UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the

Securities Exchange Act of 1934

(Amendment

No. 1)*

| Lions Gate Entertainment Corp. |

| (Name of Issuer) |

| |

| Class A Voting Common Shares, no par value per share |

| (Title of Class of Securities) |

| |

| 535919401 |

| (CUSIP Number) |

| |

William Barratt

Liberty 77 Capital L.P.

2099 Pennsylvania Ave NW

Washington, DC 20006

(202) 984-7070 |

| (Name, Address and Telephone Number of Person |

| Authorized to Receive Notices and Communications) |

| |

| January

16, 2024 |

| (Date

of Event which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies

are to be sent.

* The remainder of this cover page shall be filled

out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Act”), or otherwise subject to the liabilities of Section 18 of the Act but shall be subject to all other

provisions of the Act (however, see the Notes).

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

2 of 13 |

| 1 |

NAME OF REPORTING PERSON

Liberty 77 Capital L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

6,620,482 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

6,620,482 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,620,482 | |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9% |

|

| 14 |

TYPE OF REPORTING PERSON

IA, PN |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

3 of 13 |

| 1 |

NAME OF REPORTING PERSON

Liberty 77 Fund L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

1,436,129 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

1,436,129 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,436,129 | |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

1.7% |

|

| 14 |

TYPE OF REPORTING PERSON

PN |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

4 of 13 |

| 1 |

NAME OF REPORTING PERSON

Liberty 77 Fund International L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

5,184,353 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

5,184,353 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

5,184,353 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.2% |

|

| 14 |

TYPE OF REPORTING PERSON

PN |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

5 of 13 |

| 1 |

NAME OF REPORTING PERSON

Liberty 77 Capital Partners L.P. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

6,620,482 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

6,620,482 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,620,482 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9% |

|

| 14 |

TYPE OF REPORTING PERSON

PN |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

6 of 13 |

| 1 |

NAME OF REPORTING PERSON

Liberty Capital L.L.C. |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

6,620,482 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

6,620,482 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,620,482 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

7 of 13 |

| 1 |

NAME OF REPORTING PERSON

STM Partners LLC |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

6,620,482 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

6,620,482 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,620,482 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9% |

|

| 14 |

TYPE OF REPORTING PERSON

OO |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

8 of 13 |

| 1 |

NAME OF REPORTING PERSON

Steven T. Mnuchin |

|

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ☐

(b) ☐ |

| 3 |

SEC USE ONLY

|

|

| 4 |

SOURCE OF FUNDS

OO |

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT

TO ITEMS 2(d) or 2(e)

|

☐ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America |

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

7 |

SOLE VOTING POWER

6,620,482 |

| 8 |

SHARED VOTING POWER

0 |

| 9 |

SOLE DISPOSITIVE POWER

6,620,482 |

| 10 |

SHARED DISPOSITIVE POWER

0 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

6,620,482 |

|

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

☐ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.9% |

|

| 14 |

TYPE OF REPORTING PERSON

IN |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

9 of 13 |

This Amendment No. 1 amends and supplements the statement on Schedule 13D, dated September 5, 2023, as amended through the date hereof

(as so amended, the "Schedule 13D"), and is being filed with the Securities and Exchange Commission by the "Reporting Persons" identified

herein relating to the Class A Voting Common Shares, no par value per share (the "Class A Shares"), of Lions Gate Entertainment Corp.,

a corporation existing under the laws of British Columbia (the "Issuer").

| Item 2. | Identity and Background. |

Item 2 is hereby restated as follows:

This Schedule 13D is being filed by each of:

| |

(i) |

Liberty 77 Capital L.P. (the “Liberty Manager”), a Delaware limited partnership and investment manager of the Liberty Funds; |

| |

(ii) |

Liberty 77 Fund L.P., a Cayman Islands exempted limited partnership; |

| |

(iii) |

Liberty 77 Fund International L.P., a Cayman Islands exempted limited partnership (together with Liberty 77 Fund L.P., the “Liberty Funds”); |

| |

(iv) |

Liberty 77 Capital Partners L.P. (“Liberty Manager GP”), a Delaware limited partnership and the general partner of the Liberty Manager; |

| |

(v) |

Liberty Capital L.L.C., a Delaware limited liability company and the general partner of the Liberty Manager GP; |

| |

(vi) |

STM Partners LLC, a Delaware limited liability company which indirectly controls the Liberty Manager and the general partner of the Liberty Funds; |

| |

(vii) |

Steven T. Mnuchin (“Secretary Mnuchin”), an individual and citizen of the United States and chief executive officer and controlling member of STM Partners LLC, |

each person or entity listed in clauses

(i) – (vii), a “Reporting Person” and, collectively, the “Reporting Persons.”

The address of the principal place of business and

principal office of the Reporting Persons is c/o Liberty 77 Capital L.P., 2099 Pennsylvania Avenue NW, Washington, D.C. 20006.

The Reporting Persons are making this single, joint filing, pursuant to

a joint filing agreement in accordance with Rule 13d-1(k) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), which was previously filed as Exhibit 1 hereto.

None of the Reporting Persons has, during the last five years, (i) been

convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors), or (ii) been a party to a civil proceeding

of a judicial or administrative body of competent jurisdiction and as a result of such proceeding were or are subject to a judgment, decree

or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or

finding any violation with respect to such laws.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby restated as follows:

As of the date hereof, the aggregate of 6,620,482 Class A Shares

reported herein were acquired for aggregate consideration of approximately $49,996,200. The source of the purchase price for the

Class A Shares was capital available for investment from the Liberty Funds.

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page

10 of 13 |

| Item 5. | Interest in Securities of the Issuer. |

Item 5 is hereby restated as follows:

References to percentage ownership of the Class A Shares in this

Schedule 13D are based on 83,530,119 Class A Shares outstanding as of November 6, 2023, as reported by the Issuer in its Quarterly Report on Form 10-Q for the period ended September 30, 2023.

The Reporting Persons may

be deemed to constitute a “person” or “group” within the meaning of Section 13(d)(3) of the Exchange Act. Each

Reporting Person disclaims beneficial ownership of the securities reported herein except to the extent of its pecuniary interest therein,

and the filing of this Schedule 13D shall not be construed as an admission of such beneficial ownership or that the Reporting Persons

constitute a person or group.

(a) By

virtue of the fact that (i) the Class A Shares reported herein were purchased for the respective accounts of the Liberty Funds, (ii) the

Liberty Manager is the investment manager of the Liberty Funds, (iii) Liberty Manager GP is

the general partner of the Liberty Manager, (iv) Liberty Capital L.L.C. is the general partner of the Liberty Manager GP, (v) STM

Partners LLC indirectly controls the Liberty Manager and the general partner of the Liberty Funds,

and (vi) Secretary Mnuchin is the controlling member of STM Partners LLC, the other Reporting Persons may be deemed to have the

power to vote and direct the disposition of the Class A Shares owned of record by Liberty 77 Fund L.P. and Liberty 77 Fund

International L.P.

As a result, as of the date

hereof, each of the Reporting Persons may be deemed to beneficially own the Class A Shares indicated on row (11) on such Reporting Person’s

cover page included herein, or the approximate percentage of the aggregate amount of Class A common shares indicated on row (13) on such

Reporting Person’s cover page included herein.

(b) Each of the Reporting

Persons has the sole power to vote or direct the vote and the shared power to dispose or to direct the disposition of the Class A Shares

indicated on such Reporting Person’s cover page included herein.

(c) The table below

specifies the date, amount and price of shares of Class A Shares purchased by the Reporting Persons during the 60-day period prior

to January 18, 2024. The Reporting Persons effected purchases of Class A Shares through open market transactions.

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page 11 of 13 |

| Reporting Person |

|

Date |

|

Shares Purchased |

|

Price Per Share |

| Liberty 77 Fund L.P. |

|

1/10/2024 |

|

33,743 |

|

9.9505 |

| Liberty 77 Fund International L.P. |

|

1/10/2024 |

|

122,017 |

|

9.9505 |

| Liberty 77 Fund L.P. |

|

1/11/2024 |

|

229 |

|

10.00 |

| Liberty 77 Fund International L.P. |

|

1/11/2024 |

|

828 |

|

10.00 |

| Liberty 77 Fund L.P. |

|

1/16/2024 |

|

36,325 |

|

9.9975 |

| Liberty 77 Fund International L.P. |

|

1/16/2024 |

|

131,351 |

|

9.9975 |

| Liberty 77 Fund L.P. |

|

1/17/2024 |

|

146,340 |

|

10.2196 |

| Liberty 77 Fund International L.P. |

|

1/17/2024 |

|

529,167 |

|

10.2196 |

| Liberty 77 Fund L.P. |

|

1/17/2024 |

|

53,032 |

|

10.3838 |

| Liberty 77 Fund International L.P. |

|

1/17/2024 |

|

191,764 |

|

10.3838 |

| Liberty 77 Fund L.P. |

|

1/18/2024 |

|

43,107 |

|

10.4885 |

| Liberty 77 Fund International L.P. |

|

1/18/2024 |

|

155,873 |

|

10.4885 |

(d) Liberty 77 Capital GenPar

L.P. is the general partner of each of the Liberty Funds, and as such, has the right to receive, and the right to direct the receipt of,

dividends from or the proceeds from the sale of the securities that are reported in this Schedule 13D.

Liberty 77 Capital UGP L.L.C. is the general partner of Liberty

77 Capital GenPar L.P. and STM Partners LLC is the managing member of Liberty 77 Capital UGP L.L.C.

(e) Not applicable.

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page 12 of 13 |

SIGNATURES

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: January 18, 2024

| |

LIBERTY 77 CAPITAL L.P. |

| |

|

|

|

| |

By: |

Liberty

77 Capital Partners L.P.,

its

general partner |

|

| |

|

|

|

| |

By: |

Liberty

Capital L.L.C.,

its

general partner |

|

| |

|

|

|

| |

By: |

STM

Partners LLC,

its

manager |

|

| |

|

|

|

| |

By: |

/s/ Steven T.

Mnuchin |

|

| |

Name: |

Steven T. Mnuchin |

|

| |

Title: |

Chief

Executive Officer |

|

| |

|

|

|

| |

LIBERTY 77 FUND L.P.

|

| |

|

|

|

| |

By: |

Liberty

77 Capital GenPar L.P.,

its

general partner

|

|

| |

|

|

|

| |

By: |

Liberty

77 Capital UGP L.L.C.,

its

general partner

|

|

| |

|

|

|

| |

By: |

/s/ Jesse Burwell |

|

| |

Name: |

Jesse Burwell |

|

| |

Title: |

Chief Financial Officer |

|

| |

|

|

|

| |

LIBERTY 77 FUND INTERNATIONAL L.P.

|

| |

|

|

|

| |

By: |

Liberty

77 Capital GenPar L.P.,

its

general partner

|

|

| |

|

|

|

| |

By: |

Liberty

77 Capital UGP L.L.C.,

its

general partner

|

|

| |

|

|

|

| |

By: |

/s/ Jesse Burwell |

|

| |

Name: |

Jesse Burwell |

|

| |

Title: |

Chief Financial Officer |

|

| |

|

|

|

| |

LIBERTY 77 CAPITAL PARTNERS L.P.

|

| |

|

|

|

| |

By: |

Liberty

Capital L.L.C.,

its

general partner |

|

| |

|

|

|

| |

By: |

/s/ Jesse Burwell |

|

| |

Name: |

Jesse Burwell |

|

| |

Title: |

Chief Financial Officer |

|

| CUSIP No. 535919401 |

SCHEDULE 13D |

Page 13 of 13 |

| |

LIBERTY CAPITAL L.L.C. |

|

| |

|

|

|

| |

By: |

/s/ Jesse Burwell |

|

| |

Name: |

Jesse Burwell |

|

| |

Title: |

Chief

Financial Officer |

|

| |

STM PARTNERS

LLC |

|

| |

|

|

|

| |

By: |

/s/ Steven T. Mnuchin |

|

| |

Name: |

Steven T. Mnuchin |

|

| |

Title: |

Chief Executive Officer |

|

| |

|

|

|

| |

/s/ Steven T. Mnuchin |

|

| |

STEVEN T. MNUCHIN |

|

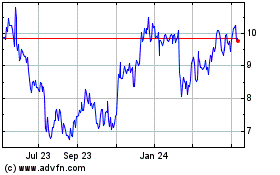

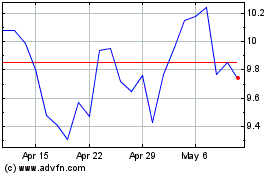

Lions Gate Entertainment (NYSE:LGF.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Lions Gate Entertainment (NYSE:LGF.B)

Historical Stock Chart

From Apr 2023 to Apr 2024