Form 8-K - Current report

January 23 2024 - 5:00PM

Edgar (US Regulatory)

false

0001767057

0001767057

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 18, 2024

Osprey

Bitcoin Trust

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-56307 |

|

83-2424407 |

(State

or other jurisdiction of

Incorporation or organization) |

|

Commission

File No. |

|

(I.R.S.

Employer

Identification No.) |

1241

Post Road, 2nd Floor

Fairfield, CT 06824

(Address

of principal executive offices) (Zip Code)

(914)

214-4697

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

3.03. Material Modifications to Rights of Security Holders

On

January 18, 2024, Osprey Funds, LLC, the sponsor (the “Sponsor”) of Osprey Bitcoin Trust (the “Trust”), and Delaware

Trust Company entered into an amendment (the “Second Amendment”) to the Second Declaration of Trust and Trust Agreement (the

“Trust Agreement”) to, among other things, include redemption procedures for the

Trust’s common units of fractional undivided beneficial interest as Schedule A to the Trust Agreement, pursuant to Section 6.1

of the Trust Agreement.

The

foregoing description is a summary, does not purport to be a complete description of the Second Amendment, and is subject to, and qualified

entirely by reference to, the full text of the Second Amendment, which is filed as Exhibit 3.01 to this Current Report on Form 8-K and

incorporated by reference herein.

Item

9.01. Financial Statements and Exhibits

(d) Exhibits

The

exhibit listed in the following Exhibit Index is filed as part of this Current Report on Form 8-K.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereto duly authorized.

Dated:

January 23, 2024

| |

Osprey Funds, LLC as Sponsor of Osprey Bitcoin Trust (OBTC) |

| |

|

|

| |

By: |

/s/

Gregory D. King |

| |

|

Name:

Gregory D. King

Title:

Chief Executive Officer |

Exhibit 3.01

AMENDMENT

TO TRUST AGREEMENT

This

Second Amendment (the “Amendment”) to the Second Declaration of Trust and Trust Agreement of Osprey Bitcoin Trust, by and

among Osprey Funds, LLC, a Delaware limited liability company (“Sponsor”), Delaware Trust Company (“Trustee”),

and the Unitholders, dated as of November 1, 2020 (the “Trust Agreement”) is dated and effective as of January 18, 2024.

Capitalized terms used herein and not otherwise defined shall have the meanings ascribed to them in the Trust Agreement.

WHEREAS,

Section 10.1 of the Trust Agreement provides that the Sponsor may amend the Trust Agreement without the consent of Unitholders, subject

to certain exceptions, including without limitation that the Sponsor deems the amendment necessary or advisable and the amendment in

not adverse to the interest of Unitholders;

WHEREAS,

the Sponsor deems it necessary or advisable to amend the Trust Agreement to facilitate redemption of Trust Units at the election of individual

Unitholders or as otherwise determined by the Sponsor and to make corresponding changes to the Trust Agreement, which changes in each

case are not adverse to the interests of Unitholders;

NOW,

THEREFORE, in consideration of the mutual covenants contained in this Agreement, and for other good and valuable consideration the receipt

and adequacy of which are hereby acknowledged, the parties hereto agree to amend the Trust Agreement as follows:

| A. | Section

4.3(n) of the Trust Agreement is hereby deleted in its entirety and replaced with the following:

“In connection with Unitholder requests for redemption, as permitted by the Sponsor

under this Agreement, to facilitate such redemptions in accordance with procedures adopted

by the Sponsor and made a part of this Agreement;” |

| B. | The

Trust Agreement is hereby amended, to add an additional sentence at the end of Section 6.1

to read as follows: “The Redemption Procedures provided on Schedule A hereto shall

be considered adopted and a part of this Agreement.” |

All

other terms and conditions of the Trust Agreement not hereby amended shall otherwise remain unchanged and in full force and effect.

IN

WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed by their respective authorized signatories as of the

date first indicated above.

| |

OSPREY

FUNDS, LLC: |

| |

|

| |

By |

/s/ Gregory

King |

| |

Name: |

Gregory

King |

| |

Title: |

CEO |

| |

|

| |

DELAWARE

TRUST COMPANY: |

| |

|

| |

By |

/s/

Dana Dugan |

| |

Name: |

Dana

Dugan |

| |

Title: |

Assistant

Vice President |

SCHEDULE

A

REDEMPTION

PROCEDURES

Capitalized

terms used herein and not otherwise defined shall have the meanings ascribed to them in the Seconded Amended and Restated Declaration

of Trust and Trust Agreement, between and among Osprey Funds, LLC (“Sponsor”), Delaware Trust Company (“Trustee”),

and the Unitholders, dated November 1, 2020, as amended.

| 1. | On

“Effective Date,” Sponsor, working with Transfer Agent and DTCC, will inform

Unitholders of redemption offer (“Offer”). |

| 2. | On

approximately the Effective Date, Sponsor, on behalf of the Trust, will file Schedule TO

and exhibits (collectively, the “Schedule TO”) with the SEC describing the Offer.

The Schedule TO will provide the notice of, and terms of, the redemption offer, including

that Unitholders may begin transmitting orders of redemption upon receipt of notice, and

the date that the Offer and withdrawal rights expire (the “Offer Termination Date”).

The Offer Termination Date will be not less than 20 business days from the Effective Date.

The Schedule TO will also specify the date on which the redeemed Units are to be valued (the

“Valuation Date”) for purposes of the redemption. |

| 3. | Transfer

Agent and broker-dealers will accept redemption requests (and withdrawals) from Unitholders

starting on the Effective Date and through the Offer Termination Date. |

| 4. | Once

the Offer expires, Transfer Agent will no longer accept redemption requests or withdrawals,

and the Transfer Agent will aggregate requests for redemption from Unitholders. |

| 5. | If

the Offer is oversubscribed, Transfer Agent will determine, the redemptions to be received

by each requesting Unitholder, which shall be abated pro rata such that the aggregate abatement

is equal to the total amount by which the redemption offer is oversubscribed. |

| 6. | Transfer

Agent will inform each Unitholders (either directly or through the Unitholder’s broker)

of the amount of the Unitholder’s redemption request that has been accepted. |

| 7. | On

the Valuation Date, Transfer Agent will multiply the Valuation Date NAV of the Units by the

number of Units to be redeemed. |

| 8. | Transfer

Agent will inform Sponsor of amount of cash required for distribution to redeeming Unitholders. |

| 9. | Sponsor,

acting as agent for the Trust, meet the Trust’s cash payment obligations by selling

the requisite amount of Bitcoin at the 4:00 P.M. ET price of Bitcoin based on the Coinbase

Pro Exchange price. |

| 10. | Where

applicable, Sponsor will meet in-kind obligations by transferring requisite BTC from the

trust to the wallet of the unitholder to which in kind BTC is due. |

| 11. | Sponsor,

acting as agent for the Trust, will promptly send the cash from the sale of Bitcoin to the

Transfer Agent, which will distribute cash to each record owner for the redeemed Units (either

directly or through the Unitholder’s broker), minus applicable fees, which will be

withheld from each redeeming Unitholder’s distribution pro rata. |

| 12. | Sponsor

may charge reasonable fees to redeeming Unitholders, in part to offset expenses incurred

on behalf of the Trust administering the Offer, and otherwise for administration of the Offer.

Such fees will be paid by redeeming Unitholders (via the Trust), as the difference between

the cash received by Unitholders for each Unit redeemed and the Valuation Date NAV per Unit. |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

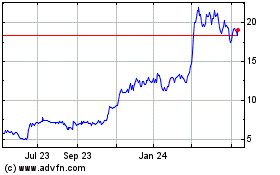

Osprey Bitcoin (QX) (USOTC:OBTC)

Historical Stock Chart

From Apr 2024 to May 2024

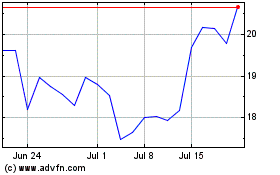

Osprey Bitcoin (QX) (USOTC:OBTC)

Historical Stock Chart

From May 2023 to May 2024