Form SC 13D/A - General statement of acquisition of beneficial ownership: [Amend]

December 29 2023 - 4:30PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment No. 18)*

The

Herzfeld Caribbean Basin Fund, Inc.

(Name

of Issuer)

Common

stock

(Title

of Class of Securities)

42804T106

(CUSIP

Number)

119

Washington Avenue, Suite 504 Miami Beach, FL 33139

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

12/18/2023

(Date

of Event which Requires Filing of this Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [ ]

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out

for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page. |

The

information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section

18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

| |

|

|

|

|

| CUSIP No. 42804T106 |

|

13D |

|

Page

2 of 3 Pages |

| 1. |

|

NAMES

OF REPORTING PERSONS I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Thomas J. Herzfeld, et al. |

|

|

| 2. |

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(see instructions)

(a) [ ]

(b) [ ] |

|

|

| 3. |

|

SEC USE

ONLY

|

|

|

| 4. |

|

SOURCE

OF FUNDS (see instructions)

PF, OO |

|

|

| 5. |

|

CHECK

BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) [ ] |

|

|

| 6. |

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

United States |

|

|

| NUMBER

OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7. |

|

SOLE

VOTING POWER

1,619,776 |

| |

8. |

|

SHARED

VOTING POWER

2,754,528 |

| |

9. |

|

SOLE

DISPOSITIVE POWER

1,619,776 |

| |

10. |

|

SHARED

DISPOSITIVE POWER

2,754,528 |

| 11. |

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

4,374,304 |

|

|

| 12. |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(see instructions) [ ]

|

|

|

| 13. |

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

27.08% |

|

|

| 14. |

|

TYPE

OF REPORTING PERSON (see instructions)

IN, IA |

|

|

| |

|

|

|

|

| CUSIP No. 42804T106 |

|

13D |

|

Page 3 of 3 Pages |

Schedule

13D

This

Amendment No. 18 to Schedule 13D (this “Amendment”) amends and supplements the Schedule 13D filed with the Securities

and Exchange Commission (the “SEC”) on August 18, 2011, as previously amended (the “Schedule 13D”) by

Thomas J. Herzfeld.

This

amendment is filed on behalf of Thomas J. Herzfeld, et al. (the “Reporting Person”) with respect to common stock owned

individually by the Reporting Person and in his role as portfolio manager of investment advisory accounts of the clients (“Advisory

Clients”) of Thomas J. Herzfeld Advisors, Inc. a registered investment adviser for which Mr. Herzfeld has a dispositive

and/or voting power (“Accounts”).

Items

4 and 5 of the Schedule 13D are hereby amended to the extent hereinafter expressly set forth. All capitalized terms used and not

expressly defined in this Amendment have the respective meanings ascribed to them in the Schedule 13D.

Item

4. Purpose of Transaction.

Not

applicable.

Item

5. Interest in Securities of the Issuer.

| (a) | The

aggregate number of shares of common stock to which this Schedule 13D relates is 4,374,304

shares representing 27.08% of the 16,150,673 shares outstanding as reported by the issuer

as of December 19, 2023. |

| (b) | With

respect to the shares of common stock owned individually, the Reporting Person beneficially

owns with sole power to vote and dispose of 1,619,776 shares of common stock. With respect

to the Accounts, the Reporting Person beneficially owns with shared power to vote and/or

dispose of 2,754,528 shares of common stock. |

| (c) | Open

Market Transactions |

On

October 24, 2023 through the open market, the Advisory clients sold 4,544 shares at $2.9491. On October 31, 2023 through the open

market, the Advisory clients sold 7,197 shares at $2.9613. On November 1, 2023 through the open market, the Advisory clients sold

3,846 shares at $3.0467. On November 2, 2023 through the open market, the Advisory clients sold 470 shares at $2.66. On November

20, 2023 through the open market, the Advisory clients sold 687 shares at $2.29. On November 21, 2023 through the open market,

the Advisory clients sold 110 shares at $2.3519. On November 30, 2023 through the open market, the Advisory clients sold 663 shares

at $2.48. On December 7, 2023 through the open market, the Advisory clients sold 2,655 shares at $2.6076. On December 13, 2023,

an Advisory client with 1,178 shares closed their account. On December 14, 2023 through the open market, the Advisory clients

sold 1,107 shares at $2.5505.

Rights

Offering

The Herzfeld Caribbean Basin

Fund, Inc. (the "Fund") recently completed a pro rata offering (the "Rights Offering") of non-transferable

subscription rights ("Rights") to its common stockholders of record as of the close of business on November 3, 2023 (the

"Record Date Stockholder") entitling the holders of such Rights to purchase additional shares of common stock of the

Fund (the "Common Stock"). Record Date Stockholders received one Right for each outstanding whole share of Common Stock

held on the record date. The Rights entitled their holders to purchase one new share of Common Stock for every one Right held at

a discount to the market price of the Common Stock. The subscription price per share of Common Stock was $2.31 (the "basic

subscription privilege"). Record Date Stockholders who fully exercised their Rights were entitled to subscribe, subject to

certain limitations and subject to allotment, for additional shares of Common Stock which were not subscribed for (the "Over-Subscription

Privilege"). Both with respect to Common Stock owned by the Reporting Person (i) individually and (ii) in his role as portfolio

manager of the Accounts, the Reporting Person fully exercised all Rights received and subscribed for additional shares of Common

Stock pursuant to the Over-Subscription Privilege, subject to the pro rata allocation of available shares of Common Stock. Fractional

shares of Common Stock were not issued. The subscription period commenced on the Record Date and expired on December 13, 2023.

Following the conclusion of the Rights Offering, the shares of Common Stock that were not subscribed for by the holders of Rights

in the basic subscription privilege were allocated pro rata among Rights holders that exercised their Over-Subscription Privilege

based on the number of shares of Common Stock each of those Rights holders owned on the record date and subject to the amount of

shares of Common Stock such holder subscribed for. The Reporting Person purchased 600,831 shares of Common Stock from the exercise

of his rights in the basic subscription privilege, plus an additional 418,114 shares of Common Stock pursuant to the Over-Subscription

Privilege associated with the Reporting Person's subscription rights on the basis of the Fund's allocation of shares of Common

Stock after the close of the subscription period. On December 18, 2023, the third-party subscription agent for the Rights Offering

determined the allocations to be made to the Record Date Stockholders who exercised their Over-Subscription Privilege. The Common

Stock subscribed for will be issued after receipt of all stockholder payments.

| (d) | The

owner of each of the Accounts individually has the right to receive and the power to

direct the receipt of dividends from, or proceeds from the sale of, the shares of common

stock. To date no owner of an Account holds more than 5% of the Issuer’s common

shares. |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| |

|

| |

Thomas J. Herzfeld Advisors, Inc. |

| |

|

| |

/s/ Thomas J. Herzfeld |

| |

Thomas J. Herzfeld |

| |

Chairman |

| |

|

| |

12/29/2023 |

| |

Date |

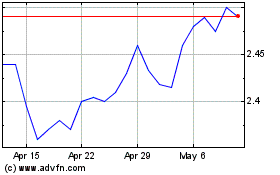

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

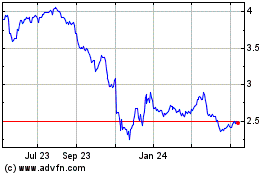

Herzfeld Caribbean Basin (NASDAQ:CUBA)

Historical Stock Chart

From Apr 2023 to Apr 2024