false

0000891532

PERMA FIX ENVIRONMENTAL SERVICES INC

0000891532

2024-01-18

2024-01-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported) January 18, 2024

PERMA-FIX

ENVIRONMENTAL SERVICES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-11596

|

|

58-1954497 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

| 8302

Dunwoody Place, Suite 250, Atlanta, Georgia |

|

30350 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (770) 587-9898

Not

applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, Par Value, $.001 Per Share |

|

PESI |

|

NASDAQ

Capital Markets |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item

5.02 – Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Principal Officers.

Management

Incentive Plans (“MIPs”)

On

January 18, 2024, the Compensation and Stock Option Committee (the “Compensation Committee”) of Perma-Fix Environmental Services,

Inc. (the “Company”) recommended approval of, and the Company’s Board of Directors approved, with Mark Duff and Dr.

Louis Centofanti abstaining, individual MIPs for the calendar year 2024 for Mark Duff, our Chief Executive Officer (the “CEO”);

Ben Naccarato, our Executive Vice President (“EVP”) and Chief Financial Officer (“CFO”); Dr. Louis Centofanti,

our EVP of Strategic Initiatives; and Richard Grondin, our EVP of Waste Treatment Operations (collectively, the “Executive Officers”).

Each of the MIPs is effective January 1, 2024 and applicable for the 2024 calendar year. Each MIP provides guidelines for the calculation

of annual cash incentive-based compensation, subject to Compensation Committee oversight and modification.

The

performance compensation under the MIP for each Executive Officer is based upon meeting certain separate target objectives during 2024

as described in the separate MIPs for each of the Executive Officers, attached to this Report as Exhibits 99.1 to 99.4, incorporated

herein by reference.

All

of the 2024 MIPs include revenue and EBITDA (earnings before interest, taxes, depreciation and amortization) targets, which in the

Compensation Committee’s expectation for performance would warrant payment of an incentive cash compensation. EBITDA is a

non-GAAP measure. In formulating such targets, the Compensation Committee and the Board considered 2023 results, the Board-approved

budget for 2024, economic conditions, and forecasts for 2024 government spending. Other performance criteria for all Executive

Officers other than the EVP and Chief Financial Officer include health, safety, and compliance statistics, as well as permit and

license violations. In addition to performance targets for revenue and EBITDA, the 2024 MIP for the EVP and CFO includes a

performance incentive for meeting regulatory filings deadlines for Form 10-Ks, Form 10-Qs and Form 8-Ks as required by the

Securities and Exchange Commission.

Total

potential target performance compensation is determined based on the percentage of the target achieved. The total potential target performance

compensation payable ranges from 25% to 150% of the 2024 base salary for the CEO ($104,287 to $625,733), 29% to 100% of the 2024 base

salary for the CFO ($95,681 to $332,811), 25% to 100% of the 2024 base salary for the EVP of Strategic Initiatives ($69,337 to $277,346),

and 25% to 100% ($71,317 to $285,267) of the 2024 base salary for the EVP of Waste Treatment Operations.

Performance

compensation amounts under the 2024 MIPs are to be paid on or about 90 days after year-end, or sooner, based on finalization of our audited

financial statements for 2024.

The

Compensation Committee retains the right to modify, change or terminate each MIP and may adjust the various target amounts described

above, at any time and for any reason.

The

total to be paid to the Executive Officers under the MIPs, in the aggregate, may not exceed 50% of the Company’s pre-tax net income

prior to the calculation of performance compensation. Additionally, no performance incentive compensation will be payable for any of

the performance targets unless a minimum of 75% of the EBITDA Target is achieved.

The

descriptions of the 2024 MIPs contained herein are qualified by reference to the respective MIPs attached to this Report as exhibits

99.1 to 99.4.

Section

9 – Financial Statements and Exhibits

Item

9.01. Financial Statements and Exhibits

| Exhibit |

|

Description |

| |

|

|

| 99.1 |

|

2024 Management Incentive Plan for Chief Executive Officer, approved January 18, 2024, but effective January 1, 2024. |

| |

|

|

| 99.2 |

|

2024 Management Incentive Plan for Chief Financial Officer, approved January 18, 2024, but effective January 1, 2024. |

| |

|

|

| 99.3 |

|

2024 Management Incentive Plan for EVP of Strategic Initiatives, approved January 18, 2024, but effective January 1, 2024. |

| |

|

|

| 99.4 |

|

2024 Management Incentive Plan for EVP of Waste Treatment Operations, approved January 18, 2024, but effective January 1, 2024. |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

January 23, 2024

| |

PERMA-FIX

ENVIRONMENTAL SERVICES, INC. |

| |

|

|

| |

By:

|

/s/

Ben Naccarato |

| |

|

Ben

Naccarato |

| |

|

Executive

Vice President and |

| |

|

Chief

F1inancial Officer |

Exhibit

99.1

*CERTAIN

INFORMATION IN THIS DOCUMENT HAS BEEN EXCLUDED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERAL AND WOULD LIKELY CAUSE COMPETITIVE HARM

TO THE COMPANY IF PUBLICLY DISCLOSED

CHIEF

EXECUTIVE OFFICER AND PRESIDENT

Effective:

January 1, 2024

CHIEF

EXECUTIVE OFFICER AND PRESIDENT

PURPOSE:

To define the compensation plan for the Chief Executive Officer (“CEO”) and President.

SCOPE:

Perma-Fix Environmental Services, Inc.

POLICY:

The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial

objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE

SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE

INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the CEO

MIP MATRIX below. Effective date of plan is January 1, 2024 and incentive will be for entire year of 2024. Performance incentive compensation

will be paid on or about 90 days after year-end, or sooner, based on finalization of the Company’s audited financial statements

for 2024.

ACKNOWLEDGEMENT:

Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed

acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

The

executive officer agrees and acknowledges that the executive officer is fully bound by, and subject to, all of the terms and conditions

of the Company’s Clawback Policy (as may be amended, restated, supplemented for otherwise modified from time to time).

INTERPRETATIONS:

The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time

and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan

and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition

of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily

be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan

and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

[***]

INDICATED CERTAIN INFORMATON IN THIS DOCUMENT WHICH HAS BEEN OMITTED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERIAL AND WOULD LIKELY

CAUSE COMPETITIVE HARM TO THE COMPANY IS PUBLICLY DISCLOSED

CHIEF

EXECUTIVE OFFICER AND PRESIDENT

Base

Pay and Performance Incentive Compensation Targets

The

compensation for the below named individual as follows:

| Annualized Base Pay: | |

$ | 417,155 | |

| Performance Incentive Compensation Target (at 100% of Plan): | |

$ | 208,578 | |

| Total Annual Target Compensation (at 100% of Plan): | |

$ | 625,733 | |

The

Performance Incentive Compensation Paid is based on the CEO MIP MATRIX below.

Perma-Fix

Environmental Serivces, Inc.

2024

Management Incentive Plan

CEO

MIP MATRIX

| Target Objectives | |

Performance Target Achieved | |

| | |

75%-89% | | |

90%-110% | | |

111%-129% | | |

130%-150% | | |

>150% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 10,429 | | |

$ | 20,858 | | |

$ | 35,756 | | |

$ | 50,655 | | |

$ | 80,451 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 62,572 | | |

| 125,146 | | |

| 214,537 | | |

| 303,927 | | |

| 482,708 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Health & Safety | |

| 15,643 | | |

| 31,287 | | |

| 31,287 | | |

| 31,287 | | |

| 31,287 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Permit & License Violations | |

| 15,643 | | |

| 31,287 | | |

| 31,287 | | |

| 31,287 | | |

| 31,287 | |

| | |

$ | 104,287 | | |

$ | 208,578 | | |

$ | 312,867 | | |

$ | 417,156 | | |

$ | 625,733 | |

| 1) | Revenue

is defined as the total consolidated third-party top line revenue as publicly reported in

the Company’s 2024 financial statements. The percentage achieved is determined by comparing

the actual consolidated revenue for 2024 to the Board approved Revenue Target for 2024, which

is $[***]. The Board reserves the right to modify or change the Revenue Targets as

defined herein in the event of the sale or disposition of any of the assets of the Company

or in the event of an acquisition. |

| | |

| 2) | EBITDA

is defined as earnings before interest, taxes, depreciation, and amortization from continuing

and discontinued operations. The percentage achieved is determined by comparing the actual

EBITDA to the Board approved EBITDA Target for 2024, which is $[***]. The Board reserves

the right to modify or change the EBITDA Targets as defined herein in the event of the sale

or disposition of any of the assets of the Company or in the event of an acquisition. |

| | |

| 3) | The

Health and Safety Incentive Target is based upon the actual number of Worker’s Compensation

Lost Time Accidents, as provided by the Company’s Worker’s Compensation carrier.

The Corporate Controller will submit a report on a quarterly basis documenting and confirming

the number of Worker’s Compensation Lost Time Accidents, supported by the Worker’s

Compensation Loss Report provided by the company’s carrier or broker. Such claims will

be identified on the loss report as “indemnity claims.” The following number

of Worker’s Compensation Lost Time Accidents and corresponding Performance Target Thresholds

has been established for the annual Incentive Compensation Plan calculation for 2024. |

Work

Comp.

Claim

Number |

|

Performance

Target

Achieved |

| 3 |

|

75%-89% |

| 2 |

|

90%-110% |

| 1 |

|

111%-129% |

| 1 |

|

130%-150% |

| 1

|

|

>150% |

| 4) |

Permits

or License Violations incentive is earned/determined according to the scale set forth below:

An “official notice of non-compliance” is defined as an official communication

during 2024 from a local, state, or federal regulatory authority alleging one or more violations

of an otherwise applicable Environmental, Health or Safety requirement or permit provision,

which results in a facility’s implementation of corrective action(s) which includes

a material financial obligation, as determined by the Company’s Board of Directors

in their sole discretion, to the Company. |

Permit

and

License

Violations |

|

Performance

Target

Achieved |

| 3 |

|

75%-89%

|

| 2 |

|

90%-110% |

| 1 |

|

111%-129%

|

| 1 |

|

130%-150%

|

| 1

|

|

>150% |

| 5) | No

performance incentive compensation will be payable for achieving the health and safety, permit

and license violation, and revenue targets unless a minimum of 75% of the EBITDA Target is

achieved. |

Performance

Incentive Compensation Payment

Effective

date of plan is January 1, 2024 and incentive will be for entire year. Performance incentive compensation will be paid on or about 90

days after year-end, or sooner, based on finalization of the Company’s audited financial statements for 2024.

In

no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income computed prior

to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed

50% of Pretax Net Income.

ACKNOWLEDGMENT:

I

acknowledge receipt of the aforementioned Chief Executive Officer and President 2024 - Compensation Plan. I have read and understand

and accept employment under the terms and conditions set forth therein.

| /s/

Mark Duff |

|

01/19/2024 |

|

| Mark

Duff |

|

Date |

|

| |

|

|

|

| /s/

Larry Shelton |

|

01/22/2024 |

|

| Board

of Directors |

|

Date |

|

Exhibit

99.2

*CERTAIN

INFORMATION IN THIS DOCUMENT HAS BEEN EXCLUDED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERAL AND WOULD LIKELY CAUSE COMPETITIVE HARM

TO THE COMPANY IF PUBLICLY DISCLOSED

EXECUTIVE

VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

Effective:

January 1, 2024

EXECUTIVE

VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

PURPOSE:

To define the compensation plan for the Chief Financial Officer (“CFO”).

SCOPE:

Perma-Fix Environmental Services, Inc.

POLICY:

The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial

objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE

SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE

INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the CFO

MIP MATRIX below. Effective date of plan is January 1, 2024 and incentive will be for entire year of 2024. Performance incentive compensation

will be paid on or about 90 days after year-end, or sooner, based on finalization of the Company’s audited financial statements

for 2024.

ACKNOWLEDGEMENT:

Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed

acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

The

executive officer agrees and acknowledges that the executive officer is fully bound by, and subject to, all of the terms and conditions

of the Company’s Clawback Policy (as may be amended, restated, supplemented for otherwise modified from time to time).

INTERPRETATIONS:

The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time

and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan

and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition

of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily

be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan

and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

[***]

INDICATED CERTAIN INFORMATON IN THIS DOCUMENT WHICH HAS BEEN OMITTED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERIAL AND WOULD LIKELY

CAUSE COMPETITIVE HARM TO THE COMPANY IS PUBLICLY DISCLOSED

EXECUTIVE

VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

Base

Pay and Performance Incentive Compensation Targets

The

compensation for the below named individual as follows:

| Annualized Base Pay: | |

$ | 332,811 | |

| Performance Incentive Compensation Target (at 100% of Plan): | |

$ | 166,406 | |

| Total Annual Target Compensation (at 100% of Plan): | |

$ | 499,217 | |

The

Performance Incentive Compensation Paid is based on the CFO MIP MATRIX below.

Perma-Fix

Environmental Serivces, Inc.

2024

Management Incentive Plan

CFO

MIP MATRIX

Annualized

Base Pay:

Performance

Incentive Compensation Target (at 100% of Plan):

Total

Annual Target Compensation (at 100% of Plan):

| Target Objectives | |

Performance Target Achieved | |

| | |

| 75%-89% | | |

| 90%-110% | | |

| 111%-129% | | |

| 130%-150% | | |

| >150% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 8,320 | | |

$ | 16,641 | | |

$ | 27,338 | | |

$ | 36,847 | | |

$ | 43,979 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 62,401 | | |

| 124,805 | | |

| 164,029 | | |

| 221,082 | | |

| 263,872 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| 70,721 | | |

| 141,446 | | |

| 191,367 | | |

| 257,929 | | |

| 307,851 | |

| | |

Performance Target Achieved | |

| | |

| 100% | | |

| 100% | | |

| 100% | | |

| 100% | | |

| 100% | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Regulatory Filing | |

| 24,960 | | |

| 24,960 | | |

| 24,960 | | |

| 24,960 | | |

| 24,960 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

$ | 95,681 | | |

$ | 166,406 | | |

$ | 216,327 | | |

$ | 282,889 | | |

$ | 332,811 | |

| 1) |

Revenue

is defined as the total consolidated third-party top line revenue as publicly reported in the Company’s 2024 financial statements.

The percentage achieved is determined by comparing the actual consolidated revenue for 2024 to the Board approved Revenue Target

for 2024, which is $[***]. The Board reserves the right to modify or change the Revenue Targets as defined herein in the event

of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

| |

|

| 2) |

EBITDA

is defined as earnings before interest, taxes, depreciation, and amortization from continuing and discontinued operations. The percentage

achieved is determined by comparing the actual EBITDA to the Board approved EBITDA Target for 2024, which is $[***]. The Board

reserves the right to modify or change the EBITDA Targets as defined herein in the event of the sale or disposition of any of the

assets of the Company or in the event of an acquisition. |

| |

|

| 3) |

Regulatory

Filing Incentive Target is based on meeting all deadlines (including allowable extension granted by the SEC) for the Form 10-K, Form

10-Q and 8-Ks required by SEC (Securities and Exchange Commission). |

| 4) |

No

performance incentive compensation will be payable for achieving the Regulatory Filing and revenue targets unless a minimum of 75%

of the EBITDA Target is achieved. |

Performance

Incentive Compensation Payment

Effective

date of plan is January 1, 2024 and incentive will be for entire year. Performance incentive compensation will be paid on or about 90

days after year-end, or sooner, based on finalization of the Company’s audited financial statements for 2024.

In

no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income computed prior

to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed

50% of Pretax Net Income.

ACKNOWLEDGMENT:

I

acknowledge receipt of the aforementioned Chief Financial Officer 2024 - Compensation Plan. I have read and understand and accept employment

under the terms and conditions set forth therein.

| /s/

Ben Naccarato |

|

01/19/2024 |

|

| Ben

Naccarato |

|

Date |

|

| |

|

|

|

| /s/

Larry Shelton |

|

01/22/2024 |

|

| Board

of Directors |

|

Date |

|

Exhibit

99.3

*CERTAIN

INFORMATION IN THIS DOCUMENT HAS BEEN EXCLUDED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERAL AND WOULD LIKELY CAUSE COMPETITIVE HARM

TO THE COMPANY IF PUBLICLY DISCLOSED

EXECUTIVE

VICE PRESIDENT OF STRATEGIC INITIATIVES

Effective:

January 1, 2024

EVP

OF STRATEGIC INITIATIVES

PURPOSE:

To define the compensation plan for the Executive Vice President of Strategic Initiatives (“EVP of Strategic Initiatives”).

SCOPE:

Perma-Fix Environmental Services, Inc.

POLICY:

The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial

objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE

SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE

INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the EVP

OF STRATEGIC INITIATIVES MIP MATRIX below. Effective date of plan is January 1, 2024 and incentive will be for entire year of 2024. Performance

incentive compensation will be paid on or about 90 days after year-end, or sooner, based on finalization of the Company’s audited

financial statements for 2024.

ACKNOWLEDGEMENT:

Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed

acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

The

executive officer agrees and acknowledges that the executive officer is fully bound by, and subject to, all of the terms and conditions

of the Company’s Clawback Policy (as may be amended, restated, supplemented for otherwise modified from time to time).

INTERPRETATIONS:

The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time

and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan

and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition

of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily

be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan

and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

[***]

INDICATED CERTAIN INFORMATON IN THIS DOCUMENT WHICH HAS BEEN OMITTED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERIAL AND WOULD LIKELY

CAUSE COMPETITIVE HARM TO THE COMPANY IS PUBLICLY DISCLOSED

EVP

OF STRATEGIC INITIATIVES

Base

Pay and Performance Incentive Compensation Targets

The

compensation for the below named individual as follows:

| Annualized Base Pay: | |

$ | 277,346 | |

| Performance Incentive Compensation Target (at 100% of Plan): | |

$ | 138,673 | |

| Total Annual Target Compensation (at 100% of Plan): | |

$ | 416,019 | |

The

Performance Incentive Compensation Paid is based on the EVP OF STRATEGIC INITIATIVES MATRIX below.

Perma-Fix

Environmental Serivces, Inc.

2024

Management Incentive Plan

EVP

OF STRATEGIC INITIATIVES MIP MATRIX

| Target Objectives | |

Performance Target Achieved |

|

| | |

75%-89% | | |

90%-110% | | |

111%-129% | | |

130%-150% | | |

>150% | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 6,935 | | |

$ | 13,867 | | |

$ | 22,782 | | |

$ | 30,706 | | |

$ | 36,649 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 52,002 | | |

| 104,006 | | |

| 136,692 | | |

| 184,237 | | |

| 219,897 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Health & Safety | |

| 5,200 | | |

| 10,400 | | |

| 10,400 | | |

| 10,400 | | |

| 10,400 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Permit & License Violations | |

| 5,200 | | |

| 10,400 | | |

| 10,400 | | |

| 10,400 | | |

| 10,400 | |

| | |

$ | 69,337 | | |

$ | 138,673 | | |

$ | 180,274 | | |

$ | 235,743 | | |

$ | 277,346 | |

| 1) | Revenue

is defined as the total consolidated third-party top line revenue as publicly reported in

the Company’s 2024 financial statements. The percentage achieved is determined by comparing

the actual consolidated revenue for 2024 to the Board approved Revenue Target for 2024, which

is $[***]. The Board reserves the right to modify or change the Revenue Targets as

defined herein in the event of the sale or disposition of any of the assets of the Company

or in the event of an acquisition. |

| | |

| 2) | EBITDA

is defined as earnings before interest, taxes, depreciation, and amortization from continuing

and discontinued operations. The percentage achieved is determined by comparing the actual

EBITDA to the Board approved EBITDA Target for 2024, which is $[***]. The Board reserves

the right to modify or change the EBITDA Targets as defined herein in the event of the sale

or disposition of any of the assets of the Company or in the event of an acquisition. |

| | |

| 3) | The

Health and Safety Incentive Target is based upon the actual number of Worker’s Compensation

Lost Time Accidents, as provided by the Company’s Worker’s Compensation carrier.

The Corporate Controller will submit a report on a quarterly basis documenting and confirming

the number of Worker’s Compensation Lost Time Accidents, supported by the Worker’s

Compensation Loss Report provided by the company’s carrier or broker. Such claims will

be identified on the loss report as “indemnity claims.” The following number

of Worker’s Compensation Lost Time Accidents and corresponding Performance Target Thresholds

has been established for the annual Incentive Compensation Plan calculation for 2024. |

Work

Comp.

Claim

Number |

|

Performance

Target

Achieved |

| 3 |

|

75%-89% |

| 2 |

|

90%-110% |

| 1 |

|

111%-129% |

| 1 |

|

130%-150% |

| 1 |

|

>150% |

| 4) | Permits

or License Violations incentive is earned/determined according to the scale set forth below:

An “official notice of non-compliance” is defined as an official communication

during 2024 from a local, state, or federal regulatory authority alleging one or more violations

of an otherwise applicable Environmental, Health or Safety requirement or permit provision,

which results in a facility’s implementation of corrective action(s) which includes

a material financial obligation, as determined by the Company’s Board of Directors

in their sole discretion, to the Company. |

Permit

and

License

Violations |

|

Performance

Target

Achieved |

| 3 |

|

75%-89%

|

| 2 |

|

90%-110% |

| 1 |

|

111%-129%

|

| 1 |

|

130%-150%

|

| 1 |

|

>150% |

| 5) | No

performance incentive compensation will be payable for achieving the health and safety, permit

and license violation, and revenue targets unless a minimum of 75% of the EBITDA Target is

achieved. |

Performance

Incentive Compensation Payment

Effective

date of plan is January 1, 2024 and incentive will be for entire year. Performance incentive compensation will be paid on or about 90

days after year-end, or sooner, based on finalization of the Company’s audited financial statements for 2024.

In

no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income computed prior

to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed

50% of Pretax Net Income.

ACKNOWLEDGMENT:

I

acknowledge receipt of the aforementioned Executive Vice President of Strategic Initiatives 2024 - Compensation Plan. I have read and

understand and accept employment under the terms and conditions set forth therein.

| /s/

Louis Centofanti |

|

01/19/2024 |

|

| Dr.

Louis Centofanti |

|

Date |

|

| |

|

|

|

| /s/

Larry Shelton |

|

01/22/2024 |

|

| Board

of Directors |

|

Date |

|

Exhibit

99.4

*CERTAIN

INFORMATION IN THIS DOCUMENT HAS BEEN EXCLUDED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERAL AND WOULD LIKELY CAUSE COMPETITIVE HARM

TO THE COMPANY IF PUBLICLY DISCLOSED

EXECUTIVE

VICE PRESIDENT OF WASTE TREATMENT OPERATIONS

Effective:

January 1, 2024

EXECUTIVE

VICE PRESIDENT OF WASTE TREATMENT OPERATIONS

PURPOSE:

To define the compensation plan for the EXECUTIVE VICE PRESIDENT (“EVP”) OF WASTE TREATMENT OPERATIONS.

SCOPE:

Perma-Fix Environmental Services, Inc.

POLICY:

The Compensation Plan is designed to retain, motivate and reward the incumbent to support and achieve the business, operating and financial

objectives of Perma-Fix Environmental Services, Inc. (the “Company”).

BASE

SALARY: The Base Salary indicated below is paid in equal periodic installments per the regularly scheduled payroll.

PERFORMANCE

INCENTIVE COMPENSATION: Performance Incentive Compensation is available based on the Company’s financial results noted in the EVP

OF WASTE TREATMENT OPERATIONS MIP Matrix below. Effective date of plan is January 1, 2024 and incentive will be for entire year of 2024.

Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based on finalization of the Company’s

audited financial statements for 2024.

ACKNOWLEDGEMENT:

Payment of Performance Incentive Compensation of any type will be forfeited, unless the Human Resources Department has received a signed

acknowledgement of receipt of the Compensation Plan prior to the applicable payment date.

The

executive officer agrees and acknowledges that the executive officer is fully bound by, and subject to, all of the terms and conditions

of the Company’s Clawback Policy (as may be amended, restated, supplemented for otherwise modified from time to time).

INTERPRETATIONS:

The Compensation Committee of the Board of Directors retains the right to modify, change or terminate the Compensation Plan at any time

and for any reason. It also reserves the right to determine the final interpretation of any provision contained in the Compensation Plan

and it reserves the right to modify or change the Revenue and EBITDA Targets as defined herein in the event of the sale or disposition

of any of the assets of the Company. While the plan is intended to represent all situations and circumstances, some issues may not easily

be addressed. The Compensation Committee will endeavor to review all standard and non-standard issues related to the Compensation Plan

and will provide quick interpretations that are in the best interest of the Company, its shareholders and the incumbent.

[***]

INDICATED CERTAIN INFORMATON IN THIS DOCUMENT WHICH HAS BEEN OMITTED FROM THIS PUBLIC FILING BECAUSE IT IS NOT MATERIAL AND WOULD LIKELY

CAUSE COMPETITIVE HARM TO THE COMPANY IS PUBLICLY DISCLOSED

EXECUTIVE

VICE PRESIDENT OF WASTE TREATMENT OPERATIONS

Base

Pay and Performance Incentive Compensation Targets

The

compensation for the below named individual as follows:

| Annualized Base Pay: | |

$ | 285,267 | |

| Performance Incentive Compensation Target (at 100% of Plan): | |

$ | 142,634 | |

| Total Annual Target Compensation (at 100% of Plan): | |

$ | 427,901 | |

The

Performance Incentive Compensation Target is based on the EVP of WASTE TREATMENT OPERATIONS MIP Matrix below.

Perma-Fix

Environmental Serivces, Inc.

2024

Management Incentive Plan

EVP

OF WASTE TREATMENT OPERATIONS MIP MATRIX

| Target Objectives | |

Performance Target Achieved | |

| | |

75%-89% | | |

90%-110% | | |

111%-129% | | |

130%-150% | | |

>150% | |

| | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

$ | 7,132 | | |

$ | 14,263 | | |

$ | 20,376 | | |

$ | 28,527 | | |

$ | 34,640 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| EBITDA | |

| 42,789 | | |

| 85,581 | | |

| 122,257 | | |

| 171,160 | | |

| 207,837 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Health & Safety | |

| 10,698 | | |

| 21,395 | | |

| 21,395 | | |

| 21,395 | | |

| 21,395 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Permit & License Violations | |

| 10,698 | | |

| 21,395 | | |

| 21,395 | | |

| 21,395 | | |

| 21,395 | |

| | |

$ | 71,317 | | |

$ | 142,634 | | |

$ | 185,423 | | |

$ | 242,477 | | |

$ | 285,267 | |

| 1) |

Revenue

is defined as the total consolidated third-party top line revenue as publicly reported in the Company’s 2024 financial statements.

The percentage achieved is determined by comparing the actual consolidated revenue for 2024 to the Board approved Revenue Target

for 2024, which is $[***]. The Board reserves the right to modify or change the Revenue Targets as defined herein in the event

of the sale or disposition of any of the assets of the Company or in the event of an acquisition. |

| |

|

| 2) |

EBITDA

is defined as earnings before interest, taxes, depreciation, and amortization from continuing and discontinued operations. The percentage

achieved is determined by comparing the actual EBITDA to the Board approved EBITDA Target for 2024, which is $[***]. The Board

reserves the right to modify or change the EBITDA Targets as defined herein in the event of the sale or disposition of any of the

assets of the Company or in the event of an acquisition. |

| |

|

| 3) |

The

Health and Safety Incentive target is based upon the actual number of Worker’s Compensation Lost Time Accidents in the Company’s

Treatment Segment, as provided by the Company’s Worker’s Compensation carrier. The Corporate Controller will submit a

report on a quarterly basis documenting and confirming the number of Worker’s Compensation Lost Time Accidents, supported by

the Worker’s Compensation Loss Report provided by the company’s carrier or broker. Such claims will be identified on

the loss report as “indemnity claims.” The following number of Worker’s Compensation Lost Time Accidents and corresponding

Performance Target Thresholds has been established for the annual Incentive Compensation Plan calculation for 2024. |

Work

Comp.

Claim

Number |

|

Performance

Target

Achieved |

| 3 |

|

75%-89% |

| 2 |

|

90%-110% |

| 1 |

|

111%-129% |

| 1 |

|

130%-150% |

| 1

|

|

>150% |

| 4) |

Permits

or License Violations incentive is earned/determined according to the scale set forth below: An “official notice of non-compliance”

is defined as an official communication during 2024 from a local, state, or federal regulatory authority alleging one or more violations

of an otherwise applicable Environmental, Health or Safety requirement or permit provision, which results in a facility’s implementation

of corrective action(s) which includes a material financial obligation, as determined by the Company’s Board of Directors in

their sole discretion, to the Company . |

Permit

and

License

Violations |

|

Performance

Target

Achieved |

| 3 |

|

75%-89%

|

| 2 |

|

90%-110% |

| 1 |

|

111%-129%

|

| 1 |

|

130%-150%

|

| 1 |

|

>150% |

| 5) |

No

performance incentive compensation will be payable for achieving the health and safety, permit and license violations, and revenue

targets unless a minimum of 75% of the EBITDA Target is achieved. |

Performance

Incentive Compensation Payment

Effective

date of plan is January 1, 2024. Performance incentive compensation will be paid on or about 90 days after year-end, or sooner, based

on finalization of the Company’s audited financial statements for 2024.

In

no event will Performance Incentive Compensation paid to all Executive Officers as a group exceed 50% of Pretax Net Income computed prior

to the calculation of bonus expense. If applicable, Incentive Compensation payments will be reduced on a pro-rata basis, so not to exceed

50% of Pretax Net Income.

ACKNOWLEDGMENT:

I

acknowledge receipt of the aforementioned EVP OF WASTE TREATMENT OPERATIONS 2024 - Compensation Plan. I have read and understand and

accept employment under the terms and conditions set forth therein.

| /s/

Richard Grondin |

|

01/20/2024 |

|

| Richard

Grondin |

|

Date |

|

| |

|

|

|

| /s/

Larry Shelton |

|

01/22/2024 |

|

| Board

of Directors |

|

Date |

|

v3.23.4

Cover

|

Jan. 18, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 18, 2024

|

| Entity File Number |

1-11596

|

| Entity Registrant Name |

PERMA FIX ENVIRONMENTAL SERVICES INC

|

| Entity Central Index Key |

0000891532

|

| Entity Tax Identification Number |

58-1954497

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

8302

Dunwoody Place

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30350

|

| City Area Code |

(770)

|

| Local Phone Number |

587-9898

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, Par Value, $.001 Per Share

|

| Trading Symbol |

PESI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

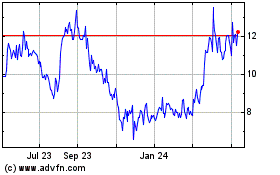

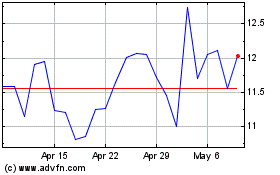

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Mar 2024 to Apr 2024

PermaFix Environmental S... (NASDAQ:PESI)

Historical Stock Chart

From Apr 2023 to Apr 2024