false

0000890447

0000890447

2023-12-08

2023-12-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): December 8, 2023

VERTEX ENERGY, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

001-11476 |

94-3439569 |

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

1331 Gemini Street

Suite 250

Houston, Texas |

77058 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (866) 660-8156

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

Common Stock,

$0.001 Par Value Per Share |

VTNR |

The NASDAQ

Stock Market LLC

(Nasdaq

Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive

Agreement. |

On

December 8, 2023, Vertex Refining Alabama LLC, a wholly-owned subsidiary of Vertex Energy, Inc. (“Vertex”

or the “Company”), and Macquarie Energy North America Trading Inc.

(“Macquarie”), entered into Amendment No. 3 to Supply and Offtake

Agreement (“Amendment No. 3”). Amendment No. 3 amended that certain

April 1, 2022 Supply and Offtake Agreement entered into between Vertex and Macquarie (as amended from time to time, the “Supply

and Offtake Agreement”), to, among other things, include a certain additional hydrocarbon storage tank located at the

Center Point Chickasaw Terminal, located in Chickasaw, Alabama (the “Product

Tanks”) as an Included Product Tank under and as defined in the Supply and Offtake Agreement. The Product Tank has a

storage capacity of approximately 120,000 barrels. In connection with Amendment No. 3, the Company entered into certain ancillary agreements with Macquarie and the owners/operator of the Product Tank, providing

Macquarie with, among other things, certain storage rights with respect to the Product Tank and related consents and acknowledgments

with respect to the Product Tank and Macquarie’s usage of such tanks.

The

foregoing description of Amendment No. 3 does not purport to be complete and is qualified in its entirety by reference to the full text

of Amendment No. 3, which is filed as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated into

this Item 1.01 by reference in its entirety.

| Item 9.01 |

Financial Statements and Exhibits. |

| Exhibit

No. |

|

Description |

|

| |

|

|

|

| 10.1*+ |

|

Amendment No. 3 to Supply and Offtake Agreement

dated and effective December 8, 2023, between Vertex Refining Alabama LLC and Macquarie Energy North America Trading Inc. |

| 104 |

|

Inline XBRL for the cover page of this

Current Report on Form 8-K |

| |

+ |

Certain

schedules, annexes and similar attachments have been omitted pursuant to Item 601(a)(5) of Regulation S-K. A copy of any omitted

schedule or exhibit will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however that

Vertex Energy, Inc. may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended,

for any schedule or exhibit so furnished. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VERTEX ENERGY, INC. |

| |

|

| Date: December 13, 2023 |

By: |

/s/

Chris Carlson |

| |

|

Chris Carlson |

| |

|

Chief Financial Officer |

Vertex Energy Inc. 8-K

Exhibit 10.1

AMENDMENT

NO. 3 TO

SUPPLY

AND OFFTAKE AGREEMENT

This

AMENDMENT NO. 3 TO SUPPLY AND OFFTAKE AGREEMENT (this “Amendment”) is made and entered effective as of

December 8, 2023, by and between VERTEX REFINING ALABAMA LLC (“Vertex” or “Company”) and

MACQUARIE ENERGY NORTH AMERICA TRADING INC. (“Macquarie”).

RECITALS

WHEREAS,

Vertex and Macquarie are parties to that certain Supply and Offtake Agreement dated April 1, 2022, as amended to date (together with

all annexes, schedules and exhibits thereto, and as further amended from time to time, the “Agreement”); and

WHEREAS,

the parties hereto desire to amend the Agreement as set forth in more detail herein.

NOW

THEREFORE, the parties hereto hereby agree as follows:

AGREEMENT

Section

1. Defined Terms. Capitalized terms used but not defined in this Amendment have the meaning given to them in

the Agreement.

Section

2. Amendments to Agreement. The Agreement is hereby amended as follows:

| (a) | Section

1.1 –Definitions –is hereby amended in part as follows: |

| (i) | The

definition of “Center Point Operator” is deleted in its entirety and replaced

with the following new definition: |

“Center

Point Operator” means Center Point Terminal Chickasaw, LLC, or such other successor that operates the Center Point Storage

Facilities.

| (ii) | The

definition of “Center Point Storage Rights Agreement” is deleted in its entirety

and replaced with the following new definition: |

“Center

Point Storage Rights Agreement” means the sub-lease agreement entered into between the Company and Macquarie in respect of

Tank 21 at the Center Point Storage Facilities on or prior to the Center Point Inclusion Date.

| (iii) | The

definition of “Center Point Terminalling Agreement” is deleted in its entirety

and replaced with the following new definition: |

“Center

Point Terminalling Agreement” means the service agreement dated as of January 10, 2023, between the Center Point Operator and

the Company as amended on each of March 9, 2023, April 24, 2023, and July 28, 2023, and as may be further amended from time to time.

| (iv) | Schedule

E, as in effect as of the date hereof (including as a result of any amendments or modifications

prior to the date hereof effected pursuant to Section 31 of the Agreement) is hereby

replaced in its entirety by the Schedule E attached hereto and incorporated herein. |

| (v) | Schedule

F-12 (Center Point Chickasaw Daily Inventory Report), in substantially the form attached

hereto, shall be added to the Agreement. |

| (vi) | Schedule

I (Scheduling and Communications Protocol) is amended and replaced by Schedule I

hereto. |

| (vii) | Schedule

O (Included Storage Locations) is amended to include the following additional Included

Storage Locations: |

(9)

From and after the Center Point Inclusion Date, Tank 21 at the terminalling and storage facilities at the storage facility located at

200 Viaduct Road North, Chickasaw, Alabama 36611, regardless of whether owned and operated by Center Point Terminal Chickasaw, LLC.

Section

3. Counterparts. This Amendment may be executed in any number of counterparts and by different parties hereto in separate

counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and

the same agreement. This Amendment may be executed via electronic, digital, or handwritten signature. For all purposes, a copy of this

Amendment as executed shall have the same force and effect as an original thereof.

Section

4. Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their

respective successors and assigns permitted pursuant to the Agreement, as amended hereby.

Section

5. Severability. In case one or more provisions of this Amendment shall be invalid, illegal, or unenforceable in any respect

under applicable law, the validity, legality, and enforceability of the remaining provisions contained herein or therein shall not be

affected or impaired thereby.

Section

6. Governing Law. This Amendment shall be governed by, and construed and enforced in accordance with, the laws of the State

of New York without regard to conflicts of laws principles.

EXECUTED

effective as of the date first above written.

| |

|

MACQUARIE ENERGY NORTH AMERICA TRADING INC. |

| |

|

|

| |

|

|

| |

|

By: |

/s/ Brian Houstoun |

| |

|

Name: |

Brian Houstoun |

| |

|

Title: |

Senior Managing Director |

| |

|

|

| |

|

|

| |

|

By: |

/s/ Travis McCullough |

| |

|

Name: |

Travis

McCullough |

| |

|

Title: |

Division Director |

| |

|

VERTEX

REFINING ALABAMA LLC |

| |

|

|

| |

|

|

| |

|

By: |

/s/ Chris Carlson |

| |

|

Name: |

Chris

Carlson |

| |

|

Title: |

Chief

Financial Officer |

SCHEDULE

O

FORM

OF INCLUDED STORAGE LOCATIONS

(1) Terminalling

and storage at the Refinery owned and operated by Vertex Refining Alabama, LLC, except for all sulfur, LPGs and molecules within the

processing units.

(2) Internal

pipe systems located at the Refinery in Saraland, Alabama owned and operated by Vertex Refining Alabama, LLC (the “Saraland

Refinery”).

(3) Terminalling

and storage facility at Blakely Island owned and operated by Vertex Refining Alabama, LLC (the “Blakely Island Facility”).

(4) Terminalling

and storage facility at Plains Mobile Terminal located at 1871 Hess Road Mobile, AL 36610 (the “Plains Mobile Terminal Facility”),

whether or not owned and operated by Plains Marketing, L.P.

(5) Terminalling

and storage facility at BWC Blakeley Terminal located at 1437 Cochrane Causeway Mobile, AL 36602 (the “BWC Blakeley Terminal

Facility”), whether or not owned and operated by BWC Alabama LLC

| (6) | In

transit to and from the Saraland Refinery to the Blakely Island Facility. |

| (7) | In

transit to and from the Saraland Refinery to the Plains Mobile Terminal Facility. |

| (8) | In

transit to and from the Saraland Refinery to the Chickasaw Dock. |

(9) From

and after the Center Point Inclusion Date, Tank 21 at the terminalling and storage facilities at the storage facility located at 200

Viaduct Road North, Chickasaw, Alabama 36611, regardless of whether owned and operated by Center Point Terminal Chickasaw, LLC.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

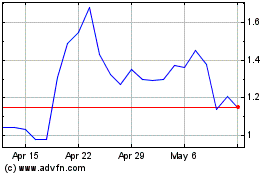

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vertex Energy (NASDAQ:VTNR)

Historical Stock Chart

From Apr 2023 to Apr 2024