As filed with the Securities and Exchange Commission on January 31, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Corbus Pharmaceuticals Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware |

|

46-4348039 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

Corbus Pharmaceuticals Holdings, Inc.

500 River Ridge Drive

Norwood, MA 02062

(617) 963-0100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Yuval Cohen

Chief Executive Officer

Corbus Pharmaceuticals Holdings, Inc.

Norwood, MA 02062

(617) 963-0100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

|

Michael J. Lerner, Esq. Steven M. Skolnick, Esq. Lowenstein Sandler LLP 1251 Avenue of the Americas New York, New York 10020 (212) 262-6700 |

|

|

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☒333-272314

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registration Statement shall become effective upon filing in accordance with Rule 462(b) under the Securities Act of 1933, as amended.

EXPLANATORY NOTE AND INCORPORATION OF

CERTAIN INFORMATION BY REFERENCE

Pursuant to Rule 462(b) under the Securities Act of 1933, as amended, Corbus Pharmaceuticals Holdings, Inc. (the “Registrant”) is filing this Registration Statement on Form S-3 (this “Registration Statement”) with the Securities and Exchange Commission (the “Commission”). This Registration Statement relates to the public offering of securities contemplated by the Registration Statement on Form S-3 (File No. 333-272314) (the “Prior Registration Statement”), which the Registrant filed with the Commission on June 1, 2023, and which the Commission declared effective on June 13, 2023.

The Registrant is filing this Registration Statement for the sole purpose of increasing the aggregate amount of securities offered by the Registrant by a proposed aggregate offering price of $15,752,564. The additional securities that are being registered for issuance and sale are in an amount and at a price that together represent no more than 20% of the maximum aggregate offering price of unsold securities under the Prior Registration Statement. The information set forth in the Prior Registration Statement and all exhibits to the Prior Registration Statement are hereby incorporated by reference into this Registration Statement.

The required opinion and consents are listed on the Exhibit Index below and filed herewith or incorporated by reference herein.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 16. Exhibits.

|

|

|

|

|

|

(a) |

|

Exhibits. All exhibits filed with or incorporated by reference in the Registration Statement on Form S-3 (File No. 333-272314) are incorporated by reference into, and shall be deemed a part of, this Registration Statement, and the following additional exhibits are filed herewith, as part of this Registration Statement: |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Norwood, Commonwealth of Massachusetts, on January 31, 2024.

|

|

|

|

|

|

CORBUS PHARMACEUTICALS HOLDINGS, INC. |

|

|

By: |

|

/s/ Yuval Cohen |

|

|

Yuval Cohen, Ph.D. |

|

|

Chief Executive Officer (Principal Executive Officer) |

|

|

|

|

|

|

|

|

|

|

Signature |

|

Title |

|

Date |

/s/ Yuval Cohen |

|

Chief Executive Officer and Director |

|

January 31, 2024 |

Yuval Cohen Ph.D. |

|

(Principal Executive Officer) |

|

|

|

|

|

/s/ Sean Moran |

|

Chief Financial Officer |

|

January 31, 2024 |

Sean Moran |

|

(Principal Financial Officer) |

|

|

|

|

|

* |

|

Chairperson of the Board |

|

January 31, 2024 |

Alan Holmer |

|

|

|

|

|

|

|

* |

|

Director |

|

January 31, 2024 |

Anne Altmeyer |

|

|

|

|

|

|

|

* |

|

Director |

|

January 31, 2024 |

Avery W. Catlin |

|

|

|

|

|

|

|

* |

|

Director |

|

January 31, 2024 |

John Jenkins |

|

|

|

|

|

|

|

* |

|

Director |

|

January 31, 2024 |

Rachelle Jacques |

|

|

|

|

|

|

|

* |

|

Director |

|

January 31, 2024 |

Peter Salzmann |

|

|

|

|

|

|

|

* |

|

Director |

|

January 31, 2024 |

Yong Ben |

|

|

|

|

|

|

|

|

|

|

*By: |

|

/s/ Yuval Cohen |

|

|

Yuval Cohen |

|

|

Attorney-in-fact |

Exhibit 5.1

January 31, 2024

Corbus Pharmaceuticals Holdings, Inc.

100 River Ridge Drive, Suite 103

Norwood, MA 02062

Re: Shelf Registration Statement on Form S-3

Ladies and Gentlemen:

This opinion is being furnished to you in connection with the Registration Statement on Form S-3 (the “Registration Statement”), including the prospectus that is part of the Registration Statement (the “Prospectus”), filed by Corbus Pharmaceuticals Holdings, Inc., a Delaware corporation (the “Company”), with the Securities and Exchange Commission (the “Commission”) on the date hereof pursuant to Rule 462(b) under the Securities Act of 1933, as amended (the “Securities Act”).

The Prospectus provides that it will be supplemented in the future by one or more prospectus supplements (each, a “Prospectus Supplement”). The Prospectus, as supplemented by the various Prospectus Supplements, will provide for the issuance and sale by the Company from time to time of up to $15,752,564 aggregate offering price of (i) shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), (ii) shares of the Company’s preferred stock, par value $0.0001 per share (the “Preferred Stock”), in one or more series or classes, (iii) warrants to purchase shares of Common Stock or Preferred Stock (the “Warrants”), (iv) secured or unsecured debt securities, in one or more series, which may be either senior debt securities, senior subordinated debt securities, subordinated debt securities or junior subordinated securities (the “Debt Securities”) to be issued pursuant to an Indenture between the Company and a trustee or bank to be named (the “Trustee”), which may be supplemented for any series of Debt Securities (the “Indenture”), or (v) units composed of any of the foregoing (the “Units”). The Common Stock, Preferred Stock, Warrants, Debt Securities and Units are collectively referred to herein as the “Securities.” The Warrants may be issued pursuant to a warrant agreement (the “Warrant Agreement”) between the Company and a bank or trust company as warrant agent. Any Preferred Stock may be exchangeable for and/or convertible into shares of Common Stock or another series of Preferred Stock. Any Debt Securities may be exchangeable and/or convertible into shares of Common Stock or Preferred Stock. The Units may be issued pursuant to a Unit Agreement (the “Unit Agreement”) between the Company and a bank or trust company as unit agent. The Securities are being registered for offering and sale from time to time pursuant to Rule 415 under the Securities Act.

In rendering our opinions set forth below, we have reviewed the Registration Statement and the exhibits thereto. We have also reviewed such corporate documents and records of the Company, such certificates of public officials and officers of the Company and such other matters as we have deemed necessary or appropriate for purposes of this opinion. In our examination, we have assumed: (i) the authenticity of original documents and the genuineness of all signatures; (ii) the conformity to the originals of all documents submitted to us as copies; (iii) the truth, accuracy and completeness of the information, representations and warranties contained in the instruments, documents, certificates and records we have reviewed; and (iv) the legal capacity for all purposes relevant hereto of all natural persons and, with respect to all parties to agreements or instruments relevant hereto other than the Company, that such parties had the requisite power and authority (corporate or otherwise) to execute, deliver and perform such agreements or instruments, that such agreements or instruments have been duly authorized by all requisite action (corporate or otherwise), executed and delivered by such parties and that such agreements or instruments are the valid, binding and enforceable obligations of such parties. As to any facts material to the opinions expressed herein that were not independently established or verified, we have relied upon oral or written statements and representations of officers and other representatives of the Company.

Based on the foregoing, and subject to the assumptions, limitations and qualifications set forth herein, we are of the opinion that:

1. With respect to shares of Common Stock, when (a) the issuance and the terms of the sale of the shares of Common Stock have been duly authorized by the Board of Directors of the Company in conformity with the Company's certificate of incorporation and bylaws; (b) such shares have been issued and delivered against payment of the purchase price therefor in an amount in excess of the par value thereof, in accordance with the applicable definitive purchase, underwriting or similar agreement, and as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement; and (c) to the extent such shares of Common Stock are to be issued upon the conversion, exchange or exercise of any Preferred Stock, Warrants or Debt Securities, when such shares have been duly issued and delivered as contemplated by the terms of the applicable Preferred Stock, the Warrant Agreement relating to

such Warrants or the Indenture relating to such Debt Securities, respectively, the shares of Common Stock will be validly issued, fully paid and nonassessable.

2. With respect to any particular series of shares of Preferred Stock, when (a) the issuance and the terms of the sale of the shares of Preferred Stock have been duly authorized by the Board of Directors of the Company in conformity with the Company's certificate of incorporation and bylaws; (b) an appropriate certificate of designation relating to a series of the Preferred Stock to be sold under the Registration Statement has been duly authorized and adopted and filed with the Secretary of State of Delaware; (c) the terms of issuance and sale of shares of such series of Preferred Stock have been duly established in conformity with the Company's certificate of incorporation and bylaws so as not to violate any applicable law or result in a default under or breach of any agreement or instrument binding upon the Company and comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Company or any of its property; (d) such shares have been issued and delivered against payment of the purchase price therefor in an amount in excess of the par value thereof, in accordance with the applicable definitive purchase, underwriting or similar agreement, and as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement; and (e) to the extent such shares of Preferred Stock are to be issued upon the conversion, exchange or exercise of any Preferred Stock, Warrants or Debt Securities, when such shares have been duly issued and delivered as contemplated by the terms of the applicable Preferred Stock, the Warrant Agreement relating to such Warrants or Indenture relating to such Debt Securities, respectively, the shares of Preferred Stock will be validly issued, fully paid and nonassessable.

3. With respect to Warrants, when (a) the issuance and the terms of the sale of the Warrants have been duly authorized by the Board of Directors of the Company; (b) the terms of the Warrants and of their issuance and sale have been duly established so as not to violate any applicable law or result in a default under or breach of any agreement or instrument binding upon the Company and comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Company or any of its property; (c) the Warrants and the applicable Warrant Agreement relating to the Warrants, if any, have been duly executed and countersigned and the Warrants have been issued and sold in accordance with the applicable definitive purchase, underwriting or similar agreement, as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement; and (d) the Company has received the applicable consideration for the Warrants as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement(s), the Warrants will constitute valid and binding obligations of the Company.

4. With respect to Debt Securities, when (a) the issuance and the terms of the sale of the Debt Securities have been duly authorized by the Board of Directors of the Company; (b) the terms of the Debt Securities and of their issuance and sale have been duly established so as not to violate any applicable law or result in a default under or breach of any agreement or instrument binding upon the Company and comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Company or any of its property; (c) the Debt Securities and the applicable Indenture relating to the Debt Securities have been duly executed and countersigned and in the case of the Indenture, duly authenticated by the Trustee, and the Debt Securities have been issued and sold as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement; and (d) the Company has received the applicable consideration for the Debt Securities as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement(s), the Debt Securities will constitute valid and binding obligations of the Company.

5. With respect to Units, when (a) the issuance and the terms of the sale of the Units have been duly authorized by the Board of Directors of the Company; (b) the terms of the Units and of their issuance and sale have been duly established so as not to violate any applicable law or result in a default under or breach of any agreement or instrument binding upon the Company and comply with any requirement or restriction imposed by any court or governmental body having jurisdiction over the Company or any of its property; (c) the Unit Agreement and the Units have been duly executed and countersigned and the Units have been issued and sold in accordance with the applicable Unit Agreement, as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement; and (d) the Company has received the applicable consideration for the Units as contemplated by the Registration Statement, the Prospectus and the related Prospectus Supplement(s), the Units will constitute valid and binding obligations of the Company.

In rendering the opinions set forth above, we have assumed that (i) the Registration Statement (and any applicable post-effective amendment thereto) will have become effective under the Securities Act, a Prospectus Supplement will have been prepared and filed with the Commission describing the Securities offered thereby and such Securities will have been issued and sold in accordance with the terms of such Prospectus Supplement and in compliance with all applicable laws; (ii) a definitive purchase, underwriting or similar agreement with respect to such Securities (if applicable) will have been duly authorized, executed and delivered by the Company and the other parties thereto; (iii) the Securities will be duly authorized by all necessary corporate action by the Company and any agreement pursuant to which such Securities may be issued will be duly authorized, executed and delivered by the Company and the other parties thereto; (iv) the Company is and will remain duly organized, validly existing and in good standing under applicable state law; and (v) the Company has reserved a sufficient number of shares of its duly authorized, but unissued, Common Stock and

Preferred Stock as is necessary to provide for the issuance of the shares of Common Stock and Preferred Stock pursuant to the Registration Statement.

The opinions set forth above are subject to the following exceptions, limitations and qualifications: (i) the effect of bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium or other similar laws now or hereafter in effect relating to or affecting the rights and remedies of creditors; (ii) the effect of general principles of equity, including without limitation, concepts of materiality, reasonableness, good faith and fair dealing and the possible unavailability of specific performance or injunctive relief, regardless of whether enforcement is considered in a proceeding in equity or at law, and the discretion of the court before which any proceeding therefor may be brought; and (iii) the unenforceability under certain circumstances under law or court decisions of provisions providing for the indemnification of, or contribution to, a party with respect to liability where such indemnification or contribution is contrary to public policy. We express no opinion concerning the enforceability of any waiver of rights or defenses with respect to stay, extension or usury laws. Our opinion expressed herein is also subject to the qualification that no term or provision shall be included in any certificate of designation relating to any series of the Preferred Stock, Warrant Agreement, Indenture, Unit Agreement or any other agreement or instrument pursuant to which any of the Securities are to be issued that would affect the validity of such opinion.

Our opinion is limited to the federal laws of the United States, the General Corporation Law of the State of Delaware (including reported judicial decisions interpreting the General Corporation Law of the State of Delaware) and the State of New York. We express no opinion as to the effect of the law of any other jurisdiction. Our opinion is rendered as of the date hereof, and we assume no obligation to advise you of changes in law or fact (or the effect thereof on the opinions expressed herein) that hereafter may come to our attention.

We hereby consent to the inclusion of this opinion as Exhibit 5.1 to the Registration Statement and to the references to our firm therein and in the Prospectus and in any Prospectus Supplement under the caption “Legal Matters.” In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

Very truly yours,

/s/ Lowenstein Sandler LLP

LOWENSTEIN SANDLER LLP

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in this Registration Statement of Corbus Pharmaceuticals Holdings, Inc. on Form S-3, to be filed on or about January 31, 2024 of our report dated March 7, 2023, on our audits of the consolidated financial statements as of December 31, 2022 and 2021 and for each of the years then ended, which report was included in the Annual Report on Form 10-K filed March 7, 2023.

/s/ EisnerAmper LLP

EISNERAMPER LLP

Iselin, New Jersey

January 31, 2024

EXHIBIT 107

Calculation of Filing Fee Tables

Form S-3

(Form Type)

Corbus Pharmaceuticals Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Security Type |

|

Security Class Title |

|

Fee Calculation Rule |

|

Amount Registered |

|

Proposed Maximum Offering Price Per Share |

|

Maximum Aggregate Offering Price |

|

Fee Rate |

|

Amount of Registration Fee |

Equity |

|

Common Stock, $0.0001 par value per share |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

|

|

|

Equity |

|

Preferred Stock, $0.0001 par value per share |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

|

|

|

Debt |

|

Debt Securities |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

|

|

|

Other |

|

Warrants |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

|

|

|

Other |

|

Units |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

|

|

|

Other |

|

Subscription Rights |

|

457(o) |

|

(1) |

|

(1) |

|

(1) |

|

|

|

|

Unallocated (Universal) Shelf |

|

--- |

|

457(o) |

|

(1) |

|

(1) |

|

$15,752,564 |

|

0.00014760 |

|

$2,325.08 |

Total Offering Amounts |

|

|

|

$15,752,564 |

|

|

|

$2,325.08 |

Total Fees Paid Previously |

|

|

|

|

|

|

|

— |

Total Fee Offsets |

|

|

|

|

|

|

|

— |

Net Fee Due |

|

|

|

|

|

|

|

$2,325.08 |

|

|

(1) |

The Registrant previously registered the offer and sale of certain securities having a proposed maximum aggregate offering price of $100,000,000 pursuant to a Registration Statement on Form S-3 (File No. 333-272314) (the “Prior Registration Statement”), which was initially filed on June 1, 2023 and declared effective by the Securities and Exchange Commission on June 13, 2023. As of the date hereof, a balance of $78,762,823 of such securities remains unsold under the Prior Registration Statement. In accordance with Rule 462(b) under the Securities Act of 1933, as amended, and General Instruction IV(A) of Form S-3, the registrant is hereby registering the offer and sale of an additional $15,752,564 of its Securities. The additional amount of Securities that is being registered for offer and sale represents no more than 20% of the maximum aggregate offering price of the remaining securities available to be sold under the Prior Registration Statement. |

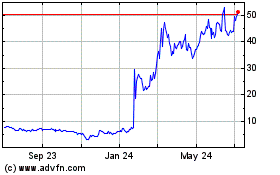

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

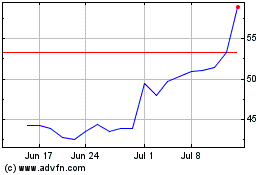

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Apr 2023 to Apr 2024