false

0000095552

0000095552

2024-01-11

2024-01-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): January 11, 2024

Superior Industries International, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware |

001-6615 |

95-2594729 |

|

(State or Other Jurisdiction

of Incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

|

26600 Telegraph Road, Suite 400

Southfield, Michigan |

48033 |

| (Address of Principal Executive Offices) |

(Zip Code) |

| |

(248) 352-7300 |

|

| (Registrant’s Telephone Number, Including Area Code) |

| |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of Each Class |

Trading

Symbol

|

Name of Each Exchange

on Which Registered

|

| Common Stock, par value $0.01 per share |

SUP |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On January 11, 2024, Superior Industries International, Inc. (the

“Company”) and Mill Road Capital III, L.P. (“Mill Road”) entered into a Cooperation Agreement (the

“Agreement”).

Pursuant to the Agreement, the Company has agreed that the board of

directors of the Company (the “Board”) will appoint Deven Petito (the “Mill Road Designee”, which

term includes certain successor designees) to the Board and will include him as a nominee to the Board on the slate of nominees recommended

by the Board in the Company’s proxy statement and on its proxy card relating to the 2024 Annual Meeting.

The Mill Road Designee shall have all of the rights and obligations

of a director under applicable law and the Company’s organizational documents while serving on the Board and shall be entitled to

the same rights and benefits as a majority of the other non-employee directors, including with respect to expense reimbursement, insurance,

indemnification, advancement of expenses, compensation and preparation and filing of certain forms with the Securities and Exchange Commission.

The Mill Road Designee must, at all times while serving as a member of the Board, comply with all policies applicable to Board members.

The Company’s obligation to nominate the Mill Road Designee will terminate, and the Mill Road Designee has irrevocably agreed to

offer to resign, if (1) Mill Road and its affiliates cease to collectively beneficially own at least 5.0% of the Company’s common

stock then outstanding or (2) both (a) Mill Road or the Mill Road Designee commits a material breach of the Agreement, which breach, if

capable of being cured, is not cured within 15 days after receipt by Mill Road of written notice from the Company specifying the material

breach and (b) the Company is not in material breach of the Agreement.

If the Mill Road Designee is unable or unwilling to serve as a director

of the Company, resigns as a director of the Company, is removed as a director of the Company or ceases to be a director of the Company

for any reason prior to the expiration of the Standstill Period (as defined below), or if the Mill Road Designee is nominated by the Company

but not elected as a director of the Company at the Applicable Meeting (as defined below), Mill Road may designate a replacement designee,

subject to the Company’s approval (not to be unreasonably withheld) and subject to any applicable reelection requirements required

by law, stock exchange rules, or the Company’s organizational documents. The Company will, in connection with the cessation of the

Mill Road Designee’s service as a director of the Company for any reason, take all actions reasonably necessary to extend any directors’

and officer’s liability insurance coverage for the Mill Road Designee for a period of not less than one (1) year from such event.

Mill Road has agreed to various standstill provisions in the Agreement.

Subject to the more detailed terms and conditions of the Agreement, for the duration of the Standstill Period (as defined below), Mill

Road has generally agreed, among other things, that it will not, subject to certain exceptions described in the Agreement:

| |

1. |

in any way participate in any “solicitation” of proxies, or knowingly advise, encourage or seek to influence any person (other than its affiliates) with respect to the voting of any securities of the Company for the election of directors or approval of any stockholder proposals; |

| |

2. |

except with the prior written consent of the Chair of the Board, knowingly acquire any ownership interest of 17.0% or more of the Company’s common stock outstanding at such time; |

| |

3. |

engage in any short sale or other trade with respect to any security that Mill Road knows to derive any significant part of its value from a decline in the market price or value of the securities of the Company; |

| |

4. |

effect any tender or exchange offer, merger, consolidation, acquisition, recapitalization, reorganization, sale or acquisition of material assets or other extraordinary transaction involving the Company; |

| |

|

|

| |

5. |

call any meeting of stockholders, nominate any candidate to the Board (except as set forth in the Agreement), seek the removal of any member of the Board, solicit consents from stockholders or otherwise take corporation action by written consent of stockholders in a manner inconsistent with the recommendation of the Board; or |

| |

|

|

| |

6. |

take any material action in support of or make any proposal or request that constitutes advising, controlling, changing or influencing the Board or management of the Company, any material change in the capitalization, capital allocation practices or dividend policy of the Company, or any other material change in the Company’s management, business or corporate structure, including amendments to the Company’s certificate of incorporation or bylaws. |

Mill Road has also agreed that, during the Standstill Period (as defined

below), it will vote its shares in favor of all directors nominated by the Board for election at such meetings. It will also vote its

shares in accordance with the Board’s recommendations on all other matters, except with respect to certain specified matters, including

proposals relating to (i) an extraordinary transaction, (ii) any amendment to the certificate of incorporation or bylaws of the Company,

(iii) the implementation of takeover defenses or (iv) certain issuances of securities.

Mill Road and the Company have each agreed, subject to certain exceptions,

that during the Standstill Period (as defined below), neither will make or cause to be made any public statement or announcement that

constitutes an ad hominem attack on, or otherwise defames or slanders the other party or affiliates thereof or any of its officers,

directors or employees.

The "Standstill Period" means the period commencing

on the date of the Agreement and ending on the date that is thirty (30) days prior to the expiration of the Company’s advance notice

period for the nomination of directors at the 2025 annual meeting of stockholders of the Company. If, on or before the date that is sixty

(60) days prior to the expiration of the Company’s advance notice provision for the nomination of directors at the then-next annual

meeting of stockholders of the Company, starting with the 2025 annual meeting of stockholders of the Company (each, an “Applicable

Meeting”), both (i) the Company irrevocably agrees with Mill Road in writing to include the Mill Road Designee on the Company’s

slate of director nominees for such Applicable Meeting, and (ii) the Mill Road Designee agrees to serve as a director of the Company,

then the Standstill Period shall be extended (A) if the Mill Road Designee is not elected as a director of the Company at the Applicable

Meeting, to the date the Mill Road Designee ceases to serve as a director of the Company, or (B) if the Mill Road Designee is elected

as a director of the Company at the Applicable Meeting, to the date that is thirty (30) days prior to the expiration of the Company’s

advance notice period for the nomination of directors at the next annual meeting of stockholders of the Company following such Applicable

Meeting.

The restrictions during the Standstill Period terminate upon the expiration

of the Standstill Period. They terminate earlier if (1) the Company enters into a definitive agreement with a third party that would result

in such third party acquiring securities representing a majority of the voting power of the Company or a majority of the consolidated

assets of the Company or (2) both (a) the Company commits a material breach of the Agreement, which breach, if capable of being cured,

is not cured within 15 days after receipt by the Company of written notice from Mill Road specifying the material breach and (b) neither

Mill Road nor the Mill Road Designee is in material breach of the Agreement.

The foregoing summary of the Agreement is not complete and is subject

to, and qualified in its entirety by, the full text of the Agreement, which is filed as Exhibit 99.1 to this Current Report on Form 8-K

and incorporated herein by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 11, 2024, to fulfill its obligations

under the Agreement, the Board appointed Mr. Petito as a director of the Company and to serve until his successor is elected and qualified

or until his earlier resignation or removal.

As a non-employee director, Mr. Petito will receive

compensation in the same manner as the Company’s other non-employee directors.

Item 8.01 Other Events.

On January 11, 2024, the Company and Mill Road

issued a joint news release relating to the entry into the Cooperation Agreement. A copy of the joint news release is attached as Exhibit

99.2.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Registrant) |

| |

|

|

| Date: |

January 11, 2024 |

|

/s/ David Sherbin |

| |

|

|

David Sherbin |

| |

|

|

Senior Vice President, General Counsel and Chief Compliance Officer |

Exhibit 99.1

COOPERATION AGREEMENT

This

COOPERATION AGREEMENT (this “Agreement”) dated as of January 11, 2024 is by and between MILL ROAD CAPITAL III,

L.P., a Cayman Islands exempted limited partnership (“Mill Road”), and SUPERIOR INDUSTRIES INTERNATIONAL, INC. (the

“Company”).

WHEREAS,

the Company and Mill Road have engaged in discussion concerning the Company’s business;

WHEREAS,

Mill Road has informed the Company that it beneficially owns 4,380,940 shares of the common stock, par value $0.01 per share, of the

Company (the “Common Stock”), which represented approximately 15.6% of the issued and outstanding shares of Common

Stock based upon that certain Schedule 13D amendment filed on October 30, 2023;

WHEREAS,

the Nominating and Corporate Governance Committee of the Board (the “Nominating Committee”) and the Company’s

Board of Directors (the “Board”) have considered the qualifications of Deven Petito (the “Designee”)

and have conducted such review as they have deemed appropriate; and

WHEREAS,

the Company and Mill Road have determined to come to an agreement regarding the appointment of the Designee to the Board and to the subsequent

nomination of the Designee at the Company’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”)

and certain other matters as set forth herein.

NOW,

THEREFORE, in consideration of and reliance upon the mutual covenants and agreements contained herein, and for other good and valuable

consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1. Nomination

of Designee.

(a) The

Board shall appoint the Designee to serve as a director within one (1) business day following the date of this Agreement. In addition,

the Company shall include the Designee as a nominee to the Board on the slate of nominees recommended by the Board in the Company’s

proxy statement and on its proxy card relating to the 2024 Annual Meeting. With respect to any meeting of stockholders for which the

Designee has been nominated by the Board for election as a director, the Board shall recommend, and solicit proxies for, the election

of the Designee in the same manner in which the Company recommends, and solicits proxies for, the election of the other nominees of the

Board for election as directors for the same annual meeting.

(b) The

Company acknowledges receipt of Designee’s written consent to serve as a director of the Company and a completed D&O Questionnaire

in the form provided to Mill Road by the Company. As a condition to the Designee’s nomination for election as a director of the

Company at the 2024 Annual Meeting, Mill Road shall (or shall cause the Designee to) provide to the Company an executed consent from

the Designee to be named as nominee in the Company’s proxy statement for the 2024 Annual Meeting and to serve as a director if

so elected, a completed D&O Questionnaire in the form provided to Mill Road by the Company and an executed irrevocable agreement

to resign as a director in the form attached hereto as Exhibit A (the “Irrevocable Resignation Agreement”).

As a further condition to the Designee’s nomination for election as a director of the Company at the 2024 Annual Meeting, Mill

Road shall (or shall cause the Designee to), as promptly as practicable upon the reasonable written request of the Company, provide any

information required to be or customarily disclosed for directors, candidates for directors, and their affiliates and representatives

in a proxy statement or other filings under applicable law or stock exchange rules or listing standards, information reasonably required

in connection with assessing eligibility, independence and other criteria applicable to directors or satisfying compliance and legal

obligations, and such other information as reasonably requested by the Company from time to time with respect to Mill Road or the Designee;

provided, that the Company applies, administers and enforces this condition on all nominees for election as a director of the

Company at the 2024 Annual Meeting in a reasonable and equitable manner consistent with prior years’ practice.

(c) Mill

Road acknowledges that the Designee shall have all of the rights and obligations, including fiduciary duties to the Company and its stockholders,

of a director under applicable law and the Company’s organizational documents while the Designee is serving on the Board. Without

limiting the generality of the foregoing, the Designee shall be entitled to the same rights and benefits as a director of the Company

as a majority of the other non-employee directors, including with respect to expense reimbursement, insurance, indemnification, advancement

of expenses, compensation and preparation and filing with the Securities and Exchange Commission (the “SEC”), at the

Company’s expense, of any Forms 3, 4 and 5 under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Mill Road further acknowledges that, at all times while serving as a member of the Board, the Designee shall have the

obligation to (i) comply with all policies, procedures, processes, codes, rules, standards and guidelines applicable to all Board members,

including the Company’s Corporate Governance Guidelines (collectively, “Company Policies,” which shall include

the confidentiality obligations in clause (ii) below), and (ii) preserve the confidentiality of Company business and information, including

discussions or matters considered in meetings of the Board or Board committees to the extent not disclosed publicly by the Company. The

Company shall not apply, administer or enforce the Company Policies against the Designee except in a manner that is reasonable, equitable

and consistent with prior years’ practice. The parties agree that, solely for purposes of any stock ownership requirements, guidelines

or policies of the Company that may apply to the Designee, the Designee shall be deemed to own the securities of the Company or any securities

convertible or exchangeable into or exercisable for any such securities (collectively, “securities of the Company”)

that are beneficially owned by the Mill Road Affiliates.

(d) The

Company shall, in connection with the cessation of the Designee’s service as a director of the Company for any reason, take all

actions reasonably necessary to extend any directors’ and officer’s liability insurance coverage for the Designee for a period

of not less than one (1) year from such event in respect of any act or omission occurring at or prior to such event (or for such longer

period as shall then be provided by any policy or practice of the Company for non-employee directors).

(e) The

Company shall use reasonable efforts to cause all transactions in securities of the Company involving the Designee and the Company to

be exempt from Section 16(b) of the Exchange Act by virtue of Rule 16b-3(d)(1) or Rule 16b-3(e) thereunder (or any successor or other

rule) to the extent permitted thereby. Without limiting the generality of the foregoing, the Company acknowledges that, as a result of

the Designee’s service on the Board, one or more of the Mill Road Affiliates may be considered directors by deputization under

applicable interpretations of Section 16 of the Exchange Act. The Company shall use reasonable efforts to cause all transactions in securities

of the Company involving the Company and any Mill Road Affiliate who may be considered to be a director by deputization to be exempt

from Section 16(b) of the Exchange Act by virtue of Rule 16b-3(d)(1) or Rule 16b-3(e) thereunder (or any successor or other rule) to

the extent permitted thereby.

(f) Notwithstanding

anything to the contrary in this Agreement, the Company’s obligations under this Section 1 shall terminate immediately, and, if

the Designee has joined the Board, such Designee shall promptly offer to resign from the Board and any committee thereof (and, if requested

by the Company, promptly deliver his written resignation to the Board (which shall provide for his immediate resignation) it being understood

that it shall be in the Board’s sole discretion whether to accept or reject such resignation), and the Company shall have no further

obligation under this Section 1, if: (A) the Mill Road Affiliates (as defined below), collectively, cease to beneficially own at least

5.0% of the Common Stock then outstanding; or (B) both (i) Mill Road or the Designee materially breaches any of the terms of this

Agreement (assuming for this purpose that the Designee is a party to this Agreement) and, if capable of being cured, such breach has

not been cured within fifteen (15) days of receipt of written notice of such breach, which notice specifies in reasonable detail the

facts constituting such material breach, and (ii) at the time of the giving of such notice and during such cure period, the Company is

not in material breach of any of the terms of this Agreement. Mill Road agrees to cause the Designee to resign from the Board if the

Designee fails to resign if and when required pursuant to this Section 1(f). The percentage threshold set forth in this Section 1(f)(A)

shall be deemed satisfied notwithstanding a failure to maintain such ownership threshold to the extent that such failure results from

share issuances or similar Company actions that increase the number of outstanding shares of Common Stock. In furtherance of this Section

1(f), the Designee has, concurrently with the execution of this Agreement, executed the Irrevocable Resignation Agreement and delivered

it to the Company.

(g) If

the Designee is unable or unwilling to serve as a director of the Company, resigns as a director of the Company, is removed as a director

of the Company or ceases to be a director of the Company for any reason prior to the expiration of the Standstill Period, or if the Designee

(or other candidate selected by Mill Road pursuant to Section 2(c)) is nominated by the Company but not elected as a director of the

Company at the Applicable Meeting (as defined below), and at such time the condition set forth in Section 1(f)(A) above is satisfied,

Mill Road shall be entitled to designate a replacement director (the “Replacement Designee”), subject to the Company’s

approval, such approval not to be unreasonably delayed, withheld or conditioned, and subject to the execution and delivery to the Company

by the Replacement Designee of an irrevocable resignation agreement in substantially the form of Exhibit A hereto, and the Board

and all applicable committees thereof shall as promptly as practicable take (or shall cause to be taken) such actions as are necessary

to appoint the Replacement Designee to serve as a director of the Company for the remainder of the Designee’s term (or, in the

case of a failure to be elected at an Applicable Meeting, until the next annual meeting of stockholders of the Company), subject to any

applicable reelection requirements required by law, stock exchange rules, or the Company’s organizational documents. Effective

upon the appointment of the Replacement Designee to the Board, such Replacement Designee will be considered the Designee for all purposes

of this Agreement from and after such appointment.

2. Standstill.

(a) Mill

Road agrees that, during the Standstill Period (as defined below), (unless specifically requested in writing by the Company, acting through

a resolution of the Board not including the Designee), it shall not, and shall cause each of its Affiliates or Associates (as such terms

are defined in Rule 12b-2 promulgated by the SEC under the Exchange Act) that is controlled by or under common control with Mill Road

(collectively (with Mill Road) and individually, the “Mill Road Affiliates”, which for avoidance of doubt shall be

deemed to include the general partner of Mill Road, any management company that controls Mill Road, any members of the board of directors,

managing directors, general partners, managers or managing members (or substantial equivalent) of any such general partner or management

company, and any Affiliate or Associate that is controlled by or under common control with such general partner or management company),

not to, directly or indirectly, in any manner, alone or in concert with others:

(i) make,

engage in, or in any way participate in, directly or indirectly, any “solicitation” of “proxies” (as such terms

are used in the proxy rules of the SEC but without regard to the exclusion set forth in Rule 14a-1(l)(2)(iv) of the Exchange Act) or

consents to vote or knowingly advise, encourage or seek to influence any person (other than Mill Road Affiliates) with respect to the

voting of any securities of the Company for the election of individuals to the Board or to approve stockholder proposals, or become a

“participant” in any contested “solicitation” for the election of directors with respect to the Company (as such

terms are defined or used under the Exchange Act), other than a “solicitation” or acting as a “participant” in

support of all of the nominees of the Board at any stockholder meeting or voting its shares at any such meeting in its sole discretion

(subject to compliance with this Agreement), or make or be the proponent of any stockholder proposal (pursuant to Rule 14a-8 under the

Exchange Act or otherwise);

(ii) form,

join, or in any way knowingly participate in any “group” (as such term is defined in Section 13(d)(3) of the Exchange Act)

with any persons who are not Mill Road Affiliates with respect to any securities of the Company, or knowingly advise, encourage or seek

to influence any such “group” in a manner inconsistent with any recommendation of the Board with respect thereto or otherwise

in any manner agree, attempt, seek or propose to deposit any securities of the Company in any voting trust or similar arrangement, or

subject any securities of the Company to any arrangement or agreement with respect to the voting thereof (including by granting any proxy,

consent or other authority to vote (other than proxies solicited by the Board) but excluding any customary brokerage account, margin

account, prime brokerage account or the like), except as expressly set forth in this Agreement;

(iii) except

with the prior written consent of the Chair of the Board of Directors of the Company, knowingly acquire, offer or propose to acquire,

or agree to acquire, directly or indirectly, whether by purchase, tender or exchange offer, through the acquisition of control of another

person, by joining a partnership, limited partnership, syndicate or other group, through swap or hedging transactions or otherwise, any

securities of the Company or any rights decoupled from the underlying securities of the Company that would result in Mill Road (together

with the Mill Road Affiliates) owning, controlling or otherwise having any beneficial or other ownership interest in excess of 17.0%

of the Common Stock outstanding at such time; provided, that, nothing herein will require Common Stock to be sold to the

extent that the Mill Road Affiliates, collectively, exceed the ownership limit under this clause (iii) as the result of a share repurchase

or other reduction in the number of outstanding shares of Common Stock;

(iv) effect

or seek to effect, offer or propose to effect, or knowingly participate in (or in any way knowingly assist or facilitate any other person

to effect or seek, offer or propose to effect or participate in) any tender or exchange offer, merger, consolidation, acquisition, scheme,

arrangement, business combination, recapitalization, reorganization, sale or acquisition of material assets, liquidation, dissolution

or other extraordinary transaction involving the Company or any of its subsidiaries or joint ventures or any of their respective securities

or a material amount of any of their respective assets or businesses (each, an “Extraordinary Transaction”);

provided, however, that this clause (iv) shall not preclude the tender (or action not to tender) by the Mill Road Affiliates

of any securities of the Company into any tender or exchange offer or vote by the Mill Road Affiliates of any securities of the Company

with respect to any Extraordinary Transaction or any other participation in any Extraordinary Transaction by the Mill Road Affiliates

as holders of securities of the Company on substantially the same terms as other similarly situated holders of securities of the Company;

(v) engage

in any short sale or any purchase, sale or grant of any option, warrant, convertible security, stock appreciation right, or other similar

right (including any put or call option or “swap” transaction) with respect to any security (other than a broad-based market

basket or index) that Mill Road knows to derive any significant part of its value from a decline in the market price or value of the

securities of the Company;

(vi)

call or request the calling of any meeting of stockholders of the Company, including by written consent, seek representation on, or nominate

any candidate to, the Board, except as set forth herein, seek the removal of any member of the Board, solicit consents from stockholders

of the Company or otherwise take corporate action by written consent of the stockholders of the Company in a manner inconsistent with

the recommendation of the Board, conduct a referendum of stockholders of the Company, present at any annual meeting or any special meeting

of the Company’s stockholders (provided that at any such meeting the Designee may respond to questions directed to Designee

in his capacity as a director of the Company), or make a request for any stockholder list of the Company;

(vii) take

any material action in support of or make any proposal or request that constitutes: advising, controlling, changing or influencing the

Board or management of the Company, including any plans or proposals to change the number or term of directors or to fill any vacancies

on the Board; any material change in the capitalization, stock repurchase programs and practices, capital allocation programs and

practices or dividend policy of the Company; any other material change in the Company’s management, business or corporate

structure; seeking to have the Company waive or make amendments or modifications to the Company’s certificate of incorporation

or its by-laws, or other actions, that would reasonably be expected to impede or facilitate the acquisition of control of the Company

by any person; causing a class of securities of the Company to be delisted from, or to cease to be authorized to be quoted on, any

securities exchange; or causing a class of securities of the Company to become eligible for termination of registration pursuant

to Section 12(g)(4) of the Exchange Act;

(viii) make

any public disclosure, announcement or statement regarding any intent, purpose, plan or proposal with respect to the Board, the Company,

its management, policies or affairs, any of its securities or assets or this Agreement that is inconsistent with the provisions of this

Agreement;

(ix) knowingly

enter into any discussions, negotiations, agreements or understandings with any third party to take any action with respect to any action

prohibited by this Section 2(a), or advise, assist, knowingly encourage or seek to persuade any third party to take any action or make

any public statement with respect to any action prohibited by this Section 2(a), or otherwise take or cause any action or make any public

statement inconsistent with this Section 2(a); or

(x) request,

directly or indirectly, any amendment or waiver of the foregoing.

Neither the foregoing

provisions of this Section 2(a) nor any organizational document or agreement of the Company or Company Policy shall be deemed to prohibit

the Mill Road Affiliates or the directors, officers, partners, employees, members, managers, agents or other representatives (acting

in such capacity) (“Representatives”) of the Mill Road Affiliates from communicating privately with, or from privately

requesting a waiver of any of the foregoing provisions of this Section 2(a) from, the Company’s Representatives so long as such

communications or requests would not reasonably be expected to require any public disclosure of such communications or requests. For

avoidance of doubt, this Section 2(a) shall not restrict the ability of the Designee, in his capacity as a director of the Company, to

propose in any meeting of the Board or any committee thereof, or in any private communication with Representatives of the Company, that

the Company take or refrain from taking any course of action contemplated by this Section 2(a).

(b) For

purposes of this Agreement the terms “person” or “persons” shall mean any individual, corporation

(including not-for-profit), general or limited partnership, limited liability or unlimited liability company, joint venture, estate,

trust, association, organization or other entity of any kind or nature.

(c) For

purposes of this Agreement the term “Standstill Period” means the period commencing on the date hereof and ending

on the date that is thirty (30) days prior to the expiration of the Company’s advance notice period for the nomination of directors

at the 2025 annual meeting of stockholders of the Company; provided, however, that if, on or before the date that is sixty (60)

days prior to the expiration of the Company’s advance notice provision for the nomination of directors at the then-next annual

meeting of stockholders of the Company, starting with the 2025 annual meeting of stockholders of the Company (each, an “Applicable

Meeting”), both (i) the Company shall irrevocably agree with Mill Road in writing to include the Designee (or another candidate

selected by Mill Road) on the Company’s slate of director nominees for such Applicable Meeting, and (ii) the Designee (or such

other candidate, if selected by Mill Road) agrees to serve as a director of the Company, then the Standstill Period shall be extended

(A) if the Designee (or such other candidate, if selected by Mill Road) is not elected as a director of the Company at the Applicable

Meeting, to the date the Designee ceases to serve as a director of the Company, or (B) if the Designee (or such other candidate, if selected

by Mill Road) is elected as a director of the Company at the Applicable Meeting, to the date that is thirty (30) days prior to the expiration

of the Company’s advance notice period for the nomination of directors at the next annual meeting of stockholders of the Company

following such Applicable Meeting.

(d) The

restrictions in this Section 2 shall terminate automatically if:

(i) the

Company enters into a definitive agreement with a third party providing for an Extraordinary Transaction that would result in such third

party acquiring securities representing a majority of the voting power of the Company or a successor (or a parent of the Company or a

successor) or a majority of the consolidated assets of the Company; provided, however, that if such Extraordinary Transaction

and all other proposed Extraordinary Transactions publicly announced thereafter by other third parties, if any, are abandoned or terminated

prior to consummation or closing of any such Extraordinary Transaction, then the restrictions in this Section 2 shall be reinstated and

continue in effect (subject to subsequent expiration or termination in accordance with the terms of this Section 2), unless, prior to

the abandonment or termination of all such Extraordinary Transactions, a Mill Road Affiliate shall have publicly announced a proposed

Extraordinary Transaction and shall not have abandoned or terminated such Extraordinary Transaction; or

(ii) the

Company materially breaches this Agreement (including a failure by the Company to comply with its obligations in Section 1 to appoint

and nominate the Designee, a failure to perform any of the actions contemplated in Section 1(g) or a failure by the Company to issue

the Press Release in accordance with Section 7), Mill Road provides the Company with written notice of such material breach (which notice

specifies in reasonable detail the facts constituting such material breach) and such breach, if capable of being cured, shall not have

been cured within fifteen (15) days following the receipt of such notice; provided that, at the time of the giving of such notice

and during such cure period, neither Mill Road nor the Designee is in material breach of any of the terms of this Agreement.

(e) Notwithstanding

anything to the contrary in this Agreement, nothing in this Agreement (including the restrictions in this Section 2) will prohibit or

restrict any Mill Road Affiliate or Representative thereof from (A) making any factual statement to comply with any subpoena, legal requirement

or other legal process or to respond to a request for information from any governmental authority with jurisdiction over such person

from whom information is sought (so long as such requirement, process or request did not arise as a result of discretionary acts with

respect to the Company by any Mill Road Affiliate or Representative thereof) or (B) negotiating, evaluating and/or trading, directly

or indirectly, in any mutual fund, exchange-traded fund, benchmark fund or broad basket of securities which may contain or otherwise

reflect the performance of, but not primarily consist of, securities of the Company. Furthermore, for the avoidance of doubt, nothing

in this Agreement will be deemed to restrict in any way the Designee in the performance of his fiduciary duties in his capacity as a

director of the Company.

3. Mutual

Non-Disparagement. Each of the Company and Mill Road agrees that, during the Standstill Period, it will not, and will cause its Affiliates

and Associates (as such terms are defined in Rule 12b-2 promulgated by the SEC under the Exchange Act) that are controlled by or under

common control with it, and its and such Affiliates’ and Associates’ Representatives acting on its behalf (collectively,

“Covered Persons”) not to, make or cause to be made, or in any way knowingly encourage any other person to make or

cause to be made, any statement or announcement, including in any document or report filed with or furnished to the SEC or through the

press, media, analysts or other persons, that constitutes an ad hominem attack on, or otherwise defames or slanders the other

party or the other party’s known Affiliates or Associates or any of their respective known current or former Representatives (in

their capacity as Representatives of the other party). The foregoing will not (a) restrict the ability of any person to comply with any

subpoena, legal requirement or other legal process or to respond to a request for information from any governmental or regulatory authority

with jurisdiction over the party from whom information is sought or to enforce such person’s rights hereunder or (b) apply to any

private communications (i) between or among the Company, Mill Road, their respective Affiliates and Associates, and their and their respective

Affiliates’ and Associates’ respective Covered Persons (in their respective capacities as such) or (ii) by the Mill Road

Affiliates and their Covered Persons to the Mill Road Affiliates’ respective limited partner investors or potential limited partner

investors (or equivalent) (provided, that in the case of this clause (b)(2), any such private communications are limited to factual

statements that do not otherwise violate the terms of this Section 3).

4. Voting

Agreement. During the Standstill Period, Mill Road shall cause all shares of Common Stock beneficially owned, directly or indirectly,

by it, or by any Mill Road Affiliate, to be present for quorum purposes and to be voted, at any annual or special meeting of stockholders

(and at any adjournments or postponements thereof), and further agrees that at such meetings it and they shall vote in favor of all directors

nominated by the Board for election at such meetings and further agrees that at such meetings it and they shall vote in accordance with

the Board’s recommendations with respect to any other proposal or business that may be the subject of stockholder action at such

meetings; provided, however, that Mill Road and the Mill Road Affiliates may vote their shares of Common Stock beneficially

owned, directly or indirectly, in the discretion of Mill Road or the Mill Road Affiliate, as applicable, with respect to any proposal

related to an Extraordinary Transaction, any amendment to the certificate of incorporation or bylaws of the Company, any shareholder

rights plan, poison pill or other takeover defense, any reincorporation, domestication or conversion, or any issuance of securities (excluding

the adoption or amendment of any employee benefit plan (as defined in Rule 405 under the Securities Act of 1933, as amended) or any issuance

thereunder).

5. Representations

of the Company. The Company represents and warrants to Mill Road as follows: the Company has the power and authority to execute,

deliver and carry out the terms and provisions of this Agreement and to consummate the transactions contemplated hereby; and this

Agreement has been duly and validly authorized, executed and delivered by the Company, constitutes a valid and binding obligation and

agreement of the Company and is enforceable against the Company in accordance with its terms.

6. Representations

of Mill Road. Mill Road represents and warrants to the Company as follows: Mill Road is duly organized, validly existing and in good

standing under the laws of its jurisdiction of organization and has the requisite organizational power and authority to execute, deliver

and carry out the terms and provisions of this Agreement and to consummate the transactions contemplated hereby; this Agreement

has been duly and validly authorized, executed and delivered by Mill Road, constitutes a valid and binding obligation and agreement of

Mill Road and is enforceable against Mill Road in accordance with its terms; and the Mill Road Affiliates beneficially own, directly

or indirectly, an aggregate of 4,380,940 shares of Common Stock and such shares of Common Stock constitute all of the Common Stock beneficially

owned by the Mill Road Affiliates or in which the Mill Road Affiliates have any interest or right to acquire or vote (whether through

derivative securities, voting agreements or otherwise) within the meaning of Rule 13d-3 under the Exchange Act.

7. Public

Announcement.

(a) Mill

Road and the Company shall announce this Agreement by means of a joint press release in the form attached hereto as Exhibit B

(the “Press Release”) as soon as practicable following the execution and delivery of this Agreement.

(b) The

Company shall within two (2) business days prepare and file a Form 8-K (the “Form 8-K”) reporting entry

into this Agreement and appending or incorporating by reference this Agreement and the Press Release as exhibits thereto.

(c) Mill

Road shall promptly (but in no event prior to the date of the filing of the Form 8-K, if timely filed in accordance with Section 7(b))

prepare and file an amendment (the “13D Amendment”) to its Schedule 13D with respect to the Company reporting the

entry into this Agreement and amending the applicable items to conform to the obligations hereunder.

(d) The

parties shall mutually agree to a summary description of this Agreement which shall be used to describe this Agreement in both the Company’s

Form 8-K and Mill Road’s 13D Amendment. Each party shall provide the other party with a reasonable opportunity to review and comment

upon the Form 8-K or 13D Amendment, as the case may be, prior to filing, and shall consider in good faith any changes proposed by the

other party.

(e)

During the Standstill Period, neither party will make or cause to be made any public announcement or statement with respect to the terms

of this Agreement that is inconsistent with or contrary to the statements made in the Press Release or the summary description prepared

pursuant to Section 7(d), except as a party may reasonably determine to be required by law or the rules of any stock exchange or with

the prior written consent of the other party.

8. Confidentiality

Agreement. The parties hereby agrees that, notwithstanding any other provision of this Agreement to the contrary, Mill Road may be

provided confidential information in accordance with and subject to the terms of the Confidentiality Agreement in the form

attached hereto as Exhibit C (the “Confidentiality Agreement”), which Confidentiality Agreement shall become

effective at the time the Designee’s appointment to the Board becomes effective. The Company represents, warrants and agrees that,

during the Standstill Period, no Company Policy will prohibit any member of the Board from communicating with any Mill Road Affiliate,

subject to such director’s compliance with applicable law, observance of his or her confidentiality obligations, fiduciary duties

and obligations to the Company and other Company policies and practices generally applicable to nonemployee directors of the Company.

9. Miscellaneous.

The parties agree that irreparable damage would occur in the event any of the provisions of this Agreement were not performed in accordance

with the terms hereof and that such damage would not be adequately compensable in monetary damages. Accordingly, the parties hereto shall

be entitled to an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the terms and provisions

of this Agreement, in each case without proof of the inadequacy of monetary damages, exclusively in the Court of Chancery of the State

of Delaware or, if such court shall not have jurisdiction, any state or federal court sitting in the State of Delaware, in addition to

any other remedies at law or in equity. Each of the parties hereto agrees to waive any bonding requirement under any applicable law if

the other party seeks to enforce the terms of this Agreement by way of equitable relief. Furthermore, each of the parties hereto consents

to submit itself to the personal jurisdiction of the Court of Chancery of the State of Delaware and the federal and other state courts

sitting in the State of Delaware in the event any dispute arises out of this Agreement or the transactions contemplated by this Agreement,

agrees that it shall not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court,

agrees that it shall not bring any action relating to this Agreement or the transactions contemplated by this Agreement in any court

other than such federal or state courts of the State of Delaware, and each of the parties irrevocably waives the right to trial by jury,

and each of the parties irrevocably consents to service of process by a reputable overnight mail delivery service, signature requested,

to the address set forth in Section 12 hereof or as otherwise provided by applicable law. THIS AGREEMENT SHALL BE GOVERNED IN ALL RESPECTS,

INCLUDING VALIDITY, INTERPRETATION AND EFFECT, BY THE LAWS OF THE STATE OF DELAWARE APPLICABLE TO CONTRACTS EXECUTED AND TO BE PERFORMED

WHOLLY WITHIN SUCH STATE WITHOUT GIVING EFFECT TO ANY CONFLICT OR CHOICE OF LAW PRINCIPLES THAT MAY RESULT IN THE APPLICATION OF THE

LAWS OF ANOTHER JURISDICTION.

10. Expenses.

All attorneys’ fees, costs and expenses incurred in connection with this Agreement and all matters related hereto will be paid

by the party incurring such fees, costs or expenses.

11. Entire

Agreement; Amendment. This Agreement, the Confidentiality Agreement and the Irrevocable Resignation Agreement contain the entire

agreement and understanding of the parties with respect to the subject matter hereof and supersede any and all prior and contemporaneous

agreements, memoranda, arrangements and understandings, both written and oral, between the parties with respect to the subject matter

hereof. This Agreement may be amended only by an agreement in writing executed by the parties hereto, and no waiver of compliance with

any provision or condition of this Agreement and no consent provided for in this Agreement shall be effective unless evidenced by a written

instrument executed by the party against whom such waiver or consent is to be enforced. No failure or delay by a party in exercising

any right, power or privilege hereunder shall operate as a waiver thereof, nor shall any single or partial exercise thereof preclude

any other or further exercise thereof or the exercise of any right, power or privilege hereunder.

12. Notices.

All notices, consents, requests, instructions, approvals and other communications provided for herein and all legal process in regard

hereto shall be in writing and shall be deemed validly given, made or served, when actually received during normal business hours at

the address specified in this subsection:

| if to the Company: |

Superior Industries International, Inc. |

| |

26600 Telegraph Road, Suite 400 |

| |

Southfield, Michigan 48033 |

| |

Attention: David M. Sherbin |

| |

|

| |

With a copy (which shall not constitute notice) to: |

| |

|

| |

Davis Polk & Wardwell LLP |

| |

450 Lexington Avenue |

| |

New York, New York 10017 |

| |

Attention: |

Michael Kaplan |

| |

|

Marc O. Williams |

| if to Mill Road: |

Mill Road Capital III, L.P. |

| |

328 Pemberwick Road |

| |

Greenwich, CT 06831 |

| |

Attention: Deven Petito |

| |

|

| |

With a copy (which shall not constitute notice) to: |

| |

|

| |

Foley Hoag LLP |

| |

155 Seaport Boulevard |

| |

Boston, MA 02210 |

| |

Attention: |

John D. Hancock |

13. Severability.

If at any time subsequent to the date hereof, any provision of this Agreement shall be held by any court of competent jurisdiction to

be illegal, invalid or unenforceable, such provision shall be of no force and effect, but the illegality, invalidity or unenforceability

of such provision shall have no effect upon the legality, validity or enforceability of any other provision of this Agreement.

14. Counterparts.

This Agreement may be executed in two or more counterparts either manually or by electronic or digital signature (including by email

transmission), each of which shall be deemed to be an original and all of which together shall constitute a single binding agreement

on the parties, notwithstanding that not all parties are signatories to the same counterpart.

15. No

Third-Party Beneficiaries; Assignment. This Agreement is solely for the benefit of the parties hereto and is not binding upon

or enforceable by any other persons. No party to this Agreement may assign its rights or delegate its obligations under this Agreement,

whether by operation of law or otherwise, and any assignment in contravention hereof shall be null and void. Nothing in this Agreement,

whether express or implied, is intended to or shall confer any rights, benefits or remedies under or by reason of this Agreement on any

persons other than the parties hereto, nor is anything in this Agreement intended to relieve or discharge the obligation or liability

of any third persons to any party.

16. Interpretation

and Construction. When a reference is made in this Agreement to a Section, such reference shall be to a Section of this Agreement,

unless otherwise indicated. The headings contained in this Agreement are for reference purposes only and shall not affect in any way

the meaning or interpretation of this Agreement. Whenever the words “include,” “includes” and “including”

are used in this Agreement, they shall be deemed to be followed by the words “without limitation.” The words “hereof,

“herein” and “hereunder” and words of similar import when used in this Agreement shall refer to this Agreement

as a whole and not to any particular provision of this Agreement. The word “will” shall be construed to have the same meaning

as the word “shall.” The words “dates hereof” refer to the date of this Agreement. The word “or”

is not exclusive. The definitions contained in this Agreement are applicable to the singular as well as the plural forms of such terms.

Any agreement, instrument, law, rule or statute defined or referred to herein means, unless otherwise indicated, such agreement, instrument,

law, rule or statute as from time to time amended, modified or supplemented. Each of the parties hereto acknowledges that it has been

represented by counsel of its choice throughout all negotiations that have preceded the execution of this Agreement, and that it has

executed the same with the advice of said independent counsel. Each party cooperated and participated in the drafting and preparation

of this Agreement and the documents referred to herein, and any and all drafts relating thereto exchanged among the parties shall be

deemed the work product of all of the parties and may not be construed against any party by reason of its drafting or preparation. Accordingly,

any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against any party that drafted

or prepared it is of no application and is hereby expressly waived by each of the parties hereto, and any controversy over interpretations

of this Agreement shall be decided without regards to events of drafting or preparation.

[Signature Pages

Follow]

IN

WITNESS WHEREOF, each of the parties hereto has executed this Agreement, or caused the same to be executed by its duly authorized representative,

as of the date first above written.

| |

SUPERIOR INDUSTRIES INTERNATIONAL, INC. |

| |

|

| |

|

| |

By: |

/s/ Tim McQuay |

| |

|

Name: |

Tim McQuay |

| |

|

Title: |

Chairman of the Board |

| |

MILL ROAD CAPITAL III, L.P.

By: Mill Road Capital III GP LLC,

its General Partner |

| |

|

| |

|

| |

By: |

/s/ Thomas Lynch |

| |

|

Name: |

Thomas Lynch |

| |

|

Title: |

Managing Director |

[Signature Page to Cooperation Agreement]

EXHIBIT A

FORM OF DESIGNEE’S

IRREVOCABLE AGREEMENT TO RESIGN

January 11, 2024

Attention: Board of

Directors

Superior Industries

International, Inc.

26600 Telegraph Road,

Suite 400

Southfield, Michigan 48033

Re: Irrevocable Agreement

to Resign

Ladies and Gentlemen:

This

irrevocable agreement to resign is delivered pursuant to Sections 1(b) and 1(f) of the Cooperation Agreement, dated as of January

11, 2024 (the “Agreement”), by and between Superior Industries International, Inc. and Mill Road Capital III,

L.P. Capitalized terms used herein but not defined shall have the meaning set forth in the Agreement.

I

hereby irrevocably agree that, pursuant to Section 1(f) of the Agreement, I will promptly offer to resign from the Board and any committee

thereof (and, if requested by the Company, promptly delivery my resignation to the Board providing for my immediate resignation) if I

receive written notice that either a court of competent jurisdiction shall have determined, in a final judgment not subject to further

appeal, or Mill Road and the Company shall have agreed in a written instrument executed by them, that Section 1(f) of the Agreement requires

me to do so.

[Signature

Page Follows]

[Signature

Page to Irrevocable Agreement to Resign]

EXHIBIT B

PRESS RELEASE

[See

attached]

EXHIBIT C

CONFIDENTIALITY

AGREEMENT

[See

attached]

Exhibit 99.2

|

News Release

|

Superior Appoints Deven Petito

to its Board of Directors

SOUTHFIELD, MICHIGAN

– January 11, 2024 – Superior Industries International, Inc. (“Superior” or the “Company”)

(NYSE:SUP) today announced the appointment of Deven Petito to its Board of Directors as an independent director, effective as of January

11, 2024. With the addition of Mr. Petito, the Board will be comprised of nine directors, eight of whom are independent.

Tim

McQuay, Chairman of the Board of Superior, commented, “We are pleased to welcome Deven to Superior’s Board of Directors.

Deven brings a broad range of financial and capital markets experience, as well as valuable perspective

as the designee of one of our largest shareholders. We look forward to benefiting from his insights as

we advance our strategy and generate long-term value for our shareholders.”

Mr. Petito is a

Management Committee Director of Mill Road Capital Management LLC, where he has worked since 2014. Mill Road Capital Management is an

investment firm that manages multiple funds with approximately $1.0 billion of assets under management. The firm focuses on investing

in, and partnering with, small publicly traded companies in the U.S. and Canada. Mr. Petito is responsible for leading public equity

and private equity investments for Mill Road’s funds. Before joining Mill Road, Mr. Petito began his investing career in the private

equity group at Kohlberg Kravis Roberts & Co. (KKR). Prior to KKR, Mr. Petito worked at Morgan Stanley in the firm’s investment

banking division. Mr. Petito holds an AB in Economics from Princeton University and an MBA from Harvard Business School.

About Superior

Industries

Superior is one

of the world’s leading aluminum wheel suppliers. Superior’s team collaborates with customers to design, engineer, and manufacture

a wide variety of innovative and high quality products utilizing the latest light weighting and finishing technologies. Superior also

maintains leading aftermarket brands ATS®, RIAL®, ALUTEC®, and ANZIO®. Headquartered

in Southfield, Michigan, Superior is listed on the New York Stock Exchange. For more information, please visit www.supind.com.

Contact:

Superior Investor

Relations:

(248) 234-7104

Investor.Relations@supind.com

v3.23.4

Cover

|

Jan. 11, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 11, 2024

|

| Entity File Number |

001-6615

|

| Entity Registrant Name |

Superior Industries International, Inc.

|

| Entity Central Index Key |

0000095552

|

| Entity Tax Identification Number |

95-2594729

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

26600 Telegraph Road

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Southfield

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48033

|

| City Area Code |

248

|

| Local Phone Number |

352-7300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SUP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

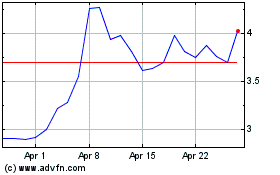

Superior Industries (NYSE:SUP)

Historical Stock Chart

From Apr 2024 to May 2024

Superior Industries (NYSE:SUP)

Historical Stock Chart

From May 2023 to May 2024