false

0001413754

0001413754

2023-12-21

2023-12-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 21, 2023

| MARIZYME,

INC. |

| (Exact

name of registrant as specified in its charter) |

| Nevada |

|

000-53223 |

|

82-5464863 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 555

Heritage Drive, Suite 205, Jupiter, Florida |

|

33458 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

| |

(561)

935-9955 |

|

| |

(Registrant’s

telephone number, including area code) |

|

| |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Not

applicable. |

|

|

|

|

Item

1.01 Entry into a Material Definitive Agreement.

Under

a letter agreement dated December 21, 2023 between Marizyme, Inc. (the “Company”) and Univest Securities, LLC (the “December

2023 Convertible Notes Letter Agreement”), the 10% Secured Convertible Promissory Notes that were issued pursuant to a certain

Unit Purchase Agreement, dated as of December 21, 2021, between the Company and the investor parties to such agreement (the “December

2021 Convertible Notes”), were amended in the following respects: (1) The maturity date of each of the December 2021 Convertible

Notes was extended from December 21, 2023 to December 21, 2024, and (2) the definition of the term “Mandatory Default Amount”

was amended to mean the amount equal to 135% of the outstanding principal and accrued and unpaid interest on each of the December 2021

Convertible Notes on the date on which the first Event of Default (as defined in each of the December 2021 Convertible Notes) has occurred

and the amount of accrued and unpaid interest on each of the December 2021 Convertible Notes from the date of the second anniversary

of the date of issuance (i.e., December 21, 2023) until the earlier of the date of the payment or conversion in full or the maturity

of each of such December 2021 Convertible Notes.

As

a result, at the current conversion price of $0.10 per share and as of the date of this report, additional accrued and unpaid interest

on each of the outstanding December 2021 Convertible Notes will become convertible into up to an additional 7,152,965 shares of common

stock in aggregate.

The

foregoing description of the terms of the December 2023 Convertible Notes Letter Agreement is qualified in its entirety by reference

to the full text of such document which is filed as Exhibit 10.1 to this Current Report on Form 8-K, and which is incorporated by reference

herein.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

3.02. Unregistered Sales of Equity Securities.

The

information set forth under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The offer

of securities pursuant to the amendment to the Convertible Notes to provide for conversion of the Amended Mandatory Default Amount and

the issuance of the Placement Agent Warrants described above was made in reliance on the exemption from registration provided by Section

4(a)(2) of the Securities Act and Rule 506(b) of Regulation D promulgated thereunder for transactions not involving a public offering.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, Marizyme, Inc. has duly caused this current report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date:

December 28, 2023 |

MARIZYME,

INC. |

| |

|

|

| |

By: |

/s/

David Barthel |

| |

|

David

Barthel |

| |

|

Chief

Executive Officer |

Exhibit

10.1

Marizyme,

Inc.

555

Heritage Drive, Suite 205

Jupiter,

Florida 33458

December

21, 2023

Univest

Securities, LLC

As

Unitholder Representative for the Investors

375 Park Avenue, 15th Floor

New

York, NY 10152

| Re: |

Amendment

to 10% Secured Convertible Promissory Notes |

Dear

Sirs:

Reference

is made to each (a) Unit Purchase Agreement dated as of December 21, 2021(each, as amended, superseded, replaced, or otherwise modified

from time to time, the “Unit Purchase Agreement”), between the Company and the investor identified therein (individually,

“Investor” and collectively, “Investors”); and (b) 10% Secured Convertible Promissory Note issued

to such Investor in connection with such Unit Purchase Agreement, if not repaid or converted in full or otherwise cancelled or fully

discharged in accordance with its terms or by law prior to the date hereof (as amended, superseded, replaced, or otherwise modified from

time to time, “Note”) issued to such Investor in connection with such Unit Purchase Agreement. Capitalized terms used

but not defined herein shall have the meanings given to them in the Unit Purchase Agreement, or if not defined therein, in the Note,

or if not defined therein, in any of the applicable Transaction Documents (as defined in the Unit Purchase Agreement), in each case as

of the date hereof.

This

letter agreement (this “Letter Agreement”) confirms our agreement to the amendment of each Note in order to amend

the Maturity Date (as defined in each note), the accrual of interest, and certain related matters. Univest Securities, LLC, as Unitholder

Representative for the Investors pursuant to Section

11.16

of each Unit Purchase Agreement, confirms that it has the authority to agree to the following amendment to each Note on behalf of each

Investor pursuant to Section 11.16.

In

consideration of the foregoing recitals and the covenants and agreements set forth herein, and other good and valuable consideration,

the receipt and sufficiency of which are hereby acknowledged, the Company and each Investor hereby agree as follows:

| |

(1) |

This

Letter Agreement shall be deemed to be included in the definition of “Transaction Documents” as such term is defined

by the Unit Purchase Agreement. |

| |

|

|

| |

(2) |

The

first line of nonbold text on the first page of each Note is amended and restated in its entirety to state, “10% Secured Convertible

Promissory Note”. |

| |

|

|

| |

(3) |

The

second line of nonbold text on the first page of each Note is amended to insert the words “on the first anniversary of”

following the text “Note due”. |

| |

|

|

| |

(4) |

The

second sentence of the second paragraph of nonbold text on the first page of each Note is amended and restated in its entirety to

state: “The outstanding principal balance of this Note and any interest on the aggregate unconverted and then outstanding principal

amount hereof shall be due and payable on the date that is the 36-month anniversary of the Issuance Date (the “Maturity

Date”) or at such earlier time as provided herein.” |

| |

|

|

| |

(5) |

Section

16.4(c) of each Note is amended and restated to read in its entirety as follows: |

| |

|

|

| |

|

“‘Mandatory

Default Amount’ means an amount equal to one hundred and thirty- five percent (135%) of the Outstanding Principal Amount and

accrued and unpaid interest on this Note on the date on which the first Event of Default has occurred hereunder and the amount of

accrued and unpaid interest on this Note from the date of the second anniversary of the Issuance Date of the Note until the earlier

of the date of the payment or conversion in full of the Note or the Maturity Date.” |

The

Company hereby reaffirms all such representations, warranties, obligations and liabilities and agrees that such representations, warranties,

obligations and liabilities shall remain in full force and effect.

The

execution, delivery and effectiveness of this Letter Agreement shall not, except as expressly provided herein, (A) waive or modify any

right, power or remedy under, or any other provision of, any of the Transaction Documents or (B) commit or otherwise obligate Investor

to enter into or consider entering into any other amendment, waiver or modification of any of the Transaction Documents.

All

communications and notices hereunder shall be given as provided in the Transaction Documents. This Letter Agreement (a) shall be governed

by and construed in accordance with the law of the State of Nevada, (b) except as otherwise provided in the Transaction Documents, is

for the exclusive benefit of the parties hereto and beneficiaries of the Unit Purchase Agreement and, together with the other Transaction

Documents, constitutes the entire agreement of such parties, superseding all prior agreements among them, with respect to the subject

matter hereof, (c) may be modified, waived or assigned only in writing and only to the extent such modification, waiver or assignment

would be permitted under the Transaction Documents (and any attempt to assign this Letter Agreement without such writing shall be null

and void), (d) is a negotiated document, entered into freely among the parties upon advice of their own counsel, and shall not be construed

against any of its drafters and (e) shall survive the satisfaction or discharge of the amounts owing under the Transaction Documents.

The fact that any term or provision of this Letter Agreement is held invalid, illegal or unenforceable as to any person in any situation

in any jurisdiction shall not affect the validity, enforceability or legality of the remaining terms or provisions hereof or the validity,

enforceability or legality of such offending term or provision in any other situation or jurisdiction or as applied to any person.

This

Letter Agreement is expressly conditioned on (a) the Company’s board of directors approving this Letter Agreement and all undertakings

thereto in all respects and written evidence of the same provided to the Unitholder Representative and (b) the Company filing within

four Business Days after the full execution and delivery of this Letter Agreement a current report on Form 8-K relating to the transactions

and amendments contained in this Letter Agreement, which current report shall describe the material terms and conditions herein; provided,

however, that at the reasonable request of an Investor the Company will use commercially reasonable efforts to file such report prior

to the time required herein.

Kindly

confirm your agreement with the above by signing in the space indicated below and by returning by email a partially executed PDF copy

of this letter to the undersigned, and which may be executed in identical counterparts, each of which shall be deemed an original but

all of which shall constitute one and the same agreement.

| |

Very

truly yours, |

| |

|

| |

Marizyme,

Inc. |

| |

|

|

| |

By: |

/s/

David Barthel |

| |

Name:

|

David

Barthel |

| |

Title: |

|

AGREED

AND ACCEPTED:

| Univest Securities, LLC, as Unitholder Representative for the Investors |

| |

|

|

| By: |

/s/

Bradley Richmond |

|

| Name:

|

Bradley

Richmond |

|

| Title: |

COO |

|

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

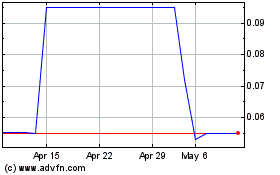

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

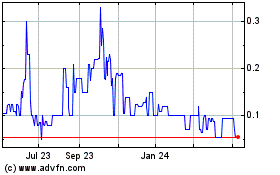

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Apr 2023 to Apr 2024