Form 8-K - Current report

January 24 2024 - 4:05PM

Edgar (US Regulatory)

false

0001460602

0001460602

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 18, 2024

ORGENESIS

INC.

(Exact

name of registrant as specified in its charter)

| Nevada

|

|

001-38416

|

|

98-0583166

|

(State or other jurisdiction

|

|

(Commission

File |

|

(IRS

Employer |

| of

incorporation |

|

Number)

|

|

Identification

No.) |

20271

Goldenrod Lane, Germantown, MD 20876

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (480) 659-6404

Not

Applicable

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

ORGS

|

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b -2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

Term

Sheet for the Acquisition of MM OS Holdings, L.P. Interests in Octomera LLC

On

January 18, 2024, Orgenesis Inc. (the “Company”) entered into a binding Term Sheet with MM OS Holdings L.P. (the “Seller”),

an affiliate of Metalmark Capital Partners, for the acquisition by the Company from the Seller of 3,670,324 Class A Preferred Units of

the Company’s subsidiary Octomera LLC (“Octomera”), which constitute all of the equity interests of Octomera that are

owned by the Seller (the “Acquisition”). In consideration for such Acquisition, the Seller and the Company shall agree to

the following consideration (the “Consideration”):

| |

(1) |

Monitoring

Agreement: The advisory services and monitoring agreement between Octomera and Metalmark Management II LLC shall be terminated

as of the closing of the Acquisition (the “Closing”), and all unpaid amounts as of the Closing shall be deemed cancelled. |

| |

(2) |

Seller

Loans: The outstanding loans payable from Orgenesis Maryland LLC to Seller shall be amended and extended in a mutually agreeable

manner to reflect a maturity of 10 years from the Closing, with extensions as mutually agreed and the maturity to be accelerated

upon a change of control of Octomera or the Company. |

| |

(3) |

Royalty:

5% of Net Revenue of the Business of Octomera excluding revenues of Orgenesis Gmbh and Tissue Genesis International LLC (“Excluded

Assets”) for a period of four years from the Closing (as defined in the original agreements). At the option of the Company,

at any point during such four year period, the Company may buy out the remaining royalty stream for $40 million of consideration

consisting of cash and/or equity in a ratio determined by the Company. |

| |

(4) |

Milestone:

If the Company sells Octomera within five years from the date of the Closing at a price that is more than $40 million excluding consideration

for Excluded Assets, the Company shall pay the Seller 5% of the net proceeds. If there is a change of control of the Company within

five years from Closing, and the portion of the purchase price allocable to Octomera excluding consideration for Excluded Assets

is more than $40 million, the Company shall pay the Seller 5% of the net proceeds allocable to Octomera. The allocation of purchase

price for purposes of this milestone payment shall be done in good faith by the Company and subject to standard dispute resolutions

between the parties. |

| |

(5) |

Ownership

Claims. Seller will settle all outstanding ownership claims of Octomera (e.g. Octomera options granted to any services providers),

such that at Closing, the entire equity and ownership interests of Octomera will belong to the Company. |

The

Seller members of the Board of Managers of Octomera shall resign after execution of the Term Sheet (and in any event, prior to Closing)

and the Octomera LLC operating agreement shall be revised and amended to provide for a single member LLC.

Upon

execution of the Term Sheet, the parties agreed to promptly negotiate, in good faith, the terms of definitive agreements in connection

with such Term Sheet in order to consummate the Acquisition.

Upon

Closing, Octomera shall assume and, within 90 days of Closing, pay Seller’s reasonable legal expenses associated with the transaction

contemplated by the Term Sheet, up to a cap of $300,000.

The

foregoing summary of the Term Sheet does not purport to be complete and is subject to, and qualified in its entirety by, such document

attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ORGENESIS

INC. |

| |

|

| Date:

January 24, 2024 |

By:

|

/s/

Victor Miller |

| |

|

Victor

Miller |

| |

|

Chief

Financial Officer, Treasurer and |

| |

|

Secretary

|

Exhibit

10.1

NON-BINDING

TERM SHEET

for

the

ACQUISITION

OF MM OS HOLDINGS L.P. INTERESTS IN

OCTOMERA

LLC

January

18, 2024

| Seller |

MM

OS Holdings L.P. (the “Seller”) |

| |

|

| Purchaser |

Orgenesis

Inc. (the “Purchaser”) |

| |

|

| Target

Companies |

Octomera

LLC and its Subsidiaries (the “Target”, and together with the Purchaser and the Seller, the “Parties”) |

| |

|

| Consideration

|

As

consideration for the acquisition by the Purchaser from the Seller of 3,670,324 Class A Preferred units of the Target which constitute

all of the equity interests of the Target that are owned by the Seller (the “Acquisition”), the Purchaser shall

agree to the following consideration (the “Consideration”): |

| |

(1) |

Monitoring Agreement: The advisory services and monitoring agreement between Target and Metalmark Management II LLC shall be terminated as of the Closing, and all unpaid amounts as of the closing shall be deemed cancelled. |

| |

(2) |

Seller Loans: The outstanding loans payable from Orgenesis Maryland to Seller shall be amended and extended in a mutually agreeable manner to reflect a maturity of 10 years from the Closing, with extensions as mutually agreed and the maturity to be accelerated upon a change of control of Target or Purchaser. |

| |

(3) |

Royalty: 5% of Net Revenue of the Business excluding revenues of Orgenesis Gmbh and Tissue Genesis International LLC (“Excluded Assets”) for a period of 4 years from Closing (as defined in the original agreements). At the option of the Purchaser, at any point during such 4 year period, the Purchaser may buy out the remaining royalty stream for $40 million of consideration consisting of cash and/or equity in a ratio determined by the Purchaser. |

| |

(4) |

Milestone: If the Purchaser sells the Target within 5 years from the date of the closing at a price that is more than $40 million excluding consideration for Excluded Assets, the Purchaser shall pay the Seller 5% of the net proceeds. |

| |

|

a. |

If there is a change of control of Purchaser within 5 years from Closing, and the portion of the purchase price allocable to Target excluding consideration for Excluded Assets is more than $40 million, the Purchaser shall pay the Seller 5% of the net proceeds allocable to Target. The allocation of purchase price for purposes of this milestone payment shall be done in good faith by the Purchaser and subject to standard dispute resolutions between the parties. |

| |

(5) |

Seller will settle all

outstanding ownership claims of Target (e.g. Target options granted to any services providers, such that at Closing, the entire equity

and ownership interests of Target will belong to Purchaser. |

| Conditions

Precedent |

The

following will be conditions precedent to the closing of the transaction (the “Closing”), which the parties contemplate

occurring on January 18th, 2024:

|

| |

|

(1) The parties shall have

executed all required Definitive Agreements.

(2) The Board of Directors

of Orgenesis shall have approved the Acquisition.

(3) There will be no

significant impairment of Target’s business operations between the date of this term sheet and Closing.

|

| Post-Closing

Operations |

The

Definitive Agreements shall include customary covenants of Purchaser concerning: i) Any restructuring by Purchaser resulting in a

reduction in the value of the Seller’s economic interest. For clarity, cost restructuring is not prohibited., and ii) all business

associated with Target will be conducted in all material respects by Target (meaning that Purchaser will not have related operations

to the Target in subsidiaries outside of Target post-closing), unless deemed necessary at Purchaser’s sole discretion for the

successful operating of Target. Purchaser shall otherwise fully control and be responsible for all operations of Target post-Closing,

and shall timely pay payroll obligations of Orgenesis Maryland LLC at January month end. For the avoidance of doubt, Purchaser understands

that, from and after the date of this Term Sheet, Seller does not expect to extend additional funding or financing to Octomera. |

| |

|

| Security |

Seller

shall relinquish all security encumbrances against Purchaser, Target and any other affiliates of either entity. |

| |

|

| Board

of Octomera |

The

Seller members of the Board of Managers of the Target shall resign after execution of this Term Sheet (and in any event, prior to

Closing) and the operating agreement shall be revised to provide for a single member LLC. |

| |

|

| Definitive

Agreements |

Upon

execution of this Term Sheet, the Parties shall promptly negotiate, in good faith, the terms of definitive agreements in connection

herewith in order to consummate the Acquisition (the “Definitive Agreements”). The Definitive Agreements will

be in a form customary for transaction of this type. The parties will cooperate in providing each other with all documentation to

complete the diligence in a timely manner. For the avoidance of doubt, all Seller preferences and controls will be cancelled. |

| |

|

| Fees

& Expenses |

Each

of the Parties shall bear its own expenses in connection with this Term Sheet and the negotiation of the Definitive Agreements in

the event the Closing does not occur. Upon Closing, Target shall assume and, within 90 days of Closing, pay Seller’s legal

expenses (to Davis Polk & Wardwell) associated with the transaction contemplated by this term sheet, up to a cap of $300,000.

Notwithstanding anything to the contrary, Target will not bear any of the Fees and Expenses related to the Blair fundraising unless

mutually agreed upon by the Parties. |

| |

|

| Confidentiality;

Publicity |

Each

Party hereto acknowledges and confirms that this Term Sheet and all terms hereof are confidential and, subject to applicable law,

that neither its existence nor the terms hereof will be disclosed to any other person other than Parties’ officers, directors,

employees and advisors. Any public announcement relating to the Acquisition shall be agreed upon by the Parties in advance and in

writing. |

| |

|

Notices

|

All

notices and other communications hereunder shall be in writing and shall be furnished to the other Parties hereto by hand delivery

or registered or certified mail or electronic transmission (e-mail) at the respective addresses of the Parties as set forth on the

signature page hereof. Any such notice shall be considered to have been delivered to the other Parties: (i) if delivered by hand

or electronic transmission, when actually delivered; or (ii) 7 (seven) days after being mailed by certified or registered mail. |

| |

|

| Governing

Law |

This

Term Sheet shall be governed by the laws of the State of New York. |

| |

|

| Taxes |

Seller

shall bear all the tax liabilities relating to its holdings of Target including but not limited to its share of partnership taxes

from 2022. |

| |

|

| Severability |

If

any term, provision, covenant or restriction contained in this Term Sheet is held by a court of competent jurisdiction to be invalid,

void or unenforceable, the remainder of the terms, provisions, covenants and restrictions contained in this Term Sheet shall remain

in full force and effect and shall in no way be affected, impaired or invalidated. |

| |

|

| Counterparts |

This

Term Sheet may be executed in any number of counterparts, and by facsimile or scanned signature, each of which when executed and

delivered shall constitute an original of this Term Sheet, but all the counterparts shall together constitute the same Term Sheet.

No counterpart shall be effective until each party has executed at least one counterpart. |

| |

|

| Term

and Termination |

This

Term Sheet shall expire at end of the day January 16th. |

[Signature

page follows]

[Signature

Page to Term Sheet for Asset Purchase and Investment]

The

authorized representatives of the Parties have signed this non-binding Term Sheet as of January 15, 2024.

| Orgenesis Inc. |

|

MM OS Holdings L.P. |

| |

|

|

|

|

| by: |

|

|

by: |

|

| name: |

|

|

name: |

|

| title: |

|

|

title: |

|

Acknowledged

and Agreed

| Octomera LLC |

|

| |

|

|

| by: |

|

|

| name: |

|

|

| title: |

|

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

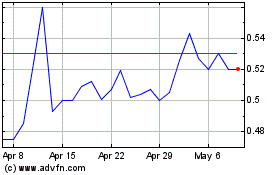

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Orgenesis (NASDAQ:ORGS)

Historical Stock Chart

From Apr 2023 to Apr 2024