false

0000882508

0000882508

2023-12-08

2023-12-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 08, 2023

QuickLogic Corporation

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-22671

|

|

77-0188504

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| |

|

|

|

|

|

2220 Lundy Avenue, San Jose, CA

|

|

|

|

95131-1816

|

|

(Address of principal executive offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code (408) 990-4000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $.001 per share

|

QUIK

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

On December 8, 2023, QuickLogic Corporation (the “Company”) entered into the Seventh Amendment (the “Seventh Amendment”) to their Amended and Restated Loan and Security Agreement (as amended, the “Loan Agreement”) dated December 21, 2018, with Heritage Bank of Commerce (the "Bank"). The Seventh Amendment amends the Loan Agreement to, among other things, i) increase the line of credit from $15M to $20M, ii) extend the loan maturity date for one year through December 31, 2025 and iii) increase annual facility fees to $60K.

The foregoing description of the Seventh Amendment to the Loan Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Seventh Amendment, a copy of which is attached as Exhibit 10.1 hereto.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth above in Item 1.01 is incorporated by reference herein.

Item 8.01 Other Events.

On December 12, 2023, the Company issued a press release announcing that it had entered into the Seventh Amendment. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01(d) Exhibits.

The following exhibit is furnished as a part of this report:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: December 12, 2023

|

|

QuickLogic Corporation

|

|

| |

|

|

|

| |

|

/s/ Elias Nader

|

|

| |

|

Elias Nader

Chief Financial Officer, and Senior Vice-President, Finance

|

|

Exhibit 10.1

SEVENTH AMENDMENT TO

AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

THIS SEVENTH AMENDMENT to Loan and Security Agreement is entered into as of December 8, 2023 (the “Amendment”), by and between HERITAGE BANK OF COMMERCE (“Bank”) and QUICKLOGIC CORPORATION (“Borrower”).

Recitals

Borrower and Bank are parties to that certain Amended and Restated Loan and Security Agreement dated as of December 21, 2018 and as amended from time to time, including pursuant to that certain First Amendment to Amended and Restated Loan and Security Agreement dated as of November 6, 2019 and that certain Second Amendment to Amended and Restated Loan and Security Agreement dated as of December 11, 2020, that certain Third Amendment to Loan and Security Agreement dated as of August 16, 2021, that certain Fourth Amendment to Amended and Restated Loan and Security Agreement dated as of November 16, 2021, that certain Fifth Amendment to Amended and Restated Loan and Security Agreement dated as of April 4, 2022 and that certain Sixth Amendment to Amended and Restated Loan and Security Agreement dated as of December 31, 2022 (collectively, the “Agreement”). The parties desire to amend the Agreement in accordance with the terms of this Amendment.

NOW, THEREFORE, the parties agree as follows:

1. The following definitions in Section 1.1 of the Agreement are amended and restated in their entirety to read as follows:

“Revolving Line” means a credit extension of up to Twenty Million Dollars ($20,000,000).

“Revolving Maturity Date” means December 31, 2025.

2. Section 2.5(a) of the Agreement is amended and restated in its entirety to read as follows

(a) Facility Fees. On December 31, 2023 and each anniversary thereof for so long as the Revolving Facility is in place, a facility fee with respect to the Revolving Facility equal to Sixty Thousand Dollars ($60,000), each of which shall be nonrefundable; and

3. Borrower represents and warrants that the representations and warranties contained in the Agreement are true and correct as of the date of this Amendment, and that no Event of Default has occurred and is continuing.

4. Borrower affirms and acknowledges that by submitting a Payment/Advance Form to Bank pursuant to Section 3.2 of the Agreement, Borrower is certifying that the representations and warranties contained in Section 5 of the Agreement are true and correct in all material respects, and that there are no actions or proceedings pending by or against Borrower or any Subsidiary before any court or administrative agency, on and as of the date of Borrower’s request for such Credit Extension, and no Event of Default shall have occurred and be continuing, or would exist after giving effect to such Credit Extension

5. Unless otherwise defined, all initially capitalized terms in this Amendment shall be as defined in the Agreement. The Agreement, as amended hereby, shall be and remain in full force and effect in accordance with its respective terms and hereby is ratified and confirmed in all respects. Except as expressly set forth herein, the execution, delivery, and performance of this Amendment shall not operate as a waiver of, or as an amendment of, any right, power, or remedy of Bank under the Agreement, as in effect prior to the date hereof. Borrower ratifies and reaffirms the continuing effectiveness of all agreements entered into in connection with the Agreement

6. This Amendment may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one instrument. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original hereof.

7. As a condition to the effectiveness of this Amendment, Bank shall have received, in form and substance satisfactory to Bank, the following:

(a) this original signed Agreement, duly executed by Borrower,

(b) corporate resolutions and incumbency certificate;

(c) payment of the facility fee in the amount of $60,000 (that is due and payable on December 31, 2023 pursuant to Section 2.5(a) of the Agreement, as amended herein), plus all Bank Expenses incurred through the date of this Amendment; and

(d) such other documents, and completion of such other matters, as Bank may reasonably deem necessary or appropriate.

[remainder of this page intentionally left blank]

| In Witness Whereof, the parties hereto have caused this Amendment to be duly executed and delivered as of the date first written above. |

| HERITAGE BANK OF COMMERCE |

QUICKLOGIC CORPORATION |

| By: |

/s/ Mike Hansen |

|

By: |

/s/ Elias Nader |

|

| Name: |

MIKE HANSEN |

|

Name |

ELIAS NADER |

|

| Title: |

SVP & MANAGER, CORPORATE FINANCE |

|

Title: |

CFO |

|

[Signature Page to Seventh Amendment to Amended and Restated Loan and Security Agreement]

Exhibit 99.1

QuickLogic Announces the Amendment and Extension of Credit Facility

SAN JOSE, Calif. - December 12, 2023 - QuickLogic Corporation (NASDAQ: QUIK) ("QuickLogic" or the "Company"), a developer of embedded FPGA (eFPGA) IP, ruggedized FPGAs and Endpoint AI solutions, today announced that, effective December 8, 2023, it entered into a seventh amendment (the "Seventh Amendment") to its amended and restated credit facility, dated as of December 21, 2018 (as amended, the "Credit Agreement") to increase the line of credit and extend the maturity date.

The Seventh Amendment increases the credit facility from $15M to $20M and extends the maturity date from December 31, 2024 to December 31, 2025.

Mike Hansen, Senior Vice President of Heritage Bank, commented, "We are pleased to be able to increase our commitment to QuickLogic and have greatly appreciated our long-term partnership with the Company."

"We are pleased to have the continued support of Heritage Bank," said Chief Financial Officer, Elias Nader. "Increasing our credit facility provides us with enhanced operational flexibility for our business needs while recognizing our solid financial results and improving business outlook."

Additional details on the terms of the amendment are available in the 8-K filed with the Securities and Exchange Commission on December 12, 2023.

About QuickLogic

QuickLogic is a fabless semiconductor company that develops innovative embedded FPGA (eFPGA) IP, discrete FPGAs, and FPGA SoCs for a variety of industrial, aerospace and defense, edge and endpoint AI, consumer, and computing applications. Our wholly owned subsidiary, SensiML Corporation, completes the end-to-end solution portfolio with AI / ML software that accelerates AI at the edge/endpoint. For more information, visit www.quicklogic.com.

QuickLogic uses its website (www.quicklogic.com), the company blog (https://www.quicklogic.com/blog/), corporate Twitter account (@QuickLogic_Corp), Facebook page (https://www.facebook.com/QuickLogic), and LinkedIn page (https://www.linkedin.com/company/13512/) as channels of distribution of information about its products, its planned financial and other announcements, its attendance at upcoming investor and industry conferences, and other matters. Such information may be deemed material information, and QuickLogic may use these channels to comply with its disclosure obligations under Regulation FD. Therefore, investors should monitor the Company’s website and its social media accounts in addition to following the Company’s press releases, SEC filings, public conference calls, and webcasts.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, without limitation, expectations regarding our future business, and actual results may differ due to a variety of factors including: delays in the market acceptance of the Company’s new products; the ability to convert design opportunities into customer revenue; our ability to replace revenue from end-of-life products; the level and timing of customer design activity; the market acceptance of our customers’ products; the risk that new orders may not result in future revenue; our ability to introduce and produce new products based on advanced wafer technology on a timely basis; our ability to adequately market the low power, competitive pricing and short time-to-market of our new products; intense competition by competitors; our ability to hire and retain qualified personnel; our ability to capitalize on synergies with our subsidiary SensiML Corporation; changes in product demand or supply; general economic conditions; political events, international trade disputes, natural disasters and other business interruptions that could disrupt supply or delivery of, or demand for, the Company’s products; the unpredictable and ongoing impact of the effects from the COVID-19 pandemic; and changes in tax rates and exposure to additional tax liabilities. These and other potential factors and uncertainties that could cause actual results to differ materially from the results contemplated or implied are described in more detail in the Company’s public reports filed with the Securities and Exchange Commission (the "SEC"), including the risks discussed in the “Risk Factors” section in the Company’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and in the Company’s prior press releases, which are available on the Company's Investor Relations website at http://ir.quicklogic.com/, and on the SEC website at www.sec.gov/. In addition, please note that the date of this press release is December 12, 2023, and any forward-looking statements contained herein are based on assumptions that we believe to be reasonable as of this date. We are not obliged to update these statements due to latest information or future events.

QuickLogic and logo are registered trademarks of QuickLogic. All other trademarks are the property of their respective holders and should be treated as such.

Company Contact

Elias Nader

Chief Financial Officer

(408) 990-4000

ir@quicklogic.com

IR Contact

Alison Ziegler

Darrow Associates, Inc.

(201) 220-2678

ir@quicklogic.com

CODE: QUIK-E

v3.23.3

Document And Entity Information

|

Dec. 08, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

QuickLogic Corporation

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 08, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-22671

|

| Entity, Tax Identification Number |

77-0188504

|

| Entity, Address, Address Line One |

2220 Lundy Avenue

|

| Entity, Address, City or Town |

San Jose

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

95131

|

| City Area Code |

408

|

| Local Phone Number |

990-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

QUIK

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000882508

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

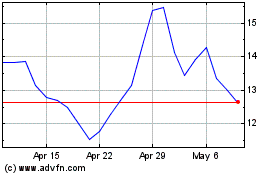

QuickLogic (NASDAQ:QUIK)

Historical Stock Chart

From Apr 2024 to May 2024

QuickLogic (NASDAQ:QUIK)

Historical Stock Chart

From May 2023 to May 2024