0000866374false00-0000000SG00008663742023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2023

FLEX LTD.

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | | | | |

| Singapore | 0-23354 | Not Applicable |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

2 Changi South Lane, Singapore | 486123 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (65) 6876-9899

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Ordinary Shares, No Par Value | FLEX | The Nasdaq Stock Market LLC |

| | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | |

| Emerging growth company | ☐ |

| | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 8.01 Other Events.

On December 18, 2023, Flex Ltd. (the “Company”) announced that the High Court of Singapore approved the capital reduction to be carried out by the Company pursuant to Section 78G of the Singapore Companies Act (the “Capital Reduction”), in order to effect the distribution in specie of all of the shares of common stock, par value $0.001 per share (“Yuma Common Stock”), of Yuma, Inc. (“Yuma”) to the shareholders of the Company on a pro rata basis based on the number ordinary shares of the Company (each, an “Ordinary Share”) held by each shareholder of the Company (the “Distribution”) as of the record date of the Distribution pursuant to that certain Agreement and Plan of Merger by and among Nextracker Inc. (“Nextracker”), the Company, Yuma and Yuma Acquisition Corp. (“Merger Sub”), dated as of February 7, 2023 (the “Merger Agreement”). The Company has set the record date for the Distribution as December 29, 2023 (the “Distribution Record Date”).

The Company expects to effect the Distribution on January 2, 2024. Immediately following the Distribution, each holder of Ordinary Shares will hold one share of Yuma Common Stock for each Ordinary Share held by such holder as of the Distribution Record Date.

On the same day as and immediately following the Distribution, the Company and Nextracker expect, on the terms and subject to the conditions set forth in the Merger Agreement, to effect the merger of Yuma with and into Merger Sub, with Yuma surviving the merger as a wholly-owned subsidiary of Nextracker (the “Merger”). As a result of the Merger, each share of Yuma Common Stock issued and outstanding as of immediately prior to the closing of the Merger will be automatically converted into the right to receive a number of shares of Class A common stock, par value $0.0001, of Nextracker (“Nextracker Class A Common Stock”) based on an exchange ratio set forth in the Merger Agreement (with cash payments to holders of shares of Yuma Common Stock in lieu of any fractional shares of Nextracker Class A Common Stock in accordance with the terms of the Merger Agreement).

As a result, the Company expects the Merger to close on or around January 2, 2024. The Merger will become effective upon the filing of the certificate of merger with the Delaware Secretary of State or at such later time as may be agreed by the Company and Nextracker in writing and specified in the certificate of merger for the Merger.

A copy of the press release is furnished with this report as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit No. | |

| |

| 104 | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | FLEX LTD. |

| | | |

| | | |

Date: December 18, 2023 | | | |

| | | |

| By: | |

| | Name:

Title: | Paul R. Lundstrom

Chief Financial Officer |

EXHIBIT 99.1

PRESS RELEASE

FLEX ANNOUNCES RECORD AND DISTRIBUTION DATES FOR NEXTRACKER SPIN-OFF AND RELATED SINGAPORE HIGH COURT APPROVAL

Austin, Texas, December 18, 2023 – Flex (NASDAQ: FLEX) today announced that it has declared December 29, 2023 as the record date for its previously announced spin-off of all of its remaining interest in Nextracker Inc. (“Nextracker”) to Flex shareholders on a pro rata basis and January 2, 2024 as the distribution date for the spin-off.

The spin-off will be effected pursuant to a distribution of shares of the common stock of Yuma Inc., a wholly-owned subsidiary of Flex (“Yuma”), to the holders of Flex ordinary shares, with each Flex shareholder as of the record date receiving one share of Yuma common stock for each Flex ordinary share held. Immediately following the distribution, Yuma will merge with and into a wholly-owned subsidiary of Nextracker. As consideration in the merger, Flex shareholders are expected to receive approximately 0.17 shares of Nextracker Class A common stock for every share of Yuma common stock held as of immediately prior to the merger. Flex shareholders will receive cash in lieu of fractional shares. Flex expects both the distribution and the merger to be completed on January 2, 2024.

Earlier today, Flex obtained the approval of the High Court of Singapore necessary to complete the distribution of Yuma common stock to Flex shareholders under applicable Singapore law.

As previously disclosed, Flex shareholders have approved the distribution of Yuma common stock at an extraordinary general meeting of Flex shareholders held on November 20, 2023. Accordingly, no further action is required by Flex shareholders in order to approve the distribution or receive shares of Nextracker Class A common stock.

The distribution and the merger will be effected pursuant to that certain Agreement and Plan of Merger (the “Merger Agreement”), entered into by Flex and Nextracker on February 7, 2023, and disclosed in connection with Nextracker’s previously completed initial public offering. The dates set forth above may be delayed subject to satisfaction or waiver of the conditions set forth in the Merger Agreement.

Flex shareholders are urged to consult their financial and tax advisors regarding the particular consequences of the distribution and merger in their situation, including the applicability and effect of any U.S. federal, state, local and non-U.S. tax laws.

Information regarding the distribution and merger can be found in the Registration Statement on Form S-4 filed by Nextracker with the Securities and Exchange Commission (“SEC”) on October 25, 2023 and declared effective on October 27, 2023, and in other documents that Flex and Nextracker file with the SEC.

Advisors

J.P. Morgan Securities LLC is serving as Flex’s financial advisor and Sidley Austin LLP is serving as Flex’s legal advisor in connection with the spin-off.

About Flex

Flex (Reg. No. 199002645H) is the manufacturing partner of choice that helps a diverse customer base design and build products that improve the world. Through the collective strength of a global workforce across 30 countries and responsible, sustainable operations, Flex delivers technology innovation, supply chain, and manufacturing solutions to diverse industries and end markets.

Contacts

Investors & Analysts

David Rubin

Vice President, Investor Relations

(408) 577-4632

David.Rubin@flex.com

Media & Press

Yvette Lorenz

Director, Corporate PR and Executive Communications

(415) 225-7315

Yvette.Lorenz@flex.com

Forward-Looking Statements

This communication contains certain statements about Flex and Nextracker that are forward-looking statements. Forward-looking statements are based on current expectations and assumptions regarding Flex’s and Nextracker’s respective businesses, the economy and other future conditions. In addition, the forward-looking statements contained in this communication may include statements about the expected effects on Flex and Nextracker of the proposed business combination and related transactions (the “Transactions”) involving Flex and Nextracker, the anticipated timing and benefits of the Transactions, Flex’s and Nextracker’s respective anticipated financial results, and all other statements in this communication that are not historical facts. Because forward-looking statements relate to the future, by their nature, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and are detailed more fully in Flex’s and Nextracker’s respective periodic reports filed from time to time with the SEC, the Registration Statement referred to above, and other documents filed by Flex or Nextracker, as applicable, with the SEC. Such uncertainties, risks and changes in circumstances could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Forward-looking statements included herein are made as of the date hereof, and neither Flex nor Nextracker undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances, except to the extent required by applicable securities laws. Investors should not put undue reliance on forward-looking statements.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

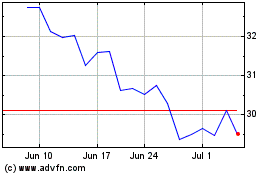

Flex (NASDAQ:FLEX)

Historical Stock Chart

From Apr 2024 to May 2024

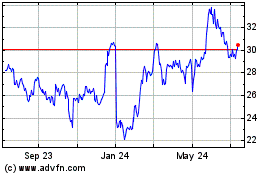

Flex (NASDAQ:FLEX)

Historical Stock Chart

From May 2023 to May 2024