false

0001844862

0001844862

2024-01-10

2024-01-10

0001844862

us-gaap:CommonStockMember

2024-01-10

2024-01-10

0001844862

us-gaap:WarrantMember

2024-01-10

2024-01-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

January 10, 2024

Solid

Power, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-40284 |

|

86-1888095 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

486

S. Pierce Avenue, Suite E

Louisville, Colorado |

|

80027 |

| (Address of principal executive offices) |

|

(Zip code) |

(303) 219-0720

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

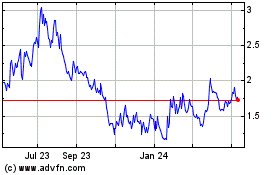

| Common stock, par value $0.0001 per share |

|

SLDP |

|

The Nasdaq Stock Market LLC |

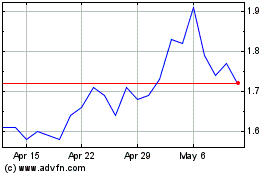

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

SLDPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§ 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On January 10, 2024, Solid

Power Operating, Inc. (“SP Operating”), a wholly owned subsidiary of Solid Power, Inc. (the “Company,”

“Solid Power,” “we,” or “our”), and SK On Co., Ltd. (“SK On”)

entered into a Research and Development Technology License Agreement (the “R&D License Agreement”) and Electrolyte

Supply Agreement (the “Electrolyte Supply Agreement”). On January 10, 2024, Solid Power Korea Co., Ltd. (“SP

Korea”), a wholly owned subsidiary of the Company, SK On, and, for the limited purposes of Section 12.16 of the Line Installation

Agreement, the Company entered into a Line Installation Agreement (the “Line Installation Agreement”).

R&D License Agreement

Pursuant to the terms

of the R&D License Agreement, SP Operating granted SK On a license to certain of SP Operating’s intellectual property relating

to all-solid-state battery cell manufacturing (the “R&D License”). The R&D License allows, among other things,

SK On to install and operate a pilot cell production line at SK On’s facilities (the “SK On Line”) using SP Operating’s

proprietary information. The R&D License is limited to SK On’s research and development activities and may not be used for commercial

battery cell production. In consideration of the R&D License and other obligations of SP Operating and SK On in the R&D License

Agreement, SK On will pay SP Operating $20 million between June 2024 and July 2027, subject to SP Operating and SP Korea achieving certain

milestones.

The foregoing description

of the R&D License Agreement is qualified in its entirety by the full text of the R&D License Agreement, a copy of which is filed

as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Electrolyte Supply Agreement

Pursuant to the terms

of the Electrolyte Supply Agreement, SK On will purchase electrolyte from SP Operating in an amount necessary to validate that the SK

On Line meets certain performance metrics. Following validation of the SK On Line, SK On will purchase an aggregate of at least eight

metric tons of electrolyte from SP Operating (the “Initial Quantity”). SK On is obligated to place binding orders for

the Initial Quantity by December 31, 2028 and take full delivery of the Initial Quantity by December 31, 2030. From January 2028 to December

2030, SP Operating will have a right of first refusal to supply SK On with SK On’s electrolyte requirements. SP Operating expects

to generate an aggregate of at least $10 million in revenue from sales of electrolyte under the Electrolyte Supply Agreement.

The foregoing description

of the Electrolyte Supply Agreement is qualified in its entirety by the full text of the Electrolyte Supply Agreement, a copy of which

is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Line Installation Agreement

Pursuant to the terms

of the Line Installation Agreement, SP Korea will, or will cause a subcontractor to, design and install the SK On Line at SK On’s

facility. In consideration of the foregoing, SK On will pay SP Korea approximately $22.3 million in three installments.

The foregoing description

of the Line Installation Agreement is qualified in its entirety by the full text of the Line Installation Agreement, a copy of which is

filed as Exhibit 10.3 to this Current Report on Form 8-K and incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On January 16, 2024, the Company issued a press

release announcing the transactions with SK On. The full text of the press release is furnished as Exhibit 99.1 to this Current Report

on Form 8-K. Internet addresses in the press release are for informational purposes only and are not intended to be hyperlinks to other

information of the Company. Such exhibit and the information set forth therein will not be deemed to be filed for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities

of that section, nor will it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended (the

“Securities Act”), or the Exchange Act.

Forward-Looking Statements

All statements other than

statements of present or historical fact contained herein or in Exhibit 99.1 to this Current Report on Form 8-K are “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including Solid Power’s

or its management team’s expectations, objectives, beliefs, intentions or strategies regarding the future. When used herein, the

words “could,” “should,” “will,” “may,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “plan,” “outlook,”

“seek,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current

expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future

events. Except as otherwise required by applicable law, Solid Power disclaims any duty to update any forward-looking statements, all of

which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Readers are

cautioned not to put undue reliance on forward-looking statements and Solid Power cautions you that these forward-looking statements are

subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Solid

Power, including the following factors: (i) risks relating to the uncertainty of the success of our research and development efforts,

including our ability to achieve the technological objectives or results that our partners require, and to commercialize our technology

in advance of competing technologies; (ii) risks relating to the non-exclusive nature of our original equipment manufacturers and joint

development agreement relationships; (iii) our ability to negotiate, execute, and perform on our agreements on commercially reasonable

terms; (iv) rollout of our business plan and the timing of expected business milestones; (v) delays in the construction and operation

of production facilities; (vi) our ability to protect our intellectual property, including in jurisdictions outside of the United States;

(vii) broad market adoption of battery electric vehicles and other technologies where we are able to deploy our cell technology and electrolyte

material, if developed successfully; (viii) our success in retaining or recruiting, or changes required in, our officers, key employees,

including technicians and engineers, or directors; (ix) risks and potential disruptions related to management and board of directors transitions;

(x) changes in applicable laws or regulations; (xi) risks related to technology systems and security breaches; (xii) the possibility that

we may be adversely affected by other economic, business or competitive factors, including supply chain interruptions, and may not be

able to manage other risks and uncertainties; (xiii) risks relating to our status as a research and development stage company with a history

of financial losses, and an expectation to incur significant expenses and continuing losses for the foreseeable future; (xiv) the termination

or reduction of government clean energy and electric vehicle incentives; and (xv) changes in domestic and foreign business, market, financial,

political and legal conditions. Additional information concerning these and other factors that may impact the operations and projections

discussed herein or in Exhibit 99.1 to this Current Report on Form 8-K can be found in the “Risk Factors” sections of Solid

Power’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended

March 31, 2023 and other documents filed by Solid Power from time to time with the Securities and Exchange Commission (the “SEC”),

all of which are available on the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties

that could cause actual events and results to differ materially from those contained in the forward-looking statements. Solid Power gives

no assurance that it will achieve its expectations.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

See the Exhibit index

below, which is incorporated herein by reference.

Exhibit

No. |

|

Description |

| 10.1± |

|

Research and Development Technology License Agreement, dated January 10, 2024, between Solid Power Operating, Inc. and SK On Co., Ltd. |

| 10.2± |

|

Electrolyte Supply Agreement, dated January 10, 2024, between Solid Power Operating, Inc. and SK On Co., Ltd. |

| 10.3± |

|

Line Installation Agreement, dated January 10, 2024, among Solid Power Korea Co., Ltd., SK On Co., Ltd., and, for the limited purposes of Section 12.16 of the Line Installation Agreement, Solid Power, Inc. |

| 99.1 |

|

Press Release, dated January 16, 2024. |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

± Certain portions of this exhibit have been omitted in

accordance with Regulation S-K Item 601. The Company agrees to furnish an unredacted copy of the exhibit to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: January 16, 2024

| |

SOLID POWER, INC. |

| |

|

|

| |

By: |

/s/ James Liebscher |

| |

|

Name: James Liebscher |

| |

|

Title: Chief Legal Officer and Secretary |

Exhibit 10.1

CERTAIN

IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) WOULD BE COMPETITIVELY

HARMFUL IF PUBLICLY DISCLOSED. [* * *] INDICATES THAT INFORMATION HAS BEEN REDACTED.

Execution

Version

RESEARCH

AND DEVELOPMENT TECHNOLOGY LICENSE Agreement

This RESEARCH

AND DEVELOPMENT TECHNOLOGY LICENSE Agreement (together with the exhibits attached hereto, this “Agreement”)

is entered into effective as of January 10, 2024 (the “Effective Date”) and is between Solid Power Operating, Inc.,

a Colorado corporation and having its registered office at 486 S. Pierce Ave., Suite E, Louisville, Colorado 80027 USA (“Solid

Power”), and SK On Co., Ltd., a Company incorporated under the laws of Republic of Korea and having its registered

office at 51 Jongro, Jongno-gu, Seoul 03188 Republic of Korea (“SK On,” and together with Solid Power, the “Parties”).

BACKGROUND

A. Solid

Power is developing and/or acquiring technology relating to all-solid-state battery cells (“ASSB”) having a

sulfide-based solid electrolyte.

B. SK

On is developing and securing technology in the field of lithium-ion batteries including electrode powders, electrode coatings, electrolyte

compositions, battery assembly, battery formation, and battery cycling and sells batteries to third-parties, including original equipment

manufacturers in the automotive market (Auto OEMs).

C. SK

On desires (i) to have Solid Power Korea Co., Ltd. (“Solid Power Korea”) install a pilot production

line at SK On’s facilities in Daejeon, Republic of Korea (the “SK On Line”) based on Solid Power’s

pilot cell production line in Louisville, Colorado (the “Solid Power EV Line”), (ii) to have access to

Solid Power Know-How necessary to operate the SK On Line to produce cells with the same level of productivity and Cell Performance as

the Solid Power EV Line, and (iii) to procure Material from Solid Power to be used in the SK On Line (i, ii, and iii collectively,

the “Project”).

Agreement

NOW, THEREFORE, in consideration of the premises

and the mutual promises contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged,

the Parties agree as follows:

Article I

DEFINITIONS

1.01 Definitions.

(a) “A-sample”

means the cell concept validation phase during which a manufacturer (i) evaluates multiple designs against customer requirements

and (ii) tests and selects suppliers.

(b) “Affiliate”

of a specified person means a person who, directly or indirectly through one or more intermediaries, Controls, is Controlled by, or is

under common Control with, such specified person.

(c) “Affiliate

License” has the meaning set forth in Section 2.01.

(d) “Agreement”

has the meaning set forth in the introductory paragraph.

(e) “ASSB”

has the meaning set forth in the recitals.

(f) “B-sample”

means the cell design validation phase during which a manufacturer (i) freezes the cell design, (ii) selects suppliers for cell

materials, (ii) produces cell samples on pilot equipment, (iii) ensures sample performance meets customer specifications, and

(iv) begins module and pack testing and validation.

(g) “Background

IP” means Intellectual Property conceived, created, developed, or reduced to practice by a Party or an Affiliate of a Party

prior to the Effective Date or outside of the scope of this Agreement.

(h) “Battery

Cell Inventions” has the meaning set forth in Section 3.05.

(i)

“Battery Cell Material” means SK On’s proprietary battery

cells.

(j) “Business

Day” means a day other than Saturday, Sunday, or any day on which the Federal Reserve Bank of New York is closed or the

Bank of Korea is closed.

(k) “C-sample”

means the cell process validation phase during which a manufacturer (i) manufactures frozen cell design on production equipment,

(ii) ensures production samples continue to meet customer specifications, and (iii) continues pack testing and prototype vehicle

integration.

(l) “Cell

Performance Data” has the meaning set forth in Section 2.05.

(m) “Cell

Performance Guarantee” has the meaning set forth in Section 2 of Exhibit E.

(n) “Commercial

License Agreement” means a commercial Intellectual Property and technology transfer agreement signed in writing by both

Parties or their Affiliates, consistent with the terms and conditions of this Agreement (including, specifically, the terms of Article IV)

and otherwise to be agreed by the Parties in due course, governing the licensing of Intellectual Property rights and transfer of technology

to SK On in order to support SK On’s commercial exploitation of ASSB battery cells.

(o) “Commercial

Framework” has the meaning set forth in Section 4.01.

(p) “Confidential

Information” has the meaning set forth in Section 7.01.

(q) “Control”

(including the terms “Controlled by” and “under common Control with”) means the possession,

directly or indirectly, or as a trustee or executor, of the power to direct or cause the direction of the management and policies of a

person, whether through the ownership of voting securities, as trustee or executor, by contract, or otherwise.

(r) “D-sample”

means the cell production validation phase during which a manufacturer (i) produces cells at full production rates, (ii) achieves

quality and process certifications, and (iii) continues vehicle level testing. It should be noted that to expedite qualification,

C-sample and D-sample activities can be combined.

(s) “Disclosing

Party” has the meaning set forth in Section 7.01.

(t) “EAR”

has the meaning set forth in Section 9.15(a).

(u) “Effective

Date” has the meaning set forth in the introductory paragraph.

(v) “EI”

has the meaning set forth in Section 9.15(c).

(w) “Electrolyte

Supply Agreement” means the Electrolyte Supply Agreement, dated as of the Effective Date, between the Parties and attached

hereto as Exhibit A.

(x) “First

Round Validation” has the meaning set forth in Section 5.03.

(y) “Foreground

IP” means Intellectual Property first conceived, created, or developed by one of the Parties during the Term and solely

within the scope of this Agreement, but in all cases excluding Background IP.

(z) “Intellectual

Property” means all or any of the following throughout the world: (i) patents, patent applications (including originals,

divisions, continuations, continuations-in-part, extensions, reexaminations, and reissues thereof), patent disclosures, inventions, and

invention disclosures (whether or not patentable), (ii) trademarks, service marks, trade dress, trade names, corporate names, logos,

and slogans (and all translations, transliterations, adaptations, derivations, and combinations of the foregoing) and Internet domain

names, and franchises, together with all goodwill associated with each of the foregoing, (iii) copyrights and copyrightable works,

(iv) registrations and applications for any of the foregoing, (v) trade secrets, customer lists, data and customer records,

reports, software development methodologies, source code, technical information, proprietary business information, process technology,

plans, drawings, blue prints, know-how and inventions (whether patentable or unpatentable and whether or not reduced to practice (those

items in subclause (v) collectively, “Trade Secrets”), (vi) all rights of publicity, including

the right to use the name, voice, likeness, signature, and biographies of real persons, together with all goodwill related thereto, and

(vii) all other intellectual or proprietary rights.

(aa) “Joint

IP” means Intellectual Property developed jointly by the Parties under this Agreement and pursuant to the scope of this

Agreement.

(bb) “License”

has the meaning set forth in Section 2.01.

(cc) “Licensee”

has the meaning set forth in Section 2.01.

(dd) “Line

Installation Agreement” means the Line Installation Agreement, dated as of the Effective Date, among SK On, Solid Power

Korea, and, for the limited purposes of Section 12.16 of the Line Installation Agreement, Solid Power, Inc., a copy of which

is attached hereto as Exhibit F.

(ee) “Material”

means Solid Power’s proprietary sulfide-based solid electrolyte.

(ff)

“Material Inventions” has the meaning set forth in Section 3.04.

(gg) “OEM”

has the meaning set forth in Section 2.05.

(hh) “Parties”

has the meaning set forth in the introductory paragraph.

(ii) “Project”

has the meaning set forth in the recitals.

(jj)

“Receiving Party” has the meaning set forth in Section 7.01.

(kk) “Representatives”

has the meaning set forth in Section 7.03(b).

(ll)

“Rules” has the meaning set forth in Section 9.07.

(mm) “Second

Round Validation” has the meaning set forth in Section 5.03.

(nn) “SK

On” has the meaning set forth in the introductory paragraph.

(oo) “SK

On Line” has the meaning set forth in the recitals.

(pp) “SK

On Line Documents” has the meaning set forth in Section 2.04.

(qq) “Solid

Power” has the meaning set forth in the introductory paragraph.

(rr) “Solid

Power EV Line” has the meaning set forth in the recitals.

(ss) “Solid

Power Know-How” means the SK On Line Documents and the information set forth on Exhibit B, which relates solely

to Solid Power’s silicon anode and NMC cathode cell chemistry, including materials used, cell specifications, and all processes,

control plans, work instructions and material vendor list for such cell chemistry, regardless if such information is (i) considered

to be Solid Power’s Foreground IP or Solid Power’s Background IP, (ii) is not protected by an Intellectual Property right,

or (iii) constitutes know-how, technical information, trade secrets, work products, methods, processes, schematics, or other forms

of technology. For the avoidance of doubt, the Material does not constitute Solid Power Know-How.

(tt) “Solid

Power Korea” has the meaning set forth in the recitals.

(uu) “Term”

has the meaning set forth in Section 5.01.

(vv) “Validation

Performance Metrics” has the meaning set forth in Section 5.03.

(ww) “Validation

Termination Right” has the meaning set forth in Section 5.03.

1.02 Interpretation.

The words “include” and “including” and other words of similar import when used herein shall not be deemed to

be terms of limitation but rather shall be deemed to be followed in each case by the words “without limitation,” whether or

not they are in fact followed by those words or words of like import. The definitions contained in this Agreement are applicable to the

singular as well as the plural forms of such terms. Whenever required by the context, any pronoun used in this Agreement shall include

the corresponding masculine, feminine, or neuter forms, and the singular form of nouns, pronouns, and verbs shall include the plural and

vice versa. Any capitalized term used in any Exhibit but not otherwise defined therein will have the meaning given to such term in

this Agreement. Any reference to “days” means calendar days unless Business Days are expressly specified. If any action under

this Agreement is required to be done or taken on a day that is not a Business Day, then such action shall be required to be done or taken

not on such day but on the first succeeding Business Day thereafter. The words “herein,” “hereto,” “hereunder”

and “hereby” and other words of similar import in this Agreement shall be deemed in each case to refer to this Agreement as

a whole and not to any particular Article, Section or other subdivision of this Agreement. When a reference is made in this Agreement

to an Article, Section, or Exhibit, such reference is to an Article or Section of, or an Exhibit to, this Agreement unless

otherwise indicated. Any reference herein to “dollars” or “$” shall mean United States dollars. The term “or”

is not exclusive.

Article II

License to Solid Power Know-How

2.01 Grant

of License and Affiliate License; Delivery of Information. Solid Power hereby grants and will grant to SK On a non-exclusive, non-transferrable,

non-sublicensable, worldwide, royalty-free license to use the Solid Power Know-How and Intellectual Property therein, subject to the limitations

set forth in this Agreement (the “License”). Solid Power will deliver the Solid Power Know-How in accordance

with the schedule set forth in Exhibit B. Solid Power grants to SK On’s parent company, currently SK Innovation Co., Ltd.,

and Affiliates that are wholly-owned subsidiaries of SK On (each such entity, together with SK On, “Licensee”)

a license to use the Solid Power Know-How and Intellectual Property therein, on the same terms and subject to the same limitations set

forth in this Agreement (the “Affiliate License”). SK On shall be responsible for any breaches of the Affiliate

License by any Licensee.

2.02 Limitations

of License and Affiliate License.

(a) Licensee

may use the License or Affiliate License, as applicable, solely for its own research and development activities in the field of solid

state battery cell technology and achievement of the Project. Licensee may not use the License or Affiliate License, as applicable, any

of Solid Power’s Background IP or Solid Power’s Foreground IP, or any derivatives of the foregoing, either directly or indirectly,

for any purpose other than set forth in this Agreement, including C- or D-sample cell production or for commercial cell production. Any

use of Solid Power Know-How or any other Solid Power Intellectual Property by Licensee for C- or D-sample cell production or for commercial

cell production will be subject to a separate commercial agreement between Licensee and Solid Power. For the purposes of this Agreement,

use of Solid Power Know-How for A- or B-sample production shall not be deemed as use for commercial production.

(b) Licensee

will not and will not attempt to, directly or indirectly, lease, loan, license, transfer, or otherwise disclose or share with any third

party any of the Solid Power Know-How or Solid Power’s Background IP or Solid Power’s Foreground IP.

(c) Licensee

will not and will not attempt to, directly or indirectly, lease, loan, or otherwise disclose or share with any third party, modify, analyze,

reverse engineer (or otherwise attempt to learn the ingredients or chemical structure of), or otherwise seek to identify or uncover any

Trade Secrets embodied in any Material; provided, however, that modifications and analyses (including analyses for COA)

of the Material solely for the purpose of the Project shall not be considered reverse engineering or breach of this Agreement.

2.03 Updates

to Solid Power Know-How. Until the Milestone #3 set forth in Exhibit C is met, and to the extent permitted under other

contractual arrangements, Solid Power shall provide to SK On all information relating to any optimization or advancements to the Solid

Power Know-How, including updates to the dossiers set forth on Exhibit B, which shall be governed by this Agreement and included

in the definition of Solid Power Know-How.

2.04 Level

of Information. The Parties acknowledge that the SK On Line will be different from but substantially similar to the Solid Power EV

Line due to different vendors, improvements to processes, and the physical layout of SK On’s facilities. Solid Power will use commercially

reasonable efforts to ensure the Solid Power Know-How will be at a level that allows SK On to operate the SK On Line in a substantially

similar level to Solid Power operating the Solid Power EV Line in terms of throughput, yield, and cell performance to satisfy the covenants

in Exhibit E. Solid Power agrees to develop and provide SK On with documents that allow SK On to operate the SK On Line at

a substantially similar level to the Solid Power EV Line (the “SK On Line Documents”) and represents and warrants

that the SK On Line Documents and Solid Power Know-How will be the most recent and updated information that allows SK On to operate the

SK On Line at a substantially similar level to Solid Power operating the Solid Power EV Line in terms of throughput, yield, and cell performance

to satisfy the covenants in Exhibit E. Except as set forth in this Agreement, Solid Power makes no representation or warranty,

and assumes no liability, with respect to the Solid Power Know-How or SK On’s use thereof. Except for the representations and warranties

in this Agreement, including Section 2.04, Article VI, and the Cell Performance Guarantee, SK On expressly accepts the Solid

Power Know-How on an “AS IS” basis without any warranty by, or liability of, Solid Power.

2.05

Feedback and Limited License. SK On will provide cell performance data in the format set

forth in Table 1 in Exhibit E (“Cell Performance Data”) of battery cells that are designed

based on or incorporating, directly or indirectly, Solid Power Know-How and manufactured during the Term (such data, “SK

On Data”). The obligation to provide SK On data will end upon the earlier of (a) termination of this Agreement,

(b) the full payment of all consideration due upon completion of the Milestone #3 set forth in Exhibit C. But for

any Cell Performance Data of battery cells that are designed based in whole or in part on SK On know-how, the scope of the data

provided by SK On will be negotiated in good faith by Solid Power and SK On, with the ultimate determination to be made by SK On. SK

On hereby grants to Solid Power a non-exclusive, non-transferable, worldwide, and royalty-free license to use the SK On Data solely

for Solid Power’s own research and development activities in the field of solid state cell technology. Solid Power may not use

SK On Data, any of SK On’s Intellectual Property, or any derivatives of the foregoing, either directly or indirectly, for any

other purpose including commercial cell manufacturing and licensing;. However, each Party may share Cell

Performance Data with its original equipment manufacturer (“OEM”) partners so long as such OEM partners

are subject to confidentiality terms at least as restrictive as the Party’s confidentiality obligations with respect to the

other Party and subject to the other Party’s prior written consent for such data sharing. Any commercial use of SK On Data or

SK On’s Intellectual Property for cell manufacturing or licensing shall be subject to a separate commercial agreement between

SK On and Solid Power.

2.06

Compensation. In consideration of the License, the Affiliate License, and the other

obligations of SK On and Solid Power set forth in this Agreement, SK On shall pay Solid Power an aggregate of

USD $20 million. Subject to Section 2.07, any payments under this Section 2.06 are subject to the

milestones set forth in Exhibit C having been met. Each milestone payment shall become due and payable within 30 days

after receipt of invoice from Solid Power. Solid Power shall issue each invoice subject to, and only after, receipt of written

confirmation of milestone completion by SK On (which shall not be unreasonably delayed or withheld by SK On). All invoices shall be

paid in accordance with the banking instructions Solid Power has provided to SK On, as may be changed from time to time by Solid

Power upon 30 days’ written notice to SK On; provided, however, if any necessary qualification of Solid Power's

banking institute takes longer than 30 days due to administrative reasons despite SK On's reasonable efforts, the due date for such

invoice shall be tolled until such bank is qualified. The estimated completion dates set forth in Exhibit C are

estimates only and do not constitute due dates for such payments. All payments shall be made in U.S. dollars to a bank account

directed by Solid Power. Failure to make a payment when due pursuant to this Section 2.06 shall constitute a material

breach of this Agreement by SK On.

2.07 Line

Installation Agreement. Contemporaneous with the execution of this Agreement, SK On, Solid Power Korea, and, for the limited purposes

of Section 12.16 of the Line Installation Agreement, Solid Power, Inc. have entered into the Line Installation Agreement.

2.08 Electrolyte

Supply Agreement. Contemporaneous with the execution of this Agreement, the Parties have entered into the Electrolyte Supply Agreement.

2.09 Statement

of Work and Training of SK On Personnel. In connection with the License, Solid Power and SK On will undertake the activities, including

training activities of SK On personnel, in accordance with the schedule set forth on Exhibit D. As set forth in Exhibit D,

Solid Power will develop training activities to prepare SK On personnel to operate the SK On Line. Solid Power represents and warrants

that Solid Power’s training activities will include substantially the same information, and will be provided in substantially the

same manner, as the trainings then provided to Solid Power personnel, modified as needed for the SK On Line. Except as set forth in the

foregoing, Solid Power makes no representation or warranty, and assumes no liability, with respect to any training activities or SK On’s

use thereof. In conducting the activities contemplated by this Section 2.09, SK On shall make its facilities available to

Solid Power personnel and will ensure that all legal requirements for training are met.

Article III

INTELLECTUAL PROPERTY

3.01 Background

IP. Each Party shall retain all right, title, and interest in and to all of such Party’s, or such Party’s Affiliate’s,

Background IP, and, except as otherwise expressly set forth in this Agreement, the other Party shall obtain no, nor shall it be deemed

to have been granted any, license, right, title, or interest therein.

3.02 Foreground

IP. Each Party shall retain all right, title, and interest in and to all of such Party’s, or such Party’s Affiliate’s,

Foreground IP and, except as otherwise expressly set forth in this Agreement, the other Party shall obtain no, nor shall it be deemed

to have been granted any, license, right, title, or interest therein.

3.03 Joint

IP. The Parties shall jointly own all Joint IP. Either Party and its Affiliates are free to use and exploit Joint IP, including the

right to make, have made, use, sell, have sold, import, and export products or services, without payment to the other Party or obligation

to account to the other Party; provided, however, neither Party shall be permitted to, without the consent of the other

Party, grant a license under such Joint IP. Each Party shall solely own all modifications and derivative works to the Joint IP that it

creates after the Term, without any disclosure, financial, or cross-license obligation to the other Party.

3.04 Material;

Material Inventions. Notwithstanding anything herein to the contrary, Solid Power will exclusively own all right, title, and interest,

including all Intellectual Property rights, in and to any improvements or enhancements to the Material that are conceived, developed,

or reduced to practice by or on behalf of one or both of the Parties under this Agreement (“Material Inventions”),

and SK On hereby assigns to Solid Power all right, title, and interest, including all Intellectual Property rights, in and to any Material

Inventions; provided, however, (a) for the avoidance of doubt and for the purpose of this Agreement, incorporation of a Party’s

Background IP or Foreground IP into the Material (including adding materials such as a binder to the Material or processing the Material

to make an interfacial layer) shall not be considered a Material Invention, such that Solid Power does not have, and SK On does not grant

to Solid Power, any Intellectual Property rights related to electrolytes conceived, created, developed or reduced to practice by SK On

through research and development independent of this Agreement, and (b) Solid Power agrees to grant, and hereby does grant, to SK

On and its Affiliates a worldwide, perpetual, irrevocable, non-sublicensable, and royalty-free license under all Intellectual Property

right in and to the Material Inventions that are conceived, developed, or reduced to practice by SK On. SK On will, no later than five

days after becoming aware of a Material Invention, disclose to Solid Power such Material Invention governed by this section and provide

to Solid Power copies of all Material Invention disclosures and other documents that disclose such Material Invention. Such Material Invention

disclosure and other documents will contain sufficient detail to enable Solid Power to determine whether: (i) the respective Material

Invention contains patentable subject matter, and (ii) to file for patent protection of the Material Invention.

3.05 Battery

Cell Material; Battery Cell Inventions. Notwithstanding anything herein to the contrary, SK On will exclusively own all right, title,

and interest, including all Intellectual Property rights, in and to any improvements or enhancements to the Battery Cell Material that

are conceived, developed, or reduced to practice by or on behalf of one or both of the Parties under this Agreement (“Battery

Cell Inventions”), and Solid Power hereby assigns to SK On all right, title, and interest, including all Intellectual Property

rights, in and to any Battery Cell Inventions; provided, however, (a) for the avoidance of doubt and for the purpose of this

Agreement, incorporation of a Party’s Background IP or Foreground IP into Battery Cell Material shall not be considered a Battery

Cell Invention, such that SK On does not have, and Solid Power does not grant to SK On, any Intellectual Property rights related to battery

cells conceived, created, developed or reduced to practice by Solid Power through research and development independent of this Agreement,

and (b) SK On agrees to grant, and hereby does grant, to Solid Power and its Affiliates a worldwide, perpetual, irrevocable, non-sublicensable,

and royalty-free license under all Intellectual Property right in and to any Battery Cell Inventions that are conceived, developed, or

reduced to practice by Solid Power. Solid Power will, no later than five days after becoming aware of a Battery Cell Invention, disclose

to SK On such Battery Cell Invention governed by this section and provide to SK On copies of all Battery Cell Invention disclosures and

other documents that disclose such Battery Cell Invention. Such Battery Cell Invention disclosures and other documents will contain sufficient

detail to enable SK On to determine whether: (i) the respective Battery Cell Invention contains patentable subject matter, and (ii) to

file for patent protection of the Battery Cell Invention.

Article IV

FUTURE COMMERCIALIZATION

4.01 Commercial

Framework. At SK On’s option, exercisable by written notice to Solid Power at any time and from time to time, SK On and Solid

Power shall make a commercially reasonable effort to enter into a mutually beneficial ASSB commercialization framework, for example (but

without limitation) a joint venture (the “Commercial Framework”). The Parties shall engage in [* * *] onsite

workshops to assess technology commercialization status and review the strategy for commercialization, which review shall commence upon

completion of the SK On Line.

4.02 Commercial

License Agreement. SK On and Solid Power, as part of the Commercial Framework, make a commercially reasonable effort to enter into

a commercial license. The commercial license will include terms customary for an agreement of that type, including but not limited to

the following:

(a) representations

and warranties of ownership, sufficiency, and non-infringement with respect to technology and Intellectual Property rights conveyed under

the commercial license;

(b)

covenants sufficient to ensure that the financial terms of any commercial license to Solid Power

Know-How and Intellectual Property therein pursuant to the commercial license are no less favorable to SK On than terms offered to

other commercial licensees of Solid Power Know-How and Intellectual Property therein in transactions of similar duration, volume,

and structure; and

(c) a

grant of rights sufficient to allow SK On to manufacture, or have manufactured ASSB battery cells in the event that the manufacturing

arrangement otherwise provided in the Commercial Framework terminates or is unsuccessful.

4.03 [*

* *]

Article V

TERM; TERMINATION

5.01 Term.

This Agreement shall be effective commencing on the Effective Date and will continue until December 31, 2030, unless earlier terminated

pursuant to Section 5.02 (the “Term”).

5.02 Termination.

This Agreement shall terminate upon the earlier of:

(a) expiration

of the Term;

(b) exercise

by SK On of the Validation Termination Right; or

(c) the

exercise of a Party’s termination right under Section 5.04.

5.03 Validation

of SK On Line Termination Right. [* * * ]

5.04

Termination for Breach of Agreement. This Agreement may be terminated by:

(a) SK

On, if Solid Power materially breaches any term of this Agreement or the Electrolyte Supply Agreement, or Solid Power Korea materially

breaches any term of the Line Installation Agreement, and Solid Power or Solid Power Korea, as applicable, fails to cure such breach within

30 days, or 60 days in the case of the Line Installation Agreement, after receipt of written notice from SK On requesting such breach

be cured. Upon a termination pursuant to this Section 5.04(a), each Party’s rights and obligations under this Agreement

shall terminate, including any compensation required to be paid by SK On to Solid Power pursuant to Section 2.06.

(b) Solid

Power, if SK On materially breaches any term of this Agreement, the Line Installation Agreement, or the Electrolyte Supply Agreement and

SK On fails to cure such breach within 30 days after receipt of written notice from Solid Power or Solid Power Korea, as applicable, requesting

such breach be cured. Upon a termination pursuant to this Section 5.04(b), each Party’s rights and obligations under

this Agreement shall terminate; provided, however, the compensation due to Solid Power from SK On pursuant to Section 2.06

shall accelerate and become immediately due and payable.

5.05 Survival.

Upon termination of this Agreement pursuant to Section 5.02 all obligations and rights of the Parties shall also terminate,

except for Section 2.02(a), Section 2.02(b), Section 2.02(c), Article III, this Section 5.05,

Article VII, Article VIII, and Article IX, and all defined terms required to interpret those Articles

and Sections. Unless this Agreement is terminated by Solid Power pursuant to Section 5.04(b), Section 2.01 (solely

with respect to the license of intellectual property rights) shall survive termination of this Agreement until the later of (a) December 31,

2030 or (b) the time at which SK On and Solid Power are no longer engaged in ASSB development or otherwise conducting business between

the Parties, for example pursuant to a joint development agreement or an electrolyte supply agreement.

Article VI

REPRESENTATIONS AND WARRANTIES

Each Party hereby represents and warrants to the other Party

as follows:

6.01 Power

and Authority. This Agreement and the documents referred to herein to have been duly executed and delivered by such Party and are

legal, valid, and binding obligations of such Party, enforceable against such Party in accordance with their terms.

6.02 No

Conflict. Such Party does not have any agreement with any third party or other commitment or obligation that materially conflicts

with such Party’s obligations under this Agreement. During the Term, such Party will not enter into any agreement, commitment, or

obligation that materially conflicts with its obligations under this Agreement.

6.03 IP

Ownership. To the knowledge of Solid Power, Solid Power owns or has all necessary rights to use and license, and will retain interest

in and to the Solid Power Know-How and Intellectual Property therein, and such ownership or all necessary rights will be retained throughout

the Term and is sufficient to grant the rights and licenses under this Agreement.

6.04 Non-infringement.

[* * *]

6.05 Disclaimer.

Except as set forth in Section 2.04, Section 2.09, Section 3.04, Section 6.01, Section 6.02,

Section 6.03, and Section 6.04, as applicable, such Party does not make any warranties in connection with this

Agreement, whether express, implied, statutory, or otherwise and such Party specifically disclaims all implied warranties, including those

of merchantability, title, noninfringement, and fitness for a particular purpose.

Article VII

CONFIDENTIALITY

7.01 Definition.

A Party (“Disclosing Party”) may, directly or indirectly, disclose or make available Confidential Information

to the other Party (“Receiving Party”) in connection with this Agreement. “Confidential Information”

means information in any form or medium (whether oral, written, electronic, or other) that is marked as confidential or proprietary to

Disclosing Party or that otherwise should reasonably be considered confidential to Disclosing Party given the nature of the information

and circumstances of disclosure, including information consisting of or relating to Disclosing Party’s technology, Intellectual

Property, know-how, business operations, plans, strategies, customers, and pricing, and information with respect to which Disclosing Party

has contractual or other confidentiality obligations.

7.02 Exclusions.

Confidential Information does not include information that Receiving Party can demonstrate by written or other documentary records: (a) was

rightfully known to Receiving Party without restriction on use or disclosure prior to such information being disclosed or made available

to Receiving Party in connection with this Agreement; (b) was or becomes generally known by the public other than by Receiving Party’s

noncompliance with this Agreement; (c) was or is received by Receiving Party on a non-confidential basis from a third party that,

to Receiving Party’s knowledge, was not or is not, at the time of such receipt, under any obligation to maintain its confidentiality;

or (d) was or is independently developed by Receiving Party without reference to or use of any Confidential Information. Notwithstanding

the foregoing in this Section 7.02 and without otherwise limiting the definition of Confidential Information set forth in

Section 7.01, Solid Power Know-How, the Material, Material Inventions and the terms and existence of this Agreement are Confidential

Information.

7.03 Protection

of Confidential Information. Receiving Party will:

(a) not

access or use Confidential Information other than as necessary to exercise its rights or perform its obligations under and in accordance

with this Agreement;

(b) not

disclose or permit access to Confidential Information other than: (i) in accordance with Section 7.04; or (i) to

its employees, officers, directors, consultants, Affiliates, and agents (collectively, “Representatives”) who:

(1) need to know such Confidential Information for the Project and/or Receiving Party’s exercise of its rights or performance

of its obligations under and in accordance with this Agreement; (2) have been informed of the confidential nature of the Confidential

Information and Receiving Party’s obligations under this Article VII; and (ii) are bound by written confidentiality

and restricted use obligations at least as protective of the Confidential Information as the terms set forth in this Article VII;

(c) safeguard

the Confidential Information from unauthorized use, access or disclosure using at least the degree of care it uses to protect its own

sensitive information and in no event less than a reasonable degree of care; and

(d) ensure

that its Representatives comply with, and be responsible and liable for any noncompliance with, the terms of this Article VII.

7.04 Compelled

Disclosures. If Receiving Party or any of its Representatives is compelled by applicable law or regulation to disclose any Confidential

Information then, to the extent permitted by the applicable law or regulation, Receiving Party will: (a) promptly, and prior to such

disclosure, notify Disclosing Party in writing of such requirement so that Receiving Party can seek a protective order or other remedy,

or waive its rights under Section 7.03; and (b) provide reasonable assistance to Disclosing Party, at Disclosing Party’s

cost and expense, in opposing such disclosure or seeking a protective order or other limitations on disclosure. If Disclosing Party waives

compliance or, after providing the notice and assistance required under this Section 7.04, Receiving Party remains required

by applicable law or regulation to disclose any Confidential Information, Receiving Party will disclose only that portion of the Confidential

Information that, on the advice of Receiving Party’s legal counsel, Receiving Party is legally required to disclose and, upon Disclosing

Party’s request, will use commercially reasonable efforts, at Disclosing Party’s cost and expense, to obtain assurances from

the applicable court or other presiding authority that such Confidential Information will be afforded confidential treatment.

Article VIII

INDEMNIFICATION; REMEDIES

8.01 Indemnification.

Each Party will defend, indemnify, and hold harmless the other Party, its Affiliates, and their respective officers, directors, employees,

agents, licensors, successors, and assigns, from and against any and all losses or liabilities (including reasonable attorneys’

fees) arising out of or resulting from the indemnifying Party’s breach of this Agreement.

8.02 Remedies.

Notwithstanding anything herein to the contrary, the Parties hereby agree that, in the event any Party violates any provisions of this

Agreement, the remedies at law available to the non-breaching Party may be inadequate. In such event, the non-breaching Party shall have

the right, in addition to all other rights and remedies it may have, to seek specific performance or other equitable relief (including

rights of rescission) at any time to enforce or prevent any breaches by the breaching Party.

Article IX

Miscellaneous

9.01 Notices.

Any notice required or permitted to be given under this Agreement shall be sufficient if made in writing and shall be deemed to be given

(a) when personally delivered, (b) upon actual delivery when sent by electronic mail, or (c) on the next business day following

dispatch when sent by overnight courier service, costs prepaid, to the addresses specified below:

If to Solid Power:

Solid Power Operating, Inc.

486 S. Pierce Ave., Suite E

Louisville, CO 80027

Attention: Legal Department

Email: [* * *]

If to SK On:

SK On Co., Ltd.

26 Jongro, Jongro-gu, Seoul 03188

Republic of Korea

Attention: [* * *]

Email: [* * *]

9.02 Assignment.

The rights and obligations of a Party under this Agreement shall not be assigned, including by operation of law or otherwise, by a Party

without the prior written consent of the other Party.

9.03 Binding

Nature of Agreement; No Third Party Beneficiaries. All the terms and provisions of this Agreement will be binding upon and will inure

to the benefit of the Parties and their respective successors, permitted assigns, heirs, and personal representatives. It is not the intention

of the Parties to confer third party beneficiary rights upon any other third party.

9.04 Entire

Agreement. This Agreement, together with the attached Exhibits, constitutes the entire agreement between the Parties with respect

to the subject matter hereof and supersedes any prior understandings, agreements, or representations by or between the Parties, written

or oral, that may have related in any way to the subject matter hereof.

9.05 No

Exclusive Agreement. This is not an exclusive agreement. Each Party has and will continue to perform battery cell development internally

and with other partners, including other battery manufacturers, automotive manufacturers, universities, research entities, and other non-profit,

for-profit, or governmental organizations.

9.06 Governing

Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Delaware without giving effect

to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause

the application of the laws of any jurisdiction other than the State of Delaware.

9.07

Arbitration. All disputes arising out of or in connection with this Agreement

shall be submitted to confidential arbitration before the International Court of Arbitration of the International Chamber of

Commerce and shall be finally and confidentially settled under the Rules of Arbitration of the International Chamber of

Commerce (the “Rules”) by three arbitrators appointed in accordance with the Rules. The language of

the arbitration will be English. The place of the arbitration will be London, England. Judgment upon any award rendered

by the arbitrator may be entered in any court having jurisdiction. Notwithstanding the foregoing, a Party may institute and

sustain an action for equitable relief to prevent an actual or threatened breach of this Agreement, or to stop a continuing breach

of this Agreement, in any court having jurisdiction.

9.08 Headings.

The headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation

of this Agreement.

9.09 Incorporation

of Exhibits. The Exhibits identified in this Agreement are incorporated herein by reference and made a part hereof.

9.10 Severability.

If any provision of this Agreement is held to be illegal, invalid, or unenforceable under any present or future law, and if the rights

or obligations of any Party under this Agreement will not be materially and adversely affected thereby, (a) such provision will be

fully severable, (b) this Agreement will be construed and enforced as if such illegal, invalid, or unenforceable provision had never

comprised a part hereof, (c) the remaining provisions of this Agreement will remain in full force and effect and will not be affected

by the illegal, invalid, or unenforceable provision or by its severance therefrom, and (d) in lieu of such illegal, invalid, or unenforceable

provision, there will be added automatically as a part of this Agreement a legal, valid and enforceable provision as similar in terms

to such illegal, invalid or unenforceable provision as may be possible.

9.11 Rules of

Construction. The Parties agree that they have been represented by counsel (or have had the opportunity to retain counsel and knowingly

forego such opportunity) during the negotiation, preparation, and execution of this Agreement and therefore waive the application of any

law, rule, regulation, holding, or rule of construction providing that ambiguities in an agreement or other document will be construed

against the Party drafting such agreement or document.

9.12 Amendment;

Waiver. This Agreement may not be amended except by an instrument in writing signed by each of the Parties. Any agreement on the part

of a Party to the waiver of any provision of this Agreement shall be valid only if set forth in an instrument in writing signed on behalf

of such Party.

9.13

Public Announcements. Solid Power, Solid Power Korea, Solid

Power, Inc., and SK On shall collectively issue a press release announcing the execution of this Agreement and the transactions

contemplated hereby. Subsequently, each Party agrees to consult with the other before issuing any press release or otherwise making

any public statement with respect to this Agreement or the transactions contemplated hereby and not issue any such press release or

make any such public statement prior to such consultation and review and the receipt of the prior consent of the other; provided, however,

that if such press release or public statement is required by applicable law, the Party required to make such press release or

public statement shall advise the other Party of such obligation and the Parties shall attempt to cause a mutually agreeable press

release or public statement to be issued. The foregoing shall not restrict Solid Power, Solid Power Korea, Solid Power, Inc.,

or SK On from providing any information required by a securities exchange or to comply with its disclosure obligations under the

Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, or any rules promulgated by the Securities

and Exchange Commission thereunder, or under Korean Securities Exchange Act, Financial Investment Services and Capital Markets Act

of Republic of Korea, or the Monopoly Regulation and Fair Trade Act of Republic of Korea, as applicable.

9.14 Counterparts;

Electronic Signatures. This Agreement may be executed and delivered by each Party in separate counterparts, each of which when so

executed and delivered shall be deemed an original and all of which taken together shall constitute one and the same Agreement. This Agreement,

and any amendments hereto or thereto, to the extent signed and delivered by means of a facsimile machine, PDF, or other electronic transmission,

shall be treated in all manner and respects as an original contract and shall be considered to have the same binding legal effects as

if it were the original signed version thereof delivered in person. Any such signature page shall be effective as a counterpart signature

page hereto without regard to page, document, or version numbers or other identifying information thereon, which are for convenience

of reference only. At the request of a Party, the other Party shall re-execute original forms thereof and deliver them to the other Party.

9.15 Export

Control Matters.

(a) As

a foreign national (non-U.S. citizen without U.S. permanent resident, refugee, or asylee status), SK On understands that access to the

Solid Power Know-How constitutes an export of technical data/software from the United States and is governed by U.S. export control laws,

including the Export Administration Regulations (“EAR”). SK On agrees to, and agrees to compel its Affiliates

to, comply with the EAR as they pertain to any technical data or software to which SK On or its Affiliates has access. SK On, on behalf

of itself and its Affiliates, hereby certifies that, without U.S. government authorization, neither SK On nor its Affiliates shall knowingly

disclose, export, or reexport, directly or indirectly, any such technical data/ software, and in particular neither SK On nor its Affiliates

will export it without prior U.S. government authorization to any of the following nations or nationals thereof:

Country Group E:1/E:2 (Cuba, Iran, North Korea, Syria)

or Russian-occupied regions of Ukraine, or

Country Group D:1 (Armenia, Azerbaijan,

Belarus, Burma/Myanmar, Cambodia, China (PRC including Hong Kong), Georgia, Iraq, Kazakhstan, North Korea, Kyrgyzstan, Laos, Libya,

Macau, Moldova, Mongolia, Russia, Tajikistan, Turkmenistan, Ukraine, Uzbekistan, Venezuela, Vietnam, Yemen).

(b) SK

On, on behalf of itself and its Affiliates, agrees to be bound by future modifications of the foregoing list by amendments to the EAR

or other U.S. laws and regulations.

(c) In

addition, SK On acknowledges, on behalf of itself and its Affiliates, that certain software SK On or its Affiliates has access to during

the Term may contain encryption functionality controlled for Encryption Item (“EI”) purposes by the EAR, which

is subject to additional export control restrictions. Neither SK On nor its Affiliates will use such software for any purpose other than

internal company use, which includes the development of new software products. Unless notified of the appropriate authorization, neither

SK On nor its Affiliates will export, re-export, or transfer such software to any other destination or end-user outside the United States

or Canada.

9.16 Taxes.

Unless stated otherwise, any taxes, levies, or assessments of any kind whatsoever which are or may become imposed or assessed in the U.S.

in connection with this Agreement shall be borne by Solid Power. Any taxes, levies, or assessments of any kind whatsoever which are or

may become imposed or assessed in the Republic of Korea in connection with this Agreement shall be borne by SK On. The Parties shall cooperate

with each other to ensure both Parties receive available tax treaty or benefits. Each Party will bear its own expenses other than the

fees and taxes mentioned herein.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties have executed

this Agreement effective as of the Effective Date.

| |

SOLID POWER: |

| |

|

| |

Solid Power Operating, Inc. |

| |

|

| |

By: |

/s/

JOHN VAN SCOTER |

| |

Name: JOHN VAN SCOTER |

| |

Title: President and Chief Executive

Officer |

| |

|

| |

SK ON: |

| |

|

| |

SK On Co., Ltd. |

| |

|

| |

By: |

/s/ MINSUK SUNG |

| |

Name: MINSUK SUNG |

| |

Title: Chief Commercial Officer |

Signature

Page to Research & Development Technology Transfer Agreement

Exhibit A

Electrolyte Supply Agreement

(see attached)

Exhibit B

Solid Power Know-How

[* * *]

Exhibit C

Compensation Schedule

| Milestone

# |

Amount

(USD) |

Milestone

Payment

Requirements |

Estimated

Completion

Date |

| 1 |

$6

million |

1. [*

* *] |

June 30,

2024 |

| 2 |

$7

million |

1. [*

* *] |

April 30,

2026 |

| 3 |

$7

million |

1. [*

* *] |

1st

half payment: January 1, 2027

2nd

half payment: July 1, 2027

[* *

*] |

Exhibit D

SOW and Training of SK On Personnel

[* * *]

Exhibit E

[* * *]

Exhibit F

Line Installation Agreement

(see attached)

Exhibit 10.2

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED

FROM THE EXHIBIT BECAUSE IT IS BOTH (I) NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED. [*

* *] INDICATES THAT INFORMATION HAS BEEN REDACTED.

Execution Version

electrolyte

supply agreement

This electrolyte

supply agreement (together with the schedules attached hereto, this “Agreement”) is entered into effective

as of January 10, 2024 (the “Effective Date”) and is between Solid Power Operating, Inc., a Colorado

corporation and having its registered office at 486 S. Pierce Ave., Suite E, Louisville, Colorado 80027 USA (“Solid

Power”), and SK On Co., Ltd., a Company incorporated under the laws of Republic of Korea and having its registered

office at 51 Jongro, Jongno-gu, Seoul 03188 Republic of Korea (“SK On,” and together with Solid Power, the

“Parties”).

BACKGROUND

A. Solid

Power is developing and/or acquiring technology relating to all-solid-state battery cells having a sulfide-based solid electrolyte.

B. SK

On is developing and securing technology in the field of lithium-ion batteries including electrode powders, electrode coatings, electrolyte

compositions, battery assembly, battery formation, and battery cycling and sells batteries to third-parties, including original equipment

manufacturers in the automotive market.

C. SK

On desires (i) to have Solid Power Korea Co., Ltd. (“Solid Power Korea”) install a pilot production

line at SK On’s facilities in Daejeon, Republic of Korea (the “SK On Line”) based on Solid Power’s

pilot cell production line in Louisville, Colorado (the “Solid Power EV Line”), (ii) to have access to

Solid Power Know-How (as defined in the Research and Development Technology License Agreement) necessary to operate the SK On Line to

produce cells with the same level of productivity and cell performance as the Solid Power EV Line, and (iii) to procure Material

from Solid Power to be used in the SK On Line (I, ii, and iii collectively, the “Project”); and

D. In

connection with the Project, SK On, Solid Power Korea, and, for the limited purposes of Section 12.16 of the Line Installation Agreement,

Solid Power, Inc. have executed a Line Installation Agreement (the “Line Installation Agreement”), and

the Parties have executed a Research and Development Technology License Agreement (the “Research and Development Technology

License Agreement”).

Agreement

NOW, THEREFORE, in consideration of the premises

and the mutual promises contained herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged,

the Parties agree as follows:

Article I

DEFINITIONS

1.01 Definitions.

(a) “Affiliate”

of a specified person means a person who, directly or indirectly through one or more intermediaries, Controls, is Controlled by, or is

under common Control with, such specified person.

(b) “Agreement”

has the meaning set forth in the introductory paragraph.

(c) “Business

Day” means a day other than Saturday, Sunday, or any day on which the Federal Reserve Bank of New York is closed or the

Bank of Korea is closed.

(d) “Control”

(including the terms “Controlled by” and “under common Control with”) means the possession,

directly or indirectly, or as a trustee or executor, of the power to direct or cause the direction of the management and policies of

a person, whether through the ownership of voting securities, as trustee or executor, by contract, or otherwise.

(e) “Effective

Date” has the meaning set forth in the introductory paragraph.

(f) “Feedback”

has the meaning set forth in Section 7.04.

(g) “First

Round Validation” has the meaning set forth in the Research and Development Technology License Agreement.

(h) “Forecast”

has the meaning set forth in Section 3.05.

(i) “Force

Majeure Event” has the meaning set forth in Section 11.02(a).

(j) “[*

* *] Specifications” has the meaning set forth in Section 3.07.

(k) “Infringement

Claim” has the meaning set forth in Section 10.02(a).

(l) “Initial

Period” has the meaning set forth in Section 3.04(a).

(m) “Initial

Quantity” has the meaning set forth in Section 3.04(a).

(n) “Intellectual

Property” means all or any of the following throughout the world: (i) patents, patent applications (including originals,

divisions, continuations, continuations-in-part, extensions, reexaminations, and reissues thereof), patent disclosures, inventions, and

invention disclosures (whether or not patentable), (ii) trademarks, service marks, trade dress, trade names, corporate names, logos,

and slogans (and all translations, transliterations, adaptations, derivations, and combinations of the foregoing) and Internet domain

names, and franchises, together with all goodwill associated with each of the foregoing, (iii) copyrights and copyrightable works,

(iv) registrations and applications for any of the foregoing, (v) trade secrets, customer lists, data and customer records,

reports, software development methodologies, source code, technical information, proprietary business information, process technology,

plans, drawings, blue prints, know-how and inventions (whether patentable or unpatentable and whether or not reduced to practice (those

items in subclause (v) collectively, “Trade Secrets”), (vi) all rights of publicity, including

the right to use the name, voice, likeness, signature, and biographies of real persons, together with all goodwill related thereto, and

(vii) all other intellectual or proprietary rights.

(o) “Li2S”

means lithium sulfide.

(p) [*

* *]

(q) “Line

Installation Agreement” has the meaning set forth in the recitals.

(r) “Material”

means Solid Power’s proprietary sulfide-based solid electrolyte.

(s) “Material

Price” has the meaning set forth in Section 3.04(d).

(t) “MT”

has the meaning set forth in Section 3.04(a).

(u) “Next

Generation Material” has the meaning set forth in Section 3.07.

(v) “Parties”

has the meaning set forth in the introductory paragraph.

(w) “Project”

has the meaning set forth in the recitals.

(x) “Purchase

Order” has the meaning set forth in Section 3.01.

(y) “Research

and Development Technology License Agreement” has the meaning set forth in the recitals.

(z) “Rules”

has the meaning set forth in Section 11.07.

(aa) “Second

Round Validation” has the meaning set forth in the Research and Development Technology License Agreement.

(bb) “SK

On” has the meaning set forth in the introductory paragraph.

(cc) “SK

On Indemnified Parties” has the meaning set forth in Section 10.02(a).

(dd) “SK

On Line” has the meaning set forth in the recitals.

(ee) “Solid

Power” has the meaning set forth in the introductory paragraph.

(ff) “Solid

Power EV Line” has the meaning set forth in the recitals.

(gg) “Solid

Power Korea” has the meaning set forth in the recitals.

(hh) “Specifications”

has the meaning set forth in Section 3.07.

(ii) “Taxes”

has the meaning set forth in Section 3.04(f).

(jj) “Term”

has the meaning set forth in Section 2.01.

1.02 Interpretation.

The words “include” and “including” and other words of similar import when used herein shall not be deemed to

be terms of limitation but rather shall be deemed to be followed in each case by the words “without limitation,” whether

or not they are in fact followed by those words or words of like import. The definitions contained in this Agreement are applicable to

the singular as well as the plural forms of such terms. Whenever required by the context, any pronoun used in this Agreement shall include

the corresponding masculine, feminine, or neuter forms, and the singular form of nouns, pronouns, and verbs shall include the plural

and vice versa. Any capitalized term used in any Schedule but not otherwise defined therein will have the meaning given to such term

in this Agreement. Any reference to “days” means calendar days unless Business Days are expressly specified. If any action

under this Agreement is required to be done or taken on a day that is not a Business Day, then such action shall be required to be done

or taken not on such day but on the first succeeding Business Day thereafter. The words “herein,” “hereto,” “hereunder”

and “hereby” and other words of similar import in this Agreement shall be deemed in each case to refer to this Agreement

as a whole and not to any particular Article, Section or other subdivision of this Agreement. When a reference is made in this Agreement

to an Article, Section, or Schedule, such reference is to an Article or Section of, or an Schedule to, this Agreement unless

otherwise indicated. Any reference herein to “dollars” or “$” shall mean United States dollars. The term “or”

is not exclusive.

Article II

TERM AND TERMINATION

2.01 Term.

The initial term of this Agreement will commence on the Effective Date and continue until December 31, 2030, unless earlier terminated

pursuant to the terms hereof (the “Term”).

2.02 Termination

for Breach. This Agreement may be terminated:

(a) By

SK On, if Solid Power materially breaches any term of this Agreement or the Research and Development Technology License Agreement, or

Solid Power Korea materially breaches any term of the Line Installation Agreement, and Solid Power or Solid Power Korea, as applicable,

fails to cure such breach within 30 days, or 60 days in the case of the Line Installation Agreement, after receipt of written notice

from SK On requesting such breach be cured.

(b) By

Solid Power, if SK On materially breaches any term of this Agreement, the Line Installation Agreement, or the Research and Development

Technology License Agreement and SK On fails to cure such breach within 30 days after receipt of written notice from Solid Power or Solid

Power Korea, as applicable, requesting such breach be cured.

2.03 Outstanding

Purchase Orders. Upon a termination pursuant to Section 2.02(a) or Section 2.02(b), the terminating

Party may also terminate all, or any portion of, the then outstanding Purchase Orders issued pursuant to this Agreement.

2.04 Survival.

The expiration or prior termination of this Agreement for whatever reason will not affect the accrued rights of either Party arising

under this Agreement or the rights or obligations under Section 5.03, Article VII, Article VIII,

Article IX, Article X, and Article XI, and all defined terms required to interpret those Articles

and Sections, which will survive such expiration or termination.

Article III

PURCHASE AND SALE OF MATERIAL

3.01 Purchase

Orders. All orders of Material will be made via a purchase order (each, a “Purchase Order”), the current

form of which is attached as Schedule 1. Solid Power will acknowledge its acceptance of each Purchase Order within five Business

Days following receipt. This Agreement shall be incorporated into each Purchase Order and this Agreement shall be the exclusive terms

and conditions governing each Purchase Order. Any standard terms and conditions of SK On shall not apply, notwithstanding any reference

to such terms in the Purchase Order. During the Term, Solid Power will be SK On’s preferred supplier for sulfide-based solid electrolytes.

3.02 Lead

Time. Unless otherwise agreed in writing by Solid Power, Purchase Orders must be received by Solid Power at least 90 days in advance

of the desired delivery date and are non-cancellable, irrevocable purchase obligations.

3.03 First

Round Validation and Second Round Validation Supply.

(a) During

the First Round Validation, SK On shall place, and Solid Power will accept, binding Purchase Orders for the amount of Material necessary

to complete the First Round Validation. Notwithstanding anything herein to the contrary, the price of Material during the First Round

Validation will be [* * *] per kilogram.

(b) During

the Second Round Validation, if required, SK On shall place, and Solid Power will accept, binding Purchase Orders for the amount of Material

necessary to complete the Second Round Validation. Notwithstanding anything herein to the contrary, the price of Material during the