UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2024

Commission file number: 001-39838

Gracell Biotechnologies Inc.

Building 12, Block B, Phase II

Biobay Industrial Park

218 Sangtian St.

Suzhou Industrial Park, 215123

People’s Republic of China

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form

40-F ¨

EXTRAORDINARY GENERAL MEETING

An

extraordinary general meeting (“EGM”) of the shareholders of Gracell Biotechnologies Inc. (the

“Company” or “Gracell”) will be held at 2:00 p.m. (China Standard Time)

on February 19, 2024 (1:00 a.m. (Eastern Standard Time)) at 35th Floor, Two Exchange Square, 8 Connaught Place, Central,

Hong Kong and virtually via live webcast, to approve and authorize the execution, delivery and performance by the Company of the

Agreement and Plan of Merger (the “Merger Agreement”), dated as of December 23, 2023, by and among the

Company, AstraZeneca Treasury Limited, a private limited company incorporated under the laws of England and Wales

(“Parent”), and Grey Wolf Merger Sub, an exempted company with limited liability incorporated under the

Laws of the Cayman Islands and a wholly owned subsidiary of Parent, the Plan of Merger, in the form attached as Exhibit A to the

Merger Agreement, and the other agreements or documents contemplated thereby or any documents or instruments delivered in connection

thereunder to which the Company is a party, and the consummation of the transactions contemplated by the Merger Agreement and the

Contingent Value Rights Agreement, in the form attached as Exhibit B to the Merger Agreement (including the Merger) (the

“Transactions”).

ORDINARY SHARE RECORD DATE AND ADS RECORD DATE

The close of business in the Cayman Islands on

January 8, 2024 has been fixed as the record date (the “Record Date”) such that only shareholders registered

in the Company’s register of members as of the Record Date are entitled to receive notice of and vote at the EGM or any adjourned

or postponed meeting thereof.

Holders of record

of American Depositary Shares (the “ADSs”) as of the close of business in New York City on January 8, 2024 (the

“ADS Record Date”) who wish to exercise their voting rights for the underlying ordinary shares of the

Company must give voting instructions to The Bank of New York Mellon, the depositary of the ADS program.

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this Form 6-K

contain “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. Statements

that are not historical or current facts, including statements about the beliefs and expectations and statements relating to the proposed

Transactions, are forward-looking statements. The words “anticipate,” “look forward to,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. Forward-looking statements involve inherent risks and uncertainties, and important factors could cause

actual results to differ materially from those anticipated, including, but not limited to: the satisfaction of the conditions precedent

to the consummation of the Transactions, including, the receipt of shareholder approval and regulatory clearances; the possibility that

the milestone related to the contingent value right will not be achieved, even if the Transactions are consummated; unanticipated difficulties

or expenditures relating to the Transactions; legal proceedings, judgments or settlements, including those that may be instituted against

the Company, the Company’s board of directors and executive officers and others following the announcement of the Transactions;

disruptions of current plans and operations caused by the announcement of the Transactions; potential difficulties in employee retention

due to the announcement of the Transactions; and other risks and uncertainties and the factors discussed in the section entitled “Risk

Factors” in the Company’s most recent annual report on Form 20-F, as well as discussions of potential risks, uncertainties,

and other important factors in the Company’s subsequent filings with the Securities and Exchange Commission (the “SEC”).

Any forward-looking statements contained in this Form 6-K speak only as of the date hereof. Except as may be required by law, neither

the Company nor Parent undertakes any duty to update these forward-looking statements.

Additional Information and Where to Find It

In connection with the Transactions, the Company

intends to file or furnish relevant materials with or to the SEC, including a proxy statement. Promptly after the proxy statement is filed

or furnished with the SEC, the Company will mail or otherwise provide the proxy statement and a proxy card to each of its shareholders

entitled to vote at the EGM. This communication is not a substitute for the proxy statement or any other document that the Company may

file or furnish with or to the SEC or send to its shareholders in connection with the Transactions. BEFORE MAKING ANY VOTING DECISION,

SHAREHOLDERS OF THE COMPANY ARE URGED TO READ THESE MATERIALS (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT

DOCUMENTS IN CONNECTION WITH THE TRANSACTIONS THAT THE COMPANY WILL FILE OR FURNISHED WITH OR TO THE SEC WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS AND THE PARTIES TO THE TRANSACTIONS. The proxy statement and other relevant

materials in connection with the Transactions (when they become available), and any other documents filed or furnished with or to the

SEC by the Company, may be obtained free of charge at the SEC’s website at www.sec.gov or at the Company’s website at www.gracellbio.com.

Participants in the Solicitation

The Company and certain of its directors, executive

officers and other members of management and employees may, under SEC rules, be deemed to be “participants” in the solicitation

of proxies from the Company’s shareholders with respect to the Transactions. Information regarding the persons who may be considered

“participants” in the solicitation of proxies will be set forth or incorporated by reference in the proxy statement relating

to the Transactions when it is filed or furnished with or to the SEC. Additional information regarding the interests of such potential

participants will be included in the proxy statement and the other relevant documents filed or furnished with or to the SEC when they

become available.

No Offer or Solicitation

This Form 6-K is neither a solicitation of a proxy,

an offer to purchase nor a solicitation of an offer to sell any securities and it is not a substitute for any proxy statement or other

filings that may be made with the SEC should the Transactions proceed.

Signature

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Gracell Biotechnologies Inc. |

| |

|

| |

By: |

/s/ William Wei Cao |

| |

Name: |

William Wei Cao |

| |

Title: |

Chairman and Chief Executive Officer |

Date: January 8, 2024

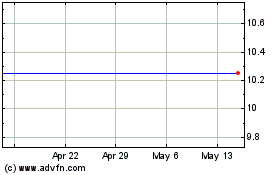

Gracell Biotechnologies (NASDAQ:GRCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

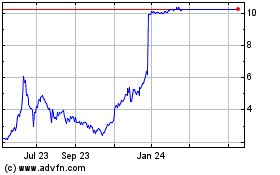

Gracell Biotechnologies (NASDAQ:GRCL)

Historical Stock Chart

From Apr 2023 to Apr 2024