UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☒ Soliciting Material under §240.14a-12

KARUNA THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

Karuna Therapeutics, Inc. circulated the following FAQs to certain of its employees on December 22, 2023:

Karuna & BMS Announcement

Employee FAQ

Transaction overview

What has been announced?

▪On December 22, 2023, we announced that we entered into a definitive agreement and plan of merger (the “Merger Agreement”) with Bristol Myers Squibb (“BMS”), pursuant to which BMS has agreed to acquire Karuna Therapeutics, Inc. (“Karuna Therapeutics,” “Karuna,” “we,” “us” or “our”) pending Karuna stockholder approval, required antitrust approvals, and customary closing conditions, for $330.00 per share in cash, reflecting a total equity value of approximately $14.0 billion (the “merger,” the “transaction” or the “proposed transaction”).

Why is the merger happening?

▪We’ve all joined Karuna because we share the same vision – and that’s to discover, develop and deliver transformative therapies for those living with mental illness. We see innovation, value, and promise in our work, and have built a great company. Others see this too.

▪Like us, BMS believes that KarXT could be one of the most innovative advances in psychiatry in decades, and one of the most significant product launches in 2024. They’ve expressed admiration for what we’ve accomplished, see the promise and potential of what we’re doing, and recognize the internal capabilities and talent of our team. Simply put, this merger demonstrates that what we have done, what each of you have done, is special. Take pride in that.

▪As for the rationale behind the merger, BMS is accelerating the expansion and diversification of its neuroscience portfolio, with KarXT serving as the cornerstone of their psychiatry franchise. Both companies believe in KarXT and share the exact same commitment to innovative neuroscience and serving patients. The combination of the two companies unlocks additional opportunities to execute on what we have always set out to do. The resources and global scale of BMS mean we have the potential to do more – discover novel compounds, run additional clinical trials and, most importantly, reach more patients. Together, we are stronger.

Did another party approach Karuna?

▪We will disclose the material events leading to the signing of the transaction as part of our proxy statement relating to the merger.

What are the terms of the transaction?

▪Under the terms of the merger agreement, BMS will acquire all of the outstanding shares of Karuna common stock for $330.00 per share in cash. This represents an approximately 53% premium to Karuna’s closing stock price on December 21.

When will the transaction be finalized?

▪We expect the transaction to close in the first half of 2024, subject to customary closing conditions, including approval of Karuna stockholders and receipt of required antitrust approvals.

What needs to be completed for the merger to close?

▪As described above, the merger is subject to customary closing conditions, including receipt of required antitrust approvals and approval by our stockholders. There will be a shareholder meeting in which all stockholders, including employees who own stock, will be able to vote.

Human Resources

Will there be any layoffs as a result of this announcement?

▪There will be no layoffs as a result of the announcement. We will continue to operate as an independent company until the closing of the transaction. BMS will need time to fully assess our organization and capabilities and the best integration approach.

How does this announcement impact my base compensation, bonus, benefits, or other terms of my employment?

▪There will be no impact to base compensation, bonus, benefits, and other terms of employment agreements prior to closing. The year-end review process will continue as planned, including merit adjustments, bonus payments, planned promotions and annual equity grants for eligible employees. All health plans, including new health plans implemented for 2024, will be in place through closing.

Will there be promotions and merit raises in 2024?

▪Yes, there will be promotions for employees eligible for our year-end review process.

What will happen to my equity when the transaction closes?

▪There are two categories of equity that will be treated slightly differently in the transaction. Let’s discuss each in turn.

▪Equity outstanding at the end of 2023:

▪Equity awards granted by the Company have historically been made in the form of Options and RSUs. All equity awards that are outstanding at the end of 2023 will remain unchanged until closing, including the vesting schedules associated with these awards. If you choose to exercise and sell such equity between signing and closing, you will have the ability to do so, subject to our regular “black out” windows and pre-clearance requirements. At closing, all of your then-unvested and outstanding equity (i.e., what you hold at that time) that was granted in 2023 or before will immediately accelerate and become vested, and you will be entitled to receive a cash payment with respect to such equity that you will receive following closing. You will not need to take any action (such as submitting a trade request) to receive this cash payment.

▪Equity that is granted in 2024, including annual grants to current employees and grants to new hires:

▪Equity awards that are granted in 2024 will be made in the form of RSUs, which will vest on the same schedule as our current RSU awards: 25% on each of the first four anniversaries of the date of grant. At the closing, these awards will convert into a future right to receive cash and continue to vest after the closing (i.e., they will not automatically be converted into a right to receive cash at closing as with respect to the awards granted in 2023 or prior) as you continue to work at BMS. In the event that you are terminated without cause by BMS or you resign for “good reason” (the definition of which will be provided in the grant award agreement) within two years following closing, up to 50% of these awards will vest and pay out in cash. Any portion of the RSU award that vested prior to the date of termination will be included in the calculation of 50%. For example, if 0% of the award has vested on the date of your termination of employment without cause or resignation for good reason, and such date of termination occurs before the second anniversary of closing, 50% of your award will vest upon such termination of employment. If 25% of the award has vested on the date of your termination of employment without cause or resignation for good reason, and such date of termination occurs before the second anniversary of closing, an additional 25% of your award will vest upon such termination of employment.

▪How does vesting acceleration work?

▪An example is provided below of how “vesting acceleration” works with respect to RSUs (Example A). This is the same for Options (Example B), however the value is determined by the merger price of $330 / share less the exercise price (which can be found in your Charles Schwab Equity Awards Center account). RSUs do not have an exercise price.

Example A:

Example B:

What does severance look like?

▪You will be eligible for a severance package that includes base salary for at least 6 months, pro rata bonus target, and payment of the employer portion of COBRA for at least 6 months, in the event your employment is terminated without cause or you resign for “good reason” in the 12-month period following closing. You will also receive the equity acceleration set forth above.

Will my job remain the same?

▪Yes, your job will remain the same and we will continue to operate as an independent company until the closing of the merger.

I’m on a work visa. How will this impact me?

▪Please discuss this directly with Jonathan Rosin, CHRO, at Jonathan.rosin@karunatx.com.

Can I exercise my vested options or sell vested shares before the closing of the transaction?

▪Yes, subject to our regular “black out” windows and pre-clearance requirements, you will be able to exercise vested options or sell vested shares before the closing of the transaction.

Am I still an employee of Karuna or BMS?

▪You will continue to be an employee of Karuna until the closing of the merger.

At the closing of the merger, will I then work for BMS?

▪There will be no organizational changes before the closing of the merger. BMS will need time to assess our organization and capabilities to best determine how this aligns with their organization. In the event an employee’s role is impacted after closing, severance agreements will be honored.

Organization & Operational Impact

Will the Karuna leadership team remain in place?

▪Our leadership team and organization will remain in place between now and the closing of the merger. We will continue to operate independently until the closing and will work with BMS to discuss the best way to integrate our two companies following the closing.

How will Karuna fit into the overall organization of BMS? When will we know what the new organizational structure will be?

▪BMS values the neuroscience development and commercialization capabilities we bring to their organization. Between now and the closing of the transaction, we will discuss the integration plan in more detail.

How does this merger affect my day-to-day responsibilities? Do we have to get approval from BMS on critical decisions before close?

▪Your day-to-day responsibilities do not change. We will continue to operate as an independent company until the closing of the transaction, which means we will continue to invest in and execute our pre-clinical and clinical programs, pre-commercialization activities, and hiring as planned. Please consult with your functional leader and/or the executive team with any questions.

What are the expectations with regard to interactions between Karuna and BMS employees between now and closing? Should I reach out to, or expect to hear from, my counterpart at BMS?

▪Our two companies will continue to operate independently until the closing of the merger. In the coming weeks, the two companies expect to establish integration teams to determine how to best facilitate a smooth transition at the time of close.

Will my manager remain the same?

▪Yes. Until the closing of the merger, we will keep our organizational structure and reporting lines.

How should I handle previously scheduled travel, business meetings, etc.?

▪Until the merger closes, you should continue to perform your job as you normally would, which includes continuing to keep meetings and travel plans as scheduled. If you have any questions, please ask your manager or your respective Executive Leadership Team leader.

I have approved open headcount. Can I still fill my position?

▪Yes, you should continue to recruit and hire for critical positions.

I have a new hire that has accepted an offer and is planning to start in the coming weeks/months. What do I do?

▪Signed offer letters for new hires still stand, and we will continue to hire and recruit for critical roles in line with our operating plan.

▪HR will connect with hiring managers and new hires to discuss the announcement and answer any questions they will understandably have. If you receive questions you feel unable to answer using the key messages, please direct these to Jonathan Rosin, CHRO, at Jonathan.rosin@karunatx.com.

How does this affect our interactions with patient advocacy groups, physicians, customers, regulatory agencies, vendors, clinical trial sites, etc.? What type of transition will occur before closing?

▪We will continue to operate as an independent company until the closing of the transaction. It’s important that we continue to support ongoing activities and manage relationships with external organizations and stakeholders.

Will we continue with planned regulatory (i.e., FDA) interactions before the closing of the transaction?

▪Yes. Karuna will continue to operate as an independent company until the closing of the transaction and continue working with regulators, including the FDA.

What impact will this have on our current clinical trials and programs? How does this affect work on earlier pipeline assets?

▪We will continue to operate as an independent company and proceed with all ongoing and planned activities. This includes the ongoing support and advancement of active clinical programs, as well as the initiation / advancement of planned programs, including KAR-2618, earlier pipeline assets and formulation programs.

Misc.

What should I do if I am contacted by an external party, such as the media or an investor?

▪The U.S. Securities and Exchange Commission has very specific communication standards related to a transaction like this, and it is critically important that we follow these guidelines. As a result, if you are contacted by the media, an investor, or other outside party relating to the transaction, please do not respond and instead forward the inquiry Corporate Communications at corporatecommunications@karunatx.com.

How will I be informed in the future about any changes / updates?

▪Management will communicate regularly with employees until the closing of the transaction. If you have any questions, please reach out to your manager or your respective Executive Leadership Team leader.

Who can I contact if I have more questions?

▪If you have questions, please speak with your manager or Executive Leadership Team representative. Management will continue to provide updates to you throughout the process when we are able to do so.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements are often identified by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “will,” “would” or the negative or plural of these words or similar expressions or variations. Forward-looking statements are made based upon management’s current expectations and beliefs and are not guarantees of future performance. Such forward-looking statements are subject to a number of risks, uncertainties, assumptions and other factors that could cause actual results and the timing of certain events to differ materially from future results expressed or implied by the forward-looking statements. These factors include, among others: completion of the proposed transaction is subject to various risks and uncertainties related to, among other things, its terms, timing, structure, benefits, costs and completion; required approvals to complete the proposed transaction by our stockholders and the receipt of certain regulatory approvals, to the extent required, and the timing and conditions for such approvals; the stock price of Karuna Therapeutics, Inc. prior to the consummation of the proposed transaction; and the satisfaction of the closing conditions to the proposed transaction; our limited operating history; our ability to obtain necessary funding; our ability to generate positive clinical trial results for our product candidates; risks inherent in clinical development; the timing and scope of regulatory approvals; changes in laws and regulations to which we are subject; competitive pressures; our ability to identify additional product candidates; risks relating to business interruptions; and other risks set forth under the heading “Risk Factors,” of our Annual Report on Form 10-K for the year ended December 31, 2022 and in our subsequent filings with the Securities and Exchange Commission. You should not rely upon forward-looking statements as predictions of future events. Furthermore, such forward-looking statements speak only as of the date of this report. Our actual results could differ materially from the results described in or implied by such forward looking statements. Forward-looking statements speak only as of the date hereof, and, except as required by law, we undertake no obligation to update or revise these forward-looking statements.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This communication relates to a proposed acquisition of Karuna Therapeutics, Inc. by Bristol-Myers Squibb Company. In connection with this proposed acquisition, Karuna Therapeutics, Inc. plans to file one or more proxy statements or other documents with the SEC. This communication is not a substitute for any proxy statement or other document that Karuna Therapeutics, Inc. may file with the SEC in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS OF KARUNA THERAPEUTICS, INC. ARE URGED TO READ THE PROXY STATEMENT AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s) (if and when available) will be mailed to stockholders of Karuna Therapeutics, Inc. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Karuna Therapeutics, Inc. through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Karuna Therapeutics, Inc. will be available free of charge on Karuna Therapeutics, Inc.’s internet website at www.karunatx.com or upon written request to: Investor Relations, Karuna Therapeutics, Inc., 99 High Street, Floor 26, Boston, Massachusetts or by telephone at (857) 449-2244.

Participants in Solicitation

Karuna, its directors and certain of its executive officers may be considered participants in the solicitation of proxies in connection with the proposed transaction. Information about the directors and executive officers of Karuna is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 27, 2023. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC when they become available. These documents can be obtained free of charge from the sources indicated above.

Karuna Therapeutics, Inc.

99 High Street, 26th Floor

Boston, Massachusetts 02110

Attention: Mia Kelley

Tel. (857) 449-2244

www.karunatx.com

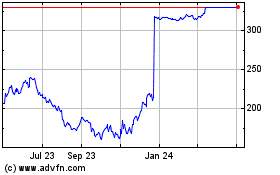

Karuna Therapeutics (NASDAQ:KRTX)

Historical Stock Chart

From Apr 2024 to May 2024

Karuna Therapeutics (NASDAQ:KRTX)

Historical Stock Chart

From May 2023 to May 2024