false

0001347858

0001347858

2023-12-22

2023-12-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): December

22, 2023

22nd Century Group, Inc.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

001-36338 |

98-0468420 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

|

500 Seneca Street, Suite 508, Buffalo, New York

(Address of Principal Executive Office) |

14204

(Zip Code) |

Registrant’s

telephone number, including area code: (716) 270-1523

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

symbol |

Name

of each exchange on which registered |

| Common

Stock, $0.00001 par value |

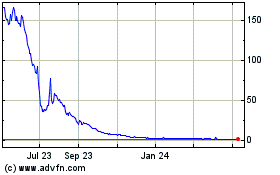

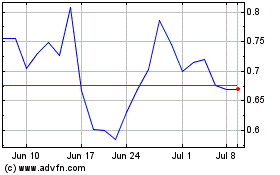

XXII |

NASDAQ Capital Market |

Item 1.01 Entry into

a Material Definitive Agreement

Equity Purchase Agreement

As previously announced,

on November 20, 2023, 22nd Century Group, Inc. (the “Company”) entered into an Equity Purchase Agreement (the “Purchase

Agreement”) with Specialty Acquisition Corporation, a Nevada corporation (the “Buyer”) pursuant to which

the Company agreed to sell substantially all of its equity interests in its GVB hemp/cannabis business (the “Purchased Interests”)

for a purchase price of $2,250,000 (the “Purchase Price”).

On December 22, 2023,

the Company and the Buyer entered into an Amendment to Equity Purchase Agreement (the “GVB Amendment”) pursuant to

which the Company and the Buyer increased the Purchase Price to $3,100,000 (the “New Purchase Price”) which consists

of (i) a cash payment of $1,100,000 to the Company’s senior lender, on behalf of and at the direction of the Company and (ii) a

12% secured promissory note issued by the Buyer to the Company’s senior lender, on behalf of and at the direction of the Company,

in an aggregate principal amount of $2,000,000 (the “Note”).

The parties previously

agreed that the Company would retain any insurance proceeds received in connection with the fire at the Grass Valley manufacturing facility

(the “Insurance Proceeds”) and up to the first $2,000,000 of the Insurance Proceeds would be used to offset the Buyer’s

portion of certain shared liabilities. Pursuant to the terms of the GVB Amendment, the Buyer will be entitled to offset its portion of

certain shared liabilities up to $1,000,000; provided that, the Insurance Proceeds exceed $5,000,000.

The foregoing description

of the GVB Amendment is qualified in its entirety by reference to the full text of the GVB Amendment, which is filed as Exhibit 10.1 hereto.

Senior Secured Credit

Facility

As previously disclosed

on March 3, 2023, the Company entered into that certain Securities Purchase Agreement (the “SPA”) with JGB Partners,

LP (“JGB Partners”), JGB Capital, LP (“JGB Capital”) and JGB Capital Offshore Ltd. (“JGB

Offshore” and collectively with JGB Partners and JGB Capital, the “Holders”) and JGB Collateral, LLC, as

collateral agent for the Holders (the “Agent”). Pursuant to the SPA, the Holders purchased (i) 7% Original Issue Discount

Senior Secured Debentures (the “Debentures”) of the Company and (ii) warrants to purchase up to 330,293 shares (after

the redemption of 166,667 warrants) shares of the Company’s common stock, par value $0.00001 per share.

On December 22, 2023,

the Company, the Holders and the Agent entered into an Amendment Agreement (the “JGB Amendment”) pursuant to which

the Holders and the Agent consented to the Purchase Agreement, as amended by the GVB Amendment. In consideration of the Holders and the

Agents’ consent, the Company agreed to (i) pay to the Agent, a cash payment of $2,200,000 to reduce the outstanding principal of

the Debentures (which includes the cash portion of the New Purchase Price paid directly to Agent by Buyer as described above), (ii) direct

the Buyer to issue the Note to the Agent, on the Company’s behalf, (iii) assign the Insurance Proceeds to the Agent until the outstanding

aggregate principal amount of the Debentures, plus accrued and unpaid interest, has been repaid in full; provided that the first

$1,000,000 of Insurance Proceeds in excess of $5,000,000 shall be applied as stated above, and (iv) post-closing within 30 days enter into a deed in lieu of foreclosure

agreement with respect to 224 acres of real property in Delta County, Colorado commonly known as Needle Rock Farms, resulting in a non-monetary

exchange yielding further debt reduction of $1,000,000.

Additionally, the Company,

the Holders and the Agent agreed to amend the Debentures to (i) allow the Holders to voluntarily convert the Debentures, in whole or in

part, into shares of the Company’s common stock (“Voluntary Conversion Option”) on the earlier of (i) June 30,

2024 and (ii) the public announcement of a Fundamental Transaction at a conversion price equal to the lower of (x) $1.00 per share and

(y) the closing sale price of the Company’s common stock on June 29, 2024 (the “Conversion Price”), and (ii)

include a mandatory prepayment of the outstanding principal of the Debentures in an amount equal to 20% of the net cash proceeds of any

issuance by the Company of any of its stock, or other Equity Interests (as defined in the Debentures) or the incurrence or issuance of

any indebtedness.

The Voluntary Conversion

Option is subject to the approval of the Company’s stockholders and the Company is required pursuant to the JGB Amendment to use

its commercially reasonable efforts to obtain such approval.

Additional terms of the

JGB Amendment include a financial covenant holiday through the third quarter of 2024 and revised certain covenants thereafter to reflect

the sale of the Purchased Interests, including lowering the Company’s quarterly revenue targets.

The JGB Amendment contains

customary reaffirmations, reconfirmations of security interests and subsidiary guarantees, and representations and warranties typical

for an amendment of this type.

The foregoing description

of the terms of the JGB Amendment and the amended Debentures does not purport to be complete and is qualified in its entirety by reference

to the JGB Amendment and Form of Amended Debentures which are attached hereto as Exhibit 10.2 and 4.1, respectively.

Cautionary Note Regarding

Forward-Looking Statements

Except for historical

information, all of the statements, expectations, and assumptions contained in this Form 8-K are forward-looking statements. Forward-looking

statements typically contain terms such as “anticipate,” “believe,” “consider,” “continue,”

“could,” “estimate,” “expect,” “explore,” “foresee,” “goal,” “guidance,”

“intend,” “likely,” “may,” “plan,” “potential,” “predict,” “preliminary,”

“probable,” “project,” “promising,” “seek,” “should,” “will,”

“would,” and similar expressions. Forward-looking statements include, but are not limited to, (i) our expectations regarding

the Insurance Proceeds, (ii) regarding the terms of the JGB Amendment, (iii) our ability to repay our debt to the Holders, (iv) expectations

for the use of proceeds of the sale of the Purchased interests, and (v) the Company’s ability to obtain shareholder approval. Actual

results might differ materially from those explicit or implicit in forward-looking statements. These forward-looking statements reflect

our current views about future events and involve assumptions which may be affected by risks and uncertainties in our business, as well

as other external factors, which could cause future results to materially differ from those expressed or implied in any forward-looking

statement. These risks include, but are not limited to the risks and uncertainties applicable to the Company and included in the Company’s

Annual Report on Form 10-K filed on March 9, 2023 and Quarterly Report on Form 10-Q filed May 9, 2023, August 14, 2023 and November 6,

2023. All information provided in this Form 8-K is as of the date hereof, and the Company assumes no obligation to and does not intend

to update these forward-looking statements, except as required by law.

Item 2.01. Completion

of Acquisition or Disposition of Assets.

On December 22, 2023,

the Company completed the sale of the Purchased Interests pursuant to the Purchase Agreement, as amended by the GVB Amendment. The consideration

for the sale of the Purchased Interests was determined by analyzing information related to the historical, current and future operations,

financial condition and prospects of the Purchased Interests, including a liquidation analysis, along with an analysis of market comparable

transactions. At the closing, the Company’s board of directors received an opinion as to the fairness, from a financial point of

view, of the consideration received by the Company pursuant to the Purchase Agreement, as amended by the GVB Amendment. The proceeds of

the sale of the Purchased Interests was used to repay amounts due under the amended Debentures.

The information required

by this item is included in Item 1.01 of this Current Report and is incorporated herein by reference.

Item 2.03. Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information required

by this item is included under “Senior Secured Credit Facility” in Item 1.01 of this Current Report and is incorporated

herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The information required

by this item with respect to the shares issuable upon conversion of the amended Debentures is included under “Senior Secured

Credit Facility” in Item 1.01 of this Current Report and is incorporated herein by reference.

The amended Debentures

and shares issuable upon conversion of the amended Debentures were issued in a private placement and were exempt from registration under

the Securities Act of 1933, as amended, in reliance on Section 4(a)(2) thereof as a transaction not involving a public offering and/or

Rule 506 of Regulation D promulgated thereunder. The amount of shares issuable upon conversion of the Amended Debentures will be calculated

based on the amount of amended Debentures the Holders converted divided by the Conversion Price.

Item 7.01. Regulation FD Disclosure.

On December 28, 2023, the Company issued a

press release regarding the GVB Amendment and the JGB Amendment and Form of Amended Debentures, a copy of which is attached hereto as

Exhibit 99.1.

Item 9.01: Financial Statements and Exhibits.

| (b) |

Pro Forma Financial Information. |

| |

|

The unaudited pro forma balance sheet as of September 30, 2023, and the related unaudited pro forma statement of operations and comprehensive loss for the nine month period ended September 30, 2023 and for the year ended December 31, 2022, and the related notes thereto, of the Company, after giving effect to the sale of the Purchased Interests, are filed as Exhibit 99.2 to this Current Report on Form 8-K and are incorporated herein by reference. |

(d) Exhibits.

| 4.1 |

Form of Amended Debenture (filed herewith). |

| 10.1 |

Amendment to Equity Purchae Agreement, dated December 22, 2023 (filed herewith). |

| 10.2 |

JGB Amendment Agreement, dated December 22, 2023 (filed herewith). |

| 99.1 |

Press Release dated December 28, 2023 (filed herewith). |

| 99.2 |

The unaudited pro forma balance sheet as of September 30, 2023, and the related unaudited pro forma statement of operations and comprehensive loss for the nine month period ended September 30, 2023 and for the year ended December 31, 2022, and the related notes thereto, of the Company, after giving effect to the sale of the Purchased Interests (filed herewith). |

| 104 |

Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

/s/ R. Hugh Kinsman |

| Date: December 28, 2023 |

R. Hugh Kinsman |

| |

Chief Financial Officer |

Exhibit 4.1

EXECUTION VERSION

NEITHER THIS SECURITY NOR THE SECURITIES ISSUABLE

HEREUNDER HAVE BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON

AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT

BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION

FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE

SECURITIES LAWS AS EVIDENCED BY A LEGAL OPINION OF COUNSEL TO THE TRANSFEROR TO SUCH EFFECT, THE SUBSTANCE OF WHICH SHALL BE REASONABLY

ACCEPTABLE TO THE COMPANY. THIS SECURITY AND THE SECURITIES ISSUABLE HEREUNDER MAY BE PLEDGED IN CONNECTION WITH A BONA FIDE MARGIN

ACCOUNT OR OTHER LOAN WITH A FINANCIAL INSTITUTION THAT IS AN “ACCREDITED INVESTOR” AS DEFINED IN RULE 501(a) UNDER THE

SECURITIES ACT OR OTHER LOAN SECURED BY SUCH SECURITIES TO THE EXTENT PERMITTED UNDER THE SECURITIES PURCHASE AGREEMENT DATED MARCH 3,

2023, AMONG THE COMPANY AND THE PURCHASERS SIGNATORY THERETO.

THIS DEBENTURE HAS BEEN ISSUED WITH ORIGINAL

ISSUE DISCOUNT (“OID”). PURSUANT TO TREASURY REGULATION §1.1275-3(b)(1), THE CHIEF FINANCIAL OFFICER OF THE COMPANY,

BEGINNING TEN (10) DAYS AFTER THE ISSUANCE DATE OF THIS DEBENTURE, WILL PROMPTLY MAKE AVAILABLE TO THE HOLDER UPON REQUEST THE INFORMATION

DESCRIBED IN TREASURY REGULATION §1.1275-3(b)(1)(i). THE CHIEF FINANCIAL OFFICER OF THE COMPANY MAY BE REACHED AT TELEPHONE

NUMBER (716) 270-1523.

Original Issue Date: March 3, 2023

$[__]

7%

ORIGINAL ISSUE DISCOUNT

SENIOR

SECURED DEBENTURE

DUE

March 3, 2026

THIS 7% ORIGINAL ISSUE

DISCOUNT SENIOR SECURED DEBENTURE is one of a series of duly authorized and validly issued 7% Original Issue Discount Senior Secured

Debentures of 22nd Century Group, Inc., a Nevada corporation, (the “Company”), having its principal place

of business at 500 Seneca Street, Suite 507, Buffalo, New York 14204 (this debenture, as amended, restated, supplemented or otherwise

modified from time to time, the “Debenture” and collectively with the other debentures of such series, the “Debentures”)

and is issued pursuant to the Purchase Agreement (as defined below).

FOR VALUE RECEIVED, the Company

promises to pay in cash to [__], or its registered assigns (the “Holder”), or shall have paid pursuant to the

terms hereunder, the principal sum of $[__] on March 3, 2026 (the “Maturity Date”) or such earlier date

as this Debenture is required or permitted to be repaid as provided hereunder, and to pay interest to the Holder on the aggregate then

outstanding principal amount of this Debenture in accordance with the provisions hereof. This Debenture is subject to the following additional

provisions:

Section 1. Definitions.

For the purposes hereof, in addition to the terms defined elsewhere in this Debenture, (a) capitalized terms not otherwise defined

herein shall have the meanings set forth in the Purchase Agreement and (b) the following terms shall have the following meanings:

“Agent”

means JGB Collateral LLC, a Delaware limited liability company.

“Applicable

Interest Rate” means an annual rate equal to 7.00%; provided, however, following the occurrence and during the continuance

of an Event of Default, the “Applicable Interest Rate” shall automatically, without notice or any other action

required by Holder, mean an annual rate equal to 12.00%.

“Available

Advance Shares” shall have the meaning set forth in Section 5(a)(iv).

“Bankruptcy

Event” means any of the following events: (a) the Company or any Subsidiary thereof commences a case or other proceeding

under any bankruptcy, reorganization, arrangement, adjustment of debt, relief of debtors, dissolution, insolvency or liquidation or similar

law of any jurisdiction relating to the Company or any Subsidiary thereof, (b) there is commenced against the Company or any Subsidiary

thereof any such case or proceeding that is not dismissed within sixty (60) days after commencement, (c) the Company or any Subsidiary

thereof is adjudicated insolvent or bankrupt or any order of relief or other order approving any such case or proceeding is entered, (d) the

Company or any Subsidiary thereof suffers any appointment of any custodian or the like for it or any substantial part of its property

that is not discharged or stayed within sixty (60) calendar days after such appointment, (e) the Company or any Subsidiary thereof

makes a general assignment for the benefit of creditors, (f) the Company or any Subsidiary thereof calls a meeting of its creditors

with a view to arranging a composition, adjustment or restructuring of its debts, (g) the Company or any Subsidiary thereof, by any

act or failure to act, expressly indicates its consent to, approval of or acquiescence in any of the foregoing or takes any corporate

or other action for the purpose of effecting any of the foregoing, or (h) the Company or any Subsidiary admits in writing its inability,

or is otherwise unable, to pay its debts generally as they become due.

“Beneficial

Ownership Limitation” shall have the meaning set forth in Section 5(h).

“Bloomberg”

means Bloomberg, L.P.

“Board

of Directors” means the board of directors of the Company.

“Buy-In”

shall have the meaning set forth in Section 5(e).

“Buy-In

Price” shall have the meaning set forth in Section 5(e).

“Change

of Control Put Period” has the meaning set forth in Section 3(b).

“Change

of Control Put Right” has the meaning set forth in Section 3(b).

“Change

of Control Transaction” means the occurrence after the date hereof of any of (a) an acquisition after the date hereof

by an individual or legal entity or “group” (as described in Rule 13d-5(b)(1) promulgated under the Exchange

Act) of effective control (whether through legal or beneficial ownership of capital stock of the Company, by contract or otherwise) of

in excess of 50% of the voting securities of the Company, (b) the Company merges into or consolidates with any other Person, or any

Person merges into or consolidates with the Company and, after giving effect to such transaction, the stockholders of the Company immediately

prior to such transaction own less than 50% of the aggregate voting power of the Company or the successor entity of such transaction,

or (c) the Company Disposes of all or substantially all of its assets to another Person.

“Closing

Sale Price” means, for any security as of any date, the last trade price for such security on the Principal Market for such

security, as reported by Bloomberg, or, if such Principal Market begins to operate on an extended hours basis and does not designate the

last trade price, then the last trade price of such security immediately prior to 4:00 P.M., New York City time, as reported by Bloomberg,

or if the foregoing do not apply, the last trade price of such security in the over-the-counter market on the electronic bulletin board

for such security as reported by Bloomberg, or, if no last trade price is reported for such security by Bloomberg, the average of the

last bid and ask prices of any market makers for such security as reported on OTC Pink (also known as the “pink sheets”) by

the OTC Markets, Inc. If the Closing Sale Price cannot be calculated for a security on a particular date on any of the foregoing

bases, the Closing Sale Price of such security on such date shall be the fair market value of such security as determined by an independent

appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the reasonable, actual and documented fees and

reasonable, actual and documented out-of-pocket expenses of which shall be paid by the Company.

“Collateral”

shall have the meaning given such term in the Security Agreement.

“Commission”

means the U.S. Securities Exchange Commission.

“Common

Stock Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire

at any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is

at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Company”

shall have the meaning given such term in the preambles hereto.

“Company

Counsel” means Greenberg Traurig, P.A., 401 East Las Olas Boulevard Suite 2000, Fort Lauderdale, FL 33301.

“Conversion

Date” shall have the meaning set forth in Section 5(b).

“Conversion

Price” shall have the meaning set forth in Section 5(b)(i).

“Conversion

Share Delivery Date” shall have the meaning set forth in Section 5(b)(ii).

“Conversion

Shares” means, collectively, the shares of Common Stock issuable upon conversion of this Debenture pursuant to Section 5(b).

“Debenture(s)”

shall have the meaning given such term in the preambles hereto.

“Debenture

Register” shall have the meaning set forth in Section 2(d).

“Debenture

Shares” means all Stock Payment Shares, Monthly Redemption Advance Shares, Interest Advance Shares, Interest True-Up

Shares and Conversion Shares.

“Delivery

Date” means (a) with respect to Stock Payment Shares, the applicable Holder Redemption Payment Date, (c) with

respect to Interest True-Up Shares, the applicable Interest Payment Date, (d) with respect to Interest Advance Shares, the applicable

Interest Advance Shares Date, (e) with respect to Monthly Redemption Advance Shares, the applicable Monthly Redemption Advance Date,

and (f) the first (1st) Trading Day after the delivery of the applicable Notice of Conversion.

“Delivery

Failure” shall have the meaning set forth in Section 5(e).

“Dispose”

and “Disposition” means the sale, transfer, license, lease or other disposition (including any sale and leaseback

transaction or by way of a merger) of any assets or property by any Person, including, without limitation, any sale, assignment, transfer

or other disposal, with or without recourse, of any notes or accounts receivable or any rights and claims associated therewith, in each

case, whether or not the consideration therefor consists of cash, securities or other assets owned by the acquiring Person, excluding

any sales of inventory in the ordinary course of business on ordinary business terms.

“Distribution”

shall have the meaning set forth in Section 6(c).

“Disqualified

Stock” shall mean, with respect to any person, any Equity Interests of such person that, by its terms (or by the terms of

any security or other Equity Interests into which it is convertible or for which it is exchangeable) or upon the happening of any event

or condition (a) matures or is mandatorily redeemable, pursuant to a sinking fund obligation or otherwise (except as a result of

a Change of Control Transaction so long as any rights of the holders thereof upon the occurrence of a Change of Control Transaction shall

be subject to the prior repayment in full of the Debentures), (b) is redeemable at the option of the holder thereof, in whole or

in part, (c) provides for the scheduled payments of dividends in cash, or (d) is or becomes convertible into or exchangeable

for Indebtedness or any other Equity Interests that would constitute Disqualified Stock.

“Domestic

Subsidiary” means any Subsidiary that is incorporated or organized under the laws of any state of the United States or the

District of Columbia, other than any such Subsidiary owned directly or indirectly by a Foreign Subsidiary.

“DTC”

means the Depository Trust Company.

“Equity

Conditions” means, during the period in question, (a) all of the shares of Common Stock issued, issuable or required

to be issued pursuant to the Transaction Documents may be resold pursuant to Rule 144 without volume or manner-of-sale restrictions

as set forth in a written opinion letter of Company Counsel to such effect, addressed and acceptable to the Transfer Agent and the Holder,

provided, however, this condition shall not be deemed satisfied during (1) any period that the Company is not in compliance with

the current public information requirements under Rule 144 or any information requirements of paragraph (i) of Rule 144,

if applicable, or (2) any Rule 12b-25 extension period with respect to any quarterly or annual report of the Company

that is not filed by the prescribed due date therefor (for the avoidance of doubt, without giving effect to any extension of such due

date), (b) the Common Stock is trading on a Trading Market and all of shares of Common Stock issued, issuable or required to be issued

pursuant to the Transaction Documents are listed or quoted for trading on such Trading Market (and the Company believes, in good faith,

that trading of the Common Stock on a Trading Market will continue uninterrupted for the foreseeable future) and the issuance of such

shares of Common Stock pursuant to the Transaction Documents would not violate the rules and regulations of any such Trading Market,

(c) there is a sufficient number of authorized but unissued and otherwise unreserved shares of Common Stock for the issuance of all

of the shares then issuable pursuant to the Transaction Documents, (d) there is no existing Event of Default and no existing event

which, with the expiration of cure period or the giving of notice, would constitute an Event of Default, (e) the issuance of the

shares of Common Stock in question to the Holder would not violate the limitations set forth in Section 5(h), (f) there

has been no public announcement of a pending or proposed Fundamental Transaction or Change of Control Transaction that has not been consummated,

(g) the applicable Holder is not in possession of any information provided by or on behalf of the Company that constitutes, or may

constitute, material non-public information, (h) the VWAP of the Common Stock is at least $0.75 per share (appropriately adjusted

for any stock split, stock dividend, stock combination, stock buy-back or other similar transaction) on each Trading Day, (i) the

Common Stock is DTC eligible (and not subject to “chill”) and the Company’s transfer agent is participating in DTC’s

Fast Automated Securities Transfer Program; and (j) the Holder, in its sole determination, are able to engage in transactions in

Common Stock on the Principal Market through reputable broker-dealers or otherwise on terms that are economical and commercially reasonable

to the Holder (it being understood, without limiting the foregoing, that if brokerage commissions and/or holders’ other out-of-pocket

costs would generally exceed, as determined by the holders in good faith, the difference between the market price for the Common Stock

and the Stock Payment Price, such a situation would not be economical or commercially reasonable).

“Equity

Conditions Failure” shall have the meaning set forth in Section 5(a)(iii).

“Equity

Interests” means, with respect to any Person, all of the shares of capital stock of (or other ownership or profit interests

in) such Person, all of the warrants, options or other rights for the purchase or acquisition from such Person of shares of capital stock

of (or other ownership or profit interests in) such Person, all of the securities convertible into or exchangeable for shares of capital

stock of (or other ownership or profit interests in) such Person or warrants, rights or options for the purchase or acquisition from such

Person of such shares (or such other interests), and all of the other ownership or profit interests in such Person (including partnership,

member or trust interests therein), whether voting or nonvoting, and whether or not such shares, warrants, options, rights or other interests

are outstanding on any date of determination.

“Event

of Default” shall have the meaning set forth in Section 8(a).

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“Exit

Payment” has the meaning set forth in Section 2(e).

“Foreign

Subsidiary” means any Subsidiary that is not a Domestic Subsidiary.

“Fundamental

Transaction” means (a) the Company, directly or indirectly, in one or more related transactions effects any merger

or consolidation of the Company with or into another Person, (b) the Company, directly or indirectly, effects any sale, lease, exclusive

license, assignment, transfer, conveyance or other disposition of all or substantially all of its assets in one or a series of related

transactions, (c) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Company or another Person)

is completed pursuant to which holders of Common Stock are permitted to sell, tender or exchange their shares for other securities, cash

or property and has been accepted by the holders of 50% or more of the outstanding Common Stock, (d) the Company, directly or indirectly,

in one or more related transactions effects any reclassification, reorganization or recapitalization of the Common Stock or any compulsory

share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other securities, cash or property, (e) the

Company, directly or indirectly, in one or more related transactions consummates a stock or share purchase agreement or other business

combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with another Person

whereby such other Person acquires more than 50% of the outstanding shares of Common Stock (not including any shares of Common Stock held

by the other Person or other Persons making or party to, or associated or Affiliated with the other Persons making or party to, such stock

or share purchase agreement or other business combination).

“Governmental

Authority” means any national, supranational, federal, state, county, provincial, local, municipal or other government or

political subdivision thereof (including any Regulatory Authority), whether domestic or foreign, and any agency, authority, commission,

ministry, instrumentality, regulatory body, court, tribunal, arbitrator, central bank or other Person exercising executive, legislative,

judicial, taxing, regulatory or administrative powers or functions of or pertaining to any such government.

“Holder”

shall have the meaning given such term in the preambles hereto.

“Holder

Redemption Amount” shall have the meaning set forth in Section 5(a)(i).

“Holder

Redemption Notice” shall have the meaning set forth in Section 5(a)(i).

“Holder

Redemption Payment Date” shall have the meaning set forth in Section 5(a)(i).

“Holder

Redemption Right” shall have the meaning set forth in Section 5(a)(i).

“Indebtedness”

of a Person shall include (a) all obligations for borrowed money or the deferred purchase price of property or services (excluding

trade credit, trade accounts payable and accrued expenses incurred in the ordinary course of business, together with any credit card indebtedness

incurred to pay any such trade credit, trade accounts payable and accrued expenses), (b) all obligations evidenced by bonds, debentures,

notes, or other similar instruments and all reimbursement or other obligations in respect of letters of credit (other than trade letters

of credit issued in the ordinary course of business), surety bonds, bankers acceptances, current swap agreements, interest rate hedging

agreements, interest rate swaps or other financial products, (c) all capital lease obligations (as determined in accordance with

GAAP), (d) all obligations or liabilities secured by a Lien on any asset of such Person, irrespective of whether such obligation

or liability is assumed by such Person, (e) any obligation arising with respect to any other transaction that is the functional equivalent

of borrowing but which does not constitute a liability on the balance sheets of such Person (excluding trade credit, trade accounts payable

and accrued expenses incurred in the ordinary course of business, together with any credit card indebtedness incurred to pay any such

trade credit, trade accounts payable and accrued expenses), (f) Disqualified Stock, and (g) any obligation guaranteeing or intended

to guarantee (whether directly or indirectly guaranteed, endorsed, co-made, discounted or sold with recourse) any of the foregoing obligations

of any other Person. Notwithstanding anything to the contrary set forth herein, (i) notwithstanding any change in GAAP after the

Original Issue Date that would require lease obligations that would be treated as operating leases as of the Original Issue Date to be

classified and accounted for as capital leases or otherwise reflected on the Company’s consolidated balance sheet, such obligations

shall continue to be treated as operating leases and shall be excluded from the definition of Indebtedness and (ii) any lease that

was entered into after the Original Issue Date that would have been considered an operating lease under GAAP in effect as of the Original

Issue Date shall be treated as an operating lease for all purposes under this Debenture, and obligations in respect thereof shall be excluded

from the definition of Indebtedness.

“Interest

Advance Shares” has the meaning set forth in Section 2(a).

“Interest

Advance Shares Date” has the meaning set forth in Section 2(a).

“Interest

Notice Period” means, with respect to each Interest Payment Date, the twenty (20) consecutive Trading Days immediately preceding

such Interest Payment Date.

“Interest

Payment Date” shall have the meaning set forth in Section 2(a).

“Interest

Share Amount” shall have the meaning set forth in Section 2(a).

“Interest

True-Up Shares” has the meaning set forth in Section 2(b).

“Investments”

means, as to any Person, any direct or indirect acquisition or investment by such Person, whether by means of (a) the purchase or

other acquisition (including by merger) of Equity Interests of another Person, (b) a loan, advance or capital contribution to, guarantee

or assumption of debt of, or purchase or other acquisition of any other debt or interest in, another Person, or (c) the purchase

or other acquisition (in one transaction or a series of transactions) of assets of another Person that constitute a business unit or all

or a substantial part of the business of, such Person.

“Lien”

means any mortgage, deed of trust, pledge, hypothecation, assignment for security, security interest, encumbrance, levy, lien or charge

of any kind, whether voluntarily incurred or arising by operation of law or otherwise, against any property, any conditional sale or other

title retention agreement, and any lease in the nature of a security interest.

“Material

Adverse Effect” means a material adverse effect upon: (a) the business, operations, properties, assets or financial

condition of the Company and its Subsidiaries taken as a whole; or (b) the ability of the Company or any Subsidiary to perform or

pay any of its respective obligations in accordance with the terms of the Transaction Documents, or the ability of Agent or Holder to

enforce any of its rights or remedies with respect to such obligations; or (c) the Collateral or Agent’s Liens on the Collateral

or the priority of such Liens (except, solely with respect to this clause (c) to the extent resulting from any action or inaction

of the Agent or any Holder); provided, that, solely for the purposes of Section 8(a)(xviii), any effect resulting from

any of the following shall not be considered when determining whether a Material Adverse Effect shall have occurred: (i) conditions

affecting generally the United States economy, including the financial, credit, or securities markets, (ii) acts of terrorism, armed

hostilities or war, including civil unrest or cyberattacks, (iii) any change in law or GAAP, or the interpretation thereof, (iv) the

execution and delivery of the Purchase Agreement or the Debentures, the public announcement or the pendency of Purchase Agreement or the

Debentures or the pendency or consummation of the transactions contemplated by the Purchase Agreement or the Debentures and the taking

of any action required by the Purchase Agreement or the Debentures, (v) natural disasters or acts of God, including pandemics, (vi) any

changes in conditions generally affecting the industry in which the Company and its Subsidiaries operate, or (vii) fluctuations in

the trading price of shares of the capital stock of the Company (it being understood and agreed that the circumstances underlying any

such fluctuations may, unless otherwise excluded by another clause in this definition, be taken into account in determining whether a

Material Adverse Effect has occurred or would be reasonably likely to occur), except, in the case of clauses (i), (ii) and (vi),

to the extent (and only to the extent) that the Company and its Subsidiaries are materially disproportionately impacted, or would reasonably

be expected to be materially disproportionately impacted, by such events in comparison to others in the industry in which the Company

and its Subsidiaries operate.

“Maturity

Date” shall have the meaning given such term in the preambles hereto.

“Monthly

Allowance” means, with respect to each calendar month commencing with the calendar month of May, 2024, a portion of the

principal amount of this Debenture equal to two (2%) percent of the original principal amount of this Debenture.

“Monthly

Redemption Advance Date” shall have the meaning set forth in Section 5(a)(ii).

“Monthly

Redemption Advance Shares” shall have the meaning set forth in Section 5(a)(ii).

“Needle

Rock Ranch” means the approximately 224 acres of real property located in Delta County, Colorado having an address of 41437

Cottonwood Creek Rd, Crawford, Colorado 81415 and more particularly described in the Deed of Trust.

“Net

Cash Proceeds” means, with respect to, any issuance or incurrence of any Indebtedness or equity issuance by the Company,

the aggregate amount of cash received (directly or indirectly) from time to time (whether as initial consideration or through the payment

or disposition of deferred consideration) by or on behalf of the Company, in connection therewith after deducting therefrom (a) reasonable

expenses related thereto incurred by the Company in connection therewith (including, in the case of any issuance or incurrence of Indebtedness,

reasonable commissions, costs, underwriting discounts and other fees and expenses incurred and required to be paid in connection therewith),

(b) transfer taxes paid to any taxing authorities by the Company in connection therewith, and (c) net income taxes to be paid

in connection therewith (after taking into account any tax credits or deductions), in each case, to the extent, but only to the extent,

that the amounts so deducted are (i) actually paid to the Company that, except in the case of reasonable out-of-pocket expenses,

is not an affiliate of the Company and (ii) properly attributable to such transaction or to the asset that is the subject thereof.

“New

York Courts” shall have the meaning set forth in Section 9(d).

“Notice

of Conversion” shall have the meaning set forth in Section 5(b).

“Original

Issue Date” means March 3, 2023, regardless of any transfers of the Debenture or amendments to the Debenture and regardless

of the number of instruments which may be issued to evidence the Debenture.

“Permitted

Dispositions” means (a) sales of inventory in the ordinary course of business, (b) the sale, lease, sub-lease,

assignment, conveyance, transfer, license, exchange or disposition of inventory or services or other assets, including the non-exclusive

license (as licensor or sublicensor) of intellectual property, in each case, in the ordinary course of business consistent with past practice,

(c) the sale or discount, in each case without recourse and in the ordinary course of business consistent with past practice, by

the Company or its Subsidiaries of accounts receivable or notes receivable arising in the ordinary course of business, but only in connection

with the compromise or collection thereof or in connection with the bankruptcy or reorganization of the applicable account debtors and

dispositions of any securities or other Investments received in any such bankruptcy or reorganization, (d) the sale, lease, sub-lease,

assignment, conveyance, transfer, license, exchange or disposition of used, worn out, obsolete or surplus property by the Company or its

Subsidiaries, including the abandonment or other disposition of intellectual property, in each case, which, in the reasonable judgment

of the Company, is no longer economically practicable to maintain or useful in the conduct of the business of the Company and its Subsidiaries,

taken as a whole, (e) terminations of leases, subleases, licenses and sublicenses in the ordinary course of business, (f) the

use or other disposition of cash and cash equivalents in the ordinary course of business and (g) other transfers of assets having

a fair market value of not more than $250,000 in the aggregate during any fiscal year.

“Permitted

Indebtedness” means (a) the Indebtedness evidenced by the Debentures, (b) capital lease obligations and purchase

money indebtedness of up to One Hundred Fifty Thousand Dollars $150,000, in the aggregate, at any one time outstanding incurred in connection

with the acquisition of capital assets and lease obligations with respect to newly acquired or leased assets, provided that such lease

obligations and purchase money indebtedness are only recourse to the assets being acquired or leased, (c) Subordinated Indebtedness,

(d) other Indebtedness outstanding on the Original Issue Date identified on Schedule A hereto, (e) Indebtedness

of the Company or its Subsidiaries in an aggregate principal amount not to exceed $500,000 at any one time outstanding and (f) any

guarantees of any Permitted Indebtedness.

“Permitted

Investment” means: (a) Investments existing on, or contemplated to occur following, the Original Issue Date which are

disclosed on Schedule B; (b) (i) U.S. Treasury bills, notes, and bonds maturing within 1 year from the date of

acquisition thereof, (ii) U.S. agency and government-sponsored entity debt obligations maturing within one 1 year from the date of

acquisition thereof, and (iii) U.S. Securities and Exchange Commission-registered money market funds that have a minimum of $1,000,000,000

in assets, (c) Investments consisting of notes receivable of, or prepaid royalties and other credit extensions and advances, to customers,

suppliers, contract manufacturers, and/or licensors who are not Affiliates, in the ordinary course of business, provided that this subparagraph

(c) shall not apply to Investments of the Company in any Subsidiary, (d) Investments in newly-formed or newly-acquired Domestic

Subsidiaries, provided that each such Domestic Subsidiary promptly executes a joinder to the Subsidiary Guaranty and a joinder to the

Security Agreement, in each case, in a form reasonably acceptable to the Holder, (e) Investments in Foreign Subsidiaries either (x) in

an aggregate amount not in excess of $500,000 in the aggregate during any fiscal year, or (y) that are otherwise approved in advance

by the Agent in writing, (f) Investments by the Company or any Qualified Subsidiary in any Qualified Subsidiary, (g) Investments

received in satisfaction or partial satisfaction thereof from financially troubled account debtors or pursuant to any plan of reorganization

or similar arrangement upon the bankruptcy or insolvency of such account debtors, (h) deposits, prepayments and other credits to

suppliers made in the ordinary course of business or consistent with the past practices of the Company and its Subsidiaries, (i) Investments

made in the ordinary course of business consisting of negotiable instruments held for collection in the ordinary course of business and

lease, utility and other similar deposits in the ordinary course of business, (j) guarantees or other contingent obligations constituting

Permitted Indebtedness, (k) advances, loans or extensions of credit to officers, members of the Board of Directors, and employees

of the Company or any of its Subsidiaries in the ordinary course of business for travel, entertainment or relocation, out-of-pocket or

other business-related expenses, (l) Indebtedness owing to insurance companies and insurance brokers incurred in connection with

the financing of insurance premiums in the ordinary course of business and (m) additional Investments that do not exceed $500,000

in the aggregate in any fiscal year.

“Permitted

Lien” means the individual and collective reference to the following: (a) Liens for taxes, assessments and other governmental

charges or levies not yet due or Liens for taxes, assessments and other governmental charges or levies being contested in good faith and

by appropriate proceedings for which adequate reserves (in the good faith judgment of the management of the Company) have been established

in accordance with GAAP, (b) Liens imposed by law which were incurred in the ordinary course of business of the Company or any of

its Subsidiaries, such as carriers’, warehousemen’s and mechanics’ Liens, statutory landlords’ Liens, and other

similar Liens arising in the ordinary course of business of the Company or any of its Subsidiaries, and which (x) do not individually

or in the aggregate materially detract from the value of the property or assets subject to such Lien or materially impair the use thereof

in the operation of the business of the Company and its consolidated Subsidiaries or (y) are being contested in good faith by appropriate

proceedings, which proceedings have the effect of preventing for the foreseeable future the forfeiture or sale of the property or asset

subject to such Lien, (c) Liens in favor of the Agent, (d) Liens for reasonable and customary banking fees granted to banks

or other financial institutions in the ordinary course of business in connection with, and which solely encumber, deposit, disbursement

or concentration accounts (other than in connection with borrowed money) maintained with such banks or financial institutions, (e) Liens

in respect of any Indebtedness referred to in clause (b) of the definition of “Permitted Indebtedness”, (f) pledges

or deposits in the ordinary course of business in connection with workers’ compensation, unemployment insurance and other social

security legislation, (g) covenants, conditions, easements, rights-of-way, building codes, restrictions (including zoning restrictions),

encroachments, licenses, protrusions and other similar encumbrances, minor title defects or irregularities, in each case affecting real

estate assets and that do not, individually or in the aggregate materially interfere with the ordinary conduct of the business of the

Company and its Subsidiaries or materially affect the value of or current and contemplated uses of the real estate assets, (h) any

interest or title of a lessor, sub-lessor, licensor or sub-licensor under leases, subleases, licenses or sublicenses entered into by the

Company or any of its Subsidiaries in the ordinary course of business, (i) purported Liens evidenced by the filing of precautionary

UCC filings in connection with operating leases and subleases in the ordinary course of business, (j) Liens securing obligations

of the Company and its Subsidiaries not to exceed $500,000 at any one time outstanding, (k) Liens on insurance policies and proceeds

thereof securing obligations incurred to pay annual insurance premiums or Liens on premium refunds in respect of insurance policies and

proceeds thereof granted in favor of insurance companies, in each case, in the ordinary course of business, (l) deposits, prepayments

and other credits to suppliers and landlords made in the ordinary course of business and consistent with the past practices of the Company

and its Subsidiaries in an aggregate amount not to exceed $250,000 at any time outstanding, and (m) Liens existing on the Original

Issue Date which are disclosed on Schedule C.

“Prepayment

Amount” means, with respect to any payment of this Debenture prior to the Maturity Date pursuant to Section 3(a),

Section 3(b) or Section 8(b), the entire outstanding principal balance (including, for the

avoidance of doubt, any original issue discount) of this Debenture, all accrued and unpaid interest thereon, and all other amounts due

and payable under this Debenture, together with the Prepayment Premium.

“Prepayment

Date” shall have the meaning set forth in Section 3(a).

“Prepayment

Notice” shall have the meaning set forth in Section 3(a).

“Prepayment

Notice Date” shall have the meaning set forth in Section 3(a).

“Prepayment

Period” shall have the meaning set forth in Section 3(a).

“Prepayment

Premium” means, in connection with any prepayment of this Debenture in full prior to the Maturity Date pursuant to Section 3(a), Section 3(b) or Section 8(b),

an amount equal to three percent (3%) of the principal amount of this Debenture prepaid on such date.

“Principal

Market” means the Nasdaq Capital Market or such other Trading Market where the Common Stock is then listed or quoted.

“Pro

Rata Share” means, with respect to the value or amount in question, the Holder’s pro rata share thereof based on the

outstanding principal balance of this Debenture relative to the aggregate outstanding principal balance of all Debentures.

“Purchase

Agreement” means that certain Securities Purchase Agreement, dated as of March 3, 2023, among the Company and the purchasers

signatory thereto (including the original Holder), as amended, modified or supplemented from time to time in accordance with its terms.

“Purchase

Rights” has the meaning set forth in Section 6(d).

“Qualified

Subsidiary” means any Subsidiary that has guaranteed the Company’s obligations hereunder and granted to the Holder

or the Agent a first ranking (subject to Permitted Liens) security interest in substantially all of the assets of such Subsidiary.

“Repudiation”

shall have the meaning set forth in Section 5(d).

“Revenue

Target” shall have the meaning set forth in Section 7(d).

“Securities

Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Stock

Off” shall have the meaning set forth in Section 5(a)(ii).

“Stock

On” shall have the meaning set forth in Section 5(a)(ii).

“Stock

On/Off Notice” shall have the meaning set forth in Section 5(a)(ii).

“Stock

Payment Price” means, with respect to the Monthly Redemption Advance Date, the date of the Holder Redemption Notice, Interest

Shares Advance Date or Interest Payment Date in question, the lesser of (a) 85% of the average of the daily VWAP for each of the

twenty (20) consecutive Trading Days immediately preceding such date and (b) 90% of the VWAP for the Trading Day immediately preceding

such date.

“Stock

Payment Shares” shall have the meaning set forth in Section 5(a)(iv).

“Subordinated

Indebtedness” means (i) Indebtedness in respect of the subordinated Promissory Note in the principal amount of $2,700,000

made by ESI Holdings, LLC payable to Omnia Ventures, Inc., and (ii) any other Indebtedness that is expressly subordinated to

the Indebtedness to the Holder pursuant to a written subordination agreement and/or inter-creditor agreement satisfactory to the Holder

in its sole discretion.

“Subsidiary”

means an entity, whether corporate, partnership, limited liability company, joint venture or otherwise, in which the Company owns or controls

a majority of the total voting power of the outstanding voting securities, including each entity listed on Schedule D hereto.

“Successor

Entity” shall have the meaning set forth in Section 6.

“Trading

Day” means a day on which the Principal Market is open for trading.

“Trading

Market” means any of the following markets or exchanges on which the Common Stock is listed or quoted for trading on the

date in question: the NYSE American, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange or the Principal

Market (or any successors to any of the foregoing).

“Volume

Limitation” means 15% of the aggregate trading volume of the Common Stock on the Principal Market (or other applicable Trading

Market) over the twenty (20) consecutive Trading Day period ending on the Trading Day immediately preceding the date of any Holder Redemption

Notice or the commencement of any Interest Notice Period.

“VWAP”

means, for any date, the price determined by the first of the following clauses that applies: (a) if the Common Stock is then listed

or quoted on a Trading Market, the daily volume weighted average price of the Common Stock for such date (or the nearest preceding date)

on the Trading Market on which the Common Stock is then listed or quoted as reported by Bloomberg (based on a Trading Day from 9:30 a.m. (local

time in New York City, New York) to 4:00 p.m. (local time in New York City, New York)), (b) if NASDAQCM is not a Trading Market,

the volume weighted average price of the Common Stock for such date (or the nearest preceding date) on NASDAQCM, (c) if the Common

Stock is not then listed or quoted for trading on NASDAQCM and if prices for the Common Stock are then reported in the “Pink Sheets”

published by OTC Markets Group, Inc. (or a similar organization or agency succeeding to its functions of reporting prices), the most

recent bid price per share of the Common Stock so reported, or (d) in all other cases, the fair market value of a share of Common

Stock as determined by an independent appraiser selected in good faith by the Holder and reasonably acceptable to the Company, the reasonable,

actual and documented fees and reasonable, actual and documented out-of-pocket expenses of which shall be paid by the Company.

Section 2. Interest;

Exit Payment.

a) Payment

of Interest in Cash or Common Stock. The Company shall pay interest to the Holder on the aggregate then outstanding principal amount

of this Debenture at the Applicable Interest Rate, payable monthly in arrears as of the last Trading Day of each calendar month and on

the Maturity Date (each such date, an “Interest Payment Date”) (if any Interest Payment Date is not a Business

Day, then the applicable payment shall be due on the next succeeding Business Day), in cash or, at the Company’s election in duly

authorized, validly issued and fully paid shares of Common Stock at the Stock Payment Price on the Interest Payment Date, or a combination

thereof (the amount to be paid in shares of Common Stock, the “Interest Share Amount”). Notwithstanding anything

contained herein to the contrary, any payment of interest in shares of Common Stock may only occur if (i) all of the Equity Conditions

have been met (unless waived by the Holder in writing) during the twenty (20) Trading Days immediately prior to the applicable Interest

Payment Date and through and including the date such shares of Common Stock are actually issued to the Holder, (ii) the Company shall

have given the Holder notice in accordance with the notice requirements set forth below and (iii) as to such Interest Payment Date,

prior to such Interest Notice Period (but not more than three (3) Trading Days prior to the commencement of such Interest Notice

Period), the Company shall have delivered to the Holder's or its broker's DTC account the number of shares of Common Stock to be applied

against such Interest Share Amount equal to the quotient (such quotient of (x) and (y), the “Interest Advance Shares”)

of (x) the applicable Interest Share Amount divided by (y) the Stock Payment Price assuming for such purposes that the Interest

Payment Date is the third (3rd) Trading Day immediately prior to the commencement of the Interest Notice Period (the “Interest

Advance Shares Date”). In the event that the number of Interest Advance Shares or Interest True-Up Shares (in the aggregate

with the number of Monthly Redemption Advance Shares and Stock Payment Shares, if any, issued to the holder during the applicable Interest

Notice Period) exceeds the Volume Limit for any Interest Payment Date, or the delivery of Interest Advance Shares or Interest True Up

Shares would cause the Beneficial Ownership Limitation to be exceeded, then the Company shall pay the portion of the Interest Share Amount

that would be in excess of the Dollar Volume Limitation or would cause the Holder to exceed the Beneficial Ownership Limitation in cash.

b) Company’s

Election to Pay Interest in Cash or Common Stock. Subject to the terms and conditions herein, including the last sentence of Section 2(a),

the decision whether to pay interest hereunder in cash, shares of Common Stock or a combination thereof shall be at the sole discretion

of the Company. Subject to the last sentence of Section 2(a), prior to the commencement of any Interest Notice Period,

the Company, if it desires to make an election to pay any interest due on the related Interest Payment Date in shares of Common Stock

or in a combination of cash and shares of Common Stock, shall deliver to the Holder a written notice of such election and setting forth

the Interest Share Amount as to such Interest Payment Date, provided that the Company may indicate in such notice that the election contained

in such notice shall apply to future Interest Payment Dates until revised by a subsequent notice. During any Interest Notice Period, the

Company’s election (whether specific to an Interest Payment Date or continuous) shall be irrevocable as to such Interest Payment

Date. Subject to the aforementioned conditions, failure to timely deliver such written notice to the Holder shall be deemed an election

by the Company to pay the interest on such Interest Payment Date in cash. On the Interest Payment Date, the Company shall issue to the

Holder a number of shares of Common Stock (if any) (“Interest True-Up Shares”) equal to the excess, if any,

of (A) the Interest Share Amount divided by the Stock Payment Price for the Interest Payment Date over (B) the number of Interest

Advance Shares actually issued to the Holder on the related Interest Advance Shares Date. With respect to any Interest Payment Date, to

the extent that the number of Interest Advance Shares exceeds the quotient obtained by dividing the Interest Share Amount divided by the

Stock Payment Price for the Interest Payment Date, then (x) the Holder will retain the excess Interest Advance Shares in partial

satisfaction of the obligation of the Company to deliver Interest Advance Shares in respect of the next month on which the Company elects

to pay interest in shares of Common Stock; and (y) such retained Interest Advance Shares will be taken into account for purposes

of calculating clause (B) above with respect to such month.

c) Exception

for Interest on Holder Principal Redemption Amount. Notwithstanding the foregoing, if the Holder exercises its Holder Redemption Right

with respect to a Holder Redemption Amount for any calendar month, then accrued and unpaid interest on such Holder Redemption Amount shall

be due on the related Holder Redemption Payment Date and will be paid in accordance with Section 5(a) and will

not be subject to Section 2(a) and Section 2(b).

d) Interest

Calculations. Interest shall be calculated on the basis of a 365-day (or, if applicable, a 366-day) year and the actual number of

days elapsed, and shall accrue daily commencing on the Original Issue Date until payment in full of the outstanding principal (including,

for the avoidance of doubt, any original issue discount), together with all accrued and unpaid interest, liquidated damages and other

amounts which may become due hereunder, has been made. Interest hereunder will be paid to the Person in whose name this Debenture is registered

on the records of the Company regarding registration and transfers of this Debenture (the “Debenture Register”)

or such Person’s designee identified to the Company in writing.

e) Exit

Payment. On the Maturity Date or any other date when the Debenture is paid in full pursuant to Section 3(a), Section 3(b),

Section 8(b) or otherwise, the Company will pay to the Holder an exit payment equal to five percent 5% of the

original principal amount of this Debenture, which is $[__] (the “Exit Payment”).

Section 3. Prepayment.

a) Prepayment

at the Option of the Company. Subject to the provisions of this Section 3(a), at any time after March 3, 2024,

the Company may deliver a notice to the Holder and the holders of the other outstanding Debentures (a “Prepayment Notice”

and the date such notice is deemed delivered hereunder, the “Prepayment Notice Date”) of its irrevocable election

to redeem all, but not less than all, of the then outstanding principal amount of this Debenture and the other outstanding Debentures

(including, for the avoidance of doubt, any original issue discount) for cash in an amount equal to the Prepayment Amount and the Exit

Payment on the thirtieth (30th) Trading Day following the Prepayment Notice Date (such date, the “Prepayment Date”,

such thirty (30) Trading Day period, the “Prepayment Period”). The Prepayment Amount and the Exit Payment shall

be due and payable in full in cash on the Prepayment Date. The Company covenants and agrees that, to the extent that this Debenture is

Stock On, it will honor all Holder Redemption Notices, tendered from the time of delivery of the Prepayment Notice through the date all

amounts owing thereon are due and paid in full. The Company will, concurrently with the delivery of the Prepayment Notice to the Holder,

publicly announce its intention to prepay this Debenture by means of a Current Report on Form 8-K filed with the Commission. If any

portion of Prepayment Amount shall not be paid by the Company by the Prepayment Date, interest shall accrue thereon at an interest rate

equal to the lesser of ten percent (10%) per annum or the maximum rate permitted by applicable law until such amount is paid in full.

Notwithstanding anything herein contained to the contrary, if any portion of the Prepayment Amount remains unpaid after the Prepayment

Date, then the Holder may elect, by written notice to the Company given at any time thereafter, to invalidate such prepayment, ab initio.

For the avoidance of doubt, the Company may not prepay this Debenture pursuant to this Section 3(a) prior to March 3,

2024.

b) Prepayment

at the Option of the Holder. The Holder may require the Company to prepay the entire outstanding principal amount of this Debenture

(including, for the avoidance of doubt, any original issue discount) for cash in an amount equal to the Prepayment Amount and the Exit

Payment (the “Change of Control Put Right”), at any time following the Company’s entry into a definitive

agreement for a Change of Control Transaction until the twentieth (20th) Trading Day following the consummation of such Change

in Control Transaction (the “Change of Control Put Period”). The Holder may exercise the Change of Control Put

Right by delivering a written notice to the Company at any time during the Change of Control Put Period and the Change of the Control

Prepayment Amount and the Exit Payment shall be due and payable in cash on the third (3rd) Trading Day following the Company’s

receipt of such notice.

c) Mandatory

Prepayment.

i. Commencing

January 25, 2024, concurrently with the issuance by the Company of any of its stock or other Equity Interests, Company shall prepay

the outstanding principal of this Debenture and the other outstanding Debentures in the amount equal to twenty percent (20%) of the Net

Cash Proceeds thereof (which such prepayment shall be applied among Debenture and the other outstanding Debentures pro rata based on the

relative outstanding principal balances thereof).

ii. Commencing

January 25, 2024, concurrently with the incurrence or issuance by the Company of any Indebtedness (other than Permitted Indebtedness),

Company shall prepay the outstanding principal of this Debenture and the other outstanding Debentures in the amount equal to twenty percent

(20%) of the Net Cash Proceeds thereof (which such prepayment shall be applied among Debenture and the other outstanding Debentures pro

rata based on the relative outstanding principal balances thereof).

Section 4. Registration

of Transfers and Exchanges.

a) Different

Denominations. This Debenture is exchangeable for an equal aggregate principal amount of Debentures of different authorized denominations,

as requested by the Holder surrendering the same. No service charge will be payable for such registration of transfer or exchange.

b) Investment

Representations. This Debenture has been issued subject to certain investment representations of the original Holder set forth in

the Purchase Agreement and may be transferred or exchanged only in compliance with the Purchase Agreement and applicable federal and state

securities laws and regulations.

c) Reliance

on Debenture Register. Prior to due presentment for transfer to the Company of this Debenture, the Company and any agent of the Company

may treat the Person in whose name this Debenture is duly registered on the Debenture Register as the owner hereof for the purpose of

receiving payment as herein provided and for all other purposes, whether or not this Debenture is overdue, and neither the Company nor

any such agent shall be affected by notice to the contrary.

Section 5. Monthly

Redemption; Voluntary Conversion; Delivery of Debenture Shares.

a) Monthly

Redemption.

i. Commencing

with the calendar month of March, 2024, the Holder shall have the right, at its option, to require the Company to redeem up to the Monthly

Allowance (plus accrued and unpaid interest) per calendar month (the “Holder Redemption Right) in accordance with

this Section 5(a). The Holder may exercise its Holder Redemption Right for a calendar month, at any time and from time

to time, during such calendar month, by sending one or more written notices, the form of which is attached hereto as Annex A

(each a “Holder Redemption Notice”), to the Company by not later than 11:59:59 P.M. (local time in New

York, New York) on the last Trading Day of such calendar month, which Holder Redemption Notices shall specify the principal amount to

be redeemed and the amount of accrued and unpaid interest thereon (together, the “Holder Redemption Amount”).

The Company shall promptly, but in any event no more than two (2) Trading Days after the date that the Holder delivers a Holder Redemption

Notice to the Company (the “Holder Redemption Payment Date”) (1) if this Debenture is Stock Off, on the

date that the Holder delivers the Holder Redemption Notice to the Company, pay to the Holder in cash by wire transfer of immediately available

funds an amount equal to the Holder Redemption Amount specified in the Holder Redemption Notice or (2) if this Debenture is Stock

On, on the date that the Company delivers the Holder Redemption Notice to the Company, deliver to the Holder shares of Common Stock as

provided in this Section 5(a). For the avoidance of doubt, payment in cash or shares of Common Stock shall be determined

according to the status of the Debenture as Stock On or Stock Off on the date that the Holder delivers the Holder Redemption Notice to

the Company and not the Holder Redemption Payment Date. For the further avoidance of doubt, the Holder and the Company agree that the

Holder may deliver more than one (1) Holder Redemption Notice during a calendar month provided that the sum of the Holder Redemption

Amounts set forth in all of the Holder Redemption Notices delivered during such calendar month does not exceed the Monthly Allowance (plus

accrued and unpaid interest). For the further avoidance of doubt, no reduction in the outstanding principal amount of this Debenture (as

a result of redemption or otherwise) shall reduce or otherwise have any effect on the amount of the Monthly Allowance, which shall remain

unchanged regardless of any such reduction in the outstanding principal amount of this Debenture, except that the Monthly Allowance shall

not exceed the outstanding principal amount of this Debenture plus accrued and unpaid interest thereon.

ii. With

respect to each calendar month during the term of this Debenture, the Company shall elect whether this Debenture shall be Stock On or

Stock Off for such calendar month by delivering, on the fifth (5th) Trading Day prior to the first day of such calendar month,

a written notice (a “Stock On/Off Notice”) to the Holder of the Company’s election to pay any Holder Redemption

Amounts under Section 5(a)(i) in shares of Common Stock (“Stock On”) or in cash (“Stock

Off”) during such calendar month. For the avoidance of doubt, the Company shall make the same election of Stock On or Stock

Off with respect to all of the outstanding Debentures. If the Company fails to deliver the Stock On/Off Notice by the date required herein

for any calendar month, the Company shall be deemed to have delivered a Stock On/Off Notice electing Stock Off for such calendar month.

Once delivered (or deemed delivered) a Stock On/Off Notice shall be irrevocable as to the applicable calendar month and the Company may

not change its election for such calendar month. If the Company elects Stock On in such Stock On/Off Notice, then the Company shall certify

in such notice that the Equity Conditions are satisfied. In addition, to the extent that the Company elects Stock On, on the Trading Day

prior to the first day of the applicable calendar month (such Trading Day, the “Monthly Redemption Advance Date”),

the Company shall deliver to the Holder’s or its broker’s DTC account a number of freely tradable shares of Common Stock free

from restrictive legends (“Monthly Redemption Advance Shares”) equal to the quotient of (x) the Monthly

Allowance and (y) the Stock Payment Price. For example, if the Stock Payment Price for the applicable Monthly Redemption Advance

Date is $5.00 per share, then the Company shall deliver to the Holder a number of Monthly Redemption Advance Shares equal to 100,000 shares

(e.g., $500,000/$5.00). For the avoidance of doubt and purposes of clarification, the Monthly Redemption Advance Shares are an advance

on the Stock Payment Shares that the Holder anticipates receiving pursuant to Section 5(a)(iv) and shall not be

deemed a payment of principal or interest hereunder except as provided in Section 5(a)(iv).

iii. If

the Equity Conditions cease, for any reason, to be satisfied while this Debenture is Stock On (an “Equity Conditions Failure”),

then, unless such Equity Conditions Failure is waived in writing by the Holder, this Debenture shall immediately be deemed to be Stock

Off. The Company shall promptly, but in any event within one (1) Trading Day, notify the Holder of any Equity Conditions Failure

and, unless such Equity Conditions Failure is waived in writing by the Holder, the Company shall not be permitted to make any Holder Redemption

Payments during such calendar month in shares of Common Stock and all Holder Redemption Payments for the remainder of such calendar month

shall be made in cash as provided herein.

iv. With

respect to each Holder Redemption Notice delivered to the Company pursuant to Section 5(a)(i) at a time when this

Debenture was Stock On, subject to the provisions of this Section 5(a)(iv), the Company shall, in payment of the Holder

Redemption Amount deliver to the Holder a number of shares of Common Stock equal to the quotient of (x) the applicable Holder Redemption

Amount and (y) the Stock Payment Price (such quotient of (x) and (y), the “Stock Payment Shares”)

by not later than the applicable Holder Redemption Payment Date; provided, that if the Holder has actually received Monthly Redemption

Advance Shares, the number of Stock Payment Shares deliverable pursuant to the immediately preceding sentence shall be reduced (but not

below zero) by the excess (if any) of the Monthly Redemption Advance Shares actually received by the Holder over the aggregate

number of Stock Payment Shares that were deliverable pursuant to this Section 5(a)(iv) for all other prior Holder

Redemption Notices given during the same calendar month (such excess, as the Monthly Redemption Advance Shares may be further reduced

pursuant to the last sentence of Section 5(e), the “Available Advance Shares”). For example,

if, with respect to a particular calendar month, the Company delivered 100,000 Monthly Redemption Advance Shares on the Monthly Redemption

Advance Date, the Holder submits a Holder Redemption Notice which would result in the issuance of 60,000 Stock Payment Shares, then the

Monthly Redemption Advance Shares shall be deemed reduced by 60,000 shares, and the Available Advance Shares shall be 40,000 shares, and

if subsequently during such calendar month, the Holder submits a Holder Redemption Notice that would require the issuance of 45,000 Stock

Payment Shares, then the Monthly Redemption Advance Shares and the Available Advance Shares shall be deemed reduced to zero and the Company

shall be required to deliver 5,000 shares to the Holder. The Holder’s calculation of the Available Advance Shares set forth on the

Holder Redemption Notice shall be binding on the Company absent manifest error.

v. Notwithstanding

the foregoing or any other provision to the contrary contained herein, in the event that the number of Stock Payment Shares that the Company

would be required to deliver in respect of any Holder Redemption Notice, when aggregated with the Stock Payment Shares issued in respect