0000934549FALSE00009345492023-11-092023-11-1300009345492023-08-032023-08-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 9, 2023

ACACIA RESEARCH CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-37721 | 95-4405754 |

(State or other jurisdiction of

incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | |

| 767 Third Avenue, | |

| 6th Floor | |

| New York, | |

| NY | 10017

|

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code): (332) 236-8500

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | ACTG | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02.Results of Operations and Financial Condition.

On November 13, 2023, Acacia Research Corporation (the “Corporation) issued a press release announcing its financial results for the quarter ended September 30, 2023. A copy of that release is furnished as Exhibit 99.1 to this Current Report on Form 8-K (this “Report”).

The information contained within this Report and the exhibit attached hereto as Exhibit 99.1 are being furnished pursuant to Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section. The information in this Report and the exhibit attached hereto as Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, regardless of any general incorporation by reference language in such filings, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events

On November 9, 2023, the Board of Directors (the “Board”) of Acacia Research Corporation (the “Company”) approved a stock repurchase program authorizing the Company to purchase up to an aggregate of $20 million of the Company’s common stock subject, to a cap of 5,800,000 shares of common stock. The repurchase authorization has no time limit and does not require the repurchase of a minimum number of shares. The common stock may be repurchased on the open market, in block trades, or in privately negotiated transactions, including under plans complying with the provisions of Rule 10b5-1 and Rule 10b-18 of the Exchange Act.

Item 9.01.Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: November 13, 2023 | |

| ACACIA RESEARCH CORPORATION |

| |

| By: | /s/ Martin D. McNulty Jr. |

| Name: | Martin D. McNulty Jr. |

| Title: | Interim Chief Executive Officer |

Exhibit 99.1

Acacia Research Reports Third Quarter 2023 Financial Results

New York, NY, November 13, 2023 - Acacia Research Corporation (Nasdaq: ACTG) (“Acacia” or the “Company”) today reported financial results for the three and nine months ended September 30, 2023.

Key Business Highlights

•Generated $10.1 million in consolidated revenue for the quarter compared to $15.9 million in revenue in the third quarter of 2022.

•Recorded $12.2 million of net realized and unrealized gains during the quarter.

•Subsequent to the end of the quarter, a wholly owned subsidiary of Acacia entered into an agreement to sell its shares of Arix Bioscience PLC for a cash purchase price of $57.1 million (which represents a purchase price of 1.43 British pound per share, based on the exchange rate on the date that the parties agreed to the purchase price), conditioned solely upon the prospective buyer receiving the necessary approval from the United Kingdom’s Financial Conduct Authority. Such share purchase is expected to be completed in the first quarter of 2024.

•On November 13, 2023, Acacia acquired a majority stake in Benchmark Energy II LLC, an independent oil and gas company engaged in the acquisition, production and development of oil and gas assets in mature resource plays in Texas and Oklahoma. Acacia has made a control investment in Benchmark and intends to utilize Acacia’s significant capital base to support future growth through acquisitions of producing oil and gas assets at attractive valuations.

•On November 9, 2023, Company’s Board of Directors approved a stock repurchase program authorizing the Company to purchase up to an aggregate of $20 million of the Company’s common stock, subject to a cap of 5,800,000 shares of common stock. The repurchase authorization has no time limit and does not require the repurchase of a minimum number of shares.

Third Quarter 2023 Financial Highlights

(In millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (unaudited) | | (unaudited) |

| Intellectual property operations | $ | 1.8 | | | $ | 6.3 | | | $ | 6.3 | | | $ | 17.0 | |

| Industrial operations | 8.3 | | | 9.6 | | | 26.5 | | | 29.1 | |

| Total revenues | $ | 10.1 | | | $ | 15.9 | | | $ | 32.8 | | | $ | 46.1 | |

| Operating loss | $ | (15.4) | | | $ | (11.4) | | | $ | (37.3) | | | $ | (25.5) | |

Unrealized gains (losses) 1 | $ | 8.8 | | | $ | (36.4) | | | $ | 18.8 | | | $ | (266.2) | |

| Realized gains (losses) | $ | — | | | $ | 36.1 | | | $ | (9.4) | | | $ | 114.4 | |

Non-cash derivative liability gains 2 | $ | 1.5 | | | $ | 41.6 | | | $ | 8.2 | | | $ | 34.6 | |

| GAAP Net income (loss) | $ | 1.6 | | | $ | 28.1 | | | $ | (7.7) | | | $ | (106.7) | |

| GAAP Diluted (loss) income per share | $ | (0.03) | | | $ | 0.02 | | | $ | (0.23) | | | $ | (2.63) | |

| | | | | | | |

1 Unrealized gains and (losses) are related to the change in fair value of equity securities as of the end of the reported period. |

2 The non-cash derivative liability gains and (losses) are related to the change in fair value of Acacia’s Series A and B warrants and embedded derivatives and gains and (losses) from the exercise of warrants. |

Martin D. McNulty, Jr. “MJ”, Interim Chief Executive Officer, stated, “In the last few weeks, our value-creation strategy has accelerated. We established a platform, in collaboration with accomplished executives we have worked with in the past,

to acquire producing, cash generating oil and gas assets at what we believe will be favorable valuations. Acacia and our new partners are already evaluating potential asset acquisitions to take advantage of this new structure. Simultaneously, we reached an agreement to sell our stake in the last public holding in our life science portfolio, allowing us to recognize a meaningful profit on the trade once complete and further bolstering our capital position.”

“Our pipeline of acquisition targets continues to grow, mature, and advance,” continued Mr. McNulty. “We are methodically advancing specific opportunities, including both public and private targets. With the right processes in place and a growing number of opportunities, I am confident that 2024 will be a year of tangible progress.”

Third Quarter 2023 Financial Summary:

•Total revenues were $10.1 million, compared to $15.9 million in the same quarter last year.

◦Printronix generated $8.3 million in revenue during the quarter, compared to $9.6 million in the same quarter last year.

◦The Intellectual Property business generated $1.8 million in licensing and other revenue during the quarter, compared to $6.3 million in the same quarter last year.

•General and administrative expenses were $13.9 million, compared to $15.0 million in the same quarter of last year, with the decrease due to the decrease in personnel costs and compensation costs related to reduced headcount.

•Operating loss of $15.4 million, compared to $11.4 million in the same quarter of last year, with the increase due to lower revenues generated.

◦Printronix contributed $163,000 in operating income which included $730,000 of non-cash depreciation and amortization expense.

•GAAP net income of $1.6 million, or a net loss of $0.03 per diluted share, compared to GAAP net income of $28.1 million, or $0.02 per diluted share, in the third quarter of last year. Diluted earnings per share adjusts the numerator used in the basic earnings per share computation for the return on settlement of Series A redeemable convertible preferred stock, resulting in a diluted net loss attributable to common stockholders for the 2023 period.

◦Net income included $8.8 million in unrealized gains related to the increase in share price of certain holdings.

◦The Company recognized non-cash income of $1.5 million related to the gain on exercise of Series B warrants.

◦The third quarter included $6.0 million in non-recurring charges related to severance, legal and other professional fees associated with the separation from our former CEO, and other non-recurring charges.

Life Sciences Portfolio

Acacia has generated $506.5 million in proceeds from sales and royalties of the Life Sciences Portfolio through September 30, 2023, which was purchased for an aggregate price of $301.4 million. At the end of the third quarter, the remaining positions in the Life Sciences Portfolio represent $76.1 million in book value, inclusive of Arix:

•At quarter end, a wholly owned subsidiary of Acacia held 33.0 million shares of Arix Bioscience plc (LSE: ARIX), valued at $50.4 million. Subsequently, on November 1, 2023, such wholly owned subsidiary of the Company entered into an agreement with RTW Biotech Opportunities Ltd. ("RTW Bio") to sell its shares of Arix to RTW Bio for a purchase price of $57.1 million (which represents a purchase price of 1.43 British pound per share, based on the exchange rate on the date that the parties agreed to the purchase price), conditioned solely upon RTW Bio receiving the necessary approval from the United Kingdom’s Financial Conduct Authority. Per the terms of the share purchase agreement, the transaction contemplated thereby will close following the satisfaction of this condition; provided, that, if the condition is not satisfied by March 31, 2024 (as well as upon other termination triggers as set forth in such agreement), the such agreement will terminate.

•Acacia holds interests in three private companies, valued at an aggregate of $25.7 million, net of non-controlling interest, including a 26% interest in Viamet Pharmaceuticals, Inc., a 18% interest in AMO Pharma, and a 4% interest in NovaBiotics. Values are based on cost or equity accounting.

Balance Sheet and Capital Structure

•Cash, cash equivalents and equity investments measured at fair value totaled $409.2 million at September 30, 2023 compared to $349.4 million at December 31, 2022. The increase in cash was primarily due to the completed Rights Offering and concurrent Private Rights Offering and the proceeds from the exercise of the Series B warrants.

•Equity securities without readily determinable fair value totaled $5.8 million at September 30, 2023, which amount was unchanged from December 31, 2022.

•Investment securities representing equity method investments totaled $19.9 million at September 30, 2023 (net of noncontrolling interests), which amount was unchanged from December 31, 2022. Acacia owns 64% of MalinJ1, which results in a 26% ownership stake in Viamet Pharmaceuticals, Inc. for Acacia.

•Total indebtedness was zero at September 30, 2023 following the conversion of the Senior Secured Notes issued to Starboard.

•The Company’s book value totaled $503.6 million, or $5.04 per share, at September 30, 2023. Acacia’s book value reflects the exercise of the warrant and conversion of the preferred stocks which occurred on July 13, 2023 as part of the recapitalization transaction.

Book Value as of September 30, 2023

At September 30, 2023, book value was $503.6 million and there were 99.9 million shares of common stock outstanding, for a book value per share of $5.04.

Book value and book value per share calculations are performed in accordance with GAAP. The calculation of book value under GAAP requires the Company to reflect the impact of liabilities associated with issuances of shares related to the exercise of the Company’s Series B warrants and conversion of the Company’s Series A preferred stock. The value of those liabilities varies over time based on fluctuations in the trading price of the Common Stock. The recapitalization transaction with Starboard which occurred on July 13, 2023 streamlines the Company’s capital structure and strengthens its financial position (the “recapitalization transactions”) and eliminated all of these instruments and the associated liabilities.

In connection with the recently completed recapitalization transactions with Starboard, which occurred on July 13, 2023:

•In the first quarter of 2023, Starboard purchased 15.0 million new shares in a private Rights Offering, at $5.25 per share, for total proceeds of $78.8 million;

•In the third quarter of 2023, $35.0 million in face value of Series A preferred stock was eliminated, and 9.6 million shares of common stock were issued;

•In the third quarter of 2023, $60.0 million of liabilities attributable to the Senior Secured Notes were converted into equity, and Starboard invested an additional $55.0 million in cash related to the Series B warrant exercise, and received 31.5 million shares of common stock;

•In the third quarter of 2023, total warrant and embedded derivative liabilities attributable to the Series B warrants and Series A preferred stock were eliminated; and

•In the third quarter of 2023, Acacia paid Starboard a total of $66.0 million, representing a negotiated settlement of the foregone time value of the Series B warrants and the Series A preferred stock (which amount was paid through a reduction in the exercise price of the Series B Warrants).

•As a result of the recapitalization transactions, Starboard held 61,123,595 shares of common stock as of July 13, 2023, representing approximately 61.2% of the common stock based on 99,886,322 shares of common stock issued and outstanding as of such date and no shares of Series A Redeemable Convertible Preferred Stock, no Series B Warrants, nor any Senior Secured Notes remain outstanding.

Investor Conference Call

The Company will host a conference call today, November 13, 2023 at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time).

To access the live call, please dial 888-506-0062 (U.S. and Canada) or 973-528-0011 (international) and if requested, reference conference ID 435061. The conference call will also be simultaneously webcasted on the investor relations section of the Company’s website at http://www.acaciaresearch.com under Events & Presentations. Following the conclusion of the live call, a replay of the webcast will be available on the Company's website for at least 30 days.

About the Company

Acacia is a publicly traded (Nasdaq: ACTG) company that is focused on acquiring and operating attractive businesses across the industrial, healthcare, energy, and mature technology sectors where it believes it can leverage its expertise, significant capital base, and deep industry relationships to drive value. Acacia evaluates opportunities based on the attractiveness of the underlying cash flows, without regard to a specific investment horizon. Acacia operates its businesses based on three key principles of people, process and performance and has built a management team with demonstrated

expertise in research, transactions and execution, and operations and management. Additional information about Acacia and its subsidiaries is available at www.acaciaresearch.com.

Safe Harbor Statement

This news release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon the Company’s current expectations and speak only as of the date hereof. This news release attempts to identify forward-looking statements by using words such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will,” or other forms of these words or similar words or expressions or the negative thereof, although not all forward-looking statements contain these terms. The Company’s actual results may differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors and uncertainties, including the Company’s ability to successfully implement its strategic plan, changes to the Company’s relationship and arrangements with Starboard Value LP, the Company’s ability to successfully identify and complete strategic acquisitions of businesses, divisions, and/or assets, the performance of businesses, divisions, and/or assets the Company acquires, the ability to successfully develop licensing programs and attract new business, changes in demand for current and future intellectual property rights, legislative, regulatory and competitive developments addressing licensing and enforcement of patents and/or intellectual property in general, the decrease in demand for Printronix' products, general economic conditions, and the success of the Company’s investments. The Company’s Annual Report on Form 10-K, and other SEC filings discuss these and other important risks and uncertainties that may materially affect the Company’s business, results of operations and financial condition. In addition, actual results may differ as a result of additional risks and uncertainties of which the Company is currently unaware or which the Company does not currently view as material. Except as otherwise required by applicable law, the Company undertakes no obligation to revise or update publicly any forward-looking statements for any reason.

The results achieved by the Company in prior periods are not necessarily indicative of the results to be achieved by us in any subsequent periods. It is currently anticipated that the Company’s financial results will vary, and may vary significantly, from quarter to quarter.

Investor Contact:

FNK IR

Rob Fink, 646-809-4048

rob@fnkir.com

ACACIA RESEARCH CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | | | | | | | |

| |

| September 30, 2023 | | December 31, 2022 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 344,733 | | | $ | 287,786 | |

| Equity securities | 64,511 | | | 61,608 | |

| Equity securities without readily determinable fair value | 5,816 | | | 5,816 | |

| Equity method investments | 30,934 | | | 30,934 | |

| | | |

| Accounts receivable, net | 5,896 | | | 8,231 | |

| Inventories | 12,375 | | | 14,222 | |

| Prepaid expenses and other current assets | 20,182 | | | 19,388 | |

| Total current assets | 484,447 | | | 427,985 | |

| | | |

| | | |

| Property, plant and equipment, net | 2,647 | | | 3,537 | |

| Goodwill | 7,541 | | | 7,541 | |

| | | |

| Other intangible assets, net | 27,557 | | | 36,658 | |

| | | |

| Leased right-of-use assets | 1,488 | | | 2,005 | |

| Deferred income tax assets, net | 321 | | | — | |

| Other non-current assets | 5,146 | | | 5,202 | |

| Total assets | $ | 529,147 | | | $ | 482,928 | |

| | | |

| LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK, AND STOCKHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 8,530 | | | $ | 6,036 | |

| Accrued expenses and other current liabilities | 5,256 | | | 14,058 | |

| Accrued compensation | 5,202 | | | 4,737 | |

| Royalties and contingent legal fees payable | 1,296 | | | 699 | |

| | | |

| Deferred revenue | 1,149 | | | 1,229 | |

| Senior secured notes payable | — | | | 60,450 | |

| Total current liabilities | 21,433 | | | 87,209 | |

| | | |

| Deferred revenue, net of current portion | 497 | | | 568 | |

| | | |

| Series A embedded derivative liabilities | — | | | 16,835 | |

| Series B warrant liabilities | — | | | 84,780 | |

| Long-term lease liabilities | 1,535 | | | 1,873 | |

| Deferred income tax liabilities, net | — | | | 742 | |

| Other long-term liabilities | 2,084 | | | 1,675 | |

| Total liabilities | 25,549 | | | 193,682 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Series A redeemable convertible preferred stock, par value $0.001 per share; stated value $100 per share; zero and 350,000 shares authorized, issued and outstanding as of September 30, 2023 and December 31, 2022, respectively; aggregate liquidation preference of zero and $35,000 as of September 30, 2023 and December 31, 2022, respectively | — | | | 19,924 | |

| | | |

| Stockholders' equity: | | | |

| Preferred stock, par value $0.001 per share; 10,000,000 shares authorized; no shares issued or outstanding | — | | | — | |

| Common stock, par value $0.001 per share; 300,000,000 shares authorized; 99,886,322 and 43,484,867 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | 99 | | | 43 | |

| Treasury stock, at cost, 16,183,703 shares as of September 30, 2023 and December 31, 2022 | (98,258) | | | (98,258) | |

| Additional paid-in capital | 905,200 | | | 663,284 | |

| Accumulated deficit | (314,485) | | | (306,789) | |

| Total Acacia Research Corporation stockholders' equity | 492,556 | | | 258,280 | |

| | | |

| Noncontrolling interests | 11,042 | | | 11,042 | |

| | | |

| Total stockholders' equity | 503,598 | | | 269,322 | |

| | | |

| Total liabilities, redeemable convertible preferred stock, and stockholders' equity | $ | 529,147 | | | $ | 482,928 | |

ACACIA RESEARCH CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| Revenues: | | | | | | | |

| Intellectual property operations | $ | 1,760 | | | $ | 6,320 | | | $ | 6,330 | | | $ | 16,997 | |

| Industrial operations | 8,324 | | | 9,558 | | | 26,461 | | | 29,105 | |

| Total revenues | 10,084 | | | 15,878 | | | 32,791 | | | 46,102 | |

| | | | | | | |

| Costs and expenses: | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of revenues - intellectual property operations | 5,470 | | | 5,282 | | | 15,218 | | | 14,480 | |

| Cost of revenues - industrial operations | 4,377 | | | 4,648 | | | 13,530 | | | 13,432 | |

| Engineering and development expenses - industrial operations | 172 | | | 156 | | | 593 | | | 491 | |

| Sales and marketing expenses - industrial operations | 1,613 | | | 2,119 | | | 5,385 | | | 6,429 | |

| General and administrative expenses | 13,872 | | | 15,038 | | | 35,338 | | | 36,813 | |

| Total costs and expenses | 25,504 | | | 27,243 | | | 70,064 | | | 71,645 | |

| Operating loss | (15,420) | | | (11,365) | | | (37,273) | | | (25,543) | |

| | | | | | | |

| Other income (expense): | | | | | | | |

| Equity securities investments: | | | | | | | |

| Change in fair value of equity securities | 8,823 | | | (36,352) | | | 18,783 | | | (266,202) | |

| (Loss) gain on sale of equity securities | — | | | 36,060 | | | (9,360) | | | 114,434 | |

| Earnings on equity investment in joint venture | 3,375 | | | 850 | | | 3,375 | | | 42,935 | |

| Net realized and unrealized gain (loss) | 12,198 | | | 558 | | | 12,798 | | | (108,833) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Change in fair value of the Series A and B warrants and embedded derivatives | 1,525 | | | 41,638 | | | 8,241 | | | 34,590 | |

| (Loss) gain on foreign currency exchange | (70) | | | (1,905) | | | 25 | | | (4,532) | |

| Interest expense on Senior Secured Notes | (130) | | | (1,072) | | | (1,930) | | | (5,532) | |

| Interest income and other, net | 4,462 | | | 1,221 | | | 12,210 | | | 3,091 | |

| Total other income (expense) | 17,985 | | | 40,440 | | | 31,344 | | | (81,216) | |

| | | | | | | |

| Income (loss) before income taxes | 2,565 | | | 29,075 | | | (5,929) | | | (106,759) | |

| | | | | | | |

| Income tax benefit (expense) | 197 | | | (679) | | | (641) | | | 14,399 | |

| | | | | | | |

| Net income (loss) including noncontrolling interests in subsidiaries | 2,762 | | | 28,396 | | | (6,570) | | | (92,360) | |

| | | | | | | |

| Net income attributable to noncontrolling interests in subsidiaries | (1,126) | | | (306) | | | (1,126) | | | (14,319) | |

| | | | | | | |

| Net income (loss) attributable to Acacia Research Corporation | $ | 1,636 | | | $ | 28,090 | | | $ | (7,696) | | | $ | (106,679) | |

| | | | | | | |

| (Loss) income per share: | | | | | | | |

| Net (loss) income attributable to common stockholders - Basic | $ | (1,740) | | | $ | 20,587 | | | $ | (15,703) | | | $ | (112,507) | |

| Weighted average number of shares outstanding - Basic | 94,328,452 | | | 38,052,426 | | | 67,072,835 | | | 42,830,700 | |

| Basic net (loss) income per common share | $ | (0.02) | | | $ | 0.54 | | | $ | (0.23) | | | $ | (2.63) | |

| Net (loss) income attributable to common stockholders - Diluted | $ | (3,163) | | | $ | 1,531 | | | $ | (15,703) | | | $ | (112,507) | |

| Weighted average number of shares outstanding - Diluted | 99,122,973 | | | 71,164,236 | | | 67,072,835 | | | 42,830,700 | |

| Diluted net (loss) income per common share | $ | (0.03) | | | $ | 0.02 | | | $ | (0.23) | | | $ | (2.63) | |

Cover

|

Nov. 13, 2023 |

Aug. 03, 2023 |

| Cover [Abstract] |

|

|

| Document Type |

8-K

|

|

| Document Period End Date |

Nov. 09, 2023

|

|

| Entity Registrant Name |

ACACIA RESEARCH CORPORATION

|

|

| Entity Incorporation, State or Country Code |

DE

|

|

| Entity File Number |

001-37721

|

|

| Entity Tax Identification Number |

95-4405754

|

|

| Entity Address, Address Line One |

767 Third Avenue,

|

|

| Entity Address, Address Line Two |

6th Floor

|

|

| Entity Address, City or Town |

New York,

|

|

| Entity Address, State or Province |

NY

|

|

| Entity Address, Postal Zip Code |

10017

|

|

| City Area Code |

|

332

|

| Local Phone Number |

|

236-8500

|

| Written Communications |

false

|

|

| Soliciting Material |

true

|

|

| Pre-commencement Tender Offer |

false

|

|

| Pre-commencement Issuer Tender Offer |

false

|

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

|

| Trading Symbol |

ACTG

|

|

| Security Exchange Name |

NASDAQ

|

|

| Entity Emerging Growth Company |

false

|

|

| Entity Central Index Key |

0000934549

|

|

| Amendment Flag |

false

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

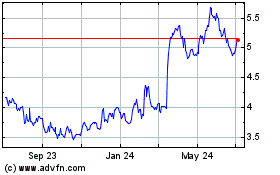

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

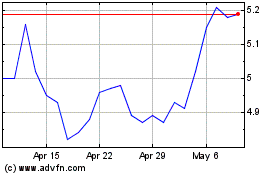

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024