Form SC TO-C - Written communication relating to an issuer or third party

December 07 2023 - 4:30PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission

on December 7, 2023

Securities and

Exchange Commission

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement Under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

Morgan Stanley

China A Share Fund, Inc.

(Name of Subject Company [Issuer])

Morgan Stanley

China A Share Fund, Inc.

(Name of Filing Persons [Issuer])

Common Stock, Par Value $0.01 Per Share

(Title of Class of Securities)

617468103

(CUSIP Number of Class of Securities)

1585 Broadway

New York, New York 10036

(Address of Principal Executive Office)

Telephone Number, Including Area Code: (212)

537-2607

Mary E. Mullin, Esq.

1633 Broadway

New York, New York 10019

(Name and Address of Agent for Service)

Copies to:

|

Mark F. Parise, Esq.

Perkins Coie LLP

1155 Avenue of the Americas

22nd Floor

New York, New York 10036 |

|

Allison M. Fumai, Esq.

Dechert LLP

1095 Avenue of the Americas

New York, New York 10036 |

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of the Person(s) Filing Statement)

| x | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below

to designate any transactions to which the statement relates:

| ¨ | third party tender offer subject to Rule 14d-1. |

| x | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer. ¨

For more

information:

(800) 231-2608

Morgan Stanley

For Immediate

Release

Morgan Stanley China A Share Fund,

Inc. Announces Tender Offer

NEW YORK, December

7, 2023 – Morgan Stanley China A Share Fund, Inc. (NYSE: CAF) (the “Fund”) announced today that its Board of Directors

has approved a tender offer to acquire in exchange for cash up to 20 percent of the Fund’s outstanding shares at a price equal

to 98.5 percent of the Fund’s net asset value per share (“NAV”) (net of expenses related to the tender offer) as of

the close of regular trading on the New York Stock Exchange (“NYSE”) on the business day immediately following the day the

offer expires (a “Tender Offer”). The Tender Offer will commence on January 22, 2024 and will terminate on February 20, 2024,

unless extended. If the Fund’s shares are trading at a premium to NAV on January 22, 2024, no Tender Offer will be conducted. Additional

terms and conditions of the Tender Offer will be set forth in its offering materials, which will be distributed to the Fund’s stockholders.

If more than 20

percent of the Fund’s outstanding shares are tendered, the Fund will purchase its shares from tendering stockholders on a pro rata

basis (odd-lot tenders for stockholders who own fewer than 100 shares are still subject to pro ration), based on the number of tendered

shares, at a price equal to 98.5 percent of the fund’s NAV (net of expenses related to the Tender Offer).

The Fund continues

to maintain a share repurchase program (the “Program”) for purposes of enhancing stockholder value by providing the ability

to repurchase shares at a discount to NAV. Since commencing share repurchases under the Program on June 23, 2023, the Fund has repurchased

0.38% of its outstanding shares. The Board of Directors regularly monitors the Program as part of its review and consideration of the

Fund's premium/discount history. The Fund may only repurchase its outstanding shares at such time and in such amounts as it believes

will further the accomplishment of the foregoing objectives of the Program, subject to review by the Board of Directors and the Fund’s

ability to repatriate capital gains and income out of China. Upon commencement of the Tender Offer, the Fund expects to temporarily suspend

any purchases of shares in the open market pursuant to the Program until at least 10 business days after the termination of the Tender

Offer, as required by the Securities Exchange Act of 1934, as amended.

The Fund is a non-diversified,

closed-end management investment company that seeks capital growth by investing, under normal circumstances, at least 80% of its assets

in A-shares of Chinese companies listed on the Shanghai and Shenzhen Stock Exchanges. The Fund’s shares are listed on the NYSE

under the symbol “CAF.”

Morgan Stanley

Investment Management, together with its investment advisory affiliates, has more than 1,300 investment professionals around the world

and $1.4 trillion in assets under management or supervision as of September 30, 2023. MSIM strives to provide outstanding long-term investment

performance, service and a comprehensive suite of investment management solutions to a diverse client base, which includes governments,

institutions, corporations and individuals worldwide.

Morgan Stanley

(NYSE: MS) is a leading global financial services firm providing a wide range of investment banking, securities, wealth management and

investment management services. With offices in 42 countries, the Firm’s employees serve clients worldwide including corporations,

governments, institutions and individuals. For further information about Morgan Stanley, please visit www.morganstanley.com.

The Fund has

not commenced the Tender Offer described in this release. The Tender Offer will only be made pursuant to a tender offer statement on

Schedule TO containing an offer to purchase, a related letter of transmittal and other documents filed with the SEC as exhibits to the

tender offer statement on Schedule TO (collectively, the “Tender Offer Materials”), with all such documents made available

on the SEC’s website at www.sec.gov. The Fund will also make available to shareholders without charge the offer to purchase,

the letter of transmittal and other necessary documents related to the Tender Offer. Shareholders should read any Tender Offer Materials

carefully and in their entirety when and if they become available, as well as any amendments or supplements thereto, as they would contain

important information about the Tender Offer.

# # #

This press release

shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any state

in which such offer, solicitation or sale would be unlawful under the securities laws of any such state.

Investing involves risk and it is

possible to lose money on any investment in the Fund.

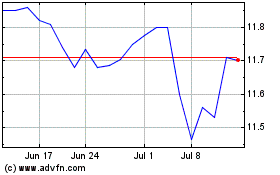

Morgan Stanley China A S... (NYSE:CAF)

Historical Stock Chart

From Apr 2024 to May 2024

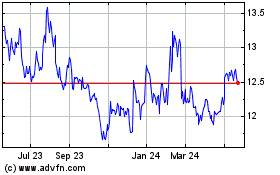

Morgan Stanley China A S... (NYSE:CAF)

Historical Stock Chart

From May 2023 to May 2024