FALSE000133349300013334932024-01-262024-01-260001333493dei:FormerAddressMember2024-01-262024-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event reported): January 26, 2024

EHEALTH, INC.

(Exact Name of Registrant as Specified in its Charter) | | | | | | | | |

| | |

| Delaware | 001-33071 | 56-2357876 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

13620 RANCH ROAD 620 N, SUITE A250

AUSTIN, TX 78717

(Address of principal executive offices) (Zip Code)

(737) 248-2340

(Registrant’s telephone number, including area code)

2625 AUGUSTINE DRIVE, SUITE 150

SANTA CLARA, CA 95054

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | EHTH | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Item 2.02 | | Results of Operations and Financial Condition. |

On January 26, 2024, eHealth, Inc. (the “Company”) issued a press release announcing preliminary results for the fourth quarter and fiscal year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in Item 2.02 of this Current Report on Form 8-K and the exhibit attached hereto is intended to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended. Except as shall be expressly set forth by specific reference in such filing, the information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

| | | | | | | | |

| Item 9.01 | | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| | eHealth, Inc. |

| Date: | January 26, 2024 | /s/ John Stelben |

| | John Stelben Chief Financial Officer (Principal Financial Officer) |

PRESS RELEASE

eHealth, Inc. Announces Preliminary Results for the Fourth Quarter and Fiscal Year 2023

AUSTIN, Texas, January 26, 2024 — eHealth, Inc. (Nasdaq: EHTH), a leading private online health insurance marketplace, today announced preliminary, unaudited financial results and select operating metrics for the fourth quarter and fiscal year ended December 31, 2023.

“Our Annual Enrollment Period performance is a testament to the success of the business transformation plan that we initiated two years ago as well as our organization-wide AEP preparedness efforts. Ahead of the fourth quarter, we scaled our telesales organization, launched a successful brand campaign, and further enhanced customer experience on our omni-channel platform,” said Fran Soistman, Chief Executive Officer of eHealth.

Continued Mr. Soistman, “During the fourth quarter, eHealth delivered strong year-over-year revenue and Medicare enrollment growth, while driving further expansion of our Medicare unit gross margin. Importantly, our full year 2023 operating cash flow represents a substantial improvement compared to a year ago, driven by favorable commission collections from our existing member cohorts as well as our disciplined approach to operating costs. We entered 2024 on a strong financial and operating foundation and will continue our efforts to build a leadership position in the important Medicare Advantage market as well as to pursue our business diversification strategy across adjacent areas.”

Select AEP and Fourth Quarter 2023 Operating Metrics

•Medicare Advantage approved members for the fourth quarter of 2023 were 159,595, an increase of 22% year-over-year.

•Total Medicare approved members for the fourth quarter of 2023 were 186,567, an increase of 16% year-over-year.

•Fourth quarter 2023 Medicare Advantage lifetime values (LTV) grew year-over-year, driven by favorable member retention and carrier mix, among other factors.

Fourth Quarter and Fiscal Year 2023 Preliminary Results

•Total revenue for the fourth quarter of 2023 is expected to be in the range of $241 to $249 million. Total revenue for the year ended December 31, 2023 is expected to be in the range of $446 to $454 million as compared to the company’s guidance of $439 to $459 million.

◦Fourth quarter 2023 total revenue includes positive net adjustment revenue of approximately $12 to $17 million, reflective of continued positive trends in beneficiary persistency and commissions payments.

•GAAP net income for the fourth quarter of 2023 is expected to be in the range of $47 to $52 million. GAAP net loss for the year ended December 31, 2023 is expected to be in the range of $32 to $27 million as compared to the company’s guidance of GAAP net loss of $46 to $26 million.

•Adjusted EBITDA for the fourth quarter of 2023 is expected to be in the range of $65 to $70 million. Adjusted EBITDA for the year ended December 31, 2023 is expected to be in the range of $10 to $15 million as compared to the company’s guidance of $(3) to $17 million.

•Operating cash flow for the year ended December 31, 2023 is expected to be approximately $(7) million as compared to the company’s guidance of $(30) to $(15) million.

The preliminary, unaudited financial results and select operating metrics included in this press release are based on information available as of January 26, 2024 and management's initial review of operations for the fourth quarter and year ended December 31, 2023. They remain subject to change based on management's ongoing review of the Company's fourth quarter and full year results and are forward-looking statements. eHealth assumes no obligation to update these

statements. The actual results may be materially different and are affected by the risk factors and uncertainties identified in this press release and in eHealth's annual and quarterly filings with the Securities and Exchange Commission.

About eHealth

We’re Matchmakers. For over 25 years, eHealth has helped millions of Americans find the healthcare coverage that fits their needs at a price they can afford. Consumers can visit our health insurance marketplace at eHealth.com, or call us to speak with a licensed insurance agent at 1-833-964-1202, TTY 711. As a leading independent licensed insurance agency and advisor, eHealth offers access to over 180 health insurers, including national and regional companies.

For more information, visit eHealth.com or follow us on LinkedIn, Facebook, Instagram, and X. Open positions can be found on our career page.

Forward-Looking Statements

This press release contains statements that are forward-looking statements as defined within the Private Securities Litigation Reform Act of 1995. These include statements regarding factors that impacted our fourth quarter performance; our expected operating and financial performance in 2024; our expected total revenue, GAAP net income (loss), Adjusted EBITDA and operating cash flow for the fourth quarter of 2023 and the year ended December 31, 2023, as applicable; our Medicare Advantage approved members for the fourth quarter of 2023; our Medicare approved members for the fourth quarter of 2023; our Medicare unit gross margin for the fourth quarter of 2023; our estimates regarding constrained lifetime values of commissions per approved member by product category; our expectations regarding our financial and operating condition and performance; our expectations regarding our business, operations, initiatives and strategies, including the Medicare Advantage market and our business diversification strategy; and other statements regarding our future operations, financial condition, prospects and business strategies.

These forward-looking statements are inherently subject to various risks and uncertainties that could cause actual results to differ materially from the statements made. In particular, we are required by Accounting Standards Codification 606 — Revenue from Contracts with Customers to make numerous assumptions that are based on historical trends and our management’s judgment. These assumptions may change over time and have a material impact on our revenue recognition, guidance, and results of operations. Please review the assumptions stated in this press release carefully.

The risks and uncertainties that could cause our results to differ materially from those expressed or implied by such forward-looking statements include, but are not limited to, our ability to retain existing members and enroll new members during the annual healthcare open enrollment period, the Medicare annual enrollment period, the Medicare Advantage annual open enrollment period and other special enrollment periods; changes in laws, regulations and guidelines, including in connection with healthcare reform or with respect to the marketing and sale of Medicare plans; competition, including competition from government-run health insurance exchanges and other sources; the seasonality of our business and the fluctuation of our operating results; our ability to accurately estimate membership, lifetime value of commissions and commissions receivable; changes in product offerings among carriers on our ecommerce platform and changes in our estimated conversion rate of an approved member to a paying member and the resulting impact of each on our commission revenue; the concentration of our revenue with a small number of health insurance carriers; our ability to execute on our growth strategy and other business initiatives; changes in our management and key employees; our ability to hire, train, retain and ensure the productivity of licensed insurance agents, or benefit advisors, and other employees; exposure to security risks and our ability to safeguard the security and privacy of confidential data; our relationships with health insurance carriers; the success of our carrier advertising and sponsorship program; our success in marketing and selling health insurance plans and our unit cost of acquisition; our ability to effectively manage our operations as our business evolves and execute on our transformation plan and other strategic initiatives; the need for health insurance carrier and regulatory approvals in connection with the marketing of Medicare-related insurance products; changes in the market for private health insurance; consumer satisfaction of our service and actions we take to improve the quality of enrollments; changes in member conversion rates; changes in commission rates; our ability to sell qualified health insurance plans to subsidy-eligible individuals and to enroll subsidy-eligible individuals through government-run health insurance exchanges; our ability to maintain and enhance our brand identity; our ability to derive desired benefits from investments in our business, including membership growth and retention initiatives; reliance on marketing partners; the impact of our direct-to-consumer mail, email, social media, telephone and television marketing efforts; timing of receipt and accuracy of commission reports; payment practices of health insurance carriers; dependence on our operations in China; the restrictions in our debt obligations; the restrictions in our investment agreement with convertible preferred stock investors and our ability to comply with such restrictions and conditions; our ability to raise additional capital; compliance with insurance, privacy, cybersecurity, and other laws and regulations; the outcome of litigation in which we may from time to time be involved; the performance, reliability and availability of our information technology systems, ecommerce platform and underlying network infrastructure; including any new systems we may implement; public health crises, pandemics, natural disasters, changing climate conditions and other extreme events;

general economic conditions, including inflation, recession, financial, banking and credit market disruptions; and our ability to affectively administer our self-insurance program. Other factors that could cause operating, financial and other results to differ are described in our most recent Quarterly Report on Form 10-Q or Annual Report on Form 10-K filed with the Securities and Exchange Commission and available on the investor relations page of our website at http://www.ehealthinsurance.com and on the Securities and Exchange Commission’s website at www.sec.gov.

All forward-looking statements in this press release are based on information available to us as of the date hereof, and we do not assume any obligation to update the forward-looking statements provided to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

Non-GAAP Financial Information

This press release includes Adjusted EBITDA, a financial measure that is not calculated in accordance with generally accepted accounting principles in the United States (GAAP). Adjusted EBITDA is calculated by excluding provision for (benefit from) income taxes, depreciation and amortization, stock-based compensation expense, other income (expense), net, and other non-recurring charges from GAAP net income (loss). Other non-recurring charges to GAAP net income (loss) may include transaction expenses in connection with capital raising transactions (whether debt, equity or equity-linked) and acquisitions, whether or not consummated, purchase price adjustments and the cumulative effect of a change in accounting principles.

eHealth believes that the presentation of Adjusted EBITDA provides important supplemental information to management and investors regarding financial and business trends relating to eHealth’s financial condition and results of operations. Management believes that the use of Adjusted EBITDA provides consistency and comparability with eHealth’s past financial reports. Management also believes that Adjusted EBITDA provides an additional measure of eHealth’s operating results and facilitates comparisons of eHealth’s core operating performance against prior periods and business model objectives. This information is provided to investors in order to facilitate additional analyses of past, present and future operating performance and as a supplemental means to evaluate eHealth’s ongoing operations. eHealth believes that Adjusted EBITDA is useful to investors in their assessment of eHealth’s operating performance.

Adjusted EBITDA is not calculated in accordance with GAAP, and should be considered supplemental to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Adjusted EBITDA has limitations in that it does not reflect all of the revenue and costs associated with the operations of eHealth’s business and does not reflect income tax as determined in accordance with GAAP. As a result, you should not consider this measure in isolation or as a substitute for analysis of eHealth’s results as reported under GAAP. eHealth expects to continue to incur the stock-based compensation costs and depreciation and amortization described above, and exclusion of these costs, and their related income tax benefits, from Adjusted EBITDA should not be construed as an inference that these costs are unusual or infrequent. eHealth compensates for these limitations by prominently disclosing GAAP net income (loss) and providing investors with a reconciliation from eHealth’s GAAP net income (loss) to Adjusted EBITDA for the relevant periods.

The accompanying table provides more details on GAAP net income (loss), which is the most directly comparable GAAP financial measure to Adjusted EBITDA, a non-GAAP financial measure, and the related reconciliation between these financial measures.

Non-GAAP Financial Information Reconciliation – Preliminary Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, 2023 | | Year Ended

December 31, 2023 |

| (in millions, unaudited) | Low | | High | | Low | | High |

| GAAP net income (loss) | $ | 47 | | | $ | 52 | | | $ | (32) | | | $ | (27) | |

| Stock-based compensation expense | 6 | | | 5 | | | 24 | | | 23 | |

| Depreciation and amortization | 5 | | | 5 | | | 20 | | | 20 | |

| | | | | | | |

| Other expense, net | 1 | | | 1 | | | 1 | | | 1 | |

| Provision for (benefit from) income taxes | 6 | | | 7 | | | (3) | | | (2) | |

| Adjusted EBITDA | $ | 65 | | | $ | 70 | | | $ | 10 | | | $ | 15 | |

Non-GAAP Financial Information Reconciliation – Fiscal Year 2023 Guidance

| | | | | | | | | | | |

| Year Ended

December 31, 2023 |

| (in millions, unaudited) | Low | | High |

GAAP net loss | $ | (46) | | | $ | (26) | |

| Stock-based compensation expense | 22 | | | 20 | |

| Depreciation and amortization | 22 | | | 21 | |

| | | |

| Other expense, net | 7 | | | 6 | |

Benefit from income taxes | (8) | | | (4) | |

| Adjusted EBITDA | $ | (3) | | | $ | 17 | |

Investor Relations Contact:

Kate Sidorovich, CFA

Senior Vice President, Investor Relations & Strategy

investors@ehealth.com

v3.23.4

Cover Page

|

Jan. 26, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity Registrant Name |

EHEALTH, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33071

|

| Entity Tax Identification Number |

56-2357876

|

| Entity Address, Address Line One |

13620 RANCH ROAD 620 N, SUITE A250

|

| Entity Address, City or Town |

AUSTIN

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78717

|

| City Area Code |

737

|

| Local Phone Number |

248-2340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

EHTH

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001333493

|

| Entity Addresses [Line Items] |

|

| Entity Address, Postal Zip Code |

78717

|

| Entity Address, Address Line One |

13620 RANCH ROAD 620 N, SUITE A250

|

| Entity Address, City or Town |

AUSTIN

|

| Entity Address, State or Province |

TX

|

| Former Address |

|

| Cover [Abstract] |

|

| Entity Address, Address Line One |

2625 AUGUSTINE DRIVE, SUITE 150

|

| Entity Address, City or Town |

SANTA CLARA

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

95054

|

| Entity Addresses [Line Items] |

|

| Entity Address, Postal Zip Code |

95054

|

| Entity Address, Address Line One |

2625 AUGUSTINE DRIVE, SUITE 150

|

| Entity Address, City or Town |

SANTA CLARA

|

| Entity Address, State or Province |

CA

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

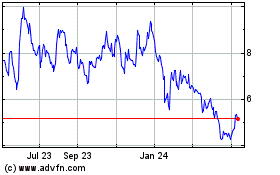

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Mar 2024 to Apr 2024

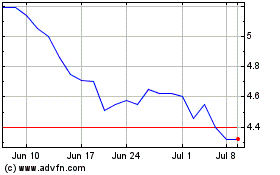

eHealth (NASDAQ:EHTH)

Historical Stock Chart

From Apr 2023 to Apr 2024