false

0000050292

0000050292

2023-11-30

2023-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 30, 2023

IEH

Corporation

(Exact Name of Registrant as Specified in Charter)

| |

|

|

|

|

| New York |

|

0-5278 |

|

13-5549348 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

140 58th Street, Suite 8E

Brooklyn, New York 11220

(Address of Principal Executive Offices, and Zip

Code)

(718) 492-4440

Registrant’s Telephone Number, Including

Area Code

Not Applicable

(Former Name or Former Address, if Changed Since

Last Report)

Securities registered pursuant to Section 12(b) of

the Act: None

Securities registered pursuant to Section 12(g) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock |

IEHC |

OTC Pink Market |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

The following exhibit is attached to this Current Report on Form 8-K:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

IEH Corporation

By: /s/ David Offerman

Name: David Offerman

Title: President and Chief Executive Officer

Date: December 1, 2023

EXHIBIT 99.1

IEH CORPORATION FILES FORM 10-Q FOR FISCAL QUARTERS ENDED

JUNE 30, 2023 AND SEPTEMBER 30, 2023

Brooklyn, NY (Nov 30, 2023) (OTC:IEHC) IEH Corporation

today filed with the Securities and Exchange Commission its quarterly reports on Form 10-Q for the fiscal quarters ending June 30, 2023

and September 30, 2023.

For the quarter ended June 30, 2023, IEH had revenues of $4,679,845

as compared to $4,078,584 for the quarter ended June 30, 2022 reflecting a 14.7% increase; an operating loss of $1,334,392 for 1st

quarter fiscal year 2024 as compared to an operating loss of $2,097,845 for 1st quarter fiscal year 2023; a net loss of $1,315,902

for 1st quarter fiscal year 2024 as compared to a net loss of 2,903,776 for 1st quarter fiscal year 2023; and a basic loss

per share of $.56 for 1st quarter fiscal year 2024 as compared to a basic loss per share of $1.23 for first quarter fiscal

year 2023.

For the quarter ended September 30, 2023, IEH had revenues of

$4,810,988 as compared to $4,193,646 for the quarter ended September 30, 2022 reflecting a 14.7% increase; an operating loss of $1,120,435

for 2nd quarter fiscal year 2024 as compared to an operating loss of $1,503,719 for 2nd quarter fiscal year 2023;

a net loss of $1,100,603 for 2nd quarter of fiscal year 2024 as compared to a net loss of $1,445,342 for 2nd quarter

of fiscal year 2023; and a basic loss per share of $.46 for 2nd quarter fiscal year 2024 as compared to a basic loss per share

of $.61 for 2nd quarter fiscal year 2023.

Dave Offerman, President and CEO of IEH Corporation commented,

“By all appreciable indicators, IEH’s financial metrics have improved in this first half of our fiscal year 2024, as compared

to the same period of fiscal year 2023. Revenue has increased and our losses have narrowed. Although we are not yet approaching pre-COVID

levels of revenue and net income, these most recent results demonstrate that we are moving in the right direction, and with a backlog

that is now 28% higher than it was at the beginning of this fiscal year, further confirm that we are on a recovery trajectory. While progress

may be choppy from one quarter to the next, the long-term trend certainly points upward.

In addition, with the publishing of these reports IEH is now

up-to-date in our SEC filings. Having reached this point, we look forward to engaging with the SEC to resolve the pending administrative

proceeding, and with the OTC Market Group, to make the necessary application to resume trading on their Marketplace.

On behalf of the management team and staff of IEH, we again

wish to express our sincere gratitude for the patience and support of our valued shareholders while we worked through this process. We

look forward to sharing more positive news in the coming months and quarters.”

Cautionary Statement Regarding Forward-Looking Statements

Any statements

contained in this press release that do not describe historical facts may constitute “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including without limitation, statements or expectations regarding our financial condition, regarding our revenues, inventory levels,

cash and backlog, the commercial space launch industry, the success of our marketing and sales efforts in the medical industry, expectations

regarding governance changes, our diversification of products and markets, expectations regarding future cash requirements, revenue and

revenue recovery, including for fiscal 2024, projected timelines for making our SEC filings or successfully preventing our registration

from suspension or revocation and expectations regarding our efforts and ability to resolve our inventory accounting issues. These statements

often include words such as “believe,” “expect,” “estimate,” “plan,” “will,”

“may,” “would,” “should,” “could,” or similar expressions, although not all forward-looking

statements contain such identifying words. These statements are based on certain assumptions that the Company has made on its current

expectations and projections about future events. The Company believes these judgments are reasonable, but you should understand that

these statements are not guarantees of performance or results, and you should not place undue reliance on any forward-looking statements.

The Company’s actual performance or results could differ materially from those expressed in the forward-looking statements due to

a variety of important factors, both positive and negative, as they will depend on many factors about which we are unsure, including many

factors beyond our control. Among other items, such factors could include: any claims, investigations or proceedings arising as a result

of our past due SEC periodic reports, including changes in the proceedings related to the SEC Order; our ability to remediate our inventory

accounting issue; our ability to reduce costs or increase revenue; changes in the macroeconomic environment or in the finances of our

customers; changes in accounting principles, or their application or interpretation, and our ability to make accurate estimates and the

assumptions underlying the estimates; our ability to attract and retain key employees and key resources; and other risk factors discussed

from time to time in our filings with the SEC, including those factors discussed under the caption “Risk Factors” in our most

recent annual report on Form 10-K, filed with the SEC on June 22, 2023, and in subsequent reports filed with or furnished to the SEC.

All forward-looking statements attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by

the foregoing cautionary statements. Except as may be required by applicable law, we assume no obligation and do not intend to update

or revise our forward-looking statements contained in this press release as a result of new information or future events or developments.

Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking

statements. You should carefully review and consider the various disclosures we make in our filings with the SEC that attempt to advise

interested parties of the risks, uncertainties and other factors that may affect our business.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

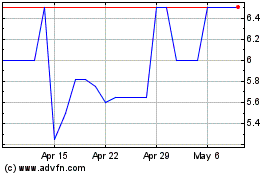

IEH (PK) (USOTC:IEHC)

Historical Stock Chart

From Apr 2024 to May 2024

IEH (PK) (USOTC:IEHC)

Historical Stock Chart

From May 2023 to May 2024