false0001294133Inogen Inc00012941332024-01-212024-01-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 21, 2024 |

INOGEN, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36309 |

33-0989359 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

859 Ward Drive |

|

Goleta, California |

|

93111 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (805) 562-0500 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

INGN |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Chief Financial Officer

On January 21, 2024, the Board of Directors (“Board”) of Inogen, Inc. (the “Company”) appointed Michael Bourque to serve as Executive Vice President, Chief Financial Officer and Treasurer (“CFO”) of the Company, effective March 4, 2024.

Most recently, Mr. Bourque, 60, served as Chief Financial Officer and Treasurer of Chase Corporation (NYSE: CCF) since February 2021. He also served as Chief Financial Officer of Keystone Dental, Senior Vice President, Chief Financial Officer and Treasurer of Analogic Corporation from 2014 to 2018 and as Vice President of Finance for Axcelis Technologies from 2011 to 2014. Bourque received a bachelor’s degree in accounting from Bentley University.

On January 21, 2024, the Board, upon the recommendation of the Compensation Committee of the Board, approved, and the Company entered into, an employment and severance agreement with Mr. Bourque (the “employment agreement”), effective March 4, 2024 (the “Effective Date”). Mr. Bourque’s employment under the employment agreement will begin on the Effective Date and is at will and may be terminated at any time by the Company or by Mr. Bourque. Pursuant to the employment agreement, Mr. Bourque will receive an annual base salary of $425,000 and a target annual performance bonus opportunity of sixty percent (60%) of his annual base salary. The employment agreement also provides for a cash sign-on bonus of $100,000, which is repayable on a pro-rata basis if, prior to the second anniversary of the Effective Date, Mr. Bourque’s employment is terminated by the Company for cause or Mr. Bourque resigns without good reason (in each case as defined in the employment agreement).

The employment agreement also provides for equity awards of restricted stock units covering an aggregate of 150,000 shares of the Company’s common stock, comprised of (i) 75,000 time-based restricted stock units (“RSUs”) and (ii) 75,000 performance-based restricted stock units (“PSUs”); provided, overachievement of the performance goals may result in Mr. Bourque receiving up to a maximum of 150,000 PSUs. Subject to Mr. Bourque’s continued service with the Company, one-third of the RSUs will vest annually over three years. Subject to Mr. Bourque’s continued service with the Company, the PSUs will vest based on the Company’s achievement of specified performance goals for each of 2024 and 2025.

The RSUs and PSUs will be granted on the Effective Date and are each subject to the terms and conditions of the applicable award agreements. The RSUs and PSUs will be granted as independent inducement awards outside of the terms of the Company’s existing equity incentive plans in compliance with an exemption from NASDAQ’s shareholder approval requirements under NASDAQ Stock Market Rule 5635(c)(4).

The employment agreement also provides that beginning in March 2025 and for each year thereafter in which Mr. Bourque serves as the Company’s CFO, he will be eligible for annual Company equity awards, on the same terms and conditions as the annual equity awards made to the Company’s similarly situated executives and as approved by the Board or the Compensation Committee.

Mr. Bourque’s employment agreement also provides that if, outside of the period beginning on the date 3 months before, and ending on the date 12 months following, a change of control (as defined in the employment agreement) (such period, the “change of control period”), his employment with the Company is terminated by the Company without cause (excluding by reason of death or disability) or he resigns for good reason, he will be eligible to receive the following severance benefits:

•continued payment of his base salary for a period of 12 months following his termination date; and

•for the period of time permitted under the Consolidated Omnibus Budget Reconciliation Act of 1986 following his termination date, he and his eligible dependents will only be required to pay the portion of the costs of medical benefits as he was required to pay as of the date of his termination, or he will receive taxable monthly payments for the equivalent period in the event the Company determines that the COBRA subsidy could violate applicable law (the “COBRA Benefits”).

The employment agreement further provides that if, during the change of control period, Mr. Bourque’s employment with the Company is terminated by the Company without cause (excluding by reason of death or disability) or he resigns for good reason, he will be eligible to receive the same severance benefits described above, except that he will receive continued payment of his base salary for a period of 24 months following his termination date.

Mr. Bourque’s receipt of the severance benefits described above is conditioned on his timely signing and not revoking a release of claims, resigning all directorships, committee memberships or any other positions he holds with the Company, and continuing to comply with certain covenants in the employment agreement and in his at-will employment, confidential information, invention assignment, and arbitration agreement with the Company.

If any of the payments provided for under the employment agreement or otherwise payable to Mr. Bourque would constitute “parachute payments” within the meaning of Section 280G of the Internal Revenue Code and would be subject to the related excise tax under Section 4999 of the Internal Revenue Code, then he will be entitled to receive either full payment of benefits or such lesser amount that would result in no portion of the benefits being subject to the excise tax, whichever results in the greater amount of after-tax benefits to him.

The summary of Mr. Bourque’s employment and severance agreement set forth above does not purport to be complete and is qualified in its entirety by reference to the full text of the employment and severance agreement, which is filed with this Current Report on Form 8-K as Exhibit 10.1 and incorporated by reference herein.

In addition, Inogen has entered into its standard form of indemnification agreement with Mr. Bourque. The form indemnification agreement was filed with the Securities and Exchange Commission on November 27, 2013 as Exhibit 10.1 to the Company’s Registration Statement on Form S-1 and is incorporated herein by reference. Mr. Bourque has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K promulgated under the Securities Exchange Act of 1934, as amended, nor are any such transactions currently proposed. There is no arrangement or understanding between Mr. Bourque or any other person pursuant to which Mr. Bourque was selected as an officer. There are no family relationships between Mr. Bourque and any of the Company’s directors or executive officers.

Interim CFO Transition

As a result of the engagement of Mr. Bourque, effective March 4, 2024, Michael Sergesketter, the Company’s interim Executive Vice President, Chief Financial Officer and Treasurer, will no longer be consider an executive officer of the Company or hold the position of Executive Vice President, Chief Financial Officer and Treasurer, but will remain employed with the Company pursuant to his employment contract to assist with the transition of his duties.

Item 7.01. Regulation FD Disclosure.

On January 24, 2024, the Company issued a press release announcing the appointment and transition described in this Current Report on Form 8-K. A copy of the press release is furnished herewith as Exhibit 99.1.

The information set forth under this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

INOGEN, INC. |

|

|

|

|

Date: |

January 24, 2024 |

By: |

/s/ Michael Sergesketter |

|

|

|

Michael Sergesketter

Interim Chief Financial Officer

(Principal Accounting and Financial Officer) |

Exhibit 10.1

INOGEN, INC.

EMPLOYMENT AND SEVERANCE AGREEMENT

This EMPLOYMENT AND SEVERANCE AGREEMENT (this “Agreement”) is made and effective as of March 4, 2024 (the “Effective Date”), by and between Inogen, Inc., a Delaware corporation (the “Company”), and Michael Joseph Bourque (the “Executive”).

WITNESSETH:

WHEREAS, the Company desires to enter into this Agreement embodying the terms of Executive’s employment from and after the Effective Date and Executive desires to enter into this Agreement, and to provide the terms of severance benefits that may be payable upon certain qualifying employment termination events, subject to the terms and conditions set forth below.

NOW, THEREFORE, in consideration of the promises and mutual covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are mutually acknowledged, the Company and Executive hereby agree as follows:

Section 1. Definitions.

(a) “Accrued Obligations” shall mean (i) all accrued but unpaid Base Salary through the date of termination of Executive’s employment, (ii) any unpaid or unreimbursed expenses incurred in accordance with Section 7 below, (iii) any benefits provided under the Company’s employee benefit plans, subject to the terms hereof, and (iv) any benefits under policies, if any, upon a termination of employment, in accordance with the terms contained therein, including, without limitation, rights with respect to accrued but unused vacation.

(b) “Annual Bonus” shall have the meaning set forth in Section 4(b) below.

(c) “Base Salary” shall mean the salary provided for in Section 4(a) below, subject to any modification by the Company, under Section 4(a).

(d) “Board” shall mean the Board of Directors of the Company.

(e) “Cause” shall mean (i) Executive’s conviction of any crime (A) constituting a felony or (B) that has, or could reasonably be expected to result in, an adverse impact on the performance of Executive’s duties to the Company, or otherwise has, or could reasonably be expected to result in, an adverse impact to the business or reputation of the Company; (ii) conduct of Executive, in connection with Executive’s employment, that has, or could reasonably be expected to result in, material injury to the business or reputation of the Company, including, without limitation, act(s) of fraud, embezzlement, misappropriation and breach of fiduciary duty; (iii) any material violation of the operating and ethics policies of the Company, including, but not limited to those relating to sexual harassment and the disclosure or misuse of confidential information; (iv) willful neglect in the performance of Executive’s duties or willful or repeated failure or refusal to perform such duties; or (v) Executive’s breach of any material provision of this Agreement, including, without limitation, any provision of Section 8 or any breach of the Confidentiality Agreement (as defined below).

(f) “Change of Control” shall mean the occurrence of any of the following events:

(i) A change in the ownership of the Company which occurs on the date that any one Person, or more than one Person acting as a group, acquires ownership of the stock of the Company that, together with the stock held by such Person, constitutes more than fifty percent (50%) of the total voting power of the stock of the Company; provided, however, that for purposes of this subsection (i), the acquisition of additional stock by any one Person, who is considered to own more than fifty percent (50%) of the total voting power of the stock of the Company will not be considered a Change of Control; or

(ii) A change in the effective control of the Company which occurs on the date that a majority of members of the Board is replaced during any twelve (12) month period by members of our Board whose appointment or election is not endorsed by a majority of the members of the Board prior to the date of the appointment or election. For purposes of this clause (ii), if any Person is considered to be in effective control of the Company, the acquisition of additional control of the Company by the same Person will not be considered a Change of Control; or

(iii) A change in the ownership of a substantial portion of the Company’s assets which occurs on the date that any Person acquires (or has acquired during the twelve (12) month period ending on the date of the most recent acquisition by such person or persons) assets from the Company that have a total gross fair market value equal to or more than 50% of the total gross fair market value

of all of the assets of the Company immediately prior to such acquisition or acquisitions; provided, however, that for purposes of this subsection (iii), the following will not constitute a change in the ownership of a substantial portion of the Company’s assets: (A) a transfer to an entity that is controlled by the Company’s stockholders immediately after the transfer, or (B) a transfer of assets by the Company to: (1) a stockholder of the Company (immediately before the asset transfer) in exchange for or with respect to the Company’s stock, (2) an entity, 50% or more of the total value or voting power of which is owned, directly or indirectly, by the Company, (3) a Person, that owns, directly or indirectly, 50% or more of the total value or voting power of all the outstanding stock of the Company, or (4) an entity, at least 50% of the total value or voting power of which is owned, directly or indirectly, by a Person described in subsection (iii)(B)(3). For purposes of this subsection (iii), gross fair market value means the value of the assets of the Company, or the value of the assets being disposed of, determined without regard to any liabilities associated with such assets.

For purposes of this definition, Persons will be considered to be acting as a group if they are owners of a corporation that enters into a merger, consolidation, purchase or acquisition of stock, or similar business transaction with the Company.

Notwithstanding the foregoing, a transaction will not be deemed a Change of Control unless the transaction qualifies as a change in control event within the meaning of Code Section 409A, as it has been and may be amended from time to time, and any proposed or final Treasury Regulations and Internal Revenue Service guidance that has been promulgated or may be promulgated thereunder from time to time.

Further and for the avoidance of doubt, a transaction will not constitute a Change of Control if: (i) its sole purpose is to change the state of the Company’s incorporation, or (ii) its sole purpose is to create a holding company that will be owned in substantially the same proportions by the persons who held the Company’s securities immediately before such transaction.

(g) “Change of Control Period” shall mean, the period beginning on the date three (3) months prior to, and ending on the date twelve (12) months following, a Change of Control.

(h) “Change of Control Severance Term” shall mean a twenty-four (24) month period following Executive’s termination by the Company without Cause (other than by reason of death or Disability) or by Executive for Good Reason, provided such termination occurred within the Change of Control Period, and subject to Sections 8(h) and 12 below.

(i) “Code” shall mean the Internal Revenue Code of 1986, as amended.

(j) “Company” shall have the meaning set forth in the preamble hereto.

(k) “Confidential Information” shall have the meaning set forth in the At-Will Employment, Confidential Information, Invention Assignment, and Arbitration Agreement between Executive and the Company (the “Confidentiality Agreement”), signed prior to or concurrently herewith.

(l) “Confidentiality Agreement” shall have the meaning set forth under subsection (k) above.

(m) “Disability” shall mean any physical or mental disability or infirmity that prevents the performance (with or without reasonable accommodation) of Executive’s performance of the essential functions of Executive’s duties for a period of (i) ninety (90) consecutive days or (ii) one hundred twenty (120) non-consecutive days during any twelve (12) month period. Any question as to the existence, extent or potentiality of Executive’s Disability upon which Executive and the Company cannot agree shall be determined by a qualified, independent physician selected by the Company and approved by Executive (which approval shall not be unreasonably withheld).

(n) “Effective Date” shall have the meaning set forth in the preamble hereto.

(o) “Executive” shall have the meaning set forth in the preamble hereto.

(p) “Good Reason” shall mean, without Executive’s prior written consent, (i) a material diminution in Executive’s duties or responsibilities; (ii) a reduction in Base Salary or Annual Bonus opportunity of 10% or more; (iii) the failure of the Company to pay any material compensation when due, or (iv) a requirement that Executive permanently relocate outside of a commutable distance of his current home location.

(q) “MIP” shall have the meaning set forth in Section 4(b) below.

(r) “Person” shall mean any individual, corporation, partnership, limited liability company, joint venture, association, joint-stock company, trust (charitable or non-charitable), unincorporated organization, or other form of business entity.

2

(s) “Severance Term” shall mean a twelve (12) month period following Executive’s termination by the Company without Cause (other than by reason of death or Disability) or by Executive for Good Reason, and subject to Sections 8(h) and 12 below.

(t) “Term of Employment” shall mean the period specified in Section 2 below.

Section 2. Term of Employment.

Subject to Section 8 below, the Company agrees to employ Executive, and Executive agrees to serve the Company, on an at-will basis, which means that either the Company or Executive may terminate Executive’s employment with the Company at any time and for any or no reason. The period of such at-will employment under this Agreement is referred to herein as the “Term of Employment.”

Section 3. Position, Duties and Responsibilities; Place of Performance.

(a) During the Term of Employment, Executive shall serve as the Executive Vice President, Chief Financial Officer for the Company reporting to the Company’s President and Chief Executive Officer (the “CEO”), together with such other position or positions consistent with Executive’s title as the Board shall specify from time to time and shall have such duties typically associated with such title.

(b) Executive shall devote his full business time, attention, skill and best efforts to the performance of his duties under this Agreement and shall not engage in any other business or occupation during the Term of Employment that (x) conflicts with the interests of the Company, (y) interferes with the proper and efficient performance of his duties for the Company, or (z) interferes with the exercise of his judgment in the Company’s best interests. Notwithstanding the foregoing, nothing herein shall preclude Executive from (i) serving, with the prior written consent of the CEO, as a member of the board of directors or advisory board (or their equivalents in the case of a non-corporate entity) of non-competing businesses and charitable organizations, (ii) engaging in charitable activities and community affairs, and (iii) managing his personal investments and affairs; provided, however, that the activities set out in clauses (i), (ii) and (iii) shall be limited by Executive so as not to materially interfere, individually or in the aggregate, with the performance of his duties and responsibilities hereunder or otherwise conflict with the terms of the Confidentiality Agreement (as defined above).

(c) Executive’s principal place of employment shall be at split between his home at 1 Landau Way Merrimack, NH 03054 and other Inogen offices as designated within a reasonable commute from this location or such other location mutually agreed by Executive and the CEO in writing. Other business travel to locations outside of this designation will be treated as described in the Inogen travel policy.

Section 4. Compensation. During the Term of Employment, Executive shall be entitled to the following compensation:

(a) Base Salary. Commencing as of the Effective Date Executive shall be paid an annualized Base Salary of $425,000 (the “Base Salary”), payable in accordance with the regular payroll practices of the Company. The Base Salary shall be subject to annual review, based on both Executive and Company performance.

(b) Annual Bonus.

(i) Beginning with the Company’s fiscal year 2024 Executive is eligible for a discretionary annual performance bonus award (the “Annual Bonus”), determined pursuant to the Company’s Management Incentive Plan (the “MIP”), as may be modified by the Company. Executive’s initial target Annual Bonus is 60% of Executive’s Base Salary (the “Bonus Target”), and the Bonus Target for fiscal year 2024 will be pro-rated based on the fraction obtained by dividing (x) the number of days during the period beginning on the Effective Date and ending on December 31, 2024, by (y) 365.

(ii) The actual Annual Bonus payable shall be between 0% of the Bonus Target and the maximum percentage of the Bonus Target set forth in the MIP, with specific financial targets for the MIP. To the extent that such targets are financial and quantifiable, such Annual Bonus is payable on a sliding scale as set forth in the MIP. The Annual Bonus, or installments thereof, is earned as of the end of any applicable fiscal year, provided all relevant targets and conditions have been met, and paid to Executive following the annual audit for such fiscal year at such time as annual bonuses are paid to other senior executives of the Company, as discussed more fully in the MIP. The eligibility for and payment of any bonus under the MIP is subject to the terms and conditions of the MIP, which are at the discretion of the Company.

(c) Company Equity Awards.

(i) Subject to the approval of the Committee, as a material inducement to Executive accepting employment with the Company, Executive will be granted the following equity awards (each, a “New Hire Award”): (i) a one-time award of 75,000 time-based restricted stock units (“RSUs”) and (ii) a one-time award of 75,000 performance-based restricted stock units (“PSUs”). The RSUs will vest over

3

three (3) years based on satisfaction of time and service-based requirements as follows: 1/3rd of the RSUs will vest on each anniversary of the vesting commencement date (as determined by the Committee), subject to Executive continuing to be a service provider to the Company through each such date. The PSUs shall vest based on the Company’s achievement of the performance goals set forth in 2024 equity plan that apply to the PSU awards that were granted to the Company’s similarly situated executives, and subject to Executive continuing to be a service provider to the Company through each applicable vesting date (as determined by the Committee). Each New Hire Award shall be subject to the terms and conditions of an equity incentive plan of the Company and the applicable form of award agreement. Subject to the approval of the Compensation Committee (the “Committee”),

(ii) Subject to the approval of the Committee, Executive will also be eligible for annual equity awards beginning in March 2025 with vesting based on the same terms and conditions as the annual equity awards made to the Company’s similarly situated executives.

(iii) Executive will be eligible to receive equity awards, including stock options, restricted stock units, performance stock units, or other equity awards, pursuant to any plans or arrangements the Company may have in effect from time to time. The Board or Committee will determine in its discretion whether Executive will be granted any such equity awards and the terms of any such award in accordance with the terms of any applicable plan or arrangement that may be in effect from time to time.

(d) Sign-On Bonus. Within thirty (30) days of the Effective Date, the Company will pay Executive a $100,000 cash sign-on bonus, less applicable withholdings (the “Sign-On Bonus”). If, prior to the second anniversary of the Effective Date, Executive’s employment is terminated by the Company for Cause or by Executive voluntarily without Good Reason, Executive agrees to repay the Company a portion of the Sign-On Bonus within thirty (30) days of Executive’s employment termination date, with such portion equal to (i) the net after tax amount of the Sign-On Bonus multiplied by (ii) a fraction (A) the numerator of which is equal to the difference between (x) twenty four (24) minus (y) the number of completed months between the Effective Date and the date Executive’s employment with the Company terminates and (B) the denominator of which is twenty four (24). For clarity, if Executive’s employment is terminated by the Company without Cause or by Executive voluntarily for Good Reason, Executive will not be obligated to repay any portion of the Sign-On Bonus.

(i) Indemnification Agreement; Director and Officer Liability Insurance. Executive shall be covered under an Indemnification Agreement substantially in the form provided to the Company’s other officers and directors. In addition, Executive shall be covered under the Company’s director and officer liability insurance coverage.

Section 5. Executive Benefits.

During the Term of Employment, Executive shall be entitled to participate in health, insurance, retirement and other benefits provided to other similarly-situated executives of the Company, including the same number of holidays, sick days and other benefits as are generally allowed to such executives of the Company in accordance with the Company policy in effect from time to time. Executive initially will be entitled to accrue paid time off (“PTO”) at a rate equal to 20 days per year to be taken in accordance with the Company’s PTO policy, with the timing and duration of specific days off mutually and reasonably agreed to by the parties. After Executive’s first full year of service, Executive’s PTO accrual rate will increase at a rate equal to one additional day per year for each of the next seven years of service up to a maximum accrual rate equal to 27 days of PTO per year and capped as described in the company policy and carryover guidelines. Executive initially will be entitled to voluntary time off for community service (“VTO”) for 1 day per year to be taken in accordance with the Company’s VTO policy, with the timing of specific days off mutually and reasonably agreed to by the parties.

Section 6. Key-Man Insurance.

At any time during the Term of Employment, the Company shall have the right to insure the life of Executive for the sole benefit of the Company, in such amounts, and with such terms, as it may determine. All premiums payable thereon shall be the obligation of the Company. Executive shall have no interest in any such policy but agrees to cooperate with the Company in taking out such insurance by submitting to physical examinations, supplying all information required by the insurance company, and executing all necessary documents, provided that no financial obligation is imposed on Executive by any such documents or examinations.

Section 7. Payment and Reimbursement of Business Expenses.

Executive is authorized to incur reasonable business expenses in carrying out Executive’s duties and responsibilities under this Agreement and the Company shall pay, or if Executive shall have paid, shall promptly reimburse Executive for any and all such reasonable business expenses for business, entertainment, promotion, professional association dues and travel incurred by Executive in connection with carrying out the business of the Company, subject to documentation and the other limitations and requirements under the Company’s policy, as in effect from time to time, and subject to the consent of the CEO.

4

Section 8. Termination of Employment.

(a) General. The Term of Employment shall terminate upon the earliest to occur of (i) Executive’s death, (ii) a termination by reason of a Disability, (iii) a termination by the Company with or without Cause, or (iv) a termination by Executive with or without Good Reason. Upon any termination of Executive’s employment for any reason, except as may otherwise be requested by the Company in writing and agreed upon in writing by Executive, Executive shall resign from any and all directorships, committee memberships or any other positions Executive holds with the Company (collectively, the “Board Resignation”). The payment hereunder of any deferred compensation (within the meaning of Section 409A of the Code) upon a termination of employment shall not be paid to Executive until such time as Executive has undergone a “separation from service” as defined in Treas. Reg. 1.409A-1(h) (the “Separation from Service”).

(b) Termination due to Death or Disability. Executive’s employment shall terminate automatically upon his death. The Company may terminate Executive’s employment immediately upon the occurrence of a Disability, such termination to be effective upon Executive’s receipt of written notice of such termination. In the event Executive’s employment is terminated due to his death or Disability, Executive or his estate or his beneficiaries, as the case may be, shall be entitled to:

(i) The Accrued Obligations; and

(ii) Any unpaid Annual Bonus in respect to any completed fiscal year, which has ended prior to the date of such termination, which amount shall be paid at such time annual bonuses are paid to other senior executives of the Company.

Following such termination of Executive’s employment by the reason of death or Disability, except as set forth in this Section 8(b), Executive shall have no further rights to any compensation or any other benefits under this Agreement or otherwise.

(c) Termination by the Company for Cause.

(i) The Company may terminate Executive’s employment at any time for Cause, effective upon Executive’s receipt of written notice of such termination; provided, however, that with respect to any termination for Cause which is described in clause (iv) of Section 1(e) or, to the extent capable of being cured (as determined by the Company in its discretion), clause (v) of Section 1(e) above, Executive shall be given not less than ten (10) days’ written notice by the CEO of the intention to terminate his employment for Cause, such notice to state in detail the particular act or acts or failure or failures to act that constitute the grounds on which the proposed termination for Cause is based, and such termination shall be effective at the expiration of such ten (10)-day notice period unless Executive has fully cured such acts or failure or failures to act that give rise to Cause during such period to the satisfaction of the Company.

(ii) In the event the Company terminates Executive’s employment for Cause, he shall be entitled only to the Accrued Obligations. Following such termination of Executive’s employment for Cause, except as set forth in this Section 8(c)(ii), Executive shall have no further rights to any compensation or any other benefits under this Agreement or otherwise.

(d) Termination by the Company without Cause Unrelated to a Change of Control. The Company may terminate Executive’s employment at any time without Cause, effective upon Executive’s receipt of written notice of such termination. In the event Executive’s employment is terminated by the Company without Cause (other than due to death or Disability) outside of the Change of Control Period, subject to the conditions set forth under Sections 8(h) and Section 12 below, Executive shall be entitled to:

(i) The Accrued Obligations;

(ii) Any unpaid Annual Bonus in respect to any completed fiscal year which has ended prior to the date of such termination, which amount shall be paid at such time annual bonuses are paid to other senior executives of the Company;

(iii) Continuation of payment of Base Salary during the Severance Term, payable in accordance with the Company’s regular payroll practices, it being agreed that each installment of Base Salary payable hereunder shall be deemed to be a separate payment for purposes of Section 409A of the Code; and

(iv) Continuation, during the period of time permitted under the Consolidated Omnibus Budget Reconciliation Act of 1986 (the “COBRA Period”), of the medical benefits provided to Executive and his covered dependents under the Company’s health plans in effect as of the date of such termination, it being understood and agreed that Executive shall be required to pay that portion of the cost of such medical benefits as Executive was required to pay (including through customary deductions from Executive’s paycheck) as of the date of Executive’s termination of employment with the Company. Notwithstanding the foregoing, the Company’s obligation to provide such continuation of benefits shall terminate prior to the expiration of the COBRA Period in the event that Executive becomes eligible to receive any such or similar benefits while employed by or providing service to, in any capacity, any other business or entity during the COBRA Period.

5

Notwithstanding anything in this Section 8(d)(iv) to the contrary, if the Company determines, in its sole discretion, that it cannot provide the foregoing benefit related to COBRA premiums without potentially violating, or being subject to an excise tax under, applicable law (including, without limitation, Section 2716 of the Public Health Service Act, the Patient Protection and Affordable Care Act, and the Health Care and Education Reconciliation Act of 2010), the Company will in lieu thereof provide to Executive a taxable monthly payment, payable on the last day of a given month (except as provided by the following sentence), in an amount equal to the portion of the monthly COBRA premium that Executive would be required to pay to continue the group health coverage for Executive and his eligible dependents at coverage levels in effect immediately prior to Executive’s termination (which amount will equal the excess of the full monthly COBRA premium cost Executive would be required to pay and the monthly medical premium costs that Executive was required to pay as of immediately prior to the date of Executive’s termination of employment with the Company), which payments will be made regardless of whether Executive or his eligible dependents elect COBRA continuation coverage on the first payroll date following Executive’s termination of employment (subject to any delay as may be required by Section 12 of this Agreement) and will end on the earlier of (x) the date upon which Executive obtains other employment or (y) the end of the COBRA Period. For the avoidance of doubt, the taxable payments in lieu of COBRA subsidies may be used for any purpose, including, but not limited to continuation coverage under COBRA, and will be subject to all applicable tax withholdings.

Notwithstanding the foregoing, the payments and benefits described in clauses (ii), (iii), and (iv) above shall immediately terminate, and the Company shall have no further obligations to Executive with respect thereto, in the event that Executive breaches any provision of Section 9 hereof or the terms of the Confidentiality Agreement. Following such termination of Executive’s employment by the Company without Cause, except as set forth in this Section 8(d), Executive shall have no further rights to any compensation or any other benefits under this Agreement or otherwise.

(e) Termination by Executive with Good Reason Unrelated to a Change of Control. Executive may terminate his employment with Good Reason by providing the Company thirty (30) days’ written notice setting forth in reasonable specificity the event that constitutes Good Reason, which written notice, to be effective, must be provided to the Company within thirty (30) days of the occurrence of such event. During such thirty (30) day notice period, the Company shall have a cure right (if curable), and if not cured within such period, Executive’s termination will be effective upon the expiration of such cure period, and, if such termination occurs outside of the Change of Control Period, Executive shall be entitled to the same payments and benefits as provided in Section 8(d) above for a termination by the Company without Cause, subject to the same conditions on payment and benefits as described in Section 8(d) above. Following such termination of Executive’s employment by Executive with Good Reason, except as set forth in this Section 8(e), Executive shall have no further rights to any compensation or any other benefits under this Agreement or otherwise.

(f) Termination by Company without Cause or by Executive with Good Reason in Connection with a Change of Control. In the event Executive’s employment is terminated by the Company without Cause (other than due to death or Disability) or Executive terminates his employment with Good Reason (by providing thirty (30) days’ written notice to the Company and with such cure period as described in subsection 8(e), above) during the Change of Control Period, Executive shall be entitled to the same payments and benefits as described in Section 8(d) above, provided, however, that payment of Executive’s Base Salary shall continue through the Change of Control Severance Term, rather than the Severance Term. Such continuing payments shall be payable in accordance with the Company’s regular payroll practices, it being agreed that each installment of Base Salary payable hereunder shall be deemed to be a separate payment for purposes of Section 409A of the Code. Any such payments or benefits shall also be subject to the same conditions described in Section 8(d) above. Any payments or benefits previously made to Executive under Section 8(d) or 8(e) above, shall offset the payments and benefits due to Executive under this Section 8(f), if any

(g) Termination by Executive without Good Reason. Executive may terminate his employment without Good Reason by providing the Company thirty (30) days’ written notice of such termination. In the event of a termination of employment by Executive under this Section 8(g), Executive shall be entitled only to the Accrued Obligations. In the event of termination of Executive’s employment under this Section 8(g), the Company may, in its sole and absolute discretion, by written notice accelerate such date of termination and still have it treated as a termination without Good Reason. Following such termination of Executive’s employment by Executive without Good Reason, except as set forth in this Section 8(g), Executive shall have no further rights to any compensation or any other benefits under this Agreement or otherwise.

(h) Conditions Precedent. Any severance payments and post-employment benefits (other than the Accrued Obligations), in each case, as applicable, contemplated by Sections 8(b), (d), (e), and (f) above are conditional on Executive: (i) continuing to comply with the terms of this Agreement and the Confidentiality Agreement (as defined above); and (ii) Executive executing and not revoking a Separation Agreement, including a general release of claims, in favor of the Company, substantially in the form approved by the Company, and such release becoming effective within 60 days following Executive’s Separation from Service (as defined above); and (iii) effectuating the Board Resignation (as discussed above). The severance benefits will be paid and/or provided in installments immediately beginning on the first payroll date after the 60th day following Executive’s Separation from Service, provided the Separation Agreement becomes effective and other conditions precedent have been met, and will continue to be paid thereafter, if applicable, based on the Company’s regular payroll schedule. The payment following the 60th day from Executive’s Separation from Service will include a lump sum of any severance payments that Executive would have received on or prior to such date under the original schedule but for the delay while waiting for the 60th day in compliance with Code Section 409A and the effectiveness of the release, with the balance of the Severance Benefits being paid in installments as originally scheduled, if applicable.

6

Section 9. Disclosure of Confidential information; Return of Documents.

(a) Disclosure of Confidential Information. At any time during and after the end of the Term of Employment, without the prior written consent of the CEO, except to the extent required by an order of a court having jurisdiction or under subpoena from an appropriate government agency, in which event, Executive shall use his best efforts to consult with the CEO prior to responding to any such order or subpoena, and except as required in the performance of his duties hereunder, Executive shall not disclose to or use for his individual benefit or the benefit of any third party any Confidential Information, as further discussed under the Confidentiality Agreement.

(b) Return of Documents. In the event of the termination of Executive’s employment for any reason, Executive shall deliver to the Company all of (i) the property of the Company, and (ii) the documents and data of any nature and in whatever medium of the Company, and Executive shall not take with his any such property, documents or data or any reproduction thereof, or any documents containing or pertaining to any Confidential Information, as set forth in more detail under Section 5 of the Confidentiality Agreement.

Section 10. Taxes.

The Company may withhold from any payments made under this Agreement all applicable taxes, including but not limited to income, employment and social insurance taxes, as shall be required by law. Executive acknowledges and represents that the Company has not provided any tax advice to him in connection with this Agreement and that he has been advised by the Company to seek tax advice from his own tax advisors regarding this Agreement and payments that may be made to his pursuant to this Agreement, including specifically, the application of the provisions of Section 409A of the Code to such payments.

Section 11. Set Off; Mitigation.

The Company’s obligation to pay Executive the amounts provided and to make the arrangements provided hereunder shall be subject to set-off, counterclaim or recoupment of amounts lawfully owed by Executive to the Company or its affiliates. Executive shall not be required to mitigate the amount of any payment provided for pursuant to this Agreement by seeking other employment or otherwise and, except as provided in Section 8(d)(iv) hereof, the amount of any payment provided for pursuant to this Agreement shall not be reduced by any compensation earned as a result of Executive’s other employment or otherwise.

Section 12. Section 409A

(a) Notwithstanding anything to the contrary in this Agreement, no severance pay or benefits to be paid or provided to Executive, if any, pursuant to this Agreement that, when considered together with any other severance payments or separation benefits, are considered deferred compensation under Code (as defined below) Section 409A, and the final regulations and any guidance promulgated thereunder (“Section 409A”) (together, the “Deferred Payments”) will be paid or otherwise provided until Executive has a Separation from Service.

(b) Any severance payments or benefits under this Agreement that would be considered Deferred Payments will be paid on, or, in the case of installments, will not commence until, the sixtieth (60th) day following Executive’s Separation from Service, or, if later, such time as required by Section 12(c). Except as required by Section 12(c), and as discussed under Section 8(h), any installment payments that would have been made to Executive during the sixty (60) day period immediately following Executive’s Separation from Service but for the preceding sentence will be paid to Executive on the sixtieth (60th) day following Executive’s Separation from Service and the remaining payments shall be made as provided in this Agreement.

(c) Notwithstanding anything to the contrary in this Agreement, if Executive is a “specified employee” within the meaning of Section 409A at the time of Executive’s termination (other than due to death), then the Deferred Payments that are payable within the first six (6) months following Executive’s Separation from Service, will become payable on the first payroll date that occurs on or after the date six (6) months and one (1) day following the date of Executive’s Separation from Service. All subsequent Deferred Payments, if any, will be payable in accordance with the payment schedule applicable to each payment or benefit. Notwithstanding anything herein to the contrary, if Executive dies following Executive’s Separation from Service, but prior to the twelve (12) month anniversary of the Separation from Service, then any payments delayed in accordance with this paragraph will be payable in a lump sum as soon as administratively practicable after the date of Executive’s death and all other Deferred Payments will be payable in accordance with the payment schedule applicable to each payment or benefit. Each payment and benefit payable under this Agreement is intended to constitute a separate payment for purposes of Section 1.409A-2(b)(2) of the Treasury Regulations.

(d) Any amount paid under this Agreement that satisfies the requirements of the “short-term deferral” rule set forth in Section 1.409A-1(b)(4) of the Treasury Regulations will not constitute Deferred Payments for purposes of subsection (a) above.

7

(e) Any amount paid under this Agreement that qualifies as a payment made as a result of an involuntary Separation from Service pursuant to Section 1.409A-1(b)(9)(iii) of the Treasury Regulations that does not exceed the Section 409A Limit (as defined below) will not constitute Deferred Payments for purposes of subsection (a) above.

(f) The foregoing provisions are intended to comply with the requirements of Section 409A so that none of the severance payments and benefits to be provided hereunder will be subject to the additional tax imposed under Section 409A, and any ambiguities herein will be interpreted to so comply. The Company and Executive agree to work together in good faith to consider amendments to this Agreement and to take such reasonable actions which are necessary, appropriate or desirable to avoid imposition of any additional tax or income recognition prior to actual payment to Executive under Section 409A.

(g) For purposes of this Agreement, “Section 409A Limit” will mean two (2) times the lesser of: (i) Executive’s annualized compensation based upon the annual rate of pay paid to Executive during Executive’s taxable year preceding Executive’s taxable year of his Separation from Service as determined under Treasury Regulation Section 1.409A-1(b)(9)(iii)(A)(1) and any Internal Revenue Service guidance issued with respect thereto; or (ii) the maximum amount that may be taken into account under a qualified plan pursuant to Section 401(a)(17) of the Code for the year in which Executive’s Separation from Service occurred.

Section 13. Successors and Assigns; No Third-Party Beneficiaries.

(a) The Company. This Agreement shall inure to the benefit of the Company and its respective successors and assigns. Neither this Agreement nor any of the rights, obligations or interests arising hereunder may be assigned by the Company without Executive’s prior written consent (which shall not be unreasonably withheld, delayed or conditioned), to a person or entity other than an affiliate or parent entity of the Company, or their respective successors or assigns; provided, however, that, in the event of the merger, consolidation, transfer or sale of all or substantially all of the assets of the Company with or to any other individual or entity, this Agreement shall, subject to the provisions hereof, be binding upon and inure to the benefit of such successor and such successor shall discharge and perform all the promises, covenants, duties and obligations of the Company hereunder, it being agreed that in such circumstances, the consent of Executive shall not be required in connection therewith.

(b) Executive. Executive’s rights and obligations under this Agreement shall not be transferable by Executive by assignment or otherwise, without the prior written consent of the Company; provided, however, that if Executive shall die, all amounts then payable to Executive hereunder shall be paid in accordance with the terms of this Agreement to Executive’s devisee, legatee or other designee or, if there be no such designee, to Executive’s estate.

(c) No Third-Party Beneficiaries. Except as otherwise set forth in Section 8(b) or Section 13(b) hereof, nothing expressed or referred to in this Agreement will be construed to give any person or entity other than the Company and Executive any legal or equitable right, remedy or claim under or with respect to this Agreement or any provision of this Agreement.

Section 14. Waiver and Amendments.

Any waiver, alteration, amendment or modification of any of the terms of this Agreement shall be valid only if made in writing and signed by each of the parties hereto; provided, however, that any such waiver, alteration, amendment or modification is consented to on the Company’s behalf by the Board. No waiver by either of the parties hereto of their rights hereunder shall be deemed to constitute a waiver with respect to any subsequent occurrences or transactions hereunder unless such waiver specifically states that it is to be construed as a continuing waiver.

Section 15. Severability.

If any covenants or such other provisions of this Agreement are found to be invalid or unenforceable by a final determination of a court of competent jurisdiction or an arbitrator: (a) the remaining terms and provisions hereof shall be unimpaired, and (b) the invalid or unenforceable term or provision hereof shall be deemed replaced by a term or provision that is valid and enforceable and that comes closest to expressing the intention of the invalid or unenforceable term or provision hereof.

Section 16. Governing Law.

This Agreement is governed by and is to be construed under the laws of the State of Texas, without regard to conflict of laws rules, and any legal actions shall be conducted in the federal or state courts in Dallas, Texas.

8

Section 17. ARBITRATION

THE PARTIES AGREE THAT ANY AND ALL DISPUTES ARISING OUT OF THE TERMS OF THIS AGREEMENT, THEIR INTERPRETATION, AND ANY OF THE MATTERS ADDRESSED HEREIN, SHALL BE SUBJECT TO THE ARBITRATION AND DISPUTE RESOLUTION PROCESS DETAILED IN THE CONFIDENTIALITY AGREEMENT. EMPLOYEE ACKNOWLEDGES AND AGREES THAT EMPLOYEE IS HEREBY WAIVING THE RIGHT TO JURY TRIAL.

Section 18. Notices.

(a) Every notice or other communication relating to this Agreement shall be in writing, and shall be mailed to or delivered to the party for whom it is intended at such address as may from time to time be designated by it in a notice mailed or delivered to the other party as herein provided; provided that, unless and until some other address be so designated, all notices or communications by Executive to the Company shall be mailed or delivered to the Company at its principal executive office, and all notices or communications by the Company to Executive may be given to Executive personally or may be mailed to Executive at Executive’s last known address, as reflected in the Company’s records.

(b) Any notice so addressed shall be deemed to be given: (i) if delivered by hand, on the date of such delivery; (ii) if mailed by courier or by overnight mail, on the first business day following the date of such mailing; and (iii) if mailed by registered or certified mail, on the third business day after the date of such mailing.

Section 19. Section Headings.

The headings of the sections and subsections of this Agreement are inserted for convenience only and shall not be deemed to constitute a part thereof, affect the meaning or interpretation of this Agreement or of any term or provision hereof.

Section 20. Entire Agreement.

This Agreement and the Confidentiality Agreement, together with any exhibits attached thereto, constitute the entire understanding and agreement of the parties hereto regarding the employment of Executive. This Agreement supersedes all prior negotiations, discussions, correspondence, communications, understandings and agreements between the parties relating to the subject matter of this Agreement.

Section 21. Survival of Operative Sections.

Upon any termination of Executive’s employment, the provisions of Section 8 through Section 24 of this Agreement (together with any related definitions set forth in Section 1 hereof) shall survive to the extent necessary to give effect to the provisions thereof.

Section 22. Limitation on Payments.

In the event that the severance and other benefits provided for in this Agreement or otherwise payable to Executive (i) constitute “parachute payments” within the meaning of Section 280G of the Code and (ii) but for this Section 22, would be subject to the excise tax imposed by Section 4999 of the Code, then Executive’s severance and other benefits will be either:

(a) delivered in full, or

(b) delivered as to such lesser extent which would result in no portion of such severance and other benefits being subject to the excise tax under Section 4999 of the Code,

whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the excise tax imposed by Section 4999, results in the receipt by Executive on an after-tax basis, of the greatest amount of severance and other benefits, notwithstanding that all or some portion of such severance and other benefits may be taxable under Section 4999 of the Code. If a reduction in the severance and other benefits constituting “parachute payments” is necessary so that no portion of such severance benefits is subject to the excise tax under Section 4999 of the Code, the reduction shall occur in the following order: (1) reduction of the cash severance payments; (2) cancellation of accelerated vesting of equity awards that vest, in whole or in part, based on the achievement of performance criteria, in the reverse order that such awards would have vested; (3) cancellation of accelerated vesting of equity awards that vest based solely on continued service, in the order of the percentage of the fair market value of such awards that constitutes a parachute payment (commencing with the largest percentage); and (4) reduction of continued employee benefits. In the event that acceleration of vesting of equity award compensation is to be reduced, such acceleration of vesting shall be cancelled in the reverse order of the date of grant of Executive’s equity awards. Notwithstanding the foregoing, to the extent the Company submits any payment or benefit payable to Executive under this Agreement or otherwise to the Company’s stockholders for approval in accordance with Treasury Regulation Section 1.280G-1 Q&A 7, the foregoing provisions shall not apply following such submission and such payments

9

and benefits will be treated in accordance with the results of such vote, except that any reduction in, or waiver of, such payments or benefits required by such vote will be applied without any application of discretion by Executive and in the order prescribed by this Section 22.

Unless the Company and Executive otherwise agree in writing, any determination required under this Section 22 will be made in writing by an independent firm (the “Firm”), whose determination will be conclusive and binding upon Executive and the Company for all purposes. For purposes of making the calculations required by this Section 22, the Firm may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of Sections 280G and 4999 of the Code. The Company and Executive will furnish to the Firm such information and documents as the Firm may reasonably request in order to make a determination under this Section 22. The Company will bear all costs the Firm may reasonably incur in connection with any calculations contemplated by this Section 22.

Section 23. Counterparts.

This Agreement may be executed in two or more counterparts, each of which shall be deemed to be an original but all of which together shall constitute one and the same instrument. The execution of this Agreement may be by actual or facsimile signature.

Section 24. Protected Activity Not Prohibited.

Executive understands that nothing in this Agreement shall in any way limit or prohibit Executive from engaging for a lawful purpose in any Protected Activity. For purposes of this Agreement, “Protected Activity” shall mean filing a charge or complaint, or otherwise communicating, cooperating, or participating with, any state, federal, or other governmental agency, including the Securities and Exchange Commission, the Equal Employment Opportunity Commission, and the National Labor Relations Board. Notwithstanding any restrictions set forth in this Agreement, Executive understands that she is not required to obtain authorization from the Company prior to disclosing information to, or communicating with such agencies, nor is she obligated to advise the Company as to any such disclosures or communications. Notwithstanding, in making any such disclosures or communications, Executive agrees to take all reasonable precautions to prevent any unauthorized use or disclosure of any information that may constitute the Company’s Confidential Information to any parties other than the relevant government agencies. Executive further understands that “Protected Activity” does not include the disclosure of any Company attorney- client privileged communications, and that any such disclosure without the Company’s written consent shall constitute a material breach of this Agreement. Each of these issues are more fully discussed in the Confidentiality Agreement.

Section 25. General.

Executive’s employment is made contingent upon a satisfactory background investigation, credit report and Executive’s ability to provide proof of identification and authorization to work in the United States, in accordance with the Immigration and Control Act of 1986. This offer expires at the close of business on January 19, 2024. To indicate acceptance, Executive must sign in the space provided below.

* * *

10

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the date first above written.

|

|

|

COMPANY: |

|

|

|

|

|

Inogen, Inc. |

|

|

|

|

|

/s/ Kevin Smith |

By: Kevin Smith |

|

|

Title: President & Chief Executive Officer |

|

EXECUTIVE: |

|

|

|

|

|

/s/ Michael Bourque |

Michael Bourque |

|

|

|

11

Exhibit 99.1

Inogen Names Michael Bourque As New Chief Financial Officer

Goleta, CA – January 24, 2024 – Inogen, Inc. (Nasdaq: INGN), a medical technology company offering innovative respiratory products for use in the homecare setting, today announced the appointment of Michael Bourque as Chief Financial Officer, effective March 4, 2024. Mr. Bourque has served as Treasurer and Chief Financial Officer of Chase Corporation (formally NYSE:CCF) now owned by KKR & Co. Inc. He succeeds Interim Chief Financial Officer Mike Sergesketter, who will remain in an advisory role during the transition.

Mr. Bourque has served as Chief Financial Officer and Treasurer of Chase Corporation since 2021. He also served as Chief Financial Officer of Keystone Dental, Senior Vice President, Chief Financial Officer and Treasurer of Analogic Corporation from 2014 to 2018 and as Vice President of Finance for Axcelis Technologies from 2011 to 2014. Bourque received a bachelor’s degree in accounting from Bentley University.

Kevin Smith, President and Chief Executive Officer of Inogen said, “I am incredibly excited to announce Michael as the new Chief Financial Officer of Inogen. His experience building best-inclass finance teams at Chase, Keystone and Analogic display what makes him uniquely qualified to help Inogen continue to deliver superior respiratory solutions to patients around the world.” Mr. Smith continued, “I would also like to thank Mike Sergesketter for once again stepping into the role of CFO during our search. His experience and stewardship helped ensure a smooth transition during the beginning of my tenure and the previous six months. He’s been a tremendous contributor and I wish him the best in his retirement.”

“I am excited to be joining Inogen at such a pivotal point in the Company’s story,” said Michael Bourque. “It is an incredible opportunity to deliver value to our patients and shareholders.”

About Inogen

Inogen, Inc. (Nasdaq: INGN) is a leading global medical technology company offering innovative respiratory products for use in the homecare setting. Inogen supports patient respiratory care by developing, manufacturing, and marketing innovative best-in-class portable oxygen concentrators used to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. Inogen partners with patients, prescribers, home medical equipment providers, and distributors to make its oxygen therapy products widely available allowing patients the chance to remain ambulatory while managing the impact of their disease.

For more information, please visit www.inogen.com.

Inogen has used, and intends to continue to use, its Investor Relations website, http://investor.inogen.com/, as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. For more information, visit http://investor.inogen.com/.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, among others, statements with respect to the announced changes to management; statements concerning or implying Inogen’s future financial performance; the ability of management personnel to contribute to the execution of Inogen’s strategic plans and goals. Any statements contained in this communication that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “believes,” “anticipates,” “plans,” “expects,” “will,” “intends,” “potential,” “possible,” and similar expressions are intended to identify forward-looking statements. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks related to its announced management and organizational changes, and risks arising from the possibility that

1

Inogen will not realize anticipated future financial performance or strategic goals. In addition, Inogen's business is subject to numerous additional risks and uncertainties, including, among others, risks relating to market acceptance of its products; competition; its sales, marketing and distribution capabilities; its planned sales, marketing, and research and development activities; interruptions or delays in the supply of components or materials for, or manufacturing of, its products; seasonal variations; unanticipated increases in costs or expenses; risks associated with international operations; and the possibility that Inogen will not realize anticipated revenue from recent or future technology acquisitions or that expenses and costs related thereto will exceed Inogen’s expectations. Information on these and additional risks, uncertainties, and other information affecting Inogen’s business operating results are contained in its Annual Report on Form 10-K for the period ended December 31, 2022, its Quarterly Report on Form 10-Q for the calendar quarter ended September 30, 2023 and in its other filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date hereof. Inogen disclaims any obligation to update these forward-looking statements except as may be required by law.

Investor Contact

ir@inogen.net

2

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

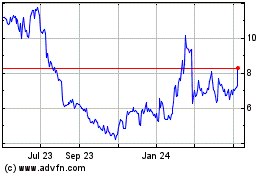

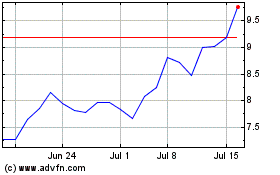

Inogen (NASDAQ:INGN)

Historical Stock Chart

From Apr 2024 to May 2024

Inogen (NASDAQ:INGN)

Historical Stock Chart

From May 2023 to May 2024