253 | | | 2,463 | |

| Restructuring charges | — | | | — | | | 5,704 | | | — | |

| Loss contingency | — | | | — | | | 7,000 | | | — | |

| Impairment of lease related assets | — | | | 1,814 | | | — | | | 5,225 | |

| Non-GAAP income from operations | $ | 51,102 | | | $ | 54,435 | | | $ | 151,253 | | | $ | 190,400 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 9,665 | | | $ | 1,858 | | | $ | 18,180 | | | $ | 266,638 | |

| Share-based compensation expense | 31,906 | | | 35,115 | | | 133,502 | | | 133,456 | |

| Amortization of intangible assets | 5,705 | | | 6,129 | | | 24,387 | | | 25,872 | |

| Acquisition-related compensation costs | 204 | | | 3,438 | | | 6,290 | | | 14,427 | |

| Amortization of debt issuance costs | 546 | | | 1,082 | | | 3,156 | | | 5,166 | |

| Income tax effect of non-GAAP adjustments | (5,368) | | | — | | | (12,633) | | | — | |

| Gain on early extinguishment of debt | — | | | — | | | (85,926) | | | (93,519) | |

| Content and related assets charge | — | | | — | | | 41,842 | | | — | |

| Restructuring charges | — | | | — | | | 5,704 | | | — | |

| Loss contingency | — | | | — | | | 7,000 | | | — | |

| Transitional logistics charges | — | | | 266 | | | 253 | | | 2,463 | |

| Realized loss on sale of investments | — | | | 9,057 | | | — | | | 9,057 | |

| Tax benefit related to release of valuation allowance | — | | | — | | | — | | | (174,601) | |

| Impairment of lease related assets | — | | | 1,814 | | | — | | | 5,225 | |

| Non-GAAP net income | $ | 42,658 | | | $ | 58,759 | | | $ | 141,755 | | | $ | 194,184 | |

| | | | | | | |

Weighted average shares used to compute net income (loss) per share, diluted | 118,902 | | | 127,518 | | | 128,569 | | | 149,859 | |

| Effect of shares for stock plan activity | — | | | — | | | 514 | | | — | |

| Effect of shares related to convertible senior notes | — | | | 18,226 | | | — | | | — | |

| Non-GAAP weighted average shares used to compute non-GAAP net income per share, diluted | 118,902 | | | 145,744 | | | 129,083 | | | 149,859 | |

| | | | | | | |

Net income (loss) per share, diluted | $ | 0.09 | | | $ | 0.01 | | | $ | (0.34) | | | $ | 1.34 | |

| Adjustments | 0.27 | | | 0.39 | | | 1.44 | | | (0.04) | |

| Non-GAAP net income per share, diluted | $ | 0.36 | | | $ | 0.40 | | | $ | 1.10 | | | $ | 1.30 | |

CHEGG, INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Years Ended December 31, |

| 2023 | | 2022 |

| Net cash provided by operating activities | $ | 246,198 | | | $ | 255,736 | |

| Purchases of property and equipment | (83,052) | | | (103,092) | |

| Purchases of textbooks | — | | | (3,815) | |

| Proceeds from disposition of textbooks | 9,787 | | | 6,003 | |

| Free cash flow | $ | 172,933 | | | $ | 154,832 | |

CHEGG, INC.

SELECTED QUARTERLY FINANCIAL DATA

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31,

2023 | | June 30,

2023 | | September 30, 2023 | | December 31, 2023 |

| Subscription Services | $ | 168,440 | | | $ | 165,855 | | | $ | 139,912 | | | $ | 166,313 | |

| Skills and Other | 19,161 | | | 16,998 | | | 17,942 | | | 21,674 | |

| Total net revenues | $ | 187,601 | | | $ | 182,853 | | | $ | 157,854 | | | $ | 187,987 | |

| | | | | | | |

| Gross profit | 138,451 | | | 135,441 | | | 74,279 | | | 142,183 | |

| (Loss) income from operations | (4,446) | | | (18,696) | | | (57,870) | | | 13,287 | |

| Net income (loss) | 2,186 | | | 24,612 | | | (18,283) | | | 9,665 | |

Weighted average shares used to compute net income (loss) per share: | | | | | | | |

| Basic | 123,710 | | | 117,977 | | | 115,407 | | | 109,093 | |

| Diluted | 124,304 | | | 132,944 | | | 115,407 | | | 118,902 | |

Net income (loss) per share: | | | | | | | |

| Basic | $ | 0.02 | | | $ | 0.21 | | | $ | (0.16) | | | $ | 0.09 | |

| Diluted | $ | 0.02 | | | $ | (0.11) | | | $ | (0.16) | | | $ | 0.09 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| March 31,

2022 | | June 30,

2022 | | September 30, 2022 | | December 31, 2022 |

| Subscription Services | $ | 173,037 | | | $ | 175,424 | | | $ | 146,001 | | | $ | 177,506 | |

| Skills and Other | 29,207 | | | 19,297 | | | 18,738 | | | 27,687 | |

| Total net revenues | $ | 202,244 | | | $ | 194,721 | | | $ | 164,739 | | | $ | 205,193 | |

| | | | | | | |

| Gross profit | 147,159 | | | 149,037 | | | 119,536 | | | 153,769 | |

| Income (loss) from operations | 5,376 | | | 7,343 | | | (11,435) | | | 7,673 | |

| Net income | 5,742 | | | 7,476 | | | 251,562 | | | 1,858 | |

Weighted average shares used to compute net income per share: | | | | | | | |

| Basic | 132,162 | | | 126,272 | | | 126,132 | | | 125,750 | |

| Diluted | 133,270 | | | 149,574 | | | 148,045 | | | 127,518 | |

Net income per share: | | | | | | | |

| Basic | $ | 0.04 | | | $ | 0.06 | | | $ | 1.99 | | | $ | 0.01 | |

| Diluted | $ | 0.04 | | | $ | 0.06 | | | $ | 1.23 | | | $ | 0.01 | |

CHEGG, INC.

RECONCILIATION OF FORWARD-LOOKING NET LOSS TO EBITDA AND ADJUSTED EBITDA

(in thousands)

(unaudited)

| | | | | | | | |

| | Three Months Ending March 31, 2024 | | |

| Net loss | | $ | (6,100) | | | |

| Interest expense, net | | 500 | | | |

| Provision for income taxes | | 6,400 | | | |

| Other depreciation and amortization expense | | 20,100 | | | |

| EBITDA | | 20,900 | | | |

| Share-based compensation expense | | 30,000 | | | |

Other income, net | | (7,100) | | | |

| Acquisition-related compensation costs | | 200 | | | |

| Adjusted EBITDA* | | $ | 44,000 | | | |

* Adjusted EBITDA guidance for the three months ending March 31, 2024 represents the midpoint of the range of $43 million to $45 million.

Chegg Appoints David Longo as Chief Financial Officer

February 5, 2024 -- SANTA CLARA, Calif.--(BUSINESS WIRE)-- Chegg, Inc. (NYSE: CHGG), the leading student-first connected learning platform, today announced the appointment of David Longo as Chief Financial Officer, effective February 21.

Mr. Longo currently serves as Vice President, Chief Accounting Officer, Corporate Controller, and Assistant Treasurer at Chegg. He will succeed Andrew Brown, who announced his retirement in the fall of last year, after more than 12 years at Chegg.

“David is the perfect candidate to take on the CFO role and I couldn’t be more confident in his ability to drive growth and shareholder value,” said Dan Rosensweig, CEO and President of Chegg. “David’s dynamic and forward-thinking leadership has already played a key role in advancing Chegg’s mission of harnessing AI to improve student outcomes.” Rosensweig added, “I also want to thank Andy Brown for his innumerable contributions to Chegg over the past 12 years. Andy played a key role in transforming Chegg into the leading student-first connected learning platform. We are deeply grateful for his financial stewardship over the years and wish him all the best in his retirement.”

Prior to joining Chegg in December 2021, Mr. Longo served as Chief Accounting Officer for Shutterfly, Inc., a digital retailer and manufacturer of personalized products and services. Before that, he was Senior Vice President and Controller at CBS Interactive, an online content network for information and entertainment and a division of CBS Inc.

David Longo said: “I have seen first-hand how Chegg is leading the charge in utilizing AI to support and enhance student outcomes. I couldn’t be more excited by this opportunity to work closely with such a visionary team at such a pivotal time in the education sector. I look forward driving value not just for Chegg’s shareholders, but also for the millions of students that it serves.”

Mr. Longo holds a B.S. in Business Administration, with a concentration in accounting, from Boston University. He is a licensed CPA.

About Chegg

Millions of people all around the world learn with Chegg. No matter your goal, level or style, Chegg helps you learn with confidence. We provide 24/7 on-demand support and our personalized learning assistant leverages the power of artificial intelligence (AI), more than a hundred million pieces of proprietary content, as well as, a decade of learning insights. Our platform also helps learners build essential life and job skills to accelerate their path from learning to earning, and we work with companies to offer learning programs for their employees. Chegg is a publicly held company and trades on the NYSE under the symbol CHGG. For more information, visit www.chegg.com.

v3.24.0.1

Cover Page

|

Feb. 02, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 02, 2024

|

| Entity Registrant Name |

Chegg, Inc

|

| Entity File Number |

001-36180

|

| Entity Tax Identification Number |

20-3237489

|

| Entity Address, Address Line One |

3990 Freedom Circle

|

| Entity Address, City or Town |

Santa Clara,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95054

|

| City Area Code |

408

|

| Local Phone Number |

855-5700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, $0.001 par value per share

|

| Trading Symbol |

CHGG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001364954

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |