UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38198

BEST Inc.

(Registrant’s name)

2nd Floor, Block A, Huaxing Modern Industry

Park

No. 18 Tangmiao Road, Xihu District, Hangzhou

Zhejiang Province 310013

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1) :¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7) :¨

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | BEST Inc. |

| | | |

| | | By: |

/s/ Shao-Ning Johnny Chou |

| | | |

Name: |

Shao-Ning Johnny Chou |

| | | |

Title: |

Chairman and Chief Executive Officer |

| | | |

|

| Date: November 24, 2023 | | |

|

EXHIBIT INDEX

Exhibit 99.1

BEST Inc. Announces Unaudited

Third Quarter 2023 Financial Results

HANGZHOU, China,

November 23, 2023 -- BEST Inc. (NYSE: BEST) (“BEST” or the “Company”), a leading integrated smart

supply chain solutions and logistics services provider in China and Southeast Asia (“SEA”), today announced its unaudited

financial results for the third quarter ended September 30, 2023.

FINANCIAL HIGHLIGHTS(1)

For the Third

Quarter Ended September 30, 2023:(2)

| ● | Revenue was RMB2,226.7 million (US$305.2

million), compared to RMB2,029.1 million in the third quarter of 2022. The increase was primarily due to increased revenue of BEST Freight

and BEST Global. |

| ● | Gross profit was RMB51.8 million (US$7.1

million), compared to a gross loss of RMB39.0 million in the third quarter of 2022. The increase was primarily due to further improvements

in operating efficiency for both Freight and Supply Chain Management. Gross profit margin was 2.3%, compared to a gross loss margin

of 1.9% in the third quarter of 2022. |

| ● | Net

Loss from continuing operations was RMB193.0 million (US$26.5 million), compared to RMB378.9 million in the third quarter of 2022.

Non-GAAP net loss from continuing operations(3)(4)

was RMB180.9 million (US$24.8 million), compared to RMB363.0 million in the third quarter of 2022. |

| ● | Diluted loss per ADS(5)

from continuing operations was RMB9.46 (US$1.30), compared to a loss of RMB17.60 in the third quarter of 2022. Non-GAAP diluted

loss per ADS(3)(4) from continuing operations was RMB8.81 (US$1.21), compared to a loss of RMB16.79 in the

third quarter of 2022. |

(1)

All numbers presented have been rounded to the nearest integer, tenth, or hundredth, and year over year comparisons are based on

figures before rounding.

(2)

In December 2021, BEST sold its China express business, the principal terms of which were previously announced. As

a result, China express business has been deconsolidated from the Company and its historical financial results are reflected in the Company’s

consolidated financial statements as discontinued operations accordingly. The financial information and non-GAAP financial information

disclosed in this press release is presented on a continuing operations basis, unless otherwise specifically stated.

(3)

Non-GAAP net income/loss represents net income/loss excluding share-based compensation expenses, amortization of intangible assets

resulting from business acquisitions, and fair value change of equity investments (if any).

(4)

See the sections entitled “Use of Non-GAAP Financial Measures” and “Reconciliations of Non-GAAP Measures to the

Nearest Comparable GAAP Measures” for more information about the non-GAAP measures referred to within this results announcement.

(5)

Diluted earnings/loss per ADS, is calculated by dividing net income/loss attributable to ordinary shareholders as adjusted for

the effect of dilutive ordinary equivalent shares, if any, by the weighted average number of ordinary and dilutive ordinary equivalent

shares expressed in ADS outstanding during the period.

| ● | EBITDA(6)

from continuing operations was negative RMB151.2 million (US$20.7 million), compared to negative RMB335.9 million in the third

quarter of 2022. Adjusted EBITDA(6) from continuing operations was negative RMB139.1 million (US$19.1 million),

compared to negative RMB320.0 million in the third quarter of 2022. |

BEST Freight

– BEST Freight recorded a revenue growth of 10.0% in the third quarter of 2023, year over year. Freight’s gross margin was

3.2%, representing a 6.2% percentage points improvement from the same period of 2022 as we continued to reduce operating expenses and

improve efficiency.

BEST Supply Chain

Management – Driven by its best-in-class service quality and digital capabilities, BEST Supply Chain Management recorded

a gross margin of 9.1% compared to 7.2% in the same period of 2022.

BEST Global

– In the third quarter, BEST Global continued its robust post-COVID recovery. BEST Global’s revenue increased by 30.2% and

its parcel volumes increased by 44.9%, both year over year, with parcel volumes in Vietnam and Malaysia, increased by 64.9% and 122.0%,

respectively. Total volume of the cross-border business in the third quarter increased by approximately 41.2% quarter-over-quarter.

Others

– The Company continued to wind down its Capital business line and expects to complete the wind-down by the end of 2023.

(6)

EBITDA represents net income/loss excluding depreciation, amortization, interest expense and income tax expense and minus interest

income. Adjusted EBITDA represents EBITDA excluding share-based compensation expenses and fair value change of equity investments (if

any).

Key Operational Metrics

| | |

Three Months Ended | | |

% Change YOY | |

| | |

September 30,

2021 | | |

September 30,

2022 | | |

September 30,

2023 | | |

2022 vs

2021 | | |

2023 vs

2022 | |

| Freight Volume (Tonne in ‘000) | |

| 2,427 | | |

| 2,527 | | |

| 2,557 | | |

| 4.1 | % | |

| 1.2 | % |

| Supply Chain Management volume (Tonne in ‘000) | |

| 260 | | |

| 480 | | |

| 680 | | |

| 84.6 | % | |

| 41.7 | % |

| Global Parcel Volume in SEA (in ‘000) | |

| 37,082 | | |

| 27,044 | | |

| 39,194 | | |

| (27.1 | )% | |

| 44.9 | % |

FINANCIAL RESULTS(7)

For the Third Quarter Ended September 30,

2023:

Revenue

The following table sets forth a breakdown of

revenue by business segment for the periods indicated.

Table 1 – Breakdown of Revenue by Business

Segment

| | |

Three Months Ended | | |

| |

| | |

September 30, 2022 | | |

September 30, 2023 | | |

| |

| (In ‘000, except for )% | |

RMB | | |

% of

Revenue | | |

RMB | | |

US$ | | |

% of

Revenue | | |

% Change

YOY | |

| Total Freight | |

| 1,325,833 | | |

| 65.3 | % | |

| 1,457,988 | | |

| 199,834 | | |

| 65.5 | % | |

| 10.0 | % |

| Supply Chain Management | |

| 461,527 | | |

| 22.7 | % | |

| 465,790 | | |

| 63,842 | | |

| 20.9 | % | |

| 0.9 | % |

| Global | |

| 211,347 | | |

| 10.4 | % | |

| 275,198 | | |

| 37,719 | | |

| 12.4 | % | |

| 30.2 | % |

| Others(8) | |

| 30,417 | | |

| 1.6 | % | |

| 27,680 | | |

| 3,794 | | |

| 1.2 | % | |

| (9.0 | )% |

| Total Revenue | |

| 2,029,124 | | |

| 100.0 | % | |

| 2,226,656 | | |

| 305,189 | | |

| 100.0 | % | |

| 9.7 | % |

| ● | Freight Service Revenue was RMB1,458.0 million

(US$199.8 million) for the third quarter of 2023, compared to RMB1,325.8 million in the same period last year. Freight service revenue

increased by 10.0% year over year, primarily resulting from increases in average selling price per tonne. |

| ● | Supply Chain Management Service Revenue increased

by 0.9% year over year to RMB465.8 million (US$63.8 million) for the third quarter of 2023, up from RMB461.5 million in the same period

of last year. |

| ● | Global Service Revenue increased by 30.2% year

over year to RMB275.2 million (US$37.7 million) for the third quarter of 2023 from RMB211.3 million in the same period last year primarily

due to rapid volume growth in Vietnam, Malaysia and cross-border business. |

(7)

All numbers represented the financial results from continuing operations, unless otherwise stated.

(8)

“Others” Segment primarily represents Capital business

unit.

Cost of Revenue

The following table sets forth a breakdown of

cost of revenue by business segment for the periods indicated.

Table 2 – Breakdown of Cost of Revenue

by Business Segment

| | |

Three Months Ended | | |

|

| | |

September 30, 2022 | | |

September 30, 2023 | | |

% of Revenue |

| (In ‘000, except for )% | |

RMB | | |

% of

Revenue | | |

RMB | | |

US$ | | |

% of

Revenue | | |

Change

YOY |

| Freight | |

| (1,365,074 | ) | |

| 103.0 | % | |

| (1,410,625 | ) | |

| (193,342 | ) | |

| 96.8 | % | |

| (6.2)ppt |

| Supply Chain Management | |

| (428,190 | ) | |

| 92.8 | % | |

| (423,320 | ) | |

| (58,021 | ) | |

| 90.9 | % | |

| (1.9)ppt |

| Global | |

| (255,341 | ) | |

| 120.8 | % | |

| (324,408 | ) | |

| (44,464 | ) | |

| 117.9 | % | |

| (2.9)ppt |

| Others | |

| (19,469 | ) | |

| 64.0 | % | |

| (16,540 | ) | |

| (2,267 | ) | |

| 59.8 | % | |

| (4.2)ppt |

| Total Cost of Revenue | |

| (2,068,074 | ) | |

| 101.9 | % | |

| (2,174,893 | ) | |

| (298,094 | ) | |

| 97.7 | % | |

| (4.2)ppt |

| ● | Cost of Revenue for Freight was RMB1,410.6 million

(US$193.3 million), or 96.8% of revenue in the third quarter of 2023. The 6.2 percentage points year-over-year decrease in cost of revenue

as a percentage of revenue was mainly due to higher price and reduced unit cost. |

| ● | Cost of Revenue for Supply Chain Management was

RMB423.3 million (US$58.0 million), or 90.9% of revenue in the third quarter of 2023. The 1.9 percentage points year-over-year decrease

in cost of revenue as a percentage of revenue was primarily due to improved operating efficiency and optimized customer mix. |

| ● | Cost of Revenue for Global was RMB324.4 million

(US$44.5 million), or 117.9% of revenue in the third quarter of 2023. The 2.9% year-over-year decrease in cost of revenue as a percentage

of revenue was primarily due to higher gross margin in cross-border business and Vietnam. |

Gross Profit

was RMB51.8 million (US$7.1 million), compared to a gross loss of RMB39.0 million in the third quarter of 2022; Gross Margin

was positive 2.3%, compared to negative 1.9% in the third quarter of 2022.

Operating Expenses

Selling, General

and Administrative (“SG&A”) Expenses were RMB236.3 million (US$32.4 million), or 10.6% of revenue, in the third

quarter of 2023, compared to RMB275.2 million, or 13.6% of revenue, in the same period of 2022. SG&A expenses in the third quarter

decreased by 14.1% year over year due to reduced headcount and bad debt expense.

Research and

Development Expenses were RMB27.8 million (US$3.8 million) or 1.3% of revenue in the third quarter of 2023, compared to RMB39.6

million or 2.0% of revenue in the third quarter of 2022, primarily due to reduced headcount.

Share-based Compensation

(“SBC”) Expenses included in the cost and expense items above were RMB12.2 million (US$1.7 million) in the third

quarter of 2023, compared to RMB15.9 million in the same period of 2022. Of the total SBC expenses, RMB0.05 million (US$0.01 million)

was allocated to cost of revenue, RMB0.5 million (US$0.1 million) was allocated to selling expenses, RMB10.7 million (US$1.5 million)

was allocated to general and administrative expenses, and RMB0.8 million (US$0.1 million) was allocated to research and development expenses.

Net Loss and Non-GAAP Net Loss from continuing

operations

Net Loss from

continuing operations in the third quarter of 2023 was RMB193.0 million (US$26.5 million), compared to RMB378.9 million in

the same period of 2022. Excluding SBC expenses, non-GAAP net loss from continuing operations in the third quarter of 2023 was

RMB180.9 million (US$24.8 million), compared to RMB363.0 million in the third quarter of 2022.

Diluted loss per ADS and Non-GAAP diluted

loss per ADS from continuing operations

Diluted loss

per ADS from continuing operations in the third quarter of 2023 was RMB9.46 (US$1.30), compared to a loss of RMB17.60 in the

same period of 2022. Excluding SBC expenses non-GAAP diluted loss per ADS from continuing operations in the third quarter of 2023

was RMB8.81 (US$1.21), compared to a loss of RMB16.79 in the third quarter of 2022. A reconciliation of non-GAAP diluted loss per ADS

to diluted loss per ADS is included at the end of this results announcement.

Adjusted EBITDA and Adjusted EBITDA Margin

from continuing operations

Adjusted EBITDA

from continuing operations in the third quarter of 2023 was negative RMB139.1 million (US$19.1 million), compared to negative

RMB320.0 million in the same period of 2022. Adjusted EBITDA margin from continuing operations in the third quarter of 2023 was

negative 6.2%, compared to negative 15.8% in the same period of 2022.

Cash and Cash Equivalents, Restricted Cash and Short-term Investments

As of September 30, 2023, cash and cash equivalents,

restricted cash and short-term investments were RMB2,360.9 million (US$323.6 million), compared to RMB3,332.0 million as of September 30,

2022. In the third quarter, the Company repurchased approximately US$75 million (RMB 542 million) aggregate principal amount of its existing

Convertible Senior Notes due 2024.

Net Cash Used In Continuing Operating Activities

Net cash used in continuing operating activities

in the third quarter of 2023 was RMB234.4 million (US$32.13 million), compared to RMB250.4 million of net cash used in continuing operating

activities in the same period of 2022. The decrease in net cash used in operating activities was mainly due to the decreased net loss

in the third quarter of 2023.

SHARES OUTSTANDING

As of November 09,

2023, the Company had approximately 397.6 million ordinary shares outstanding (9).

Each American Depositary Share represents twenty (20) Class A ordinary shares.

As previously announced, effective from April 4,

2023, the Company changed the ratio of its American Depositary Shares to its Class A ordinary shares, par value US$0.01 per share,

from the original ADS ratio of one (1) ADS to five (5) Class A ordinary share, to a new ADS ratio of one (1) ADS to

twenty (20) Class A ordinary shares.

As previously announced,

the Company’s board of directors authorized a share repurchase program, under which the Company could repurchase up to US$20 million

worth of its outstanding American Depositary Shares over a 12-month period. The Company’s board of directors has terminated

the share repurchase program, effective as of September 25, 2023. Prior to the program’s termination, the Company repurchased

a total of 1,265,685 ADSs for a total amount paid of US$3,311,134.95 (excluding commissions) under the program.

ABOUT BEST INC.

BEST Inc. (NYSE:

BEST) is a leading integrated smart supply chain solutions and logistics services provider in China and Southeast Asia. Through its proprietary

technology platform and extensive networks, BEST offers a comprehensive set of logistics and value-added services, including freight

delivery, supply chain management and global logistics services. BEST’s mission is to empower business and enrich life by leveraging

technology and business model innovation to create a smarter, more efficient supply chain. For more information, please visit: http://www.best-inc.com/en/.

(9)

The total number of shares outstanding excludes shares reserved for future issuances upon exercise or vesting of awards granted

under the Company’s share incentive plans.

For investor and media inquiries, please contact:

BEST Inc.

Investor relations team

ir@best-inc.com

SAFE HARBOR STATEMENT

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates” and similar statements.

Among other things, the business outlook and quotations from management in this announcement, as well as BEST's strategic and operational

plans, contain forward-looking statements. BEST may also make written or oral forward-looking statements in its periodic reports to the

U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts,

including statements about BEST's beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent

risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement, including but not limited to the following: BEST's goals and strategies; BEST's future business development, results of operations

and financial condition; BEST's ability to maintain and enhance its ecosystem; BEST's ability to compete effectively; BEST's ability to

continue to innovate, meet evolving market trends, adapt to changing customer demands and maintain its culture of innovation; fluctuations

in general economic and business conditions in China and other countries in which BEST operates, and assumptions underlying or related

to any of the foregoing. Further information regarding these and other risks is included in BEST's filings with the SEC. All information

provided in this press release and in the attachments is as of the date of this press release, and BEST does not undertake any obligation

to update any forward-looking statement, except as required under applicable law.

USE OF NON-GAAP FINANCIAL MEASURES

In evaluating its business, BEST considers and

uses non-GAAP measures, such as non-GAAP net loss/income, non-GAAP net loss/income margin, adjusted EBITDA, adjusted EBITDA margin, EBITDA,

and non-GAAP Diluted earnings/loss per ADS, as supplemental measures in the evaluation of the Company’s operating results and in

the Company’s financial and operational decision-making. The Company believes these non-GAAP financial measures that help identify

underlying trends in the Company’s business that could otherwise be distorted by the effect of the expenses and gains that the Company

includes in loss from operations and net loss. The Company believes that these non-GAAP financial measures provide useful information

about its operating results, enhance the overall understanding of its past performance and future prospects and allow for greater visibility

with respect to key metrics used by the Company’s management in its financial and operational decision-making. The presentation

of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with U.S. GAAP. For more information on these non-GAAP financial measures, please see the table captioned

“Reconciliations of Non-GAAP Measures to the Nearest Comparable GAAP Measures” in the results announcement.

The non-GAAP financial measures are provided as

additional information to help investors compare business trends among different reporting periods on a consistent basis and to enhance

investors' overall understanding of the Company's current financial performance and prospects for the future. These non-GAAP financial

measures should be considered in addition to results prepared in accordance with U.S. GAAP, but should not be considered a substitute

for, or superior to, U.S. GAAP results. In addition, the Company's calculation of the non-GAAP financial measures may be different from

the calculation used by other companies, and therefore comparability may be limited.

Summary of Unaudited Condensed Consolidated

Income Statements

(In Thousands)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Revenue | |

| | |

| | |

| | |

| | |

| | |

| |

| Freight | |

| 1,325,833 | | |

| 1,457,988 | | |

| 199,834 | | |

| 3,627,082 | | |

| 3,902,486 | | |

| 534,880 | |

| Supply Chain Management | |

| 461,527 | | |

| 465,790 | | |

| 63,842 | | |

| 1,321,473 | | |

| 1,387,250 | | |

| 190,138 | |

| Global | |

| 211,347 | | |

| 275,198 | | |

| 37,719 | | |

| 721,227 | | |

| 711,607 | | |

| 97,534 | |

| Others | |

| 30,417 | | |

| 27,680 | | |

| 3,794 | | |

| 92,895 | | |

| 78,250 | | |

| 10,725 | |

| Total Revenue | |

| 2,029,124 | | |

| 2,226,656 | | |

| 305,189 | | |

| 5,762,677 | | |

| 6,079,593 | | |

| 833,277 | |

| Cost of Revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Freight | |

| (1,365,074 | ) | |

| (1,410,625 | ) | |

| (193,342 | ) | |

| (3,837,911 | ) | |

| (3,784,616 | ) | |

| (518,725 | ) |

| Supply Chain Management | |

| (428,190 | ) | |

| (423,320 | ) | |

| (58,021 | ) | |

| (1,233,307 | ) | |

| (1,256,540 | ) | |

| (172,223 | ) |

| Global | |

| (255,341 | ) | |

| (324,408 | ) | |

| (44,464 | ) | |

| (817,573 | ) | |

| (861,338 | ) | |

| (118,056 | ) |

| Others | |

| (19,469 | ) | |

| (16,540 | ) | |

| (2,267 | ) | |

| (78,967 | ) | |

| (44,989 | ) | |

| (6,166 | ) |

| Total Cost of Revenue | |

| (2,068,074 | ) | |

| (2,174,893 | ) | |

| (298,094 | ) | |

| (5,967,758 | ) | |

| (5,947,483 | ) | |

| (815,170 | ) |

| Gross (Loss)/Profit | |

| (38,950 | ) | |

| 51,763 | | |

| 7,095 | | |

| (205,081 | ) | |

| 132,110 | | |

| 18,107 | |

| Selling Expenses | |

| (62,241 | ) | |

| (68,054 | ) | |

| (9,328 | ) | |

| (183,297 | ) | |

| (184,541 | ) | |

| (25,293 | ) |

| General and Administrative Expenses | |

| (212,921 | ) | |

| (168,286 | ) | |

| (23,066 | ) | |

| (680,607 | ) | |

| (528,375 | ) | |

| (72,420 | ) |

| Research and Development Expenses | |

| (39,632 | ) | |

| (27,843 | ) | |

| (3,816 | ) | |

| (114,934 | ) | |

| (86,468 | ) | |

| (11,851 | ) |

| Other operating (expense)/income, net | |

| (14,185 | ) | |

| 973 | | |

| 133 | | |

| 105,430 | | |

| 83 | | |

| 11 | |

| Loss from Operations | |

| (367,929 | ) | |

| (211,447 | ) | |

| (28,982 | ) | |

| (1,078,489 | ) | |

| (667,191 | ) | |

| (91,446 | ) |

| Interest Income | |

| 19,981 | | |

| 18,283 | | |

| 2,506 | | |

| 61,153 | | |

| 65,962 | | |

| 9,041 | |

| Interest Expense | |

| (20,569 | ) | |

| (15,800 | ) | |

| (2,166 | ) | |

| (72,729 | ) | |

| (50,419 | ) | |

| (6,911 | ) |

| Foreign Exchange (loss)/gain | |

| (98,628 | ) | |

| 6,177 | | |

| 847 | | |

| (201,048 | ) | |

| (25,760 | ) | |

| (3,531 | ) |

| Other Income | |

| 2,657 | | |

| 131 | | |

| 18 | | |

| 23,765 | | |

| 10,598 | | |

| 1,453 | |

| Other Expense | |

| (464 | ) | |

| (103 | ) | |

| (14 | ) | |

| 19,578 | | |

| (3,819 | ) | |

| (524 | ) |

| Gain on changes in the fair value of derivative assets/liabilities | |

| 86,108 | | |

| 10,279 | | |

| 1,409 | | |

| 149,196 | | |

| 46,436 | | |

| 6,365 | |

| Loss before Income Tax and Share of Net Loss of Equity Investees | |

| (378,844 | ) | |

| (192,480 | ) | |

| (26,382 | ) | |

| (1,098,574 | ) | |

| (624,193 | ) | |

| (85,553 | ) |

| Income Tax Expense | |

| (93 | ) | |

| (568 | ) | |

| (77 | ) | |

| (405 | ) | |

| (892 | ) | |

| (122 | ) |

| Loss before Share of Net loss of Equity Investees | |

| (378,937 | ) | |

| (193,048 | ) | |

| (26,459 | ) | |

| (1,098,979 | ) | |

| (625,085 | ) | |

| (85,675 | ) |

| Net Loss from continuing operations | |

| (378,937 | ) | |

| (193,048 | ) | |

| (26,459 | ) | |

| (1,098,979 | ) | |

| (625,085 | ) | |

| (85,675 | ) |

| Net (Loss)/income from discontinued operations | |

| (8,904 | ) | |

| - | | |

| - | | |

| (6,677 | ) | |

| 15,222 | | |

| 2,086 | |

| Net Loss | |

| (387,841 | ) | |

| (193,048 | ) | |

| (26,459 | ) | |

| (1,105,656 | ) | |

| (609,863 | ) | |

| (83,589 | ) |

| Net Loss from continuing operations attributable to non-controlling interests | |

| (9,976 | ) | |

| (14,942 | ) | |

| (2,048 | ) | |

| (26,925 | ) | |

| (42,171 | ) | |

| (5,780 | ) |

| Net Loss attributable to BEST Inc. | |

| (377,865 | ) | |

| (178,106 | ) | |

| (24,411 | ) | |

| (1,078,731 | ) | |

| (567,692 | ) | |

| (77,809 | ) |

Summary of Unaudited Condensed Consolidated

Balance Sheets

(In Thousands)

| | |

As of December 31,2022 | | |

As of September 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Assets | |

| | |

| | |

| |

| Current Assets | |

| | | |

| | | |

| | |

| Cash and Cash Equivalents | |

| 533,481 | | |

| 482,817 | | |

| 66,175 | |

| Restricted Cash | |

| 399,337 | | |

| 227,113 | | |

| 31,128 | |

| Accounts and Notes Receivables | |

| 691,324 | | |

| 869,922 | | |

| 119,233 | |

| Inventories | |

| 16,480 | | |

| 10,213 | | |

| 1,400 | |

| Prepayments and Other Current Assets | |

| 777,842 | | |

| 687,850 | | |

| 94,278 | |

| Short-term Investments | |

| 725,043 | | |

| 36,377 | | |

| 4,986 | |

| Amounts Due from Related Parties | |

| 76,368 | | |

| 41,732 | | |

| 5,720 | |

| Lease Rental Receivables | |

| 43,067 | | |

| 40,326 | | |

| 5,527 | |

| Total Current Assets | |

| 3,262,942 | | |

| 2,396,350 | | |

| 328,447 | |

| Non-current Assets | |

| | | |

| | | |

| | |

| Property and Equipment, Net | |

| 784,732 | | |

| 731,424 | | |

| 100,250 | |

| Intangible Assets, Net | |

| 75,553 | | |

| 88,541 | | |

| 12,136 | |

| Long-term Investments | |

| 156,859 | | |

| 156,859 | | |

| 21,499 | |

| Goodwill | |

| 54,135 | | |

| 54,135 | | |

| 7,420 | |

| Non-current Deposits | |

| 50,767 | | |

| 42,907 | | |

| 5,881 | |

| Other Non-current Assets | |

| 75,666 | | |

| 113,360 | | |

| 15,537 | |

| Restricted Cash | |

| 1,545,605 | | |

| 1,614,553 | | |

| 221,293 | |

| Lease Rental Receivables | |

| 40,188 | | |

| 3,817 | | |

| 523 | |

| Operating Lease Right-of-use Assets | |

| 1,743,798 | | |

| 1,413,430 | | |

| 193,727 | |

| Total non-current Assets | |

| 4,527,303 | | |

| 4,219,026 | | |

| 578,266 | |

| Total Assets | |

| 7,790,245 | | |

| 6,615,376 | | |

| 906,713 | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | | |

| | |

| Long-term borrowings-current | |

| 79,148 | | |

| 19,801 | | |

| 2,714 | |

| Convertible Senior Notes held by related parties | |

| 522,744 | | |

| 538,485 | | |

| 73,806 | |

| Convertible Senior Notes held by third parties | |

| 77 | | |

| 79 | | |

| 11 | |

| Short-term Bank Loans | |

| 183,270 | | |

| 442,845 | | |

| 60,697 | |

| Accounts and Notes Payable | |

| 1,430,004 | | |

| 1,597,125 | | |

| 218,904 | |

| Income Tax Payable | |

| 1,563 | | |

| 2,538 | | |

| 348 | |

| Customer Advances and Deposits and Deferred Revenue | |

| 277,737 | | |

| 279,771 | | |

| 38,346 | |

| Accrued Expenses and Other Liabilities | |

| 1,145,654 | | |

| 1,051,736 | | |

| 144,152 | |

| Financing Lease Liabilities | |

| 11,873 | | |

| 1,267 | | |

| 174 | |

| Operating Lease Liabilities | |

| 544,262 | | |

| 538,255 | | |

| 73,774 | |

| Amounts Due to Related Parties | |

| 1,315 | | |

| 1,436 | | |

| 196 | |

| Total Current Liabilities | |

| 4,197,647 | | |

| 4,473,338 | | |

| 613,122 | |

Summary of Unaudited Condensed Consolidated

Balance Sheets (Cont’d)

(In Thousands)

| | |

As of December 31, 2022 | | |

As of September 30, 2023 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Non-current Liabilities | |

| | | |

| | | |

| | |

| Convertible senior notes held by related parties | |

| 522,744 | | |

| - | | |

| - | |

| Long-term borrowings | |

| 381 | | |

| - | | |

| - | |

| Operating Lease Liabilities | |

| 1,292,057 | | |

| 1,138 | | |

| 156 | |

| Financing Lease Liabilities | |

| 26,024 | | |

| 21,368 | | |

| 2,929 | |

| Other Non-current Liabilities | |

| 18,752 | | |

| 956,243 | | |

| 131,064 | |

| Long-term Bank Loans | |

| 928,894 | | |

| 963,976 | | |

| 132,124 | |

| Total Non-current Liabilities | |

| 2,788,852 | | |

| 1,942,725 | | |

| 266,273 | |

| Total Liabilities | |

| 6,986,499 | | |

| 6,416,063 | | |

| 879,395 | |

| Mezzanine Equity: | |

| | | |

| | | |

| | |

| Convertible Non-controlling Interests | |

| 191,865 | | |

| 191,865 | | |

| 26,297 | |

| Total mezzanine equity | |

| 191,865 | | |

| 191,865 | | |

| 26,297 | |

| Shareholders’ Equity | |

| | | |

| | | |

| | |

| Ordinary Shares | |

| 25,988 | | |

| 25,988 | | |

| 3,562 | |

| Treasury Shares | |

| - | | |

| (23,853 | ) | |

| (3,269 | ) |

| Additional Paid-In Capital | |

| 19,481,417 | | |

| 19,518,882 | | |

| 2,675,285 | |

| Accumulated Deficit | |

| (18,934,860 | ) | |

| (19,502,552 | ) | |

| (2,673,047 | ) |

| Accumulated Other Comprehensive Income | |

| 124,464 | | |

| 115,794 | | |

| 15,871 | |

| BEST Inc. Shareholders’ Equity | |

| 697,009 | | |

| 134,259 | | |

| 18,402 | |

| Non-controlling Interests | |

| (85,128 | ) | |

| (126,811 | ) | |

| (17,381 | ) |

| Total Shareholders’ Equity | |

| 611,881 | | |

| 7,448 | | |

| 1,021 | |

| Total Liabilities, Mezzanine Equity and Shareholders’ Equity | |

| 7,790,245 | | |

| 6,615,376 | | |

| 906,713 | |

Summary of Unaudited Condensed Consolidated

Statements of Cash Flows

(In Thousands)

| | |

Three Months Ended September 30, | | |

Nine Months Ended September 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| | |

RMB | | |

RMB | | |

US$ | | |

RMB | | |

RMB | | |

US$ | |

| Net cash used in continuing operating activities | |

| (250,375 | ) | |

| (234,429 | ) | |

| (32,131 | ) | |

| (809,772 | ) | |

| (555,609 | ) | |

| (76,153 | ) |

| Net cash used in discontinued operating activities | |

| (7,917 | ) | |

| - | | |

| - | | |

| (66,174 | ) | |

| - | | |

| - | |

| Net cash used in operating activities | |

| (258,292 | ) | |

| (234,429 | ) | |

| (32,131 | ) | |

| (875,946 | ) | |

| (555,609 | ) | |

| (76,153 | ) |

| Net cash generated from/(used in) from continuing investing activities | |

| 891,756 | | |

| 65,212 | | |

| 8,938 | | |

| (88,780 | ) | |

| 701,698 | | |

| 96,176 | |

| Net cash generated from/(used in) investing activities | |

| 891,756 | | |

| 65,212 | | |

| 8,938 | | |

| (88,780 | ) | |

| 701,698 | | |

| 96,176 | |

| Net cash used in from continuing financing activities | |

| (982,052 | ) | |

| (602,297 | ) | |

| (82,552 | ) | |

| (1,948,848 | ) | |

| (375,362 | ) | |

| (51,448 | ) |

| Net cash used in from financing activities | |

| (982,052 | ) | |

| (602,297 | ) | |

| (82,552 | ) | |

| (1,948,848 | ) | |

| (375,362 | ) | |

| (51,448 | ) |

| Exchange Rate Effect on Cash and Cash Equivalents, and Restricted Cash | |

| 44,482 | | |

| 27,416 | | |

| 3,758 | | |

| 92,586 | | |

| 75,333 | | |

| 10,325 | |

| Net decrease in Cash and Cash Equivalents, and Restricted Cash | |

| (304,106 | ) | |

| (744,098 | ) | |

| (101,987 | ) | |

| (2,820,988 | ) | |

| (153,940 | ) | |

| (21,099 | ) |

| Cash and Cash Equivalents, and Restricted Cash at Beginning of Period | |

| 2,799,266 | | |

| 3,068,581 | | |

| 420,584 | | |

| 5,316,148 | | |

| 2,478,423 | | |

| 339,696 | |

| Cash and Cash Equivalents, and Restricted Cash at End of Period | |

| 2,495,160 | | |

| 2,324,483 | | |

| 318,597 | | |

| 2,495,160 | | |

| 2,324,483 | | |

| 318,597 | |

| Cash and Cash Equivalents, and Restricted Cash from continuing operations at End of Period | |

| 2,495,160 | | |

| 2,324,483 | | |

| 318,597 | | |

| 2,495,160 | | |

| 2,324,483 | | |

| 318,597 | |

RECONCILIATIONS OF NON-GAAP MEASURES TO THE NEAREST COMPARABLE GAAP

MEASURES

For the Company’s continuing operations,

the table below sets forth a reconciliation of the Company’s net (loss)/income to EBITDA, adjusted EBITDA and adjusted EBITDA margin

for the periods indicated:

Table 3 – Reconciliation of EBITDA, Adjusted

EBITDA and Adjusted EBITDA Margin

| | |

Three Months Ended September 30, 2023 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated(10) | | |

Total | |

| Net Loss | |

| (37,702 | ) | |

| (477 | ) | |

| (114,597 | ) | |

| (16,993 | ) | |

| (23,279 | ) | |

| (193,048 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation & Amortization | |

| 19,330 | | |

| 8,558 | | |

| 11,278 | | |

| 283 | | |

| 4,287 | | |

| 43,736 | |

| Interest Expense | |

| - | | |

| - | | |

| - | | |

| - | | |

| 15,800 | | |

| 15,800 | |

| Income Tax Expense | |

| 2 | | |

| 1 | | |

| - | | |

| 565 | | |

| - | | |

| 568 | |

| Subtract | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

| - | | |

| - | | |

| - | | |

| - | | |

| (18,283 | ) | |

| (18,283 | ) |

| EBITDA | |

| (18,370 | ) | |

| 8,082 | | |

| (103,319 | ) | |

| (16,145 | ) | |

| (21,475 | ) | |

| (151,227 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 1,680 | | |

| 865 | | |

| 510 | | |

| 9 | | |

| 9,089 | | |

| 12,153 | |

| Adjusted EBITDA | |

| (16,690 | ) | |

| 8,947 | | |

| (102,809 | ) | |

| (16,136 | ) | |

| (12,386 | ) | |

| (139,074 | ) |

| Adjusted EBITDA Margin | |

| (1.1 | )% | |

| 1.9 | % | |

| (37.4 | )% | |

| (58.3 | )% | |

| - | | |

| (6.2 | )% |

| | |

| |

| | |

Three Months Ended September 30, 2022 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated | | |

Total | |

| Net Loss | |

| (138,749 | ) | |

| (9,664 | ) | |

| (110,426 | ) | |

| (48,601 | ) | |

| (71,497 | ) | |

| (378,937 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Depreciation & Amortization | |

| 19,417 | | |

| 8,397 | | |

| 6,531 | | |

| 1,976 | | |

| 6,025 | | |

| 42,346 | |

| Interest Expense | |

| - | | |

| - | | |

| - | | |

| - | | |

| 20,569 | | |

| 20,569 | |

| Income Tax Expense | |

| - | | |

| (22 | ) | |

| - | | |

| 115 | | |

| - | | |

| 93 | |

| Subtract | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest Income | |

| - | | |

| - | | |

| - | | |

| - | | |

| (19,981 | ) | |

| (19,981 | ) |

| EBITDA | |

| (119,332 | ) | |

| (1,289 | ) | |

| (103,895 | ) | |

| (46,510 | ) | |

| (64,884) | | |

| (335,910 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 2,511 | | |

| 1,314 | | |

| 1,354 | | |

| 23 | | |

| 10,694 | | |

| 15,896 | |

| Adjusted EBITDA | |

| (116,821 | ) | |

| 25 | | |

| (102,541 | ) | |

| (46,487 | ) | |

| (54,190 | ) | |

| (320,014 | ) |

| Adjusted EBITDA Margin | |

| (8.8 | )% | |

| 0.0 | % | |

| (48.5 | )% | |

| (152.8 | )% | |

| - | | |

| (15.8 | )% |

(10)

Unallocated expenses are primarily related to corporate administrative expenses and other miscellaneous items that are not allocated

to individual segments.

For the Company’s continuing operations,

the table below sets forth a reconciliation of the Company’s net (loss)/income to non-GAAP net Income/(loss), non-GAAP net Income/(loss)

margin for the periods indicated:

Table 4 – Reconciliation

of Non-GAAP Net (Loss)/Income and Non-GAAP Net (Loss)/Income Margin

| | |

Three Months Ended September 30, 2023 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated | | |

Total | |

| Net Loss | |

| (37,702 | ) | |

| (477 | ) | |

| (114,597 | ) | |

| (16,993 | ) | |

| (23,279 | ) | |

| (193,048 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 1,680 | | |

| 865 | | |

| 510 | | |

| 9 | | |

| 9,089 | | |

| 12,153 | |

| Non-GAAP Net (Loss)/Income | |

| (36,022 | ) | |

| 388 | | |

| (114,087 | ) | |

| (16,984 | ) | |

| (14,190 | ) | |

| (180,895 | ) |

| Non-GAAP Net (Loss)/Income Margin | |

| (2.5 | )% | |

| 0.1 | % | |

| (41.5 | )% | |

| (61.4 | )% | |

| - | | |

| (8.1 | )% |

| | |

Three Months Ended September 30, 2022 | |

| (In RMB‘000) | |

Freight | | |

Supply Chain | | |

Global | | |

Others | | |

Unallocated | | |

Total | |

| Net Loss | |

| (138,749 | ) | |

| (9,664 | ) | |

| (110,426 | ) | |

| (48,601 | ) | |

| (71,497 | ) | |

| (378,937 | ) |

| Add | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 2,511 | | |

| 1,314 | | |

| 1,354 | | |

| 23 | | |

| 10,694 | | |

| 15,896 | |

| Non-GAAP Net Loss | |

| (136,238 | ) | |

| (8,350 | ) | |

| (109,072 | ) | |

| (48,578 | ) | |

| (60,803 | ) | |

| (363,041 | ) |

| Non-GAAP Net Loss Margin | |

| (10.3 | )% | |

| (1.8 | )% | |

| (51.6 | )% | |

| (159.7 | )% | |

| - | | |

| (17.9 | )% |

For the Company’s continuing operations,

the table below sets forth a reconciliation of the Company’s diluted loss per ADS to Non-GAAP diluted loss per ADS for the periods

indicated:

Table 5 – Reconciliation of diluted loss

per ADS and Non-GAAP diluted loss per ADS

| | |

Three Months Ended September

30, | | |

Nine Months Ended September

30, | |

| | |

2023 | | |

2023 | |

| (In ‘000) | |

RMB | | |

US$ | | |

RMB | | |

US$ | |

| Net Loss Attributable to Ordinary Shareholders | |

| (178,106 | ) | |

| (24,411 | ) | |

| (582,914 | ) | |

| (79,895 | ) |

| Add | |

| | | |

| | | |

| | | |

| | |

| Share-based Compensation Expenses | |

| 12,153 | | |

| 1,666 | | |

| 37,419 | | |

| 5,129 | |

| Non-GAAP Net Loss Attributable to Ordinary Shareholders | |

| (165,953 | ) | |

| (22,746 | ) | |

| (545,495 | ) | |

| (74,766 | ) |

| Weighted Average Diluted Ordinary Shares Outstanding During the Quarter | |

| | | |

| | | |

| | | |

| | |

| Diluted | |

| 376,632,651 | | |

| 376,632,651 | | |

| 385,954,907 | | |

| 385,954,907 | |

| Diluted (Non-GAAP) | |

| 376,632,651 | | |

| 376,632,651 | | |

| 385,954,907 | | |

| 385,954,907 | |

| Diluted loss per ordinary share | |

| (0.47 | ) | |

| (0.06 | ) | |

| (1.51 | ) | |

| (0.21 | ) |

| Add | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjustment to net loss per ordinary share | |

| 0.03 | | |

| 0.00 | | |

| 0.10 | | |

| 0.02 | |

| Non-GAAP diluted loss per ordinary share | |

| (0.44 | ) | |

| (0.06 | ) | |

| (1.41 | ) | |

| (0.19 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Diluted loss per ADS | |

| (9.46 | ) | |

| (1.30 | ) | |

| (30.21 | ) | |

| (4.14 | ) |

| Add | |

| | | |

| | | |

| | | |

| | |

| Non-GAAP adjustment to net loss per ADS | |

| 0.65 | | |

| 0.09 | | |

| 1.94 | | |

| 0.27 | |

| Non-GAAP diluted loss per ADS | |

| (8.81 | ) | |

| (1.21 | ) | |

| (28.27 | ) | |

| (3.87 | ) |

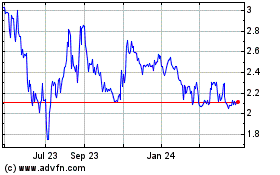

BEST (NYSE:BEST)

Historical Stock Chart

From Mar 2024 to Apr 2024

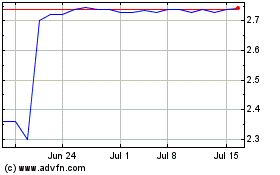

BEST (NYSE:BEST)

Historical Stock Chart

From Apr 2023 to Apr 2024