| PROSPECTUS |

Filed

Pursuant to Rule 424(b)(1)

File No. 333-275726 |

2,941,179

shares

common

stock

This

prospectus relates to the offer for sale of up to an aggregate of 2,941,179 shares of common stock, par value $0.0001 per share, of Vivos

Therapeutics, Inc., by the stockholder named herein (who we refer to as the selling stockholder), which is comprised of:

(i) 130,000 shares of common stock, (ii) 850,393 shares of common stock underlying a pre-funded warrant held by the selling stockholder,

(iii) 980,393 shares of common stock underlying a Series A warrant held by the selling stockholder, and (iv) 980,393 shares of

common stock underlying a Series B warrant held by the selling stockholder, all of which securities were issued to the selling stockholder

in a private placement which closed on November 2, 2023. We refer to the Series A warrant and the Series B warrants collectively as the

“warrants” in this prospectus.

We

will not receive any proceeds from the resale of any of the shares of common stock being registered hereby. We would, however, receive

proceeds upon the exercise for cash of the warrants held by the selling stockholder. Proceeds, if any, received from the exercise of

such warrants will be used for general corporate purposes and working capital or for other purposes that our Board of Directors, in their

good faith, deem to be in the best interest of our company. No assurances can be given that any of such warrants will be exercised or

that we will receive any cash proceeds upon such exercise if cashless exercise is available.

The

distribution of shares of common stock offered hereby may be effected in one or more transactions that may take place in the Nasdaq

Capital Market (or Nasdaq), including ordinary brokers’ transactions, privately negotiated transactions or through sales

to one or more dealers for resale of such securities as principals, at market prices prevailing at the time of sale, at prices related

to such prevailing market prices or at negotiated prices. Usual and customary or specifically negotiated brokerage fees or commissions

may be paid by the selling stockholder.

The

selling stockholder and intermediaries through whom such securities are sold may be deemed “underwriters” within the meaning

of the Securities Act of 1933, as amended (which we refer to as the “Securities Act”), with respect to the

securities offered hereby, and any profits realized or commissions received may be deemed underwriting compensation.

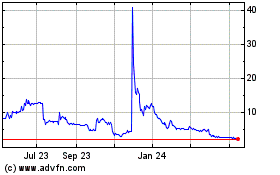

Our

common stock is listed on the Nasdaq under the symbol “VVOS.” On November 30, 2023, the last reported sale price of

the shares of our common stock as reported on Nasdaq was $24.50 per share.

We

are an “emerging growth company”, as that term is used in the Jumpstart Our Business Startups Act of 2012, and will be subject

to reduced public company reporting requirements.

Investing

in our common stock is highly speculative and involves a significant degree of risk. See “Risk Factors” beginning on page

13 of this prospectus for a discussion of information that should be considered before making a decision to purchase our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is December 1, 2023.

TABLE

OF CONTENTS

Please

read this prospectus carefully. It describes our business, our financial condition and our results of operations. We have prepared this

prospectus so that you will have the information necessary to make an informed investment decision. You should rely only on the information

contained in this prospectus. We and the selling stockholder have not authorized anyone to provide you with any information or to make

any representations about us, the securities being offered pursuant to this prospectus or any other matter discussed in this prospectus,

other than the information and representations contained or incorporated by reference in this prospectus. If any other information or

representation is given or made, such information or representation may not be relied upon as having been authorized by us.

The

information contained or incorporated by reference in this prospectus is accurate only as of the date of this prospectus, regardless

of the time of delivery of this prospectus or of any sale of our common stock. Neither the delivery of this prospectus nor any distribution

of securities in accordance with this prospectus shall, under any circumstances, imply that there has been no change in our affairs since

the date of this prospectus. This prospectus will be updated and made available for delivery to the extent required by the federal securities

laws.

We

are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal

surveys, market research, publicly available information and industry publications. The market research, publicly available information

and industry publications that we use generally state that the information contained therein has been obtained from sources believed

to be reliable. The information contained herein represents the most recently available data from the relevant sources and publications

and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking

information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking

statements in this prospectus.

We

own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate

names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that

protect the content of our products. This prospectus may also contain trademarks, service marks and trade names of other companies, which

are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products

in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely

for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ®

and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks.

All other trademarks are the property of their respective owners.

PROSPECTUS

SUMMARY

This

summary of the prospectus highlights material information concerning our business and this offering. This summary does not contain all

of the information that you should consider before making your investment decision. You should carefully read the entire prospectus,

including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before

making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results

may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set

forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.”

Unless

the context specifically requires otherwise, all share and per share figures appearing in this prospectus give effective to a 1-for-25

reverse stock split of our common stock which became effective on October 25, 2023.

In

this prospectus, unless the context indicates otherwise, the terms “the Company,” “Vivos,” “we,”

“our,” “ours” “us” or similar terminology refer to Vivos Therapeutics, Inc. and its consolidated

subsidiaries.

Overview

We

are a revenue stage medical technology company focused on the development and commercialization of a suite of innovative diagnostic and

multi-disciplinary treatment modalities for patients with dentofacial abnormalities and the wide array of medical conditions that may

result from them, including mild to severe obstructive sleep apnea (known as OSA) and snoring in adults. We believe our proprietary

oral appliances, diagnostic tools, myofunctional therapy, clinical treatments, continuing education, and practice solutions represent

a powerful and highly effective set of resources for healthcare providers of all disciplines who treat patients suffering from debilitating

and even life-threatening breathing and sleep disorders and their comorbidities.

Up

to this point, our primary focus has been on expanding awareness of, and providing treatment options for OSA for and through the dental

industry, which we believe represents a large and relatively untapped market for OSA treatment. As our business has evolved, we have

expanded our marketing, provider outreach, and treatment programs to encompass a broader more multidisciplinary approach, with a greater

emphasis on working with medical doctors and other healthcare providers beyond dentists. Now that we have established a national network

of Vivos-trained dentists, it is time to focus our resources and efforts on the source of where the vast majority of OSA patients are

first diagnosed and treated—the medical profession and durable medical equipment (DME) companies. In this prospectus, we sometimes

refer to dentists and other medical professionals who treat OSA as “providers” (including our own Vivos-trained dentists).

Studies

have shown our comprehensive and multidisciplinary approach represents a significant improvement in the treatment of mild to severe OSA

in comparison to or when combined with other largely palliative treatments such as continuous positive airway pressure (or CPAP) or

oral myofunctional therapy. We call our solution The Vivos Method.

Our

Products and Services

Currently,

The Vivos Method comprises the following products and services:

| |

● |

Vivos

Complete Airway Repositioning and/or Expansion (CARE) oral appliance therapy including our: |

| |

○ |

Daytime

Nighttime Appliance (or DNA appliance®) was granted 510(k) clearance from the U.S. Food & Drug Administration

(or FDA) as a Class II medical device in December 2022 for the treatment of snoring and mild to moderate OSA, jaw repositioning and

snoring in adults. It is the only oral appliance ever to receive FDA clearance to treat OSA without mandibular advancement as its

primary mechanism of action. In November 2023, our DNA appliance was cleared by the FDA to treat moderate and severe OSA in adults,

18 years of age and older along with positive airway pressure (PAP) and/or myofunctional therapy, as needed. |

| |

○ |

Mandibular

Repositioning Nighttime Appliance (or mRNA appliance®) has 510(k) clearance from the FDA as a Class II medical

device for the treatment of snoring and mild to moderate OSA in adults. In November 2023, our mRNA appliance was cleared by the

FDA to treat moderate and severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP) and/or myofunctional

therapy, as needed. |

| |

|

|

| |

○ |

Modified

Mandibular Repositioning Nighttime Appliance (or mmRNA appliance), for which we were granted FDA Class II market clearance

in August 2021 for treating mild to moderate OSA, jaw reposition and snoring in adults. In November 2023, our mmRNA appliance

was cleared by the FDA to treat moderate and severe OSA in adults, 18 years of age and older along with positive airway pressure

(PAP) and/or myofunctional therapy, as needed. |

The

November 2023 clearance of our CARE appliances for the indication described above represents the first time the FDA has ever granted

an oral appliance a clearance to treat severe OSA. We believe this unprecedented decision by the FDA will generate broader acceptance

throughout the medical community for our treatment options, leading to the potential for higher patient referrals and case starts as

well as collaboration with medical professionals. We also believe it will enhance our value proposition to third-party distribution partners

such as DME companies. This approval could also clear the way for greater reimbursement levels from medical insurance payors and Medicare.

| |

● |

Vivos

oral appliances and therapies outside of CARE system include: |

| |

○ |

Vivos

Guides are pre-formed, flexible, BPA-free, base polymer, monoblock intraoral guide and rescue appliances. The Guides are

FDA Class I registered product for orthodontic tooth positioning typically used by dentists in children to address malocclusions

and promote proper guided growth and development of the mouth and jaws. |

| |

|

|

| |

○ |

Vivos

VersaTM is an FDA 510k cleared Class II device for treating mild to moderate OSA in adults. It is a comfortable,

easy-to-wear, medical grade nylon, 3D printed oral appliance featuring mandibular advancement as its mechanism of action. It is priced

to be very cost effective and offers Vivos providers and patients a comfortable and effective product at a much lower price point

for treatment. As with all other non-CARE oral appliances, the Vivos Versa must be worn nightly for life in order to remain clinically

effective. We believe many Vivos Versa patients will eventually migrate up to our proprietary Vivos CARE products. While we do

not own this product, we are a reseller of this product. |

| |

|

|

| |

○ |

Vivos

MyoCorrect oral myofunctional therapy (OMT) services. Studies have shown OMT to be a clinically valuable adjunctive treatment

for patients with breathing and sleep disorders. When combined with Vivos’ CARE products and treatments, OMT can deliver an

enhanced effect in many patients using our appliances. MyoCorrect treatment services are cost-effective for providers and convenient

for patients. MyoCorrect is billable to medical insurance in most cases and constitutes an additional profit center for both Vivos

and providers. |

| |

|

|

| |

○ |

Vivos

Vida ™ is an FDA cleared appliance as unspecified classification for the alleviation of TMD symptoms, and aids in treating

bruxism and TMJ Dysfunction. The Vivos Vida help to alleviate symptoms such as TMJ/TMD, headaches and facial muscle pain. The Vivos

Vida is worn during sleep, and serves to protect the teeth and restorations from destructive forces of bruxism. It is a custom fabricated

appliance, designed for patient comfort. |

| |

|

|

| |

○ |

Vivos

Vida Sleep ™ is an FDA 510K cleared Class II for treating mild to moderate OSA in adults. It uses the Vivos Unilateral

BiteBlock Technology and is designed to advance the mandible incrementally to stabilize the patient’s oropharyngeal

airway. It is highly efficient and has a sleep design which promotes space for the tongue to sit in the roof of the palate. It’s

novel design decreases contact points between the maxillary and mandibular teeth that may help reduce clenching and overall

bite forces that occur during sleep. |

| |

● |

VivoScore

(from SleepImage), Rhinomanometry (from GM Instruments), Cone Beam Computerized Tomography or CBCT (from multiple vendors), Joint

Vibration Analysis (from BioResearch) and other key diagnostic technologies play an essential role as part of The Vivos Method

in patient assessment, proper clinical diagnosis, treatment planning, progress measurement, and optimal outcome facilitation. We

believe the combination and integration of such diagnostic tools and equipment as particularly taught to and practiced by Vivos-trained

providers constitutes a key trade secret of our company. |

| |

|

|

| |

● |

Vivos

AireO2 is an Electronic Health Record (EHR) software program specifically designed for use as a full practice

management software program in a medical or dental practice environment where treating breathing and sleep disorders is performed.

The program is very well suited to handle both medical and dental billing and is integral in our Treatment Navigator program. |

| |

● |

Adjunctive

Treatment from specialty chiropractors and other healthcare providers according to a very specific set of particular

integrated protocols has also proven to enhance and improve clinical outcomes using CARE and other Vivos devices. |

| |

|

|

| |

● |

Treatment

Navigator is our most recent program to assist a clinician’s patients who may have a breathing or sleep disorder to

get screened, diagnosed by a board-certified sleep specialist, obtain insurance verification of benefits and preauthorization (where

required), have their questions answered, and receive assistance with scheduling, financing, medical billing or any other concerns

regarding treatment options best suited to their individual situation. Dentists typically pay set fees to us for this service. |

| |

|

|

| |

● |

Vivos

Billing Intelligence Service (BIS) is our medical and dental billing service. It is both a subscription and fee for service

program for healthcare practitioners who wish to optimize their insurance reimbursement by leveraging both medical and dental benefits.

We are unaware of any other software platform or service on the market that offers the same set of features or capabilities. |

| |

|

|

| |

● |

Vivos

Airway Intelligence Service (AIS) is our technical support and advisory service that supports clinicians in their patient

data analysis, case selection, treatment planning and treatment implementation. AIS reports and services are priced into the cost

of appliances to providers. |

| |

|

|

| |

● |

The

Vivos Institute® (TVI) is widely regarded as one of the top educational and learning centers for dentofacial related

breathing and sleep disorders in North America. Opened in 2021, TVI is housed in a state-of-the-art 18,000 square foot facility near

the Denver International Airport where doctors from around the world come to receive instruction and advanced clinical training in

a wide range of topics delivered by leading national and international medical sleep specialists, cardiologists, pediatric sleep

specialists, dentists, orthodontists, specially trained chiropractors, nutritionists, key industry business leaders, and university-based

clinical researchers. |

These

products and services are used in a collaborative multidisciplinary treatment model comprising dentists, general practice physicians,

sleep specialist physicians, myofunctional therapists, nutritionists, chiropractors, physical therapists, and healthcare professionals.

Our subscription-based program to train dentists and offer them other value-added services is called the Vivos Integrated Practice

(VIP) program.

During

2023, we expanded our product portfolio by acquiring certain devices (now known as Vivos Vida and Vivos Vida

Sleep) from Advanced Facialdontics, LLC. During 2022, we continued to expand and grow our screening and home sleep test (or HST)

program (which we call our VivoScore Program) featuring SleepImage® technology, a 510(k)

cleared ring-based recorder and diagnostic platform for home sleep apnea testing. We market and distribute our SleepImage HST in the

U.S. and Canada pursuant to a licensing agreement with MyCardio LLC. During 2022, Vivos providers performed nearly 60,000 VivoScore home

sleep tests in 2022 and to date in 2023. Due to the volume of business that we have generated with MyCardio LLC, we now receive pricing

and terms for SleepImage® products and services that are well below their published retail prices. We believe

the rapid growth of our VivoScore program confirms our belief that the SleepImage® HST offers significant

commercial advantages over existing home sleep apnea products and technologies in the market and allows healthcare providers to more

efficiently screen, diagnose and initiate treatment for OSA in their patients.

We

have not yet seen a corresponding increase in patient enrollment in The Vivos Method treatment, however, and based on feedback from our

Vivos-trained providers, we believe this to be a function of staffing turnover and labor shortages that continue to plague the dental

workplace. Throughout 2022, we continued to address this by conducting additional regional dental team training sessions on integrating

Vivos products and treatments. In addition, we drastically reduced the number of Practice Advisors who had previously been dispatched

as “boots on the ground” to help facilitate case starts and provide Vivos-trained providers with support, and we replaced

them with a new service called Treatment Navigator which we piloted and rolled out in the late summer and fall of 2022.

Treatment

Navigators work effectively as extensions of the dental office, working directly with perspective patients to provide them information

on The Vivos Method, aiding in education, screening, insurance verification of benefits and preauthorization, coordination among various

professional practitioners, recordkeeping, problem solving, as well as, delivering a home sleep test and following up with scheduling

an appointment with a VIP in their area. Dental offices who wish to avail themselves of this service pay Vivos enrollment fees and per

case fees for the service, thus adding an important new revenue line and profit center to the business. As of the date of this prospectus,

there are approximately 60 Vivos-trained (VIP) dental offices who are at some stage of onboarding with our Treatment Navigator program.

Based on early feedback, we expect the Treatment Navigator program to continue to grow into a material and important revenue stream as

we move forward.

Background

on OSA

OSA

is a serious and chronic disease that negatively impacts a patient’s sleep, health, and quality of life. According to a 2019 article

published in Chest Physician, it is estimated that OSA afflicts 54 million adults in the U.S. alone. According to a 2016 report

by Frost & Sullivan, OSA has an annual societal cost of over $149.6 billion. According to the study “Global Prevalence of

Obstructive Sleep Apnea (OSA)” conducted by an international panel of leading researchers, nearly 1 billion people worldwide

have sleep apnea, and as many as 80% remain undiagnosed. Research has shown that when left untreated, OSA can increase the risk of comorbidities,

such as high blood pressure, heart failure, stroke, diabetes, dementia, chronic pain and other debilitating, life-threatening diseases.

Unfortunately

for OSA patients, the medical profession has not been able to provide them with solutions that are both effective and desirable. CPAP

is the “gold standard” treatment for over 90% of OSA patients, but no one wants to wear those devices to bed every night

for life, rendering long-term compliance rates low. Traditional oral appliances can be effective over limited time frames, but often

create other problems with temporomandibular joint (or TMJ) dysfunction, open bites, infections, and more. As with CPAP, they too must

be worn every night for life to be effective. More radical and invasive options such as neuro-stimulation devices, or maxillomandibular

advancement surgery are likewise viewed more as treatments of last resort. When The Vivos Method is presented as a viable treatment option

against the alternatives discussed above, we believe it will be the preferred choice of most patients.

We

believe our proprietary products comprising the Vivos CARE oral appliances represent the first non-surgical, non-invasive treatment option

for patients diagnosed with mild to severe OSA that offers cost-effective treatment featuring (i) limited treatment times; with

(ii) lasting or durable effects; and (iii) the prospect of seeing a complete reversal of symptoms. Combining treatment technologies that

impact the upper airway by altering the size, shape, patency and position of corresponding hard and soft tissues, Vivos CARE represents

a completely new treatment modality in the treatment of dentofacial abnormalities that often lead to OSA and many other health conditions.

The

Vivos Method is estimated to be indicated and potentially effective (within the scope of the FDA cleared uses) in approximately 80% of

cases of OSA where patients are compliant with clinical treatments. Our patented oral appliances have been utilized in approximately

40,000 patients treated worldwide by more than 1,850 trained dentists.

Our

Target Customers

The

House of Delegates of the American Dental Association in 2017 adopted a policy statement describing the important role dentists can play

in helping identify patients at greater risk of sleep related breathing disorders. By virtue of the close connection and relationship

between the oral cavity and airway form and function, properly trained dentists can play a pivotal and even leading role in the treatment

of dentofacial abnormalities which are known to impact breathing and sleep, which in turn can lead to serious health conditions. The

VIP program provides dentists with compelling clinical reasons coupled with strong economic incentives to provide their breathing and

sleep disordered patients the best care possible.

We

have recently expanded our mission and product line positioning to extend the reach and scope of The Vivos Method beyond the dental profession

and to allow for greater collaboration and mutual referrals from other healthcare practitioners, including primary care physicians, medical

specialists, chiropractors, nutritionists, physical therapists, and others who see and treat patients with breathing and sleep disorders.

We believe this extension of our approach will broaden the knowledge among various professions as to what our technology and products

can do for their patients, ultimately leading more patients into treatment with Vivos products and services. We also incorporate courses

and curricula at The Vivos Institute into our Vivos Method training that provides information, tools, techniques, and systems that enable

other healthcare professionals to engage directly with dentists and actively contribute to the best possible clinical outcome for patients.

During

the second half of 2021, we increased our efforts to market The Vivos Method and related products and services to larger dental support

organizations (or DSOs). Marketing to DSOs creates an opportunity to enroll and onboard multiple dental practices as VIPs under one common

ownership structure. This would allow us to leverage training and support across multiple VIP practices and gain economies of scale with

the goal of faster growth, both in VIP enrollments and in Vivos case starts. As of September 30, 2023, we believe we have made important

progress in penetrating this market, but as we cautioned previously, DSOs tend to move slowly when adopting new technologies or programs.

During

2023, we further extended our market reach by executing a U.S. nationwide distribution agreement with Lincare, a leading supplier of

in-home respiratory therapy products and services for approximately 1.8 million patients. The agreement follows the successful conclusion

of a distribution pilot with Lincare, and marks an important milestone in our strategy to engage with leading durable medical equipment

(DME) companies in the United States. Under the agreement, Lincare will have a six-month exclusivity to distribute certain designated

devices in our portfolio. We also executed distribution and other strategic collaborations during 2023 to help drive sales of our expanding

portfolio of products.

Our

Mission

Our

mission is to rid the world of sleep apnea by being a leading technology platform and go-to resource for the latest and most effective

treatment modalities, products, and clinical education available to healthcare providers of all specialties who treat patients suffering

from breathing and sleep disorders and their comorbidities. We fully recognize that breathing and sleep disorders, including OSA,

are often complex conditions with multiple contributing factors that require more than a single solution. To that end, we have broadened

our product and services lines that comprise The Vivos Method to go beyond the proprietary technologies featured in our CARE oral appliances,

and now offer providers far greater optionality in selecting a diagnostic or treatment solution that is best for their patients. This

approach recognizes that there is no “one size fits all” solution for patients, and that both providers and patients are

best served by offering a variety of solutions at various price points that can meet the needs of a larger segment of the population.

We

believe this evolution of our mission (which was originally focused almost exclusively on the dental community) will appeal to a much

broader array of healthcare professionals, including chiropractors, nutritionists, primary care physicians, cardiologists, physical therapists,

dentists and others, all of whom have a strong vested interest in the overall health and wellbeing of their patients, and each of whom

has something meaningful to contribute when properly educated and trained. As word spreads among a broader array of professionals and

their patients, we expect more people to come to know and understand the compelling advantages of The Vivos Method. We believe this will

allow us to scale our business and grow our company more rapidly.

Our

Market Opportunity

According

to a March 2021 Sleep Apnea Devices Market Size & Share Report, the global sleep apnea devices market size was valued at $3.7 billion

in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.2% from 2021 to 2028. According to an American Sleep Association

study published in 2020, an estimated 50 million to 70 million people in the U.S. are suffering from some form of sleep disorders. Moreover,

according to Canadian Respiratory Journal in 2014, around 5.4 million adults in Canada were diagnosed with sleep apnea or were at higher

risk of developing OSA. According to a study conducted by ResMed in 2018, around 175 million people in Europe were suffering from sleep

apnea. We therefore believe that effective diagnostic and treatment strategies are needed to minimize the negative health impacts of

OSA and to maximize cost-effectiveness.

Based

on our direct experience with our Vivos-trained providers performing nearly 60,000 VivoScore HSTs during 2022, we strongly believe the

published estimates from available public information, which range from 12% to 20% of the population, seriously underestimate the extent

of the condition and scope of the problem in the United States and Canada. Our VivoScore testing routinely results in approximately 50%

of patients testing positive OSA, a number consistent with a recent study published in the Journal of the American Heart Association

on a sample consisting of ~2000 middle-aged to older adults from the Multi-Ethnic Study of Atherosclerosis (MESA), where 47 percent had

moderate-to-severe OSA. We therefore believe our prior estimate that approximately 15% of the adult population in the United

States and Canada suffers from OSA to be extremely conservative. Based on the estimated total adult population of 284 million in the

United States and Canada, we believe the total addressable United States and Canadian market could be as high as 80 million adults. To

be conservative and based on available data and our internal market analysis, we estimate that over 80% of individuals diagnosed with

OSA in the North American addressable market may be candidates for The Vivos Method, leaving us with a total addressable consumer market

of approximately 64 million adults.

We

currently charge clinicians an average sales price of approximately $1,500 per adult case for The Vivos Method. There are approximately

200,000 general dentists and dental specialists in the United States and another 30,000 in Canada who could potentially offer the Vivos

Method to their patients. Add to that the nearly 80,000 licensed chiropractors and over 1.1 million medical doctors across all specialties

who routinely see and treat patients with OSA. Each of them see and treat patients with OSA for many related conditions on a regular

basis even though the vast majority remain undiagnosed with respect to their OSA. As we raise awareness, and now that new technologies

such as SleepImage have driven the cost of diagnosis down dramatically, more providers will be able to integrate evaluations of breathing

and sleep into their basic clinical treatments, and more patients will get diagnosed and seek treatment. Therefore, based on the addressable

U.S. and Canadian consumer market described above and average sales price, we believe the addressable consumer market for adults in the

United States and Canada is approximately $96 billion.

Our

Treatment Alternative for OSA – The Vivos Method

The

Vivos Method is a non-invasive, non-surgical, non-pharmaceutical, multi-disciplinary treatment modality for the treatment of dentofacial

abnormalities and/or mild, moderate and severe OSA and snoring in adults. Proprietary and virtually painless, The Vivos

Method has been shown to typically expand the upper airway and offers patients what we believe to be an effective treatment alternative

based on published peer-reviewed retrospective clinical data. Based on feedback from independent VIPs and their patients, we believe

initial therapeutic benefits from using the treatment guidance’s and devices are often achieved relatively quickly (in days or

weeks) and final clinical results are typically achieved in 12 to 18 months), all at a relatively low cost to consumers ranging between

$7,000 and $10,000 for adults (costs vary by provider) when compared to other options such as lifetime CPAP or surgery.

The Vivos Method alters the

size, shape and position of the tissues that surround and define the functional space known as the upper airway. Our treatment also improves

nasal breathing, reduces mouth breathing, reduces Apnea Hypopnea Index (AHI) scores, and generally facilitates better breathing and sleep.

These statements are based on retrospective raw data with validated before and after sleep studies, rhinomanometry testing before and

after treatment, Cone Beam Computerized Tomography (CBCT) scans from treating clinicians and patient testimony. As The Vivos Method treatment

process progresses, the airway typically expands, with many patients reporting a significant reduction of their OSA and snoring symptoms.

The primary products used in The Vivos Method are our CARE devices – the DNA appliance®, the mRNA appliance®,

and the mmRNA appliance®– each of which is a specifically designed, customized oral appliance that is worn primarily

in the evening hours and overnight. The treatment time may range from 9 to 18 months, with 12 to 15 months being typical. Our appliances

may require periodic adjustments some of which can be performed by the patient and others that are typically rendered at the dental office

where treatment was initiated.

Our

Growth Strategy

Our

goal is to be the global leader in providing a clinically effective non-surgical, non-invasive, non-pharmaceutical, and low-cost alternative

for patients with dentofacial abnormalities and/or mild to severe OSA and snoring in adults. We believe the following strategies

will play a critical role in achieve this goal and in establishing more predictable and growing revenue leading, ultimately, to cash

flow positive and profitable operations:

| |

● |

Expand

public awareness of the life-threatening and debilitating nature of OSA and its prevalence throughout the world, while letting the

world know of our proprietary and highly effective treatment as an alternative to CPAP. |

| |

● |

Cultivate

Active Referral Sources Among Physicians, Sleep Specialists, Dentists and Other Healthcare

Providers. |

| |

|

|

| |

● |

Drive

more qualified new patients to our VIP practices and teach VIPs how to better present and close Vivos treatment via the “Boost”

and “Kick-Off” programs. |

| |

|

|

| |

● |

Achieve

full payment by in network major insurance carriers for Vivos Method treatment. |

| |

|

|

| |

● |

Make

it easy for both dental and medical professionals to interact and do business with Vivos. |

| |

|

|

| |

● |

Continue

to drive medical and dental community awareness of The Vivos Method and build bridges between medical doctors and dentists through

DSO marketing and our Medical Integration Division. |

| |

|

|

| |

● |

Expand

our market penetration with DME distribution agreements. |

| |

|

|

| |

● |

Invest

in research and development to drive innovation and expand indications. |

| |

|

|

| |

● |

Pursue

strategically adjacent markets and international opportunities. |

Our

Revenue Model

Our

revenue is currently derived from the following primary sources:

| |

● |

VIP

office training and enrollment fees. These fees are comprised of one-time, up-front fees, as well as optional renewal fees

after 12 months. |

| |

|

|

| |

● |

Recurring

Vivos appliance sales. Once we train the VIP on how dentists can help treat OSA, the goal is to have them initiate “new

case starts” with patients, which leads to sales of our appliances and guides. We are also seeking to drive appliance sales

through our distribution arrangements with DMEs. |

| |

|

|

| |

● |

Recurring

VIP subscription fees. These are recurring fees that a portion of our VIPs pay us to receive additional value-added services

and training. |

| |

|

|

| |

● |

SleepImage

HST revenue. In 2022, we modified our agreement with MyCardio LLC relating to our SleepImage HST for sleep apnea, which creates

the potential for revenue from our leasing of SleepImage HST ring recorders to our VIPs as part of the VivoScore Program. |

| |

|

|

| |

● |

The

Vivos Institute. Our TVI provides product-specific training for the use of our products and services. Revenue from such courses

is not material at the present time, but our expectation is that increased training awareness of OSA and the promotion of our products

and services will be enhanced by our TVI. |

| |

|

|

| |

● |

The

Airway Intelligence Service (AIS). This service provides a complete resource for VIPs to help simplify the diagnostic and

appliance design matrix and expedite the treatment planning process. AIS is provided as part of the price of each appliance and is

not a separate revenue stream. |

| |

|

|

| |

● |

Billing

Intelligence Services (BIS). This complete third-party billing solution includes a comprehensive integrated revenue cycle

management software system that allows dentists to focus on running their practice and delivering the best care for their patients.

This medical billing service generates recurring subscription fees from participating VIPs and independent dentists in the United

States. |

| |

|

|

| |

● |

AireO2

Patient Management Software. This management software enables healthcare professionals to diagnose, treat and monitor patients

with OSA and its related conditions more effectively. Developed in collaboration with Lyon Dental, AireO2 contains features that

enhance a VIP’s billing services and practice management systems. AireO2 is a complement to our BIS software system. |

| |

|

|

| |

● |

Medical

Integration Division (MID). In late 2020, we launched our MID to assist VIP practices to establish clinical collaboration

ties to local primary care physicians, sleep specialists, ear, nose a throat doctors (ENTs), cardiologists, pediatricians, pulmonologists

and other healthcare providers who routinely see or treat patients with sleep and breathing disorders. The primary objective of our

MID is to promote The Vivos Method to medical providers and thus facilitate the potential for additional mild to severe

OSA patients gaining access to The Vivos Method while offering continuum of care. The MID seeks to fulfill that objective by meeting

with VIP dentists and medical providers in their local areas to establish physician practices using the trademarked name “Pneusomnia

Sleep Reimagined Center” (which are referred to as Pneusomnia Centers). These independent medical practices will be managed

by our company under a management and development agreement which pays us six (6% to 8%) percent of all net revenue from sleep-related

services. We also collect a development fee for each clinic prior to opening establishing all operational treatments. |

| |

|

|

| |

● |

MyoCorrect

(Orofacial Myofunctional Therapy) Program. In March 2021, we introduced orofacial myofunctional therapy (or OMT) as a service

that is part of The Vivos Method, under the name MyoCorrect. Through MyoCorrect, dentists enrolled in the VIP program will have access

to trained therapists who provide OMT via telemedicine technology. Our CARE appliances are cleared by the FDA to treat moderate

and severe OSA in adults, 18 years of age and older along with positive airway pressure (PAP) and/or myofunctional therapy, as needed. |

Our

Competitive Strengths

We

believe that The Vivos Method has numerous advantages that, taken together, set us apart from the competition and position us for success

in the marketplace:

| |

● |

Significant

barriers to entry. |

| |

|

|

| |

● |

Vivos

Method insurance reimbursement. |

| |

|

|

| |

● |

Body

of published research and strong patient outcomes. |

| |

|

|

| |

● |

First

mover advantage. |

| |

● |

Differentiated

products. |

| |

|

|

| |

● |

Intellectual

property portfolio and research and development capabilities. |

| |

|

|

| |

● |

Extensive

Training and Support Systems. |

| |

|

|

| |

● |

Targeted

approach to market development. |

| |

|

|

| |

● |

Marketplace

acceptance. |

November

2023 Private Placement

On

October 30, 2023 we entered into a Securities Purchase Agreement (or the Purchase Agreement) with an institutional investor (who is the

selling stockholder hereunder) pursuant to which we sold an aggregate of $4,000,003.44 of securities in a private placement consisting

of (i) 130,000 shares of our common stock, (ii) a pre-funded warrant to purchase 850,393 shares of our common stock, (iii) a five-year

Series A Common Stock Purchase Warrant to purchase up to 980,393 shares of our common stock with an exercise price of $3.83 per share

and (iii) an 18-month Series B Common Stock Purchase Warrant to purchase up to 980,393 shares of our common stock with an exercise price

of $3.83 per share.

The

private placement closed on November 2, 2023. After deducting the placement agent fees and estimated offering expenses, we received net

proceeds of approximately $3.5 million. We intend to use these net proceeds for general working capital and general corporate purposes.

The

warrants contain customary stock-based anti-dilution protection as well as beneficial ownership limitations that may be waived at the

option of each holder upon 61 days’ notice to us. The Purchase Agreement includes standard representations, warranties and covenants

of our company and the purchaser, including a 45-day standstill provision other restrictions on future issuances of our capital stock.

Additionally,

as part of the private placement, we agreed to amend an existing outstanding common stock purchase warrant held by the purchaser and

issued in January 2023 to purchase up to an aggregate of 266,667 shares of Common Stock at an exercise price of $30.00 per share with

an expiration date of July 5, 2028. Such amendment, which became effective upon the closing of the private placement, reduced the exercise

price of the January warrant to $3.83 per share and extended the expiration date of such warrant to November 2, 2028. The amendment also

restates in its entirety the definition of “Black Scholes Value” contained in the January warrant with the intention of eliminating

an embedded derivative liability associated with such warrant.

We

agreed with the purchaser to file a registration statement with the Securities and Exchange Commission covering the resale of the shares

and the shares of common stock issuable upon exercise of the warrants issued in the private placement We have filed the registration

statement of which this prospectus forms a part to satisfy this obligation. We are subject to customary penalties and liquidated damages

in the event we do not meet certain filing and effectiveness deadlines associated with such registration, up to a maximum aggregate penalty

of 10.5% of the gross proceeds of the private placement.

A.G.P./Alliance

Global Partners acted as placement agent for the private placement. We paid to such placement agent a cash fee equal to 7.0% of the gross

proceeds we received in the private placement, and reimbursement of up to $60,000 in legal expenses and a $25,000 non-accountable expense

allowance.

Summary

of Risks Affecting Our Business

Investing

in our common stock is highly speculative and involves significant risks and uncertainties. You should carefully consider the

risks and uncertainties discussed under the section titled “Risk Factors” elsewhere in this prospectus before making a decision

to invest in our common stock. Certain of the key risks we face include, without limitation:

Risks

Related to Our Business and Industry

| |

● |

Our

business has a limited operating history, and we continue to refine our business model, which makes it difficult to evaluate our

past performance and future prospects. Moreover, we have recently made significant strategic, operational and staffing changes to

our business, and it is impossible to know how or if such changes will affect future revenue and earnings. |

| |

|

|

| |

● |

We

have a history of operating losses and may never achieve cash flow positive or profitable results of operations. |

| |

|

|

| |

● |

Our

VIP program is a relatively new business model for us, and management has limited experience operating this model. |

| |

● |

We

will need to raise additional capital to bolster our stockholders’ equity and to fund and grow our business. Such funding,

even if obtained, could result in substantial dilution or significant debt service obligations. We may not be able to obtain additional

capital on commercially reasonable terms in a timely manner, which could adversely affect our liquidity, financial position, and

ability to continue operations. |

| |

|

|

| |

● |

We

have identified material weaknesses in our internal control over financial reporting. |

| |

|

|

| |

● |

A

material portion of our future revenue is expected to derive from sales and enrollments of new dentists into our Vivos Integrated

Practice (VIP) program, including dentists who are part of a DSO which leaves us reliant on the willingness

of dentists and/or DSO groups to continue to enroll. |

| |

|

|

| |

● |

We face risks from negative publicity from unregistered

oral appliances which has and may continue to hurt our sales. |

| |

|

|

| |

● |

The failure to expand our market penetration with DME

distribution agreements would adversely affect our revenue and results of operations. |

| |

|

|

| |

● |

We

will not be successful if The Vivos Method is not sufficiently adopted by the medical and dental communities, including independent

practitioners and dental service organizations. |

| |

|

|

| |

● |

We

may not be able to successfully implement our growth strategies for our VIPs, which could harm our business, financial condition

and results of operations. |

| |

|

|

| |

● |

The

long-term success of our VIP program is highly dependent on our ability to successfully identify, recruit and enroll target dental

practices as well as to convince other medical professionals to participate in the treatment of OSA with our products and services. |

| |

|

|

| |

● |

The

SleepImage® home sleep test used in our VivoScore Program is a relatively new technology which may not be utilized

by VIPs to the degree anticipated. |

| |

|

|

| |

● |

Further

clinical studies of our products comprising The Vivos Method may adversely impact our ability to generate revenue if they do not

demonstrate that The Vivos Method is effective. |

| |

|

|

| |

● |

Our

business and results of operations may be impacted by the extent to which patients using The Vivos Method achieve adequate levels

of third-party insurance reimbursement. |

| |

|

|

| |

● |

Our

products and third-party contract manufacturing activities are subject to extensive governmental regulation that could prevent us

from selling Vivos appliances or introducing new and/or improved products in the United States or internationally. |

| |

|

|

| |

● |

We

face significant competition in the market for treating sleep breathing disorders, and we may be unable to manage or respond to competitive

pressures. |

| |

|

|

| |

● |

The

misuse or off-label use of The Vivos Method could result in injuries that lead to product liability suits or result in costly investigations,

fines, or sanctions by regulatory bodies if we are deemed to have engaged in the promotion of these uses, any of which could be costly

to our business. |

Risks

Related to Our Products and Regulation

| |

● |

Our

failure to obtain government approvals, or to comply with ongoing, and ever increasing, governmental regulations relating to our

technologies and products, could delay or limit introduction of our products and result in failure to achieve revenue or maintain

our ongoing business. |

| |

|

|

| |

● |

We

cannot assure that we will be able to complete any required clinical trial programs successfully within any specific time, and if

such clinical trials take longer to complete than we project, our ability to execute our current business strategy will be adversely

affected. |

| |

|

|

| |

● |

Modifications

to The Vivos Method may require additional FDA approvals which, if not obtained, could force us to cease marketing and/or recall

the modified device until we obtain new approvals. |

| |

|

|

| |

● |

We

are subject to inspection and market surveillance by the FDA to determine compliance with regulatory requirements. |

| |

|

|

| |

● |

Treatment

with The Vivos Method has only been available for a relatively limited time, and we do not know whether there will be significant

post-treatment regression or relapse. |

| |

|

|

| |

● |

Our

Medical Integration Division business line may implicate federal and state laws involving the practice of medicine and related anti-kickback

and similar laws. |

Risks

Related to Our Securities Generally

| |

● |

The

market for our common stock is relatively new and may not develop to provide investors with adequate liquidity. |

| |

|

|

| |

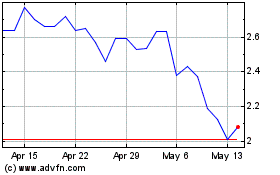

● |

The

market price of our common stock has been and may continue to be highly volatile resulting in substantial losses for investors. |

| |

|

|

| |

● |

We

are presently subject to potential delisting from Nasdaq, and our failure to meet and maintain the continuing listing requirements

of The Nasdaq Capital Market could result in a delisting of our securities. |

| |

|

|

| |

● |

The

terms of our November 2023 private placement could hamper our fundraising efforts. |

Emerging

Growth Company under the JOBS Act

As

a company with less than $1.235 billion in revenue during our last fiscal year, we qualify as an “emerging growth company”

under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we have elected to take advantage

of reduced reporting requirements and are relieved of certain other significant requirements that are otherwise generally applicable

to public companies. As an emerging growth company:

| |

● |

we

may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis

of Financial Condition and Results of Operations; |

| |

|

|

| |

● |

we

are exempt from the requirement to obtain an attestation and report from our auditors on whether we maintained effective internal

control over financial reporting under the Sarbanes-Oxley Act; |

| |

|

|

| |

● |

we

are permitted to provide less extensive disclosure about our executive compensation arrangements; and |

| |

|

|

| |

● |

we

are not required to give our stockholders non-binding advisory votes on executive compensation or golden parachute arrangements. |

We

may take advantage of these provisions until December 31, 2025 (the last day of the fiscal year following the fifth anniversary of our

initial public offering) if we continue to be an emerging growth company. We would cease to be an emerging growth company if we have

more than $1.07 billion in annual revenue, have more than $700 million in market value of our shares held by non-affiliates or issue

more than $1.0 billion of non-convertible debt over a three-year period. We may choose to take advantage of some but not all of these

reduced burdens. We have elected to provide two years of audited financial statements. Additionally, we have elected to take advantage

of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for

complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier

of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition

period provided in Section 7(a)(2)(B) of the Securities Act.

Corporate

Information

Our

principal offices are located at 7921 Southpark Plaza, Suite 210, Littleton, Colorado 80120, and our telephone number is (866) 908-4867.

Our website is www.vivos.com. Our website and the information on or that can be accessed through such website are not part

of this prospectus.

Available

Information

We

maintain a website at www.vivos.com. You may access our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports

on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act with the SEC free

of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC.

The reference to our website address does not constitute incorporation by reference of the information contained on our website, and

you should not consider the contents of our website in making an investment decision with respect to our common stock.

THE

OFFERING

| Shares

of common stock offered by the selling stockholder |

|

2,941,179

shares of common stock |

| |

|

|

| Use

of proceeds: |

|

We

will not receive any proceeds from the sale of the common stock by the selling stockholder. We would, however, receive proceeds upon

the exercise of the warrants held by the selling stockholder which, if such warrants are exercised in full for cash, would be approximately

$8.0 million. Proceeds, if any, received from the exercise of any such warrants will be used for general corporate purposes and working

capital or for other purposes that our Board of Directors, in their good faith, deem to be in the best interest of our company. No

assurances can be given that any of such warrants will be exercised or that we will receive any cash proceeds upon such exercise

if cashless exercise is available. |

| |

|

|

| Nasdaq

Capital Market symbol: |

|

Our

common stock is listed on the Nasdaq Capital Market under the symbol “VVOS”. |

| |

|

|

| Risk

factors: |

|

Investing

in our common stock is highly speculative and involves a significant degree of risk. As an investor you should be able to bear

a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section

beginning on page 13. |

RISK

FACTORS

Investing

in our common stock is highly speculative and involves a significant degree of risk. Before you invest in our securities,

you should give careful consideration to the following risk factors, in addition to the other information included in this prospectus,

including our financial statements and related notes, before deciding whether to invest in our securities. The occurrence of any of the

adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results

of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks

Related to Our Business and Industry

Our

business has a limited operating history, and we continue to refine our business model, which makes it difficult to evaluate our past

performance and future prospects. Moreover, we have recently made significant strategic, operational and staffing changes to our business,

and it is impossible to know how or if such changes will affect future revenue and earnings.

Our

business was formed only in 2016, and therefore there is limited historical data on which to evaluate our company. This is particularly

true because our current VIP-focused business model only commenced in mid-2018. In addition, since the roll out of our VIP-focused business

model, we have continued to refine our strategies, for example by experimenting with different VIP enrollment and subscription plans

and by adding strategic offerings like OMT. Therefore, there is limited and evolving or differing historical operating data on which

to evaluate the results of and prospects for our current business model.

We

have a history of operating losses and may never achieve cash flow positive or profitable results of operations.

Since

our inception, we have not been profitable and have incurred significant losses and cash flow deficits. For the fiscal years ended December

31, 2022 and 2021, we reported net losses of $23.8 million and $20.3 million respectively, and negative cash flow from operating activities

of $19.6 million and $15.7 million, respectively. As of December 31, 2022, we had an aggregate accumulated deficit of $79.5 million.

As of September 30, 2023, the Company had an accumulated deficit of approximately $88.8 million and ended the period with approximately

$1.0 million in cash assets. For the nine months ended September 30, 2023 and 2022, the Company incurred a net loss of approximately

$9.3 and $17.8 million, respectively. Net cash used in operating activities amounted to approximately $9.2 million and $16.6 million

for the nine months ended September 30, 2023 and 2022, respectively. As of September 30, 2023, the Company had total liabilities of approximately

$10.3 million. We anticipate that we will continue to report losses and negative cash flow until we can substantially increase our revenues,

which we may be unable to do. There is therefore a risk that we will be unable to operate our business in a manner that generate positive

cash flow or profit, and our failure to increase our revenues, generate positive cash flow and operate our business profitably would

damage our reputation and stock price.

Our

VIP program is a relatively new business model for us, and management has limited experience operating this model.

Our

VIP program is a relatively new business model for us, and members of our management team have only a few years of experience in operating

our company through this model. As a result, our historical financial results may not be comparable to future results. Also, we are subject

to many risks associated with the VIP business model, some of which we have faced and some which we may be unable to presently identify,

such as risks associated pricing, competition, marketing and regulatory matters. Moreover, our ability to onboard new VIPs may be impeded

by the investments VIPs must make in adapting their practices to the use of The Vivos Method. We cannot assure you that management will

be able to recruit and adopt new VIPs. Any such failure may have an adverse impact on our business, financial condition and results of

operations.

We

will need to raise additional capital to bolster our stockholders’ equity and to fund and grow our business. Such funding, even

if obtained, could result in substantial dilution or significant debt service obligations. We may not be able to obtain additional capital

on commercially reasonable terms in a timely manner or at all, which could adversely affect our liquidity, financial position, and ability

to continue operations.

We

have a present need for additional capital to fund and grow our business, as well as to bolster our stockholders’ equity for Nasdaq

Stock Market purposes. We will need to obtain additional financing either through borrowings, private offerings, public offerings,

or some type of business combination, such as a merger, or buyout, and there can be no assurance that we will be successful in such pursuits.

We may be unable to acquire the additional funding necessary to fund our growth or to continue operating. Accordingly, if we are unable

to generate adequate cash from operations, and if we are unable to find sources of funding, it may be necessary for us to sell one or

more lines of business or all or a portion of our assets, enter into a business combination, or reduce or eliminate operations. Any of

these possibilities, to the extent available, may be on terms that result in significant dilution to our shareholders or that result

in our investors losing all of their investment in our company.

Even

if we are able to raise additional capital, we do not know what the terms of any such capital raising would be. In addition, any future

sale of our equity securities would dilute the ownership and control of your shares and could be at prices substantially below prices

at which our shares currently trade. Our inability to raise capital, coupled with our inability to generate adequate cash from operations,

could require us to significantly curtail or terminate our operations. We may seek to increase our cash reserves through the sale of

additional equity or debt securities. The sale of convertible debt securities or additional equity securities could result in additional

and potentially substantial dilution to our shareholders. The incurrence of indebtedness would result in increased debt service obligations

and could result in operating and financing covenants that would restrict our operations and liquidity and ability to pay dividends.

In addition, our ability to obtain additional capital on acceptable terms is subject to a variety of uncertainties. We cannot assure

you that financing will be available in amounts or on terms acceptable to us, if at all. Any failure to raise additional funds on favorable

terms could have a material adverse effect on our liquidity and financial condition.

Additionally,

starting in 2022 and through 2023, we have been engaged in an active process of reducing staff, eliminating or renegotiating certain

vendor contracts, strategically reorganizing our business and revamping our business model. Further such steps, or even more, may be

required before management is satisfied that we are positioned to succeed or even survive, and there is a risk that we will be unable

to implement cost cutting programs effectively.

We

have identified material weaknesses in our internal control over financial reporting.

In

connection with the audit of our consolidated financial statements for the years ended December 31, 2022 and 2021, we and our independent

registered public accounting firm identified a material weakness in our internal control over financial reporting. A material weakness

is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility

that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. The material

weakness in our case related to the operating effectiveness of our review controls in that we did not put the appropriate resources in

place to be able to identify technical accounting issues and perform review functions appropriately. Material errors were also identified

in our analysis and review of our VIP contracts for applicable factors to meet the definition of a contract under ASC 606 Contracts

with Customers, step 1, and our evaluation of our note receivable with respect to our former Orem dental clinic for impairment in

accordance with ASC 310 Receivables.

Furthermore,

material errors were also identified during 2022 in our analysis and review of our VIP contracts for applicable factors to meet the definition

of a contract under ASC 606 Contracts with Customers. Our management (with the concurrent of our Audit Committee of the Company’s

Board of Directors) determined that our existing revenue recognition policy was not consistent with the guidance in ASC 606. After analyzing

our contracts using the five-step process in ASC 606, we determined that for VIP enrollment contracts, it is necessary for us to separately

identify the performance obligations and recognize the revenue as the performance obligations are satisfied or over the customer life

as applicable. These errors led to a restatement of our Quarterly Report on Form 10-Q for the period ended March 31, 2022 and significant

delays in the filing of our Quarterly Reports on Form 10-Q for the periods ended June 30, and September 30, 2022.

In

summary, we identified a material weaknesses related to the operating effectiveness of our review controls in that we did not put the

appropriate resources in place to be able to identify technical accounting issues and perform review functions appropriately for the

revenue recognition issues described above and for those items which we had previously identified in Part II, Item 9A of our Annual

Report on Form 10-K for the year ended December 31, 2022.

If

we are unable to remedy these or similar material weakness that may arise in the future, or if we generally fail to establish and maintain

effective internal controls appropriate for a public company, we may be unable to produce timely and accurate financial statements, and

we may continue to conclude that our internal control over financial reporting is not effective, which could adversely impact our investors’

confidence and our stock price. Delays in filing our periodic reports have led and could in the future lead to the loss of our ability

to use certain “short form” registration statements (including “shelf” registration statements used for more

efficient fundraising).

We

expect to derive a substantial portion of our prospective future revenue from sales of our appliances and treatments, which leaves us

reliant on the commercial viability of The Vivos Method.

Currently,

our primary product is The Vivos Method, inclusive of MyoCorrect and our SleepImage HST. Our secondary source of revenue is our clinical

training and practice support programs, including Billing Intelligence Services, Airway Intelligence System and AireO2. We

expect that sales of the component aspects of The Vivos Method and our services to our VIPs related to the use of such treatments will

account for a significant majority of our prospective revenue for the foreseeable future. We currently market and sell our appliances

(which are central to The Vivos Method) primarily in the United States and Canada, with a very limited presence in Australia. The Vivos

Method is different from current surgical and non-surgical treatments dentofacial abnormalities and/or mild to severe OSA and

snoring, therefore we cannot assure you that dentists in corroboration with physicians will use The Vivos Method or become VIPs, and

demand for The Vivos Method may decline or may not increase as quickly as we expect. Also, we cannot assure you that The Vivos Method

will compete effectively as a treatment alternative to other more well-known and well-established therapies, such as CPAP, mandibular

advancement, or palatal surgical procedures. Since The Vivos Method currently represents our primary product, and since our VIP program

is our primary means of commercialization, we are significantly reliant on the level of recurring sales of The Vivos Method treatment

and decreased or lower than expected sales or recruitment and maintenance of new VIPs would cause us to lose all or substantially all

of our revenue.

A

material portion of our future revenue is expected to derive from sales and enrollments of new dentists into our Vivos Integrated Practice

(VIP) program, including dentists who are part of a DSO which leaves us reliant on the willingness of dentists and/or DSO groups

to continue to enroll.

We

believe that The Vivos Method is the first commercially available treatment based on our proprietary technology for the treatment of

dentofacial abnormalities and/or mild to severe OSA. Our success depends both on the sufficient acceptance and adoption by the

medical/dental community of The Vivos Method as a non-invasive treatment for the treatment of dentofacial abnormalities and/or mild to

severe OSA. Currently, a relatively limited number of dentists and other medical clinicians provide treatment with The Vivos

Method. We cannot predict how quickly, if at all, the medical/dental community will accept The Vivos Method, or, if accepted, the extent

of its use. For us to be successful:

| |

● |

our

dentist customers and referring physicians must believe that The Vivos Method offers meaningful clinical and economic benefits for

the treating provider and for the patient as compared to the other surgical and non-surgical procedures or devices currently being

used to treat individuals with dentofacial abnormalities and/or mild to severe OSA and referring physicians must write a

prescription for the use of a Class II Vivos appliance; |

| |

|

|

| |

● |

our

dentist customers must believe patients will pay for The Vivos Method out-of-pocket, and patients must believe that paying out-of-pocket

for treatment in The Vivos Method is the best alternative to either doing nothing or entering into another treatment option; and |

| |

|

|

| |

● |

Our

dentist customers must be willing to pay us for the right to become VIPs and to commit the time and resources required to learn the

new clinical and technical skills and invest in the technology required to treat patients with dentofacial abnormalities and/or mild

to severe OSA using The Vivos Method. Independent dentists as well as dentists affiliated with a DSO may not desire to continue

to enroll in our VIP or DSO program. |

In

reference to the treatment of mild to severe OSA and snoring, studies have shown that a significant percentage of people who

have OSA remain undiagnosed and therefore do not seek treatment. Many of those patients who are diagnosed with OSA may be reluctant to

seek treatment because of the significant costs of treatment given the less severe nature of their condition, the potentially negative

lifestyle effects of traditional treatments, and the lack of awareness of new treatment options. If we are unable to increase public

awareness of the prevalence of OSA or if the medical/dental community is slow to adopt or fails to adopt The Vivos Method as a treatment

for their patients, we would suffer a material adverse effect on our business, financial condition and results of operations.

The

failure of large U.S. customers or DSO to pay for their purchases of The Vivos Method products and services

on a timely basis could reduce our future sales revenue and negatively impact our liquidity.

The

timing and extent of our future growth in sales revenue depends, in part, on our ability to continue to increase the number of U.S. dentists

using The Vivos Method, as well as expanding the number of The Vivos Method treatments used by these physicians/dentists. To the extent

one or more of our large U.S. dentist customers or DSO groups fails to pay us on a timely basis, we may be required to discontinue selling

to these organizations and find new customers, which could reduce our future sales revenue and negatively impact our liquidity.

We

face risks from negative publicity from unregistered oral appliances which has and may continue to hurt our sales.

On

or about March 1, 2023, CBS News reported the tragic case of a woman with a malocclusion and breathing problem who had received treatment

via a fixed oral appliance known as the AGGA (Anterior Growth Guidance Appliance). According to the televised CBS report, the device

created serious issues with her dentition and jaws, resulting in the loss of several anterior teeth. The patient filed a $10 million

lawsuit against the treating dentist. News of this lawsuit quickly spread throughout the country, and particularly within the dental

and orthodontic communities. Within days, rumors and wildly untrue statements were published on social media platforms and elsewhere

that began to associate and confuse our appliances with the AGGA. Our company was not named in the lawsuit, nor was our

device implicated in creating the tooth displacement and other concerns that gave rise to the lawsuit. We have never had any association