false

0000788611

0000788611

2023-11-19

2023-11-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF THE

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of report (Date of earliest event reported): November 19, 2023

SIGMA

ADDITIVE SOLUTIONS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38015 |

|

27-1865814 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

(Address

of Principal Executive Offices) (Zip Code)

Registrant’s

telephone number, including area code: (505) 438-2576

Former

name or former address, if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

SASI |

|

The

NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

November 19, 2023, upon the recommendation of the Compensation Committee of the Board of Directors (the “Board”) of Sigma

Additive Solutions, Inc. (“we,” “our,” “us,” or the “Company”), the Board approved and

adopted certain retention bonus and separation plans for Jacob Brunsberg, our President and Chief Executive Officer, and Frank Orzechowski,

our Chief Financial Officer. The separation plans were adopted in contemplation of our proposed acquisition of NextTrip Holdings, Inc.,

or NextTrip, pursuant to the previously announced Share Exchange Agreement, which contemplates that Mr. Brunsberg will resign as our

President and Chief Executive Officer and as an employee of the Company concurrently with the closing of the acquisition and that William

Kerby, the co-founder and Chief Executive Officer of NextTrip, will concurrently be appointed as our Chief Executive Officer.

The separation plans approved by the Board are memorialized in Retention Bonus and Separation Agreements dated November 22, 2023

(each, a “Separation Agreement”) between the Company and each of Messrs. Brunsberg and Orzechowski.

The

Company’s former retention bonus plan and related change in control plan and the Retention Bonus and Change in Control Agreements

dated as of January 26, 2023 between the Company and each of Messrs. Brunsberg and Orzechowski (together, the “CIC Agreements”)

have been terminated, and Messrs. Brunsberg and Orzechowski have no further rights or benefits under the CIC Agreements.

Pursuant

to the Separation Agreement with Mr. Brunsberg, he will resign from his roles as President and Chief Executive Officer of the

Company effective as of the closing of the acquisition of NextTrip. Subject to his resignation, he will be entitled to receive (1) a

cash payment in the amount of $204,511 (the “Brunsberg Prorated Retention Bonus”), which is equal to the retention bonus

that would have otherwise been payable to Mr. Brunsberg under his CIC Agreement, prorated through December 31, 2023, and (2) subject

to his execution of a general lease, a separation payment equal to three months’ base salary, in the amount of $62,500. Mr. Brunsberg

also will be awarded 31,250 shares of restricted stock, or restricted stock units, or stock options to purchase up to 31,250 shares of

Company common stock, which equity shall be issued under the Company’s 2023 Equity Incentive Plan (the “Plan”), subject

to stockholder approval of the Plan at the Company’s 2023 Annual Meeting of Stockholders; in the event that the 2023 Plan has not

been adopted and implemented by the Company as of the closing of the acquisition, then such equity award will be issued to Mr. Brunsberg

on such later date that the 2023 Plan or a similar equity incentive plan is adopted and implemented by the Company. Notwithstanding the

foregoing, in the event that the acquisition does not close for any reason, the Separation Agreement will have no force or effect,

except that the Company will pay Mr. Brunsberg the Brunsberg Prorated Retention Bonus in conjunction with the closing of the previously

disclosed sale of assets to Divergent Technologies, Inc., if ever.

Pursuant

to the Separation Agreement with Mr. Orzechowski, he will be entitled to receive a cash payment in the amount of $109,073 (the “Orzechowski

Prorated Retention Bonus”), which is equal to the retention bonus that would have otherwise been payable to Mr. Orzechowski under

his CIC Agreement, prorated through December 31, 2023, upon the closing of the acquisition of NextTrip. Subject to his execution of a

general release, Mr. Orzechowski will also be entitled to receive a severance payment of $200,00, which is equal to his current base

annual salary, in the event that his employment is terminated by the Company without “cause” or he resigns for “good

reason” (in each case as defined in his Separation Agreement) within 18 months following the closing of the acquisition. Notwithstanding

the foregoing, in the event that the acquisition does not close for any reason, the Separation Agreement will have no force or

effect, except that the Company will pay Mr. Orzechowski the Orzechowski Prorated Retention Bonus in conjunction with the closing of

the previously disclosed sale of assets to Divergent Technologies, Inc., if ever.

The

foregoing description of the Separation Agreements does not purport to be complete and is qualified in its entirety by reference to the

full and complete terms of the Separation Agreements, copies of which are filed as Exhibits 10.1 and 10.2, respectively, to this Current

Report and incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

November 24, 2023 |

SIGMA ADDITIVE SOLUTIONS, INC. |

| |

|

|

| |

By:

|

/s/

JACOB BRUNSBERG |

| |

Name:

|

Jacob

Brunsberg |

| |

Title: |

President

and Chief Financial Officer |

Exhibit

10.1

RETENTION

BONUS AND SEPARATION AGREEMENT

This

Retention Bonus and Separation Agreement (this “Agreement”), dated as of November 22, 2023, is entered into

by and between JACOB BRUNSBERG (“Executive”) and SIGMA ADDITIVE SOLUTIONS, INC, a Nevada corporation (together with

its subsidiaries and affiliated companies, the “Company”). Throughout this Agreement, Executive and the Company are

sometimes referred to individually as a “party” and collectively as the “parties.”

Recitals

A.

Executive is willing to resign as the President and Chief Executive Officer of the Company to facilitate the closing of the Company’s

pending acquisition of NextTrip Holdings, Inc. (the “Acquisition”) pursuant to the Share Exchange Agreement dated

as of October 12, 2023 between the Company, NextTrip Holdings, Inc., NextTrip LLC and the NextTrip Representative, as amended by that

First Amendment dated November 19, 2023, and to forego certain rights and benefits under the Retention Bonus and Change in Control Agreement

entered into on January 26, 2023 (the “CIC Agreement”) by Executive and the Company.

B.

Executive and the Company wish to enter into an agreement to set forth certain rights and obligations of the parties in connection with

Executive’s resignation in connection with the Acquisition or, in the event the Acquisition does not occur, the Company’s

sale of assets (the “Asset Sale”) pursuant to the Asset Purchase Agreement dated as of October 6, 2023 between the

Company and Divergent Technologies, Inc.

Agreements

NOW,

THEREFORE, in consideration of the foregoing recitals and the mutual promises contained below, it is agreed as follows:

1.

Resignation. In conjunction with the closing of the Acquisition, Executive shall tender to the Board of Directors of the Company

his written resignation as the President and Chief Executive Officer and an employee of the Company, effective as of closing of the Acquisition

(the “Resignation Date”). Executive’s employment by the Company will terminate on the Resignation Date. For

clarity, Executive shall continue to serve as a director of the Company following the Acquisition.

2.

Resignation Consideration.

(a)

Subject to Executive’s tender of his resignation as provided in Section 1, on the Resignation Date, to the extent it has not previously

done so, the Company shall pay Executive all accrued and unpaid salary, paid time off, and any other amounts owed or would be owed in

the ordinary course due him through the Resignation Date and shall reimburse Executive for unreimbursed business expenses incurred by

Executive to the extent they are valid and reimbursable under the Company’s policies. In addition to the payment of such salary,

paid time off, and reimbursement of expenses, subject to the terms and provisions of this Agreement, on the Resignation Date the Company

shall pay Executive $204,511, which amount is equal to the “Retention Bonus” that would otherwise be payable to Executive

under the CIC Agreement, prorated through December 31, 2023 (the “Prorated Retention Bonus”). Subject to the terms

and provisions of this Agreement, on the Resignation Date the Company also shall pay Executive three months’ base salary, in the

amount of $62,500, and award to Executive under the Sigma Additive Solutions, Inc. 2023 Equity Incentive Plan (the “2023 Plan”)

31,250 shares of “Restricted Stock” or “Restricted Stock Units” (as such terms are defined in the 2023 Plan)

or “Stock Options” to purchase up to 31,250 shares of common stock of the Company, as determined by the Administrator of

the 2023 Plan (in each case, the “Equity Award”), as severance (the “Severance”). Notwithstanding

the foregoing, in the event that the 2023 Plan has not been adopted and implemented by the Company as of the Resignation Date, then the

Equity Award shall be issued by the Company to Executive on such later date that the 2023 Plan or a similar equity incentive plan is

adopted and implemented by the Company. The parties agree that the Prorated Retention Bonus and the Severance are in lieu of any and

all other compensation and benefits payable to Executive under the CIC Agreement. The parties agree that the provisions of this Section

2(a) shall have no force or effect if the Acquisition does not occur for any reason; provided, however, that the Company shall nonetheless

pay Executive the Prorated Retention Bonus in conjunction with the closing of the Asset Sale.

(b)

The Company shall withhold payroll and withholding taxes from amounts paid or awarded under this Agreement to the extent such withholding

is required. The Company and Executive shall enter into a mutually satisfactory Award Agreement with respect to the Equity Award which,

among other things, shall provide that the Company shall withhold from the Equity Award a number of shares of common stock underlying

the Equity Award with a fair value equal to the payroll and withholding taxes attributable to the Equity Award, or utilize a broker-assisted

sale of a number of underlying shares of common stock, to satisfy such payroll and withholding taxes.

(c)

As a condition to payment of the Severance, Executive shall execute and deliver to the Company a general release of all employment-related

claims in form and content reasonably satisfactory to the Company.

3.

No On-the-Job Injury. Executive represents and warrants that he has not experienced a job-related illness or injury during his

service to the Company for which he has not already filed a claim, and that on or prior to the Resignation Date he shall disclose to

the Company any pending or previously filed claim relating to an on-the-job injury or illness.

4.

Termination of the CIC Agreement. The parties hereby terminate the CIC Agreement as of the date of this Agreement in accordance

with Section 4.10 thereof. Executive acknowledges and agrees that he shall have no further rights or benefits under the CIC Agreement.

5.

Counterparts. This Agreement may be executed in counterparts, which taken together form one legal instrument. Multiple signature

pages and signatures delivered via scanned-in PDF copy or facsimile will all constitute originals and together will constitute one and

the same instrument.

6.

Binding Agreement. This Agreement shall be binding upon the parties and their respective heirs, administrators, representatives,

executors, successors, and assigns.

7.

No Representations. Executive acknowledges that no promises or representations other than those set forth in this Agreement have

been made to him to induce him to sign this Agreement, and that he only has relied on promises expressly stated herein.

8.

Entire Agreement. This Agreement sets forth the entire understanding between Executive and the Company and supersedes any prior

agreements or understandings, express or implied, pertaining to the subject matter hereof, including without limitation the CIC Agreement.

9.

Amendment and Termination. This Agreement may be amended only pursuant to a writing executed by the Company and the Executive.

10.

Provisions Subject to Applicable Law. All provisions of this Agreement shall be applicable only to the extent that they do not

violate any applicable law and are intended to be limited to the extent necessary so that they will not render this Agreement invalid,

illegal or unenforceable under any applicable law. If any provision of this Agreement or any application thereof shall be held to be

invalid, illegal or unenforceable, the validity, legality and enforceability of other provisions of this Agreement or of any other application

of such provision shall in no way be affected thereby.

11.

Governing Law. This Agreement shall be construed as a whole in accordance with its fair meaning and in accordance with the laws

of the State of Nevada. The language of this Agreement shall not be construed for or against either party. The headings used herein are

for reference only and shall not affect the construction of this Agreement.

12.

Representation of the Executive; Interpretation of This Agreement. The Executive acknowledges that he has had an adequate opportunity

to review this Agreement with the Executive’s counsel, if any, prior to executing this Agreement. The terms of this Agreement have

been negotiated by the Company and the Executive, and the language used herein was chosen by the parties to express their mutual intent.

This Agreement shall be construed without regard to any presumption or rule requiring construction against the party causing the instrument

to be drafted. The Executive further acknowledges that (i) TroyGould PC has served as counsel to the Company only (and not to the Executive)

in connection with this Agreement, and (ii) neither the Company nor its agents or representatives has made any representations to the

Executive regarding the tax consequences to him of any payments pursuant to this Agreement.

13.

Arbitration. Any dispute or controversy arising under this Agreement relating to its interpretation or the breach hereof, including

the arbitrability of any such dispute or controversy (each, a “Disputed Matter”), shall be determined and settled

by arbitration in Santa Fe, New Mexico pursuant to the Rules of the American Arbitration Association in effect at the time the Disputed

Matter arises. Any award rendered herein shall be final and binding on each and all of the parties, and judgment may be entered thereon

in any court of competent jurisdiction. Notwithstanding the foregoing, the parties shall be entitled to seek injunctive relief in any

court of competent jurisdiction.

[Signature

Page Follows]

The

parties have executed this Agreement, consisting of five pages, including this page, on the dates indicated below.

| Dated:

November 22, 2023 |

SIGMA

ADDITIVE SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/

MARK RUPORT |

| |

|

Mark

Ruport, Chairman of the Board |

| |

|

|

| Date:

November 22, 2023 |

|

/s/

JACOB BRUNSBERG |

| |

|

JACOB

BRUNSBERG |

Exhibit

10.2

RETENTION

BONUS AND SEPARATION AGREEMENT

This

Retention Bonus and Separation Agreement (this “Agreement”), dated as of November 22, 2023, is entered into

by and between FRANK ORZECHOWSKI (“Executive”) and SIGMA ADDITIVE SOLUTIONS, INC, a Nevada corporation (together with

its subsidiaries and affiliated companies, the “Company”). Executive and the Company are sometimes referred to individually

herein as a “party” and collectively as the “parties.”

Recitals

A.

Executive is willing to continue to serve as the Chief Financial Officer of the Company to facilitate the closing of the Company’s

pending acquisition of NextTrip Holdings, Inc. (the “Acquisition”) pursuant to the Share Exchange Agreement dated

as of October 12, 2023 between the Company, NextTrip Holdings, Inc., NextTrip LLC and the NextTrip Representative, as amended by that

First Amendment dated November 19, 2023, and to forego certain rights and benefits under the Retention Bonus and Change in Control Agreement

entered into on January 26, 2023 (the “CIC Agreement”) by Executive and the Company.

B.

Executive and the Company wish to enter into an agreement to set forth certain obligations of the parties in connection with Executive’s

continued employment by the Company after the closing of the Acquisition.

Agreements

NOW,

THEREFORE, in consideration of the foregoing recitals and the mutual promises contained below, it is agreed as follows:

1.

Retention Bonus. On the first regular payroll date of the Company following the closing of the Acquisition, the Company shall

pay Executive $109,073, which amount is equal to the “Retention Bonus” that would otherwise be payable to Executive under

the CIC Agreement, prorated through December 31, 2023 (the “Prorated Retention Bonus”), in lieu of any and all other

compensation and benefits payable to Executive under the CIC Agreement. In the event the Acquisition does not occur for any reason, the

Company shall pay Executive the Prorated Retention Bonus in conjunction with the closing of the Company’s sale of assets to Divergent

Technologies, Inc. (“Divergent”) pursuant to the Asset Purchase Agreement dated as of October 6, 2023 between the

Company and Divergent.

2.

Severance; General Release.

(a)

The parties agree that in the event of the termination of Executive’s employment by the Company without “Cause” or

by Executive for “Good Reason” within 18 months following the closing of the Acquisition, the Company shall pay Executive

severance in the amount of $200,000 (the “Severance”) in addition to any all accrued and unpaid salary, paid time

off, and other amounts owed to him through date of the termination of his employment. The Company shall withhold payroll and withholding

taxes from amounts due under this Agreement to the extent such withholding is required. As a condition to payment of the Severance, Executive

shall execute and deliver to the Company a general release of all claims in form and content reasonably satisfactory to the Company.

This Section 2 shall have no force or effect if the Acquisition does not occur for any reason.

(b)

For purposes of this Agreement, “Cause” means Executive’s (i) conviction of a felony that is injurious to the

business of the Company, (ii) willful and continued failure to perform his employment duties, (iii) willful misconduct that is injurious

to the business of the Company, or (iv) willful violation of any material provision of any employment policy of the Company; provided,

however, that the Executive’s inability to perform his duties because of a disability shall not constitute a basis for the Company’s

termination of the Executive’s Employment for Cause. Notwithstanding the foregoing, Executive’s employment shall not be subject

to termination for Cause without (w) the Company’s delivery to Executive of a notice of intention to terminate, such notice to

describe the reasons for the proposed employment termination and to be delivered to the Executive at least ten days prior to the termination

date, (x) an opportunity for the Executive within the period prior to the proposed employment termination to cure any such breach (if

curable) giving rise to the proposed termination, and (y) an opportunity for Executive, if he chooses, to be heard before the Board of

Directors of the Company.

(c)

For purposes of this Agreement, “Good Reason” means any of the following actions by the Company, unless the Executive,

in his discretion, consents thereto in writing or the action by the Company is reversed or abandoned within 30 days after the Company

receives from Executive written notice of Executive’s objection to the action: (i) a reduction in the Executive’s annual

base salary as in effect on the date of this Agreement or a failure to make any scheduled base salary payment within 15 days after its

due date, unless the Company’s Board of Directors determines in good faith that such base salary reduction is more than offset

by the aggregate value of any new compensation plans or other employment-related benefits that are provided to Executive; (ii) the Company’s

requirement that Executive perform his Employment duties at an office that is more than 25 miles from the Company’s office at 3900

Paseo del Sol, Santa Fe, New Mexico; (iii) a change or diminution in Executive’s employment duties that is materially inconsistent

with the duties usually associated with the office of the Chief Financial Officer of a corporation; or (iv) a failure by the Company

to continue for the benefit of Executive any material compensation plan in which Executive, unless the discontinuation of such plan is

outside the Company’s reasonable control or unless the Company discontinues such plan for all of its executive officers. Notwithstanding

the foregoing, Good Reason for the Executive to terminate his Employment shall not exist by reason of any of the Company’s actions

described in the preceding sentence if the action is preceded by a written notice from the Company of an intention to terminate Executive’s

employment for Cause or because of Executive’s Disability and is then followed by a termination of Employment for Cause or Disability.

(d)

“Disability” means a physical or mental disability of Executive that results in Executive being unable to perform

his duties as an employee of the Company on a full-time basis (after reasonable accommodation by the Company to the extent required by

applicable law) for (i) 120 consecutive days or (ii) a total of 180 days (regardless of whether such days are consecutive) during any

period of 365 consecutive days.

3.

Termination of the CIC Agreement. The parties hereby terminate the CIC Agreement as of the date of this Agreement in accordance

with Section 4.10 thereof. Executive acknowledges and agrees that he shall have no rights or benefits under the CIC Agreement.

4.

Counterparts. This Agreement may be executed in counterparts, which taken together form one legal instrument. Multiple signature

pages and signatures delivered via scanned-in PDF copy or facsimile will all constitute originals and together will constitute one and

the same instrument.

5.

Binding Agreement. This Agreement shall be binding upon the parties and their respective heirs, administrators, representatives,

executors, successors, and assigns.

6.

No Representations. Executive acknowledges that no promises or representations other than those set forth in this Agreement have

been made to him to induce him to sign this Agreement, and that he only has relied on promises expressly stated herein.

7.

Entire Agreement. This Agreement sets forth the entire understanding between Executive and the Company and supersedes any prior

agreements or understandings, express or implied, pertaining to the subject matter hereof, including without limitation the CIC Agreement.

8.

Amendment and Termination. This Agreement may be amended only pursuant to a writing executed by the Company and the Executive.

9.

Provisions Subject to Applicable Law. All provisions of this Agreement shall be applicable only to the extent that they do not

violate any applicable law and are intended to be limited to the extent necessary so that they will not render this Agreement invalid,

illegal or unenforceable under any applicable law. If any provision of this Agreement or any application thereof shall be held to be

invalid, illegal or unenforceable, the validity, legality and enforceability of other provisions of this Agreement or of any other application

of such provision shall in no way be affected thereby.

10.

Governing Law. This Agreement shall be construed as a whole in accordance with its fair meaning and in accordance with the laws

of the State of Nevada. The language of this Agreement shall not be construed for or against either party. The headings used herein are

for reference only and shall not affect the construction of this Agreement.

11.

Representation of the Executive; Interpretation of This Agreement. The Executive acknowledges that he has had an adequate opportunity

to review this Agreement with the Executive’s counsel, if any, prior to executing this Agreement. The terms of this Agreement have

been negotiated by the Company and the Executive, and the language used herein was chosen by the parties to express their mutual intent.

This Agreement shall be construed without regard to any presumption or rule requiring construction against the party causing the instrument

to be drafted. The Executive further acknowledges that (i) TroyGould PC has served as counsel to the Company only (and not to the Executive)

in connection with this Agreement, and (ii) neither the Company nor its agents or representatives has made any representations to the

Executive regarding the tax consequences to him of any payments pursuant to this Agreement.

12.

Arbitration. Any dispute or controversy arising under this Agreement relating to its interpretation or the breach hereof, including

the arbitrability of any such dispute or controversy (each, a “Disputed Matter”), shall be determined and settled

by arbitration in Santa Fe, New Mexico pursuant to the Rules of the American Arbitration Association in effect at the time the Disputed

Matter arises. Any award rendered herein shall be final and binding on each and all of the parties, and judgment may be entered thereon

in any court of competent jurisdiction. Notwithstanding the foregoing, the parties shall be entitled to seek injunctive relief in any

court of competent jurisdiction.

[Signature

Page Follows]

The

parties have executed this Agreement, consisting of five pages, including this page, on the dates indicated below.

| Dated:

November 22, 2023 |

SIGMA ADDITIVE SOLUTIONS, INC. |

| |

|

|

| |

By: |

/s/ JACOB BRUNSBERG |

| |

|

Jacob

Brunsberg |

| |

|

President

and Chief Executive Officer |

| |

|

|

| Date:

November 22, 2023 |

|

/s/

FRANK ORZECHOWSKI |

| |

|

FRANK

ORZECHOWSKI |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

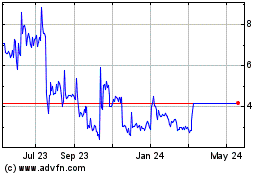

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Apr 2023 to Apr 2024