false

0001589061

0001589061

2024-01-22

2024-01-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 22, 2024

GYRODYNE, LLC

(Exact name of Registrant as Specified in its Charter)

|

New York

|

001-37547

|

46-3838291

|

|

(State or other jurisdiction

|

(Commission File

|

(I.R.S. Employer

|

|

of incorporation)

|

Number)

|

Identification No.)

|

ONE FLOWERFIELD

SUITE 24

ST. JAMES, New York 11780

(Address of principal executive

offices) (Zip Code)

(631) 584-5400

Registrant’s telephone number,

including area code

N/A

(Former name or former address, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares of Limited Liability Company Interests

|

GYRO

|

Nasdaq Capital Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 7.01 Regulation FD Disclosure.

|

A copy of a press release announcing the record date of Gyrodyne, LLC’s (the “Company”) proposed rights offering and related matters is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information contained in this Item 7.01, including Exhibit 99.1, is furnished herewith and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

| |

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

GYRODYNE, LLC

|

|

| |

|

|

|

|

|

|

|

|

|

Date: January 22, 2024

|

By:

|

/s/ Gary Fitlin

|

|

|

|

Name:

|

Gary Fitlin

|

|

|

|

Title:

|

President, Chief Executive Officer, Chief Financial Officer and Treasurer

|

|

Exhibit 99.1

Press Release

GYRODYNE ANNOUNCES RECORD DATE FOR PROPOSED RIGHTS OFFERING

Gyrodyne, LLC (“Gyrodyne” or the “Company”) (NASDAQ: GYRO), an owner and manager of a diversified portfolio of real estate properties, today announced that the record date for its proposed rights offering is January 29, 2024 at 5:00 p.m. Eastern Time (the “Record Date”).

As previously announced, the Company intends to raise up to $5 million in aggregate gross proceeds by way of a rights offering where its existing shareholders as of the Record Date will be granted rights to purchase shares of the Company’s common stock (the “Rights Offering”).

The Company filed a registration statement (File No. 333-276312) (the “Registration Statement”) with respect to the proposed Rights Offering with the Securities and Exchange Commission (the “SEC”) on December 29, 2023.

In the Rights Offering, the Company will distribute to holders of Gyrodyne’s common share non-transferable subscription rights to purchase up to an aggregate of 625,000 shares of common stock at a subscription price of $8.00 per share. Each right consists of a basic subscription privilege and an oversubscription privilege. The rights under the basic subscription privilege will be distributed in proportion to shareholders’ holdings on the Record Date. Shareholders will receive one subscription right for each five shares held. Each whole subscription right gives the shareholders the opportunity to purchase two of the Company’s common shares for $8.00 per share. If a shareholder exercises his or her basic subscription right in full, and other shareholders do not, such shareholder will be entitled to an oversubscription privilege to purchase a portion of the unsubscribed shares at the subscription price, subject to proration and certain limitations.

The Company expects to use the net proceeds received from the rights offering to complete the pursuit of entitlements on the Company’s Flowerfield and Cortlandt Manor properties, for litigation fees and expenses in the Article 78 proceeding, for property purchase agreement negotiation and enforcement, for necessary capital improvements in the Company’s real estate portfolio, and for general working capital.

Further details on the terms of the Rights Offering and the procedures pursuant to which eligible shareholders can exercise their rights, including any changes to the dates included in this press release, will be announced before the commencement of the Rights Offering.

No Rights Offering will be made until the Company announces the definitive terms of the Rights Offering and the Registration Statement incorporating those terms is declared effective by the SEC.

About Gyrodyne

Gyrodyne, LLC owns and manages a diversified portfolio of real estate properties comprising office, industrial and service-oriented properties in the New York metropolitan area. The Company owns a 63-acre site approximately 50 miles east of New York City on the north shore of Long Island, which includes industrial and office buildings and undeveloped property, and a medical office park in Cortlandt Manor, New York, both of which are the subject of plans to seek value-enhancing entitlements. The Company's common shares are traded on the NASDAQ Capital Market under the symbol GYRO. Additional information about the Company may be found on its web site at www.gyrodyne.com.

Cautionary Statement Regarding Forward-Looking Statements

The statements made in this press release and other materials the Company has filed or may file with the SEC, in each case that are not historical facts, contain "forward-looking information" within the meaning of the Private Securities Litigation Reform Act of 1995, and Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, both as amended, which can be identified by the use of forward-looking terminology such as "may," "will," "anticipates," "expects," "projects," "estimates," "believes," "seeks," "could," "should," or "continue," the negative thereof, and other variations or comparable terminology as well as statements regarding the evaluation of strategic alternatives and liquidation contingencies. These forward-looking statements are based on the current plans and expectations of management and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Such risks and uncertainties include, but are not limited to, risks and uncertainties relating to our efforts to enhance the values of our remaining properties and seek the orderly, strategic sale of such properties as soon as reasonably practicable, risks associated with the Article 78 proceeding against the Company and any other litigation that may develop in connection with our efforts to enhance the value of and sell our properties, ongoing community activism, risks associated with proxy contests and other actions of activist shareholders, risks related to the recent banking crisis and closure of two major banks (including one with whom we indirectly have a mortgage loan), regulatory enforcement, risks inherent in the real estate markets of Suffolk and Westchester Counties in New York, the ability to obtain additional capital in order to enhance the value of the Flowerfield and Cortlandt Manor properties and negotiate sales contracts and defend the Article 78 proceeding from a position of strength, the continuing effects of the COVID-19 pandemic, the ongoing risk of inflation, elevated interest rates, recession and supply chain constraints or disruptions and other risks detailed from time to time in the Company's SEC reports. These and other matters the Company discusses in this press release may cause actual results to differ from those the Company describes.

Additional Information and Where to Find It

The Company has filed the Registration Statement (including a prospectus) with the SEC for the offering to which this press release relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov.

Alternatively, you may obtain copies of the prospectus, by contacting Mackenzie Partners, Inc., the information agent for the offering, at:

Mackenzie Partners, Inc.

105 Madison Avenue

New York, NY 10016

Call toll-free: (800) 322-2885

E-mail: proxy@mackenziepartners.com

No Offer or Solicitation

This press release shall not constitute an offer, nor a solicitation of an offer, of the sale or purchase of securities, nor shall any securities of the Company be offered or sold in any jurisdiction in which such an offer, solicitation or sale would be unlawful. It is an outline of matters for discussion only. Neither the SEC nor any state securities commission has approved or disapproved of the transactions contemplated hereby or determined if this document is truthful or complete. Any representation to the contrary is a criminal offense. In connection with the Rights Offering transaction discussed herein, the Registration Statement was filed with the SEC on December 29, 2023. Shareholders of the Company are urged to read the Registration Statement and the documents incorporated by reference therein before making any investment decision with respect to the Rights Offering because they will contain important information regarding the proposed Rights Offering transaction. You should not construe the contents of this press release as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein.

v3.23.4

Document And Entity Information

|

Jan. 22, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

GYRODYNE, LLC

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 22, 2024

|

| Entity, Incorporation, State or Country Code |

NY

|

| Entity, File Number |

001-37547

|

| Entity, Tax Identification Number |

46-3838291

|

| Entity, Address, Address Line One |

ONE FLOWERFIELD

|

| Entity, Address, Address Line Two |

SUITE 24

|

| Entity, Address, City or Town |

ST. JAMES

|

| Entity, Address, State or Province |

NY

|

| Entity, Address, Postal Zip Code |

11780

|

| City Area Code |

631

|

| Local Phone Number |

584-5400

|

| Title of 12(b) Security |

Common Shares of Limited Liability Company Interests

|

| Trading Symbol |

GYRO

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001589061

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

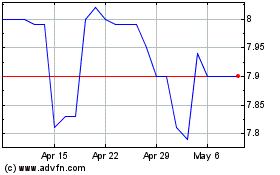

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Gyrodyne (NASDAQ:GYRO)

Historical Stock Chart

From Apr 2023 to Apr 2024