FALSE000180274900018027492024-01-122024-01-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 12, 2024

Lightning eMotors, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-39283 | 84-4605714 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification No.) |

815 14th Street SW, Suite A100

Loveland, Colorado 80537

(Address of principal executive offices, including zip code)

1-800-223-0740

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events.

On January 12, 2024, Lightning eMotors, Inc. published the Notice of Pendency of Settlement of Derivative Action attached hereto as Exhibit 99.1, which is hereby incorporated by reference. The Notice relates to Lanham v. Fenwick Smith et al., No. 1:23-cv-00507. pending in the United States District Court for the District of Colorado.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Lightning eMotors, Inc. |

| Dated: January 12, 2024 | | |

| By: | /s/ Timothy Reeser |

| Name: | Timothy Reeser |

| Title: | Chief Executive Officer and President |

Exhibit 99.1

NOTICE OF PENDENCY OF DERIVATIVE ACTION, PROPOSED AGREEMENT

OF SETTLEMENT AND RELEASE, AND SETTLEMENT HEARING

TO: ALL CURRENT RECORD HOLDERS AND BENEFICIAL OWNERS OF COMMON STOCK OF LIGHTNING EMOTORS, INC. (“LIGHTNING” OR THE “COMPANY”) AS OF SEPTEMBER 20, 2023 (THE “RECORD DATE”) (“CURRENT LIGHTNING SHAREHOLDERS”).

PLEASE READ THIS NOTICE CAREFULLY AND IN ITS ENTIRETY. THIS NOTICE RELATES TO A PROPOSED SETTLEMENT AND DISMISSAL OF LANHAM V. FENWICK-SMITH, NO. 1:23-cv-00507 (THE “ACTION”), A SHAREHOLDER DERIVATIVE ACTION, AND CONTAINS IMPORTANT INFORMATION REGARDING YOUR RIGHTS. IF THE COURT APPROVES THE SETTLEMENT, YOU WILL BE FOREVER BARRED FROM CONTESTING THE APPROVAL OF THE PROPOSED SETTLEMENT AND FROM PURSUING THE “RELEASED CLAIMS,” AS DEFINED HEREIN.

THE COURT HAS MADE NO FINDINGS OR DETERMINATIONS CONCERNING THE MERITS OF THE ACTION. THE RECITATION OF THE BACKGROUND AND CIRCUMSTANCES OF THE SETTLEMENT CONTAINED HEREIN DOES NOT CONSTITUTE THE FINDINGS OF THE COURT. IT IS BASED ON REPRESENTATIONS MADE TO THE COURT BY COUNSEL FOR THE PARTIES.

Notice is hereby provided to you of the proposed settlement (the “Settlement”) of this shareholder derivative lawsuit. This Notice is provided by Order of the U.S. District Court for the District of Colorado (the “Court”). It is not an expression of any opinion by the Court. It is to notify you of the terms of the proposed Settlement and your rights related thereto.

I.WHY THE COMPANY HAS ISSUED THIS NOTICE

The following parties: (i) Plaintiffs Zalmon Uvaydov and Kelly Lanham (“Plaintiffs”); (ii) Lightning eMotors, Inc. (“Lightning” or the “Company”); (iii) Defendants Robert Fenwick-Smith, Tim Reeser, Andrew Coors, Craig Huth, Heath Morrison, Glen Perlman, Trent Yang, Bruce Coventry, Thaddeus Senko, Diana Tremblay, Kenneth Jack, Wanda Jackson-Davis, and Teresa P. Covington (together with Lightning, the “Lightning Defendants”); and (iv) Avi Katz, Raluca Dinu, Neil Miotto, John Mikulsky, Andrea Betti-Berutto, Brad Weightman, and Peter Wang (the “Gig3 Defendants,” together with the Lightning Defendants, “Defendants”) have agreed upon terms to settle the Action and a related action, Uvaydov v. Fenwick-Smith et

al., C.A. No. 2023-013LWW (Del. Ch.) (the “Uvaydov Action”), on the terms set forth in the Stipulation and Agreement of Settlement and Release (“Agreement”), dated September 20, 2023, which can be viewed and/or downloaded at https://ir.lightningemotors.com/.

On the 8th day of March, 2024 at 10:00 a.m., the Court will hold a hearing (the “Settlement Hearing”) in the Action. The purpose of the Settlement Hearing is to determine: (i) whether the terms of the Agreement are fair, reasonable, and adequate and should be approved; (ii) whether a final judgment should be entered; and (iii) such other matters as may be necessary or proper under the circumstances.

II.SUMMARY OF THE ACTION

1.On February 22, 2022, Plaintiff Zalmon Uvaydov served certain books and records demands on the Board of Directors of Lightning eMotors, Inc. pursuant to Section 220 of the Delaware General Corporation Law (the “Uvaydov Demand”).

2.On February 6, 2023, Plaintiff Uvaydov filed a lawsuit in the Court of Chancery of the State of Delaware (the “State Court”) styled Uvaydov v. Fenwick-Smith et al., No. 2023-0137-LWW (Del. Ch.), asserting claims derivatively on behalf of Lightning.

3.On February 24, 2023, Plaintiff Kelly Lanham filed a lawsuit in the U.S. District Court for the District of Colorado (the “U.S. District Court”) styled Lanham v. Fenwick-Smith et al., No. 1:23-cv-00507 (D. Colo.), asserting claims derivatively on behalf of Lightning (the “Lanham Action,” together with the Uvaydov Demand and the Uvaydov Action, the “Actions”).

4.The Actions allege that Lightning suffered injuries as a result of Plaintiffs’ allegations set forth more specifically in each individual lawsuit (the “Allegations”), asserting claims against each Defendant.

III.SETTLEMENT

On September 20, 2023, Plaintiffs and Defendants entered into the Agreement to resolve the Actions. Pursuant to the Agreement, Lightning will institute certain internal controls and corporate governance reforms and the Gig3 Defendants will pay or cause their insurers to pay $1.85 million (the “Settlement Payment”) into an escrow account held on behalf of Lightning. The internal controls and corporate governance reforms will include: (a) additional board review and approval of prospective financial guidance provided to the market and/or publicly disclosed by Lightning; (b) additional board review of operational information, projections, or non-financial metrics provided to the market and/or publicly disclosed by Lightning; (c) procedures for issuance of corrective statements or disclosures; (d) approval requirements for transactions by Lightning with Gig3 or any of its affiliates or investors; (e) a prohibition on Gig3 or any of its affiliates or investors exerting managerial controls over Lightning; (f) referral of any acquisition proposals received by Lightning or the board to the Finance and Investment Committee; (g) board evaluation of internal controls related to approval of material contracts; (h) creation of a management-level Disclosure Committee; (i) retention of an independent consultant to conduct an analysis of appropriate steps to test and strengthen internal audit and control functions; (j) regular reports to the board on Lightning’s financial condition and prospects; and (k) adoption of a written whistleblower policy.

The Agreement also provides for the entry of judgment dismissing the Actions against the Defendants with prejudice and, as explained in more detail in the Agreement, releasing and discharging certain known and unknown claims that could have been brought in any court by the Plaintiffs in the Actions or by Lightning, or any of its shareholders, derivatively against the Defendants and Lightning, its direct and indirect subsidiaries, and all of their past, present, and future officers, directors, shareholders, members, partners, managers, agents, attorneys, and

insurers or any entity with which they are affiliated or in which they have a membership, investment, or other interest, that relate to, arise out of, or concern Plaintiffs’ Claims or Plaintiffs’ Allegations, including all claims or allegations that were brought or could have been brought in the Actions, as of the Effective Date of the Agreement. This release includes a release of the claims being asserted by Plaintiff Uvaydov in the Uvaydov Action.

IV.PLAINTIFFS’ ATTORNEYS’ FEES AND EXPENSES

After negotiating corporate governance reforms and the Settlement Payment, counsel for Plaintiffs and the Company negotiated the attorneys’ fees that Lightning would pay to Plaintiffs’ Counsel. As a result of these negotiations, and in light of the substantial benefit conferred, Lightning has agreed to pay Plaintiffs’ Counsel attorneys’ fees and expenses of $500,000 (the “Fee and Expense Award”). To date, Plaintiffs’ Counsel have not received any payments for their efforts. The Fee and Expense Award will compensate Plaintiffs’ Counsel for their efforts in prosecuting the Actions and the substantial benefits achieved for Lightning and its current shareholders.

V.REASONS FOR THE SETTLEMENT

The Court did not enter judgment in favor of Plaintiffs or Defendants. The proposed Settlement was negotiated at arm’s-length by attorneys for the Parties. The attorneys for all of the Parties have extensive experience in shareholder derivative cases, and they all believe the Settlement is in the best interest of their clients. Lightning and Plaintiffs believe that the Settlement provides substantial benefits upon Lightning and its shareholders.

A.Why Did Plaintiffs Agree to Settle?

Plaintiffs’ Counsel investigated claims and the underlying events and transactions alleged in the Actions, including by securing nonpublic Company documents through a books and records demand. Plaintiffs’ Counsel have analyzed the evidence adduced during their

investigation and have researched the applicable law with respect to the claims of Plaintiffs, Lightning, and its shareholders against Defendants and the potential defenses thereto.

Based upon their investigation, Plaintiffs and their counsel have concluded that the terms and conditions of the Agreement are fair, reasonable, and adequate to Plaintiffs, current Lightning Shareholders, and Lightning, and in their best interests, and have agreed to settle the claims raised in the Actions pursuant to the terms and provisions of the Agreement after considering, among other things: (a) the substantial benefits that Lightning and its shareholders will receive from the Agreement, (b) the attendant risks of continued litigation of the Action, and (c) the desirability of permitting the Settlement to be consummated.

In particular, Plaintiffs and their counsel considered the significant litigation risk inherent in the Actions. The law imposes significant burdens on Plaintiffs for pleading and proving a shareholder derivative claim. While Plaintiffs believe their claims are meritorious, Plaintiffs acknowledge that there is a substantial risk that the Actions may not succeed in producing a recovery in light of the applicable legal standards and possible defenses. Plaintiffs and their counsel believe that, under the circumstances, they have obtained the best possible relief for Lightning and its shareholders.

B.Why Did the Defendants Agree to Settle?

Litigation presents inherent risks. Although Defendants deny that they acted improperly, the defense of the Actions requires an expenditure of corporate resources, in particular, of management time and attention. After investigation of the underlying facts and analyzing the applicable law, Defendants believe that the arm’s-length Settlement negotiated with Plaintiffs is appropriate under the circumstances. The Settlement provides a certain and specific resolution of the disputes and provides corporate governance changes, as well as a cash payment to the Company, that are beneficial to Lightning’s shareholders. The Settlement also permits

Lightning’s management to focus its attention on Lightning’s business affairs, which is where the focus of management should be.

VI.SETTLEMENT HEARING

On the 8th day of March, 2024 at 10:00 a.m., the Court will hold a Settlement Hearing before the Honorable Nina Y. Wang at the Alfred A. Arraj United States Courthouse, 901 19th Street Denver, Colorado 80294-3589, in Courtroom A-502. At the Settlement Hearing, the Court will consider whether the terms of the Settlement are fair, reasonable, and adequate and thus should be finally approved and whether the Action should be dismissed with prejudice pursuant to the Agreement.

VII.RIGHT TO ATTEND SETTLEMENT HEARING

Any current Lightning Shareholder may, but is not required to, appear in person at the Settlement Hearing. If you want to be heard at the Settlement Hearing, you must first comply with the procedures for objecting, which are set forth below. The Court has the right to change the hearing dates or times without further notice. Thus, if you are planning to attend the Settlement Hearing, you should confirm the date and time before going to the Court. CURRENT LIGHTNING SHAREHOLDERS WHO HAVE NO OBJECTION TO THE SETTLEMENT DO NOT NEED TO APPEAR AT THE SETTLEMENT HEARING OR TAKE ANY OTHER ACTION.

VIII.RIGHT TO OBJECT TO SETTLEMENT AND PROCEDURES FOR DOING SO

You have the right to object to any aspect of the Settlement. You must object in writing, and you may request to be heard at the Settlement Hearing. If you choose to object, then you must follow these procedures:

A.You Must Make Detailed Objections in Writing.

Any objection must be presented in writing and must contain the following information. The Court may not consider any objection that does not substantially include the following information:

1.Your name, legal address, and telephone number;

2.Proof of being a current Lightning Shareholder as of the Record Date;

3.Proof of the date(s) you purchased your Lightning and/or GigCapital3, Inc., shares;

4.Proof of your continuous ownership of Lightning shares through August 16, 2021;

5.A statement of your position with respect to the matters to be heard at the Settlement Hearing, including a statement of each objection being made;

6.The grounds for each objection or the reasons for your desiring to appear and to be heard;

7.Notice of whether you intend to appear at the Settlement Hearing (this is not required if you have lodged your objection with the Court); and

8.Copies of any papers you intend to submit to the Court, along with the names of any witness(es) you intend to call to testify at the Settlement Hearing and the subject(s) of their testimony.

B.You Must Timely Deliver Written Objections to the Court, Plaintiffs’ Counsel, and Defendants’ Counsel.

YOUR WRITTEN OBJECTIONS MUST BE ON FILE WITH THE CLERK OF THE COURT NO LATER THAN FOURTEEN (14) DAYS BEFORE THE SETTLEMENT HEARING. The Court Clerk’s address is:

Clerk of the Court

U.S. District Court for the District of Colorado

Alfred A. Arraj United States Courthouse

901 19th Street

Denver, Colorado 80294-3589

YOU ALSO MUST DELIVER COPIES OF YOUR WRITTEN OBJECTIONS TO COUNSEL FOR PLAINTIFFS AND COUNSEL FOR DEFENDANTS SO THEY ARE RECEIVED NO LATER THAN FOURTEEN (14) DAYS BEFORE THE SETTLEMENT HEARING.

Counsel’s addresses are:

| | | | | |

William M. Alleman, Jr. (No. 5449) Sean A. Meluney (No. 5514) Matthew D. Beebe (No. 5980) MELUNEY ALLEMAN & SPENCE, LLC 1143 Savannah Road, Suite 3-A Lewes, DE 19958 (302) 551-6740

Aaron T. Morris Leo Kandinov Andrew W. Robertson MORRIS KANDINOV LLP 1740 Broadway, 15th Floor New York, NY 10019 (877) 216-1552

Counsel for Plaintiff Zalmon Uvaydov | Melanie Walker DLA Piper LLP (US) 2000 Avenue of the Stars, Suite 400 North Tower Los Angeles, CA 90067 Telephone: (310) 595-3000 melanie.walker@us.dlapiper.com

Ronald N. Brown, III (I.D. No. 4831) 1201 North Market Street, Suite 2100 Wilmington, DE 19801 Telephone: (302) 468-5700 ronald.brown@dlapiper.com

Counsel for Defendants Avi S. Katz, Raluca Dinu, Neil Miotto, Brad Weightman, John J. Mikulsky, Andrea Betti-Berutto and Peter Wang |

Rusty E. Glenn SHUMAN, GLENN & STECKER 600 17th Street, Ste. 2800 South Denver, CO 80202 Telephone: (303) 861-3003 Facsimile: (303) 536-7849 rusty@shumanlawfirm.com

Seth D. Rigrodsky Timothy J. MacFall RIGRODSKY LAW, P.A. 825 East Gate Blvd., Suite 300 Garden City, NY 11530 Telephone: (516) 683-3516 Facsimile: (302) 654-7530 sdr@rl-legal.com tjm@rl-legal.com

Counsel for Plaintiff Kelly Lanham | Boris Feldman Doru Gavril Freshfields Bruckhaus Deringer US LLP 855 Main Street Redwood City, CA 94063 (650) 618-9250 boris.feldman@freshfields.com doru.gavril@freshfields.com

Counsel for Defendants Lightning eMotors, Inc., Defendants Robert Fenwick-Smith, Tim Reeser, Andrew Coors, Craig Huth, Heath Morrison, Glen Perlman, Trent Yang, Bruce Coventry, Thaddeus Senko, Diana Tremblay, Kenneth Jack, Wanda Jackson-Davis, and Teresa P. Covington |

IX.HOW TO OBTAIN ADDITIONAL INFORMATION

This Notice summarizes the Agreement. It is not a complete statement of the events of the Actions or the Agreement.

You may inspect the Agreement and other papers in the Action at the U.S. District Court for the District of Colorado’s Clerk’s office at any time during regular business hours of each

business day. The Clerk’s office is located at the U.S. District Court for the District of Colorado, Alfred A. Arraj United States Courthouse, 901 19th Street, Denver, Colorado 80294-3589.

PLEASE DO NOT CALL, WRITE, OR OTHERWISE DIRECT QUESTIONS TO EITHER THE COURT OR THE CLERK’S OFFICE. Any questions you have about matters in this Notice should be directed by telephone to Rigrodsky Law, P.A. at (516) 683-3516 or in writing to Rigrodsky Law, P.A., 825 East Gate Blvd., Suite 300, Garden City, NY 11530.

Dated: January 12, 2024

By order of the U.S. District Court for the District of Colorado.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

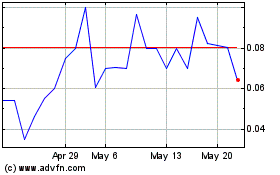

Lightning eMotors (PK) (USOTC:ZEVY)

Historical Stock Chart

From Apr 2024 to May 2024

Lightning eMotors (PK) (USOTC:ZEVY)

Historical Stock Chart

From May 2023 to May 2024