9/30false2024Q10001406587http://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrenthttp://fasb.org/us-gaap/2023#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrent00014065872023-10-012023-12-3100014065872024-01-19xbrli:shares00014065872023-12-31iso4217:USD00014065872023-09-300001406587us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001406587us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-30iso4217:USDxbrli:shares00014065872022-10-012022-12-310001406587us-gaap:CommonStockMember2023-09-300001406587us-gaap:AdditionalPaidInCapitalMember2023-09-300001406587us-gaap:RetainedEarningsMember2023-09-300001406587us-gaap:NoncontrollingInterestMember2023-09-300001406587us-gaap:CommonStockMember2023-10-012023-12-310001406587us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-310001406587us-gaap:RetainedEarningsMember2023-10-012023-12-310001406587us-gaap:NoncontrollingInterestMember2023-10-012023-12-310001406587us-gaap:CommonStockMember2023-12-310001406587us-gaap:AdditionalPaidInCapitalMember2023-12-310001406587us-gaap:RetainedEarningsMember2023-12-310001406587us-gaap:NoncontrollingInterestMember2023-12-310001406587us-gaap:CommonStockMember2022-09-300001406587us-gaap:AdditionalPaidInCapitalMember2022-09-300001406587us-gaap:RetainedEarningsMember2022-09-300001406587us-gaap:NoncontrollingInterestMember2022-09-3000014065872022-09-300001406587us-gaap:CommonStockMember2022-10-012022-12-310001406587us-gaap:AdditionalPaidInCapitalMember2022-10-012022-12-310001406587us-gaap:RetainedEarningsMember2022-10-012022-12-310001406587us-gaap:NoncontrollingInterestMember2022-10-012022-12-310001406587us-gaap:CommonStockMember2022-12-310001406587us-gaap:AdditionalPaidInCapitalMember2022-12-310001406587us-gaap:RetainedEarningsMember2022-12-310001406587us-gaap:NoncontrollingInterestMember2022-12-3100014065872022-12-310001406587us-gaap:MajorityShareholderMemberfor:D.R.HortonInc.Member2023-06-302023-06-30xbrli:pure0001406587us-gaap:LandAndLandImprovementsMember2023-12-310001406587us-gaap:LandAndLandImprovementsMember2023-09-300001406587us-gaap:LandMember2023-12-310001406587us-gaap:LandMember2023-09-300001406587for:D.R.HortonInc.Membersrt:MinimumMember2023-10-012023-12-310001406587srt:MaximumMemberfor:D.R.HortonInc.Member2023-10-012023-12-310001406587us-gaap:RealEstateMemberus-gaap:ResidentialRealEstateMember2023-10-012023-12-310001406587us-gaap:RealEstateMemberus-gaap:ResidentialRealEstateMember2022-10-012022-12-310001406587for:DeferredDevelopmentProjectMember2023-12-310001406587for:DeferredDevelopmentProjectMember2023-09-300001406587for:SeniorNotes385Member2023-12-310001406587for:SeniorNotes385Member2023-09-300001406587for:SeniorNotes50Member2023-12-310001406587for:SeniorNotes50Member2023-09-300001406587us-gaap:SecuredDebtMember2023-12-310001406587us-gaap:SecuredDebtMember2023-09-300001406587us-gaap:SeniorNotesMember2023-12-310001406587us-gaap:SeniorNotesMember2023-09-300001406587for:SeniorNotes385Member2023-10-012023-12-310001406587for:SeniorNotes50Member2023-10-012023-12-3100014065872020-04-3000014065872021-10-0800014065872021-11-180001406587for:D.R.HortonInc.Member2023-10-012023-12-310001406587for:D.R.HortonInc.Member2022-10-012022-12-31for:Lot0001406587for:UnderContractMemberfor:D.R.HortonInc.Member2023-12-310001406587for:UnderContractMemberfor:D.R.HortonInc.Member2023-09-300001406587for:RightofFirstOfferMemberfor:D.R.HortonInc.Member2023-12-310001406587for:RightofFirstOfferMemberfor:D.R.HortonInc.Member2023-09-300001406587us-gaap:CashMemberfor:UnderContractMemberfor:D.R.HortonInc.Member2023-12-310001406587us-gaap:CashMemberfor:UnderContractMemberfor:D.R.HortonInc.Member2023-09-300001406587for:D.R.HortonInc.Member2023-10-012023-12-310001406587for:D.R.HortonInc.Member2022-10-012022-12-310001406587us-gaap:OtherExpenseMemberfor:D.R.HortonInc.Member2023-10-012023-12-310001406587us-gaap:OtherExpenseMemberfor:D.R.HortonInc.Member2022-10-012022-12-310001406587us-gaap:DepositsMemberfor:D.R.HortonInc.Member2022-10-012022-12-310001406587for:D.R.HortonInc.Member2023-12-310001406587for:D.R.HortonInc.Member2023-09-300001406587us-gaap:FairValueInputsLevel1Member2023-12-310001406587us-gaap:FairValueInputsLevel2Member2023-12-310001406587us-gaap:FairValueInputsLevel3Member2023-12-310001406587us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001406587us-gaap:FairValueInputsLevel1Member2023-09-300001406587us-gaap:FairValueInputsLevel2Member2023-09-300001406587us-gaap:FairValueInputsLevel3Member2023-09-300001406587us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q | | | | | |

| (Mark One) |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended December 31, 2023

or | | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From To

Commission File Number: 001-33662

FORESTAR GROUP INC.

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | |

| Delaware | | 26-1336998 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

2221 E. Lamar Blvd., Suite 790

Arlington, Texas 76006

(Address of Principal Executive Offices, including Zip Code)

(817) 769-1860

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

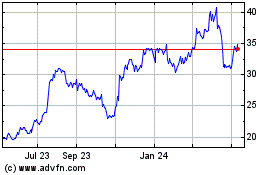

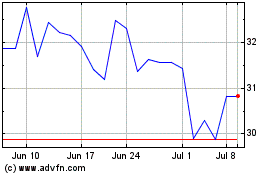

| Common Stock, par value $1.00 per share | | FOR | | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer ☐ | | Accelerated filer | ☒ | | Non-accelerated filer ¨ | | Smaller reporting company | ☐ | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Common Stock, $1.00 par value -- 49,913,423 shares as of January 19, 2024

FORESTAR GROUP INC.

TABLE OF CONTENTS

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

FORESTAR GROUP INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| | (In millions, except share data) |

| ASSETS | | | |

| Cash and cash equivalents | $ | 458.9 | | | $ | 616.0 | |

| Real estate | 2,009.8 | | | 1,790.3 | |

| Investment in unconsolidated ventures | 0.5 | | | 0.5 | |

| Property and equipment, net | 5.8 | | | 5.9 | |

| Other assets | 58.8 | | | 58.0 | |

| Total assets | $ | 2,533.8 | | | $ | 2,470.7 | |

| LIABILITIES | | | |

| Accounts payable | $ | 65.3 | | | $ | 68.4 | |

| Accrued development costs | 99.9 | | | 104.1 | |

| Earnest money on sales contracts | 140.9 | | | 121.4 | |

| Deferred tax liability, net | 50.2 | | | 50.7 | |

| Accrued expenses and other liabilities | 63.4 | | | 61.2 | |

| Debt | 705.3 | | | 695.0 | |

| Total liabilities | 1,125.0 | | | 1,100.8 | |

Commitments and contingencies (Note 11) | | | |

| EQUITY | | | |

Common stock, par value $1.00 per share, 200,000,000 authorized shares, 49,909,713 and 49,903,713 shares issued and outstanding at December 31, 2023 and September 30, 2023, respectively | 49.9 | | | 49.9 | |

| Additional paid-in capital | 644.9 | | | 644.2 | |

| Retained earnings | 713.0 | | | 674.8 | |

| Stockholders' equity | 1,407.8 | | | 1,368.9 | |

| Noncontrolling interests | 1.0 | | | 1.0 | |

| Total equity | 1,408.8 | | | 1,369.9 | |

| Total liabilities and equity | $ | 2,533.8 | | | $ | 2,470.7 | |

See accompanying notes to consolidated financial statements.

FORESTAR GROUP INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions, except per share amounts) |

| Revenues | $ | 305.9 | | | $ | 216.7 | |

| Cost of sales | 233.0 | | | 169.2 | |

| Selling, general and administrative expense | 28.0 | | | 22.9 | |

| | | |

| Gain on sale of assets | — | | | (1.6) | |

| Interest and other income | (6.3) | | | (1.7) | |

| Income before income taxes | 51.2 | | | 27.9 | |

| Income tax expense | 13.0 | | | 7.1 | |

| Net income | $ | 38.2 | | | $ | 20.8 | |

| | | |

| | | |

| | | |

| Basic net income per common share | $ | 0.76 | | | $ | 0.42 | |

| Weighted average number of common shares | 50.1 | | | 49.9 | |

| | | |

| Diluted net income per common share | $ | 0.76 | | | $ | 0.42 | |

| Adjusted weighted average number of common shares | 50.5 | | | 49.9 | |

See accompanying notes to consolidated financial statements.

FORESTAR GROUP INC.

CONSOLIDATED STATEMENTS OF TOTAL EQUITY

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Non-controlling Interests | | Total Equity |

| (In millions, except share amounts) |

Balances at September 30, 2023 (49,903,713 shares) | $ | 49.9 | | | $ | 644.2 | | | $ | 674.8 | | | $ | 1.0 | | | $ | 1,369.9 | |

Net income | — | | | — | | | 38.2 | | | — | | | 38.2 | |

Stock issued under employee benefit plans (6,000 shares) | — | | | — | | | — | | | — | | | — | |

Cash paid for shares withheld for taxes | — | | | (0.2) | | | — | | | — | | | (0.2) | |

Stock-based compensation expense | — | | | 0.9 | | | — | | | — | | | 0.9 | |

Balances at December 31, 2023 (49,909,713 shares) | $ | 49.9 | | | $ | 644.9 | | | $ | 713.0 | | | $ | 1.0 | | | $ | 1,408.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Retained Earnings | | Non-controlling Interests | | Total Equity |

| (In millions, except share amounts) |

Balances at September 30, 2022 (49,761,480 shares) | $ | 49.8 | | | $ | 640.6 | | | $ | 507.9 | | | $ | 1.0 | | | $ | 1,199.3 | |

Net income | — | | | — | | | 20.8 | | | — | | | 20.8 | |

Stock issued under employee benefit plans (11,075 shares) | — | | | — | | | — | | | — | | | — | |

Cash paid for shares withheld for taxes | — | | | (0.1) | | | — | | | — | | | (0.1) | |

Stock-based compensation expense | — | | | 0.6 | | | — | | | — | | | 0.6 | |

Balances at December 31, 2022 (49,772,555 shares) | $ | 49.8 | | | $ | 641.1 | | | $ | 528.7 | | | $ | 1.0 | | | $ | 1,220.6 | |

See accompanying notes to consolidated financial statements.

FORESTAR GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions) |

| OPERATING ACTIVITIES | | | |

| Net income | $ | 38.2 | | | $ | 20.8 | |

| Adjustments: | | | |

| Depreciation and amortization | 0.8 | | | 0.7 | |

| Deferred income taxes | (0.5) | | | (2.2) | |

| | | |

| Stock-based compensation expense | 0.9 | | | 0.6 | |

| Impairments and land option charges | 0.2 | | | 2.4 | |

| Gain on sale of assets | — | | | (1.6) | |

| Changes in operating assets and liabilities: | | | |

Increase in real estate | (209.8) | | | (49.9) | |

(Increase) decrease in other assets | (0.9) | | | 1.8 | |

Decrease in accounts payable and other accrued liabilities | (0.9) | | | (8.6) | |

Decrease in accrued development costs | (4.2) | | | (24.3) | |

Increase in earnest money deposits on sales contracts | 19.5 | | | 10.5 | |

| Net cash used in operating activities | (156.7) | | | (49.8) | |

| INVESTING ACTIVITIES | | | |

| Expenditures for property, equipment, software and other | (0.2) | | | (0.1) | |

| | | |

| Proceeds from sale of assets | — | | | 1.6 | |

| Net cash (used in) provided by investing activities | (0.2) | | | 1.5 | |

| FINANCING ACTIVITIES | | | |

| | | |

| Cash paid for shares withheld for taxes | (0.2) | | | (0.1) | |

| Net cash used in financing activities | (0.2) | | | (0.1) | |

| Decrease in cash and cash equivalents | (157.1) | | | (48.4) | |

| Cash and cash equivalents at beginning of period | 616.0 | | | 264.8 | |

| Cash and cash equivalents at end of period | $ | 458.9 | | | $ | 216.4 | |

| SUPPLEMENTAL DISCLOSURES OF NON-CASH ACTIVITIES | | | |

| Note payable issued for real estate | $ | 9.9 | | | $ | — | |

See accompanying notes to consolidated financial statements.

FORESTAR GROUP INC.

Notes to Consolidated Financial Statements

(Unaudited)

Note 1 — Basis of Presentation

The accompanying unaudited consolidated financial statements have been prepared in accordance with U.S. Generally Accepted Accounting Principles ("GAAP") for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X and include the accounts of Forestar Group Inc. ("Forestar") and all of its 100% owned, majority-owned and controlled subsidiaries, which are collectively referred to as the Company unless the context otherwise requires. The Company accounts for its investment in other entities in which it has significant influence over operations and financial policies using the equity method. All intercompany accounts, transactions and balances have been eliminated in consolidation. Noncontrolling interests in consolidated pass-through entities are recognized before income taxes. Net income attributable to noncontrolling interests is zero for all periods presented in the Company's statements of operations. The transactions included in net income in the consolidated statements of operations are the same as those that would be presented in comprehensive income. Thus, the Company's net income equates to comprehensive income.

In the opinion of management, these financial statements reflect all adjustments considered necessary to fairly state the results for the interim periods shown, including normal recurring accruals and other items. These financial statements, including the consolidated balance sheet as of September 30, 2023, which was derived from audited financial statements, do not include all of the information and notes required by GAAP for complete financial statements and should be read in conjunction with the consolidated financial statements and accompanying notes included in the Company’s annual report on Form 10-K for the fiscal year ended September 30, 2023.

In October 2017, Forestar became a majority-owned subsidiary of D.R. Horton, Inc. ("D.R. Horton") by virtue of a merger with a wholly-owned subsidiary of D.R. Horton. Immediately following the merger, D.R. Horton owned 75% of the Company's outstanding common stock. In connection with the merger, the Company entered into certain agreements with D.R. Horton, including a Stockholder’s Agreement, a Master Supply Agreement and a Shared Services Agreement. D.R. Horton is considered a related party of Forestar under GAAP. As of December 31, 2023, D.R. Horton owned approximately 63% of the Company's outstanding common stock.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions. These estimates and assumptions affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ materially from those estimates.

Pending Accounting Standards

In November 2023, the Financial Accounting Standards Board (FASB) issued ASU 2023-07, “Segment Reporting - Improvements to Reportable Segment Disclosures,” which is intended to improve reportable segment disclosures. The ASU expands public entities’ segment disclosures by requiring disclosure of significant segment expenses that are regularly provided to the chief operating decision maker and included within each reported measure of segment profit or loss. It also requires disclosure of the amount and description of the composition of other segment items and interim disclosures of a reportable segment’s profit or loss and assets. The guidance is effective for the Company beginning October 1, 2024, with early adoption permitted. The Company is currently evaluating the impact of this guidance on its consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, “Income Taxes - Improvements to Income Tax Disclosures,” which requires disclosure of disaggregated income taxes paid, prescribes standard categories for the components of the effective tax rate reconciliation and modifies other income tax related disclosures. The guidance is effective for the Company beginning October 1, 2025, with early adoption permitted. The Company is currently evaluating the impact of this guidance on its consolidated financial statements and related disclosures.

Note 2 — Segment Information

The Company manages its operations through its real estate segment, which is its core business and generates substantially all of its revenues. The real estate segment primarily acquires land and installs infrastructure for single-family residential communities, and its revenues generally come from sales of residential single-family finished lots to local, regional and national homebuilders. The Company has other business activities for which the related assets and operating results are immaterial and therefore are included within the Company's real estate segment.

Note 3 — Real Estate

Real estate consists of:

| | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 |

| | (In millions) |

| Developed and under development projects | $ | 1,895.7 | | | $ | 1,760.8 | |

| Land held for future development | 114.1 | | | 29.5 | |

| $ | 2,009.8 | | | $ | 1,790.3 | |

In the three months ended December 31, 2023, the Company invested $228.0 million for the acquisition of residential real estate and $226.5 million for the development of residential real estate. At December 31, 2023 and September 30, 2023, land held for future development primarily consisted of undeveloped land which the Company has the contractual right to sell to D.R. Horton at a sales price equal to the carrying value of the land at the time of sale plus additional consideration of 12% to 16% per annum.

Each quarter, the Company reviews the performance and outlook for all of its real estate for indicators of potential impairment and performs detailed impairment evaluations and analyses when necessary. As a result of this process, no impairment charges were recorded for either period presented in the consolidated statements of operations.

In the three months ended December 31, 2023 and 2022, land purchase contract deposit and pre-acquisition cost write-offs related to land purchase contracts that the Company has terminated or expects to terminate were $0.2 million and $2.4 million, respectively. These land option charges are included in cost of sales in the consolidated statements of operations.

Note 4 — Revenues

Revenues consist of:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions) |

| Residential lot sales | $ | 304.2 | | | $ | 206.7 | |

| Deferred development lot sales | 1.3 | | | 6.7 | |

| Tract sales and other | 0.4 | | | 3.3 | |

| $ | 305.9 | | | $ | 216.7 | |

In the three months ended December 31, 2023 and 2022, the Company recognized $1.3 million and $6.7 million, respectively, in revenues as a result of its progress towards completion of its remaining unsatisfied performance obligations on deferred development projects.

Note 5 — Capitalized Interest

The Company capitalizes interest costs to real estate throughout the development period (active real estate). Capitalized interest is charged to cost of sales as the related real estate is sold. During periods in which the Company’s active real estate is lower than its debt level, a portion of the interest incurred is reflected as interest expense in the period incurred. In the first three months of fiscal 2024 and fiscal 2023, the Company’s active real estate exceeded its debt level, and all interest incurred was capitalized to real estate.

The following table summarizes the Company’s interest costs incurred, capitalized and expensed in the three months ended December 31, 2023 and 2022.

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions) |

| Capitalized interest, beginning of period | $ | 58.5 | | | $ | 52.5 | |

| Interest incurred | 8.1 | | | 8.2 | |

| Interest charged to cost of sales | (6.1) | | | (5.0) | |

| Capitalized interest, end of period | $ | 60.5 | | | $ | 55.7 | |

Note 6 — Other Assets, Accrued Expenses and Other Liabilities

The Company's other assets at December 31, 2023 and September 30, 2023 were as follows:

| | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| | (In millions) |

| Receivables, net | $ | 28.4 | | | $ | 25.7 | |

| Lease right of use assets | 7.9 | | | 7.6 | |

| Prepaid expenses | 12.5 | | | 15.7 | |

| Land purchase contract deposits | 8.2 | | | 7.0 | |

| | | |

| Other assets | 1.8 | | | 2.0 | |

| $ | 58.8 | | | $ | 58.0 | |

The Company's accrued expenses and other liabilities at December 31, 2023 and September 30, 2023 were as follows:

| | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| | (In millions) |

| Accrued employee compensation and benefits | $ | 5.6 | | | $ | 11.2 | |

| Accrued property taxes | 2.3 | | | 7.9 | |

| Lease liabilities | 8.4 | | | 8.1 | |

| Accrued interest | 6.9 | | | 7.0 | |

| Contract liabilities | 9.2 | | | 10.0 | |

| Deferred income | 4.1 | | | 4.1 | |

| Income taxes payable | 18.0 | | | 4.4 | |

| Other accrued expenses | 5.2 | | | 4.8 | |

| Other liabilities | 3.7 | | | 3.7 | |

| $ | 63.4 | | | $ | 61.2 | |

Contract liabilities at December 31, 2023 and September 30, 2023 include $3.4 million and $3.5 million, respectively, related to the Company's remaining unsatisfied performance obligations on deferred development lot sales.

Note 7 — Debt

The Company's notes payable at their carrying amounts consist of the following:

| | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| | (In millions) |

| Unsecured: | | | |

| Revolving credit facility | $ | — | | | $ | — | |

3.85% senior notes due 2026 (1) | 397.7 | | | 397.4 | |

5.0% senior notes due 2028 (1) | 297.7 | | | 297.6 | |

| Other note payable | 9.9 | | | — | |

| $ | 705.3 | | | $ | 695.0 | |

______________

(1)Unamortized debt issuance costs that were deducted from the carrying amounts of the senior notes totaled $4.6 million and $5.0 million at December 31, 2023 and September 30, 2023, respectively.

Bank Credit Facility

The Company has a $410 million senior unsecured revolving credit facility with an uncommitted accordion feature that could increase the size of the facility to $600 million, subject to certain conditions and availability of additional bank commitments. The facility also provides for the issuance of letters of credit with a sublimit equal to the greater of $100 million and 50% of the total revolving credit commitments. Borrowings under the revolving credit facility are subject to a borrowing base calculation based on the book value of the Company's real estate assets and unrestricted cash. Letters of credit issued under the facility reduce the available borrowing capacity. The maturity date of the facility is October 28, 2026. At December 31, 2023, there were no borrowings outstanding and $24.3 million of letters of credit issued under the revolving credit facility, resulting in available capacity of $385.7 million.

The revolving credit facility is guaranteed by the Company’s wholly-owned subsidiaries that are not immaterial subsidiaries or have not been designated as unrestricted subsidiaries. The revolving credit facility includes customary affirmative and negative covenants, events of default and financial covenants. The financial covenants require a minimum level of tangible net worth, a minimum level of liquidity and a maximum allowable leverage ratio. These covenants are measured as defined in the credit agreement governing the facility and are reported to the lenders quarterly. A failure to comply with these financial covenants could allow the lending banks to terminate the availability of funds under the revolving credit facility or cause any outstanding borrowings to become due and payable prior to maturity. At December 31, 2023, the Company was in compliance with all of the covenants, limitations and restrictions of its revolving credit facility.

Senior Notes

The Company has outstanding senior notes as described below that were issued pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended (the "Securities Act"). The notes represent senior unsecured obligations that rank equally in right of payment to all existing and future senior unsecured indebtedness and may be redeemed prior to maturity, subject to certain limitations and premiums defined in the indenture agreements. The notes are guaranteed by each of the Company's subsidiaries to the extent such subsidiaries guarantee the Company's revolving credit facility.

The Company's $400 million principal amount of 3.85% senior notes (the "2026 notes") mature May 15, 2026 with interest payable semi-annually. On or after May 15, 2023, the 2026 notes may be redeemed at 101.925% of their principal amount plus any accrued and unpaid interest. In accordance with the indenture, the redemption price decreases annually thereafter and the 2026 notes can be redeemed at par on or after May 15, 2025 through maturity. The annual effective interest rate of the 2026 notes after giving effect to the amortization of financing costs is 4.1%.

The Company's $300 million principal amount of 5.0% senior notes (the "2028 notes") mature March 1, 2028 with interest payable semi-annually. On or after March 1, 2023, the 2028 notes may be redeemed at 102.5% of their principal amount plus any accrued and unpaid interest. In accordance with the indenture, the redemption price decreases annually thereafter and the 2028 notes can be redeemed at par on or after March 1, 2026 through maturity. The annual effective interest rate of the 2028 notes after giving effect to the amortization of financing costs is 5.2%.

The indentures governing the senior notes require that, upon the occurrence of both a change of control and a rating decline (as defined in each indenture), the Company offer to purchase the applicable series of notes at 101% of their principal amount. If the Company or its restricted subsidiaries dispose of assets, under certain circumstances, the Company will be required to either invest the net cash proceeds from such asset sales in its business within a specified period of time, repay certain senior secured debt or debt of its non-guarantor subsidiaries, or make an offer to purchase a principal amount of such notes equal to the excess net cash proceeds at a purchase price of 100% of their principal amount. The indentures contain covenants that, among other things, restrict the ability of the Company and its restricted subsidiaries to pay dividends or distributions, repurchase equity, prepay subordinated debt and make certain investments; incur additional debt or issue mandatorily redeemable equity; incur liens on assets; merge or consolidate with another company or sell or otherwise dispose of all or substantially all of the Company’s assets; enter into transactions with affiliates; and allow to exist certain restrictions on the ability of subsidiaries to pay dividends or make other payments. At December 31, 2023, the Company was in compliance with all of the limitations and restrictions associated with its senior note obligations.

Effective April 30, 2020, the Board of Directors authorized the repurchase of up to $30 million of the Company’s debt securities. The authorization has no expiration date. All of the $30 million authorization was remaining at December 31, 2023.

Other Note Payable

In December 2023, the Company issued a note payable of $9.9 million as part of a transaction to acquire real estate for development. The note is non-recourse and is secured by the underlying real estate, accrues interest at 4.0% per annum and matures in December 2025.

Note 8 — Earnings per Share

The computations of basic and diluted earnings per share are as follows:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions, except share and per share amounts) |

| Numerator: | | | |

| Net income | $ | 38.2 | | | $ | 20.8 | |

| Denominator: | | | |

| Weighted average common shares outstanding — basic | 50,065,832 | | | 49,890,481 | |

| Dilutive effect of stock-based compensation | 396,250 | | | 8,541 | |

| Total weighted average shares outstanding — diluted | 50,462,082 | | | 49,899,022 | |

| | | |

| Basic net income per common share | $ | 0.76 | | | $ | 0.42 | |

| Diluted net income per common share | $ | 0.76 | | | $ | 0.42 | |

Note 9 — Income Taxes

The Company’s income tax expense for the three months ended December 31, 2023 was $13.0 million compared to $7.1 million in the prior year period. The effective tax rate for both periods was 25.4% and included an expense for state income taxes and nondeductible expenses.

At December 31, 2023, the Company had deferred tax liabilities, net of deferred tax assets, of $49.3 million. The deferred tax assets were partially offset by a valuation allowance of $0.9 million, resulting in a net deferred tax liability of $50.2 million. At September 30, 2023, deferred tax liabilities, net of deferred tax assets, were $49.8 million. The deferred tax assets were partially offset by a valuation allowance of $0.9 million, resulting in a net deferred tax liability of $50.7 million. The valuation allowance for both periods was recorded because it is more likely than not that a portion of the Company's state deferred tax assets, primarily net operating loss (NOL) carryforwards, will not be realized because the Company is no longer operating in some states or the NOL carryforward periods are too brief to realize the related deferred tax asset. The Company will continue to evaluate both the positive and negative evidence in determining the need for a valuation allowance on its deferred tax assets. Any reversal of the valuation allowance in future periods will impact the effective tax rate.

Note 10 — Stockholders' Equity and Stock-Based Compensation

Stockholders' Equity

The Company has an effective shelf registration statement, filed with the Securities and Exchange Commission in October 2021, registering $750 million of equity securities, of which $300 million was reserved for sales under the at-the-market equity offering program that became effective in November 2021. In the three months ended December 31, 2023, there were no shares of common stock issued under the Company's at-the-market equity offering program. At December 31, 2023, $748.2 million remained available for issuance under the shelf registration statement, of which $298.2 million was reserved for sales under the at-the-market equity offering program.

Restricted Stock Units (RSUs)

The Company’s Stock Incentive Plan provides for the granting of stock options and restricted stock units to executive officers, other key employees and non-management directors. Restricted stock unit awards may be based on performance (performance-based) or on service over a requisite time period (time-based). RSU equity awards represent the contingent right to receive one share of the Company’s common stock per RSU if the vesting conditions and/or performance criteria are satisfied. The RSUs have no voting rights until vested.

In the three months ended December 31, 2023, a total of 24,000 time-based RSUs were granted. The weighted average grant date fair value of these equity awards was $23.47 per unit, and they vest annually in equal installments over three years. Total stock-based compensation expense related to the Company's RSUs for the three months ended December 31, 2023 was $0.9 million compared to $0.6 million in the prior year period.

Note 11 — Commitments and Contingencies

Contractual Obligations and Off-Balance Sheet Arrangements

In support of the Company's residential lot development business, it issues letters of credit under the revolving credit facility and has a surety bond program that provides financial assurance to beneficiaries related to the execution and performance of certain development obligations. At December 31, 2023, the Company had outstanding letters of credit of $24.3 million under the revolving credit facility and surety bonds of $669.1 million issued by third parties to secure performance under various contracts. The Company expects that its performance obligations secured by these letters of credit and bonds will generally be completed in the ordinary course of business and in accordance with the applicable contractual terms. When the Company completes its performance obligations, the related letters of credit and bonds are generally released shortly thereafter, leaving the Company with no continuing obligations. The Company has no material third-party guarantees.

Litigation

The Company is involved in various legal proceedings that arise from time to time in the ordinary course of business and believes that adequate reserves have been established for any probable losses. The Company does not believe that the outcome of any of these proceedings will have a significant adverse effect on its financial position, long-term results of operations or cash flows. It is possible, however, that charges related to these matters could be significant to the Company's results or cash flows in any one accounting period.

Land Purchase Contracts

The Company enters into land purchase contracts to acquire land for the development of residential lots. Under these contracts, the Company will fund a stated deposit in consideration for the right, but not the obligation, to purchase land or lots at a future point in time with predetermined terms. Under the terms of many of the purchase contracts, the deposits are not refundable in the event the Company elects to terminate the contract. Land purchase contract deposits and capitalized pre-acquisition costs are expensed to inventory and land option charges when the Company believes it is probable that it will not acquire the property under contract and will not be able to recover these costs through other means.

At December 31, 2023, the Company had total deposits of $8.2 million related to contracts to purchase land with a total remaining purchase price of approximately $483.9 million. At December 31, 2023, none of the land purchase contracts were subject to specific performance provisions.

Note 12 — Related Party Transactions

D.R. Horton

The Company has a Shared Services Agreement with D.R. Horton whereby D.R. Horton provides the Company with certain administrative, compliance, operational and procurement services. In the three months ended December 31, 2023 and 2022, selling, general and administrative expense in the consolidated statements of operations included $1.3 million and $0.9 million for these shared services, $2.4 million and $2.3 million reimbursed to D.R. Horton for the cost of health insurance and other employee benefits and $0.3 million and $0.6 million for other corporate and administrative expenses paid by D.R. Horton on behalf of the Company.

Under the terms of the Master Supply Agreement with D.R. Horton, both companies identify land development opportunities to expand Forestar's portfolio of assets. At December 31, 2023 and September 30, 2023, the Company owned approximately 55,400 and 52,400 residential lots, respectively, of which D.R. Horton had the following involvement.

| | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| | (Dollars in millions) |

| Residential lots under contract to sell to D.R. Horton | 16,200 | | | 14,400 | |

| Owned lots subject to right of first offer with D.R. Horton based on executed purchase and sale agreements | 17,500 | | | 17,000 | |

| Earnest money deposits from D.R. Horton for lots under contract | $ | 136.1 | | | $ | 117.1 | |

| Remaining sales price of lots under contract with D.R. Horton | $ | 1,500.8 | | | $ | 1,319.2 | |

Lot and land sales to D.R. Horton in the three months ended December 31, 2023 and 2022 were as follows:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (Dollars in millions) |

| Residential lots sold to D.R. Horton | 2,834 | | | 2,094 | |

| Residential lot sales revenues from sales to D.R. Horton | $ | 272.8 | | | $ | 187.1 | |

| Decrease in contract liabilities on lot sales to D.R. Horton | $ | 0.7 | | | $ | 2.7 | |

| | | |

| | | |

In the three months ended December 31, 2023, the Company reimbursed D.R. Horton approximately $4.6 million for pre-acquisition and other due diligence and development costs related to land purchase contracts identified by D.R. Horton that the Company independently underwrote and closed compared to reimbursements of $4.7 million in the prior year period. In the three months ended December 31, 2023, the Company reimbursed D.R. Horton approximately $13.3 million for previously paid earnest money related to those land purchase contracts compared to reimbursements of $0.1 million in the prior year period.

In the three months ended December 31, 2023 and 2022, the Company paid D.R. Horton $0.5 million and $0.2 million, respectively, for land development services. These amounts are included in cost of sales in the Company’s consolidated statements of operations.

At December 31, 2023 and September 30, 2023, land held for future development primarily consisted of undeveloped land which the Company has the contractual right to sell to D.R. Horton at a sales price equal to the carrying value of the land at the time of sale plus additional consideration of 12% to 16% per annum.

At December 31, 2023 and September 30, 2023, accrued expenses and other liabilities on the Company's consolidated balance sheets included $3.5 million and $3.2 million owed to D.R. Horton for any accrued and unpaid shared service charges, land purchase contract deposits and due diligence and other development cost reimbursements.

R&R

In the three months ended December 31, 2023, the Company acquired a tract of residential real estate from Double R DevCo, LLC (“R&R”) for $11.3 million and simultaneously entered into a finished lot purchase agreement with D.R. Horton. The tract was originally under contract with D.R. Horton. The Company independently underwrote the transaction and chose to close in place of D.R. Horton. R&R is owned and controlled by Ryan and Reagan Horton, the adult sons of Donald R. Horton, Chairman of D.R. Horton.

Note 13 — Fair Value Measurements

Fair value is the exchange price that would be received for an asset or paid to transfer a liability in an orderly transaction between market participants. In arriving at a fair value measurement, the Company uses a fair value hierarchy based on three levels of inputs, of which the first two are considered observable and the last unobservable. The three levels of inputs used to establish fair value are the following:

•Level 1 — Quoted prices in active markets for identical assets or liabilities;

•Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities; and

•Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to the fair value of the assets or liabilities.

The Company elected not to use the fair value option for cash and cash equivalents and debt.

For the financial assets and liabilities that the Company does not reflect at fair value, the following tables present both their respective carrying value and fair value at December 31, 2023 and September 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value at December 31, 2023 |

| | Carrying Value | | Level 1 | | Level 2 | | Level 3 | | Total |

| | (in millions) |

Cash and cash equivalents (a) | $ | 458.9 | | | $ | 458.9 | | | $ | — | | | $ | — | | | $ | 458.9 | |

Debt (b) (c) | 705.3 | | | — | | | 673.5 | | | 9.9 | | | 683.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value at September 30, 2023 |

| Carrying Value | | Level 1 | | Level 2 | | Level 3 | | Total |

| (in millions) |

Cash and cash equivalents (a) | $ | 616.0 | | | $ | 616.0 | | | $ | — | | | $ | — | | | $ | 616.0 | |

Debt (b) | 695.0 | | | — | | | 633.2 | | | — | | | 633.2 | |

_____________________

(a) The fair values of cash and cash equivalents approximate their carrying values due to their short-term nature and are classified as Level 1 within the fair value hierarchy.

(b) At December 31, 2023 and September 30, 2023, debt primarily consisted of the Company's senior notes. The fair value of the senior notes is determined based on quoted market prices in markets that are not active, which is classified as Level 2 within the fair value hierarchy.

(c) The fair value of the Company's other note payable approximates its carrying value due to its short-term nature and is classified as Level 3 within the fair value hierarchy.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our consolidated financial statements and related notes included in this quarterly report and with our annual report on Form 10-K for the fiscal year ended September 30, 2023. Some of the information contained in this discussion and analysis constitutes forward-looking statements that involve risks and uncertainties. Actual results could differ materially from those discussed in these forward-looking statements. Factors that could cause or contribute to these differences include, but are not limited to, those described in the “Forward-Looking Statements” section following this discussion.

Our Operations

Forestar Group Inc. is a national, well-capitalized residential lot development company with operations in 57 markets in 23 states as of December 31, 2023. We are focused primarily on making investments in land acquisition and development to sell finished single-family residential lots to homebuilders. Our common stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol “FOR.” The terms “Forestar,” the “Company,” “we” and “our” used herein refer to Forestar Group Inc., a Delaware corporation, and its predecessors and subsidiaries. In October 2017, Forestar became a majority-owned subsidiary of D.R. Horton, Inc. ("D.R. Horton") by virtue of a merger with a wholly-owned subsidiary of D.R. Horton. Immediately following the merger, D.R. Horton owned 75% of the Company's outstanding common stock. As of December 31, 2023, D.R. Horton owned approximately 63% of the Company's outstanding common stock. As our controlling shareholder, D.R. Horton has significant influence in guiding our strategic direction and operations.

We manage our operations through our real estate segment, which is our core business and generates substantially all of our revenues. The real estate segment primarily acquires land and installs infrastructure for single-family residential communities, and its revenues generally come from sales of residential single-family finished lots to local, regional and national homebuilders. We have other business activities for which the related assets and operating results are immaterial and therefore are included within our real estate segment.

Our real estate segment conducts a wide range of project planning and management activities related to the entitlement, acquisition, community development and sale of residential lots. We generally secure entitlements while the land is under contract by creating plans that meet the needs of the markets where we operate, and we aim to have all entitlements secured before closing on the investment. Moving land through the entitlement and development process creates significant value. We primarily invest in entitled short-duration projects that can be developed in phases, enabling us to complete and sell lots at a pace that matches market demand, consistent with our focus on maximizing capital efficiency and returns. We occasionally make short-term strategic investments in finished lots (lot banking) and undeveloped land (land banking) with the intent to sell these assets within a short time period to utilize available capital prior to its deployment into longer-term lot development projects. Our customers are primarily local, regional and national homebuilders. The lots we deliver in our communities are primarily for entry-level, first-time move-up and active adult homes. Entry-level and first-time move-up homebuyers are the largest segments of the new home market. We also market some of our communities towards build-to-rent operators.

Demand for residential lots, particularly at affordable price points, remained strong in the three months ended December 31, 2023, and our lot sales increased 39% from the prior year period. The supply of new and existing homes at affordable price points remains limited, and low resale supply continues to support the demand for new construction. Demographics supporting housing demand remain favorable despite higher mortgage rates and inflationary pressures, and homebuilders have continued to adjust to current market conditions by using incentives and price adjustments accordingly. While the disruptions in the supply chain for certain construction materials and tightness in the labor market have improved, municipality delays are still extending development cycle times, and development costs remain elevated. We increase our land and lot sales prices when market conditions permit, and we attempt to offset cost increases in one component with savings in another. However, if market conditions are challenging, we may have to reduce selling prices or may not be able to offset cost increases with higher selling prices. We believe we are well-positioned to operate effectively through changing economic conditions because of our low net leverage and strong liquidity position, our low overhead model, our geographically diverse lot portfolio that is focused on affordable price points and our strategic relationship with D.R. Horton. We plan to remain disciplined when investing in land opportunities and to remain focused on managing our lot sales pace and lot pricing at each community to optimize the return on our investments.

Results of Operations

The following tables and related discussion set forth key operating and financial data as of and for the three months ended December 31, 2023 and 2022.

Operating Results

Components of income before income taxes were as follows:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 |

| (In millions) |

| Revenues | $ | 305.9 | | | $ | 216.7 | |

| Cost of sales | 233.0 | | | 169.2 | |

| Selling, general and administrative expense | 28.0 | | | 22.9 | |

| | | |

| Gain on sale of assets | — | | | (1.6) | |

| Interest and other income | (6.3) | | | (1.7) | |

| Income before income taxes | $ | 51.2 | | | $ | 27.9 | |

Lot Sales

Residential lots sold consisted of:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| Development projects | 3,150 | | | 2,263 | |

| | | |

| | | |

| | | |

| | | |

| | | |

Average sales price per lot (a) | $ | 96,400 | | | $ | 90,100 | |

_______________

(a) Excludes lots sold from deferred development projects and any impact from change in contract liabilities.

Revenues

Revenues consisted of:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions) |

| Residential lot sales: | | | |

| Development projects | $ | 303.5 | | | $ | 204.0 | |

| | | |

| Decrease in contract liabilities | 0.7 | | | 2.7 | |

| 304.2 | | | 206.7 | |

| Deferred development projects | 1.3 | | | 6.7 | |

| 305.5 | | | 213.4 | |

| Tract sales and other | 0.4 | | | 3.3 | |

| Total revenues | $ | 305.9 | | | $ | 216.7 | |

Residential lots sold and residential lot sales revenues in the three months ended December 31, 2023 increased compared to the prior year primarily as a result of improved demand for finished lots as homebuilders have increased their pace of new home starts to better match the stronger demand for new homes, particularly at affordable price points.

Residential lot sales to D.R. Horton and customers other than D.R. Horton, excluding deferred development projects, consisted of:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| Residential lots sold to D.R. Horton | 2,834 | | | 2,094 | |

| Residential lots sold to customers other than D.R. Horton | 316 | | | 169 | |

| 3,150 | | | 2,263 | |

Residential lot revenues from lot sales to D.R. Horton and customers other than D.R. Horton, before deferred development projects and changes in contract liabilities, consisted of:

| | | | | | | | | | | |

| Three Months Ended December 31, |

| | 2023 | | 2022 |

| | (In millions) |

| Revenues from lot sales to D.R. Horton | $ | 272.8 | | | $ | 187.1 | |

| Revenues from lot sales to customers other than D.R. Horton | 30.7 | | | 16.9 | |

| $ | 303.5 | | | $ | 204.0 | |

Lots sold to customers other than D.R. Horton in the three months ended December 31, 2023 included 124 lots that were sold for $15.1 million to a lot banker who expects to sell those lots to D.R. Horton at a future date.

Cost of Sales, Real Estate Impairment and Land Option Charges and Interest Incurred

Cost of sales in the three months ended December 31, 2023 increased compared to the prior year period primarily due to the increase in the number of lots sold.

Each quarter, we review the performance and outlook for all of our real estate for indicators of potential impairment and perform detailed impairment evaluations and analyses when necessary. As a result of this process, there were no impairment charges recorded for the three months ended December 31, 2023 and 2022. In the three months ended December 31, 2023, land purchase contract deposit and pre-acquisition cost write-offs related to land purchase contracts that the we have terminated or expect to terminate were $0.2 million compared to $2.4 million in the prior year period.

We capitalize interest costs throughout the development period (active real estate). Capitalized interest is charged to cost of sales as the related real estate is sold. Interest incurred was $8.1 million in the three months ended December 31, 2023 compared to $8.2 million in the prior year period. Interest charged to cost of sales was 2.6% of total cost of sales (excluding impairments and land option charges) in the three months ended December 31, 2023 compared to 3.0% in the prior year period.

Selling, General and Administrative (SG&A) Expense and Other Income Statement Items

SG&A expense in the three months ended December 31, 2023 was $28.0 million compared to $22.9 million in the prior year period and as a percentage of revenues was 9.2% compared to 10.6%. Our SG&A expense primarily consisted of employee compensation and related costs. Our business operations employed 329 and 277 employees at December 31, 2023 and 2022, respectively. We attempt to control our SG&A costs while ensuring that our infrastructure supports our operations; however, we cannot make assurances that we will be able to maintain or improve upon the current SG&A expense as a percentage of revenues.

Income Taxes

Our income tax expense for the three months ended December 31, 2023 was $13.0 million compared to $7.1 million in the prior year period. Our effective tax rate for both periods was 25.4% and included an expense for state income taxes and nondeductible expenses.

At December 31, 2023, we had deferred tax liabilities, net of deferred tax assets, of $49.3 million. The deferred tax assets were partially offset by a valuation allowance of $0.9 million, resulting in a net deferred tax liability of $50.2 million. At September 30, 2023, deferred tax liabilities, net of deferred tax assets, were $49.8 million. The deferred tax assets were partially offset by a valuation allowance of $0.9 million, resulting in a net deferred tax liability of $50.7 million. The valuation allowance for both periods was recorded because it is more likely than not that a portion of our state deferred tax assets, primarily NOL carryforwards, will not be realized because we are no longer operating in some states or the NOL carryforward periods are too brief to realize the related deferred tax asset. We will continue to evaluate both the positive and negative evidence in determining the need for a valuation allowance on our deferred tax assets. Any reversal of the valuation allowance in future periods will impact our effective tax rate.

Land and Lot Position

Our land and lot position at December 31, 2023 and September 30, 2023 is summarized as follows:

| | | | | | | | | | | |

| | December 31, 2023 | | September 30, 2023 |

| Lots owned | 55,400 | | | 52,400 | |

| Lots controlled through land and lot purchase contracts | 27,000 | | | 26,800 | |

| Total lots owned and controlled | 82,400 | | | 79,200 | |

| | | |

| Owned lots under contract to sell to D.R. Horton | 16,200 | | | 14,400 | |

| Owned lots under contract to customers other than D.R. Horton | 500 | | | 600 | |

| Total owned lots under contract | 16,700 | | | 15,000 | |

| | | |

| Owned lots subject to right of first offer with D.R. Horton based on executed purchase and sale agreements | 17,500 | | | 17,000 | |

| Owned lots fully developed | 7,300 | | | 6,400 | |

Liquidity and Capital Resources

Liquidity

At December 31, 2023, we had $458.9 million of cash and cash equivalents and $385.7 million of available borrowing capacity on our revolving credit facility. We have no senior note maturities until fiscal 2026. We believe we are well-positioned to operate effectively during changing economic conditions because of our low net leverage and strong liquidity position, our low overhead model and our strategic relationship with D.R. Horton.

At December 31, 2023, our ratio of debt to total capital (debt divided by stockholders’ equity plus debt) was 33.4% compared to 33.7% at September 30, 2023 and 36.7% at December 31, 2022. Our ratio of net debt to total capital (debt net of unrestricted cash divided by stockholders’ equity plus debt net of unrestricted cash) was 14.9% compared to 5.5% at September 30, 2023 and 28.7% at December 31, 2022. Over the long term, we intend to maintain our ratio of net debt to total capital at approximately 40% or less. We believe that the ratio of net debt to total capital is useful in understanding the leverage employed in our operations.

We believe that our existing cash resources and revolving credit facility will provide sufficient liquidity to fund our near-term working capital needs. Our ability to achieve our long-term growth objectives will depend on our ability to obtain financing in sufficient amounts. We regularly evaluate alternatives for managing our capital structure and liquidity profile in consideration of expected cash flows, growth and operating capital requirements and capital market conditions. We may, at any time, be considering or preparing for the purchase or sale of our debt securities, the sale of our common stock or a combination thereof.

Bank Credit Facility

We have a $410 million senior unsecured revolving credit facility with an uncommitted accordion feature that could increase the size of the facility to $600 million, subject to certain conditions and availability of additional bank commitments. The facility also provides for the issuance of letters of credit with a sublimit equal to the greater of $100 million and 50% of the total revolving credit commitments. Borrowings under the revolving credit facility are subject to a borrowing base calculation based on the book value of our real estate assets and unrestricted cash. Letters of credit issued under the facility reduce the available borrowing capacity. The maturity date of the facility is October 28, 2026. At December 31, 2023, there were no borrowings outstanding and $24.3 million of letters of credit issued under the revolving credit facility, resulting in available capacity of $385.7 million.

The revolving credit facility is guaranteed by our wholly-owned subsidiaries that are not immaterial subsidiaries or have not been designated as unrestricted subsidiaries. The revolving credit facility includes customary affirmative and negative covenants, events of default and financial covenants. The financial covenants require a minimum level of tangible net worth, a minimum level of liquidity and a maximum allowable leverage ratio. These covenants are measured as defined in the credit agreement governing the facility and are reported to the lenders quarterly. A failure to comply with these financial covenants could allow the lending banks to terminate the availability of funds under the revolving credit facility or cause any outstanding borrowings to become due and payable prior to maturity. At December 31, 2023, we were in compliance with all of the covenants, limitations and restrictions of our revolving credit facility.

Senior Notes

We have outstanding senior notes as described below that were issued pursuant to Rule 144A and Regulation S under the Securities Act of 1933, as amended. The notes represent senior unsecured obligations that rank equally in right of payment to all existing and future senior unsecured indebtedness and may be redeemed prior to maturity, subject to certain limitations and premiums defined in the respective indenture. The notes are guaranteed by each of our subsidiaries to the extent such subsidiaries guarantee our revolving credit facility.

Our $400 million principal amount of 3.85% senior notes (the "2026 notes") mature May 15, 2026 with interest payable semi-annually. On or after May 15, 2023, the 2026 notes may be redeemed at 101.925% of their principal amount plus any accrued and unpaid interest. In accordance with the indenture, the redemption price decreases annually thereafter, and the 2026 notes can be redeemed at par on or after May 15, 2025 through maturity. The annual effective interest rate of the 2026 notes after giving effect to the amortization of financing costs is 4.1%.

We also have $300 million principal amount of 5.0% senior notes (the "2028 notes") outstanding, which mature March 1, 2028 with interest payable semi-annually. On or after March 1, 2023, the 2028 notes may be redeemed at 102.5% of their principal amount plus any accrued and unpaid interest. In accordance with the indenture, the redemption price decreases annually thereafter and the 2028 notes can be redeemed at par on or after March 1, 2026 through maturity. The annual effective interest rate of the 2028 notes after giving effect to the amortization of financing costs is 5.2%.

The indentures governing our senior notes require that, upon the occurrence of both a change of control and a rating decline (as defined in each indenture), we offer to purchase the applicable series of notes at 101% of their principal amount. If we or our restricted subsidiaries dispose of assets, under certain circumstances, we will be required to either invest the net cash proceeds from such asset sales in our business within a specified period of time, repay certain senior secured debt or debt of our non-guarantor subsidiaries, or make an offer to purchase a principal amount of such notes equal to the excess net cash proceeds at a purchase price of 100% of their principal amount. The indentures contain covenants that, among other things, restrict the ability of us and our restricted subsidiaries to pay dividends or distributions, repurchase equity, prepay subordinated debt and make certain investments; incur additional debt or issue mandatorily redeemable equity; incur liens on assets; merge or consolidate with another company or sell or otherwise dispose of all or substantially all of our assets; enter into transactions with affiliates; and allow to exist certain restrictions on the ability of subsidiaries to pay dividends or make other payments. At December 31, 2023, we were in compliance with all of the limitations and restrictions associated with our senior note obligations.

Effective April 30, 2020, our Board of Directors authorized the repurchase of up to $30 million of our debt securities. The authorization has no expiration date. All of the $30 million authorization was remaining at December 31, 2023.

Other Note Payable

In December 2023, we issued a note payable of $9.9 million as part of a transaction to acquire real estate for development. The note is non-recourse and is secured by the underlying real estate, accrues interest at 4.0% per annum and matures in December 2025.

Issuance of Common Stock

We have an effective shelf registration statement filed with the Securities and Exchange Commission in October 2021, registering $750 million of equity securities, of which $300 million was reserved for sales under our at-the-market equity offering program that became effective November 2021. In the three months ended December 31, 2023, there were no shares of common stock issued under our at-the-market equity offering program. At December 31, 2023, $748.2 million remained available for issuance under the shelf registration statement, of which $298.2 million was reserved for sales under our at-the-market equity offering program.

Operating Cash Flow Activities

In the three months ended December 31, 2023, net cash used in operating activities was $156.7 million, which was primarily the result of the increase in real estate, partially offset by net income generated in the period and the increase in earnest money on sales contracts. In the three months ended December 31, 2022, net cash used in operating activities was $49.8 million, which was primarily the result of the increase in real estate, partially offset by net income generated in the period.

Investing Cash Flow Activities

In the three months ended December 31, 2023, net cash used in investing activities was $0.2 million compared to $1.5 million of cash provided by investing activities in the prior year period.

Financing Cash Flow Activities

In the three months ended December 31, 2023, net cash used in financing activities was $0.2 million compared to $0.1 million in the prior year period.

Critical Accounting Policies and Estimates

There have been no material changes in our critical accounting policies or estimates from those disclosed in our 2023 Annual Report on Form 10-K.

New and Pending Accounting Pronouncements

Please read Note 1—Basis of Presentation to the consolidated financial statements included in this Quarterly Report on Form 10-Q.

Forward-Looking Statements

This Quarterly Report on Form 10-Q and other materials we have filed or may file with the Securities and Exchange Commission contain “forward-looking statements” within the meaning of the federal securities laws. These forward-looking statements are identified by their use of terms and phrases such as “believe,” “anticipate,” “could,” “estimate,” “likely,” “intend,” “may,” “plan,” “expect,” and similar expressions, including references to assumptions. These statements reflect our current views with respect to future events and are subject to risks and uncertainties. We note that a variety of factors and uncertainties could cause our actual results to differ significantly from the results discussed in the forward-looking statements. Factors and uncertainties that might cause such differences include, but are not limited to:

•the effect of D.R. Horton’s controlling level of ownership on us and the holders of our securities;

•our ability to realize the potential benefits of the strategic relationship with D.R. Horton;

•the effect of our strategic relationship with D.R. Horton on our ability to maintain relationships with our customers;

•the cyclical nature of the homebuilding and lot development industries and changes in economic, real estate and other conditions;

•the impact of significant inflation, higher interest rates or deflation;

•supply shortages and other risks of acquiring land, construction materials and skilled labor;

•the effects of public health issues such as a major epidemic or pandemic on the economy and our business;

•the impacts of weather conditions and natural disasters;

•health and safety incidents relating to our operations;

•our ability to obtain or the availability of surety bonds to secure our performance related to construction and development activities and the pricing of bonds;

•the strength of our information technology systems and the risk of cybersecurity breaches and our ability to satisfy privacy and data protection laws and regulations;

•the impact of governmental policies, laws or regulations and actions or restrictions of regulatory agencies;

•our ability to achieve our strategic initiatives;

•continuing liabilities related to assets that have been sold;

•the cost and availability of property suitable for residential lot development;

•general economic, market or business conditions where our real estate activities are concentrated;

•our dependence on relationships with national, regional and local homebuilders;

•competitive conditions in our industry;

•obtaining reimbursements and other payments from governmental districts and other agencies and timing of such payments;

•our ability to succeed in new markets;

•the conditions of the capital markets and our ability to raise capital to fund expected growth;

•our ability to manage and service our debt and comply with our debt covenants, restrictions and limitations;

•the volatility of the market price and trading volume of our common stock; and

•our ability to hire and retain key personnel.

Other factors, including the risk factors described in Item 1A of our 2023 Annual Report on Form 10-K, may also cause actual results to differ materially from those projected by our forward-looking statements. New factors emerge from time to time and it is not possible for us to predict all such factors, nor can we assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.

Any forward-looking statement speaks only as of the date on which such statement is made, and, except as required by law, we expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Interest Rate Risk

We are subject to interest rate risk on our senior debt, revolving credit facility and our other note payable. We monitor our exposure to changes in interest rates and utilize both fixed and variable rate debt. For fixed rate debt, changes in interest rates generally affect the fair value of the debt instrument, but not our earnings or cash flows. Conversely, for variable rate debt, changes in interest rates generally do not impact the fair value of the debt instrument, but may affect our future earnings and cash flows. Except in very limited circumstances, we do not have an obligation to prepay fixed-rate debt prior to maturity and, as a result, interest rate risk and changes in fair value would not have a significant impact on our cash flows related to our fixed-rate debt until such time as we are required to refinance, repurchase or repay such debt.

At December 31, 2023, our fixed rate debt consisted of $400 million principal amount of 3.85% senior notes due May 2026, $300 million principal amount of 5.0% senior notes due March 2028 and $9.9 million principal amount of 4.0% other note payable due in December 2025. Our variable rate debt consisted of the outstanding borrowings on our $410 million senior unsecured revolving credit facility, of which there were none at December 31, 2023.

Item 4. Controls and Procedures.

(a) Disclosure controls and procedures

Our management, with the participation of the Chief Executive Officer and Chief Financial Officer, has evaluated the effectiveness of our disclosure controls and procedures (as such term is defined in Rules 13a-15(e) and 15d-15(e) under the Securities Exchange Act of 1934, as amended (the "Exchange Act")), as of the end of the period covered by this report. Based on such evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that, as of the end of such period, our disclosure controls and procedures were effective in recording, processing, summarizing and reporting, on a timely basis, information required to be disclosed by us in the reports that we file or submit under the Exchange Act and were effective in ensuring that information required to be disclosed by us in the reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

(b) Changes in internal control over financial reporting

There have been no changes in our internal control over financial reporting (as such term is defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the quarter ended December 31, 2023 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II—OTHER INFORMATION

Item 1. Legal Proceedings.

We are involved in various legal proceedings that arise from time to time in the ordinary course of our business. We believe we have established adequate reserves for any probable losses and that the outcome of any of the proceedings should not have a material adverse effect on our financial position or long-term results of operations or cash flows. It is possible, however, that charges related to these matters could be significant to our results of operations or cash flow in any single accounting period.

Item 5. Other Information.

(c) Trading Plans

During the three months ended December 31, 2023, no director or Section 16 officer adopted or terminated any Rule 10b5-1 trading arrangements or non-Rule 10b5-1 trading arrangements (in each case, as defined in Item 408(a) of Regulation S-K).

Item 6. Exhibits.

| | | | | | | | |

Exhibit

Number | | Exhibit |

| 10.1* | | |

| 10.2* | | |

| 31.1* | | |

| 31.2* | | |

| 32.1* | | |

| 32.2* | | |

| 101.INS** | | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH** | | Inline XBRL Taxonomy Extension Schema Document. |

| 101.CAL** | | Inline XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.DEF** | | Inline XBRL Taxonomy Extension Definition Linkbase Document. |

| 101.LAB** | | Inline XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE** | | Inline XBRL Taxonomy Extension Presentation Linkbase Document. |

| 104** | | Cover Page Interactive Data File (embedded within the Inline XBRL document contained in Exhibit 101). |

| _____________________ |

| * | | Filed or furnished herewith. |

| ** | | Submitted electronically herewith. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | Forestar Group Inc. |

| | | |

| Date: | January 24, 2024 | By: | /s/ James D. Allen |

| | | James D. Allen, on behalf of Forestar Group Inc. |

| | | as Executive Vice President and Chief Financial Officer |

| | | (Principal Financial and Principal Accounting Officer) |

SEPARATION AGREEMENT AND GENERAL RELEASE

WHEREAS, Daniel C. Bartok (“Employee”) was hired by Forestar (USA) Real Estate Group to work as a Chief Executive Officer as an at will employee; and

WHEREAS, Forestar (as defined below) has paid Employee all employment-related compensation and provided Employee with all employment-related benefits to which Employee is entitled through January 1, 2024, with the exception of (1) redemption of Restricted Stock Units and (2) any final pay (including pay for accrued unused vacation) not yet paid at the time this Agreement is executed; and

WHEREAS, Forestar and Employee desire to fully and finally sever their relationship with one another and to resolve any current or possible disputes between them, including without limitation any such disputes arising out of Employee’s employment with Forestar; and

WHEREAS, Forestar has voluntarily offered to pay Employee monies in the form of a severance payment, in exchange for the releases and promises set forth below. The parties agree that such severance payment will not be due and owing and this agreement will not be effective unless (1) Employee executes this agreement and delivers the original to Forestar within the time prescribed herein, and (2) the revocation period described in paragraph 5 expires; and

NOW, THEREFORE, Forestar and Employee (collectively, the “Parties”), in consideration for the mutual promises, agreements, and covenants described above and below, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties, execute this Separation Agreement and General Release (the "Agreement"), and agree as follows:

1. Definitions.

A. "Forestar" means Forestar (USA) Real Estate Group, any subsidiary corporations, and all other entities related directly or indirectly to Forestar (USA) Real Estate Group, and each of their agents, employees, representatives, servants, attorneys, assigns, partners, officers, directors, and predecessors and/or successors in interest, whether current or past.

B. "Employee" means the above-described Employee, together with Employee’s heirs, assigns, insurers, attorneys, legal representatives, successors in interest, agents, delegates, designees, and other representatives.

2. Termination of Employment. Employee’s employment with Forestar has ended

effective January 1, 2024 (the “Termination Date”).