0001110803FALSE00011108032024-01-092024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2024

Illumina, Inc.

(Exact name of registrant as specified in its charter)

001-35406

(Commission File Number) | | | | | | | | |

| Delaware | | 33-0804655 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

5200 Illumina Way, San Diego, CA 92122

(Address of principal executive offices) (Zip code)

(858) 202-4500

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | ILMN | The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13a of the Exchange Act. o

TABLE OF CONTENTS

Item 2.02 Results of Operations and Financial Condition.

On January 9, 2024, in advance of a public webcast presentation at the J.P. Morgan Healthcare Conference in San Francisco, California, Illumina, Inc. (the "Company") issued a press release regarding the Company's unaudited preliminary financial results for the fourth quarter and fiscal year ended December 31, 2023. The webcast is accessible through the Investor Relations section of the Company’s website and it will remain available for at least 30 days following. Pursuant to General Instruction F to Form 8-K, a copy of the press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 2.02 by this reference.

The information furnished pursuant to this Item 2.02 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated January 9, 2024, announcing Illumina, Inc.’s preliminary financial results for the fourth quarter and fiscal year ended December 31, 2023 104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | ILLUMINA, INC. |

| Date: | January 9, 2024 | By: | /s/ JOYDEEP GOSWAMI |

| | Name: | Joydeep Goswami |

| | Title: | Chief Financial Officer, Chief Strategy and Corporate Development Officer |

Exhibit Index

| | | | | | | | |

| Exhibit Number | | Description |

| | Press release dated January 9, 2024, announcing Illumina, Inc.’s preliminary financial results for the fourth quarter and fiscal year ended December 31, 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | | | | | | | | | | | | |

| | | | Investors: Salli Schwartz +1.858.291.6421 ir@illumina.com |

| | |

| |

| |

| | Media: David McAlpine +1.347.327.1336 pr@illumina.com |

| | | |

| | | |

| | | |

Illumina Announces Preliminary Financial Results for Fourth Quarter and Fiscal Year 2023

San Diego, January 9, 2024 /PRNewswire/ -- Illumina, Inc. (Nasdaq: ILMN) (“Illumina” or the “company”) today announced unaudited preliminary financial results for the fourth quarter and fiscal year 2023 ahead of its presentation at the 42nd Annual J.P. Morgan Healthcare Conference on January 9, 2024 at 9:00am Pacific Time (12:00pm Eastern Time). The webcast can be accessed through the Investor Info section of Illumina’s website at investor.illumina.com.

Preliminary financial results

•Consolidated revenue of approximately $1,115 million for Q4 2023, up 3% from Q4 2022, and approximately $4,497 million for fiscal year 2023, down 2% from fiscal year 2022

•Core Illumina revenue of approximately $1,090 million for Q4 2023, up 2% from Q4 2022, and approximately $4,431 million for fiscal year 2023, down 3% from fiscal year 2022

•Shipped 79 NovaSeq X instruments in Q4 2023 and 352 instruments for fiscal year 2023

•Consolidated GAAP operating margin of approximately (15.5%) for Q4 2023 and approximately (24.0%) for fiscal year 2023

•Consolidated non-GAAP operating margin of approximately 3.8% for Q4 2023 and approximately 5.3% for fiscal year 2023

•Core Illumina GAAP operating margin of approximately 2.4% for Q4 2023 and approximately 12.3% for fiscal year 2023

•Core Illumina non-GAAP operating margin of approximately 18.0% for Q4 2023 and approximately 19.8% for fiscal year 2023

As previously announced, the company expects to report its full fourth quarter and fiscal year 2023 results following the close of market on Thursday, February 8, 2024. The unaudited results in this press release are preliminary and subject to the completion of accounting and annual audit procedures and are therefore subject to adjustment.

Statement regarding use of non-GAAP financial measures

The company reports non-GAAP results for diluted earnings per share, net income, gross margin, operating expenses, including research and development expense, selling general and administrative expense, and from time to time, as applicable, legal contingencies and settlement, and goodwill and intangible impairment, operating income (loss), operating margin, gross profit (loss), other income (expense), tax provision, constant currency revenue growth, and free cash flow (on a consolidated and, as applicable, segment basis for our Core Illumina and GRAIL segments) in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. The company’s financial measures under GAAP include substantial charges such as amortization of acquired intangible assets among others that are listed in the itemized reconciliations between GAAP and non-GAAP financial measures included in this press release, as well as the effects of currency translation. Management has excluded the effects of these items in non-GAAP measures to assist investors in analyzing and assessing past and future operating performance, including in the non-GAAP measures related to our Core Illumina and GRAIL segments. Additionally, non-GAAP net income and diluted earnings per share are key components of the financial metrics utilized by the company’s board of directors to measure, in part, management’s performance and determine significant elements of management’s compensation.

The company encourages investors to carefully consider its results under GAAP, as well as its supplemental non-GAAP information and the reconciliation between these presentations, to more fully understand its business. Reconciliations between GAAP and non-GAAP results are presented in the tables of this release.

Use of forward-looking statements

This release may contain forward-looking statements that involve risks and uncertainties. Among the important factors to which our business is subject that could cause actual results to differ materially from those in any forward-looking statements are: (i) the finalization of the accounting and audit procedures necessary to report our financial results for the fourth quarter and fiscal year 2023; (ii) changes in the rate of growth in the markets we serve; (iii) the volume, timing and mix of customer orders among our products and services; (iv) our ability to adjust our operating expenses to align with our revenue expectations; (v) our ability to manufacture robust instrumentation and consumables; (vi) the success of products and services competitive with our own; (vii) challenges inherent in developing, manufacturing, and launching new products and services, including expanding or modifying manufacturing operations and reliance on third-party suppliers for critical components; (viii) the impact of recently launched or pre-announced products and services on existing products and services; (ix) our ability to modify our business strategies to accomplish our desired operational goals; (x) our ability to realize the anticipated benefits from prior or future actions to streamline and improve our R&D processes, reduce our operating expenses and maximize our revenue growth; (xi) our ability to further develop and commercialize our instruments, consumables, and products; (xii) to deploy new products, services, and applications, and to expand the markets for our technology platforms; (xiii) the risks and costs associated with our ongoing inability to integrate GRAIL due to the transitional measures imposed on us by the European Commission as a result of their prohibition of our acquisition of GRAIL and orders issued by the European Commission and the Federal Trade Commission requiring that we divest GRAIL; (xiv) the risks and costs associated with the expected divestment of GRAIL, including the possibility that the terms on which we divest all or a portion of the assets or equity interests of GRAIL are materially worse than those on which we acquired GRAIL; (xv) the risk that disruptions from the consummation of our acquisition of GRAIL and associated legal or regulatory proceedings, including appeals, or obligations will harm our business, including current plans and operations; (xvi) the risk of incurring additional fines associated with the consummation of our acquisition of GRAIL; (xvii) our ability to obtain approval by third-party payors to reimburse patients for our products; (xviii) our ability to obtain regulatory clearance for our products from government agencies; (xix) our ability to successfully partner with other companies and organizations to develop new products, expand markets, and grow our business; (xx) uncertainty, or adverse economic and business conditions, including as a result of slowing or uncertain economic growth or armed conflict; (xxi) the application of generally accepted accounting principles, which are highly complex and involve many subjective assumptions, estimates, and judgments and (xxii) legislative, regulatory and economic developments, together with other factors detailed in our filings with the Securities and Exchange Commission, including our most recent filings on Forms 10-K and 10-Q, or in information disclosed in public conference calls, the date and time of which are released beforehand. We undertake no obligation, and do not intend, to update these forward-looking statements, to review or confirm analysts’ expectations, or to provide interim reports or updates on the progress of the current quarter.

About Illumina

Illumina is improving human health by unlocking the power of the genome. Our focus on innovation has established us as a global leader in DNA sequencing and array-based technologies, serving customers in the research, clinical, and applied markets. Our products are used for applications in the life sciences, oncology, reproductive health, agriculture, and other emerging segments. To learn more, visit illumina.com and connect with us on X (Twitter), Facebook, LinkedIn, Instagram, TikTok, and YouTube.

Illumina, Inc.

Preliminary Results of Operations - Non-GAAP

(unaudited)

Our performance and financial results are subject to risks and uncertainties, and actual results could differ materially from the preliminary results set forth below. Some of the factors that could affect our financial results are included from time to time in the public reports filed with the Securities and Exchange Commission (SEC), including Form 10-K for the fiscal year ended January 1, 2023, filed with the SEC on February 17, 2023, Form 10-Q for the fiscal quarter ended April 2, 2023, Form 10-Q for the fiscal quarter ended July 2, 2023, and Form 10-Q for the fiscal quarter ended October 1, 2023. We assume no obligation to update any forward-looking statements or information. The preliminary unaudited information included in the tables below is approximate and subject to change. We will report our fourth quarter and full year fiscal 2023 results in February.

CONSOLIDATED RECONCILIATION BETWEEN PRELIMINARY GAAP AND NON-GAAP OPERATING MARGIN:

| | | | | | | | | | | |

| Fourth Quarter 2023 | | Fiscal Year 2023 |

| Preliminary GAAP operating margin | (15.5)% | | (24.0)% |

| Amortization of acquired intangible assets | 4.4 | | 4.3 |

Acquisition-related expenses (b) | 3.0 | | 2.5 |

Restructuring (d) | 5.5 | | 3.5 |

Contingent consideration liabilities (e) | 5.2 | | (0.5) |

| Proxy contest | 0.2 | | 0.7 |

Goodwill and intangible (IPR&D) impairment (c) | 0.5 | | 18.4 |

Legal contingency and settlement (f) | 0.5 | | 0.4 |

Preliminary non-GAAP operating margin (a) | 3.8% | | 5.3% |

CORE ILLUMINA RECONCILIATION BETWEEN PRELIMINARY GAAP AND NON-GAAP OPERATING MARGIN:

| | | | | | | | | | | |

| Fourth Quarter 2023 | | Fiscal Year 2023 |

| Preliminary GAAP operating margin - Core Illumina | 2.4% | | 12.3% |

| Amortization of acquired intangible assets | 1.3 | | 1.3 |

Acquisition-related expenses (b) | 2.3 | | 2.0 |

Restructuring (d) | 5.5 | | 3.5 |

Contingent consideration liabilities (e) | 5.3 | | (0.6) |

| Proxy contest | 0.2 | | 0.7 |

Intangible (IPR&D) impairment (c) | 0.5 | | 0.1 |

Legal contingency and settlement (f) | 0.5 | | 0.5 |

Preliminary non-GAAP operating margin - Core Illumina (a) | 18.0% | | 19.8% |

(a) Non-GAAP operating margin excludes the effects of the pro forma adjustments as detailed above. Management has excluded the effects of these items in these measures to assist investors in analyzing and assessing past and future operating performance, including in the non-GAAP measure related to our Core Illumina segment.

(b) Amounts consist primarily of legal expenses related to the acquisition of GRAIL.

(c) Amounts for Q4 2023 consist of an IPR&D intangible asset impairment related to our Core Illumina segment. Amounts for FY 2023 also consist of goodwill and IPR&D intangible asset impairments related to GRAIL.

(d) Amounts for Q4 2023 and FY 2023 consist primarily of lease and other asset impairments and employee severance costs related to restructuring activities.

(e) Amounts consist of fair value adjustments for our contingent consideration liability related to GRAIL.

(f) Amounts for Q4 2023 consist primarily of interest for the accrued fine imposed by the European Commission. Amounts for FY 2023 also consist of a loss related to a patent litigation settlement in Q1 2023, an adjustment

recorded in Q2 2023 to our accrual for the fine imposed by the European Commission in July 2023, and a gain related to a patent litigation settlement in Q3 2023.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

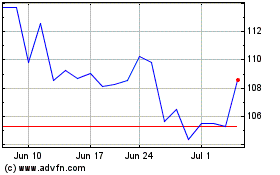

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Illumina (NASDAQ:ILMN)

Historical Stock Chart

From Apr 2023 to Apr 2024