As

filed with the United States Securities and Exchange Commission on January 25,

2024

Registration

No. 333-275127

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

AMENDMENT NO.2

TO

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CLEAN

ENERGY TECHNOLOGIES, INC.

(Exact

Name of Registrant As Specified in Its Charter)

| Nevada |

|

20-2675800 |

(State

or Other Jurisdiction of

Incorporation

or Organization) |

|

(I.R.S.

Employer

Identification Number) |

2990

Redhill Ave,

Costa

Mesa, California 92626

Telephone:

(949) 273-4990

(Address,

Including Zip Code, and Telephone Number,

Including Area Code, of Registrant’s Principal Executive Offices)

Kambiz

Mahdi

Chief

Executive Officer

Clean

Energy Technologies, Inc.

2990

Redhill Ave,

Costa

Mesa, California 92626

Telephone:

(949) 273-4990

(Name, Address, Including Zip Code, and Telephone Number,

Including Area Code, of Agent for Service)

With

copies to:

Fang

Liu, Esq.

VCL

Law LLP

1945

Old Gallows Road, Suite 260

Vienna,

VA 22182

Telephone:

(703) 919-7285

Approximate

date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Securities and Exchange Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer ☐ |

|

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

|

Smaller

reporting company ☒ |

| |

|

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY

NOTE

This

registration statement contains:

| ● |

a

base prospectus which covers the offering, issuance and sale by the registrant of up to a maximum aggregate offering price of $75,000,000

of the registrant’s common stock, warrants, and/or units consisting of two or more of these securities;

and |

| |

|

| ● |

a

sales agreement prospectus supplement covering the offering, issuance and sale of up to $25,000,000 of shares of the registrant’s

common stock that may be issued and sold under the Sales Agreement, dated October 6, 2023 (the “Sales Agreement”), by

and between the registrant and Roth Capital Partners, LLC. |

The

base prospectus immediately follows this explanatory note. The specific terms of any securities to be offered pursuant to the base prospectus

will be specified in a prospectus supplement to the base prospectus. The sales agreement prospectus supplement immediately follows the

base prospectus. The common stock that may be offered, issued and sold by the registrant under the sales agreement prospectus supplement

is included in the $75,000,000 of securities that may be offered, issued and sold by the registrant under the base prospectus.

Upon termination of the Sales Agreement, any portion of the $25,000,000 included in the sales agreement prospectus supplement that is

not sold pursuant to the Sales Agreement will be available for sale in other offerings pursuant to the base prospectus.

The

information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell

these securities, and it is not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 25, 2024

PROSPECTUS

$75,000,000

Common

Stock

Warrants

Units

From

time to time, we may offer up to $75,000,000 of any combination of the securities described in this prospectus in one or more

offerings. We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities

registered hereunder, including any applicable antidilution provisions.

This

prospectus provides a general description of the securities we may offer. Each time we offer securities, we will provide specific terms

of the securities offered in a supplement to this prospectus. We may also authorize one or more free writing prospectuses to be provided

to you in connection with these offerings. The prospectus supplement and any related free writing prospectus may also add, update or

change information contained in this prospectus. You should carefully read this prospectus, the applicable prospectus supplement and

any related free writing prospectus, as well as any documents incorporated by reference, before you invest in any of the securities being

offered.

This

prospectus may not be used to consummate a sale of any securities unless accompanied by a prospectus supplement.

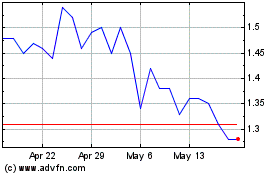

Our

common stock is quoted on The Nasdaq Capital Market under the symbol “CETY.” On January 24, 2024, the last reported

sales price of our common stock was $0.86 per share. The applicable prospectus supplement will contain information, where applicable,

as to any other listing on The Nasdaq Capital Market or any securities market or other exchange of the securities, if any, covered by

the applicable prospectus supplement.

Pursuant

to General Instruction I.B.6 of Form S-3, in no event will we sell our securities in a public primary offering with a value exceeding

more than one-third of our public float in any 12-month period so long as our public float remains below $75.0 million. As of December

1, 2023, the aggregate market value of our outstanding common stock held by non-affiliates, or public float, was approximately $20,179,232.28,

based on 12,771,666 shares of our outstanding common stock that were held by non-affiliates on such date and a price of $1.58

per share, which was the price at which our common stock was last sold on the Nasdaq Capital Market on December 1, 2023 (a

date within 60 days of the date hereof), calculated in accordance with General Instruction I.B.6 of Form S-3. During the 12 calendar

months prior to and including the date of this prospectus, we have not offered and sold any of our securities pursuant to General Instruction

I.B.6 of Form S-3.

We

will sell these securities directly to investors, through agents designated from time to time or to or through underwriters or dealers,

on a continuous or delayed basis. For additional information on the methods of sale, you should refer to the section entitled “Plan

of Distribution” in this prospectus. If any agents or underwriters are involved in the sale of any securities with respect to which

this prospectus is being delivered, the names of such agents or underwriters and any applicable fees, commissions, discounts or options

to purchase additional securities will be set forth in a prospectus supplement. The price to the public of such securities and the net

proceeds we expect to receive from such sale will also be set forth in a prospectus supplement.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading

“Risk Factors” on page 9 of this prospectus as well as those contained in the applicable prospectus supplement and any related

free writing prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Clean

Energy Technologies Inc. is a company incorporated in the State of Nevada with operations in North America, Europe, and Asia,

including in China. Clean Energy Technologies (H.K.) Limited, along with other PRC Subsidiaries and Shuya, our variable interest

entity (VIE), manages our natural gas trading operations in China to source and supply natural gas to industries and municipalities

located in China. Throughout this prospectus, unless the context requires otherwise, (i) “the Company,”

“we,” “us” and “our” refer to Clean Energy Technologies, Inc. on a consolidated basis with its

wholly-owned subsidiaries, (ii) “the PRC Subsidiaries” refers specifically to those wholly-owned subsidiaries of ours

located in the People’s Republic of China (including Hong Kong) and identified in the corporate structure diagram in the

Prospectus Summary, and (iii) “Shuya” or “the VIE” refers specifically

to Sichuan Hongzuo Shuya Energy Limited.

Sichuan

Hongzuo Shuya Energy Limited, our VIE in the PRC, is a limited liability company established under the PRC law in which we own a 49%

equity interest and is consolidated for accounting purposes only. In July 2022, Jiangsu Huanya Jieneng New Energy Co., Ltd. (“JHJ”),

one of our PRC Subsidiaries, together with three other shareholders, agreed to form Shuya and make total capital contribution of RMB

20 million ($2.81 million), with the latest contribution due date in February 2066. JHJ owned 20% equity interest in Shuya. In August

2022, JHJ purchased 100% ownership of Sichuan Shunengwei Energy Technology Limited (“SSET”) for $0, which owns a 29% equity

interest in Shuya. SSET is a holding company and did not have any operations nor made any capital contribution into Shuya as of the ownership

purchase date by JHJ. Following the purchase of SSET, JHJ ultimately owns a 49% equity interest in Shuya. On January 1, 2023 and effective

on the same date, JHJ, SSET and Chengdu Xiangyueheng Enterprise Management Co., Ltd (“Xiangyueheng”), which owns a 10% equity

interest in Shuya, entered into a three-party Concerted Action Agreement (the “CAA”), wherein the parties agreed to vote

in unison at the shareholders’ meeting of Shuya to consolidate the controlling position of the three parties in Shuya. The three

parties agreed that during the term of the CAA, before any of the three parties intends to propose motions to the shareholders’

meetings or the board of directors on major matters related to the voting rights of the shareholders, the three parties will discuss,

negotiate, and coordinate the motion topics for consistency; in the event of disagreement, the opinions of JHJ shall prevail. As a result

of the CAA, JHJ holds 59% of the voting rights in Shuya. The Company determined that Shuya is a VIE, and the Company consolidates

Shuya into its consolidated financial statements effective on or after January 1, 2023.

We,

therefore, consolidate Shuya as its primary beneficiary with a controlling financial interest through contractual arrangements, i.e.,

the CAA. However, a controlling financial interest through contractual arrangements is not considered as equal to equity interest and

this structure involves unique risks to investors. Contractual arrangements may not be as effective as direct ownership in providing

us with power to direct the activities of the VIE and we may incur substantial costs to enforce the terms of the CAA against the other

parties to such agreement. Such contractual arrangement has not been frequently tested in PRC courts. There are substantial uncertainties

regarding the interpretation and application of current and future PRC laws, regulations, and rules relating to this type of contractual

arrangement. If the PRC government finds this contractual arrangement non-compliant with the restrictions on direct foreign investment

in the relevant industries or other types of governmental regulations, or if the relevant PRC laws, regulations, and rules or the interpretation

thereof change in the future, we could be subject to severe penalties or be forced to relinquish our interests in the VIE or forfeit

our rights under the contractual arrangement. Investors in our securities face uncertainty about potential future actions by the PRC

government, which could affect the enforceability of our contractual arrangement regarding the VIE and, consequently, significantly affect

our financial condition and results of operations. If we are unable to claim our right to control the assets of the VIE, the securities

may decline in value as we hold a 49% equity interest in the VIE. The PRC government could even disallow the VIE structure entirely,

which would likely result in a material adverse change in our operations and the securities may significantly decline or become worthless

in value. Investors are purchasing equity interest in Clean Energy Technologies Inc., a Nevada corporation, which owns, indirectly,

a 49% equity interest in Shuya, and are not purchasing, and may never directly or indirectly hold, any of the remaining 51% equity interest

in Shuya. See “Risk Factors – We rely on contractual arrangements with the other shareholders of the VIE to gain effective

control of the VIE, which may not be as effective in providing operational control as direct ownership, and those shareholders may fail

to perform their obligations under the contractual arrangements.” As used in this prospectus, “we,” “us,”

or “our” refers to Clean Energy Technologies Inc. and its wholly-owned subsidiaries and does not include Shuya and its subsidiaries.

We

also face various legal and operational risks and uncertainties due to our operations in China. Our PRC Subsidiaries and the VIE could

be adversely affected by uncertainties with respect to the Chinese legal system. Rules and regulations in China can change quickly with

little advance notice. The interpretation and enforcement of Chinese laws and regulations involve additional uncertainties. Since administrative

and court authorities in China have significant discretion in interpreting and implementing statutory provisions and contractual terms,

it may be difficult to evaluate the outcome of administrative and court proceedings and the level of legal protection we enjoy. In addition,

the Chinese government exercises significant oversight and discretion over the conduct of the business of our PRC Subsidiaries and the

VIE and may intervene in or influence their operations as the government deems appropriate to further regulatory, political and societal

goals, which could result in a material change in their operations in China and/or the value of the securities we are registering

for sale, including causing the value of such securities to significantly decline or become worthless. Furthermore, the Chinese government

has recently exerted more oversight and control over overseas securities offerings and other capital markets activities and foreign investment

in China-based companies. Any such actions, once taken by the Chinese government, could significantly limit or completely hinder our

ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline or be worthless.

See “Risk Factors — The PRC government exerts substantial influence over the manner in which we conduct our business

operations. It may influence or intervene in our operations at any time as part of its efforts to enforce PRC law, which could result

in a material adverse change in our operations and the value of the securities we are offering”; and “Risk Factors

— The approval or record filing of the CSRC, CAC, or other PRC government authorities may be required in connection with this offering

and our future capital raising activities under the PRC laws.”

Recently,

the PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little

advance notice, including cracking down on illegal activities in the securities market, adopting new measures to extend the scope of

cybersecurity reviews, and expanding the efforts in anti-monopoly enforcement. We do not believe that we, our PRC Subsidiaries or

the VIE are directly subject to these regulatory actions or statements; however, because these statements and regulatory actions are

new, it is highly uncertain how soon legislative or administrative rule making bodies in China will respond to them, or what

existing or new laws or regulations will be modified or promulgated, if any, or the potential impact such modified or new laws and

regulations will have on the daily business operations or ability to accept foreign investments of our PRC Subsidiaries and the VIE.

On December 24, 2021, nine government agencies jointly issued the Opinions on Promoting the Healthy and Sustainable Development of

Platform Economy, which provides that, among others, monopolistic agreements, abuse of dominant market position and illegal

concentration of business operators in the field of platform economy will be strictly investigated and punished in accordance with

the relevant laws. Our PRC Subsidiaries or the VIE do not hold a dominant market position in their product markets and they have not

entered into any monopolistic agreement. Neither have they received any inquiry from the relevant governmental authorities. The

Cyberspace Administration of China (“CAC”), together with 12 other Chinese regulatory authorities, released the final

version of the Revised Measures for Cybersecurity Review, or the Revised Cybersecurity Measures, in December 2021, which took effect

on February 15, 2022. Pursuant to the Revised Cybersecurity Measures, critical information infrastructure operators procuring

network products and services and online platform operators carrying out data processing activities, which affect or may affect

national security, shall conduct a cybersecurity review pursuant to the provisions therein. In addition, online platform operators

possessing personal information of more than one million users seeking to be listed on foreign stock markets must apply for a

cybersecurity review. On November 14, 2021, the CAC published the Draft Regulations on the Network Data Security Administration

(Draft for Comments) (the “Security Administration Draft”), which provides that data processing operators engaging in

data processing activities that affect or may affect national security must be subject to cybersecurity review by the relevant

Cyberspace Administration of the PRC. We do not believe that our PRC Subsidiaries or the VIE are “online platform

operators” within the meaning of the Revised Cybersecurity Measures, and our PRC Subsidiaries or the VIE currently do not

possess over one million Chinese users’ personal information and do not anticipate that they will be collecting over one

million Chinese users’ personal information in the foreseeable future. In addition, our PRC Subsidiaries or the VIE will not

be subject to Security Administration Draft if the Security Administration Draft is enacted as proposed, since they currently do not

collect data that affects or may affect national security and we do not anticipate that our PRC Subsidiaries or the VIE will be

collecting data that affects or may affect national security in the foreseeable future.

On

February 17, 2023, the CSRC promulgated the Trial Administrative Measures of the Overseas Securities Offering and Listing by Domestic

Companies, or the Trial Measures, and the relevant five guidelines, which became effective on March 31, 2023. The Trial Measures comprehensively

reformed the existing regulatory regime for overseas offering and listing of PRC domestic companies’ securities and will regulate

both direct and indirect overseas offering and listing of PRC domestic companies’ securities by adopting a filing-based regulatory

regime. Pursuant to the Trial Measures, PRC domestic companies that seek to offer and list securities in overseas markets, either in

direct or indirect means, are required to fulfill the filing procedure with the CSRC and report relevant information. The Trial Measures

provides that if the issuer meets both of the following criteria, the overseas securities offering and listing conducted by such issuer

will be deemed as indirect overseas offering by PRC domestic companies: (i) 50% or more of any of the issuer’s operating revenue,

total profit, total assets or net assets as documented in its audited consolidated financial statements for the most recent fiscal year

is accounted for by domestic companies; and (ii) the main parts of the issuer’s business activities are conducted in mainland China,

or its main place(s) of business are located in mainland China, or the majority of senior management staff in charge of its business

operations and management are PRC citizens or have their usual place(s) of residence located in mainland China. As of the date of this

prospectus, we do not believe that either Clean Energy Technologies Inc., the PRC Subsidiaries or the VIE are required to obtain the

approval from or complete the filing with the CSRC for this offering and thus none of Clean Energy Technologies Inc., our PRC Subsidiaries

and the VIE have submitted an application for approval for this offering with the CSRC pursuant to the Trial Measures based on the fact

that we do not meet the explicit conditions set out in the Trial Measures to determine whether an overseas offering shall be deemed as

a direct or an indirect overseas offering and listing by a domestic company. However, as the Trial Measures was newly published, there

are substantial uncertainties as to the implementation and interpretation, and the CSRC may take a view that is contrary to our understanding

of the Trial Measures. If we are required by the CSRC to submit and complete the filing procedures of this offering and listing, we cannot

assure you that we will be able to complete such filings in a timely manner, or even at all, which could significantly limit or completely

hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline

or become worthless. Any failure by us to comply with such filing requirements under the Trial Measures may result in rectification,

warnings, and a fine between RMB 1 million and RMB 10 million on our PRC Subsidiaries or the VIE, which could adversely and materially

affect our business operations and financial outlook and could cause the value of our common stock to significantly decline or, in

extreme cases, become worthless.

As

of the date of this prospectus, these new laws and guidelines have not impacted the ability of our PRC Subsidiaries and the VIE to

conduct business and accept foreign investments; however, if (i) we inadvertently conclude that permissions or approvals are

not required from applicable PRC authorities or (ii) applicable laws, regulations, or interpretations change, and we are required to

obtain such permissions or approvals in the future, our ability to conduct our business in China may be materially impacted, the

interest of the investors may be materially and adversely affected and our common stock may significantly decrease in

value.

In addition, we face risks associated with the Holding Foreign Companies Accountable Act, or HFCAA. Trading in our securities on U.S. markets,

including Nasdaq, may be prohibited under the HFCAA if the Public Company Accounting Oversight Board, or PCAOB, determines that it

is unable to inspect or investigate completely our auditor for two consecutive years. Pursuant to the HFCAA, the PCAOB issued a

Determination Report on December 16, 2021, which found that the PCAOB is unable to inspect or investigate completely registered

public accounting firms headquartered in mainland China and Hong Kong because of positions taken by the authorities in those

jurisdictions. In addition, the PCAOB’s report identified the specific registered public accounting firms which are subject to

these determinations. On August 26, 2022, the PCAOB signed a Statement of Protocol Agreement with the CSRC and the Ministry of

Finance (the “MOF”) of the PRC governing inspections and investigations of audit firms based in China or Hong Kong. On

December 15, 2022, the PCAOB announced in the 2022 Determination its determination that the PCAOB was able to secure complete access

to inspect and investigate accounting firms headquartered in mainland China and Hong Kong, and the PCAOB Board voted to vacate

previous determinations to the contrary. Should the PCAOB again encounter impediments to inspections and investigations in mainland

China or Hong Kong as a result of positions taken by any authority in either jurisdiction, including by the CSRC or the MOF, the

PCAOB will make determinations under the HFCAA as and when appropriate. Both our current auditor, TAAD LLP, and our former auditor,

Fruci & Associates II, PLLC, are headquartered in the United States and, as PCAOB-registered public accounting firms, they are

required to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards.

TAAD LLP and Fruci & Associates II, PLLC have been subject to PCAOB inspections and are not among the PCAOB-registered public

accounting firms headquartered in the PRC or Hong Kong that are subject to PCAOB’s determination of having been unable to

inspect or investigate completely. Notwithstanding the foregoing, if it is later determined that the PCAOB is unable to inspect or

investigate our auditor completely, if there is any regulatory change or step taken by PRC regulators that does not permit our

auditor to provide audit documentations located in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB

expands the scope of the Determination so that we are subject to the HFCAA, as the same may be amended, you may be deprived of the

benefits of such inspection. Any audit reports not issued by auditors that are completely inspected or investigated by the PCAOB, or

a lack of PCAOB inspections of audit work undertaken in China that prevents the PCAOB from regularly evaluating our auditors’

audits and their quality control procedures, could result in a lack of assurance that our financial statements and disclosures are

adequate and accurate, which could result in limitation or restriction to our access to the U.S. capital markets, and trading of our

securities, including trading on the national exchange and trading on “over-the-counter” markets, may be prohibited

under the HFCAA and our securities may be delisted by an exchange. See “Risk Factors — Recent joint statement by the

SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional and more

stringent criteria to be applied to companies with operations in emerging markets upon assessing the qualification of their

auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our

continued listing or future offerings of our securities in the U.S.”

Cash

may be transferred within our organization in the following manners: (i) Clean Energy Technologies Inc. may transfer funds to the PRC

Subsidiaries and the VIE by way of capital contributions or loans, through intermediate holding subsidiaries or otherwise, as investments

or lendings, (ii) the PRC Subsidiaries may make dividends or other distributions to Clean Energy Technologies Inc. through intermediate

holding companies or otherwise, and (iii) the VIE may make dividends or other distributions to Clean Energy Technologies Inc., which

indirectly owns a 49% equity interest in the VIE, through intermediate holding companies or otherwise. Our abilities to use cash held

in PRC or in a PRC entity to fund operations or for other purposes outside of the PRC are subject to restrictions and limitations imposed

by the PRC government. Current PRC regulations only permit a wholly foreign-owned enterprise, or WFOE, to pay dividends to its offshore

parent company out of their retained earnings, if any, determined in accordance with Chinese accounting standards and regulations. In

addition, the majority of the revenues of our PRC Subsidiaries and the VIE are collected in RMB. Thus, foreign exchange shortages and

foreign exchange control may also limit their ability to pay dividends or make other payments or otherwise meet our obligations denominated

in foreign currencies. Furthermore, we may lose our ability to fund operations or for other uses outside of Hong Kong using cash in Hong

Kong or a Hong Kong entity if, in the future, the scope of the current restrictions and limitations applicable to PRC entities were to

expand to include Hong Kong or entities based in Hong Kong. Therefore, our ability to transfer cash between PRC entities and entities

outside of PRC may be restricted. See “Risk Factors – Our PRC Subsidiary are subject to restrictions on paying dividends

or making other payments to us, which may restrict our ability to satisfy our liquidity requirements in the future” and “Risk

Factors – PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and governmental control

of currency conversion may delay or prevent us from making loans or additional capital contributions to our PRC Subsidiaries”

for details. As of the date of this prospectus, (i) we have transferred $2,671,700 in total to our PRC Subsidiaries, and (ii) JHJ,

our wholly-owned subsidiary in the PRC, has transferred $701,836 in total to Shuya, our VIE in the PRC, as a capital contribution for

the formation of Shuya. No other cash flows or transfers of other assets have occurred between us, our PRC Subsidiaries, and Shuya. As

of the date of this prospectus, neither any of our PRC Subsidiaries nor Shuya has declared any dividends or made any other distributions

to the Company, and no such dividends or distributions are anticipated in the near future.

As

of the date of this prospectus, we have never declared or paid any cash dividends on our common stock. We do not anticipate declaring

or paying, in the foreseeable future, any cash dividends on our capital stock. We intend to retain all available funds and future earnings,

if any, to fund the development and expansion of our business. Any future determination regarding the declaration and payment of dividends,

if any, will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition,

operating results, contractual restrictions, capital requirements, business prospects and other factors our board of directors may deem

relevant. We are obligated to pay dividends to certain holders of our preferred stock which we pay out of legally available funds from

time to time or reach arrangements with our holders of preferred stock to convert limited quantities of preferred stock at favorable

conversion prices in lieu of dividend payments.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED

IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is January 25, 2024.

Table

of Contents

About

This Prospectus

This

prospectus is a part of a registration statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”),

utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the securities

described in this prospectus in one or more offerings up to a total aggregate offering price of $75,000,000. This prospectus provides

you with a general description of the securities we may offer.

Each

time we sell securities under this prospectus, we will provide a prospectus supplement that will contain specific information about the

terms of that offering. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information

relating to these offerings. The prospectus supplement and any related free writing prospectus that we may authorize to be provided to

you may also add, update or change information contained in this prospectus or in any documents that we have incorporated by reference

into this prospectus. You should read this prospectus, any applicable prospectus supplement and any related free writing prospectus,

together with the information incorporated herein by reference as described under the heading “Incorporation of Certain Information

by Reference,” before investing in any of the securities offered.

THIS

PROSPECTUS MAY NOT BE USED TO CONSUMMATE A SALE OF SECURITIES UNLESS IT IS

ACCOMPANIED BY A PROSPECTUS SUPPLEMENT.

Neither

we, nor any agent, underwriter or dealer has authorized any person to give any information or to make any representation other than those

contained or incorporated by reference in this prospectus, any applicable prospectus supplement or any related free writing prospectus

prepared by or on behalf of us or to which we have referred you. This prospectus, any applicable supplement to this prospectus or any

related free writing prospectus do not constitute an offer to sell or the solicitation of an offer to buy any securities other than the

registered securities to which they relate, nor do this prospectus, any applicable supplement to this prospectus or any related free

writing prospectus constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to

whom it is unlawful to make such offer or solicitation in such jurisdiction.

You

should not assume that the information contained in this prospectus, any applicable prospectus supplement or any related free writing

prospectus is accurate on any date subsequent to the date set forth on the front of the document or that any information we have incorporated

by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus, any

applicable prospectus supplement or any related free writing prospectus is delivered, or securities are sold, on a later date.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where

You Can Find More Information.”

Prospectus

Summary

This

summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in

making your investment decision. You should carefully read the entire prospectus, the applicable prospectus supplement and any related

free writing prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained

in the applicable prospectus supplement and any related free writing prospectus, and under similar headings in the other documents that

are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this

prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Unless

the context requires otherwise, references in this prospectus to “the Company,” “we,” “us” and “our”

refer to Clean Energy Technologies, Inc. on a consolidated basis with its wholly-owned subsidiaries.

Company

Overview

We

develop renewable energy products and solutions and establish partnerships in renewable energy that make environmental and economic sense.

Our mission is to be a leader in the “Zero Emission Revolution” by offering recyclable energy solutions, clean energy fuels

and alternative electric power for small and mid-sized projects in North America, Europe, and Asia. We target sustainable energy solutions

that are profitable for us, profitable for our customers and represent the future of global energy production.

Waste

Heat Recovery Solutions – we recycle wasted heat produced in manufacturing, waste to energy and power generation facilities

using our patented Clean CycleTM generator to create electricity which can be recycled or sold to the grid.

Waste

to Energy Solutions – we convert waste products created in manufacturing, agriculture, wastewater treatment plants and

other industries to electricity, renewable natural gas (“RNG”), hydrogen and bio char which are sold or used by our customers.

Engineering,

Consulting and Project Management Solutions – we have expanded our legacy electronics and manufacturing business and plan to

manufacture component parts for our Waste Heat Recovery and Waste to Energy business and to provide consulting services to municipal

and industrial customers and Engineering, Procurement and Construction (EPC) companies so they can identify, design and incorporate clean

energy solutions in their projects.

CETY

HK – Clean Energy Technologies (H.K.) Limited (“CETY HK”) consists of two business ventures in mainland

China. The first is our natural gas (“NG”) trading, operations and sourcing, as well as supplying NG to industries and

municipalities. The NG is principally used for heavy truck refueling stations and urban or industrial users. We purchase large

quantities of NG from large wholesale NG depots at fixed prices which are prepaid for in advance at a discount to market. We sell

the NG to our customers at prevailing daily spot prices for the duration of the contracts. The second business venture is our

planned joint venture with a large state-owned gas enterprise in China called Shenzhen Gas (Hong Kong) International Co. Ltd.

(“Shenzhen Gas”), acquiring natural gas pipeline operator facilities, primarily located in the southwestern part of

China. Our planned joint venture with Shenzhen Gas plans to acquire, with financing from Shenzhen Gas, natural gas pipeline operator

facilities with the goal of aggregating and selling the facilities to Shenzhen Gas in the future. According to our Framework

Agreement with Shenzhen Gas, we will be required to contribute $8 million to the joint venture, which plans to raise future rounds

of financing. The terms of the joint venture are subject to the execution of definitive agreements.

Summary

of Risk Factors

Investing

in our securities involves a high degree of risk.

We are a corporation headquartered in the United States with operations in North America, Europe, and Asia, including in China. Due to

our Chinese operations, we face various legal and operational risks and uncertainties relating to being based in and having significant

operations in China. Our PRC Subsidiaries and the VIE could be adversely affected by uncertainties with respect to the Chinese legal

system. Rules and regulations in China can change quickly with little advance notice. The interpretation and enforcement of Chinese laws

and regulations involve additional uncertainties. Since administrative and court authorities in China have significant discretion in

interpreting and implementing statutory provisions and contractual terms, it may be difficult to evaluate the outcome of administrative

and court proceedings and the level of legal protection we enjoy. In addition, the Chinese government exercises significant oversight

and discretion over the conduct of the business of our PRC Subsidiaries and the VIE and may intervene in or influence their operations

as the government deems appropriate to further regulatory, political and societal goals. The Chinese government has recently published

new policies that significantly affected certain industries, and we cannot rule out the possibility that it will in the future release

regulations or policies regarding our industry that could adversely affect our business, financial condition and results of operations

and/or the value of the securities we are registering for sale, including causing the value of such securities to significantly decline

or become worthless. Furthermore, the Chinese government has recently exerted more oversight and control over overseas securities offerings

and other capital markets activities and foreign investment in China-based companies. Any such actions, once taken by the Chinese government,

could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value

of such securities to significantly decline or be worthless. See “Risk Factors — The PRC government exerts substantial

influence over the manner in which we conduct our business operations. It may influence or intervene in our operations at any time as

part of its efforts to enforce PRC law, which could result in a material adverse change in our operations and the value of the securities

we are offering”; and “Risk Factors — The approval or record filing of the CSRC, CAC, or other PRC government

authorities may be required in connection with this offering and our future capital raising activities under the PRC laws.”

In

addition, Shuya, our VIE, manages a part of our natural gas trading operations in China. We consolidate Shuya as its primary beneficiary

with a controlling financial interest through contractual arrangements, i.e., the CAA. However, a controlling financial interest through

contractual arrangements is not considered as equal to equity interest and this structure involves unique risks to investors. Contractual

arrangements may not be as effective as direct ownership in providing us with power to direct the activities of the VIE and we may incur

substantial costs to enforce the terms of the CAA against the other parties to such agreement. Such contractual arrangement has not been

frequently tested in PRC courts. There are substantial uncertainties regarding the interpretation and application of current and future

PRC laws, regulations, and rules relating to this type of contractual arrangement. If the PRC government finds this contractual arrangement

non-compliant with the restrictions on direct foreign investment in the relevant industries or other types of governmental regulations,

or if the relevant PRC laws, regulations, and rules or the interpretation thereof change in the future, we could be subject to severe

penalties or be forced to relinquish our interests in the VIE or forfeit our rights under the contractual arrangement. Investors in our

securities face uncertainty about potential future actions by the PRC government, which could affect the enforceability of our contractual

arrangement regarding the VIE and, consequently, significantly affect our financial condition and results of operations. If we are unable

to claim our right to control the assets of the VIE, the securities may decline in value as we hold a 49% equity interest in the VIE.

The PRC government could even disallow the VIE structure entirely, which would likely result in a material adverse change in our operations

and the securities may significantly decline or become worthless in value. Investors are purchasing equity interest in Clean Energy Technologies

Inc., a Nevada corporation, which owns, indirectly, a 49% equity interest in Shuya, and are not purchasing, and may never directly or

indirectly hold, any of the remaining 51% equity interest in Shuya. See “Risk Factors – We rely on contractual arrangements

with the other shareholders of the VIE to gain effective control of the VIE, which may not be as effective in providing operational control

as direct ownership, and those shareholders may fail to perform their obligations under the contractual arrangements.”

We

also face risks associated with the HFCAA. Trading in our securities on U.S. markets, including Nasdaq, may be prohibited under the HFCAA

if the Public Company Accounting Oversight Board, or PCAOB, determines that it is unable to inspect or investigate completely our auditor

for two consecutive years. Pursuant to the HFCAA, the PCAOB issued a Determination Report on December 16, 2021, which found that the

PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong

because of positions taken by the authorities in those jurisdictions. In addition, the PCAOB’s report identified the specific registered

public accounting firms which are subject to these determinations. On August 26, 2022, the PCAOB signed a Statement of Protocol Agreement

with the CSRC and the Ministry of Finance (the “MOF”) of the PRC governing inspections and investigations of audit firms

based in China or Hong Kong. On December 15, 2022, the PCAOB announced in the 2022 Determination its determination that the PCAOB was

able to secure complete access to inspect and investigate accounting firms headquartered in mainland China and Hong Kong, and the PCAOB

Board voted to vacate previous determinations to the contrary. Should the PCAOB again encounter impediments to inspections and investigations

in mainland China or Hong Kong as a result of positions taken by any authority in either jurisdiction, including by the CSRC or the MOF,

the PCAOB will make determinations under the HFCAA as and when appropriate. Both our current auditor, TAAD LLP, and our former auditor,

Fruci & Associates II, PLLC, are headquartered in the United States and, as PCAOB-registered public accounting firms, they are required

to undergo regular inspections by the PCAOB to assess its compliance with the laws of the U.S. and professional standards. TAAD LLP and

Fruci & Associates II, PLLC have been subject to PCAOB inspections and are not among the PCAOB-registered public accounting firms

headquartered in the PRC or Hong Kong that are subject to PCAOB’s determination of having been unable to inspect or investigate

completely. Notwithstanding the foregoing, if it is later determined that the PCAOB is unable to inspect or investigate our auditor completely,

if there is any regulatory change or step taken by PRC regulators that does not permit our auditor to provide audit documentations located

in China or Hong Kong to the PCAOB for inspection or investigation, or the PCAOB expands the scope of the Determination so that we are

subject to the HFCAA, as the same may be amended, you may be deprived of the benefits of such inspection. Any audit reports not issued

by auditors that are completely inspected or investigated by the PCAOB, or a lack of PCAOB inspections of audit work undertaken in China

that prevents the PCAOB from regularly evaluating our auditors’ audits and their quality control procedures, could result in a

lack of assurance that our financial statements and disclosures are adequate and accurate, which could result in limitation or restriction

to our access to the U.S. capital markets, and trading of our securities, including trading on the national exchange and trading on “over-the-counter”

markets, may be prohibited under the HFCAA and our securities may be delisted by an exchange. See “Risk Factors — Recent

joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign Companies Accountable Act all call for additional

and more stringent criteria to be applied to companies with operations in emerging markets upon assessing the qualification of their

auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments could add uncertainties to our continued

listing or future offerings of our securities in the U.S.”

You

should carefully consider all of the information in this prospectus before making an investment in our securities, especially the risks

and uncertainties discussed under “Risk Factors.” Such risks and uncertainties include, among others, the following:

| ● | There

are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. |

| ● | The

PRC government exerts substantial influence over the manner in which we conduct our business

operations. It may influence or intervene in our operations at any time as part of its efforts

to enforce PRC law, which could result in a material adverse change in our operations and

the value of the securities we are offering. |

| ● | The

approval or record filing of the CSRC, CAC, or other PRC government authorities may be required

in connection with this offering and our future capital raising activities under the PRC

laws. |

| ● | Recent

joint statement by the SEC and the PCAOB, rule changes by Nasdaq, and the Holding Foreign

Companies Accountable Act all call for additional and more stringent criteria to be applied

to companies with operations in emerging markets upon assessing the qualification of their

auditors, especially the non-U.S. auditors who are not inspected by the PCAOB. These developments

could add uncertainties to our continued listing or future offerings of our securities in

the U.S. |

| ● | China’s

Anti-Monopoly Law, M&A rules and certain other PRC laws and regulations also establish

complex procedures for acquisitions conducted by foreign investors that could make it more

difficult for us to grow through acquisitions in China. |

| ● | Our

PRC Subsidiaries are subject to restrictions on paying dividends or making other payments

to us, which may restrict our ability to satisfy our liquidity requirements in the future. |

| | ● | PRC

regulation of loans to and direct investment in PRC entities by offshore holding companies

and governmental control of currency conversion may delay or prevent us from making loans

or additional capital contributions to our PRC Subsidiaries. |

| | ● | We

rely on contractual arrangements with the other shareholders of the VIE to gain effective

control of the VIE, which may not be as effective in providing operational control as direct

ownership, and those shareholders may fail to perform their obligations under the contractual

arrangements. |

Corporate

Information

We

were incorporated in California in July 1995 under the name Probe Manufacturing Industries, Inc. We redomiciled to Nevada in April 2005

under the name Probe Manufacturing, Inc. We manufactured electronics and provided services to original equipment manufacturers (OEMs)

of industrial, automotive, semiconductor, medical, communication, military, and high technology products. On September 11, 2015 Clean

Energy HRS, or “CE HRS”, our wholly owned subsidiary acquired the assets of Heat Recovery Solutions from General Electric

International. In November 2015, we changed our name to Clean Energy Technologies, Inc.

Our Corporate Structure

Sichuan Hongzuo Shuya Energy

Limited, our VIE in the PRC, is a limited liability company established under the PRC law in which we own a 49% equity interest and is

consolidated for accounting purpose only. In July 2022, Jiangsu Huanya Jieneng New Energy Co., Ltd. (“JHJ”), one of our PRC

Subsidiaries, together with three other shareholders, agreed to form Shuya and make total capital contribution of RMB 20 million ($2.81

million), with latest contribution due date in February 2066. At such time, JHJ owned a 20% equity interest in Shuya. In August 2022,

JHJ purchased 100% ownership of Sichuan Shunengwei Energy Technology Limited (“SSET”) for $0, which owns a 29% equity interest

in Shuya. SSET is a holding company and did not have any operations nor make any capital contribution into Shuya as of the ownership

purchase date by JHJ. Following the purchase of SSET, JHJ ultimately owns a 49% equity interest in Shuya. On January 1, 2023 and effective

on the same date, JHJ, SSET and Chengdu Xiangyueheng Enterprise Management Co., Ltd (“Xiangyueheng”), who owns a 10% equity

interest in Shuya, entered into a three-party Concerted Action Agreement (the “CAA”), wherein the parties agreed to vote

in unison at the shareholders’ meeting of Shuya to consolidate the controlling position of the three parties in Shuya. The three

parties agreed that during the term of the CAA, before a party intends to propose motions to the shareholders or the board of directors on major matters related to the voting rights of the shareholders, the three parties will discuss,

negotiate, and coordinate the motion topics for consistency; in the event of disagreement, the opinions of JHJ shall prevail. As a result

of the CAA, JHJ holds 59% of the voting rights in Shuya. The Company determined that Shuya is a VIE because (i) the equity investors

at risk, as a group, lack the characteristics of a controlling financial interest, and (ii) Shuya is structured with disproportionate

voting rights, and substantially all the activities are conducted on behalf of an investor with disproportionately few voting rights.

Under ASC 810, a reporting entity has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity

has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s

economic performance, and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant

to the VIE. The Company concluded JHJ is deemed the primary beneficiary of the VIE. Accordingly, the Company consolidates Shuya into

its consolidated financial statements effective on or after January 1, 2023.

We, therefore,

consolidate Shuya as its primary beneficiary with a controlling financial interest through contractual arrangements, i.e., the CAA.

However, a controlling financial interest through contractual arrangements is not considered as equal to equity interest and this

structure involves unique risks to investors. Contractual arrangements may not be as effective as direct ownership in providing us

with power to direct the activities of the VIE and we may incur substantial costs to enforce the terms of the CAA against other

parties to such agreement. If the other parties breach the terms of the CAA, we may not be able to claim our right to control the

assets of Shuya, and the securities may decline in value. See “Risk Factors – We rely on contractual arrangements

with the other shareholders of the VIE to gain effective control of the VIE, which may not be as effective in providing operational

control as direct ownership, and those shareholders may fail to perform their obligations under the contractual

arrangements” for details.

Investors are purchasing

equity interest in Clean Energy Technologies Inc., a Nevada corporation which owns, indirectly, 49% equity interest in Shuya, and are

not purchasing, and may never directly or indirectly hold, any of the remaining 51% equity interest in Shuya. As used in this

prospectus, “we,” “us,” or “our” refers to Clean Energy Technologies Inc. and its wholly-owned subsidiaries

and does not include Shuya and its subsidiaries.

The

Securities We May Offer

We

may offer shares of our common stock, various series of warrants to purchase any of such securities and units consisting

of two or more of these securities, up to a total aggregate offering price of $75,000,000 from time to time in one or more offerings

under this prospectus, together with any applicable prospectus supplement and any related free writing prospectus, at prices and on terms

to be determined by market conditions at the time of the relevant offering. This prospectus provides you with a general description of

the securities we may offer. Each time we offer a type or series of securities under this prospectus, we will provide a prospectus supplement

that will describe the specific amounts, prices and other important terms of the securities, including, to the extent applicable:

| ● | designation

or classification; |

| ● | aggregate

principal amount or aggregate offering price; |

| ● | maturity,

if applicable; |

| ● | original

issue discount, if any; |

| ● | rates

and times of payment of interest or dividends, if any; |

| ● | redemption,

conversion, exchange or sinking fund terms, if any; |

| ● | conversion

or exchange prices or rates, if any, and, if applicable, any provisions for changes to or

adjustments in the conversion or exchange prices or rates and in the securities or other

property receivable upon conversion or exchange; |

| ● | ranking,

if applicable; |

| ● | restrictive

covenants, if any; |

| ● | voting

or other rights, if any; and |

| ● | important

U.S. federal income tax considerations. |

The

prospectus supplement and any related free writing prospectus that we may authorize to be provided to you may also add, update or change

information contained in this prospectus or in documents we have incorporated by reference. However, no prospectus supplement or free

writing prospectus will offer a security that is not registered and described in this prospectus at the time of the effectiveness of

the registration statement of which this prospectus is a part.

This

prospectus may not be used to consummate a sale of securities unless it is accompanied by a prospectus supplement.

We

may sell the securities directly to investors or through underwriters, dealers or agents. We, and our underwriters or agents, reserve

the right to accept or reject all or part of any proposed purchase of securities. If we do offer securities through underwriters or agents,

we will include in the applicable prospectus supplement:

| ● | the

names of those underwriters or agents; |

| ● | applicable

fees, discounts and commissions to be paid to them; |

| ● | details

regarding options to purchase additional securities, if any; and |

| ● | the

estimated net proceeds to us. |

Common

Stock. We may issue shares of our common stock from time to time. Holders of our common stock are entitled to one vote per share

for the election of directors and on all other matters that require stockholder approval. In the event of our liquidation, dissolution

or winding up, holders of our common stock are entitled to share ratably in the assets remaining after payment of liabilities. Our common

stock does not carry any preemptive rights enabling a holder to subscribe for, or receive shares of, our common stock or any other securities

convertible into shares of common stock, or any redemption rights.

Warrants.

We may issue warrants for the purchase of common stock. We may issue warrants

independently or together with common stock, and the warrants may be attached to or separate from these securities. In this prospectus,

we have summarized certain general features of the warrants. We urge you, however, to read the applicable prospectus supplement (and any

free writing prospectus that we may authorize to be provided to you) related to the particular series of warrants being offered, as well

as the complete warrant agreements and warrant certificates that contain the terms of the warrants. Forms of the warrant agreements and

forms of warrant certificates containing the terms of the warrants being offered have been filed as exhibits to the registration statement

of which this prospectus is a part, and supplemental warrant agreements and forms of warrant certificates will be filed as exhibits to

the registration statement of which this prospectus is a part or will be incorporated by reference from reports that we file with the

SEC.

We

will evidence each series of warrants by warrant certificates that we will issue. Warrants may be issued under an applicable warrant

agreement that we enter into with a warrant agent. We will indicate the name and address of the warrant agent, if applicable, in the

prospectus supplement relating to the particular series of warrants being offered.

Units.

We may offer units consisting of two or more of the securities described above, in any combination, including common stock and/or

warrants in one or more series. The terms of these units will be set forth in a prospectus supplement. The description of

the terms of these units in the related prospectus supplement will not be complete. You should refer to the applicable form of unit and

unit agreement for complete information with respect to these units.

Dividend

Policy and Cash Transfers within Our Organization

As

of the date of this prospectus, we have never declared or paid any cash dividends on our common stock. We do not anticipate declaring

or paying, in the foreseeable future, any cash dividends on our capital stock. We intend to retain all available funds and future earnings,

if any, to fund the development and expansion of our business. Any future determination regarding the declaration and payment of dividends,

if any, will be at the discretion of our board of directors and will depend on then-existing conditions, including our financial condition,

operating results, contractual restrictions, capital requirements, business prospects and other factors our board of directors may deem

relevant. We are obligated to pay dividends to certain holders of our preferred stock which we pay out of legally available funds from

time to time or reach arrangements with our holders of preferred stock to convert limited quantities of preferred stock at favorable

conversion prices in lieu of dividend payments.

Cash

may be transferred within our organization in the following manners: (i) Clean Energy Technologies Inc. may transfer funds to the

PRC Subsidiaries and the VIE by way of capital contributions or loans, through intermediate holding subsidiaries or otherwise, (ii)

the PRC Subsidiaries may make dividends or other distributions to Clean Energy Technologies Inc. through intermediate holding

companies or otherwise, and (iii) the VIE may make dividends or other distributions to Clean Energy Technologies Inc., which

indirectly owns 49% equity interest in the VIE, through intermediate holding companies or otherwise. Our abilities to use cash held

in PRC or in a PRC entity through transfers, distributions, or dividends to fund operations or for other purposes outside of the PRC

are subject to restrictions and limitations imposed by the PRC government. Current PRC regulations only permit a WFOE to pay

dividends to its offshore parent company out of their retained earnings, if any, determined in accordance with Chinese accounting

standards and regulations. In addition, the majority of the revenues of our PRC Subsidiaries and the VIE are collected in RMB. Thus,

foreign exchange shortages and foreign exchange control may also limit their ability to pay dividends or make other payments or

otherwise meet our obligations denominated in foreign currencies. Furthermore, we may lose our ability to fund operations or for

other uses outside of Hong Kong using cash in Hong Kong or a Hong Kong entity if, in the future, the scope of the current

restrictions and limitations applicable to PRC entities were to expand to include Hong Kong or entities based in Hong Kong.

Therefore, our ability to transfer cash between PRC entities and entities outside of PRC may be restricted. As of the date of

this prospectus, no cash or other assets have been transferred across border between Clean Energy Technologies Inc. as well as its

domestic subsidiaries, and the PRC Subsidiaries, and there are no plans to initiate any such transfers of cash or other assets in

the near future. See “Risk Factors – Our PRC Subsidiary are subject to restrictions on paying dividends or making

other payments to us, which may restrict our ability to satisfy our liquidity requirements in the future” and

“Risk Factors – PRC regulation of loans to and direct investment in PRC entities by offshore holding companies and

governmental control of currency conversion may delay or prevent us from making loans or additional capital contributions to our PRC

Subsidiaries” for details.

As of the date of this prospectus, (i) we have transferred $2,671,700 in

total to our PRC Subsidiaries, and (ii) JHJ, our wholly-owned subsidiary in the PRC, has transferred $701,836 in total to Shuya, our VIE

in the PRC, as a capital contribution for the formation of Shuya. No other cash flows or transfers of other assets have occurred between

us, our PRC Subsidiaries, and Shuya. As of the date of this prospectus, neither any of our PRC Subsidiaries nor Shuya has declared any

dividends or made any other distributions to the Company, and no such dividends or distributions are anticipated in the near future.

Regulatory

Permissions and Licenses for Our Operations in China and This Offering

Our

operations in China are governed by PRC laws and regulations. Our PRC Subsidiaries and the VIE are required to obtain certain licenses,

permits and approvals from relevant governmental authorities in China in order to operate the business and conduct this offering. As

of the date of this prospectus, we believe our PRC Subsidiaries and the VIE have obtained all of the licenses, permits and registrations

from the PRC government authorities necessary for our business operations in China. Given the uncertainties of interpretation and implementation

of relevant laws and regulations and the enforcement practice by relevant government authorities, and the promulgation of new laws and

regulations and amendment to the existing ones, we may be required to obtain additional licenses, permits, registrations, filings or

approvals for our business operations in the future. We cannot assure you that our PRC Subsidiaries and the VIE will be able to obtain,

in a timely manner or at all, or maintain such licenses, permits or approvals, and we may also inadvertently conclude that such permissions

or approvals are not required. Any lack of or failure to maintain requisite approvals, licenses or permits applicable to us or the affiliated

entities may have a material adverse impact on our business, results of operations, financial condition and prospects and cause the value

of any securities we offer to significantly decline or, in extreme cases, become worthless.

In

addition, recent statements by the Chinese government have indicated an intent to exert more oversight and control over offerings

that are conducted overseas and/or foreign investments in PRC based issuers. See “Risk Factors – The approval or

record filing of the CSRC, CAC, or other PRC government authorities may be required in connection with this offering and our future

capital raising activities under the PRC laws” for details. We have been closely monitoring regulatory developments in PRC

regarding any necessary approvals from the CSRC or other PRC governmental authorities required for overseas listings, including this

offering. As of the date of this prospectus, we do not believe either Clean Energy Technologies, Inc., the PRC Subsidiaries or the

VIE is covered by permission requirements from CSRC, CAC or any other PRC governmental agency with respect to this offering, and we

have not received any inquiry, notice, warning, sanctions or regulatory objection to this offering from the CSRC, CAC, or other PRC

governmental authorities.

VIE Consolidation Schedule

The following table sets forth

the summary consolidated balance sheets data as of September 30, 2023 (unaudited) and the summary condensed consolidated statements of

operations and cash flows for the nine months ended September 30, 2023 (unaudited), of (i) the parent company, Clean Energy Technologies,

Inc.; (ii) the VIE, Sichuan Hongzuo Shuya Energy Limited; (iii) our Chinese subsidiaries, which include Clean Energy Technologies (H.K.)

Limited, Meishan Clean Energy Technologies Co., Ltd., Hainan Clean Energy Technologies, Inc., Element Capital International Limited,

Sichuan Huanya Jieneng New Energy Co., Ltd., and Jiangsu Huanya Jieneng New Energy Co., Ltd.; and (iv) our other subsidiaries, including

Clean Energy HRS LLC, CETY Europe SRL, CETY Capital LLC, and Leading Wave Limited. Consolidated financial statements are prepared and

presented in accordance with accounting principles generally accepted in the United States, or U.S. GAAP.

Consolidated

Balance Sheets Schedule

| | |

As of September 30, 2023 (unaudited) | |

| | |

Parent | | |

VIE and

its Consolidated Subsidiary | | |

Subsidiaries

Other Than Chinese Subsidiaries | | |

Chinese

Subsidiaries | | |

Elimination | | |

Consolidated

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current assets: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash | |

| 64,797 | | |

| 157,746 | | |

| 12,405 | | |

| 28,865 | | |

| | | |

| 263,814 | |

| Accounts receivable | |

| (11,913 | ) | |

| 92,267 | | |

| 1,051,325 | | |

| - | | |

| - | | |

| 1,131,679 | |

| Deferred offering costs | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |

| Prepaid expenses and other current assets | |

| 948,531 | | |

| 1,311,221 | | |

| 823,534 | | |

| 3,055,569 | | |

| (130,245 | ) | |

| 6,008,610 | |

| Total current assets | |

| 1,001,415 | | |

| 1,561,235 | | |

| 1,887,265 | | |

| 3,084,434 | | |

| (130,245 | ) | |

| 7,404,103 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 9,917 | | |

| 33,583 | | |

| 1 | | |

| - | | |

| - | | |

| 43,500 | |

| Right-of-use assets | |

| 28,611 | | |

| 221,037 | | |

| - | | |

| - | | |

| - | | |

| 249,648 | |

| Investment in VIE | |

| 1,468,709 | | |

| 12,925 | | |

| - | | |

| 530,727 | | |

| (530,727 | ) | |

| 1,481,634 | |

| Investment in subsidiaries | |

| 747,976 | | |

| - | | |

| 1,168,640 | | |

| - | | |

| - | | |

| 1,916,616 | |

| Total non-current assets | |

| 2,255,213 | | |

| 267,544 | | |

| 1,168,642 | | |

| 530,727 | | |

| (530,727 | ) | |

| 3,691,398 | |

| TOTAL ASSETS | |

| 3,256,628 | | |

| 1,828,779 | | |

| 3,055,906 | | |

| 3,615,160 | | |

| (660,972 | ) | |

| 11,095,502 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Short-term borrowings | |

| 3,110,442 | | |

| - | | |

| 648,368 | | |

| - | | |

| - | | |

| 3,758,810 | |

| Accounts payable | |

| (2,574,559 | ) | |

| 13,711 | | |

| 278,115 | | |

| 2,671,700 | | |

| (101,853 | ) | |

| 368,402 | |

| Deferred revenue | |

| - | | |

| - | | |

| 33,000 | | |

| - | | |

| - | | |

| 33,000 | |

| Income tax payable | |

| - | | |

| 3,771 | | |

| 26,583 | | |

| 553 | | |

| - | | |

| 30,907 | |

| Lease liabilities-current | |

| 43,725 | | |

| 225,357 | | |

| - | | |

| - | | |

| - | | |

| 269,081 | |

| Accrued expenses and other current liabilities | |

| 44,591 | | |

| 188,800 | | |

| 343,062 | | |

| 700,496 | | |

| (109,080 | ) | |

| 1,167,869 | |

| Total current liabilities | |

| 624,199 | | |

| 431,638 | | |

| 1,329,128 | | |

| 3,372,750 | | |

| (210,933 | ) | |

| 5,628,070 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Long-Term liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Lease liabilities-Long Term | |

| - | | |

| 78,381 | | |

| - | | |

| - | | |

| - | | |

| 78,381 | |

| Total Long-Term liabilities | |

| - | | |

| 78,381 | | |

| - | | |

| - | | |

| - | | |

| 78,381 | |

| TOTAL LIABILITIES | |

| 624,199 | | |

| 510,019 | | |

| 1,329,128 | | |

| 3,372,750 | | |

| (210,933 | ) | |

| 5,706,451 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| SHAREHOLDERS’ (DEFICIT)/EQUITY | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ordinary Shares | |

| 38,969 | | |

| - | | |

| - | | |

| - | | |

| - | | |

| 38,969 | |

| Additional paid-in capital | |

| 24,680,198 | | |

| 549,746 | | |

| - | | |

| 70,000 | | |

| (549,746 | ) | |

| 24,750,198 | |

| Share subscription receivable | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | |