0001593034false00015930342023-12-282023-12-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________

FORM 8-K

_______________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 28, 2023

_______________________________

Endo International plc

(Exact name of registrant as specified in its charter)

_______________________________

| | | | | | | | |

Ireland | 001-36326 | 68-0683755 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

First Floor, Minerva House, Simmonscourt Road | |

Ballsbridge, Dublin 4, | Ireland | Not Applicable |

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code 011-353-1-268-2000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None (1)

| | | | | | | | | | | |

| (1) | On August 26, 2022, Endo International plc’s ordinary shares, which previously traded on the Nasdaq Global Select Market under the symbol ENDP, began trading exclusively on the over-the-counter market under the symbol ENDPQ. On September 14, 2022, Nasdaq filed a Form 25-NSE with the United States Securities and Exchange Commission and Endo International plc’s ordinary shares were subsequently delisted from the Nasdaq Global Select Market. On December 13, 2022, Endo International plc’s ordinary shares were deregistered under Section 12(b) of the Securities Exchange Act of 1934, as amended. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

As previously disclosed, on August 16, 2022, Endo International plc, together with certain of its direct and indirect subsidiaries (the “Company” or the “Debtors”), filed voluntary petitions for relief under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”). The cases are being administered under the caption In re Endo International plc, et al. (Case No. 22-22549) (the “Chapter 11 Cases”). The Debtors continue to operate their businesses and manage their properties as “debtors-in-possession” under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and order of the Bankruptcy Court.

Monthly Operating Reports

On December 28, 2023, each of the Debtors filed monthly operating reports (the “Monthly Operating Reports”) with the Bankruptcy Court for the month ended November 30, 2023. The Monthly Operating Reports are available for review free of charge at https://restructuring.ra.kroll.com/endo/. The Monthly Operating Reports and other information available on this website are not part of this Form 8-K and are not deemed to be incorporated by reference in this Form 8-K.

The Debtors expect to file future Monthly Operating Reports and similar reports and other documents with the Bankruptcy Court while the Chapter 11 Cases remain pending. The filing of such reports and other documents may not be accompanied by a Form 8-K filing. These reports and other documents will also be available for review free of charge at https://restructuring.ra.kroll.com/endo/. Investors should review this website for additional information regarding the Debtors and their Chapter 11 Cases.

Cautionary Statement Regarding Monthly Operating Reports and Other Documents

The Company cautions investors and potential investors not to place undue reliance upon the information contained in the Monthly Operating Reports or any similar reports or other documents that have been or in the future are filed with the Bankruptcy Court and are not prepared for the purpose of providing the basis for an investment decision relating to any of the securities of the Company. The Monthly Operating Reports and any other reports or documents that have been or in the future are filed with the Bankruptcy Court are limited in scope, cover a limited time period and are prepared solely for the purpose of complying with the reporting requirements of the Bankruptcy Court. The Monthly Operating Reports and any similar reports or other documents that have been or in the future are filed with the Bankruptcy Court are not audited or reviewed by independent accountants, are not prepared in accordance with generally accepted accounting principles, are in a format prescribed by applicable bankruptcy laws or rules and are subject to future adjustment and reconciliation. There can be no assurance that, from the perspective of an investor or potential investor in the Company’s securities, the Monthly Operating Reports and any similar reports or other documents that have been or in the future are filed with the Bankruptcy Court are complete. Results and projections set forth in the Monthly Operating Reports or any similar reports or other documents that have been or in the future are filed with the Bankruptcy Court should not be viewed as indicative of future results.

Cautionary Information Regarding Trading in the Company’s Securities

The Company continues to face certain risks and uncertainties that have been affecting its business and operations, and these risks and uncertainties may affect the Company’s ability to complete a plan of reorganization or a sale transaction or to pursue an alternative emergence transaction, and could impact the outcome of the Company’s voluntary petitions for relief under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern District of New York (collectively, the “Chapter 11 Filings”). Holders of the Company’s equity securities will likely be entitled to little or no recovery on their investment and recoveries to other stakeholders cannot be determined at this time. The Company cautions that trading in the Company’s securities given the pendency of the Chapter 11 Filings is highly speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual value realized, if any, by holders of the Company’s securities in the Chapter 11 Filings. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

Cautionary Note Regarding Forward-Looking Statements

Certain information in this Current Report on Form 8-K may be considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation, including, but not limited to, statements with respect to the Monthly Operating Reports or any similar reports or other documents that have been or in the future are filed with the Bankruptcy Court, the chapter 11 proceedings, and any other statements that refer to the Company’s expected, estimated or anticipated future results or that do not relate solely to historical facts. Statements including words or phrases such as “believe,” “expect,” “anticipate,” “intend,” “estimate,” “plan,” “will,” “may,” “look forward,” “guidance,” “future,” “potential” or similar expressions are forward-looking statements. All forward-looking statements in this communication reflect the Company’s current views as of the date of this communication about its plans, intentions, expectations, strategies and prospects, which are based on the information currently available to it and on assumptions it has made. Actual results may differ materially and adversely from current expectations based on a number of factors, including, among other things, the following: the outcome of the Company’s contingency planning and restructuring activities; the timing, impact or results of any pending or future litigation, investigations, proceedings or claims, including opioid, tax and antitrust related matters; actual or contingent liabilities; settlement discussions or negotiations; the Company’s liquidity, financial performance, cash position and operations; the Company’s strategy; risks and uncertainties associated with chapter 11 proceedings; the negative impacts on the Company’s businesses as a result of filing for and operating under chapter 11 protection; the time, terms and ability to complete a chapter 11 plan of reorganization or a sale of the Company’s businesses under Section 363 of the U.S. Bankruptcy Code or to pursue an alternative emergence transaction; the adequacy of the capital resources of the Company’s businesses and the difficulty in forecasting the liquidity requirements of the operations of the Company’s businesses; the unpredictability of the Company’s financial results while in chapter 11 proceedings; the Company’s ability to discharge claims in chapter 11 proceedings; negotiations with the holders of the Company’s indebtedness and its trade creditors and other significant creditors; risks and uncertainties with performing under the terms of the restructuring support agreement and any other arrangement with lenders or creditors while in chapter 11 proceedings; the Company’s ability to conduct business as usual; the Company’s ability to continue to serve customers, suppliers and other business partners at the high level of service and performance they have come to expect from the Company; the Company’s ability to continue to pay employees, suppliers and vendors; the ability to control costs during chapter 11 proceedings; adverse litigation; the risk that the Chapter 11 Cases may be converted to cases under chapter 7 of the Bankruptcy Code; the Company’s ability to secure operating capital; the Company’s ability to take advantage of opportunities to acquire assets with upside potential; the impact of competition, including the loss of exclusivity and generic competition; our ability to satisfy judgments or settlements or pursue appeals including bonding requirements; our ability to adjust to changing market conditions; our ability to attract and retain key personnel; our inability to maintain compliance with financial covenants and operating obligations which would expose us to potential events of default under our outstanding indebtedness; our ability to incur additional debt or equity financing for working capital, capital expenditures, business development, debt service requirements, acquisitions or general corporate or other purposes; our ability to refinance our indebtedness; a significant reduction in our short-term or long-term revenues which could cause us to be unable to fund our operations and liquidity needs or repay indebtedness; supply chain interruptions or difficulties; changes in competitive or market conditions; changes in legislation or regulatory developments; our ability to obtain and maintain adequate protection for our intellectual property rights; the timing and uncertainty of the results of both the research and development and regulatory processes, including regulatory decisions, product recalls, withdrawals and other unusual items; domestic and foreign health care and cost containment reforms, including government pricing, tax and reimbursement policies; technological advances and patents obtained by competitors; the performance, including the approval, introduction, and consumer and physician acceptance of new products and the continuing acceptance of currently marketed products; our ability to integrate any newly acquired products into our portfolio and achieve any financial or commercial expectations; the impact that known and unknown side effects may have on market perception and consumer preference for our products; the effectiveness of advertising and other promotional campaigns; the timely and successful implementation of any strategic initiatives; unfavorable publicity regarding the misuse of opioids; the uncertainty associated with the identification of and successful consummation and execution of external corporate development initiatives and strategic partnering transactions; our ability to advance our strategic priorities, develop our product pipeline and continue to develop the market for products; and our ability to obtain and successfully manufacture, maintain and distribute a sufficient supply of products to meet market demand in a timely manner. In addition, U.S. and international economic conditions, including consumer confidence and debt levels, taxation, changes in interest and currency exchange rates, international relations, capital and credit availability, the status of financial markets and institutions and the impact of continued economic volatility, can materially affect our results. Therefore, the reader is cautioned not to rely on these forward-looking statements. The Company expressly disclaims any intent or obligation to update these forward-looking statements, except as required to do so by law.

Additional information concerning risk factors, including those referenced above, can be found in press releases issued by the Company, as well as the Company’s public periodic filings with the U.S. Securities and Exchange Commission (the “SEC”) and with securities regulators in Canada, including the discussion under the heading “Risk Factors” in the Company’s most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or other filings with the SEC.

Copies of the Company’s press releases and additional information about the Company are available at www.endo.com or you can contact the Company’s Investor Relations Department at relations.investor@endo.com.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | |

| |

| ENDO INTERNATIONAL PLC |

|

| |

| By: | /s/ Matthew J. Maletta |

| Name: | Matthew J. Maletta |

| Title: | Executive Vice President,

Chief Legal Officer and Company Secretary |

Dated: December 29, 2023

v3.23.4

Document and Entity Information

|

Dec. 28, 2023 |

| Entity Information [Line Items] |

|

| Document Period End Date |

Dec. 28, 2023

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 28, 2023

|

| Entity Registrant Name |

Endo International plc

|

| Entity Central Index Key |

0001593034

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-36326

|

| Entity Tax Identification Number |

68-0683755

|

| Entity Address, Address Line One |

First Floor, Minerva House, Simmonscourt Road

|

| Entity Address, City or Town |

Ballsbridge, Dublin 4,

|

| Entity Address, Country |

IE

|

| Entity Address, Postal Zip Code |

Not Applicable

|

| City Area Code |

353

|

| Local Phone Number |

1-268-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

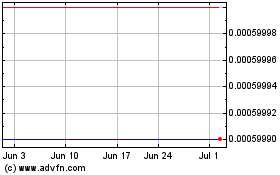

Endo (CE) (USOTC:ENDPQ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Endo (CE) (USOTC:ENDPQ)

Historical Stock Chart

From Apr 2023 to Apr 2024