false

0001273441

0001273441

2024-02-01

2024-02-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): February 1, 2024

GRAN TIERRA ENERGY INC.

(Exact Name of Registrant as Specified in

its Charter)

| Delaware |

|

001-34018 |

|

98-0479924 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

500

Centre Street S.E.

Calgary,

Alberta, Canada

T2G 1A6

(Address of Principal Executive Offices)

(Zip Code)

(403) 265-3221

(Registrant’s Telephone Number, Including

Area Code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

GTE |

NYSE American

Toronto Stock Exchange

London Stock Exchange

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

The disclosures set forth in Item 8.01 are incorporated

by reference into this Item 2.02.

Gran Tierra Energy Inc., a Delaware corporation

(“Gran Tierra” or the “Company”) is hereby presenting information regarding its oil and natural

gas reserves at December 31, 2023 and certain operational updates regarding the fourth quarter and the year ended December 31,

2023.

Reserves Information

Gran Tierra’s 2023 reserves were independently

prepared by McDaniel & Associates Consultants Ltd. (“McDaniel”).

See “Glossary” for definitions of

industry terms and abbreviations. All dollar amounts are presented in U.S. dollars.

The following table sets forth Gran Tierra’s

estimated reserves NAR as of December 31, 2023.

| | |

Oil | | |

Natural Gas | | |

Oil and Natural Gas | |

Reserves

Category | |

(Mbbl) | | |

(MMcf) | | |

(MBOE) | |

| Proved | |

| | | |

| | | |

| | |

| Total proved developed reserves | |

| 39,599 | | |

| — | | |

| 39,599 | |

| Total proved undeveloped reserves | |

| 34,697 | | |

| — | | |

| 34,697 | |

| Total proved reserves | |

| 74,296 | | |

| — | | |

| 74,296 | |

| | |

| | | |

| | | |

| | |

| Probable | |

| | | |

| | | |

| | |

| Total probable developed reserves | |

| 12,139 | | |

| — | | |

| 12,139 | |

| Total probable undeveloped reserves | |

| 34,109 | | |

| — | | |

| 34,109 | |

| Total probable reserves | |

| 46,248 | | |

| — | | |

| 46,248 | |

| | |

| | | |

| | | |

| | |

| Possible | |

| | | |

| | | |

| | |

| Total possible developed reserves | |

| 11,362 | | |

| — | | |

| 11,362 | |

| Total possible undeveloped reserves | |

| 37,144 | | |

| — | | |

| 37,144 | |

| Total possible reserves | |

| 48,506 | | |

| — | | |

| 48,506 | |

The product prices that were used to determine

the future gross revenue for each property reflect adjustments to the benchmark prices for gravity, quality, local conditions and/or distance

from market. The average realized prices for reserves in the report are:

| Oil (USD/bbl) – Colombia | |

$ | 69.91 | |

| Oil (USD/bbl) – Ecuador | |

$ | 77.44 | |

Operations Update

The following table sets forth select estimated

operational data for Gran Tierra for the year ended December 31, 2023.

| | |

Year Ended December 31, | |

| | |

2023 | | |

% Change | | |

2022 | | |

% Change | | |

2021 | |

| SEC Compliant Reserves, NAR (MMBOE) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Estimated proved oil and gas reserves | |

| 74 | | |

| 12 | | |

| 66 | | |

| (1 | ) | |

| 67 | |

| Estimated probable oil and gas reserves | |

| 46 | | |

| 28 | | |

| 36 | | |

| — | | |

| 36 | |

| Estimated possible oil and gas reserves | |

| 49 | | |

| 26 | | |

| 39 | | |

| 26 | | |

| 31 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Average Consolidated Daily Volumes (BOPD) | |

| | | |

| | | |

| | | |

| | | |

| | |

| Working interest production before royalties | |

| 32,647 | | |

| 6 | | |

| 30,746 | | |

| 16 | | |

| 26,507 | |

| Royalties | |

| (6,548 | ) | |

| (6 | ) | |

| (6,931 | ) | |

| 41 | | |

| (4,919 | ) |

| Production NAR | |

| 26,099 | | |

| 10 | | |

| 23,815 | | |

| 10 | | |

| 21,588 | |

| (Increase) decrease in inventory | |

| (152 | ) | |

| (28 | ) | |

| (119 | ) | |

| (1,290 | ) | |

| 10 | |

| Sales(1) | |

| 25,947 | | |

| 9 | | |

| 23,696 | | |

| 10 | | |

| 21,598 | |

| (1) | Sales volumes represent production NAR adjusted for inventory changes. |

The net present value (“NPV”)

discounted at 10% (“NPV10”) after tax of Gran Tierra’s estimated proved oil and gas reserves is as follows:

| (US$ thousands) | |

Colombia | | |

Ecuador | | |

Total Company | |

| December 31, 2023 | |

| | | |

| | | |

| | |

| Net present value after tax | |

$ | 1,843,425 | | |

$ | 64,987 | | |

$ | 1,908,412 | |

| 10% discount | |

| (516,451 | ) | |

| (22,924 | ) | |

| (539,375 | ) |

| Net present value at 10% discount after tax | |

$ | 1,326,974 | | |

$ | 42,063 | | |

$ | 1,369,037 | |

Gran Tierra provides the following additional

financial and production information as part of this update:

| · | Gran Tierra achieved total company average production of approximately 31,309 BOPD for the fourth quarter of 2023, and approximately

32,647 BOPD for the year ended December 31, 2023, an increase of 6% from 2022 and 23% from 2021. |

| | | |

| · | Estimated capital expenditures, including and excluding acquired properties, for the year ended December 31, 2023 were approximately

$218.9 million. |

| | | |

| · | Estimated

net debt(*) at December 31, 2023 was approximately US$510.8 million,

comprised of senior notes outstanding of $536.6 million (gross) plus $36.4 million (gross)

of borrowings outstanding under the Company’s credit facility less cash and cash equivalents

of $62.2 million. |

| | | |

| · | Oil sales for the fourth quarter of 2023 is estimated to be $154.9 million, or $54.04 per bbl, per WI sales volume. |

| | | |

| · | Operating netback(*) for the fourth quarter of 2023 is estimated to be $103.4 million, or $36.05 per bbl, per working interest production before royalties (“WI”) sales volume. |

| | | |

| · | During 2023, the Company repurchased 2,370,454 shares of common stock, or approximately 7.1% of its outstanding shares. |

| | | |

| · | Revenue for the year ended December 31, 2023 is estimated to be $637.0 million. |

| | | |

| · | Operating expenses for the year ended December 31, 2023 is estimated to be $186.9 million. |

| | | |

| · | Transportation expenses for the year ended December 31, 2023 is estimated to be $14.6 million. |

| | | |

| · | Operating netback(*)

for the year ended December 31, 2023 is estimated to be $435.5 million. |

| | | |

| · | Adjusted EBITDA(*)

for the year ended December 31, 2023 is estimated to be between $390 million

to $410 million. |

| | | |

| (*) | Each of net debt, Operating netback and Adjusted EBITDA is a non-GAAP measure which does not have any

standardized meaning prescribed under generally accepted accounting principles in the United States of America (“GAAP”).

Refer to “Non-GAAP Measures” for a description of these non-GAAP measures. |

Non-GAAP Measures

This Current Report on Form 8-K includes

non-GAAP measures which do not have a standardized meaning under GAAP. Investors are cautioned that these measures should not be construed

as alternatives to oil sales, net income or loss or other measures of financial performance as determined in accordance with GAAP. Gran

Tierra’s method of calculating these measures may differ from other companies and, accordingly, they may not be comparable to similar

measures used by other companies.

Net debt as presented is defined as Gran Tierra’s senior notes and borrowings under Gran Tierra’s credit facility, less cash

and cash equivalents.

Operating netback as presented is defined as oil

sales less operating and transportation expenses. Management believes that operating netback is a useful supplemental measure for investors

to analyze financial performance and provide an indication of the results generated by Gran Tierra’s principal business activities

prior to the consideration of other income and expenses. A reconciliation of operating netback per boe to the most directly comparable

measure calculated and presented in accordance with GAAP is as follows:

| | |

Three months ended December 31, 2023 | | |

Year Ended December 31, 2023 | |

| | |

(Thousands of U.S. dollars) | | |

($/bbl, per NAR sales volume) | | |

($/bbl, per WI sales volume) | | |

(Thousands of U.S. dollars) | | |

($/bbl, per NAR sales volume) | | |

($/bbl, per WI sales volume) | |

| Oil sales | |

$ | 154,944 | | |

$ | 67.51 | | |

$ | 54.04 | | |

$ | 636,957 | | |

$ | 62.26 | | |

$ | 53.70 | |

| Operating expenses | |

| (47,637 | ) | |

| (20.75 | ) | |

| (16.61 | ) | |

| (186,864 | ) | |

| (19.73 | ) | |

| (15.75 | ) |

| Transportation expenses | |

| (3,947 | ) | |

| (1.72 | ) | |

| (1.38 | ) | |

| (14,546 | ) | |

| (1.54 | ) | |

| (1.23 | ) |

| Operating netback | |

$ | 103,360 | | |

$ | 45.04 | | |

$ | 36.05 | | |

$ | 435,547 | | |

$ | 45.99 | | |

$ | 36.72 | |

Adjusted EBITDA is defined

as EBITDA (defined as net income or loss adjusted for depletion, depreciation and accretion expenses, interest expense and income

tax expense or recovery) adjusted for inventory impairment, non-cash lease expense, lease payments, foreign exchange gain or loss,

stock-based compensation expense, unrealized derivative instruments gain or loss, other non-cash gain or loss, and other financial

instruments gain or loss. Management uses this supplemental measure to analyze performance and income generated by our principal

business activities prior to the consideration of how non-cash items affect that income, and believes that this financial measure is

useful supplemental information for investors to analyze our performance and our financial results. A reconciliation from net income

to Adjusted EBITDA is not available due to certain components of net income, including taxes and gain on debt securities, not being

reasonably estimable at this time.

Cautionary Statement - Unaudited Financial Information

The following results reflect the Company’s

preliminary expectations of results for the year ended December 31, 2023, based on currently available information. The preliminary financial

and operational results included in this report reflect management’s estimates based solely upon information available to the Company

as of the date of this report and are the responsibility of management. The preliminary consolidated financial results presented above

are not a comprehensive statement of the Company’s financial results for the year ended December 31, 2023 and have not been audited,

reviewed or compiled by the Company’s independent registered public accounting firm. The preliminary results presented above are

subject to the completion of the Company’s financial closing procedures, which have not yet been completed. The Company’s

actual results for the year ended December 31, 2023 will not be available until completion of the Company’s audited financial statements

for the year ended December 31, 2023 and may differ materially from these estimates. Estimates are subject to risks and uncertainties,

many of which are not within the Company’s control. See “Cautionary Statement Regarding Forward-looking Statements.”

Gran Tierra anticipates filing its audited financial statements and related management’s discussion and analysis for the year ended

December 31, 2023 on or before February 20, 2024.

| Item 9.01. | Financial Statements and Exhibits. |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K contains

opinions, forecasts, projections, plans, and other statements about future events or results that constitute forward-looking statements

within the meaning of the United States Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and financial outlook and forward looking information

within the meaning of applicable Canadian securities laws (collectively, “forward-looking statements”), which can be identified

by such terms as “expect,” “plan,” “can,” “will,” “should,” “guidance,”

“estimate,” “forecast,” “signal,” “progress,” “anticipate,” and “believes,”

derivations thereof and similar terms identify forward-looking statements.

The forward-looking statements contained in this

Current Report on Form 8-K reflect several material factors and expectations and assumptions of Gran Tierra including, without limitation,

that Gran Tierra will continue to conduct its operations in a manner consistent with its current expectations, the accuracy of testing

and production results and seismic data, pricing and cost estimates (including with respect to commodity pricing and exchange rates),

rig availability, the effects of drilling down-dip, the effects of waterflood and multi-stage fracture stimulation operations, the extent

and effect of delivery disruptions, and the general continuance of current or, where applicable, assumed operational, regulatory and industry

conditions including in Colombia and Ecuador and areas of potential expansion, and the ability of Gran Tierra to execute its current business

and operational plans in the manner currently planned. Gran Tierra believes the material factors, expectations and assumptions reflected

in the forward-looking statements are reasonable at this time but no assurance can be given that these factors, expectations and assumptions

will prove to be correct.

Among the important factors that could cause actual

results to differ materially from those indicated by the forward-looking statements in this Current Report on Form 8-K are: Gran

Tierra’s operations are located in South America and unexpected problems can arise due to guerilla activity, strikes, local blockades

or protests; technical difficulties and operational difficulties may arise which impact the production, transport or sale of Gran Tierra’s

products; other disruptions to local operations; global and regional changes in the demand, supply, prices, differentials or other market

conditions affecting oil and gas, including inflation and changes resulting from a global health crisis, geopolitical events, including

the ongoing conflicts in Ukraine and the Gaza region, or from the imposition or lifting of crude oil production quotas or other actions

that might be imposed by OPEC and other producing countries and resulting company or third-party actions in response to such changes;

changes in commodity prices, including volatility or a prolonged decline in these prices relative to historical or future expected levels;

the risk that current global economic and credit conditions may impact oil prices and oil consumption more than Gran Tierra currently

predicts, which could cause Gran Tierra to further modify its strategy and capital spending program; prices and markets for oil and natural

gas are unpredictable and volatile; the effect of hedges, the accuracy of productive capacity of any particular field; geographic, political

and weather conditions can impact the production, transport or sale of Gran Tierra’s products; the ability of Gran Tierra to execute

its business plan and realize expected benefits from current initiatives; the risk that unexpected delays and difficulties in developing

currently owned properties may occur; the ability to replace reserves and production and develop and manage reserves on an economically

viable basis; the accuracy of testing and production results and seismic data, pricing and cost estimates (including with respect to commodity

pricing and exchange rates); the risk profile of planned exploration activities; the effects of drilling down-dip; the effects of waterflood

and multi-stage fracture stimulation operations; the extent and effect of delivery disruptions, equipment performance and costs; actions

by third parties; the timely receipt of regulatory or other required approvals for Gran Tierra’s operating activities; the failure

of exploratory drilling to result in commercial wells; unexpected delays due to the limited availability of drilling equipment and personnel;

volatility or declines in the trading price of Gran Tierra’s common stock or bonds; the risk that Gran Tierra does not receive the

anticipated benefits of government programs, including government tax refunds; Gran Tierra’s ability to comply with financial covenants

in its credit agreement and indentures and make borrowings under its credit agreement; and the risk factors detailed from time to time

in Gran Tierra’s periodic reports filed with the Securities and Exchange Commission (the “SEC”), including, without

limitation, under the caption “Risk Factors” in Gran Tierra’s Annual Report on Form 10-K for the year ended December 31,

2022 filed on February 21, 2023 and its subsequent quarterly reports on Form 10-Q and other filings with the SEC. These filings

are available on the SEC’s website at www.sec.gov and on the System for Electronic Data Analysis and Retrieval (“SEDAR”)

at www.sedarplus.ca. Statements relating to “reserves” are also deemed to be forward-looking statements, as they involve

the implied assessment, based on certain estimates and assumptions, including that the reserves described can be profitably produced in

the future. Should any one of a number of issues arise, Gran Tierra may find it necessary to alter its business strategy and/or capital

spending program and there can be no assurance as at the date of this Current Report on Form 8-K as to how those funds may be reallocated

or strategy changed and how that would impact Gran Tierra’s results of operations and financing position.

All forward-looking statements are made as of

the date of this Current Report on Form 8-K and the fact that this Current Report on Form 8-K remains available does not constitute

a representation by Gran Tierra that Gran Tierra believes these forward-looking statements continue to be true as of any subsequent date.

Actual results may vary materially from the expected results expressed in forward-looking statements. Gran Tierra disclaims any intention

or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as expressly required by applicable law. Gran Tierra’s forward-looking statements are expressly qualified in their entirety

by this cautionary statement.

DISCLOSURE OF OIL AND GAS INFORMATION

Boe’s have been converted on the basis of

six thousand cubic feet (“Mcf”) of natural gas to 1 bbl of oil. Boe’s may be misleading, particularly if used in

isolation. A boe conversion ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion method primarily applicable

at the burner tip and does not represent a value equivalency at the wellhead. In addition, given that the value ratio based on the current

price of oil as compared with natural gas is significantly different from the energy equivalent of six to one, utilizing a boe conversion

ratio of 6 Mcf: 1 bbl would be misleading as an indication of value.

All reserves values and ancillary information

contained in this Current Report on Form 8-K have been prepared by McDaniel and are derived from the GTE McDaniel Reserves Report,

unless otherwise expressly stated. Any reserves values or related information contained in this Current Report on Form 8-K as of

a date other than December 31, 2023 has an effective date of December 31 of the applicable year. Estimates of net present value

contained herein do not necessarily represent fair market value. Estimates of reserves for individual properties may not reflect the same

level of confidence as estimates of reserves for all properties, due to the effect of aggregation. There is no assurance that the forecast

price and cost assumptions applied by McDaniel in evaluating Gran Tierra’s reserves will be attained and variances could be material.

All reserves assigned in the GTE McDaniel Reserves Report are located in Colombia and Ecuador and presented on a consolidated basis by

foreign geographic area. There are numerous uncertainties inherent in estimating quantities of crude oil reserves. The reserve information

set forth in the GTE McDaniel Reserves Report are estimates only, and there is no guarantee that the estimated reserves will be recovered.

Actual reserves may be greater than or less than the estimates provided therein.

The Company believes that the presentation of

NPV10 is useful to investors because it presents (i) relative monetary significance of its oil and natural gas properties regardless

of tax structure and (ii) relative size and value of its reserves to other companies. The Company also uses this measure when assessing

the potential return on investment related to its oil and natural gas properties. NPV10 does not purport to present the fair value of

the Company’s oil and gas reserves. The Company has not provided a reconciliation of NPV10 to the standardized measure of discounted

future net cash flows because it is impracticable to do so.

Investors are urged to consider closely the disclosures

and risk factors in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and in the other reports and filings

with the SEC, available from the Company’s offices or website. These reports can also be obtained from the SEC website at www.sec.gov.

Glossary of Oil and Gas Terms:

In this document, the abbreviations set forth

below have the following meanings:

| bbl |

barrel |

Mcf |

thousand cubic feet |

| Mbbl |

thousand barrels |

MMcf |

million cubic feet |

| MMbbl |

million barrels |

Bcf |

billion cubic feet |

| BOE |

barrels of oil equivalent |

bopd |

barrels of oil per day |

| MMBOE |

million barrels of oil equivalent |

NGL |

natural gas liquids |

| BOEPD |

barrels of oil equivalent per day |

NAR |

net after royalty |

NAR sales volumes represent production NAR adjusted

for inventory changes and losses. Our oil and gas reserves are reported NAR. Our production is also reported NAR, except as otherwise

specifically noted as “working interest production before royalties.” NGL volumes are converted to BOE on a one-to-one basis

with oil. Gas volumes are converted to BOE at the rate of 6 Mcf of gas per bbl of oil, based upon the approximate relative energy content

of gas and oil. The rate is not necessarily indicative of the relationship between oil and gas prices. BOEs may be misleading, particularly

if used in isolation. A BOE conversion ratio of 6 Mcf:1 bbl is based on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the wellhead.

Below are explanations of some commonly used terms

in the oil and gas business and in this report.

| · | Field. An area consisting of a single reservoir or multiple reservoirs all grouped on or related to the same individual

geological structural feature and/or stratigraphic condition. |

| | | |

| · | Possible reserves. Possible reserves are those additional reserves that are less certain to be recovered than probable

reserves. The SEC provides a complete definition of possible reserves in Rule 4-10(a)(17) of Regulation S-X. |

| · | Probable reserves. Probable reserves are those additional reserves that are less certain to be recovered than proved

reserves but that, together with proved reserves, are as likely as not to be recovered. The SEC provides a complete definition of probable

reserves in Rule 4-10(a)(18) of Regulation S-X. |

| | | |

| · | Proved developed reserves. In general, reserves that can be expected to be recovered from existing wells with existing

equipment and operating methods. The SEC provides a complete definition of developed oil and gas reserves in Rule 4-10(a)(6) of Regulation S-X. |

| | | |

| · | Proved reserves. Those quantities of oil and natural gas, which, by analysis of geoscience and engineering data,

can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs and under existing

economic conditions, operating methods and government regulations prior to the time at which contracts providing the right to operate

expire, unless evidence indicates that renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are

used for the estimation. The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it

will commence the project within a reasonable time. |

| (i) | The area of the reservoir considered as proved includes: |

| (A) | The area identified by drilling and limited by fluid contacts, if any, and |

| (B) | Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be continuous

with it and to contain economically producible oil or gas on the basis of available geoscience and engineering data. |

| (ii) | In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest known

hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or performance data and reliable technology establishes

a lower contact with reasonable certainty. |

| (iii) | Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and the

potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally higher portions of the reservoir only

if geoscience, engineering, or performance data and reliable technology establish the higher contact with reasonable certainty. |

| (iv) | Reserves which can be produced economically through application of improved recovery techniques (including,

but not limited to, fluid injection) are included in the proved classification when: |

| (A) | Successful testing by a pilot project in an area of the reservoir with properties no more favorable than

in the reservoir as a whole, the operation of an installed program in the reservoir or an analogous reservoir, or other evidence using

reliable technology establishes the reasonable certainty of the engineering analysis on which the project or program was based; and |

| (B) | The project has been approved for development by all necessary parties and entities, including governmental

entities. |

| (v) | Existing economic conditions include prices and costs at which economic producibility from a reservoir

is to be determined. The price shall be the average price during the 12-month period prior to the ending date of the period covered by

the report, determined as an unweighted arithmetic average of the first-day-of-the-month price for each month within such period, unless

prices are defined by contractual arrangements, excluding escalations based upon future conditions. |

| · | Proved undeveloped reserves. In general, reserves that are expected to be recovered from new wells on undrilled

acreage or from existing wells where a relatively major expenditure is required for recompletion. The SEC provides a complete definition

of undeveloped oil and gas reserves in Rule 4-10(a)(31) of Regulation S-X. |

| | | |

| · | Reserves. Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be economically

producible, as of a given date, by application of development projects to known accumulations. In addition, there must exist, or there

must be a reasonable expectation that there will exist, the legal right to produce or a revenue interest in the production, installed

means of delivering oil and gas or related substances to market, and all permits and financing required to implement the project. |

| | | |

| · | Working interest. The operating interest that gives the owner the right to drill, produce and conduct operating

activities on the property and a share of production and requires the owner to pay a share of the costs of drilling and production operations. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Date: February 1, 2024 |

GRAN TIERRA ENERGY INC. |

| |

By: |

/s/ Gary S. Guidry |

| |

|

Name: Gary S. Guidry |

| |

|

Title: President and Chief Executive Officer |

Exhibit 23.1

Consent

of Independent Reserve Engineers

Mr. Ryan Ellson

Chief Financial Officer

Gran Tierra Energy Inc. (“Gran Tierra”)

500 Centre Street S.E.,

Calgary, Alberta, Canada T2G 1A6

| Re: | Gran Tierra Registration Statement: |

Form S-8 (Reg. Nos. 333-146815, 333-156994, 333-171122

and 333-183029)

Form S-3 (Reg. No. 333-258433)

Filed with the United States Securities Exchange Commission

Dear Mr. Ellson:

As the independent

reserve engineers for Gran Tierra, McDaniel & Associates Consultants Ltd. (“McDaniel”)

hereby confirms that it has granted and not withdrawn its consent to the filing of McDaniel reserve

report and to the reference to McDaniel’s evaluation of Gran Tierra’s reserves

as of December 31, 2023, in the form and context disclosed by Gran Tierra in its Current Report on Form 8-K submission filed

with the U.S. Securities and Exchange Commission on February 1, 2024, and to the incorporation by reference thereof in the registration

statements listed above.

Please do not hesitate to contact

us if you have any questions.

McDaniel & Associates

Consultants Ltd.

| /s/

Cam Boulton |

|

| Cam Boulton |

|

| Executive Vice President |

|

Dated: February 1, 2024

Calgary, Alberta

CANADA

Exhibit 99.1

THIRD PARTY REPORT ON RESERVES

By

McDaniel & Associates Consultants Ltd. (“McDaniel”) - (Independent Qualified Reserves Evaluator)

This

report is provided to satisfy the requirements contained in Item 1202(a)(8) of Regulation S-K (“Regulation S-K”)

of the U.S. Securities and Exchange Commission (the “SEC”) with respect to Gran Tierra Energy Inc.’s

(“Gran Tierra”) oil and gas reserves as of December 31, 2023, and to provide the qualifications of the technical person

primarily responsible for overseeing the reserve estimation process.

The numbering of items below corresponds to the

requirements set out in Item 1202(a)(8) of Regulation S-K. Terms to which a meaning is ascribed in Regulation S-K

and Regulation S-X have the same meaning in this report.

| i. | We have prepared an independent estimate

of the oil and gas reserves of Gran Tierra for the management and the board of directors

of Gran Tierra. The primary purpose of our evaluation report was to provide estimates of

reserves information in support of Gran Tierra’s year-end reserves reporting requirements

under Regulation S-K and for other internal business and financial needs of Gran Tierra. |

| ii. | We estimated the reserves of Gran Tierra

as at December 31, 2023. The completion date of our report is January 23, 2024. |

| iii. | McDaniel evaluated 100% of the reserves

of Gran Tierra. |

The following table sets forth the

net after royalty reserves of Gran Tierra:

| Category | |

Crude Oil

Mbbl | | |

Natural Gas

MMcf | | |

Oil Equivalent

MBOE (1) | | |

Portion of Reserves

Evaluated, % | |

| Proved | |

| | | |

| | | |

| | | |

| | |

| Developed | |

| | | |

| | | |

| | | |

| | |

| Colombia | |

| 38,942 | | |

| 0 | | |

| 38,942 | | |

| 100 | |

| Ecuador | |

| 657 | | |

| — | | |

| 657 | | |

| 100 | |

| Undeveloped | |

| | | |

| | | |

| | | |

| | |

| Colombia | |

| 30,725 | | |

| — | | |

| 30,725 | | |

| 100 | |

| Ecuador | |

| 3,972 | | |

| — | | |

| 3,972 | | |

| 100 | |

| Total Proved | |

| 74,296 | | |

| 0 | | |

| 74,296 | | |

| 100 | |

| | |

| | | |

| | | |

| | | |

| | |

| Probable | |

| | | |

| | | |

| | | |

| | |

| Developed | |

| | | |

| | | |

| | | |

| | |

| Colombia | |

| 12,000 | | |

| 0 | | |

| 12,000 | | |

| 100 | |

| Ecuador | |

| 138 | | |

| — | | |

| 138 | | |

| 100 | |

| Undeveloped | |

| | | |

| | | |

| | | |

| | |

| Colombia | |

| 28,243 | | |

| 0 | | |

| 28,243 | | |

| 100 | |

| Ecuador | |

| 5,866 | | |

| — | | |

| 5,866 | | |

| 100 | |

| Total Probable | |

| 46,247 | | |

| 0 | | |

| 46,247 | | |

| 100 | |

| | |

| | | |

| | | |

| | | |

| | |

| Possible | |

| | | |

| | | |

| | | |

| | |

| Developed | |

| | | |

| | | |

| | | |

| | |

| Colombia | |

| 11,211 | | |

| 0 | | |

| 11,211 | | |

| 100 | |

| Ecuador | |

| 151 | | |

| — | | |

| 151 | | |

| 100 | |

| Undeveloped | |

| | | |

| | | |

| | | |

| | |

| Colombia | |

| 30,292 | | |

| 0 | | |

| 30,292 | | |

| 100 | |

| Ecuador | |

| 6,852 | | |

| — | | |

| 6,852 | | |

| 100 | |

| Total Possible | |

| 48,506 | | |

| 0 | | |

| 48,506 | | |

| 100 | |

| (1) | Oil

equivalence factors: Crude Oil 1 bbl/bbl, Natural Gas 6 Mcf/bbl. |

| iv. | As noted in item iii., our

evaluation covered 100% of the reserves of Gran Tierra. The assumptions, methods, and procedures

followed in the evaluation reflect the standards set out in the Canadian Oil and Gas Evaluation

Handbook (the “COGE Handbook”) modified as necessary to conform to the standards

under the U.S. Financial Accounting Standards Board policies (the “FASB Standards”)

and the U.S. Securities and Exchange Commission Regulations (“SEC requirements”). |

Data used in our evaluation of Gran

Tierra’s reserves was obtained from regulatory agencies, public sources, and Gran Tierra personnel and Gran Tierra files. In the

preparation of our report, we have accepted as presented, and have relied, without independent verification, upon a variety of information

furnished by Gran Tierra such as interests and burdens on properties, recent production volumes, product transportation, and marketing

and sales agreements, historical revenue, capital costs, operating expense data, budget forecasts and capital cost estimates and well

data for recently drilled wells. If in the course of our evaluation, the validity or sufficiency of any material information was brought

into question; we did not rely on such information until such concerns were resolved to our satisfaction.

Gran Tierra warranted in a representation

letter to us that, to the best of its knowledge and belief, all data furnished to us was accurate in all material respects, and no material

data relevant to our evaluation was omitted.

A field examination of the evaluated

properties was not performed, nor was it considered necessary for our report.

In our opinion, estimates provided

in our report have, in all material respects, been determined in accordance with the applicable industry standards, and results provided

in our report and summarized herein are appropriate for inclusion in filings under Regulation S-K.

| v. | As required under Regulation S-X,

reserves are those quantities of oil and gas that are estimated to be economically producible

under existing economic conditions. The primary economic assumptions relate to pricing, capital

and operating costs, recoverable volumes and production forecasts. |

As specified, in determining economic

production, constant product benchmark prices are to be based on a 12-month average price, calculated as the unweighted arithmetic average

of the first-day-of-the-month price for each month within the 12-month period prior to the effective date of our report unless prices

are defined by contractual or other regulatory arrangements. The relevant benchmark price for Gran Tierra’s reserves is Brent Blend

Crude Oil FOB North Sea at $82.51 USD/bbl.

The product prices that were used to

determine the future gross revenue for each property reflect adjustments to the benchmark prices for gravity, quality, local conditions,

and/or distance from market, referred to herein as “differentials.” The differentials used in the preparation of this report

estimated from received price information provided by Gran Tierra.

The average realized prices for Gran

Tierra’s reserves in the report are:

| Oil (USD/bbl) – Colombia | |

$ | 69.91 | |

| Oil (USD/bbl) – Ecuador | |

$ | 77.44 | |

In our economic analysis, operating

and capital costs are those costs estimated as applicable at the effective date of our report, with no future escalation. Where deemed

appropriate, the capital costs and revised operating costs associated with the implementation of committed projects designed to modify

specific field operations in the future may be included in economic projections. Capital costs used in this report were provided by Gran

Tierra and actual costs from recent activity. Capital costs are included as required for workovers, new development wells, and production

equipment. Based on our understanding of future development plans, a review of the records provided to us, and our knowledge of similar

properties, we regard these estimated capital costs to be reasonable. Abandonment costs were assigned to the abandonment of wells assigned

reserves, including future wells.

Reserves were assigned by volumetric,

material balance, decline analysis or analogy where considered appropriate. In many cases, where sufficient data were available, a combination

of the methods were applied.

Test data and other related information

were used to estimate the anticipated initial production rates for those wells or analogous locations. For reserves not yet on production,

forecast sales were estimated to commence at an anticipated date furnished by Gran Tierra. Wells or locations that are not currently

producing may start producing earlier or later than anticipated in our estimates due to unforeseen factors causing a change in the timing

to initiate production. Such factors may include delays due to weather, the availability of rigs, the sequence of drilling, completing

and/or recompleting wells and/or constraints set by regulatory bodies.

The future production rates from wells

currently on production or wells or locations that are not currently producing may be more or less than estimated because of changes

including, but not limited to, reservoir performance, operating conditions related to surface facilities, compression and artificial

lift, pipeline capacity and/or operating conditions, producing market demand and/or allowables or other constraints set by regulatory

bodies.

| vi. | Our report has been prepared assuming

the continuation of existing regulatory and fiscal conditions subject to the guidance in

the COGE Handbook and SEC regulations. Notwithstanding that Gran Tierra currently has regulatory

approval to produce the reserves identified in our report, there is no assurance that changes

in regulation will not occur; such changes, which cannot reliably be predicted, could impact

Gran Tierra’s ability to recover the estimated reserves. |

| vii. | Oil and gas reserves estimates have an

inherent degree of associated uncertainty the extent of which is affected by many factors.

Reserves estimates will vary due to the limited and imprecise nature of data upon which the

estimates of reserves are predicated. Moreover, the methods and data used in estimating reserves

are often necessarily indirect or analogical in character rather than direct or deductive.

Furthermore, the persons involved in the preparation of reserves estimates and associated

information are required, in applying geosciences, petroleum engineering and evaluation principles,

to make numerous unbiased judgments based upon their educational background, professional

training, and professional experience. The extent and significance of the judgments to be

made are, in themselves, sufficient to render reserves estimates inherently imprecise. Reserves

estimates may change substantially as additional data becomes available and as economic conditions

impacting oil and gas prices and costs change. Reserves estimates will also change over time

due to other factors such as knowledge and technology, fiscal and economic conditions, contractual,

statutory and regulatory provisions. |

| viii. | In our opinion, the reserves information

evaluated by us have, in all material respects, been determined in accordance with all appropriate

data, assumptions, methods and procedures applicable for the filing of reserves information

under Regulation S-K. All methods and procedures we considered necessary under the circumstances

to prepare the report were used. |

| ix. | A summary of Gran Tierra’s reserves

evaluated by us is provided in item iii. |

McDaniel is a private firm established in 1955

whose business is the provision of independent geological and engineering services to the petroleum industry. McDaniel is among the largest

evaluation firms in North America with over 60 professional and technical support personnel. Mr. Boulton coordinated the evaluation

and is a qualified, independent reserves evaluator as defined in COGE Handbook, and a registered Practicing Professional Engineer

in the Province of Alberta. Mr. Boulton has over 10 years of experience in the evaluation of oil and gas reserves and resources

and has been employed at McDaniel as an evaluator/auditor since 2006.

McDaniel & Associates Consultants Ltd.

2000, Eighth Avenue Place, East Tower,

525 – 8 Avenue SW,

Calgary, Alberta, Canada T2P 1G1

Dated: February 1, 2024

| /s/ Cam Boulton |

|

| Cam Boulton |

|

| Executive Vice President |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

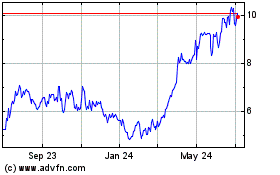

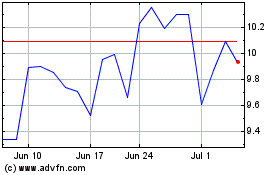

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gran Tierra Energy (AMEX:GTE)

Historical Stock Chart

From Apr 2023 to Apr 2024