UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

Sono Group N.V.

(Name of Issuer)

Ordinary shares, par value of €0.06 per share

(Title of Class

of Securities)

N81409109

(CUSIP Number)

Laurin Hahn

Waldmeisterstraße 76

80935 Munich, Germany

+49 (0)89 4520 5818

laurin.hahn@sonomotors.com

(Name, Address

and Telephone Number of Person

Authorized to

Receive Notices and Communications)

November 20, 2023

(Date of Event

Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G

to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed

original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise

subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. N81409109 | Schedule 13D | Page 2 of 8 |

| 1. |

|

Names of Reporting Persons

Laurin Hahn |

| 2. |

|

Check The Appropriate Box if a Member of a Group (See Instructions)

(a) ☒

(b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See Instructions)

OO |

| 5. |

|

Check if Disclosure of Legal Proceedings is Required Pursuant

to Item 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of Organization

Federal Republic of Germany |

| |

|

|

|

|

|

|

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With

|

|

7. |

|

Sole Voting Power

21,375,000 (1) |

| |

8. |

|

Shared Voting Power

0 (2) |

| |

9. |

|

Sole Dispositive Power

21,375,000 (3) |

| |

10. |

|

Shared Dispositive Power

0 |

| |

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

21,375,000 (4) |

| 12. |

|

Check if the Aggregate Amount in Row (11) Excludes Certain

Shares (See Instructions)

☐ |

| 13. |

|

Percent of Class Represented by Amount in Row (11)

18.2% (5) |

| 14. |

|

Type of Reporting Person (See Instructions)

IN |

(1) These represent 19,796,053 ordinary

shares and 1,578,947 high voting shares. High voting shares are convertible at any time by the holder thereof into common shares on a

one-for-one basis, whereas common shares are not convertible into high voting shares under any circumstances. Each holder of common shares

is entitled to one vote per common share and each holder of high voting shares is entitled to twenty-five votes per high voting share

on all matters submitted to them for a vote.

| CUSIP No. N81409109 | Schedule 13D | Page 3 of 8 |

(2) See Item 5. Although they do not

share voting power, as a result of entering into a shareholder commitment letter, Laurin Hahn may be deemed to be a member of a “group”

with Jona Christians, who also entered into the shareholder commitment letter and is separately reporting beneficial ownership on Schedule

13D.

(3) See footnote (1). Also see Item 4

of this Schedule 13D for the description of an undertaking by Laurin Hahn to transfer all his shares upon request of the Issuer and the

custodian of the Issuer’s sole subsidiary, Sono Motors GmbH, respectively, to the Issuer and/or members of the management board

of the issuer yet to be designated and to a trustee acting for the benefit of the creditors of Sono Motors GmbH.

(4) See footnote (1).

(5) The percentage of class of securities

beneficially owned by the Reporting Person is based on a total of 108,667,115 outstanding shares (being the sum of 105,667,115 common

shares and 3,000,000 high voting shares) of the Issuer outstanding as a single class as of November 20, 2023, assuming conversion of

all high voting shares into common shares. The voting power of the shares beneficially owned represent 32,81% of the total outstanding

voting power. The percentage of voting power is calculated by dividing the voting power beneficially owned by the Reporting Person by

the voting power of all of the Issuer’s outstanding common shares and high voting shares as a single class as of November 20, 2023.

| CUSIP No. N81409109 | Schedule 13D | Page 4 of 8 |

EXPLANATORY NOTE

Item 1. Security and Issuer

The issuer of the shares is Sono Group N.V., a public company with

limited liability under Dutch law (naamloze vennootschap) (the “Issuer”). The Issuer’s shares consist of ordinary

shares with a par value of €0.06 per share (the “Ordinary Shares”) and high voting shares (the “High Voting Shares”).

Each holder of Ordinary Shares is entitled to one vote per Ordinary Share and each holder of High Voting Shares is entitled to twenty-five

votes per High Voting Share on all matters submitted to them for vote. High Voting Shares are convertible at any time by the holder thereof

into Ordinary Shares on a one-for-one basis. Ordinary Shares are not convertible into High Voting Shares under any circumstances.

The address of the principal executive offices of the Issuer is Waldmeisterstraße

76, 80935 Munich, Germany; its telephone number is +49 (0)89 4520 5818.

Item 2. Identity and Background

(a) This Schedule 13D is

being filed by Laurin Hahn (the “Reporting Person”). Pursuant to Rule 13d-1(d), the Reporting Person previously filed a Schedule

13G in relation to his beneficial ownership of shares of the Issuer on February 14, 2022.

(b) The principal business

address for the Reporting Person is Waldmeisterstraße 76, 80935 Munich, Germany.

(c) The present principal

occupation of the Reporting Person is serving as the Co-Chief Executive Officer and member of the management board of the Issuer and as

the Co-Chief Executive Officer and Managing Director of Sono Motors GmbH (the “Subsidiary”). The business address of the Issuer

and the Subsidiary is Waldmeisterstraße 76, 80935 Munich, Germany.

(d) The Reporting Person

has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) during the last five years.

(e) During the last five

years, the Reporting Person has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction,

as a result of which the Reporting Person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting

or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The Reporting Person

is a citizen of the Federal Republic of Germany.

Item 3. Source and Amount of Funds or Other Consideration

No shares were purchased by the Reporting Person or Jona Christians

(see Item 5) in connection with the Shareholders Commitment Letter (as defined below) giving rise to the filing of this Schedule 13D,

and thus no funds were used by the Reporting Person or Jona Christians for such purpose. The Reporting Person andJona Christians –

the Issuer’s co-founders and co-CEOs (collectively, the “Founders”) – entered into a Shareholders Commitment Letter,

effective as of November 20, 2023 (the “Shareholders Commitment Letter”) with the Issuer and the Subsidiary as a condition

to the willingness of YA II PN, Ltd. (“Yorkville”) to enter into the Yorkville Agreements (as defined in Item 4) and the Transactions

(as defined in Item 4) to allow the Issuer to exit from insolvency proceedings in Germany. Under the terms of the Shareholders Commitment

Letter, each Founder in his respective capacity as a shareholder of the Issuer agrees (i) to attend the Issuer’s upcoming annual

general meeting of shareholders, which has been convened for December 29, 2023 (the “AGM”), either in person or represented

by proxy, (ii) not to transfer any shares and/or voting rights such Founder holds in the capital of the Issuer prior to the AGM, (iii)

to exercise the voting rights on all the shares in the capital of the Issuer held by such Founder in favor of all proposed resolutions.

In addition, in the event that one or more subsequent general meetings of the Issuer are convened or deemed necessary to give full effect

to the Transactions and/or the Agenda Items (as defined in Item 4), each Founder further agrees in his capacity as a shareholder of the

Issuer to comply with the requirements of (i) - (iii) above with respect to such subsequent general meeting(s) and to exercise such Founder’s

voting rights in the capital of the Issuer at such subsequent general meeting(s) in such manner so as to give effect to the Transactions

and/or the Agenda Items in the fullest possible manner.

| CUSIP No. N81409109 | Schedule 13D | Page 5 of 8 |

The information disclosed in this Item 3 does not purport to be complete

and is qualified in its entirety by reference to the Shareholders Commitment Letter, a copy of which is filed as Exhibit 1 and is incorporated

herein by reference in its entirety.

Item 4. Purpose of Transaction

The Issuer entered into certain investment-related agreements (the

“Yorkville Agreements”), effective November 20, 2023, between the Issuer and Yorkville, pursuant to which Yorkville has committed

to provide financing to the Issuer subject to the satisfaction of certain conditions precedent. The aim of the Yorkville Agreements and

the transactions contemplated therein (the “Transactions”) is the planned restructuring of the Issuer and the Subsidiary (collectively,

the “Companies”), in connection with the Companies’ respective self-administration proceedings currently before the

insolvency court of the local court of Munich, Germany.

Under the terms of Section 2 “General Meeting” of the Shareholders

Commitment Letter, each Founder has agreed, as stated in Item 3, to exercise the voting rights on all the shares in the capital of the

Issuer held by such Founder in favor of all proposed resolutions at the Issuer’s upcoming AGM, convened for December 29, 2023, and,

if subsequent general meetings of the issuer are convened or deemed necessary, to exercise the voting rights on all the shares in the

capital of the Issuer held by such Founder in such manner so as to give effect to the Transactions and/or, to the extent not included

in the AGM, the following agenda items (the “Agenda Items”):

| 1. | any proposed changes to the composition of the Issuer’s management board and/or supervisory board; |

| 2. | adoption of the annual accounts of the Issuer for the financial year 2022, including the consolidated accounts of its group; |

| 3. | to the extent legally required, the adoption of the half-year accounts of the Issuer, including the consolidated accounts of its group; |

| 4. | appointment of an auditor for the financial year 2023/2024; and |

| 5. | to the extent included in the agenda of the AGM: |

| a. | the approval of the repurchase of shares in the share capital of the Issuer by the Issuer and/or the Subsidiary; |

| b. | the approval of a cancellation of shares by the Issuer held by the Issuer and/or the Subsidiary; and |

| c. | any proposed changes to the articles of association of the Issuer required in connection with the Transactions or any of the foregoing

subjects as well as the authorization to execute the notarial deed of amendment. |

The following agenda items may be presented in subsequent general meetings,

and the Founders have covenanted to vote in favor of them insofar as they further the effectiveness of the Transactions:

| 1. | a

reduction in the nominal value per Ordinary Share of the Issuer from €0.06 to €0.01 per Ordinary Share or such lower amount

as may be legally permissible and, for the avoidance of doubt, without any (re)payment or distribution to shareholders; |

| CUSIP No. N81409109 | Schedule 13D | Page 6 of 8 |

| 2. | a

reverse stock split without cash components after good faith consultation with Yorkville; |

| 3. | any

amendment of the articles of association necessary to increase the authorized capital of the Issuer up to 600 million Ordinary Shares;

and |

| 4. | the

agreed upon steps to the restructuring agreement becoming effective. |

In addition, under the terms of Section 3 “Transfer of Shares”

of the Shareholders Commitment Letter:

| ● | The Reporting Person has undertaken to sell and transfer, if so requested, (i) 7,187,500 Ordinary Shares to a trustee to be appointed

for the benefit of the creditors of the Subsidiary and (ii) 9,108,553 Ordinary Shares and all of its High Voting Shares in the Issuer

to the Issuer and/or the new members of the management board to be appointed for the Issuer. |

| ● | Jona Christians has undertaken to sell and transfer, if so requested, (i) 6,118,749 Ordinary Shares to a trustee to be appointed for

the benefit of the creditors of the Subsidiary and (ii) 8,197,698 Ordinary Shares and all of his High Voting Shares in the Issuer to the

Issuer and/or the new members of the management board to be appointed for the Issuer. |

The new members of the management board of the Issuer have not yet

been selected.

The information disclosed in this Item 4 does not purport to be complete

and is qualified in its entirety by reference to the Shareholders Commitment Letter, a copy of which is filed as Exhibit 1 and is incorporated

herein by reference in its entirety.

Item 5. Interest in Securities of the Issuer

The responses of the Reporting Person with respect to Rows 11, 12,

and 13 of the cover pages of this Schedule 13D that relate to the aggregate number and percentage of shares (including but not limited

to footnotes to such information) are incorporated herein by reference.

The responses of the Reporting Person with respect to Rows 7, 8, 9,

and 10 of the cover pages of this Schedule 13D that relate to the number of shares as to which such Reporting Person has sole or shared

power to vote or to direct the vote of and sole or shared power to dispose of or to direct the disposition of (including but not limited

to footnotes to such information) are incorporated herein by reference.

As a result of entering into the Shareholder Commitment Letter, the

Reporting Person may be deemed to be a member of a “group” pursuant to Section 13(d) of the Exchange Act with Jona Christians,

who also entered into the Shareholder Commitment Letter and who is separately reporting beneficial ownership of shares of the Issuer on

Schedule 13D.

Jona Christians owns 19,237,500 shares of the Issuer, of which 1,421,053

shares are High Voting Shares. Jona Christians owns 16.4% of the Ordinary Shares of the Issuer and 47.4% of the High Voting Shares of

the Issuer. The voting power of the shares owned by Jona Christians represent 29.5% of the total outstanding voting power (see footnote

(4) for an explanation of the calculation).

The Reporting Person and Jona Christians in aggregate own 40,612,500

shares, representing 37,612,500 Ordinary Shares and 3,000,000 High Voting Shares. This aggregate amount represents 37.4% of the outstanding

shares and 62.3% of the total voting power of the shares (see footnote (4) for an explanation of the calculation).

The information set forth in Items 2, 3 and 4 above is hereby incorporated

by reference.

| CUSIP No. N81409109 | Schedule 13D | Page 7 of 8 |

See Item 4 of this Schedule 13D for the description of undertakings

by the Reporting Person and Jona Christians to transfer certain of their respective shares upon request of the Issuer and the custodian

of the Subsidiary, respectively, to members of the management board of the Issuer yet to be designated and to a trustee acting for the

benefit of the creditors of the Subsidiary.

(c) Except as set forth in

this Schedule 13D, neither the Reporting Person, nor, to the knowledge of the Reporting Person, Jona Christians, has effected any transactions

with respect to the shares of the Issuer during the past 60 days.

(d) Except as disclosed in

this Schedule 13D, no person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, the securities.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships

With Respect to Securities of the Issuer

The information set forth in Items 3, 4, and 5 are hereby incorporated

by reference in their entirety.

To the best knowledge of the Reporting Person, other than described

in Items 3, 4, and 5, there are no other contracts, arrangements, understandings or relationships (legal or otherwise) between the Reporting

Person and any other person with respect to any securities of the Issuer, including, but not limited to, transfer or voting of any of

the securities, finder’s fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits

or loss, or the giving or withholding of proxies, including any securities pledged or otherwise subject to a contingency, the occurrence

of which would give another person voting power or investment power over such securities, other than standard default and similar provisions

contained in loan agreements.

Item 7. Material to be Filed as Exhibits

| CUSIP No. N81409109 | Schedule 13D | Page 8 of 8 |

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief,

I certify that the information set forth in this statement is true, complete and correct.

| Date: December 19, 2023 | By: |

/s/ Laurin Hahn |

| | |

Laurin Hahn |

Exhibit 1

EXECUTION COPY 17 NOVEMBER 2023

To:

| |

1

|

Sono Group N.V., a company incorporated under Dutch law (naamloze vennootschap) and registered with the Dutch chamber of commerce under number 80683568 (the “Company”); and

|

| |

2

|

Sono Motors GmbH, a company incorporated under German law (Gesellschaft mit beschränkter Haftung) and registered with the District Court of München, Germany, under number HRB 224131 (“Sono GmbH”).

|

Date: 17 November 2023

RE: Commitment letter in respect of insolvency restructuring

Ladies and Gentlemen,

| |

1.1

|

We, the undersigned, refer to the envisaged restructuring of the Company and Sono GmbH (jointly the "Sono Group") through the implementation of certain restructuring steps as set out in inter alia the restructuring agreement between Sono Group N.V. and YA II PN, Ltd.(“Yorkville”), to be entered into on or about the date hereof (the “Restructuring Agreement”), to allow the Sono Group to exit from insolvency procedures in Germany (the "Restructuring" and the transactions in connection therewith and/or arising therefrom jointly the "Transactions"). The Transactions, as well as the documents, deeds, agreements, powers of attorney, notices, acknowledgements, letter agreements, memoranda, statements, resolutions and certificates as may be ancillary, necessary, required or useful in connection therewith are known to me, the undersigned.

|

| |

1.2

|

On the date hereof, we are the founders and majority shareholders of the Company with the shareholdings as set out in Exhibit 1.2.

|

| |

1.3

|

Our covenants und undertakings included in this commitment letter are subject to the execution of the Restructuring Agreement including the following provision:

|

| |

“10.1

|

Subject to the occurrence of the Closing, Yorkville hereby agrees – by way of a genuine contract for the benefit of a third party (Section 328 of the German Civil Code) – a pactum de non petendo regarding all potential claims – if any – arising from and/or in connection with the issuance of the Existing Convertible Debentures against (i) the following members of the management (managing directors (bestuurders) and supervisory directors) of Sono NV: Laurin Hahn (CEO), Jona Christians (CEO), Torsten Kiedel (CFO), Markus Volmer (CTO), Johannes Trischler; and/or the following former members of the management (managing directors (bestuurders) and supervisory directors) of Sono NV: Thomas Hausch, Martina Buchhauser, Sebastian Böttger, Robert Jeffe, and Arnd Schwierholz; and/or the management (Geschäftsführer) of Sono GmbH (the “Beneficiaries”).

|

| |

10.2 |

This pactum de non petendo is subject to the following qualifications:

|

| |

(a)

|

This pactum de non petendo as per section 10.1 shall be lifted and has no effect (auflösende Bedingung) if and to the extent this is preventing or otherwise limiting recourse to any D&O insurance cover.

|

| |

(b)

|

There is no intention to pursue such claims if there is no D&O insurance cover for such claims.

|

| |

(c)

|

Claims will only be pursued at the earliest 18 months after Closing.

|

| |

(d)

|

If required, the person affected will give a rolling agreement to make sure claims will not be lost because of expiration of statute of limitations. Not delivery of such declaration upon request within 20 Business Days is a condition subsequent (auflösende Bedingung) to section 10.1.

|

| |

(e)

|

No claims will be pursued, once 80 per cent of the Existing Convertible Debentures (i) have been sold by Yorkville, (ii) have been fully repaid to Yorkville, and/or (iii) converted.

|

| |

(f)

|

Lock-up: 12 months (as stipulated under the Shareholders Commitment Letter).

|

Sono NV confirms to its best knowledge that claims made have been notified to D&O insurer.”

| |

2.1

|

We, the undersigned, each acting in his capacity as managing director of the Company and member of the management board of the Company, hereby irrevocably and unconditionally covenant and undertake towards the Company and the Third Party Beneficiaries (as defined hereinafter) to prepare and convene the General Meeting (as defined below) and to establish the agenda of the General Meeting after consultation of Yorkville in its capacity as lender and sponsor to the Restructuring and which agenda shall in any event include the items set out in, and subject to, paragraph 2.2(d).

|

| |

2.2

|

Each of us, acting in his respective capacity as shareholder of the Company, hereby irrevocably and unconditionally covenants and undertakes towards the Company and the Third Party Beneficiaries to:

|

| |

(a)

|

comply with any and all formalities to be registered for and be present at any general meeting of shareholders of the Company to be held no later than 31 December 2023 (or, the adjourned meeting, as the case may be) (the “General Meeting”), either in person or represented by proxy;

|

| |

(b)

|

attend the General Meeting either in person or represented by proxy;

|

| |

(c)

|

not to transfer any shares and/or voting rights we hold in the capital of the Company prior to the General Meeting; and

|

| |

(d)

|

to exercise the voting rights on all the shares in the capital of the Company that we hold in favour of all proposed resolutions, including but not limited to:

|

| |

(i)

|

any proposed changes to the composition of the Company’s management board and/or supervisory board;

|

| |

(ii)

|

adoption of the annual accounts of the Company for the financial year 2022, including the consolidated accounts of its group;

|

| |

(iii)

|

to the extent legally required, the adoption of the half-year accounts of the Company, including the consolidated accounts of its group;

|

| |

(iv)

|

appointment of an auditor for the financial year 2023/2024; and

|

| |

(v)

|

to the extent included in the agenda of the General Meeting:

|

| |

(A)

|

the approval of the repurchase of shares in the share capital of the Company by the Company and/or Sono GmbH;

|

| |

(B)

|

the approval of a cancellation of shares by the Company held by the Company and/or Sono GmbH; and

|

| |

(C)

|

any proposed changes to the articles of association of the Company required in connection with the Transactions or any of the foregoing subjects as well as the authorization to execute the notarial deed of amendment.

|

| |

2.3

|

In the event that one or more subsequent general meetings of the Company are convened or deemed necessary to give full effect to the Transactions and/or the agenda items in paragraph 2.2(d), we, the undersigned, acting in our capacity as shareholder of the Company, hereby irrevocable and unconditionally covenant and undertake towards the Company and the Third Party Beneficiaries to comply with any and all of the items referred to in paragraphs 2.1 and 2.2 and exercise our voting rights in the capital of the Company at such general meetings and in such manner to give effect to the Transactions and/or the agenda items in paragraph 2.2(d) in the fullest possible manner.

|

| |

3.1

|

(a) I, the undersigned Laurin Hahn, acting in my capacity as shareholder of the Company, hereby irrevocably and unconditionally covenant and undertake towards the Company and the Third Party Beneficiaries to transfer:

|

| |

(i)

|

upon written request (e-mail with attached signed PDF copy sufficient) by the Company which can be made at any time, at the latest, however, on 30 June 2024:

|

– 9,108,553 of ordinary shares in the share capital of the Company; and

– 1,578,947 of high-voting shares in the share capital of the Company

to the Company and/or the managing directors of the Company – as designated in the written request by the Company – for a compensation of EUR 0.003/share, i.e., for an aggregate compensation of EUR 32,062.50 (incl. VAT, if any);

| |

(ii)

|

upon written request (e-mail with attached signed PDF copy sufficient) by Mr. Ivo-Meinert Willrodt (the “Custodian”) which can be made at any time, at the latest, however, on 31 December 2024 (i.e., irrespective of the Custodian’s function as the custodian of Sono GmbH has been ended or not):

|

– 7,187,500 of ordinary shares in the share capital of the Company

to a trustee acting for the benefit of the creditors of Sono GmbH (the “Trustee”) – as designated in the written request by the Custodian – for a compensation of EUR 0.003/share, i.e., for an aggregate compensation of EUR 21,562.50 (incl. VAT, if any).

(b) I, the undersigned Jona Christians, acting in my capacity as shareholder of the Company, hereby irrevocably and unconditionally covenant and undertake towards the Company and the Third Party Beneficiaries to transfer:

| |

(i)

|

upon written request (e-mail with attached signed PDF copy sufficient) by the Company which can be made at any time, at the latest, however, on 30 June 2024:

|

– 8,197,698 of ordinary shares in the share capital of the Company; and

– 1,421,053 of high-voting shares in the share capital of the Company

to the Company and/or the managing directors of the Company – as designated in the written request by the Company – for a compensation of EUR 0.003/share, i.e., for an aggregate compensation of EUR 28,856.25 (incl. VAT, if any);

| |

(ii)

|

upon written request (e-mail with attached signed PDF copy sufficient) by Mr. Ivo-Meinert Willrodt (the “Custodian”) which can be made at any time, at the latest, however, on 31 December 2024 (i.e., irrespective of the Custodian’s function as the custodian of Sono GmbH has been ended or not):

|

– 6,118,749 of ordinary shares in the share capital of the Company; and

to the Trustee – as designated in the written request by the Custodian – for a compensation of EUR 0.003/share, i.e., for an aggregate compensation of EUR 18,356.25 (incl. VAT, if any).

(c) The compensation for the transfer of the shares according to (a) and (b) above in the aggregate amount of up to EUR 100,837.50 shall be paid by the Trustee exclusively as follows:

| |

(i)

|

an amount of EUR 26.813.00 (incl. VAT, if any) shall be paid to Laurin Hahn, and an amount of EUR 23.606.00 (incl. VAT, if any) shall be paid to Jona Christians, in each case without undue delay after Laurin Hahn or, as the case may be, Jona Christians have validly transferred their shares to be transferred pursuant to (a) or, respectively, (b) above to the respective designated transferee, but no later than 14 days after such transfer of shares;

|

| |

(ii)

|

an amount of 50% of any payments received by the Trustee as a compensation for a sale of any of the shares to be transferred to the Trustee pursuant to (b) above until 31 December 2024 – to be forwarded to Laurin Hahn and Jona Christians by the end of each calendar quarter in which such sale(s) has/have taken place, pro rata, in accordance with the number of shares sold by Laurin Hahn and Jona Christians pursuant to (a) and (b) above; provided that the overall amount of payments to be made by the Trustee under (i) and this (ii) to Laurin Hahn shall not exceed the maximum compensation pursuant to (a) above; and provided further that the overall amount of payments to be made by the Trustee under (i) and this (ii) to Jona Christians shall not exceed the maximum (pro rata) compensation pursuant to (b) above. In addition to the payment under this (ii), the Trustee will inform Laurin Hahn and Jona Christians at the end of each calendar quarter about how many shares were sold by the Trustee during that calendar quarter and for what compensation such shares were sold. If and to the extent that by 31 December 2026 the payments under this (ii) are not sufficient to fully pay the maximum compensation to be paid to Laurin Hahn and/or Jona Christians pursuant to (a) and/or (b) above, any further claims of Laurin Hahn and Jona Christians to their respective compensation which has not yet been paid shall expire.

|

(d) Neither the Company, Sono GmbH nor any Third Party Beneficiary (other than the Trustee) shall be obligated to make any payments under this paragraph 3.1. Trustee’s obligation to make any payments in accordance with this paragraph 3.1 to Laurin Hahn shall be subject to a transfer request pursuant to (a) above being made and the shares to be transferred pursuant to (a) above being validly transferred to the respective designated transferee. The Trustee’s obligation to make any payments in accordance with this paragraph 3.1 to Jona Christians shall be subject to a transfer request pursuant to (b) above being made and the shares to be transferred pursuant to (b) above being validly transferred to the respective designated transferee.

3.2 We, the undersigned, hereby irrevocably and unconditionally covenant and undertake – without assuming any primary payment obligations (primäre Zahlungsverpflichtungen) – towards the Company and the Third Party Beneficiaries to enter into, execute, deliver and perform (as the case may be) any and all documents, deeds, agreements, powers of attorney, notices, acknowledgements, letter agreements, resolutions, waivers, consents, instructions, memoranda, statements and certificates as may be ancillary, necessary, required or useful in connection the transfer of our shares as described in this paragraph 3 including, but not limited to, entering into one or several sale and transfer agreements substantially in form to the sample share sale and transfer agreement attached as Exhibit 3.2 to this commitment letter (and make the representations and warranties provided therein) (the “Sample SPA”), provided that we will consent to any amendments to the Sample SPA requested by you in good faith (including, but not limited to, amendments due to applicability of Dutch and/or US laws.

4.1 We, the undersigned, hereby irrevocably and unconditionally covenant and undertake towards the Company and the Third Party Beneficiaries, that without the prior written consent of Company, we will not, whether directly or indirectly, at any time during the period of 12 months following the date hereof (such period, the “Lock-Up Period”), (i) dispose of, in any way, any shares in the capital of the Company, including any securities convertible into or exchangeable or exercisable for or that represent the right to receive any of the forgoing securities; (ii) dispose of, in any way, any shares or any interest in any company, entity or person holding any shares in the capital of the Company, including any securities convertible into or exchangeable or exercisable for or that represent the right to receive any of the forgoing securities; (iii) agree or contract to, or publicly announce any intention to, enter any such transaction described above; or (iv) enter into any transactions directly or indirectly with the same economic effect as any aforesaid transactions.

| |

4.2

|

Notwithstanding paragraph 4.1, the lock-up period shall end immediately if one of the following events occurs:

|

| |

(a)

|

Yorkville has converted and sold 80% of the Existing Convertible Debentures. “Existing Convertible Debentures” shall mean the convertible debentures in an aggregate principal amount of USD 31.1 million (of which an aggregate amount of USD 20 million is outstanding) which Yorkville purchased from Sono NV pursuant to the securities purchase agreement dated 7 December 2022 between Yorkville and Sono NV.

|

| |

(b)

|

The shares in Sono GmbH are sold in part or in full to a third party.

|

| |

(c)

|

Sono GmbH or Sono NV file – after the signing of this letter – for insolvency another time.

|

In the case of section paragraph 4.2 (b), we, the undersigned, undertake to sell the shares only outside the stock exchange or by offering the Company a purchase of the shares.

In the case of section paragraph 4.2. (a) the Company will inform the undersigned after such an event via email and the lock-up period shall end immediately.

In the case of section paragraph 4.2. (b) the Company will inform the undersigned in due course to the extent legally permissible, the latest 2 weeks prior to such an event via email (email: OMITTED, OMITTED) and the lockup will end immediately.

We, the undersigned, herewith undertake to keep the Company informed about our up to date notification and contact details.

| |

4.3

|

Following the Lock-Up Period, we, the undersigned, will be authorized to dispose of shares in the capital of the Company that we hold, it being understood that:

|

| |

(a)

|

such disposal shall never exceed, directly or indirectly, for Laurin Hahn 200,000 shares in the capital of the Company per calendar month and for Jona Christians 200,000 shares in the capital of the Company per calendar month; and

|

| |

(b)

|

section (i) through (iv) of paragraph 4.1 apply mutatis mutandis.

|

| |

5

|

Completion of Transactions

|

We, the undersigned, hereby irrevocably and unconditionally covenant and undertake – without assuming any primary payment obligations (primäre Zahlungsverpflichtungen) – towards the Company and the Third Party Beneficiaries to enter into, execute, deliver and perform (as the case may be) any and all documents, deeds, agreements, powers of attorney, notices, acknowledgements, letter agreements, resolutions, waivers, consents, memoranda, statements and certificates as may be ancillary, necessary, required or useful in connection with the Transactions. And we further undertake to use our best efforts to support the implementation of the restructuring.

| |

6.2

|

Each of us hereby declares:

|

I, the undersigned, hereby represent and warrant that I have the legal right and full power and authority (including all necessary consents, authorisations, confirmations, permissions, certificates, approvals, authorities or other corporate action as may be required) to provide and perform the obligations and undertakings contained in this letter (as applicable) which when executed will constitute legal, valid and binding obligations on me.

| |

6.3

|

This letter shall be treated by us, the undersigned, as strictly confidential and shall not, without your prior written consent, be disclosed in whole or in part to any person, other than to our employees, directors, professional advisers and financing sources, in each case on a confidential basis. You and the Third Party Beneficiaries shall be entitled to freely disclose this letter.

|

| |

6.4

|

No variation of this letter shall be effective unless in writing and signed by us, the undersigned, the Company, Sono GmbH and the Third Party Beneficiaries (including, but not limited to, the Trustee, once having been designated by the Custodian).

|

| |

6.5

|

If any provision in this letter shall be held to be illegal, invalid or unenforceable, in whole or in part, the provision shall apply with whatever deletion or modification is necessary so that the provision is legal, valid and enforceable and gives effect to the commercial intention between the Sono Group and us. To the extent it is not possible to delete or modify the provision, in whole or in part then such provision or part of it shall, to the extent that it is illegal, invalid or unenforceable, be deemed not to form part of this letter and the legality, validity and enforceability of the remainder of this letter shall, subject to any deletion or modification made under this paragraph, not be affected.

|

| |

6.6

|

Any set-off or retention right of any party shall be excluded, unless the existence of such right is undisputed or confirmed by a final court decision.

|

| |

7

|

Acceptance and counterparts

|

| |

7.2

|

If you agree to the above, please acknowledge your agreement and acceptance of the aforementioned by signing and returning by email to us a scanned copy of this letter countersigned by you.

|

| |

7.3

|

We deem your acknowledgment and agreement of this letter also an acknowledgment and acceptance of any third party stipulations created in this letter for the benefit (in the meaning of Section 328 BGB) of the Custodian, and/or the Trustee (jointly, the “Third Party Beneficiaries”), it being understood that any benefit of a Third Party Beneficiary may not be amended without the relevant Third Party Beneficiary’s consent.

|

| |

7.4

|

This letter may be executed in any number of counterparts and this has the same effect as if the signatures on the counterparts were on a single copy of this letter.

|

| |

8

|

Governing law and jurisdiction

|

| |

8.2

|

This letter and any non-contractual obligation arising out of or in connection with it (including any non-contractual obligations arising out of the negotiation of the transactions contemplated by this commitment letter) are governed by German law, excluding CISG.

|

| |

8.3

|

The courts of Munich, Germany, have non-exclusive jurisdiction to settle any dispute arising out of or in connection with this letter (including a dispute relating to any non-contractual obligation arising out of or in connection with this letter).

|

[signature pages follow]

Signed by:

|

/s/ Laurin Hahn

|

/s/ Jona Christians

|

|

_________________________

|

_________________________

|

|

Name: Laurin Hahn

|

Name: Jona Christians

|

|

Address: [OMITTED]

|

Address: [OMITTED]

|

Acknowledged and agreed:

|

/s/ Torsten Kiedel

|

/s/ Markus Volmer

|

|

______________________________

|

______________________________

|

|

Name: Sono Group N.V.

|

Name: Sono Group N.V.

|

|

Title: CFO

|

Title: CTO

|

|

Date: 20.11.2023

|

Date: 20.11.2023

|

Consenting:

/s/ Marlene Scheinert

______________________________

Name: Mrs. Marlene Scheinert

Title: Preliminary Custodian

Date: 20.11.2023

Acknowledged and agreed:

|

/s/ Torsten Kiedel

|

/s/ Markus Volmer

|

|

______________________________

|

______________________________

|

|

Name: Sono Motors GmbH

|

Name: Sono Motors GmbH

|

|

Title: CFO

|

Title: CTO

|

|

Date: 20.11.2023

|

Date: 20.11.2023

|

Consenting:

/s/ Ivo-Meinert Willrodt

______________________________

Name: Mr. Ivo-Meinert Willrodt

Title: Custodian

Date:

Exhibit 1.2

At the date hereof, we, Laurin Hahn and Jona Christians, the founders and majority shareholders of the Company, hold the following shares in the Company:

|

Laurin Hahn

|

|

|

Ordinary Shares:

|

19,796,053

|

|

High Voting Shares:

|

1,578,947

|

| |

|

|

Jona Christians

|

|

|

Ordinary Shares:

|

17,816,447

|

|

High Voting Shares:

|

1,421,053

|

Exhibit 3.2

To the Commitment letter dated 17 November 2023

|

Sale and transfer agreement

regarding shares in

Sono Group N.V.

|

|

Subject to review under US and Dutch law.

|

This agreement (the "Agreement") is made on [***]

Parties

| |

(1)

|

[***Laurin Hahn/Jona Christians***] (the "Transferor");

|

| |

(1)

|

[***] as the transferee designated by Mr. Ivo-Meinert Willrodt (the "Transferee 1");

|

| |

(2)

|

[***] as the transferee(s) designated by the Company (the "Transferee 2” and, jointly with the Transferee 1, the “Transferees”); and

|

| |

(3)

|

Sono Group N.V., a company incorporated under Dutch law (naamloze vennootschap) and registered with the Dutch chamber of commerce under number 80683568 (the "Company").

|

The above parties to this Agreement are collectively referred to as the "Parties" and individually as a "Party".

Background

| |

A

|

Reference is made to the envisaged restructuring of the Company and Sono Motors GmbH (jointly the "Sono Group") through the implementation of certain restructuring steps as set out in inter alia the restructuring agreement between Sono Group N.V. and YA II PN Ltd., to be entered into on or about the date hereof (the “Restructuring Agreement”), to allow the Sono Group to exit from insolvency proceedings in Germany (the "Restructuring" and the transactions in connection therewith and/or arising therefrom jointly the "Transactions").

|

| |

B

|

At the date of this Agreement, the Transferor holds:

|

| |

(i)

|

[***] high-voting shares in the capital of the Company, each with a nominal value of EUR 1.50 (the "HV Shares"); and

|

| |

(ii)

|

[***] ordinary shares in the capital of the Company, each with a nominal value of EUR 0.06 (the "Ordinary Shares"),

|

(jointly, the "Shares").

| |

C

|

As part of the Restructuring and the Transactions, it is envisaged that the Transferor will sell and transfer, inter alia, the Shares to the Transferee 1 and the Transferee 2 as set out in detail in the commitment letter dated 17 November 2023 by, inter alia, the Transferor to the Company and Sono Motors GmbH (the “Commitment Letter”).

|

It is agreed:

| |

1

|

Definitions and interpretation

|

| |

1.1

|

In this Agreement, unless the context otherwise requires, the provisions of this clause 1 apply.

|

| |

1.2

|

In this Agreement, unless otherwise specified:

|

| |

(a)

|

reference to a gender includes all genders;

|

| |

(b)

|

reference to a person includes reference to any individual, company, corporation, foundation, association, any other legal person, partnership, joint venture or any governmental authority;

|

| |

(c)

|

reference to "include" or "including" is treated as a reference to "include without limitation" or "including without limitation";

|

| |

(d)

|

reference to "writing" or "written" means any method of reproducing words in a legible and non-transitory form, including e-mail;

|

| |

(e)

|

reference to any action, remedy, method or form of proceedings, court or any other legal concept or matter is a reference to the Dutch legal concept or matter or to the legal concept or matter which most closely resembles the Dutch legal concept or matter as interpreted in a Dutch law context; and

|

| |

(f)

|

reference to a clause is a reference to a clause schedule of this Agreement.

|

| |

1.3

|

Headings are for convenience of reference only and do not affect the interpretation of any provision of this Agreement.

|

| |

2

|

Sale, purchase and transfer

|

| |

2.1

|

Subject to the terms and conditions of this Agreement, the Transferor hereby sells and transfers the following Shares to the following transferees:

|

| |

(i)

|

[***] ordinary shares in the capital of the Company, each with a nominal value of EUR 0.06 (the "Ordinary Shares 1" or the "Shares 1"),

|

which are hereby purchased and accepted by the Transferee 1; and

| |

(ii)

|

[***] ordinary shares in the capital of the Company, each with a nominal value of EUR 0.06 (the "Ordinary Shares 2" and jointly with the HV Shares, the "Shares 2"),

|

which are hereby purchased and accepted by the Transferee 2.

| |

2.2

|

The Shares are transferred to the Transferee 1 and the Transferee 2, respectively, free and clear from any mortgage, pledge, lien (retentierecht), retention of title (eigendomsvoorbehoud), any other registered obligation (kwalitatieve verplichting), personal right of enjoyment or use or right to acquire, usufruct, attachment, right of first refusal or other restriction on transfer, any restriction on voting or any other third party right or security interest of any kind, or any agreement to create any of the foregoing and together with all rights attached to them, and further in accordance with the provisions of clause 4.

|

| |

2.3

|

The Company hereby acknowledges the transfer of the HV Shares effected by this Agreement and shall register the same in its register of shareholders.

|

| |

3.1

|

The consideration for the Shares 1 and the Shares 2 amounts to EUR 0.003 per Share, i.e., EUR [***] in the aggregate (incl. VAT, if any) (the "Purchase Price").

|

| |

3.2

|

The Purchase Price shall be paid by the Transferee 1 exclusively at the time, in the partial amounts and out of the funds as provided for in paragraph 3.1 (c) of the Commitment Letter, and without any deduction, withholding, set-off or suspension, in cash to the Transferor to the following bank account in name of the Transferor:

|

[______________________]

[______________________]

| |

4

|

Completion of Transfer of Ordinary Shares

|

| |

4.1

|

The Transferor hereby irrevocable and unconditionally covenants and warrants towards the Transferee 1 and the Transferee 2, respectively, to instruct AST Financial - AMERICAN STOCK TRANSFER & TRUST COMPANY (in future doing business as Equiniti Trust Company, LLC) as transfer agent to make the following security account transfers on the date of this Agreement:

|

| |

(a)

|

the Ordinary Shares 1 are to be transferred to the following securities account of the Transferee 1: [______________________]; and

|

| |

(b)

|

the Ordinary Shares 2 are to be transferred to the following securities account of the Transferee 2: [______________________].

|

| |

4.2

|

Forthwith after giving such instruction, the Transferor will provide the Transferees with written evidence that the transfer and delivery of the Ordinary Shares 1 and the Ordinary Shares 2, as referred to in clause 4.1 has occurred.

|

| |

4.3

|

The Transferor hereby represents and warrants to each of the Transferees that any further formalities or (legal) acts which must be complied with or performed for a transfer of the full and unencumbered title to the Ordinary Shares 1 and the Ordinary Shares 2 to the Transferee 1 or, respectively, the Transferee 2, shall be complied with or performed forthwith. The Company shall, insofar as necessary, fully cooperate to effect the transfer.

|

| |

4.4

|

The Transferor hereby grants full and irrevocable power of attorney to each of the Transferees and the Company, to each of them severally, with the power of substitution, to comply with all formalities and perform all (legal) acts referred to in clause 4.3 or other rules applicable to the Ordinary Shares 1 and/or the Ordinary Shares 2 must be complied with or performed for a transfer of the full and unencumbered title to the Ordinary Shares 1 to the Transferee 1 and the Ordinary Shares 2 to the Transferee 2.

|

| |

|

The share transfer restrictions provided for in article 16.1 of the Company’s articles of association (containing a prior approval system) do not apply, as the management board of the Company has granted its written approval to the contemplated transfer of the HV Shares, as evidenced by a copy of the minutes of the meeting of the management board of the Company, a copy of which has been attached to this Agreement as Annex. |

| |

6.1

|

The Transferor hereby represents and warrants to each of the Transferees and the Company that, on the date hereof, the following is correct:

|

| |

(a)

|

The Transferor has full and unencumbered title to the Shares 1 and the Shares 2 and is fully authorised to transfer the Shares 1 and the Shares 2 to the Transferee 1 and the Transferee 2 respectively.

|

| |

(b)

|

The Shares 1 and the Shares 2 are not subject to rights of third parties or obligations to transfer to third parties or claims based on contracts of any nature.

|

| |

6.2

|

The Transferor hereby represents and warrants that it has the legal right and full power and authority (including all necessary consents, authorisations, confirmations, permissions, certificates, approvals, authorities or other corporate action as may be required) to provide and perform the obligations and undertakings contained in this Agreement (as applicable) which when executed will constitute legal, valid and binding obligations on the Transferor.

|

| |

6.3

|

Each Transferee hereby represents and warrants that it has the legal right and full power and authority (including all necessary consents, authorisations, confirmations, permissions, certificates, approvals, authorities or other corporate action as may be required) to provide and perform the obligations and undertakings contained in this Agreement (as applicable) which when executed will constitute legal, valid and binding obligations on the Transferees.

|

| |

1.1

|

The Transferees understand that the Shares have not been registered under the U.S. Securities Act and may not be offered or sold in the United States or to U.S. persons unless the Shares are registered under the U.S. Securities Act, or an exemption from the registration requirements of the U.S. Securities Act is available. The Transferees further understand that the Shares will be “restricted securities” within the meaning of Rule 144(a)(3) under the Securities Act, and Transferees understands that the certificates or book-entries representing the Shares will contain a legend or notation in respect of such restrictions. The Transferees agree not to sell, transfer, pledge, hypothecate or otherwise dispose of all or any part of the Shares unless, prior thereto, (a) a registration statement covering such Shares shall be effective under the Securities Act and the transaction shall be qualified under applicable state law or (b) the transaction is exempt from the registration requirements under the Securities Act and the qualification requirements under applicable state law. Transferees further understand that the Shares may not be transferred within 40 calendar days from the closing of the sale pursuant to this Agreement.

|

| |

1.2

|

Any certificates representing the Shares shall have endorsed thereon legends substantially as follows (and any book-entries representing the Shares shall have similar notations) and Transferees specifically acknowledge, and agree to comply with, these legends:

|

“THESE SHARES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933. THE SHARES MAY NOT BE SOLD, TRANSFERRED OR ASSIGNED IN THE ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT FOR THESE SHARES UNDER THE SECURITIES ACT OF 1933 OR UNLESS SUCH SALE, TRANSFER, OR ASSIGNMENT IS EXEMPT FROM REGISTRATION THEREUNDER.”

“PRIOR TO THE EXPIRATION OF FORTY DAYS FROM THE LATER OF (1) THE DATE ON WHICH THESE SHARES WERE FIRST OFFERED AND (2) THE DATE OF DELIVERY OF THESE SHARES, THESE SHARES MAY NOT BE OFFERED, SOLD OR DELIVERED WITHIN THE UNITED STATES OR TO A U.S. PERSON (AS DEFINED IN REGULATION S UNDER THE SECURITIES ACT) EXCEPT PURSUANT TO AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT AND, IN EACH CASE, IN ACCORDANCE WITH ALL APPLICABLE SECURITIES LAWS OF ANY OTHER JURISDICTION. THE HOLDER HEREOF, BY ACQUIRING THIS SECURITY, REPRESENTS AND AGREES FOR THE BENEFIT OF THE ISSUER AND THE GUARANTOR THAT IT WILL NOTIFY ANY TRANSFEREE OF THIS SECURITY FROM IT OF THE RESALE RESTRICTIONS REFERRED TO ABOVE.”.

The Transferee 2 submits to the same rules that apply to the Transferors pursuant to paragraph 4 of the Commitment Letter with regard to the Shares 2 after the acquisition. The parties agree that in the event of a shortening or cancellation of the lock-up period for Transferee 2, the lock-up for the Transferors agreed in the Commitment Letter shall also be cancelled.

| |

3.1

|

Each Party shall, at its own expense, sign and execute such documents and perform such further acts as the other Parties may reasonably request from time to time to give full effect to, and give each Party the full benefit of, this Agreement. The Company shall bear the costs arising in connection with paragraph 4.3 of this Agreement.

|

| |

3.2

|

Each Party shall pay its own costs and expenses in connection with the preparation, execution and completion of this Agreement and of any ancillary agreement, except as provided otherwise in this Agreement or as otherwise specifically agreed in writing after the date of this Agreement. All stamp, transfer, real estate transfer, registration, sales and other similar taxes or duties, levies or charges in connection with the sale and/or transfer of the Shares 1 and/or the Shares 2 shall be paid by the Transferee.

|

| |

3.3

|

This Agreement shall be treated as strictly confidential and shall not, without your prior written consent, be disclosed in whole or in part to any person, other than to your employees, directors, professional advisers and financing sources, in each case on a confidential basis; provided, however, that any Party, any party to the Commitment Letter and/or any Third Party Beneficiary (as defined in the Commitment Letter) shall be entitled to disclose this Agreement in whole or in part: (i) if required by any mandatory law, regulation or other rules (including, but not limited to, stock exchange regulations; (ii) as any Party, any party to the Commitment Letter and/or any Third Party Beneficiary deem necessary in connection with the insolvency proceedings regarding the Company and/or Sono Motors GmbH.

|

| |

3.4

|

No variation of this Agreement shall be effective unless in writing and signed by or on behalf of all Parties.

|

| |

3.5

|

If any provision in this Agreement shall be held to be illegal, invalid or unenforceable, in whole or in part, the provision shall apply with whatever deletion or modification is necessary so that the provision is legal, valid and enforceable and gives effect to the commercial intention between the Parties. To the extent it is not possible to delete or modify the provision, in whole or in part then such provision or part of it shall, to the extent that it is illegal, invalid or unenforceable, be deemed not to form part of this letter and the legality, validity and enforceability of the remainder of this Agreement shall, subject to any deletion or modification made under this paragraph, not be affected.

|

| |

3.6

|

Except as explicitly stated otherwise in this Agreement, each of the Parties waives its rights, if any, to in whole or in part annul, rescind or dissolve this Agreement. Each of the Parties waives its rights to request in whole or in part the annulment, rescission, dissolution or cancellation of this Agreement.

|

| |

4

|

Governing law and jurisdiction

|

| |

4.1

|

This Agreement shall be governed by German law (excluding CISG); provided, however, that the transfer of the Shares 1 and the Shares 2 shall be governed by Dutch law.

|

| |

4.2

|

The courts of Munich, Germany, have non-exclusive jurisdiction to settle any dispute arising out of or in connection with this Agreement (including a dispute relating to any non-contractual obligation arising out of or in connection with this Agreement).

|

(signature page follows)

Signature page

On behalf of the Transferor

_________________________

Name:

Date:

On behalf of the Transferee 1

_________________________

Name:

Date:

On behalf of the Transferee 2

_________________________

Name:

Date:

On behalf of the Company

_________________________

Name:

Date:

Annex

Approval management board of the Company

[Inserted separately]

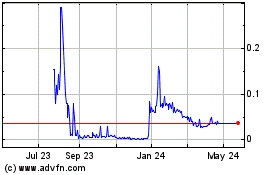

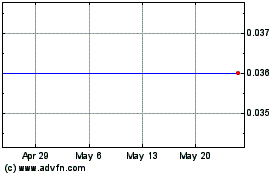

Sono Group NV (PK) (USOTC:SEVCQ)

Historical Stock Chart

From Apr 2024 to May 2024

Sono Group NV (PK) (USOTC:SEVCQ)

Historical Stock Chart

From May 2023 to May 2024