Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

December 27 2023 - 9:25AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

ISSUER PURSUANT TO RULE 13a -16 OR

15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of

December 2023

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check

mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

December

26, 2023

The

United States

Securities

and Exchange Commission

Washington

D.C. 20549

United

States of America

Attn:

Filing Desk

Dear

Sirs,

IBN

ICICI

Bank Limited (the ‘Company’) Report on Form 6-K

On

behalf of the Company, I am enclosing for filing, the Company’s Report on Form 6-K dated December 26, 2023 with respect to the

Semi Annual Report filed with Kanto Local Finance Bureau, Japan on December 25, 2023.

This

is for your reference and records.

Yours

sincerely,

For

ICICI Bank Limited

/s/ Vivek

Ranjan_____________

Vivek

Ranjan

Assistant

General Manager

Encl:

as above

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India. |

Tel.: (91-22) 2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012 |

Regd. Office: ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India |

Table of Contents

Item

| 1. | Form

6-K dated December 26, 2023 |

| 2. | Semi

Annual Report filed with the Kanto Local Finance Bureau, Japan on December 25, 2023 |

ICICI Bank Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India. |

Tel.: (91-22) 2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012 |

Regd. Office: ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India |

[Form No. 10]

Cover Page

| Document Name: |

Semi-Annual Report |

| |

|

| Filed with: |

Director of Kanto Local Finance Bureau |

| |

|

| Date of Filing: |

December 25, 2023 |

| |

|

| For Six-month Period: |

From April 1, 2023 through September 30, 2023 |

| |

|

| Corporate Name: |

ICICI Bank Limited |

| |

|

| Name and Title of Representative: |

Nilanjan Sinha |

|

General Counsel |

| |

|

| Location of Registered Office: |

ICICI Bank Tower, Near Chakli Circle, Old Padra Road, Vadodara 390 007, Gujarat, India |

| |

|

| Personal Name or Corporate Name |

Hironori Shibata, Attorney-at-Law |

| |

|

| of Attorney-in-Fact: |

|

| Address or Location of |

Anderson Mori & Tomotsune |

| Attorney-in-Fact: |

Otemachi Park Building |

|

1-1, Otemachi 1-chome |

|

Chiyoda-ku, Tokyo |

| |

|

| Telephone Number: |

03-6775-1039 |

| |

|

| Name of Person to Contact with: |

Nozomu Shiba, Attorney-at-Law |

|

Shunpei Hori, Attorney-at-Law |

|

Yoshiki Hiramatsu, Attorney-at-Law |

|

Ayako Motosugi, Attorney-at-Law |

| |

|

| Place to Contact with: |

Anderson Mori & Tomotsune |

|

Otemachi Park Building |

|

1-1, Otemachi 1-chome |

|

Chiyoda-ku, Tokyo |

| |

|

| Telephone Number: |

03-6775-1779 |

| |

|

| Place(s) for Public Inspection: |

Not applicable |

| 1. | In

this Semi-Annual Report, all references to “we”, “our” and “us”

are, unless the context otherwise requires, to ICICI Bank Limited on a standalone basis.

References to specific data applicable to particular subsidiaries or other consolidated entities

are made by reference to the name of that particular entity. References to “ICICI Bank”

or “the Bank” are, as the context requires, to ICICI Bank Limited on a standalone

basis. References to “the Group” are to ICICI Bank Limited and its consolidated

subsidiaries and other consolidated entities under generally accepted accounting principles

in India (“Indian GAAP”). |

| 2. | In this document, references to

“U.S. $” are to United States dollars, references to “Rs.” are to Indian rupees, and references to “¥”

or “JPY” are to Japanese yen. For purposes of readability, certain U.S. dollar amounts have been converted into Japanese

yen at the mean of the telegraphic transfer spot selling and buying rates vis-à-vis customers as at December 1, 2023 as quoted

by MUFG Bank, Ltd. in Tokyo (U.S. $ 1 = ¥ 147.88), and certain rupee amounts have been converted into Japanese yen at the reference

rate of Rs. 1 = ¥ 1.94 based on the foreign exchange rate as announced by MUFG Bank, Ltd. in Tokyo as at December 1, 2023. |

| 3. | The fiscal year of the Bank commences

on April 1 and ends at March 31 of each year. References to a particular “fiscal” year are to our fiscal year ending at March

31 of that particular year. For example, “fiscal 2024” refers to the year beginning on April 1, 2023 and ending at March

31, 2024. |

| 4. | Where figures in tables have been

rounded, the totals may not necessarily agree with the arithmetic sum of the figures. |

TABLE OF CONTENTS

(for reference purpose only)

COVER SHEET

| PART I. |

CORPORATE INFORMATION |

1 |

| I. |

SUMMARY OF LEGAL AND OTHER SYSTEMS IN HOME COUNTRY |

1 |

| II. |

OUTLINE OF COMPANY |

2 |

| |

1. Trends in Major Business Indices, etc. |

2 |

| |

2. Nature of Business |

7 |

| |

3. State of Affiliated Companies |

7 |

| |

4. State of Employees |

7 |

| III. |

STATEMENT OF BUSINESS |

7 |

| |

1. Management Policy, Business Environment and Problems

to be Coped with, etc. |

7 |

| |

2. Risks in Business, etc. |

7 |

| |

3. Management’s Analysis of Financial Position,

Operating Results and Statement of Cash Flows |

8 |

| |

4. Material Contracts Relating to Management, etc. |

23 |

| |

5. Research and Development Activities |

23 |

| IV. |

STATEMENT OF FACILITIES |

24 |

| |

1. State of Major Facilities |

24 |

| |

2. Plan for Installation, Retirement, etc. of Facilities |

24 |

| V. |

STATEMENT OF FILING COMPANY |

25 |

| |

1. State of Shares, etc. |

25 |

| |

(1) Total Number of Shares, etc. |

25 |

| |

(i) Total Number of Shares |

25 |

| |

(ii) Issued Shares |

25 |

| |

(2) State of Exercise of Bonds with

Stock Acquisition Rights etc.with Moving Strike Clause |

25 |

| |

(3) Total Number of Issued Shares and Capital Stock |

26 |

| |

(4) Major Shareholders |

26 |

| |

2. Statement of Directors and Officers |

27 |

| VI. |

FINANCIAL CONDITION |

34 |

| |

1. Interim Financial Statements |

34 |

| |

2. Other Information |

37 |

| |

(1) Legal and Regulatory Proceedings |

37 |

| |

(2) Subsequent Events |

40 |

| |

3. Major Differences between

United States and Japanese Accounting Principles and Practices |

40 |

| |

4. Major Differences between Indian and Japanese Accounting

Principles and Practices |

45 |

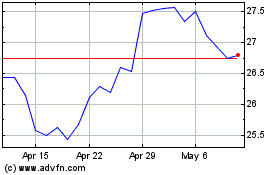

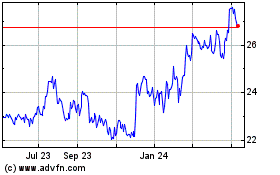

| VII. |

TRENDS IN FOREIGN EXCHANGE RATES |

52 |

| VIII. |

REFERENCE INFORMATION OF FILING COMPANY |

53 |

| PART II. |

INFORMATION ON

GUARANTY COMPANY OF FILING COMPANY, ETC. |

54 |

| I. |

INFORMATION ON GUARANTY COMPANY |

54 |

| II. |

INFORMATION ON COMPANIES OTHER THAN GUARANTY COMPANY |

54 |

| III. |

INFORMATION ON BUSINESS INDICES, ETC. |

54 |

PART I. CORPORATE INFORMATION

| I. | SUMMARY

OF LEGAL AND OTHER SYSTEMS IN HOME COUNTRY |

There has been no

material change in legal and other systems in India, since the last Annual Securities Report (“ASR”) filed on September 27,

2023 for fiscal 2023.

II. OUTLINE

OF COMPANY

| 1. | Trends

in Major Business Indices, etc. |

The following data

is derived from the audited and unaudited, standalone and consolidated financial results of ICICI Bank Limited prepared in accordance

with Indian GAAP.

Standalone financial

results

(Rs. in crore/JPY in million)

Sr.

No. |

Particulars |

Six

months ended |

Year

ended |

September

30, 2023 |

September

30, 2023 |

September

30, 2022 |

September

30, 2021 |

March

31,

2023 |

March

31,

2023 |

March

31,

2022 |

| |

|

(Unaudited) |

|

(Unaudited) |

(Unaudited) |

(Audited) |

|

(Audited) |

| 1. |

Interest earned (a)+(b)+(c)+(d) |

Rs.

68,248.00 |

JPY

1,324,011.20 |

Rs.

49,704.58 |

Rs.

41,617.05 |

Rs.

109,231.34 |

JPY

2,119,088.00 |

Rs.

86,374.55 |

| |

a)

Interest/discount on advances/bills |

52,963.02 |

1,027,482.59 |

37,563.19 |

30,722.67 |

83,942.97 |

1,628,493.62 |

63,833.56 |

| |

b)

Income on investments |

13,638.31 |

264,583.21 |

9,705.14 |

8,139.58 |

20,888.46 |

405,236.12 |

16,409.27 |

| |

c)

Interest on balances with Reserve Bank of India and other inter-bank funds |

907.04 |

17,596.58 |

829.68 |

400.27 |

1,850.51 |

35,899.89 |

1,560.83 |

| |

d)

Others |

739.63 |

14,348.82 |

1,606.57 |

2,354.53 |

2,549.40 |

49,458.36 |

4,570.89 |

| 2. |

Other income |

11,211.93 |

217,511.44 |

9,720.07 |

8,793.04 |

19,831.45 |

384,730.13 |

18,517.53 |

| 3. |

TOTAL INCOME (1)+(2) |

79,459.93 |

1,541,522.64 |

59,424.65 |

50,410.09 |

129,062.79 |

2,503,818.13 |

104,892.08 |

| 4. |

Interest expended |

31,713.63 |

615,244.42 |

21,707.75 |

18,991.55 |

47,102.74 |

913,793.16 |

38,908.45 |

| 5. |

Operating expenses (e)+(f) |

19,377.91 |

375,931.45 |

15,727.69 |

12,609.42 |

32,873.24 |

637,740.86 |

26,733.32 |

| |

e)

Employee cost |

7,609.08 |

147,616.15 |

5,737.74 |

4,758.98 |

12,059.93 |

233,962.64 |

9,672.75 |

| |

f)

Other operating expenses |

11,768.83 |

228,315.30 |

9,989.95 |

7,850.44 |

20,813.31 |

403,778.21 |

17,060.57 |

6.

|

TOTAL EXPENDITURE (4)+(5)

(excluding provisions and contingencies) |

51,091.54 |

991,175.88 |

37,435.44 |

31,600.97 |

79,975.98 |

1,551,534.01 |

65,641.77 |

7.

|

OPERATING

PROFIT (3)-(6)

(Profit before provisions and contingencies) |

28,368.39 |

550,346.77 |

21,989.21 |

18,809.12 |

49,086.81 |

952,284.11 |

39,250.31 |

8.

|

Provisions

(other than tax) and contingencies (refer note no. 4) |

1,875.07 |

36,376.36 |

2,788.34 |

5,565.17 |

6,665.58 |

129,312.25 |

8,641.42 |

9.

|

PROFIT FROM ORDINARY ACTIVITIES

BEFORE EXCEPTIONAL

ITEMS AND TAX (7)-(8) |

26,493.32 |

513,970.41 |

19,200.87 |

13,243.95 |

42,421.23 |

822,971.86 |

30,608.89 |

| 10. |

Exceptional items |

.. |

.. |

.. |

.. |

.. |

.. |

.. |

11.

|

PROFIT FROM ORDINARY ACTIVITIES

BEFORE TAX (9)-(10) |

26,493.32 |

513,970.41 |

19,200.87 |

13,243.95 |

42,421.23 |

822,971.86 |

30,608.89 |

| 12. |

Tax expense (g)+(h) |

6,584.12 |

127,731.93 |

4,738.09 |

3,116.98 |

10,524.73 |

204,179.76 |

7,269.40 |

| |

g) Current tax |

6,383.89 |

123,847.47 |

4,844.35 |

2,879.65 |

10,254.48 |

198,936.91 |

6,297.68 |

| |

h) Deferred tax |

200.23

|

3,884.46 |

(106.26) |

237.33 |

270.25 |

5,242.85 |

971.72 |

13.

|

NET

PROFIT FROM ORDINARY ACTIVITIES AFTER TAX (11)-(12) |

19,909.20 |

386,238.48 |

14,462.78 |

10,126.97 |

31,896.50 |

618,792.10 |

23,339.49 |

| 14. |

Extraordinary

items (net of tax expense) |

.. |

.. |

.. |

.. |

.. |

.. |

.. |

15. |

NET

PROFIT FOR THE PERIOD (13)-(14) |

19,909.20 |

386,238.48 |

14,462.78 |

10,126.97 |

31,896.50 |

618,792.10 |

23,339.49 |

16. |

Paid-up equity share capital

(face value Rs. 2 each) |

1,400.83 |

27,176.10 |

1,393.79 |

1,387.09 |

1,396.78 |

27,097.53 |

1,389.97 |

| 17. |

Reserves

excluding revaluation reserves |

210,508.56 |

4,083,866.06 |

177,407.93 |

152,176.34 |

195,495.25 |

3,792,607.85 |

165,659.93 |

| 18. |

Analytical ratios |

|

|

|

|

|

|

|

| |

i) Percentage

of shares held by Government of India |

0.21% |

.. |

0.20% |

0.20% |

0.20% |

.. |

0.19% |

| |

ii) Capital

adequacy ratio (Basel III) |

16.07% |

.. |

16.93% |

18.33% |

18.34% |

.. |

19.16% |

| |

iii) Earnings

per share (EPS) |

|

|

|

|

|

|

|

| |

a) Basic

EPS before and after extraordinary items, net of tax expense (not annualized) (in Rs./JPY) |

28.46 |

55.21 |

20.79 |

14.62 |

45.79 |

88.83 |

33.66 |

| |

b) Diluted

EPS before and after extraordinary items, net of tax expense (not annualized) (in Rs./JPY) |

27.96 |

54.24 |

20.38 |

14.34 |

44.89 |

87.09 |

32.98 |

| 19. |

NPA Ratio 1 |

|

|

|

|

|

|

|

| |

i) Gross

non-performing customer assets (net of write-off) |

29,836.94 |

578,836.64 |

32,570.86 |

41,437.41 |

31,183.70 |

604,963.78 |

33,919.52 |

| |

ii) Net

non-performing customer assets |

5,046.47 |

97,901.52 |

6,099.29 |

8,161.04 |

5,155.07 |

100,008.36 |

6,960.89 |

| |

iii) %

of gross non-performing customer assets (net of write-off) to gross customer assets |

2.48% |

.. |

3.19% |

4.82% |

2.81% |

.. |

3.60% |

| |

iv) %

of net non-performing customer assets to net customer assets |

0.43% |

.. |

0.61% |

0.99% |

0.48% |

.. |

0.76% |

| 20. |

Return on assets (annualized) |

2.40% |

.. |

2.02% |

1.67% |

2.16% |

.. |

1.84% |

| 21. |

Net worth 2 |

204,617.01 |

3,969,569.99 |

170,442.17 |

144,264.76 |

189,125.63 |

3,669,037.22 |

158,769.75 |

| 22. |

Outstanding redeemable preference

shares |

.. |

.. |

.. |

.. |

.. |

.. |

.. |

| 23. |

Capital redemption reserve |

350.00 |

6,790.00 |

350.00 |

350.00 |

350.00 |

6,790.00 |

350.00 |

| 24. |

Debt-equity

ratio 3 |

0.30 |

.. |

0.40 |

0.38 |

0.37 |

.. |

0.44 |

| 25. |

Total

debts to total assets 4 |

6.79% |

.. |

8.73% |

6.50% |

7.53% |

.. |

7.60% |

| 1. | At September

30, 2023, the percentage of gross non-performing advances (net of write-off) to gross advances

was 2.55% (March 31, 2023: 2.87%, September 30, 2022: 3.26%, March 31, 2022: 3.76%, September

30, 2021: 5.12%) and net non-performing advances to net advances was 0.45% (March 31, 2023:

0.51%, September 30, 2022: 0.65%, March 31, 2022: 0.81%, September 30, 2021: 1.06%). |

| 2. | Net worth

is computed as per the Reserve Bank of India Master Circular No. RBI/2015-16/70 DBR.No.Dir.BC.12/13.03.00/2015-16

on Exposure Norms dated July 1, 2015. |

| 3. | Debt represents

borrowings with residual maturity of more than one year. |

| 4. | Total debts

represents total borrowings of the Bank. |

Consolidated segmental results

of ICICI Bank Limited

(Rs. in crore/JPY in million)

Sr.

No. |

Particulars |

Six

months ended |

|

Year

ended |

September

30, 2023 |

|

September

30, 2023 |

|

September

30, 2022 |

|

September

30, 2021 |

|

March

31, 2023 |

|

March

31,

2023 |

|

March

31, 2022 |

| |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

(Audited) |

|

|

|

(Audited) |

| 1. |

Segment

revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

| a |

Retail Banking |

Rs. 64,137.23 |

|

JPY 1,244,262.26 |

|

Rs. 48,710.23 |

|

Rs. 40,693.22 |

|

Rs. 103,775.34 |

|

JPY 2,013,241.60 |

|

Rs.

84,639.22 |

| b |

Wholesale

Banking |

33,452.90 |

|

648,986.26 |

|

22,424.57 |

|

19,156.35 |

|

50,614.85 |

|

981,928.09 |

|

39,971.49 |

| c |

Treasury |

54,024.35 |

|

1,048,072.39 |

|

38,380.32 |

|

32,787.00 |

|

84,536.92 |

|

1,640,016.25 |

|

67,321.09 |

| d |

Other

Banking |

3,064.20 |

|

59,445.48 |

|

1,811.60 |

|

1,361.76 |

|

4,464.00 |

|

86,601.60 |

|

2,778.41 |

| e |

Life

Insurance |

23,350.83 |

|

453,006.10 |

|

21,051.94 |

|

20,842.14 |

|

47,930.17 |

|

929,845.30 |

|

45,340.24 |

| f |

Others |

6,416.95 |

|

124,488.83 |

|

4,500.68 |

|

4,369.02 |

|

9,725.98 |

|

188,684.01 |

|

8,733.25 |

| |

Total

segment revenue |

184,446.46 |

|

3,578,261.32 |

|

136,879.34 |

|

119,209.49 |

|

301,047.26 |

|

5,840,316.84 |

|

248,783.70 |

| |

Less:

Inter segment revenue |

75,070.20 |

|

1,456,361.88 |

|

52,482.79 |

|

44,373.03 |

|

114,868.46 |

|

2,228,448.12 |

|

91,247.38 |

| |

Income

from operations |

109,376.26 |

|

2,121,899.44 |

|

84,396.55 |

|

74,836.46 |

|

186,178.80 |

|

3,611,868.72 |

|

157,536.32 |

| 2. |

Segmental

results (i.e., Profit before tax and minority interest) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| a |

Retail

Banking |

9,074.60 |

|

176,047.24 |

|

8,342.48 |

|

2,995.57 |

|

17,533.68 |

|

340,153.39 |

|

11,400.39 |

| b |

Wholesale

Banking |

8,749.70 |

|

169,744.18 |

|

7,405.50 |

|

3,784.83 |

|

15,785.78 |

|

306,244.13 |

|

9,052.93 |

| c |

Treasury |

8,189.15 |

|

158,869.51 |

|

5,650.70 |

|

5,300.22 |

|

14,037.21 |

|

272,321.87 |

|

9,674.48 |

| d |

Other

Banking |

755.31 |

|

14,653.01 |

|

439.76 |

|

301.87 |

|

1,001.45 |

|

19,428.13 |

|

627.12 |

| e |

Life

Insurance |

456.79 |

|

8,861.73 |

|

355.17 |

|

258.84 |

|

896.89 |

|

17,399.67 |

|

790.56 |

| f |

Others |

2,712.03 |

|

52,613.38 |

|

2,060.59 |

|

2,142.69 |

|

4,202.37 |

|

81,525.98 |

|

4,349.99 |

| g |

Unallocated

expenses |

.. |

|

.. |

|

(2,550.00) |

|

1,050.00 |

|

(5,650.00) |

|

(109,610.00) |

|

25.00 |

| |

Total

segment results |

29,937.58 |

|

580,789.05 |

|

21,704.20 |

|

15,834.02 |

|

47,807.38 |

|

927,463.17 |

|

35,920.47 |

| |

Less:

Inter segment adjustment |

798.72 |

|

15,495.17 |

|

867.47 |

|

1,040.62 |

|

1,550.92 |

|

30,087.85 |

|

1,679.20 |

| |

Add:

Share of profit in associates |

586.49 |

|

11,377.91 |

|

517.78 |

|

382.68 |

|

998.29 |

|

19,366.83 |

|

754.43 |

| |

Profit

before tax and minority interest |

29,725.35 |

|

576,671.79 |

|

21,354.51 |

|

15,176.08 |

|

47,254.75 |

|

916,742.15 |

|

34,995.70 |

| 3. |

Segment

assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

| a |

Retail

Banking |

668,057.40 |

|

12,960,313.56 |

|

547,304.40 |

|

440,449.89 |

|

603,959.37 |

|

11,716,811.78 |

|

487,651.93 |

| b |

Wholesale

Banking |

463,638.43 |

|

8,994,585.54 |

|

391,612.01 |

|

334,763.84 |

|

432,874.35 |

|

8,397,762.39 |

|

379,091.80 |

| c |

Treasury |

556,107.71 |

|

10,788,489.57 |

|

516,823.60 |

|

482,178.51 |

|

512,940.50 |

|

9,951,045.70 |

|

521,896.09 |

| d |

Other

Banking |

85,485.62 |

|

1,658,421.03 |

|

77,931.47 |

|

65,889.47 |

|

83,696.05 |

|

1,623,703.37 |

|

68,286.69 |

| e |

Life

Insurance |

276,072.97 |

|

5,355,815.62 |

|

247,827.69 |

|

241,441.14 |

|

255,689.90 |

|

4,960,384.06 |

|

244,006.42 |

| f |

Others |

79,509.73 |

|

1,542,488.76 |

|

52,124.46 |

|

40,544.01 |

|

71,134.84 |

|

1,380,015.90 |

|

51,653.48 |

| g |

Unallocated |

7,409.61 |

|

143,746.43 |

|

10,294.09 |

|

10,695.36 |

|

9,656.72 |

|

187,340.37 |

|

10,572.66 |

| |

Total |

2,136,281.47 |

|

41,443,860.52 |

|

1,843,917.72 |

|

1,615,962.22 |

|

1,969,951.73 |

|

38,217,063.56 |

|

1,763,159.07 |

| |

Less:

Inter segment adjustment |

11,431.72 |

|

221,775.37 |

|

10,763.90 |

|

11,909.30 |

|

11,461.23 |

|

222,347.86 |

|

10,521.69 |

| |

Total

segment assets |

2,124,849.75 |

|

41,222,085.15 |

|

1,833,153.82 |

|

1,604,052.92 |

|

1,958,490.50 |

|

37,994,715.70 |

|

1,752,637.38 |

| 4. |

Segment

liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| a |

Retail

Banking |

940,334.15 |

|

18,242,482.51 |

|

830,053.25 |

|

726,094.15 |

|

891,354.54 |

|

17,292,278.08 |

|

791,894.25 |

| b |

Wholesale

Banking |

416,050.16 |

|

8,071,373.10 |

|

321,677.03 |

|

293,984.46 |

|

347,276.49 |

|

6,737,163.91 |

|

321,390.70 |

| c |

Treasury |

145,118.41 |

|

2,815,297.15 |

|

156,709.28 |

|

106,797.40 |

|

144,338.32 |

|

2,800,163.41 |

|

133,045.58 |

| d |

Other

Banking |

54,431.14 |

|

1,055,964.12 |

|

48,111.03 |

|

48,834.28 |

|

51,378.80 |

|

996,748.72 |

|

49,428.36 |

| e |

Life

Insurance |

265,576.06 |

|

5,152,175.56 |

|

238,362.01 |

|

232,835.33 |

|

245,755.62 |

|

4,767,659.03 |

|

234,991.26 |

| f |

Others |

69,541.69 |

|

1,349,108.79 |

|

43,866.06 |

|

33,601.16 |

|

62,250.16 |

|

1,207,653.10 |

|

44,120.97 |

| g |

Unallocated |

13,345.66 |

|

258,905.80 |

|

10,000.00 |

|

5,210.46 |

|

13,100.00 |

|

254,140.00 |

|

6,235.46 |

| |

Total |

1,904,397.27 |

|

36,945,307.04 |

|

1,648,778.66 |

|

1,447,357.24 |

|

1,755,453.93 |

|

34,055,806.24 |

|

1,581,106.58 |

| |

Less:

Inter segment adjustment |

11,431.72 |

|

221,775.37 |

|

10,763.90 |

|

11,909.30 |

|

11,461.23 |

|

222,347.86 |

|

10,521.69 |

| |

Total

segment liabilities |

1,892,965.55 |

|

36,723,531.67 |

|

1,638,014.76 |

|

1,435,447.94 |

|

1,743,992.70 |

|

33,833,458.38 |

|

1,570,584.89 |

| 5. |

Capital

employed |

231,884.20 |

|

4,498,553.48 |

|

195,139.06 |

|

168,604.98 |

|

214,497.80 |

|

4,161,257.32 |

|

182,052.49 |

| 6. |

Total

(4)+(5) |

Rs.

2,124,849.75 |

|

JPY

41,222,085.15 |

|

Rs.

1,833,153.82 |

|

Rs.

1,604,052.92 |

|

Rs.

1,958,490.50 |

|

JPY

37,994,715.70 |

|

Rs.

1,752,637.38 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________________

Notes

on segmental results:

| 1. | The disclosure on segmental reporting

has been prepared in accordance with Securities and Exchange Board of India Circular No. CIR/CFD/FAC/62/2016 dated July 5, 2016 on Revised

Formats for Financial Results and Implementation of Indian Accounting Standards by Listed Entities. |

| 2. | ‘Retail Banking’ includes

exposures of the Bank which satisfy the four criteria of orientation, product, granularity and low value of individual exposures for

retail exposures laid down in Basel Committee on Banking Supervision document ‘International Convergence of Capital Measurement

and Capital Standards: A Revised Framework’. This segment also includes income from credit cards, debit cards, third party product

distribution and the associated costs. |

| 3. | ‘Wholesale Banking’

includes all advances to trusts, partnership firms, companies and statutory bodies, by the Bank which are not included under Retail Banking. |

| 4. | ‘Treasury’ primarily

includes the entire investment and derivative portfolio of the Bank. |

| 5. | ‘Other Banking’ includes

leasing operations and other items not attributable to any particular business segment of the Bank. Further, it includes the Bank’s

banking subsidiaries i.e., ICICI Bank UK PLC and ICICI Bank Canada. |

| 6. | ‘Life Insurance’ represents

ICICI Prudential Life Insurance Company Limited. |

| 7. | ‘Others’ comprises

the consolidated entities of the Bank, not covered in any of the segments above. |

| 8. | ‘Unallocated’ includes

items such as tax paid in advance net of provision, deferred tax and provisions to the extent reckoned at the entity level. |

| 1. | The above standalone and consolidated

financial results have been approved by the Board of Directors at its meeting held on October 21, 2023. The joint statutory auditors

have conducted limited review and issued an unmodified report on the standalone and consolidated financial results for the six months

ended September 30, 2023. |

| 2. | The financial results have been

prepared in accordance with the recognition and measurement principles given in Accounting Standard 25 on ‘Interim Financial Reporting’

as prescribed under the Companies Act 2013. |

| 3. | Details of resolution plans implemented

under the Resolution Framework for COVID-19 related Stress as per the Reserve Bank of India circular dated August 6, 2020 (Resolution

Framework 1.0) and May 5, 2021 (Resolution Framework 2.0) at September 30, 2023 are given below:

|

Rs.

in crore

| Type

of Borrower |

Exposure

to accounts classified as Standard consequent to implementation of resolution plan – Position as at the end of March 31, 2023

(A) |

Of

(A), aggregate debt that slipped into NPA during the six months ended September 30, 20231 |

Of

(A) amount written off during the six months ended September 30, 2023 |

Of

(A) amount paid by the borrowers during the six months ended September 30, 20232 |

Exposure

to accounts classified as Standard consequent to implementation of resolution plan – September 30, 2023 |

| Personal

Loans3 |

1,960.78 |

111.98 |

4.98 |

281.75 |

1,567.05 |

| Corporate

persons |

810.90 |

.. |

.. |

13.32 |

797.58 |

| Of

which, MSMEs |

.. |

.. |

.. |

.. |

.. |

| Others |

568.76 |

42.20 |

2.59 |

95.26 |

431.30 |

| Total |

3,340.44 |

154.18 |

7.57 |

390.33 |

2,795.93 |

| 1. | Includes cases which have been

written off during the period. |

| 2. | Net of increase in exposure during

the period. |

| 3. | Includes various categories of

retail loans. |

| 4. | At September 30, 2023, the Bank

holds contingency provision of Rs. 13,100.00 crore (March 31, 2023: Rs. 13,100.00 crore; September 30, 2022: Rs. 10,000.00 crore). |

| 5. | During the three months ended

September 30, 2023, the Bank has allotted 6,437,365 equity shares of Rs. 2 each pursuant to exercise of employee stock options. |

| 6. | In accordance with the Reserve

Bank of India’s guidelines, consolidated Pillar 3 disclosure (unaudited), leverage ratio, liquidity coverage ratio, net stable

funding ratio and details of loans transferred/acquired under the Reserve Bank of India Master Direction on Transfer of Loan Exposures

dated September 24, 2021 is available at https://www.icicibank.com/regulatory-disclosure.page. |

| 7. | Previous period/year figures have

been re-grouped/re-classified where necessary to conform to current period classification. |

| 8. | The above standalone and consolidated

financial results have been reviewed/audited by the joint statutory auditors, MSKA & Associates, Chartered Accountants and KKC &

Associates LLP, Chartered Accountants. |

| 9. | Rs. 1.00 crore = Rs. 10.0 million. |

There has

been no material change since the last ASR filed on September 27, 2023 for fiscal 2023.

| 3. | State

of Affiliated Companies |

There has

been no material change since the last ASR filed on September 27, 2023 for fiscal 2023.

At

September 30, 2023, we had 139,105 employees, including interns, sales executives and employees on fixed-term contracts.

| III. | STATEMENT

OF BUSINESS |

| 1. | Management

Policy, Business Environment and Problems to be Coped with, etc. |

There has

been no material change since the last ASR filed on September 27, 2023 for fiscal 2023.

| 2. | Risks

in Business, etc. |

There has

been no material change since the last ASR filed on September 27, 2023 for fiscal 2023, except below.

The Board of Directors of

the Bank has, pursuant to an independent enquiry, taken action against the former Managing Director and CEO. In the event the Bank is

found by any of the enquiries in the matter by government and regulatory agencies to have violated applicable laws or regulations, the

Bank could become subject to legal and regulatory sanctions that may materially and adversely affect our results of operations or financial

condition and reputation.

In fiscal

2019, the Audit Committee under direction given by the Board of Directors of the Bank had instituted an independent enquiry to consider

various allegations relating to the former Managing Director and Chief Executive Officer, Ms. Chanda Kochhar. The enquiry was supported

by an external counsel and a forensic firm. The allegations levelled against Ms. Kochhar included nepotism, quid pro quo and claims that

Ms. Kochhar, by not disclosing conflicts of interest caused by certain transactions between certain borrowers of the Bank and entities

controlled by Ms. Kochhar’s spouse, committed infractions under applicable regulations and the Bank’s Code of Conduct. While

the enquiry was underway, the Board accepted Ms. Kochhar’s request for early retirement, while noting that the enquiry would remain

unaffected by this and certain benefits would be subject to the outcome of the enquiry. Subsequently, on consideration of the enquiry

report and its conclusions, the Board of Directors decided to treat the separation of Ms. Chanda Kochhar from the Bank as a ‘Termination

for Cause’ under the Bank’s internal policies, schemes and the Code of Conduct, with all attendant consequences.

In January

2020, the Bank instituted a recovery suit against Ms. Kochhar for, among other things, the clawback of bonus paid from April 2009 to

March 2018. Ms. Kochhar also filed a suit before Bombay High Court in January 2022 contending that her employment termination is invalid

and she is entitled to all the Employee Stock Options, which were originally allocated to her. An alternative prayer for claiming, damages

of Rs. 17.3 billion is sought by her. Both these suits are under trial and being heard by the single bench of Bombay High Court. A Special

Leave Petition was filed by Ms. Kochhar challenging the order passed by Bombay High Court was dismissed by Supreme Court on December

8, 2023.

The Securities

and Exchange Board of India issued a show-cause notice to Ms. Kochhar and to the Bank in 2018 in relation to the allegations. In November

2020, the Securities and Exchange Board of India issued a modified show cause notice to the Bank and responses were submitted by the

Bank. In fiscal 2023, pursuant to the Securities Appellate Tribunal order the Securities and Exchange Board of India sought documents

and materials in relation to the adjudication proceedings from the Bank, which were then submitted by the Bank.

Authorities

such as the Central Bureau of Investigation, Enforcement Directorate and Income-tax authorities are also probing the matter. In the event

that the Bank is found by Securities and Exchange Board of India or the Central Bureau of Investigation or by any other authority or

agency to have violated applicable laws or regulations, the Bank could become subject to legal and regulatory sanctions that may materially

and adversely affect our reputation and may impact results of operations or financial condition.

| 3. | Management’s

Analysis of Financial Position, Operating Results and Statement of Cash Flows |

The following

discussion is based on our unaudited standalone financial results for the six months ended September 30, 2023.

Profit

after tax increased from Rs. 144.63 billion in the six months ended September 30, 2022 to Rs. 199.09 billion in the six months ended

September 30, 2023 primarily due to an increase in net interest income, an increase in fee income and a decrease in provisions and contingencies,

offset, in part, by an increase in operating expenditure.

Net interest

income increased by 30.5% from Rs. 279.97 billion in the six months ended September 30, 2022 to Rs. 365.35 billion in the six months

ended September 30, 2023 due to an increase in net interest margin by 49 basis points to 4.65% and an increase of 17.2% in the average

volume of interest-earning assets.

Fee income

increased by 15.2% from Rs. 87.23 billion in the six months ended September 30, 2022 to Rs. 100.47 billion in the six months ended September

30, 2023 primarily due to an increase in payment and cards fees, income from forex and derivatives products and lending linked fees.

Non-interest

expense increased by 23.2% from Rs. 157.27 billion in the six months ended September 30, 2022 to Rs. 193.78 billion in the six months

ended September 30, 2023 primarily due to an increase in employee expenses, technology related expenses and direct marketing agency expenses.

Income

from treasury-related activities increased from a loss of Rs. 0.49 billion in the six months ended September 30, 2022 to a gain of Rs.

1.67 billion in the six months ended September 30, 2023 primarily due to a gain on government securities and other fixed income positions.

Provisions

and contingencies (excluding provisions for tax) decreased by 32.7% from Rs. 27.88 billion in the six months ended September 30, 2022

to Rs. 18.75 billion in the six months ended September 30, 2023. The provision coverage ratio was 82.6% at September 30, 2023 as compared

to 80.6% at September 30, 2022.

The income

tax expense increased from Rs. 47.38 billion in the six months ended September 30, 2022 to Rs. 65.84 billion in the six months ended

September 30, 2023 primarily due to an increase in profit before taxes. The effective tax rate increased from 24.7% in the six months

ended September 30, 2022 to 24.9% in the six months ended September 30, 2023.

Total assets

increased by 15.6% from Rs. 14,886.74 billion at September 30, 2022 to Rs. 17,207.80 billion at September 30, 2023. Total advances increased

by 18.3% from Rs. 9,385.63 billion at September 30, 2022 to Rs. 11,105.42 billion at September 30, 2023. Domestic advances increased

by 19.3% from Rs. 9,005.72 billion at September 30, 2022 to Rs. 10,742.06 billion at September 30, 2023. Total deposits increased by

18.8% from Rs. 10,900.08 billion at September 30, 2022 to Rs. 12,947.42 billion at September 30, 2023. Term deposits increased by 31.8%

from Rs. 5,821.68 billion at September 30, 2022 to Rs. 7,671.12 billion at September 30, 2023. Savings account deposits increased by

2.7% from Rs. 3,624.84 billion at September 30, 2022 to Rs. 3,723.26 billion at September 30, 2023 and current account deposits increased

by 6.8% from Rs. 1,453.56 billion at September 30, 2022 to Rs. 1,553.04 billion at September 30, 2023. Average current and savings account

deposits increased by 6.8% from Rs. 4,690.72 billion at September 30, 2022 to Rs. 5,011.16 billion at September 30, 2023. The current

and savings account ratio (current and savings account deposits to total deposits) decreased from 46.6% at September 30, 2022 to 40.8%

at September 30, 2023.

At September

30, 2023, we had 6,248 branches and extension counters, 12,510 ATMs and 4,417 cash recycler machines, as compared to 5,614 branches and

extension counters, 13,254 ATMs and 3,240 cash recycler machines at September 30, 2022.

In accordance

with Reserve Bank of India guidelines on Basel III, the total capital adequacy ratio on a standalone basis was 16.07% at September 30,

2023, with Tier 1 capital adequacy ratio of 15.35% (excluding retained earnings for the six months ended September 30, 2023) and Common

Equity Tier 1 capital adequacy ratio of 15.26% (excluding retained earnings for the six months ended September 30, 2023) as compared

to 18.34% at March 31, 2023, with Tier 1 capital adequacy ratio of 17.60% and Common Equity Tier 1 capital adequacy ratio of 17.12%.

Net

Interest Income

The following

table sets forth, for the periods indicated, the principal components of net interest income.

| | |

Six months ended September 30, |

Particulars | |

2022 | |

2023 | |

2023 | |

2023/2022

%

change |

| (in million, except percentages) |

| Interest income | |

Rs. | 497,045.8 | | |

Rs. | 682,480.0 | | |

JPY | 1,324,011.2 | | |

| 37.3 | % |

| Interest expense | |

| (217,077.5 | ) | |

| (317,136.3 | ) | |

| (615,244.4 | ) | |

| 46.1 | % |

| Net interest income(1) | |

Rs. | 279,968.3 | | |

Rs. | 365,343.7 | | |

JPY | 708,766.8 | | |

| 30.5 | % |

__________________

| (1) | Includes interest and amortisation

of premium/discount on non-trading interest rate swaps and foreign exchange currency swaps. |

Net interest

income increased by 30.5% from Rs. 279.97 billion in the six months ended September 30, 2022 to Rs. 365.35 billion in the six months

ended September 30, 2023 due to an increase in net interest margin by 49 basis points to 4.65% and an increase of 17.2% in the average

volume of interest-earning assets.

Net

Interest Margin

Net interest

margin increased by 49 basis points from 4.16% in the six months ended September 30, 2022 to 4.65% in the six months ended September

30, 2023. The yield on average interest-earning assets increased by 130 basis points from 7.39% in the six months ended September 30,

2022 to 8.69% in the six months ended September 30, 2023. The cost of funds increased by 96 basis points from 3.73% in the six months

ended September 30, 2022 to 4.69% in the six months ended September 30, 2023. The interest spread increased by 34 basis points from 3.66%

in the six months ended September 30, 2022 to 4.00% in the six months ended September 30, 2023.

The net

interest margin of domestic operations increased by 44 basis points from 4.30% in the six months ended September 30, 2022 to 4.74% in

the six months ended September 30, 2023 primarily due to an increase in yield on interest-earning assets, offset, in part, by an increase

in cost of funds. The yield on domestic interest-earning assets increased by 120 basis points from 7.56% in the six months ended September

30, 2022 to 8.76% in the six months ended September 30, 2023 primarily due an increase in yield on average advances and investments and

an increase in proportion of average advances. The cost of domestic funds increased by 90 basis points from 3.78% in the six months ended

September 30, 2022 to 4.68% in the six months ended September 30, 2023 primarily due to an increase in cost of term deposits.

The net

interest margin of overseas branches increased by 86 basis points from 0.42% in the six months ended September 30, 2022 to 1.28% in the

six months ended September 30, 2023.

The yield

on average interest-earning assets increased by 130 basis points from 7.39% in the six months ended September 30, 2022 to 8.69% in the

six months ended September 30, 2023 primarily due to the following factors:

| • | The

yield on average interest-earning assets increased mainly due to an increase in yield on

advances and investments and an increase in proportion of average advances. |

| • | The

yield on domestic average advances increased from 8.68% in the six months ended September

30, 2022 to 9.93% in the six months ended September 30, 2023, primarily due to repricing

of existing floating rate loans and incremental lending at higher rates on account of significant

increase in repurchase rates. Of the total domestic advances, interest rates on approximately

50% of domestic advances are linked to external benchmarks and interest rates on approximately

18% are linked to the marginal cost of funds based lending rate. Reserve Bank of India raised

the repurchase rates by 250 basis points from 4.00% in May 2022 to 6.50% in February 2023.

The impact of increase in repurchase rates from May 2022 started reflecting in the increase

in overall yield through repricing of repurchase and treasury bills linked portfolio from

the three months ended September 30, 2022 and onwards. |

The yield on overseas advances

increased by 407 basis points from 2.62% in the six months ended September 30, 2022 to 6.69% in the six months ended September 30, 2023

primarily due to repricing of floating rate/maturing advances on account of the rate hike by the U.S. Federal Reserve.

The overall yield on average

advances increased by 145 basis points from 8.38% in the six months ended September 30, 2022 to 9.83% in the six months ended September

30, 2023.

| • | The

yield on average interest-earning investments increased by 93 basis points from 6.23% in

the six months ended September 30, 2022 to 7.16% in the six months ended September 30, 2023.

|

The yield on investment in Indian

government securities increased by 83 basis points from 6.32% in the six months ended September 30, 2022 to 7.15% in the six months ended

September 30, 2023 primarily due to reset of floating rate bonds linked to treasury bills at higher rates pursuant to a significant increase

in treasury bill rates and new investment in government securities at higher market yields. The yield on investment in non-government

securities increased by 166 basis points from 5.57% in the six months ended September 30, 2022 to 7.23% in the six months ended September

30, 2023 due to an increase in yield on bonds and debentures, foreign government securities, commercial paper and pass through certificates.

| • | The

yield on other interest-earning assets decreased by 65 basis points from 3.56% in the six

months ended September 30, 2022 to 2.91% in the six months ended September 30, 2023. The

decrease was primarily due to a decrease in income on funding swaps, a decrease in average

short-term placements (liquidity adjustment facility) with Reserve Bank of India and an increase

in average balance with Reserve Bank of India, which does not earn any interest. During the

six months ended September 30, 2022, Reserve Bank of India had increased the cash reserve

ratio from 4.00% to 4.50%. The decrease in yield was, offset, in part, by an increase in

yield on call money lent and an increase in yield on balance with other banks. |

| • | Interest

on income tax refund decreased from Rs. 1.07 billion in the six months ended September 30,

2022 to Rs. 0.93 billion in the six months ended September 30, 2023. The receipt, amount

and timing of such income depends on the nature and timing of determinations by tax authorities

and are neither consistent nor predictable. |

The cost of

funds increased by 96 basis points from 3.73% in the six months ended September 30, 2022 to 4.69% in the six months ended September 30,

2023 primarily due to the following factors:

| • | The

cost of average deposits increased by 92 basis points from 3.51% in the six months ended

September 30, 2022 to 4.43% in the six months ended September 30, 2023 primarily due to an

increase in cost of domestic term deposits. The peak rate for retail term deposits increased

significantly from 5.75% in May 2022 to 7.10% in February 2023 in phases during the year

ended March 31, 2023 on account of significant increase in repurchase rate by the Reserve

Bank of India. |

The cost of savings account

deposits increased marginally by 1 basis point from 3.16% in the six months ended September 30, 2022 to 3.17% in the six months ended

September 30, 2023.

The average current account

and savings account deposits as a percentage of total deposits decreased from 45.4% in the six months ended September 30, 2022 to 41.7%

in the six months ended September 30, 2023.

| • | The

cost of borrowings increased by 134 basis points from 5.50% in the six months ended September

30, 2022 to 6.84% in the six months ended September 30, 2023 primarily due to an increase

in cost of refinance borrowings, call money borrowings and inter-bank participatory certificates,

offset, in part, by a decrease in proportion of average bond borrowings. |

Our yield

on advances, interest earned, net interest income and net interest margin are impacted by systemic liquidity, the competitive environment,

level of additions to non-performing loans, regulatory developments, monetary policy and the economic and geopolitical factors.

Differential

movement in the external benchmark rates vis-a-vis our cost of funds may impact our interest earned, yield on advances, interest expended,

net interest income and net interest margin.

Interest-Earning

Assets

Average interest-earning

assets increased by 17.2% from Rs. 13,407.92 billion in the six months ended September 30, 2022 to Rs. 15,714.84 billion in the six months

ended September 30, 2023 primarily due to an increase in average interest-earning advances by Rs. 1,836.03 billion and average investments

by Rs. 703.31 billion, offset, in part, by a decrease in average other interest-earning assets by Rs. 232.42 billion.

Average advances

increased by 20.5% from Rs. 8,936.87 billion in the six months ended September 30, 2022 to Rs. 10,772.90 billion in the six months ended

September 30, 2023 due to an increase of 22.7% in average domestic advances, offset, in part, by a decrease of 22.1% in average overseas

advances.

Average interest-earning

investments increased by 22.6% from Rs. 3,106.57 billion in the six months ended September 30, 2022 to Rs. 3,809.88 billion in the six

months ended September 30, 2023. Average interest-earning investments in Indian government securities increased by 21.0% from Rs. 2,743.87

billion in the six months ended September 30, 2022 to Rs. 3,319.04 billion in the six months ended September 30, 2023. Average interest-earning

non-government securities increased from Rs. 362.70 billion in the six months ended September 30, 2022 to Rs. 490.84 billion in the six

months ended September 30, 2023.

Average other

interest-earning assets decreased by 17.0% from Rs. 1,364.48 billion in the six months ended September 30, 2022 to Rs. 1,132.06 billion

in the six months ended September 30, 2023, primarily due to a decrease in call/term money lent, balance with other banks and Rural Infrastructure

and Development Fund (RIDF) and related deposits, offset, in part, by an increase in balance with Reserve Bank of India.

Interest-Bearing

Liabilities

Average interest-bearing

liabilities increased by 16.4% from Rs. 11,617.71 billion in the six months ended September 30, 2022 to Rs. 13,519.17 billion in the

six months ended September 30, 2023 due to an increase in average deposits by Rs. 1,696.81 billion and increase in average borrowings

by Rs. 204.64 billion.

Average deposits

increased by 16.4% from Rs. 10,331.94 billion in the six months ended September 30, 2022 to Rs. 12,028.75 billion in the six months ended

September 30, 2023 due to an increase in average term deposits by Rs. 1,376.36 billion and average current account and savings account

deposits by Rs. 320.45 billion.

Average borrowings

increased by 15.9% from Rs. 1,285.78 billion in the six months ended September 30, 2022 to Rs. 1,490.42 billion in the six months ended

September 30, 2023 primarily due to an increase in refinance borrowings, inter-bank participatory certificates and bond borrowings, offset,

in part, by a decrease in subordinated bonds and term money borrowings.

Non-Interest

Income

The following

table sets forth, for the periods indicated, the principal components of non-interest income.

| | |

Six

months ended September 30, |

| | |

| |

| |

| |

2023/2022 |

| Particulars | |

2022 | |

2023 | |

2023 | |

% change |

| | |

(in million, except percentages) |

| Fee income(1) | |

| Rs. 87,233.3 | | |

| Rs. 100,465.4 | | |

| JPY

194,902.9 | | |

| 15.2 | % |

| Income from treasury-related

activities(2) | |

| (483.5 | ) | |

| 1,679.3 | | |

| 3,257.8 | | |

| - | |

| Dividend from subsidiaries/associates/joint ventures | |

| 9,949.7 | | |

| 9,395.8 | | |

| 18,227.9 | | |

| (5.6 | %) |

| Other income (including lease income) | |

| 501.3 | | |

| 578.7 | | |

| 1,122.7 | | |

| 16.0 | % |

| Total non-interest income | |

| Rs. 97,200.8 | | |

| Rs. 112,119.2 | | |

| JPY 217,511.2 | | |

| 15.4 | % |

| (1) | Includes merchant foreign exchange

income, margin on customer derivative transactions, income on sale of priority sector lending certificate and income from bullion business. |

| (2) | Includes profit/loss on sale and

revaluation of investments. |

Non-interest

income primarily includes fee and commission income, income from treasury-related activities, dividend from subsidiaries/associates/joint

ventures and other income (including lease income). The non-interest income increased by 15.4% from Rs. 97.20 billion in the six months

ended September 30, 2022 to Rs. 112.12 billion in the six months ended September 30, 2023 primarily due to an increase in fee income

and an increase in income from treasury related activities.

Fee

Income

Fee income

primarily includes fees from the retail products such as loan processing fees, fees from credit cards business, account service charges

and third party referral fees and commercial banking fees such as loan processing fees and transaction banking fees. The income increased

by 15.2% from Rs. 87.23 billion in the six months ended September 30, 2022 to Rs. 100.47 billion in the six months ended September 30,

2023 primarily due to an increase in payment and cards fees, income from forex and derivatives products and lending linked fees.

Profit/(loss)

on Treasury-related Activities (net)

Income from

treasury-related activities includes income from sale of investments and changes in unrealized profit/(loss) on account of the revaluation

of investments in the fixed income, equity and preference portfolio and units of venture funds and security receipts issued by asset

reconstruction companies. Further, it includes income from foreign exchange transactions comprising various foreign exchange and derivative

products, including options and swaps.

Income from

treasury-related activities increased from a loss of Rs. 0.49 billion in the six months ended September 30, 2022 to a gain of Rs. 1.67

billion in the six months ended September 30, 2023 primarily due to a gain on government securities and other fixed income positions.

Dividend

from subsidiaries/associates/joint ventures

Dividend from

subsidiaries/associates/joint ventures decreased from Rs. 9.95 billion in the six months ended September 30, 2022 to Rs. 9.39 billion

in the six months ended September 30, 2023.

The following

table sets forth, for the periods indicated, the details of dividend received from subsidiaries/associates/joint ventures:

| | |

Six months ended September 30, |

Particulars | |

2022 | |

2023 | |

2023 |

| | |

| (in million) | |

| ICICI Prudential Asset Management Company Limited | |

Rs. | 2,853.8 | | |

Rs. | 3,421.0 | | |

JPY | 6,636.7 | |

| ICICI Securities Limited | |

| 3,081.1 | | |

| 2,235.3 | | |

| 4,336.5 | |

| ICICI Lombard General Insurance Company Limited | |

| 1,179.2 | | |

| 1,297.1 | | |

| 2,516.4 | |

| ICICI Bank UK PLC | |

| 796.8 | | |

| 825.5 | | |

| 1,601.5 | |

| ICICI Securities Primary Dealership Limited | |

| 1,360.2 | | |

| 766.1 | | |

| 1,486.2 | |

| ICICI Prudential Life Insurance Company Limited | |

| 405.7 | | |

| 442.6 | | |

| 858.6 | |

| ICICI Home Finance Company Limited | |

| 164.8 | | |

| 300.9 | | |

| 583.7 | |

| India Infradebt Limited | |

| 106.5 | | |

| 106.5 | | |

| 206.6 | |

| ICICI Prudential Trust Limited | |

| 1.5 | | |

| 0.8 | | |

| 1.6 | |

| Total dividend | |

Rs. | 9,949.6 | | |

Rs. | 9,395.8 | | |

JPY | 18,227.9 | |

Other

Income

Other income

increased by 16.0% from Rs. 0.50 billion in the six months ended September 30, 2022 to Rs. 0.58 billion in the six months ended September

30, 2023.

Non-Interest

Expense

The following

table sets forth, for the periods indicated, the principal components of non-interest expense.

| | |

Six

months ended September 30, |

Particulars | |

2022 | |

2023 | |

2023 | |

2023/2022 %

change |

| | |

(in millions, except percentages) |

| Employee expenses | |

Rs. | 57,377.4 | | |

Rs. | 76,090.8 | | |

JPY | 147,616.2 | | |

| 32.6 | % |

| Other administrative expenses | |

| 99,899.5 | | |

| 117,688.3 | | |

| 228,315.3 | | |

| 17.8 | % |

| Total non-interest

expenses | |

Rs. | 157,276.9 | | |

Rs. | 193,779.1 | | |

JPY | 375,931.5 | | |

| 23.2 | % |

Non-interest

expenses primarily include employee expenses, depreciation on assets and other administrative expenses. Non-interest expenses increased

by 23.2% from Rs. 157.27 billion in the six months ended September 30, 2022 to Rs. 193.78 billion.

Employee

Expenses

Employee expenses

increased by 32.6% from Rs. 57.38 billion in the six months ended September 30, 2022 to Rs. 76.09 billion in the six months ended September

30, 2023 primarily due to an increase in payroll cost, provision for performance bonus and performance-linked retention pay and an increase

in provision requirement for retirement benefit obligations.

Other

Administrative Expenses

Other administrative

expenses primarily include rent, taxes and lighting, advertisement, sales promotion, repairs and maintenance, direct marketing expenses

and other expenditure. Other administrative expenses increased by 17.7% from Rs. 93.46 billion in the six months ended September 30,

2022 to Rs. 110.04 billion in the six months ended September 30, 2023 primarily due to increase in technology related expenses and direct

marketing agency expenses. The technology related expenses was 10.0% of the total non-interest expenses in the six months ended September

30, 2023.

The number

of branches increased from 5,614 at September 30, 2022 to 6,248 at September 30, 2023 (at March 31, 2023: 5,900).

Provisions

and Contingencies (Excluding Provisions for Tax)

The following

table sets forth, for the periods indicated, the composition of provisions and contingencies, excluding provisions for tax.

| | |

Six

months ended September 30, |

Particulars | |

2022 | |

2023 | |

2023 | |

2023/2022 %

change |

| | |

(in millions, except percentages) |

| Provision for investments (including credit substitutes) (net) | |

Rs. | 9,748.6 | | |

Rs. | (1,410.0 | ) | |

JPY | (,735.4 | ) | |

| - | |

| Provision for non-performing and other assets(1) | |

| (5,302.1 | ) | |

| 8,422.5 | | |

| 16,339.7 | | |

| - | |

| Provision for standard assets | |

| 4,117.3 | | |

| 8,447.5 | | |

| 16,388.2 | | |

| - | |

| Others(2) | |

| 19,319.6 | | |

| 3,290.0 | | |

| 6,382.6 | | |

| (83.0 | %) |

| Total provisions

and contingencies | |

Rs. | 27,883.4 | | |

Rs. | 18,750.0 | | |

JPY | 36,375.0 | | |

| (32.7 | %) |

____________________

| (1) | Includes restructuring related

provision. |

| (2) | Includes nil contingency provision

the six months ended September 30, 2023 (During the six months ended September 30, 2022: Rs. 25.50 billion). |

Provisions and contingencies

(excluding provisions for tax) decreased from Rs. 27.88 billion in the six months ended September 30, 2022 to Rs. 18.75 billion in the

six months ended September 30, 2023.

Provision for non-performing

and other assets was Rs. 8.42 billion in the six months ended September 30, 2023 as compared to a write-back of Rs. 5.30 billion in the

six months ended September 30, 2022. During the six months ended September 30, 2023, there were higher net additions to non-performing

loans primarily in retail and rural loans, offset, in part, by recoveries in non-retail loans.

Provision for investments

was Rs. 9.75 billion in the six months ended September 30, 2022 as compared to a write-back of Rs. 1.41 billion in the six months ended

September 30, 2023 primarily due to write-back of provision on equity shares.

Provision for standard

assets increased from Rs. 4.12 billion in the six months ended September 30, 2022 to Rs. 8.45 billion in the six months ended September

30, 2023 primarily due to an increase in domestic loans.

Other provisions and

contingencies decreased from Rs. 19.32 billion in the six months ended September 30, 2022 to Rs. 3.29 billion in the six months ended

September 30, 2023. During the six months ended September 30, 2022, the Bank had made an additional contingency provision of Rs. 25.50

billion on a prudent basis. The Bank held contingency provision of Rs. 131.00 billion in the six months ended September 30, 2023.

Restructured

Loans and Non-performing Loans

We classify

our loans as performing and non-performing in accordance with Reserve Bank of India guidelines. Under Reserve Bank of India guidelines,

a loan is generally classified as non-performing if any amount of interest or principal remains overdue for more than 90 days, in respect

of term loans. In respect of overdraft or cash credit, a loan is classified as non-performing if the account remains out of order for

a period of 90 days; and in respect of bills, if the account remains overdue for more than 90 days. Reserve Bank of India guidelines

also require a loan to be classified as non-performing based on certain other criteria like restructuring of a loan, inability of a borrower

to complete a project funded by us within stipulated timelines and certain other non-financial parameters. In respect of borrowers where

loans and advances made by overseas branches are identified as impaired as per host country regulations for reasons other than record

of recovery, but which are standard as per Reserve Bank of India guidelines, the amount outstanding in the host country is classified

as non-performing.

The Reserve

Bank of India has separate guidelines for restructured loans. As per these guidelines, loans restructured are classified as non-performing

loans. However, loans granted for implementation of projects that are restructured due to a delay in implementation of the project (up

to a specified period) enjoy forbearance in loans classification subject to the fulfillment of certain conditions stipulated by the Reserve

Bank of India. The Reserve Bank of India has issued guidelines for restructuring of loans to micro and small enterprises borrowers while

continuing loans classification as standard, subject to specified conditions. Further, Reserve Bank of India through its guideline on

‘Resolution Framework for COVID-19 related Stress’ dated August 6, 2020 and May 5, 2021, has provided a prudential framework

to implement a resolution plan in respect of eligible corporate borrowers and personal loans, while classifying such exposures as standard,

subject to specified conditions. For such loans, the diminution in the fair value of the loan, if any, measured in present value terms,

has to be provided for in addition to the provisions applicable to non-performing loans.

The following

table sets forth, at the dates indicated, certain information regarding non-performing loans.

| | |

At |

| | |

(in millions, except percentages) |

| September 30, 2022 | |

| March 31,

2023 | | |

| September 30,

2023 | | |

| September 30,

2023 | | |

| 2023/2022

% change | | |

| | |

| | |

| (in millions, except percentages) | |

| Gross non-performing loans | |

Rs. | 314,214.2 | | |

Rs. | 299,860.7 | | |

Rs. | 288,947.2 | | |

JPY | 560,557.6 | | |

| (8.04 | )% |

| Provisions for non-performing loans | |

| (253,266.2 | ) | |

| (248,360.1 | ) | |

| (238,539.1 | ) | |

| (462,765.9 | ) | |

| (5.81 | )% |

| Net non-performing

loans | |

Rs. | 60,948.0 | | |

Rs. | 51,500.7 | | |

Rs. | 50,408.1 | | |

JPY | 97,791.7 | | |

| (17.29 | )% |

| Gross customer loans | |

| 9,641,438.5 | | |

| 10,446,527.1 | | |

| 11,345,548.0 | | |

| 22,010,363.1 | | |

| 17.67 | |

| Net customer loans | |

| 9,385,627.8 | | |

| 10,196,383.0 | | |

| 11,105,421.4 | | |

| 21,544,517.5 | | |

| 18.32 | |

| Gross non-performing loans as a percentage of gross customer loans | |

| 3.26 | % | |

| 2.87 | % | |

| 2.55 | % | |

| | | |

| | |

| Net non-performing loans as a percentage of net customer loans | |

| 0.65 | % | |

| 0.51 | % | |

| 0.45 | % | |

| | | |

| | |

___________________

(1) Prior period figures have been re-grouped/re-arranged

where necessary.

Gross additions

to non-performing loans decreased from Rs. 97.59 billion in the six months ended September 30, 2022 to Rs. 96.43 billion in the six months

ended September 30, 2023. The recoveries/upgrades from non-performing loans decreased from Rs. 94.65 billion in the six months ended

September 30, 2022 to Rs. 76.37 billion in the six months ended September 30, 2023. Gross non-performing loans amounting to Rs. 30.97

billion were written-off in the six months ended September 30, 2023. Gross non-performing loans decreased from Rs. 314.21 billion at

September 30, 2022 to Rs. 288.95 billion at September 30, 2023 (at March 31, 2023: Rs. 299.86 billion). Net non-performing loans decreased

from Rs. 60.95 billion at September 30, 2022 to Rs. 50.41 billion at September 30, 2023 (at March 31, 2023: Rs. 51.50 billion). The ratio

of net non-performing loans to net customer loans decreased from 0.65% at September 30, 2022 to 0.45% at September 30, 2023 (at March

31, 2023: 0.51%).

Gross non-performing

loans in the retail portfolio were 1.59% of gross retail loans at September 30, 2023 compared to 1.87% at September 30, 2022 and net

non-performing loans in the retail portfolio were 0.52% of net retail loans at September 30, 2023 compared to 0.68% at September 30,

2022.

The non-fund

based outstanding to borrowers classified as non-performing loans were Rs. 38.86 billion at September 30, 2023 as compared to Rs. 35.16

billion at September 30, 2022.

The gross outstanding loans to borrowers whose

facilities have been restructured decreased from Rs. 67.13 billion at September 30, 2022 to Rs. 35.36 billion at September 30, 2023. The

net outstanding loans to borrowers whose facilities have been restructured decreased from Rs. 64.60 billion at September 30, 2022 to Rs.

33.77 billion at September 30, 2023. The aggregate non-fund based outstanding to borrowers whose loans were restructured was Rs. 2.57

billion at September 30, 2023.

The provision coverage ratio increased from

80.6% at September 30, 2022 to 82.6% at September 30, 2023.

In addition to the above, at September 30,

2023, the outstanding loans and non-fund facilities to borrowers in the corporate and small and medium enterprises portfolio (excluding

banks, investments and fund and non-fund based outstanding to non-performing loans) rated BB and below were Rs. 47.89 billion.

Tax Expense

Income tax expense increased from Rs. 47.38

billion in the six months ended September 30, 2022 to Rs. 65.84 billion in the six months ended September 30, 2023 primarily due to an

increase in profit before taxes. The effective tax rate increased from 24.7% in the six months ended September 30, 2022 to 24.9% in the

six months ended September 30, 2023 primarily due to change in composition of income.

Financial Condition

The following table sets forth, at the dates

indicated, the principal components of assets.

| | |

At |

| | |

September

30, 2022 | |

March

31,

2023 | |

September

30, 2023 | |

September

30, 2023 | |

2023/2022

% change |

| | |

| (in million, except percentages) | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

Rs. | 1,249,129.2 | | |

Rs. | 1,194,382.7 | | |

Rs. | 1,094,617.0 | | |

JPY | 2,123,557.0 | | |

| (12.4 | )% |

| Investments(1) | |

| 3,330,308.2 | | |

| 3,623,297.3 | | |

| 4,132,530.9 | | |

| 8,017,110.0 | | |

| 24.1 | |

| Advances | |

| 9,385,627.8 | | |

| 10,196,383.1 | | |

| 11,105,421.4 | | |

| 21,544,517.5 | | |

| 18.3 | |

| Fixed assets (including leased assets) | |

| 95,096.7 | | |

| 95,998.4 | | |

| 101,659.3 | | |

| 197,219.0 | | |

| 6.9 | |

| Other assets(2) | |

| 826,580.5 | | |

| 732,005.0 | | |

| 773,567.0 | | |

| 1,500,720.0 | | |

| (6.4 | ) |

| Total assets | |

Rs. | 14,886,742.4 | | |

Rs. | 15,842,066.5 | | |

Rs. | 17,207,795.6 | | |

JPY | 3,383,123.5 | | |

| 15.6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

____________________

| (1) | Includes government and other approved securities qualifying

for statutory liquidity ratio. Banks in India are required to maintain a specified percentage, currently 18.00% (at September 30, 2023),

of their net demand and time liabilities by way of liquid assets like cash, gold or approved unencumbered securities. |

| (2) | Includes deposits made in Rural Infrastructure and Development

Fund and other such entities in lieu of shortfall in the amount required to be lent to certain specified sectors called priority sector

as per Reserve Bank of India guidelines. |

Total assets

of the Bank increased by 15.6% from Rs. 14,886.74 billion at September 30, 2022 to Rs. 17,207.80 billion at September 30, 2023 primarily

due to 24.1% increase in investments and 18.3% increase in advances, offset, in part, by 12.4% decrease in cash and cash equivalents.

Cash

and cash equivalents

Cash and

cash equivalents include cash in hand and balances with the Reserve Bank of India and other banks, including money at call and short

notice. Cash and cash equivalents decreased by 12.4% from Rs. 1,249.13 billion at September 30, 2022 to Rs. 1,094.62 billion at September

30, 2023, primarily due to a decrease in balance with United States Federal Reserve by Rs. 159.62 billion.

Total investments

increased by 24.1% from Rs. 3,330.31 billion at September 30, 2022 to Rs. 4,132.53 billion at September 30, 2023. Investments in Indian

government securities increased by 21.2% from Rs. 2,871.75 billion at September 30, 2022 to Rs. 3,480.84 billion at September 30, 2023.

Other investments increased by 42.1% from Rs. 458.56 billion at September 30, 2022 to Rs. 651.69 billion at September 30, 2023 primarily

due to an increase in investment in pass through certificates by Rs. 92.70 billion, bonds and debentures by Rs. 66.36 billion and commercial

paper by Rs. 25.15 billion.

The outstanding

net investment in security receipts issued by asset reconstruction companies at September 30, 2023 was Rs. 1.49 billion as compared to

Rs. 4.29 billion at September 30, 2022.

Net advances

increased by 18.3% from Rs. 9,385.63 billion at September 30, 2022 to Rs. 11,105.42 billion at September 30, 2023.

Domestic advances

increased by 19.3% from Rs. 9,005.72 billion at September 30, 2022 to Rs. 10,742.06 billion at September 30, 2023 primarily due to an

increase in retail advances. Net retail advances increased by 21.4% from Rs. 5,065.16 billion at September 30, 2022 to Rs. 6,148.73 billion

at September 30, 2023.

Net advances

of overseas branches decreased by 4.4% from Rs. 379.91 billion at September 30, 2022 to Rs. 363.36 billion at September 30, 2023.

Fixed

and other assets

Fixed assets

(net block) increased by 6.9% from Rs. 95.09 billion at September 30, 2022 to Rs. 101.66 billion at September 30, 2023.

Other assets

decreased by 6.4% from Rs. 826.58 billion at September 30, 2022 to Rs. 773.57 billion at September 30, 2023 primarily due to a decrease

in Rural Infrastructure and Development Fund and other related deposits and a decrease in margin deposit paid for treasury products,

offset, in part, by an increase in interest accrued on loans and investments.

The following

table sets forth, at the dates indicated, the principal components of liabilities (including capital and reserves).

| | |

At |

| Liabilities | |

September

30, 2022 | | |

March

31, 2023 | | |

September

30, 2023 | | |

September

30, 2023 | | |

2023/2022

% change |

| | |

(in

million, except percentages) |

| Deposits | |

Rs. | 10,900,079.6 | | |

Rs. | 11,808,406.9 | | |

Rs. | 12,947,417.2 | | |

JPY | 25,117,989.4 | | |

| 18.8 | % |

| Borrowings(1) | |