0001122904false00011229042024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 26, 2024

NETGEAR, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

000-50350 |

|

77-0419172 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

|

|

|

350 East Plumeria Drive |

San Jose, |

CA |

95134 |

(Address, including zip code, of principal executive offices) |

|

|

(408) |

907-8000 |

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

|

Title of each class |

|

Trading symbol(s): |

|

Name of each exchange on which registered |

Common Stock, $0.001 par value |

|

NTGR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

Emerging growth company |

☐ |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 31, 2024, NETGEAR, Inc. (the “Company”) issued a press release reporting its preliminary financial results for its fourth fiscal quarter ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished pursuant to this Item 2.02 and Exhibit 99.1 to this Current Report are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that Section. The information furnished pursuant to this Item 2.02 and Exhibit 99.1 to this Current Report shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Retirement of Chief Executive Officer and Director

On January 26, 2024, Patrick Lo, the Company’s Chairman of the Board of Directors (the “Board”) and Chief Executive Officer, notified the Company of his intent to retire as Chief Executive Officer and Chairman of the Board, effective as of Charles (CJ) Prober’s commencement of employment as the Company’s Chief Executive Officer.

Executive Succession and Advisory Services Agreement with Mr. Lo

On January 30, 2024, the Board approved an Executive Succession and Advisory Services Agreement (the “Succession and Advisory Agreement”) with Mr. Lo, to retain his assistance in commercial efforts that may assist management and the Board in the successful transition of responsibilities to the Company’s next Chief Executive Officer. Pursuant to the Succession and Advisory Agreement, Mr. Lo will continue to serve as the Company’s Chief Executive Officer until the first day of employment of a new Chief Executive Officer of the Company (the “Initial Transition Date”). Following that date and until July 31, 2024 (the “Transition Period”), Mr. Lo will serve as a consultant to the Company and shall perform advisory services to the Company as requested by the Board’s Lead Independent Director or the Board’s Chairman. For his services during the Transition Period, (i) Mr. Lo will receive consulting fees of $102,916.67 per month, (ii) Mr. Lo’s unvested time-based RSUs shall accelerate and be fully vested as of the Initial Transition Date, (iii) Mr. Lo’s COBRA premiums shall be reimbursed for up to twelve months following the Initial Transition Date, and (iv) at the conclusion of the Transition Period, Mr. Lo will be paid a cash bonus of $800,000. Additionally, Mr. Lo’s deferred compensation plan balance shall be paid out in accordance with the terms of the Company’s Deferred Compensation Plan dated May 1, 2013 and his prior election, if any, with respect thereto, Mr. Lo’s base salary shall be paid out for the period January 1, 2024 through the Initial Transition Date at the rate of $950,000 per annum, and Mr. Lo will be reimbursed for reasonable attorney’s fees incurred in the negotiation of this Agreement and all related agreements described herein, not to exceed $25,000, in the aggregate. Such payments are conditioned upon the execution and non-revocation of a release of claims as set forth in the Succession and Advisory Agreement.

The foregoing description of the Succession and Advisory Agreement is a summary and is qualified in its entirety by reference to the complete text of such agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

Appointment of Chief Executive Officer and Director

On January 30, 2024, the Board appointed Charles (CJ) Prober the Company’s Chief Executive Officer, and as a member of the Board, effective as of his January 31, 2024 commencement of employment with the Company (the “Start Date”). Mr. Prober was not named, and as of the date hereof is not expected to be named, to any Board committees. On January 31, 2024, the Company issued a press release announcing the appointment of Mr. Prober as its Chief Executive Officer and his appointment to the Board. The full text of the press release is attached hereto as Exhibit 99.2.

Prior to joining the Company, Mr. Prober, age 52, served as President of Life360, Inc. (ASX: LIFX) ("Life360") from January 2022 to July 2023. CJ joined Life360 via the acquisition of Tile, Inc. ("Tile") in January 2022 and served as the Chief Executive Officer of Tile from September 2018 to January 2022. Mr. Prober also previously served as a member of Tile’s board of directors from February 2018 to January 2022, including as its Executive Chairman from February 2018 to September 2018. Prior thereto, he served as the Chief Operating Officer of GoPro, Inc. (NASDAQ: GPRO) from January 2017 to February 2018 and its Senior Vice President of Software and Services from June 2014 to December 2016. Prior thereto, Mr. Prober held executive leadership roles at Electronic Arts Inc. (NASDAQ: EA), and prior to his executive leadership roles, Mr. Prober was a consultant with McKinsey & Company and a corporate attorney with Wilson Sonsini Goodrich & Rosati. Mr. Prober currently serves on the boards of directors of Life360 and Glorious Gaming. Mr. Prober received his Bachelor of Commerce from the University of Manitoba and a Bachelor of Laws from McGill University.

There is no arrangement or understanding between Mr. Prober and any other person pursuant to which he was selected as an officer of the Company, and there are no family relationships between Mr. Prober and any of the Company’s directors or executive officers. Mr. Prober is not a party to any transaction with the Company other than as described in this report or contemplated in the Offer Letter (as defined below) or Change in Control and Severance Agreement (as defined below).

Offer Letter with Mr. Prober

The Company entered into an Offer Letter agreement with Mr. Prober dated January 30, 2024 (the “Offer Letter”). Capitalized terms below in this description are defined in the Offer Letter. Under the terms of the Offer Letter, Mr. Prober is entitled to an initial annual base salary of $750,000 and is eligible to receive a target annual cash bonus equal to 120% of his base salary earned during the year, based on achieving performance objectives established by the Board or its Compensation Committee, as applicable; provided that for 2024, Mr. Prober’s target annual cash bonus will be pro-rated based on the number of days he is employed with the Company during such fiscal year, and the amount of his bonus for such fiscal year will be no less than such target amount. Mr. Prober will also be eligible to participate in the benefit plans and programs established by the Company for its similarly-situated executives from time to time, subject to their applicable terms and conditions, including without limitation any eligibility requirements. Mr. Prober’s employment with the Company is subject to at-will termination by either the Company or Mr. Prober.

The Company will also grant to Mr. Prober the following three restricted stock unit awards (each, an “Equity Award”) under a Company equity incentive plan: (1) an award of time-based restricted stock units (“RSUs”) covering shares of the Company’s common stock (“Shares”) with an initial value of $4.0 million (the “2024 Annual Award”); (2) an award of performance-based RSUs covering a target number of Shares with an initial value of $6.5 million (the “Sign-On PSU Award”); and (3) an award of time-based RSUs covering Shares with an initial value of $2.5 million (the “Sign-On RSU Award”). The actual number of Shares covered by each Equity Award will be determined using the trailing twenty (20) trading-day average closing price as of the day prior to Mr. Prober’s Start Date. Each Equity Award will be subject to the terms and conditions of a plan and an award agreement between Mr. Prober and the Company (an “Award Agreement”). Except as otherwise provided in the Severance Agreement (as defined below), the Equity Awards will vest as follows:

1) The 2024 Annual Award and the Sign-On RSU Award each will vest in equal annual installments over four years (with the first installment vesting on January 31, 2025), in each case subject to Mr. Prober’s continued service with the Company through the vesting date; and

2) The Sign-On PSU Award will be divided into three equal tranches that each vest based on performance during a period of approximately one year, as follows: (i) the first tranche will vest based on performance from the Start Date through December 31, 2024, (ii) the second tranche will vest based on performance during calendar year 2025, and (iii) the third tranche will vest based on performance during calendar year 2026. For each tranche, the number of Sign-On PSUs that become eligible to vest (“Earned PSUs”) will be based on how the total shareholder return (“TSR”) of the Company during the performance period compares to the TSRs of the companies in the Nasdaq Telecommunications Index (IXTC), as described in the Offer Letter.

The total number of Earned PSUs will be subject to a “true-up” if the cumulative 3-year relative TSR of the Company from the Start Date through December 31, 2026 is higher than the relative TSR as of the end of either of the first two performance periods.

Additionally, Mr. Prober will be reimbursed for reasonable attorney’s fees incurred in the negotiation of this Agreement and all related agreements described herein, not to exceed $25,000, in the aggregate.

The foregoing description of the Offer Letter is a summary and is qualified in its entirety by reference to the complete text of such agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

Change in Control and Severance Agreement with Mr. Prober

The Company also entered into a Change in Control and Severance Agreement (the “Severance Agreement”) with Mr. Prober dated January 30, 2024. Capitalized terms below in this description are defined in the Severance Agreement.

The Severance Agreement provides, among other things, for severance payments to Mr. Prober under certain conditions as follows:

In the event of a termination of Mr. Prober’s employment either (i) by the Company without Cause (excluding by reason of Mr. Prober’s death or Disability) or (ii) by Mr. Prober for Good Reason, in either case (x) during the period beginning three (3) months prior to a Change in Control and ending twelve (12) months following a Change in Control (the “Change in Control Period”) (a “Qualifying CIC Termination”) or (y) outside the Change in Control Period (a “Qualifying Non-CIC Termination”), Mr. Prober shall be entitled to severance benefits. For a Qualifying Non-CIC Termination, those severance benefits consist of: (1) A single, lump sum payment equal to twelve (12) months of Mr. Prober’s annual base salary, less applicable withholdings, (2) A single, lump sum payment equal to 100% of Mr. Prober’s target annual bonus as in effect for the fiscal year in which the Qualifying Non-CIC Termination occurs, less applicable withholdings, (3) Up to twelve (12) months of health benefits continuation, and (4) Accelerated vesting of then-unvested equity awards (other than the Sign-On PSU Award (as defined above)) that would have vested had Mr. Prober remained employed with the Company for eighteen (18) months following the date of the Qualifying Non-CIC Termination. For a Qualifying CIC Termination, those severance benefits consist of: (1) A single, lump sum payment equal to twenty-four (24) months of Mr. Prober’s annual base salary, less applicable withholdings, (2) A single, lump sum payment equal to 200% of Mr. Prober’s target annual bonus as in effect for the fiscal year in which the Qualifying CIC Termination occurs (or as in effect immediately prior to the Change in Control, if greater), less applicable withholdings, (3) Up to twenty-four (24) months of health benefits continuation, and (4) Accelerated vesting of 100% of the then-unvested shares subject to each of Mr. Prober’s then outstanding Company time-based equity awards, and (A) unless otherwise specified in the applicable equity award agreement governing any applicable award, each of Mr. Prober’s then outstanding Company equity awards with performance-based vesting based on the achievement of operating or financial goals will immediately vest, with all performance goals and other vesting criteria deemed achieved at the greater of (x) actual achievement or (y) 100% of target levels, and (B) all performance goals and other vesting criteria for the Sign-On PSU Award will be deemed achieved based on actual performance (with any performance periods that have not otherwise ended as of the date of a Qualifying Pre CIC Termination shortened to end on a date on or prior to the date of the Change in Control, but no more than ten (10) business days prior to the closing of the Change in Control, and performance for such shortened performance periods measured based on the price payable for a share of the Company’s common stock in connection with the Change in Control, and any Sign-On PSUs that become eligible to vest based on such performance will immediately vest.

If Mr. Prober’s employment with the Company is terminated due to his death or by the Company due to his Disability, then all of his then‑outstanding equity awards will immediately vest. In the case of an equity award with performance-based vesting, unless a more favorable term is specified in the applicable equity award agreement governing such award, all performance goals and other vesting criteria will be deemed achieved (A) in the case of an award that vests based on the achievement of financial operating or performance goals, at 100% of target levels, or (B) in the case of an award that vests based on the price of the Company’s shares of common stock or the total shareholder return of the Company, at actual achievement.

Severance is conditioned upon the execution and non-revocation of a release of claims and, in the case of a Qualifying Termination, Mr. Prober’s (1) resignation from all officer and director positions with the Company and its subsidiaries, (2) return of all Company documents and other property, and (3) continued compliance with any confidential information agreement between himself and the Company. The Severance Agreement does not provide for any excise tax gross-ups. If the merger-related payments or benefits are subject to the 20% excise tax under Section 4999 of the tax code, then Mr. Prober will either receive all such payments and benefits subject to the excise tax or such payments and benefits will be reduced so that the excise tax does not apply, whichever approach yields the best after-tax outcome.

The foregoing description of Severance Agreement is a summary and is qualified in its entirety by reference to the complete text of such agreement, a copy of which will be filed as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Dated: January 31, 2024 |

NETGEAR, INC. |

|

By: |

/s/ Bryan D. Murray |

|

Name: |

Bryan D. Murray |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

News Release

NETGEAR® PROVIDES PRELIMINARY FOURTH QUARTER FINANCIAL

RESULTS

SAN JOSE, Calif. – January 31, 2024 – NETGEAR, Inc., (NASDAQ: NTGR), today reported certain preliminary financial results for its fourth fiscal quarter ended December 31, 2023. NETGEAR will announce full results for the fourth quarter on February 7, 2024.

NETGEAR currently expects net revenue for the fourth quarter of 2023 to be between $179 million and $189 million, compared to prior guidance of $175 million to $190 million for the fourth quarter of 2023. The Company continued to experience strong underlying demand in the premium portion of its CHP product portfolio, riding on the success of its Orbi WiFi 7 launch which continued through the holiday season. The Company is also encouraged that its retail channel partners maintained their inventory positions as expected. The Company continued to work with its SMB channel partners to optimize their inventory carrying levels. The uncertain macro environment created by high interest rates, geopolitical tensions, and stagnant GDP growth in certain markets continued to weigh on the Company’s SMB business as expected.

GAAP operating margin for the fourth quarter of 2023 is expected to be between (3.0)% and (1.5)%, compared to prior guidance of (4.4)% to (1.4)%. Non-GAAP operating margin for the fourth quarter of 2023 is expected to be between 0% and 1.5%, compared to prior guidance of (2.0)% to 1.0%. The increased mix of the Company’s premium products within its CHP business, coupled with SMB revenues, which carry higher margins, remaining in line with Q3 performance, positively impacted the Company’s operating margin performance relative to its expectations last October. Additionally, the GAAP tax expense is expected to be in the range of $1 million to $2 million, which is in line with the prior guidance, and the non-GAAP tax expense is expected to be in the range of $1.5 million to $2.5 million, compared to prior guidance of $0 to $1 million for the fourth quarter of 2023.

A reconciliation between each of NETGEAR’s operating margin rate and NETGEAR's tax expense, on a GAAP and non-GAAP basis is provided in the following table:

|

|

|

|

|

|

|

Three months ending |

|

|

December 31, 2023 |

(in millions, except for percentage data) |

|

Operating Margin

Rate |

|

Tax Expense (Benefit) |

|

|

|

|

|

GAAP |

|

(3.0)% - (1.5)% |

|

$1.0 - $2.0 |

Estimated adjustments for1: |

|

|

|

|

Stock-based compensation expense |

|

2.3% |

|

- |

Restructuring and other charges |

|

0.7% |

|

- |

Non-GAAP tax adjustments |

|

- |

|

$0.5 |

Non-GAAP |

|

0.0% - 1.5% |

|

$1.5-$2.5 |

1 Operating margin rate does not include estimates for any currently unknown income and expense items which, by their nature, could arise late in a quarter, including: litigation reserves, net; acquisition-related charges; impairment charges; restructuring and other charges. New material income and expense items such as these could have a significant effect on our guidance and future GAAP results.

NETGEAR will release its full financial results for the fourth quarter and full year 2023 after the close of trading on February 7, 2024. Management will host a conference call on February 7, 2024 at 5 p.m. ET (2 p.m. PT) to review the results.

Page 1

About NETGEAR, Inc.

For more than 25 years, NETGEAR® (NASDAQ: NTGR) has been the innovative leader in connecting the world to the internet with advanced networking technologies for homes, businesses and service providers around the world. As staying connected has become more important than ever, NETGEAR delivers award-winning network solutions for remote work, distance learning, ultra high def streaming, online game play and more. To enable people to collaborate and connect to a world of information and entertainment, NETGEAR is dedicated to providing a range of connected solutions. From ultra-premium Orbi Mesh WiFi systems and high performance Nighthawk routers, to high-speed cable modems and 5G mobile wireless products to cloud-based subscription services for network management and security, to smart networking products and Video over Ethernet for Pro AV applications, NETGEAR keeps you connected. NETGEAR is headquartered in San Jose, California. Learn more on the NETGEAR Investor Page or by calling (408) 907-8000. Connect with NETGEAR: Twitter, Facebook, Instagram, LinkedIn and the NETGEAR blog at NETGEAR.com.

Source: NETGEAR – F

© 2024 NETGEAR, Inc. NETGEAR and the NETGEAR logo are trademarks or registered trademarks of NETGEAR, Inc. and its affiliates in the United States and/or other countries. Other brand and product names are trademarks or registered trademarks of their respective holders. The information contained herein is subject to change without notice. NETGEAR shall not be liable for technical or editorial errors or omissions contained herein. All rights reserved.

Contact:

NETGEAR Investor Relations

Erik Bylin

investors@netgear.com

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 for NETGEAR, Inc.:

This press release contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The words “anticipate,” “expect,” “believe,” “will,” “may,” “should,” “estimate,” “project,” “outlook,” “forecast” or other similar words are used to identify such forward-looking statements. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements include, but are not limited to, the Company’s estimates of future revenues and earnings. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause the actual results of the Company to be materially different from the historical results and/or from any future results or outcomes expressed or implied by such forward-looking statements. Such factors include, among others, the Company’s completion of its fourth quarter financial close processes, including without limitation its tax expense. Such factors are further addressed in the Company’s Quarterly Report on Form 10-Q for the period ended October 1, 2023 and such other documents as are filed with the Securities and Exchange Commission from time to time (available at www.sec.gov). The Company assumes no obligation, except as required by law, to update any forward-looking statements in order to reflect events or circumstances that may arise after the date of this release.

Non-GAAP Financial Information:

To supplement our unaudited selected financial data presented on a basis consistent with Generally Accepted Accounting Principles (“GAAP”), we disclose certain non-GAAP financial measures that exclude certain charges, including non-GAAP gross profit, non-GAAP gross margin, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, non-GAAP other operating expenses, net, non-GAAP total operating expenses, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP other income (expenses), net, non-GAAP net income (loss) and non-GAAP net income (loss) per diluted share. These supplemental measures exclude adjustments for amortization of intangibles, stock-based compensation expense, goodwill impairment, intangibles impairment, restructuring and other charges, litigation reserves, net, gain/loss on investments, net, gain on litigation settlements, and adjust for effects related to

Page 2

non-GAAP tax adjustments. These non-GAAP measures are not in accordance with or an alternative for GAAP, and may be different from non-GAAP measures used by other companies. We believe that these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate our results of operations in conjunction with the corresponding GAAP measures. The presentation of this additional information is not meant to be considered in isolation or as a substitute for the most directly comparable GAAP measures. We compensate for the limitations of non-GAAP financial measures by relying upon GAAP results to gain a complete picture of our performance.

In calculating non-GAAP financial measures, we exclude certain items to facilitate a review of the comparability of our operating performance on a period-to-period basis because such items are not, in our view, related to our ongoing operational performance. We use non-GAAP measures to evaluate the operating performance of our business, for comparison with forecasts and strategic plans, and for benchmarking performance externally against competitors. In addition, management’s incentive compensation is determined using certain non-GAAP measures. Since we find these measures to be useful, we believe that investors benefit from seeing results “through the eyes” of management in addition to seeing GAAP results. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by offering:

• the ability to make more meaningful period-to-period comparisons of our on-going operating results;

• the ability to better identify trends in our underlying business and perform related trend analyses;

• a better understanding of how management plans and measures our underlying business; and

• an easier way to compare our operating results against analyst financial models and operating results of competitors that supplement their GAAP results with non-GAAP financial measures.

The following are explanations of the adjustments that we incorporate into non-GAAP measures, as well as the reasons for excluding them in the reconciliations of these non-GAAP financial measures:

Amortization of intangibles consists primarily of non-cash charges that can be impacted by, among other things, the timing and magnitude of acquisitions. We consider our operating results without these charges when evaluating our ongoing performance and forecasting our earnings trends, and therefore exclude such charges when presenting non-GAAP financial measures. We believe that the assessment of our operations excluding these costs is relevant to our assessment of internal operations and comparisons to the performance of our competitors.

Stock-based compensation expense consists of non-cash charges for the estimated fair value of stock options, restricted stock units, performance shares and shares under the employee stock purchase plan granted to employees. We believe that the exclusion of these charges provides for more accurate comparisons of our operating results to peer companies due to the varying available valuation methodologies, subjective assumptions and the variety of award types. In addition, we believe it is useful to investors to understand the specific impact stock-based compensation expense has on our operating results.

Other items consist of certain items that are the result of either unique or unplanned events, including, when applicable: goodwill impairment, intangibles impairment, restructuring and other charges, litigation reserves, net, gain on litigation settlements, and gain/loss on investments, net. It is difficult to predict the occurrence or estimate the amount or timing of these items in advance. Although these events are reflected in our GAAP financial statements, these unique transactions may limit the comparability of our on-going operations with prior and future periods. The amounts result from events that often arise from unforeseen circumstances, which often occur outside of the ordinary course of continuing operations. Therefore, the amounts do not accurately reflect the underlying performance of our continuing business operations for the period in which they are incurred.

Non-GAAP tax adjustments consist of adjustments that we incorporate into non-GAAP measures in order to provide a more meaningful measure on non-GAAP net income (loss). We believe providing financial information with and without the income tax effects relating to our non-GAAP financial measures, as well as adjustments for valuation allowances on deferred tax assets, provides our management and users of the financial statements with better clarity regarding both current period performance and the on-going performance of our business. Non-GAAP income tax expense (benefit) is computed on a current and deferred basis with non-GAAP income (loss) consistent with use of non-GAAP income (loss) as a performance measure. The Non-GAAP tax provision (benefit) is calculated by adjusting the GAAP tax provision (benefit) for the impact of the non-GAAP adjustments, with specific tax provisions such as state income tax and Base-erosion and Anti-Abuse Tax recomputed on a non-GAAP basis, as well as adjustments for valuation allowances on deferred tax assets. The tax valuation allowance is a non-cash adjustment primarily reflecting our expectations of, and assumptions as to, future operating results and applicable tax laws, that are not directly attributable to the current quarter’s operating performance. For interim periods, the non-GAAP

Page 3

income tax provision (benefit) is calculated based on the forecasted annual non-GAAP tax rate before discrete items and adjusted for interim discrete items.

Page 4

Exhibit 99.2

NETGEAR Appoints Technology Leader

Charles (CJ) Prober as New CEO

Co-founder, Current CEO and Chairman Patrick C.S. Lo to Retire as Part of Planned Leadership Transition

San Jose, Calif. – January 31, 2024 – NETGEAR®, Inc. (NASDAQ: NTGR), a global networking company that delivers innovative networking and internet connected products to consumers and businesses, today announced that Patrick C. S. Lo, current Chief Executive Officer and Chairman of the board, is retiring from his position at NETGEAR and from the company’s Board. Lo will remain as a strategic advisor to support a seamless leadership transition through July 2024. The Board has appointed Charles (CJ) Prober, a senior technology executive, to succeed him effective immediately. Prober is also joining NETGEAR’s Board of Directors.

“As co-founder of NETGEAR, and leader for nearly three decades, it goes without saying that Patrick Lo’s impact on the company is undeniable. His vision for delivering the future of connectivity through advanced networking products and solutions has shaped who we are as a company, and we celebrate all he has accomplished,” said Thomas H. Waechter, NETGEAR Lead Independent Director. “CJ has the full confidence of the Board. We look forward to working with him and the NETGEAR leadership team to take the company forward for its next phase of innovation.”

“When Mark Merrill and I founded NETGEAR 28 years ago, the internet was beginning to show its impact on the world,” said Lo. “We seized the opportunity, and we’ve been innovating and leading the industry in the creation of advanced networking technologies for homes and businesses around the world ever since. We’ve pushed the boundaries of what can be experienced in a connected world, and I am all for the next chapter of the NETGEAR story.”

Prober to Succeed Lo

The appointment of Prober follows a thorough search process over the last 12 months, conducted by the NETGEAR Board, with the goal of appointing a next-generation leader with extensive consumer electronics, software and subscription experience. Prober has the unanimous support of the Board and meets all the criteria that are critical to NETGEAR’s future success in distinguishing itself as a high-performing leader in the consumer and business networking industry.

Prober is a seasoned and successful business leader who has focused on driving growth, transformation and innovation in his past roles, with decades of expertise in building cutting edge consumer experiences for devices and digital platforms. His experience spans leadership positions at top consumer and technology brands, including roles as President of Life360, CEO at Tile (acquired by Life360), Chief Operating Officer at GoPro, and SVP of Digital Publishing at Electronic Arts (EA). Prior to his operating roles, Prober served as a consultant with McKinsey & Company where he helped to guide some of the world’s leading B2B technology companies.

He currently sits on the Board of Directors of Life360 and Glorious Gaming. Past accomplishments include driving subscription and revenue growth at Life360, Tile and GoPro. Additionally, he was central to EA’s transformation from a packaged software to digital services company that unlocked significant shareholder value over his years at the company. His extensive experience in managing large teams and complex global businesses demonstrates his ability to deliver value to customers, investors, and employees.

“As an innovator and pioneer, NETGEAR is an admired and respected brand by both consumers and businesses at a time when connectivity matters more than ever,” said CJ Prober, NETGEAR CEO. “I have built my career on delivering innovative and industry-leading products and services and am proud to join the NETGEAR team to continue this path and to create value for all stakeholders, continuing the company’s strong focus on innovation in the industry. The path forward is incredibly exciting, and I look forward to partnering with the Board, our partners and NETGEAR’s global employee base.”

About NETGEAR, Inc.

NETGEAR® (NASDAQ: NTGR) has pioneered advanced networking technologies for homes, businesses, and service providers around the world since 1996 and leads the industry with a broad range of award-winning products designed to simplify and improve people's lives. By enabling people to collaborate and connect to a world of information and entertainment, NETGEAR is dedicated to delivering innovative and advanced connected solutions ranging from mobile and cloud-based services for enhanced control and security, to smart networking products, video over Ethernet for Pro AV applications, easy-to-use WiFi solutions and performance gaming routers to enhance online game play. The company is headquartered out of San Jose, Calif. with offices located around the globe. More information is available from the NETGEAR Press Room or by calling (408) 907-8000. Connect with NETGEAR: Twitter, Facebook, Instagram, and the NETGEAR blog at NETGEAR.com.

©2024 NETGEAR, Inc. NETGEAR and the NETGEAR logo are trademarks and/or registered trademarks of NETGEAR, Inc. and/or its affiliates in the United States and/or other countries. Other brand and product names are for identification purposes only and may be trademarks or registered trademarks of their respective holder(s). The information contained herein is subject to change without notice. NETGEAR shall not be liable for technical or editorial errors or omissions contained herein. All rights reserved.

Source: NETGEAR-G

U.S. Media Contact:

Valerie Motis

Valerie.motis@NETGEAR.com

NETGEAR@AccesstheAgency.com

U.S. Sales Inquiries: (408) 907-8000, sales@netgear.com

###

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

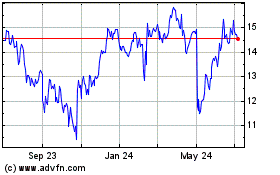

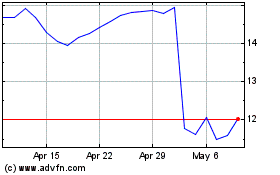

NETGEAR (NASDAQ:NTGR)

Historical Stock Chart

From Apr 2024 to May 2024

NETGEAR (NASDAQ:NTGR)

Historical Stock Chart

From May 2023 to May 2024