falseDEF 14A000140658700014065872022-10-012023-09-30iso4217:USD00014065872021-10-012022-09-3000014065872020-10-012021-09-300001406587for:DanielCBartokMemberecd:PeoMemberfor:StockAwardValuesReportedInSCTForTheCoveredYearMember2022-10-012023-09-300001406587for:DanielCBartokMemberecd:PeoMemberfor:StockAwardValuesReportedInSCTForTheCoveredYearMember2021-10-012022-09-300001406587for:DanielCBartokMemberecd:PeoMemberfor:StockAwardValuesReportedInSCTForTheCoveredYearMember2020-10-012021-09-300001406587for:DanielCBartokMemberfor:FairValueAsOfYearEndOfStockAwardsGrantedInTheCoveredYearMemberecd:PeoMember2022-10-012023-09-300001406587for:DanielCBartokMemberfor:FairValueAsOfYearEndOfStockAwardsGrantedInTheCoveredYearMemberecd:PeoMember2021-10-012022-09-300001406587for:DanielCBartokMemberfor:FairValueAsOfYearEndOfStockAwardsGrantedInTheCoveredYearMemberecd:PeoMember2020-10-012021-09-300001406587for:DanielCBartokMemberfor:YearOverYearChangeInFairValueAsOfYearEndOfOutstandingUnvestedStockAwardsGrantedInPriorYearsMemberecd:PeoMember2022-10-012023-09-300001406587for:DanielCBartokMemberfor:YearOverYearChangeInFairValueAsOfYearEndOfOutstandingUnvestedStockAwardsGrantedInPriorYearsMemberecd:PeoMember2021-10-012022-09-300001406587for:DanielCBartokMemberfor:YearOverYearChangeInFairValueAsOfYearEndOfOutstandingUnvestedStockAwardsGrantedInPriorYearsMemberecd:PeoMember2020-10-012021-09-300001406587for:DanielCBartokMemberfor:YearOverYearChangeInFairValueAsOfTheVestingDateOfStockAwardsGrantedInPriorYearsThatVestedInTheCoveredYearMemberecd:PeoMember2022-10-012023-09-300001406587for:DanielCBartokMemberfor:YearOverYearChangeInFairValueAsOfTheVestingDateOfStockAwardsGrantedInPriorYearsThatVestedInTheCoveredYearMemberecd:PeoMember2021-10-012022-09-300001406587for:DanielCBartokMemberfor:YearOverYearChangeInFairValueAsOfTheVestingDateOfStockAwardsGrantedInPriorYearsThatVestedInTheCoveredYearMemberecd:PeoMember2020-10-012021-09-300001406587ecd:NonPeoNeoMemberfor:StockAwardValuesReportedInSCTForTheCoveredYearMember2022-10-012023-09-300001406587ecd:NonPeoNeoMemberfor:StockAwardValuesReportedInSCTForTheCoveredYearMember2021-10-012022-09-300001406587ecd:NonPeoNeoMemberfor:StockAwardValuesReportedInSCTForTheCoveredYearMember2020-10-012021-09-300001406587ecd:NonPeoNeoMemberfor:FairValueAsOfYearEndOfStockAwardsGrantedInTheCoveredYearMember2022-10-012023-09-300001406587ecd:NonPeoNeoMemberfor:FairValueAsOfYearEndOfStockAwardsGrantedInTheCoveredYearMember2021-10-012022-09-300001406587ecd:NonPeoNeoMemberfor:FairValueAsOfYearEndOfStockAwardsGrantedInTheCoveredYearMember2020-10-012021-09-300001406587ecd:NonPeoNeoMemberfor:YearOverYearChangeInFairValueAsOfYearEndOfOutstandingUnvestedStockAwardsGrantedInPriorYearsMember2022-10-012023-09-300001406587ecd:NonPeoNeoMemberfor:YearOverYearChangeInFairValueAsOfYearEndOfOutstandingUnvestedStockAwardsGrantedInPriorYearsMember2021-10-012022-09-300001406587ecd:NonPeoNeoMemberfor:YearOverYearChangeInFairValueAsOfYearEndOfOutstandingUnvestedStockAwardsGrantedInPriorYearsMember2020-10-012021-09-300001406587for:YearOverYearChangeInFairValueAsOfTheVestingDateOfStockAwardsGrantedInPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2022-10-012023-09-300001406587for:YearOverYearChangeInFairValueAsOfTheVestingDateOfStockAwardsGrantedInPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2021-10-012022-09-300001406587for:YearOverYearChangeInFairValueAsOfTheVestingDateOfStockAwardsGrantedInPriorYearsThatVestedInTheCoveredYearMemberecd:NonPeoNeoMember2020-10-012021-09-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

________________________

| | | | | | | | | | | |

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: |

| ☐ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material under §240.14a-12 |

FORESTAR GROUP INC.

(Name of Registrant as Specified In Its Charter)

___________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☒ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF 2024

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On

January 16, 2024

Dear Stockholders of Forestar:

WHEN AND WHERE THE ANNUAL MEETING OF STOCKHOLDERS WILL BE HELD

You are invited to attend the 2024 Annual Meeting of Stockholders of Forestar Group Inc. Our 2024 Annual Meeting will be held at our corporate office located at 2221 E. Lamar Blvd., Arlington, Texas 76006, on Tuesday, January 16, 2024, at 9:00 a.m. Central Time.

PURPOSES OF THE MEETING

At the 2024 Annual Meeting, the stockholders will be asked to vote on the following proposals and to conduct any other business properly brought before the meeting.

| | | | | | | | |

| | Our Board's Recommendation |

| Proposal No. 1: | Election of Directors: To elect the five directors named in our proxy statement. | FOR |

| Proposal No. 2: | Advisory Vote to Approve Our Executive Compensation: To seek an advisory vote on the approval of executive compensation. | FOR |

| Proposal No. 3: | Ratification of Auditors: To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for fiscal year 2024. | FOR |

WHO CAN ATTEND AND VOTE

Our Board of Directors has set the close of business on November 27, 2023 as the record date for determining who is a stockholder entitled to receive notices about the 2024 Annual Meeting and to vote at the meeting or any later meeting if the 2024 Annual Meeting is adjourned or postponed. Only stockholders who own stock on the record date are entitled to receive notices about the 2024 Annual Meeting and to vote at the meeting.

If you need help voting your shares, please call 1-866-232-3037 (toll free) or 1-720-358-3640 (international toll free).

Sincerely,

| | |

|

| DONALD J. TOMNITZ |

| Executive Chairman |

December 15, 2023

Arlington, Texas

Your vote is important. You are invited to attend the meeting in person. If it is determined that a change in the date, time or location of the 2024 Annual Meeting or a change to a virtual meeting format is advisable or required, an announcement of such changes will be made through a press release, additional proxy materials filed with the Securities and Exchange Commission, and on the Investor Relations section of our website. Please check this website in advance of the meeting date if you are planning to attend in person.

If you need directions to the meeting location, you may contact our Corporate Secretary by phone at (817) 769-1860 or by mail at 2221 E. Lamar Blvd., Suite 790, Arlington, Texas 76006. Whether or not you plan to attend the meeting, and no matter how many shares you own, please vote over the internet or by telephone, or, if you received by mail or printed a paper proxy card, you may also vote by signing, dating and returning the proxy card by mail. By voting before the meeting, you will help us ensure that there are enough stockholders voting to hold a meeting and avoid added proxy solicitation costs. If you attend the meeting, you may vote in person, if you wish, even if you have previously submitted a proxy. You may revoke your proxy at any time by following the instructions under “General Information — How You Can Change or Revoke Your Vote.”

Important Notice Regarding Availability of Proxy Materials for the 2024 Annual Meeting to be held on January 16, 2024. The Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com.

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL NO. 1 — ELECTION OF DIRECTORS | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Proxy Statement Summary

We expect that the Proxy Statement and the accompanying form of proxy will first be released to our stockholders of record on or about December 15, 2023.

Forestar Group Inc. is referred to as “Forestar,” the “Company,” “we,” and “our” in this Proxy Statement.

Key Operating and Financial Highlights

The Forestar team, led by our executive officers, delivered strong operating and financial results during fiscal 2023. Our results reflect the strength of our experienced operational teams, differentiated business model, broad geographic footprint and strong customer base.

Consolidated revenues for fiscal 2023 were $1.4 billion on 14,040 lots sold. Since fiscal 2019, Forestar's consolidated revenues have increased more than 235% as we have continued to gain market share in the fragmented residential lot development industry. Over this same period, our pre-tax income expanded 385%, earnings per share increased 322%, book value per share increased 63% and return on equity expanded 850 basis points to 13.2%. Return on equity (ROE) is calculated as net income attributable to Forestar for the year divided by average stockholders' equity, where average stockholders' equity is the sum of ending stockholders' equity balances of the trailing five quarters divided by five.

Key Performance Highlights

| | | | | | | | | | | | | | | | | | | | | | | |

| As of and for the Fiscal Year Ended September 30 | % Change |

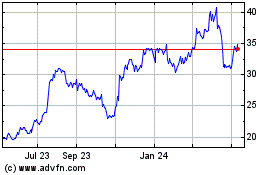

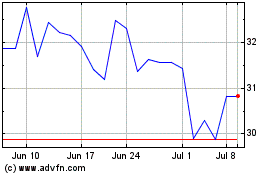

| Stock Price and Other Data | 2023 | 2022 | 2021 | 2020 | 2019 | 2023 vs 2022 | 2023 vs 2019 |

| Common stock price | $26.94 | $11.19 | $18.63 | $17.70 | $18.28 | 141% | 47% |

| Total equity market capitalization (in millions) | $1,334.4 | $556.8 | $923.7 | $850.7 | $877.4 | 140% | 52% |

| Book value per common share | $27.43 | $24.08 | $20.47 | $18.12 | $16.84 | 14% | 63% |

| Diluted earnings per common share | $3.33 | $3.59 | $2.25 | $1.26 | $0.79 | (7)% | 322% |

Corporate Governance Highlights

Our governance structure, as established by our Corporate Governance Guidelines, ensures robust independent oversight of Management and accountability to stockholders.

| | | | | | | | |

| Governance Principles | Corporate Governance Practice |

| Accountability to our Stockholders | P | Our common stock is our only class of stock, with one vote per share. |

| P | Our stockholders elect directors for one-year terms by a majority vote standard. |

| P | We do not have a “poison pill” or similar anti-takeover provision in place. |

| Board Independence | P | Four of our five director nominees are independent. |

| P | We have a separate chairman and chief executive officer and an independent Presiding Director. |

| P | Our independent directors meet in executive sessions. |

| P | All the members of our three standing Board committees—Audit, Compensation and Nominating and Governance—are independent. |

| Board Diversity | P | Two of our five directors are women. |

| P | Director gender and ethnic diversity is supported by our candidate recruitment policy. |

| P | Our Compensation Committee Chair is a woman. |

| Board Policies and Practices | P | Our Board annually reviews its performance, and the performance of each of its standing committees. |

| P | Our Nominating and Governance Committee oversees risks associated with overall governance and ESG. |

| P | Our Compensation Committee annually evaluates our CEO’s performance. |

| P | Our Board and Audit Committee oversee cybersecurity risk. |

| Risk Mitigation and Alignment of Interests | P | We prohibit our executives and directors from all forms of hedging or pledging Company stock. |

Executive Compensation Highlights

Our Compensation Committee strives to design a fair and competitive compensation package for executive officers using incentives based on Company performance that emphasize the creation of sustainable long-term stockholder value and that will attract, motivate and retain highly qualified and experienced executives.

| | | | | | | | |

| Executive Compensation Principles | Executive Compensation Objectives |

| Business Resilience | P | Achieve long-term sustainability of our business. |

| Alignment of Interests | P | Align our executives' interests with stockholders' interests with the goal of maximizing long-term shareholder value. |

| Pay-for-Performance | P | Award compensation that recognizes valuable short- and long-term individual performance as well as the Company's overall performance. |

| Attract and Retain | P | Motivate and retain highly qualified and experienced executives. |

Proposal No. 1 – Election of Directors

Our Board of Directors currently consists of five directors, all of whom are up for reelection at the 2024 Annual Meeting. Four of our directors were elected by our stockholders at the 2023 Annual Meeting. After Mr. Donald C. Spitzer's retirement in February 2023, Ms. Elizabeth (Betsy) Parmer was appointed by the Board of Directors to fill the vacancy. Each of the five directors, if elected at the 2024 Annual Meeting, will serve until the 2025 Annual Meeting and until his or her successor has been elected and qualified.

The Nominating and Governance Committee recommended to the Board of Directors our five directors as director nominees, each of whom is listed under the heading “Director Nominees” on page 6.

After review and consideration by the Board of Directors, as recommended by the Nominating and Governance Committee, the Board nominated the following five nominees for election to our Board of Directors:

| | | | | | | | | | | |

| P | Donald J. Tomnitz | P | Elizabeth (Betsy) Parmer |

| P | Samuel R. Fuller | P | G.F. (Rick) Ringler, III |

| P | Lisa H. Jamieson | | |

| | | | | | | | | | | | | | |

The Board of Directors Unanimously Recommends that Stockholders Vote “FOR”

Each of our Five Nominees for Director. |

Selection of Director Nominees

Mr. Fuller, Ms. Jamieson, Mr. Ringler, Ms. Parmer and Mr. Tomnitz are standing for election as directors to serve until the 2025 Annual Meeting, or until their replacements are duly elected and meet all requirements. All nominees are presently serving as directors. After reviewing their qualifications, the Nominating and Governance Committee recommended them as nominees to the full Board, and the full Board subsequently voted unanimously to recommend them to the stockholders as nominees. Mr. Fuller, Mr. Ringler, Ms. Parmer and Mr. Tomnitz were designated by D.R. Horton for nomination as directors. Ms. Jamieson was designated as the Non-Stockholder Designee for nomination as a director. For a description of the Stockholder’s Agreement, see the sections “Proposal No. 1 — Election of Directors — Stockholder’s Agreement” and “Certain Relationships and Related Party Transactions — Stockholder’s Agreement.”

We did not pay a fee to any third party to identify, evaluate or assist in identifying or evaluating potential nominees.

Each of the nominees has consented to being named in this Proxy Statement and to serve if elected. If any nominee becomes unavailable to serve, however, the persons named as proxies in the enclosed form of proxy intend to vote the shares represented by the proxy for the election of such other person or persons as may be nominated or designated by management, unless they are directed by the proxy to do otherwise.

Unless you specify otherwise on your proxy, the persons named as proxies in such proxy intend to vote for the election of the nominees listed below to serve as directors.

Director Qualifications

Our Nominating and Governance Committee is charged with assuring that the proper skills and experience are represented on our Board. Our Corporate Governance Guidelines, which are available on our website at www.forestar.com under the “Investor Relations — Corporate Governance — Governance Documents” section, include a non-exclusive list of qualifications that should be considered in reviewing director candidates. The qualifications consider business experience, independence, our business, geographic locations, diversity of backgrounds and skills and other factors. We expect all our directors to possess the highest personal and professional ethics, integrity and values. We also expect our directors to be committed to the long-term interests of our stockholders as a whole. We also review the existing time commitments of director candidates to confirm that they do not have any obligations that would conflict with the time commitments of a director of the Company. The Nominating and Governance Committee looks to recruit candidates that can contribute different perspectives to the Board, as the Nominating and Governance Committee recognizes the importance of having diversity of age, gender, race and ethnicity on the Board.

Stockholder’s Agreement

In October 2017, we became a majority-owned subsidiary of D.R. Horton, Inc. (“D.R. Horton”) (the “Merger”) and a controlled company under New York Stock Exchange (“NYSE”) rules. As a controlled company, we are not required to have a majority of independent directors, an independent compensation committee, or an independent nominating committee. However, at this time, we intend to continue to maintain a majority of independent directors and both an independent compensation committee and nominating committee.

In connection with the Merger, we entered into a Stockholder’s Agreement with D.R. Horton (the “Stockholder’s Agreement”) that provides for certain board and board committee appointment rights. Under the terms of the Stockholder’s Agreement and our Second Amended and Restated Certificate of Incorporation, our Board consists of five directors, comprised of four individuals designated by D.R. Horton (which includes our Executive Chairman) and one individual designated by the Nominating and Governance Committee, as the Non-Stockholder Designee (as defined in the Stockholder's Agreement).

At the time of the Merger, D.R. Horton designated Mr. Fuller, Mr. Ringler, Mr. Spitzer and Mr. Tomnitz as directors. In August 2019, the Company's Nominating and Governance Committee designated, and the Company’s Board of Directors appointed, Ms. Jamieson to serve as the Non-Stockholder Designee director. In March 2023, D.R. Horton and the Company's Nominating and Governance Committee designated Ms. Parmer to serve as a D.R. Horton designee.

At all times when D.R. Horton and its affiliates beneficially own 20% or more of our voting securities, the Board will have five directors unless otherwise agreed in writing between us (as approved by a majority of our independent directors) and D.R. Horton, and D.R. Horton will have the right to designate a number of directors equal to the percentage of our voting securities beneficially owned by D.R. Horton and its affiliates multiplied by the total number of directors that we would have if there were no vacancies, rounded up to the nearest whole number (and in any event not less than one). We and D.R. Horton have also each agreed to use reasonable best efforts to cause at least three of the directors to be considered “independent” under the rules of the SEC and under applicable listing standards.

For more information on the Stockholder’s Agreement, see the section on “Certain Relationships and Related Party Transactions — Stockholder’s Agreement.” Additional information regarding the Stockholder’s Agreement, including a copy of the Stockholder’s Agreement, can be found in our Current Report on Form 8-K filed with the SEC on June 29, 2017.

Director Elections Standard and Resignation Policy

Our amended and restated bylaws include a voting standard in uncontested elections of directors (as is the case for this annual meeting) of a majority of votes cast in the election. Under the majority of votes cast standard, a director nominee is elected if the number of votes cast “for” the nominee exceeds the number of votes cast “against” the nominee. In contested elections (that is, those in which the number of nominees exceeds the number of directors to be elected), the voting standard is a plurality of votes cast, which means that the individuals who receive the largest number of votes cast are elected as directors up to the maximum number of directors to be chosen at the meeting.

Our Board of Directors also adopted a director resignation policy, which is set forth in the Corporate Governance Guidelines available at www.forestar.com under the “Investor Relations — Corporate Governance — Governance Documents” section. This policy sets forth the procedures that will apply in the event that a director does not receive the requisite majority of votes cast “for” his or her election. In summary, an incumbent director nominee who fails to receive the required vote for election will, within five days after certification of the election results, tender his or her resignation to our Executive Chairman for consideration by the Nominating and Governance Committee of our Board of Directors. The Nominating and Governance Committee will consider the resignation and, within 45 days after the date of the stockholders meeting at which the election of directors occurred, will make a recommendation to the Board of Directors on whether to accept or reject the resignation. The Board of Directors will act on the Committee’s recommendation within 90 days after the date of the stockholders meeting. The director whose resignation is under consideration will not participate in the Committee or Board of Directors’ decision with respect to accepting or rejecting his or her resignation as director. If a resignation is not accepted by the Board of Directors, the director will continue to serve. If the failure of a nominee to be elected at the annual meeting results in a vacancy on the Board of Directors, that vacancy can be filled by action of the Board.

Following the Board’s decision on whether to accept or reject the resignation, we will publicly disclose the Board’s decision, together with an explanation of the process by which the decision was made and, if applicable, the Board’s reason(s) for rejecting the tendered resignation.

Director Nominees

| | | | | |

| Donald J. Tomnitz |

Executive Chairman of the Board

Age 75

Director

since: October 2017

Tenure: •6 years | Principal Occupation and Other Information

Donald J. Tomnitz has served as Executive Chairman of the Board of Forestar since October 2017. Prior to joining the Company, Mr. Tomnitz was a consultant to D.R. Horton from 2014 to 2017. From 1998 to 2014, Mr. Tomnitz was the Vice Chairman and Chief Executive Officer of D.R. Horton, after having served as its President, an Executive Vice President and as President of D.R. Horton’s Homebuilding Division. Mr. Tomnitz also served on the Board of Directors of D.R. Horton until October 2014. Before joining D.R. Horton, Mr. Tomnitz was a Captain in the U.S. Army, a Vice President of RepublicBank of Dallas, N.A. and a Vice President of Crow Development Company, a Trammell Crow Company. Mr. Tomnitz holds a Bachelor of Arts in economics from Westminster College and a Master of Business Administration in finance from Western Illinois University.

Qualifications

Mr. Tomnitz has significant knowledge and experience in the real estate development and homebuilding industries, including public company chief executive officer experience. |

| | | | | |

| Samuel R. Fuller |

Director

Age 80

Director

since: October 2017

Committees: •Audit Committee (Chair) •Compensation Committee •Nominating and Governance Committee

Tenure: •6 years | Principal Occupation and Other Information

Samuel R. Fuller has been retired since 2008, having obtained significant experience in accounting and financial roles through his employment with D.R. Horton from 1992 until his retirement. He served as Controller of D.R. Horton from 1995 until his promotion to Chief Financial Officer in 2000 and was a member of the Board of Directors from 2000 until 2003. Mr. Fuller holds a Bachelor of Arts degree in accounting from the University of Oregon and a Master of Business Administration in finance from the University of Texas at Arlington.

Qualifications

Mr. Fuller is an expert in accounting and financial reporting and has significant knowledge and experience in accounting, finance, and internal control over financial reporting in a public company environment. |

| | | | | |

| Lisa H. Jamieson |

Director

Age 63

Director

since: August 2019

Committees: •Audit Committee •Compensation Committee (Chair) •Nominating and Governance Committee

Tenure: •4 years | Principal Occupation and Other Information

Lisa H. Jamieson is a shareholder of Bourland, Wall and Wenzel, P.C., where she has been practicing law since 2018. Ms. Jamieson was a partner with the firm of Shannon, Gracey, Ratliff & Miller, LLP from 2008 until 2016. From 2016 to 2018, Ms. Jamieson was with the law firm of Pope, Hardwicke, Christie, Kelly & Taplett, LLP. Ms. Jamieson is experienced in all facets of estate planning and probate law, is Board Certified in Estate Planning and Probate Law by the Texas Board of Legal Specialization and is a Certified Public Accountant (retired status). Ms. Jamieson's practice includes sophisticated business and estate tax planning, administration of dependent and independent estates, guardianships for incapacitated adults and counseling and representing trustees. Ms. Jamieson is licensed in Texas, having graduated from Baylor University School of Law. She is a Fellow in the American College of Trust and Estate Counsel and is a past President of the Tarrant County Probate Bar. Ms. Jamieson is a former Chair of the Real Estate, Probate and Trust Law Section of the State Bar of Texas, the largest section of the State Bar. She also has chaired the Guardianship Code Committee of the Section as well as Chair of the Jurisdiction Committee which revised the jurisdiction statutes of decedents' estates and guardianships.

Qualifications

Ms. Jamieson provides knowledge in the accounting field. She also provides senior leadership experience gained through her executive level positions held in several sections of the State Bar and her tenured experience in her law practice. Ms. Jamieson contributes her expertise in the operational management and legal affairs to the Board. |

| | | | | |

| Elizabeth (Betsy) Parmer |

Director

Age 56

Director

since: March 2023

Committees: •Audit Committee •Compensation Committee •Nominating and Governance Committee

Tenure: •<1 year | Principal Occupation and Other Information

Elizabeth (Betsy) Parmer is the founder and owner at the Law Offices of Elizabeth Parmer. She specializes in large estate divorces and high-conflict family law litigation with a background of ad valorem tax representation. Ms. Parmer has been practicing law for 30 years. Since 1995, she has been practicing at the Law Offices of Elizabeth Parmer. She currently serves as a board member for the charity organization Dayna's Footprints. Ms. Parmer holds a Bachelor of Arts in history from Yale University and a Juris Doctor from the University of Texas at Austin.

Qualifications

Ms. Parmer brings to the Board extensive legal experience, management expertise and other business acumen. |

| | | | | |

| G.F. (Rick) Ringler, III |

Director

Age 76

Director

since: October 2017

Committees: •Audit Committee •Compensation Committee •Nominating and Governance Committee (Chair)

Tenure: •6 years | Principal Occupation and Other Information

G.F. (Rick) Ringler, III provides real estate and financial consulting to various former customers since his retirement in 2012. He retired from commercial banking in 2012 and has concentrated on personal investments since 2017. From 2006 to his retirement in 2012, he served as Senior Vice President — Commercial and Real Estate Lending for Frost Bank. Prior to that, he served on the Board of Directors of First National Bank of Burleson and Landmark Bank of Fort Worth, where he was the Chief Lending Officer. He also was a Senior Lending Officer at three other bank groups for a total of six over a career in banking that spanned 44 years beginning with Fort Worth National Bank in 1968. Mr. Ringler holds a Bachelor of Business Administration in finance from Texas Christian University.

Qualifications

Mr. Ringler has significant experience in commercial and residential real estate construction and development financing. |

How Nominees are Selected

Our Nominating and Governance Committee selects nominees based on recognized achievements and their ability to bring various skills and experience to the deliberations of our Board, as described in more detail in the Corporate Governance Guidelines available at www.forestar.com under the “Investor Relations — Corporate Governance — Governance Documents” section. The Corporate Governance Guidelines encourage board membership composed of diverse background skills, substantive pertinent experience and diversity among the directors as a whole.

Our Board approves the nominees to be submitted to the stockholders for election as directors. Our Nominating and Governance Committee and our Board consider whether non-employee director nominees are independent as defined in the corporate governance listing standards of the NYSE and whether they have a prohibited conflict of interest with our business.

Our Nominating and Governance Committee considers director candidates recommended by stockholders who are entitled to vote for the election of directors at the annual meeting of stockholders and who comply with the advance notice procedures for director nominations set forth in our amended and restated bylaws. These procedures require that notice of the director nomination be made in writing to our Corporate Secretary. The notice must be received at our executive offices not less than 75 days nor more than 100 days prior to the anniversary date of the immediately preceding annual meeting of stockholders. In the case of an annual meeting called for a date more than 50 days prior to such anniversary date, notice must be received not later than the close of business on the 10th day following the date on which notice of the annual meeting date is first mailed to stockholders or made public, whichever occurs first. In the case of a special meeting of stockholders at which directors are to be elected, notice must be received not later than the close of business on the 10th day following the date on which notice of the special meeting date is first mailed to stockholders or made public, whichever occurs first. Recommendations by stockholders that are made in this manner will be evaluated in the same manner as candidates identified through other means, which include taking into consideration the needs of the Board and the qualifications of the candidates. Our amended and restated bylaws require the notice of director nomination to include certain specified information regarding the nominating stockholder and the nominee.

Corporate Governance and Board Matters

Board Leadership Structure

Mr. Tomnitz has served as our Executive Chairman of the Board since October 2017. Mr. Tomnitz has significant experience serving in the real estate and homebuilding industry and as a public company CEO.

Our Board believes that separating the offices of Executive Chairman and CEO is in the best interests of the Company and its stockholders at this time. It allows our Executive Chairman to focus on overall strategy and vision while leading the Board, affords us the benefits of Mr. Tomnitz’s board leadership experience, and enables our CEO to focus on managing the day-to-day operations of the Company. However, should circumstances change in the future, the Board is free to choose its Executive Chairman in any way it determines is in the best interests of the Company and its stockholders in accordance with our Second Amended and Restated Certificate of Incorporation and amended and restated bylaws.

Our Board performs a number of its functions through committees. All committee members, including the chairs of each of our Audit Committee, Compensation Committee and Nominating and Governance Committee, are independent directors under NYSE listing standards. Each committee’s charter expressly provides that the committee has the sole discretion to retain, compensate and terminate its advisors. The charters of our Audit Committee, Compensation Committee, and Nominating and Governance Committee are available at www.forestar.com under the “Investor Relations — Corporate Governance — Board Committees” section. We will provide a copy of these documents, without charge, upon request to our Corporate Secretary at our principal executive office. Any changes to the committee charters will be reflected on our website.

Risk Oversight

The Board oversees our risk management processes and management is responsible for managing risks. The Board performs its risk oversight role by using several different levels of review. Our CEO reports on significant risks to the Board at times as may be necessary or appropriate. In addition, management reports on and the Board reviews the risks associated with our strategic plan periodically as part of the Board’s consideration of our strategic direction.

ESG Matters. Key ESG matters, including environmental and climate-related risks and human capital risks such as diversity, equity and inclusion and employee health and safety, could have an adverse impact on our company. Our Nominating and Governance Committee oversees these risks via regular presentations on these and other ESG matters by both internal and external personnel with responsibilities and expertise in ESG. The Board also supports and regularly inquires about progress in the Company’s reporting of ESG policies, metrics and related disclosures.

Human Capital Management. The Nominating and Governance Committee oversees a broad range of human capital management topics, including culture, talent, diversity and inclusion. We are committed to building diverse and inclusive teams, producing positive results and improving customer relationships. In fiscal 2022, the Company adopted a Human Rights Policy to set forth the Company's commitment to respect human rights. The Policy states the Company's zero tolerance for racism or discrimination of any kind, including discrimination based on race, color, genetics, religious beliefs, gender, gender identity or expression, sexual orientation, national origin, disability, age, veteran status, marital status, citizenship status or any other legally protected characteristic by anyone, including our employees, suppliers, customers or anyone with whom we do business or encounter regularly. The Human Rights Policy is available at www.forestar.com under the “Investor Relations — Corporate Governance — Governance Documents” section.

Cybersecurity. Our Company is largely reliant on information technology (IT), and potential IT failures and data security breaches could harm our business. IT and cybersecurity risk is managed by the IT Cyber Security Risk Officer and Chief Information Officer (CIO) at D.R. Horton, and our Board oversees this risk via discussions with and presentations to the Board and Audit Committee as part of Internal Audit, the CFO’s or the CIO’s materials, paired with periodic formal presentations by the CIO and IT Cybersecurity Risk Officer. The most recent formal presentation included highlights around the Company’s process to maintain IT security and discussed the mix of preventative and mitigation efforts for IT security and procedures currently in place. The Board also regularly inquires about changes, updates and potential issues in our strategy and execution of IT security risk management. Internal Audit also conducts cybersecurity reviews as part of its audit procedures and presents any findings to the Board. Additionally, we have implemented cybersecurity training for all employees. To our knowledge, the Company has not had a material cybersecurity breach within the last three years. We

believe these measures provide adequate risk oversight of information technology and cybersecurity matters that could affect the Company.

Independence. Other than Mr. Tomnitz, our Executive Chairman, all of our current Board members are classified as independent under the NYSE listing standards. We believe that the number of independent, experienced directors that make up our Board, along with oversight of the Board by the Executive Chairman, benefits our Company and our stockholders.

Each of the Board’s Committees also oversees the management of risks that fall within the Committee’s areas of responsibility. In performing this function, each Committee has full access to management, as well as the ability to engage advisors. We believe this division of responsibilities is the most effective approach for addressing the risks facing our Company and that our Board composition and leadership structure support this approach.

Board Committees and Stockholder’s Agreement

At all times when D.R. Horton and its affiliates beneficially own 20% or more of our voting securities, no committee of the Board will have more than three members unless otherwise agreed in writing between us (as approved by a majority of our independent directors) and D.R. Horton, and each committee of the Board will include in its membership (i) a number of D.R. Horton designees equal to the percentage of our voting securities beneficially owned by D.R. Horton and its affiliates multiplied by the total number of members that such committee would have if there were no vacancies on such committee, rounded up to the nearest whole number (and in any event not less than one) and (ii) at least one member not designated by D.R. Horton. In addition, at all times when D.R. Horton and its affiliates beneficially own 20% or more of our voting securities, the Board will maintain a Nominating and Governance Committee.

On October 6, 2017, D.R. Horton and our Board, including each of the members of our Board that are considered “independent” under the rules of the SEC and the NYSE, elected to waive the requirement that the Nominating and Governance Committee consist of three directors, and set the size of each of our Nominating and Governance Committee, the Compensation Committee and the Audit Committee at four directors.

Additional information regarding the Stockholder’s Agreement, including a copy of the Stockholder’s Agreement, can be found in our Current Report on Form 8-K filed with the SEC on June 29, 2017.

Audit Committee

The Audit Committee Charter has been posted to the Company’s website, which is available at www.forestar.com under the “Investor Relations — Corporate Governance — Board Committees” section. Among other things detailed in the Committee’s Charter, the Audit Committee sets the "tone at the top" and assists the Board in its oversight of:

•the integrity of our financial statements;

•compliance with legal and regulatory requirements;

•implementation of new accounting standards;

•the independent registered public accounting firm’s qualifications and independence; and

•the performance of the internal audit function and independent registered public accounting firm.

In addition, the Audit Committee prepares the report that SEC rules require to be included in the annual proxy statement. The Audit Committee has the sole authority to retain, compensate and terminate the independent registered public accounting firm. Our Board of Directors has determined that there is at least one audit committee financial expert serving on the Audit Committee, Mr. Fuller, who is an independent director. In addition, our Board of Directors has determined, in its business judgment, that all members of the Audit Committee are financially literate and independent as defined in the NYSE corporate governance standards. The current members of the Audit Committee are Mr. Fuller (Chair), Ms. Jamieson, Ms. Parmer and Mr. Ringler. The Audit Committee met four times in fiscal 2023.

Compensation Committee

The Compensation Committee Charter has been posted to the Company’s website, which is available at www.forestar.com under the “Investor Relations — Corporate Governance — Board Committees” section. Among other things detailed in the Committee’s Charter, the Compensation Committee is responsible for the following:

•determining and approving, either as a committee or together with other independent directors (as directed by the Board), the Executive Chairman’s and CEO’s compensation;

•determining and recommending to the Board the compensation of the other executive officers;

•establishing the compensation philosophies, goals and objectives for executive officers;

•monitoring incentive and equity-based compensation plans;

•administering equity-based plans;

•preparing a Compensation Committee report on executive compensation for inclusion in our annual proxy statement filed with the SEC; and

•overseeing our compliance with SEC rules regarding stockholder approvals of certain executive compensation matters and equity compensation plans.

The Compensation Committee considers the impact of our executive compensation programs, including the incentives created by the compensation awards that it administers, on our risk profile. The Compensation Committee reviews and considers, among other things, the incentives that our programs create and the factors that may reduce the likelihood of excessive risk taking. The Compensation Committee reports regularly to the full Board. We do not believe that the risks arising from our compensation policies and practices are reasonably likely to have a material adverse effect on us.

Such responsibilities may not be delegated to any persons who are not members of the Compensation Committee. The Executive Chairman recommends executive compensation amounts and programs to the Compensation Committee, except that the Executive Chairman does not participate in discussions regarding his own compensation. In addition, under the terms of the Stockholder’s Agreement with D.R. Horton, for so long as D.R. Horton beneficially owns 35% or more of our voting securities, we need the prior written consent of D.R. Horton to appoint or terminate key officers or change their compensation arrangements. Thus, under those circumstances, D.R. Horton's approval is also required. The Compensation Committee did not engage a compensation consultant in fiscal 2023.

The members of the Compensation Committee are Ms. Jamieson (Chair), Mr. Fuller, Ms. Parmer and Mr. Ringler. Our Board of Directors has determined, in its business judgment, that all members of the Compensation Committee are independent as defined in the NYSE corporate governance standards. The Compensation Committee met five times in fiscal 2023.

Nominating and Governance Committee

The Nominating and Governance Committee Charter has been posted to the Company’s website, which is available at www.forestar.com under the “Investor Relations — Corporate Governance — Board Committees” section. Among other things detailed in the Committee’s Charter, the Nominating and Governance Committee is responsible for the following:

•reviewing the structure of the Board, at least annually, to ensure that the proper skills and experience are represented on the Board;

•recommending nominees to serve on the Board;

•reviewing corporate governance issues;

•reviewing performance and qualifications of Board members before they stand for reelection;

•reviewing stockholder proposals and recommending to the Board action to be taken regarding stockholder proposals; and

•acting in an advisory capacity to the Board regarding activities that relate to issues of social and public concern, matters of public policy and the environment and significant legislative, regulatory and social trends and developments.

The members of the Nominating and Governance Committee are Mr. Ringler (Chair), Mr. Fuller, Ms. Jamieson and Ms. Parmer. Our Board of Directors has determined, in its business judgment, that all members of the Nominating and Governance Committee are independent as such term is defined in the NYSE corporate governance standards. The Nominating and Governance Committee met four times in fiscal 2023.

Executive Committee

The Executive Committee may exercise all the authority of the Board of Directors in the management of our business and affairs except for the following:

•matters related to the composition of the Board;

•changes in our bylaws; and

•certain other significant corporate matters.

The current members of the Executive Committee are Mr. Tomnitz (Chair), Ms. Jamieson and Mr. Ringler. The Executive Committee did not meet in fiscal 2023.

Director Independence

Our Board has adopted Corporate Governance Guidelines that set forth our director independence standards, which are discussed below. Our Corporate Governance Guidelines are posted at www.forestar.com under the “Investor Relations — Corporate Governance — Governance Documents” section. In accordance with our Corporate Governance Guidelines and NYSE rules, the majority of our directors are independent.

Mr. Fuller, Ms. Jamieson, Mr. Ringler, and Ms. Parmer satisfy our director independence standards. Mr. Tomnitz does not meet our independence standards because he is an executive officer. Mr. Spitzer, who retired from the Board in February 2023, also satisfied our director independence standards during the time he served in such capacity.

The Board defines independence as meeting the requirements to be considered independent directors under current NYSE rules. The Board has established the following additional guidelines to assist it in determining director independence:

•The Board will review annually the relationships that each director has with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). Only those directors who the Board affirmatively determines have no material relationship with the Company will be considered independent, subject to additional qualifications prescribed under the NYSE listing standards or applicable law.

•To serve as a member of any committee of the Board, the director must meet any additional requirements of independence set forth in the committee’s charter or applicable law or listing standards of the NYSE.

There were no material transactions or relationships between us and any of our continuing independent directors during fiscal 2023.

There is no family relationship between any of the nominees, continuing directors, executive officers or persons chosen by the Company to be an executive officer of the Company.

Board Meetings

Our Board typically meets at least four times a year. Our Board met 10 times in fiscal 2023. Each director attended virtually, in person or by conference call at least 75% of Board meetings and committee meetings held by all committees on which he or she served (held during the period he or she served).

At least once each year, our Board holds scheduled executive sessions with only non-management directors present. The Chair of the Nominating and Governance Committee serves as Presiding Director to lead these executive sessions of the Board.

Other Corporate Governance Matters

Under our Corporate Governance Guidelines, a director is deemed to have tendered his or her resignation at the next regularly scheduled meeting of the Nominating and Governance Committee in the event of a change in job status from the status held at the time of election to our Board. The Nominating and Governance Committee will review whether the new occupation or retirement of the director is consistent with the needs and composition of our Board and recommend action to our Board based on such review. Also, under our Corporate Governance Guidelines, non-employee directors may not serve on the boards of directors of more than three public companies. The Executive Chairman of the Board and the Chair of the Nominating and Governance Committee must be consulted by existing directors prior to joining another board of directors. The Executive Chairman of the Board and the Chair of the Nominating and Governance Committee will assess whether the new membership would present a conflict or otherwise compromise the ability of that director to dedicate the time necessary to serve on our Board.

We expect all of our Board members to attend our annual meeting of stockholders, but from time to time other commitments may prevent certain Board members from attending. All Board members attended our 2023 Annual Meeting of Stockholders either virtually, by teleconference or in person.

Non-employee directors must retire no later than the annual stockholders meeting following their 77th birthday unless the remaining non-employee directors determine that it would be in the best interest of the Company and our stockholders under the particular circumstances at the time for an exception to this policy to be granted. Employee directors must resign from the Board at the time they retire or otherwise terminate employment with us, but no later than their 77th birthday, unless otherwise determined by the Board. In November 2020 and later affirmed in October 2021, 2022 and 2023, the remaining non-employee directors determined that it was in the best interest of the Company and the stockholders that Mr. Fuller, although age 80, continue to serve as a director of the Company. Mr. Fuller was nominated by the Nominating and Governance Committee as a director of the Company to be included in this Proxy Statement for election at the 2024 Annual Meeting.

Policies on Business Conduct and Ethics

All our directors, officers and employees are required to abide by our Standards of Business Conduct and Ethics. This code covers all areas of professional conduct, including conflicts of interest, unfair or unethical use of corporate opportunities, protection of confidential information, compliance with all applicable laws and regulations, and oversight and compliance. Our CEO and CFO are also required to abide by our Code of Ethics for Senior Financial Officers. The Standards of Business Conduct and Ethics and Code of Ethics for Senior Financial Officers are available at www.forestar.com under the “Investor Relations — Corporate Governance — Governance Documents” section. We will provide a copy of these documents without charge to any stockholder upon request to our Corporate Secretary at our principal executive office. Any future amendments to either of these codes, and any waiver of the Code of Ethics for Senior Financial Officers and of certain provisions of the Standards of Business Conduct and Ethics for directors or executive officers, will be disclosed on our website promptly following the amendment or waiver.

Communications with Directors

Stockholders and other interested parties may communicate with our Board by forwarding written comments to the Chair of the Nominating and Governance Committee, who also serves as our Presiding Director, with a copy to our Corporate Secretary to the following:

Rick Ringler, Nominating and Governance Committee Chair

Forestar Group Inc.

2221 E. Lamar Blvd., Suite 790

Arlington, Texas 76006

Attention: Board Communications

Copy to:

Corporate Secretary

Forestar Group Inc.

2221 E. Lamar Blvd., Suite 790

Arlington, Texas 76006

Attention: Board Communications

Director Compensation

Our director compensation program is designed to compensate our directors for the time commitment and preparations required for directors to fulfill their responsibilities, to align director compensation with the long-term interests of our stockholders and to assist in recruiting high-caliber directors.

Director Fee Schedule

The director fee schedule is as follows:

| | | | | | | | |

| Retainer Fee | $12,500 per quarter, not to exceed $50,000 per annum |

| Annual Board Committee Fee | $5,000 per Committee (paid $1,250 per quarter) |

| Annual Board Committee Chair Retainer | $2,500 per Committee (paid $625 per quarter) |

In addition to the above cash-based fees, in March 2023, each non-employee director received a grant of 3,286 restricted stock units which vests ratably over three years. In addition, in connection with Ms. Parmer's appointment to the Board, Ms. Parmer received a retainer grant of 6,000 restricted stock units in March 2023 which vests ratably over three years. Such retainer fees paid in restricted stock units are generally granted to new directors upon initial appointment.

Further, directors are reimbursed for expenses incurred in attending Board and committee meetings, including those for travel, food and lodging. Each non-employee director is also eligible to participate in the Company's broad-based health care plan. Ms. Jamieson elected to participate in the plan in fiscal 2023.

Further, in October 2023, following the end of fiscal 2023, each of our non-employee directors received their standard triennial grant of retainer fees paid in the form of a grant of 6,000 restricted stock units which vests ratably over three years, beginning on October 30, 2024. These equity retainer grants are made every three years to compensate the directors for continued service to the Board and to continue to align the Directors' interests with the long-term interest of the Stockholders.

Mr. Tomnitz does not receive any additional fees or other compensation for his service on our Board other than his compensation as Executive Chairman which is discussed further below under "Executive Compensation".

Insurance and Indemnification

All directors are covered under our director and officer liability insurance policies for claims alleged in connection with their service as a director. We have entered into indemnification agreements with each of our directors, agreeing to indemnify them to the fullest extent permitted by law for claims alleged in connection with their service as a director.

Fiscal 2023 Director Compensation

The following table presents compensation earned by non-employee directors for services rendered in fiscal 2023 as calculated in accordance with SEC rules.

| | | | | | | | | | | | | | | | | | | | |

| Name(1) | | Fees

Paid in Cash(2) | | Stock

Awards(3) | | Total |

| Samuel R. Fuller | | $ | 67,500 | | | $ | 48,501 | | | $ | 116,001 | |

| Lisa H. Jamieson | | $ | 67,500 | | | $ | 48,501 | | | $ | 116,001 | |

Elizabeth (Betsy) Parmer(4) | | $ | 32,500 | | | $ | 137,061 | | | $ | 169,561 | |

| G.F. (Rick) Ringler, III | | $ | 67,500 | | | $ | 48,501 | | | $ | 116,001 | |

Donald C. Spitzer(5) | | $ | 32,500 | | | $ | — | | | $ | 32,500 | |

_________________

(1)The Company pays director fees only to non-employee directors.

(2)Amounts represent director fees paid in cash during fiscal 2023.

(3)Amount represents the grant date fair value of $14.76 per unit for the 3,286 restricted stock units granted to each non-employee director on March 21, 2023. The grant date fair value of the restricted stock units was determined in accordance with accounting guidance for share-based payments. The Company recognizes expense for this award over the three-year vesting period for those directors who are not retirement eligible.

For Ms. Parmer, the amount also includes 6,000 restricted stock units granted on March 21, 2023, with a grant date fair value of $14.76 per unit, in connection with her appointment to the Board.

(4)Ms. Parmer was appointed to the Board of Directors effective March 1, 2023.

(5)Mr. Spitzer resigned from the Board of Directors effective February 21, 2023 and thus did not receive any equity awards during fiscal 2023.

As of September 30, 2023, each non-employee director held the following number of unvested restricted stock units:

| | | | | | | | |

| Name | | Unvested

Restricted Stock Units |

| Samuel R. Fuller | | 7,786 |

| Lisa H. Jamieson | | 7,786 |

| Elizabeth (Betsy) Parmer | | 9,286 |

| G.F. (Rick) Ringler, III | | 7,786 |

Proposal No. 2 – Advisory Vote on the Approval of Executive Compensation

The Board recognizes that executive compensation is an important matter for our stockholders. Our executive compensation programs are designed to implement our core compensation philosophy that executive compensation should relate to and vary with our performance. We believe our compensation programs are aligned with the interests of our stockholders.

Pursuant to Section 14A of the Securities Exchange Act of 1934, and as a matter of good corporate governance, we are asking you to vote, in a non-binding advisory manner, to approve the executive compensation philosophy and objectives described in the Compensation Discussion and Analysis (CD&A) section of this 2024 Proxy Statement, and the compensation of our named executive officers ("NEOs"), as disclosed in this 2024 Proxy Statement.

As an advisory vote, the results of this vote will not be binding on the Board or the Company. However, the Board of Directors values the opinions of our stockholders and will consider the outcome of the vote when making future decisions on the compensation of our NEOs and our executive compensation philosophy and objectives.

After consideration of the results of our advisory vote on the frequency of future advisory votes on executive compensation held at our 2023 Annual Meeting of Stockholders, at which the overwhelming majority of votes cast supported holding advisory votes to approve executive compensation every year, the Board of Directors has determined to hold annual advisory votes on executive compensation. Accordingly, the next advisory vote on executive compensation following the 2024 Annual Meeting will occur at the 2025 Annual Meeting unless the Board of Directors modifies its policy on the frequency of holding such advisory votes.

In accordance with the foregoing, we are asking stockholders to approve the following advisory resolution at the 2024 Annual Meeting:

RESOLVED, that the stockholders of Forestar Group Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers disclosed in the Compensation Discussion and Analysis, the Summary Compensation Table and the related compensation tables, notes and narrative in the Proxy Statement for the Company’s 2024 Annual Meeting of Stockholders.

| | | | | | | | | | | | | | |

The Board of Directors Unanimously Recommends that Stockholders Vote “FOR” Approval of the Advisory Resolution on Executive Compensation. |

Executive Officers

Our Current Executive Officers are:

| | | | | | | | | | | |

Donald J. Tomnitz | Daniel C. Bartok | James D. Allen | Mark S. Walker |

| Executive Chairman | President and Chief Executive Officer | Executive Vice President and Chief Financial Officer | Executive Vice President and Chief Operating Officer |

Non-Director Executive Officers

| | | | | |

| Daniel C. Bartok |

Chief Executive Officer Age 67 | Daniel C. Bartok, is President and Chief Executive Officer of Forestar. He joined the Company as Chief Executive Officer in 2017. As previously announced, Mr. Bartok is retiring January 1, 2024. Prior to joining Forestar, he served as Executive Vice President of Wells Fargo Bank as head of its Owned Real Estate Group from 2008 to 2017. Prior to joining Wells Fargo, he was President of Clarion Realty, Inc., a real estate development company operating across multiple states, with an emphasis on residential land development and homebuilding. Mr. Bartok began his career at Price Waterhouse LLP (now PricewaterhouseCoopers LLP). Mr. Bartok holds a Bachelor of Science degree in accounting from the University of Illinois. |

| | | | | |

| James D. Allen |

Chief Financial Officer Age 64 | James D. Allen, is Executive Vice President and Chief Financial Officer of Forestar, positions he has held since March 2020. Prior to joining Forestar, he served as a Senior Operating Partner at Palm Beach Capital, a private equity investment firm, from 2019 to March 2020. He served as CFO of Hollander Sleep Products, a supplier of bedding products, from 2015 to 2018. He has also held a variety of executive roles at both private and public companies, including Operating Vice President and Group CFO of Sun Capital Partners from 2003 to 2014, Chief Administrative Officer of Mattress Firm Inc. and a variety of C-suite roles at Tandycrafts, Inc. Mr. Allen began his career at PricewaterhouseCoopers LLP. Since February 2016, Mr. Allen has served on the Board of Directors for Flexshopper, Inc. (Nasdaq: FPAY), including serving on their Audit and Compensation Committees. Mr. Allen holds a Bachelor of Business Administration degree in accounting and management from Evangel University. |

| | | | | |

| Mark S. Walker |

Chief Operating Officer Age 47 | Mark S. Walker, is Executive Vice President and Chief Operating Officer of Forestar, positions he has held since October 1, 2022. Mr. Walker has more than 20 years of experience in residential real estate. Mr. Walker joined Forestar in 2019 as Region President of the Company’s East region. Since 2019, his responsibilities have expanded to include leading Forestar’s Mid-Atlantic, North and Texas regions. Prior to joining Forestar, Mr. Walker worked for D.R. Horton from 2012 to 2019 as a Vice President in land acquisition and development. Mr. Walker holds a Bachelor of Business Administration degree in general business from the University of Georgia. |

Our Incoming Chief Executive Officer

| | | | | |

| Anthony W. Oxley |

Incoming Chief Executive Officer Age 59 | Anthony W. Oxley, effective January 1, 2024, will hold the positions of President and Chief Executive Officer. Mr. Oxley has more than 25 years of experience at D.R. Horton where he currently serves as Senior Vice President - Business Development. Mr. Oxley's experience at D.R. Horton includes extensive land acquisition and development exposure as well as homebuilding and day-to-day operations in several large markets. In his current role he oversees all merger and acquisition activity and new market opportunities for start-up divisions. Mr. Oxley holds a Bachelors degree from the University of Northern Iowa and a Juris Doctorate from Emory University. |

Executive Compensation

Compensation Discussion and Analysis

Overview

This Compensation Discussion and Analysis describes the compensation elements for our NEOs. Our NEOs for fiscal 2023 are:

•Donald J. Tomnitz, Executive Chairman;

•Daniel C. Bartok, President and Chief Executive Officer;*

•James D. Allen, Executive Vice President and Chief Financial Officer; and

•Mark S. Walker, Executive Vice President and Chief Operating Officer.**

* Effective January 1, 2024, Mr. Bartok will retire as President and Chief Executive Officer and Anthony ("Andy") W. Oxley will serve as the Company's President and Chief Executive Officer.

**Effective October 1, 2022, Mr. Walker was promoted to Executive Vice President and Chief Operating Officer of the Company.

We are a national, well-capitalized residential lot development company focused primarily on selling finished single-family residential lots to homebuilders. We are investing in land acquisition and development to expand our residential lot development business across a geographically diversified national platform while consolidating market share in the fragmented U.S. lot development industry. We are primarily investing in short-duration, phased development projects. This strategy is a unique, lower-risk business model that we expect will produce more consistent returns than other public and private land developers.

We have expanded and diversified our lot development operations across 54 markets in 22 states by investing available capital into our existing markets and by entering new markets. We believe our geographically diverse operations provide a strong platform for us to consolidate market share in the highly fragmented lot development industry. We also believe our geographic diversification lowers our operational risks and enhances our earnings potential by mitigating the effects of local and regional economic cycles.

Our real estate origins date back to the 1954 incorporation of Lumbermen’s Investment Corporation, which became a wholly-owned subsidiary of the predecessor to Temple-Inland Inc. ("Temple-Inland") in 1971. We changed our name to Forestar Real Estate Group Inc. after Temple-Inland began reporting us as a separate business segment in 2006, and in 2007, Temple-Inland completed a tax-free distribution of our shares to its stockholders, making us an independent publicly-traded company. In 2008, we changed our name from Forestar Real Estate Group Inc. to Forestar Group Inc. We became a majority-owned subsidiary of D.R. Horton, Inc. ("D.R. Horton") in October 2017 by virtue of a merger with a wholly-owned subsidiary of D.R. Horton. Immediately following the merger, D.R. Horton owned 75% of our outstanding common stock, and as of September 30, 2023, owned approximately 63% of our outstanding common stock.

We have grown significantly since the merger in October 2017. Our Compensation Committee strives to provide a fair and competitive compensation program for executive officers that will attract, motivate and retain highly qualified and experienced executives, reward superior performance and provide incentives that are based on the performance of the Company, with an overall emphasis on maximizing long-term stockholder value. The following discussion provides information regarding our compensation objectives and the relationship between the performance of the executive and the Company.

Alignment of Pay with Performance

The Board places significant emphasis on the Company's long-term success and driving long-term value for our shareholders. Our executive compensation intends to attract, motivate and retain individuals with the necessary experience and expertise to make business decisions that will create long-term shareholder value, without taking excessive risk.

In compensating executive officers for their performance, the Compensation Committee takes a discretionary and holistic approach when evaluating executive officer performance. The Compensation Committee considers several different Company-level metrics including, but not limited to financial performance, operational performance including ensuring our operating platform appropriately supports the business and maintaining a balance sheet that provides operational flexibility. Each NEO's performance, position, tenure, experience, expertise, leadership and management capabilities are considered in addition to the Company-level metrics discussed above.

As the Company becomes more mature over time, the Compensation Committee will continue to evaluate more performance-based compensation programs and criteria designed to more closely align incentive compensation to the achievement of performance-based outcomes.

Several key financial and operational highlights that illustrate our strong performance in fiscal 2023 are provided below. All comparisons are made between fiscal 2022 and fiscal 2023.

| | | | | | | | | |

| FINANCIAL HIGHLIGHTS | |

| Revenue and earnings | •Revenue of $1.4 billion and net income attributable to Forestar of $166.9 million. |

| Pre-tax profit margins | •Pre-tax income of $221.6 million, with a pre-tax profit margin of 15.4%. •Excluding non-cash impairment charges of $19.4 million and $3.8 million in fiscal 2023 and 2022, respectively, pre-tax margin for fiscal 2023 was 16.8%, an improvement of 100 basis points. | |

| Increased financial flexibility | •Generated $364.1 million in cash flow from operating activities. •Total liquidity increased 61% to $998.3 million, including $616.0 million in cash and cash equivalents and $382.3 million of availability on the revolving credit facility after the reduction for outstanding letters of credit. | |

| Value Creation | •Return on equity of 13.2%. Return on equity is calculated as net income attributable to Forestar for the trailing twelve months divided by average stockholders' equity, where average stockholders' equity is the sum of ending stockholders' equity balances of the trailing five quarters divided by five. •Book value per diluted share increased 14% to $27.43. | |

| | | |

| OPERATIONAL HIGHLIGHTS | |

| Strong execution | •Delivered 14,040 residential lots. |

| Attractive lot position | •Owned and controlled 79,200 lots across a geographically diverse footprint at September 30, 2023. •As land prices continued to increase across most of the Company’s footprint during the year, new land investment was reduced by 38% and the Company primarily focused on the phased development of land already owned. •The majority of the Company’s owned lot position was put under contract prior to 2021, before land prices increased. | |

| Diversifying customer base | •Continued to diversify and expand customer base by closing lots to 26 unique customers in fiscal 2023. | |

Advisory Vote

At our 2023 Annual Meeting of Stockholders, approximately 98% of votes cast in our advisory vote on executive compensation were in favor of the proposal. The Compensation Committee considered this result and made no changes to our compensation program as a result of our stockholders’ support of our existing executive compensation program. The Compensation Committee will continue to consider the results of stockholder advisory votes on executive compensation when making future decisions. At our 2023 Annual Meeting of Stockholders, our stockholders voted in favor of an annual frequency of an advisory vote on executive compensation. Our Board of Directors has currently determined that advisory votes on executive compensation should continue to be held annually.

The Compensation Committee has primary authority over establishing and changing our executive compensation programs and making specific compensation determinations while D.R. Horton maintains certain consent rights over certain compensation matters.

Compensation Philosophy and Objectives

Our executive compensation program is designed to attract, retain and motivate our executives to maximize company and individual performance as we grow the volume and profitability of our residential lot development business. We are guided by the following principles in determining the form and amount of executive compensation:

•Compensation should align with the performance of the Company and performance of the individual. A portion of total compensation is discretionary in nature yet evaluated based on our financial and operating performance, as well as individual performance of the executive. Bonuses are paid semi-annually based on the achievement of Company objectives and the assessment of individual performance. Also, our restricted stock unit awards generate additional value for executives as our stock price increases.

•Compensation should align executives’ and stockholders’ interests. Our discretionary bonuses are designed to incentivize and reward performance as we grow the volume and profitability of our residential lot development business. In addition, the use of equity-based compensation aligns our executives’ interests with our stockholders’ interests and encourages our executives to focus on growth and long-term performance.

•Compensation should be competitive. Our total compensation, including our base salaries, discretionary bonuses and long-term equity awards, should be competitive with our public and private peers to enable us to attract and retain key executives.

•Retention. We believe an overall package of appropriate pay and benefits helps retain executives and managers. This includes a competitive base salary, discretionary cash bonuses, health and welfare benefits and Company matching contributions under our 401(k) plan. In addition, equity awards with vesting and forfeiture provisions encourage retention.

Elements of our Compensation Program

The elements of our compensation program are as follows:

•Salaries;

•Discretionary semi-annual cash bonuses;

•Long-term time-based equity awards, with restricted stock units as the primary equity incentive;

•401(k) retirement plan contributions; and

•Health and welfare benefits.

Each element of compensation is evaluated independently to determine whether, in our Compensation Committee’s judgment, it is competitive within our industry. Our Compensation Committee maintains a balance among the elements of compensation that aligns a portion of compensation to performance. Our Compensation Committee reviews tally sheets that show all elements of compensation on an aggregate basis over the previous three years. From year to year, the Compensation Committee may also choose to award all or only certain elements of compensation to an NEO.

| | | | | | | | | | | | | | |

| Element | | Performance Measure | | Measurement / Vesting

Period |

| Base Salary | | Continued service subject to annual evaluation | | Evaluated each year |

| Discretionary cash bonus: | | | | |

| Semi-annual cash bonus | | Company and individual performance | | 6 months to 1 year |

| Long-term equity incentives: | | | | |

| Restricted stock units | | Continued service | | 3 to 5 years |

| 401(k) retirement benefits | | 401(k) contribution is dependent on the percentage elected by the NEO and allowable under regulatory limits | | None |

| Health and welfare benefits | | None | | None |

2023 TOTAL COMPENSATION

Base Salaries

Base salaries are determined based on the executive’s responsibilities, performance, experience and the Compensation Committee’s judgment. In reviewing the salaries of executives, the Compensation Committee reviews publicly-available data from our peer group companies (see "Competitive Pay Analysis and Peer Group" on page 28). Base salaries provide our NEOs a foundation of fixed income, encourage retention and recognize effective leadership. With the exception of Mr. Walker, whose base salary increased $25,000 to $300,000 upon his appointment to COO, the base salaries of our other NEOs for fiscal 2023 remained unchanged from fiscal 2022 levels. Each of the NEO’s base salaries was increased for fiscal 2024 to align their salaries with the salaries of similar executives of similar publicly-traded companies, including members of our peer group and other public companies within a range of our market capitalization and industrial classification code, and to recognize each executive’s performance in their role.

The base salaries for fiscal years 2023 and 2024 of our NEOs are set forth in the following table.

| | | | | | | | | | | | | | |

| Base Salaries of our NEOs | | Fiscal 2023 Base Salary | | Fiscal 2024 Base Salary |

| Donald J. Tomnitz | | $400,000 | | $420,000 |

| Daniel C. Bartok* | | $400,000 | | $420,000 |

| James D. Allen | | $350,000 | | $370,000 |

| Mark S. Walker | | $300,000 | | $315,000 |

*Mr Bartok has announced his retirement is effective January 1, 2024.

Semi - Annual Discretionary Bonuses

Fiscal 2023:

The Compensation Committee and the Board, as applicable, determined bonuses for fiscal 2023 in their discretion for our NEOs. The Committee's discretionary approach is intended to reward performance and align executives' interests with those of our stockholders by focusing our executives on critical short-term financial and operational objectives which also support our long-term financial goals. Consistent with the approach taken in prior years, the Compensation Committee and Board considered the following items, along with other relevant information, when determining the amount of discretionary bonuses for fiscal 2023:

•Increase in margins;

•Improvement of financial returns;

•Management of inventory;

•Extent of responsibilities;

•Increase in the number of lots delivered;

•Disciplined land acquisition;

•Controlling selling, general and administrative costs;

•Maintaining a strong balance sheet that provides operational flexibility; and

•Maintaining strong financial internal controls, financial reporting systems and financial compliance.

During fiscal 2023, after considering these factors, the Compensation Committee and the Board of Directors, as applicable, approved discretionary cash bonuses for the NEOs on a semi-annual basis.

For the first semi-annual period ended March 31, 2023, Mr. Tomnitz and Mr. Bartok each received a $350,000 bonus, Mr. Allen received a $225,000 bonus and Mr. Walker received a $175,000 bonus. For the second semi-annual period ended September 30, 2023, Mr. Tomnitz and Mr. Bartok each received a $1,200,000 bonus and Mr. Allen and Mr. Walker each