false

--03-31

2024

Q2

0001367083

0001367083

2023-04-01

2023-09-30

0001367083

2023-11-09

0001367083

2023-09-30

0001367083

2023-03-31

0001367083

us-gaap:ConvertiblePreferredStockMember

2023-09-30

0001367083

us-gaap:ConvertiblePreferredStockMember

2023-03-31

0001367083

2023-07-01

2023-09-30

0001367083

2022-07-01

2022-09-30

0001367083

2022-04-01

2022-09-30

0001367083

2022-03-31

0001367083

2022-09-30

0001367083

us-gaap:CommonStockMember

2023-03-31

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-03-31

0001367083

us-gaap:RetainedEarningsMember

2023-03-31

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-03-31

0001367083

us-gaap:CommonStockMember

2023-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-06-30

0001367083

us-gaap:RetainedEarningsMember

2023-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-06-30

0001367083

2023-06-30

0001367083

us-gaap:CommonStockMember

2022-03-31

0001367083

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001367083

us-gaap:RetainedEarningsMember

2022-03-31

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-03-31

0001367083

us-gaap:CommonStockMember

2022-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2022-06-30

0001367083

us-gaap:RetainedEarningsMember

2022-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-06-30

0001367083

2022-06-30

0001367083

us-gaap:CommonStockMember

2023-04-01

2023-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-04-01

2023-06-30

0001367083

us-gaap:RetainedEarningsMember

2023-04-01

2023-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-04-01

2023-06-30

0001367083

2023-04-01

2023-06-30

0001367083

us-gaap:CommonStockMember

2023-07-01

2023-09-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-07-01

2023-09-30

0001367083

us-gaap:RetainedEarningsMember

2023-07-01

2023-09-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-07-01

2023-09-30

0001367083

us-gaap:CommonStockMember

2022-04-01

2022-06-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2022-04-01

2022-06-30

0001367083

us-gaap:RetainedEarningsMember

2022-04-01

2022-06-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-04-01

2022-06-30

0001367083

2022-04-01

2022-06-30

0001367083

us-gaap:CommonStockMember

2022-07-01

2022-09-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2022-07-01

2022-09-30

0001367083

us-gaap:RetainedEarningsMember

2022-07-01

2022-09-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-07-01

2022-09-30

0001367083

us-gaap:CommonStockMember

2023-09-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2023-09-30

0001367083

us-gaap:RetainedEarningsMember

2023-09-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2023-09-30

0001367083

us-gaap:CommonStockMember

2022-09-30

0001367083

us-gaap:AdditionalPaidInCapitalMember

2022-09-30

0001367083

us-gaap:RetainedEarningsMember

2022-09-30

0001367083

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2022-09-30

0001367083

us-gaap:StockOptionMember

2023-07-01

2023-09-30

0001367083

us-gaap:StockOptionMember

2022-07-01

2022-09-30

0001367083

us-gaap:StockOptionMember

2023-04-01

2023-09-30

0001367083

us-gaap:StockOptionMember

2022-04-01

2022-09-30

0001367083

us-gaap:WarrantMember

2023-07-01

2023-09-30

0001367083

us-gaap:WarrantMember

2022-07-01

2022-09-30

0001367083

us-gaap:WarrantMember

2023-04-01

2023-09-30

0001367083

us-gaap:WarrantMember

2022-04-01

2022-09-30

0001367083

SNOA:CommonStockUnitsMember

2023-07-01

2023-09-30

0001367083

SNOA:CommonStockUnitsMember

2022-07-01

2022-09-30

0001367083

SNOA:CommonStockUnitsMember

2023-04-01

2023-09-30

0001367083

SNOA:CommonStockUnitsMember

2022-04-01

2022-09-30

0001367083

SNOA:Ms.TromblyMember

2023-06-16

0001367083

SNOA:Mr.ThorntonMember

2023-06-16

0001367083

SNOA:Ms.TromblyMember

2023-06-15

2023-06-16

0001367083

SNOA:Mr.ThorntonMember

2023-06-15

2023-06-16

0001367083

SNOA:Ms.TromblyMember

2023-04-01

2023-09-30

0001367083

SNOA:Mr.ThorntonMember

2023-04-01

2023-09-30

0001367083

SNOA:FinancingofInsurancePremiumsMember

2022-02-01

0001367083

SNOA:FinancingofInsurancePremiumsMember

2022-01-31

2022-02-01

0001367083

SNOA:FinancingofInsurancePremiumsMember

2023-02-01

0001367083

SNOA:FinancingofInsurancePremiumsMember

2023-01-31

2023-02-01

0001367083

us-gaap:StockOptionMember

2023-09-30

0001367083

us-gaap:StockOptionMember

2023-04-01

2023-09-30

0001367083

us-gaap:StockOptionMember

2023-03-31

0001367083

us-gaap:RestrictedStockMember

2023-03-31

0001367083

us-gaap:RestrictedStockMember

2023-04-01

2023-09-30

0001367083

us-gaap:RestrictedStockMember

2023-09-30

0001367083

SNOA:HumanCareMember

us-gaap:ProductMember

2023-07-01

2023-09-30

0001367083

SNOA:HumanCareMember

us-gaap:ProductMember

2022-07-01

2022-09-30

0001367083

SNOA:HumanCareMember

us-gaap:ProductMember

2023-04-01

2023-09-30

0001367083

SNOA:HumanCareMember

us-gaap:ProductMember

2022-04-01

2022-09-30

0001367083

SNOA:AnimalCareMember

us-gaap:ProductMember

2023-07-01

2023-09-30

0001367083

SNOA:AnimalCareMember

us-gaap:ProductMember

2022-07-01

2022-09-30

0001367083

SNOA:AnimalCareMember

us-gaap:ProductMember

2023-04-01

2023-09-30

0001367083

SNOA:AnimalCareMember

us-gaap:ProductMember

2022-04-01

2022-09-30

0001367083

SNOA:ServiceAndRoyaltyMember

us-gaap:ServiceMember

2023-07-01

2023-09-30

0001367083

SNOA:ServiceAndRoyaltyMember

us-gaap:ServiceMember

2022-07-01

2022-09-30

0001367083

SNOA:ServiceAndRoyaltyMember

us-gaap:ServiceMember

2023-04-01

2023-09-30

0001367083

SNOA:ServiceAndRoyaltyMember

us-gaap:ServiceMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

country:US

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

country:US

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

country:US

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

country:US

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:EuropeMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:EuropeMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:EuropeMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:EuropeMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:AsiaMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:AsiaMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:AsiaMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:AsiaMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:LatinAmericaMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:LatinAmericaMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:LatinAmericaMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

srt:LatinAmericaMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

SNOA:RestOfTheWorldMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

SNOA:RestOfTheWorldMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

SNOA:RestOfTheWorldMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueSegmentMember

SNOA:RestOfTheWorldMember

2022-04-01

2022-09-30

0001367083

SNOA:RestOfWorldToAsiaMember

2022-07-01

2022-09-30

0001367083

SNOA:RestOfWorldToAsiaMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerCMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerAMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerBMember

2023-07-01

2023-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerAMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerCMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerBMember

2022-07-01

2022-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerCMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerBMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerAMember

2023-04-01

2023-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerBMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerAMember

2022-04-01

2022-09-30

0001367083

us-gaap:SalesRevenueNetMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerCMember

2022-04-01

2022-09-30

0001367083

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerDMember

2023-04-01

2023-09-30

0001367083

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerCMember

2023-04-01

2023-09-30

0001367083

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerAMember

2023-04-01

2023-09-30

0001367083

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerAMember

2022-04-01

2022-09-30

0001367083

us-gaap:AccountsReceivableMember

us-gaap:CustomerConcentrationRiskMember

SNOA:CustomerDMember

2022-04-01

2022-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30,

2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to

______________

Commission file number: 001-33216

SONOMA PHARMACEUTICALS, INC.

(Name of registrant as specified in its charter)

| Delaware |

68-0423298 |

| (State or other jurisdiction of Incorporation or Organization) |

(I.R.S. Employer identification No.) |

| 5445 Conestoga Court, Suite 150, Boulder, CO |

80301 |

| (Address of principal executive offices) |

(Zip Code) |

(800) 759-9305

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address and former fiscal

year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| Common Stock, $0.0001 par value |

SNOA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No

☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth

company” in Rule 12b-2 of the Exchange Act:

| Large accelerated Filer ☐ |

Accelerated Filer ☐ |

| Non-accelerated Filer ☒ |

Smaller reporting company ☒ |

| Emerging Growth Company ☐ |

|

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock,

par value $0.0001 per share, as of November 9, 2023 was 13,679,333.

SONOMA PHARMACEUTICALS, INC.

Index

PART I - FINANCIAL INFORMATION

| Item 1. |

Financial Statements |

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

| | |

| | |

| |

| | |

September 30, 2023 | | |

March 31, 2023 | |

| | |

(Unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,137 | | |

$ | 3,820 | |

| Accounts receivable, net | |

| 2,223 | | |

| 2,572 | |

| Inventories, net | |

| 2,513 | | |

| 2,858 | |

| Prepaid expenses and other current assets | |

| 4,395 | | |

| 4,308 | |

| Current portion of deferred consideration, net of discount | |

| 248 | | |

| 240 | |

| Total current assets | |

| 11,516 | | |

| 13,798 | |

| Property and equipment, net | |

| 433 | | |

| 488 | |

| Operating lease, right of use assets | |

| 350 | | |

| 418 | |

| Deferred tax asset | |

| 840 | | |

| 949 | |

| Deferred consideration, net of discount, less current portion | |

| 421 | | |

| 505 | |

| Other assets | |

| 75 | | |

| 73 | |

| Total assets | |

$ | 13,635 | | |

$ | 16,231 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 987 | | |

$ | 841 | |

| Accrued expenses and other current liabilities | |

| 1,702 | | |

| 2,029 | |

| Deferred revenue | |

| 101 | | |

| 100 | |

| Deferred revenue Invekra | |

| 61 | | |

| 60 | |

| Short-term debt | |

| 172 | | |

| 431 | |

| Operating lease liabilities | |

| 216 | | |

| 256 | |

| Total current liabilities | |

| 3,239 | | |

| 3,717 | |

| Long-term deferred revenue Invekra | |

| 114 | | |

| 140 | |

| Withholding tax payable | |

| 4,473 | | |

| 4,235 | |

| Operating lease liabilities, less current portion | |

| 134 | | |

| 162 | |

| Total liabilities | |

| 7,960 | | |

| 8,254 | |

| Commitments and Contingencies (Note 5) | |

| – | | |

| – | |

| Stockholders’ Equity | |

| | | |

| | |

| Convertible preferred stock, $0.0001 par value; 714,286 shares authorized at September 30, 2023 and March 31, 2023, respectively, no shares issued and outstanding at September 30, 2023 and March 31, 2023, respectively | |

| – | | |

| – | |

| Common stock, $0.0001 par value; 24,000,000 shares authorized at September 30, 2023 and March 31, 2023, respectively, 5,179,333 and 4,933,550 shares issued and outstanding at September 30, 2023 and March 31, 2023, respectively (Note 7) | |

| 1 | | |

| 5 | |

| Additional paid-in capital | |

| 201,210 | | |

| 200,904 | |

| Accumulated deficit | |

| (192,416 | ) | |

| (189,514 | ) |

| Accumulated other comprehensive loss | |

| (3,120 | ) | |

| (3,418 | ) |

| Total stockholders’ equity | |

| 5,675 | | |

| 7,977 | |

| Total liabilities and stockholders’ equity | |

$ | 13,635 | | |

$ | 16,231 | |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive

Loss

(In thousands, except per share amounts)

(Unaudited)

| | |

| | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Six Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Revenues | |

$ | 2,731 | | |

$ | 3,331 | | |

$ | 6,158 | | |

$ | 7,314 | |

| Cost of revenues | |

| 1,741 | | |

| 1,795 | | |

| 3,964 | | |

| 4,132 | |

| Gross profit | |

| 990 | | |

| 1,536 | | |

| 2,194 | | |

| 3,182 | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 536 | | |

| 200 | | |

| 861 | | |

| 406 | |

| Selling, general and administrative | |

| 1,662 | | |

| 2,067 | | |

| 3,781 | | |

| 4,362 | |

| Total operating expenses | |

| 2,198 | | |

| 2,267 | | |

| 4,642 | | |

| 4,768 | |

| Loss from operations | |

| (1,208 | ) | |

| (731 | ) | |

| (2,448 | ) | |

| (1,586 | ) |

| Other expense, net | |

| (90 | ) | |

| (186 | ) | |

| (301 | ) | |

| (253 | ) |

| Income tax expense | |

| (186 | ) | |

| (100 | ) | |

| (153 | ) | |

| (65 | ) |

| Net loss | |

$ | (1,484 | ) | |

$ | (1,017 | ) | |

$ | (2,902 | ) | |

$ | (1,904 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: basic and diluted | |

$ | (0.29 | ) | |

$ | (0.33 | ) | |

$ | (0.57 | ) | |

$ | (0.61 | ) |

| Weighted-average number of shares: basic and diluted | |

| 5,164 | | |

| 3,101 | | |

| 5,051 | | |

| 3,101 | |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

$ | (1,484 | ) | |

$ | (1,017 | ) | |

$ | (2,902 | ) | |

$ | (1,904 | ) |

| Foreign currency translation adjustments | |

| (213 | ) | |

| (34 | ) | |

| 298 | | |

| (99 | ) |

| Comprehensive loss | |

$ | (1,697 | ) | |

$ | (1,051 | ) | |

$ | (2,604 | ) | |

$ | (2,003 | ) |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | |

| | |

| |

| | |

Six Months Ended | |

| | |

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities | |

| | | |

| | |

| Net loss | |

$ | (2,902 | ) | |

$ | (1,904 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 90 | | |

| 59 | |

| Stock-based compensation | |

| 307 | | |

| 327 | |

| Deferred tax asset | |

| 144 | | |

| (139 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 375 | | |

| (160 | ) |

| Inventories | |

| 403 | | |

| (447 | ) |

| Deferred consideration | |

| 104 | | |

| 82 | |

| Prepaid expenses and other current assets | |

| 47 | | |

| 397 | |

| Operating lease right-of-use assets | |

| 79 | | |

| 21 | |

| Accounts payable | |

| 132 | | |

| (558 | ) |

| Accrued expenses and other current liabilities | |

| (353 | ) | |

| (44 | ) |

| Withholding tax payable | |

| 238 | | |

| 175 | |

| Operating lease liabilities | |

| (79 | ) | |

| (23 | ) |

| Deferred revenue | |

| (31 | ) | |

| (1,149 | ) |

| Net cash used in operating activities | |

| (1,446 | ) | |

| (3,363 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (19 | ) | |

| (48 | ) |

| Deposits | |

| – | | |

| (162 | ) |

| Net cash used in investing activities | |

| (19 | ) | |

| (210 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Payment on ATM agreement offering | |

| (5 | ) | |

| – | |

| Payments on PPP Loan | |

| – | | |

| (120 | ) |

| Proceeds from debt | |

| – | | |

| 15 | |

| Principal payments on short-term debt | |

| (259 | ) | |

| (460 | ) |

| Net cash used in financing activities | |

| (264 | ) | |

| (565 | ) |

| Effect of exchange rate on cash and cash equivalents | |

| 46 | | |

| 93 | |

| Net decrease in cash and cash equivalents | |

| (1,683 | ) | |

| (4,045 | ) |

| Cash and cash equivalents, beginning of period | |

| 3,820 | | |

| 7,396 | |

| Cash and cash equivalents, end of period | |

$ | 2,137 | | |

$ | 3,351 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 10 | | |

$ | 8 | |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS, INC. AND SUBSIDIARIES

Condensed Consolidated Statements of Changes

in Stockholders’ Equity

For the Six Months ended September 30, 2023

and 2022

(In thousands, except share amounts)

(Unaudited)

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common Stock

($0.0001 par Value) | | |

Additional

Paid in | | |

Accumulated | | |

Accumulated Other Comprehensive | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Total | |

| Balance, March 31, 2023 | |

| 4,933,550 | | |

$ | 5 | | |

$ | 200,904 | | |

$ | (189,514 | ) | |

$ | (3,418 | ) | |

$ | 7,977 | |

| Cost in connection with ATM | |

| – | | |

| – | | |

| (5 | ) | |

| – | | |

| – | | |

| (5 | ) |

| Employee stock-based compensation expenses | |

| 208,046 | | |

| – | | |

| 177 | | |

| – | | |

| – | | |

| 177 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| 511 | | |

| 511 | |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (1,418 | ) | |

| – | | |

| (1,418 | ) |

| Balance, June 30, 2023 | |

| 5,141,596 | | |

$ | 5 | | |

$ | 201,076 | | |

$ | (190,932 | ) | |

$ | (2,907 | ) | |

$ | 7,242 | |

| Adjustment to correct par value | |

| – | | |

| (4 | ) | |

| 4 | | |

| – | | |

| – | | |

| – | |

| Employee stock-based compensation expenses | |

| 37,737 | | |

| – | | |

| 130 | | |

| – | | |

| – | | |

| 130 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| (213 | ) | |

| (213 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (1,484 | ) | |

| – | | |

| (1,484 | ) |

| Balance, September 30, 2023 | |

| 5,179,333 | | |

$ | 1 | | |

$ | 201,210 | | |

$ | (192,416 | ) | |

$ | (3,120 | ) | |

$ | 5,675 | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| | |

Common Stock

($0.0001 par Value) | | |

Additional

Paid in | | |

Accumulated | | |

Accumulated Other Comprehensive | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Loss | | |

Total | |

| Balance March 31, 2022 | |

| 3,100,937 | | |

$ | 2 | | |

$ | 197,370 | | |

$ | (184,363 | ) | |

$ | (4,312 | ) | |

$ | 8,697 | |

| Employee stock-based compensation expenses | |

| – | | |

| – | | |

| 214 | | |

| – | | |

| – | | |

| 214 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| (65 | ) | |

| (65 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (887 | ) | |

| – | | |

| (887 | ) |

| Balance, June 30, 2022 | |

| 3,100,937 | | |

$ | 2 | | |

$ | 197,584 | | |

$ | (185,250 | ) | |

$ | (4,377 | ) | |

$ | 7,959 | |

| Employee stock-based compensation expense | |

| – | | |

| – | | |

| 108 | | |

| – | | |

| – | | |

| 108 | |

| Stock based compensation related to issuance of restricted common stock | |

| 2,035 | | |

| – | | |

| 5 | | |

| – | | |

| – | | |

| 5 | |

| Foreign currency translation adjustment | |

| – | | |

| – | | |

| – | | |

| – | | |

| (34 | ) | |

| (34 | ) |

| Net loss | |

| – | | |

| – | | |

| – | | |

| (1,017 | ) | |

| – | | |

| (1,017 | ) |

| Balance, September 30, 2022 | |

| 3,102,972 | | |

$ | 2 | | |

$ | 197,697 | | |

$ | (186,267 | ) | |

$ | (4,411 | ) | |

$ | 7,021 | |

The accompanying footnotes are an integral part

of these unaudited condensed consolidated financial statements.

SONOMA PHARMACEUTICALS,

INC. AND SUBSIDIARIES

Notes to Condensed Consolidated Financial Statements

(Rounded to nearest thousand unless specified)

(Unaudited)

| Note 1. |

Organization and Recent Developments |

Organization

Sonoma Pharmaceuticals, Inc. (the “Company”)

was incorporated under the laws of the State of California in April 1999 and was reincorporated under the laws of the State of Delaware

in December 2006. The Company moved its principal office to Woodstock, Georgia from Petaluma, California in June 2020 and to Boulder,

Colorado in October 2022. The Company is a global healthcare leader for developing and producing stabilized hypochlorous acid (“HOCl”)

products for a wide range of applications, including wound care, eye, oral and nasal care, dermatological conditions, podiatry, animal

health care, and as a non-toxic disinfectant. The Company’s products reduce infections, scarring and harmful inflammatory responses

in a safe and effective manner. In-vitro and clinical studies of HOCl show it to have impressive antipruritic, antimicrobial, antiviral

and anti-inflammatory properties. The Company’s stabilized HOCl immediately relieves itch and pain, kills pathogens and breaks down

biofilm, does not sting or irritate skin and oxygenates the cells in the area treated assisting the body in its natural healing process.

The Company sells its products either directly or via partners in 55 countries worldwide.

Basis of Presentation

The accompanying unaudited condensed consolidated

financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”)

for interim financial statements and are in the form prescribed by the Securities and Exchange Commission (the “SEC”) in instructions

to Form 10-Q and Rule 10-01 of Regulation S-X. The accompanying condensed consolidated financial statements reflect all adjustments, consisting

of normal recurring adjustments, considered necessary for a fair statement of the Company’s financial position, results of operations

and cash flows for the periods indicated. All material intercompany accounts and transactions have been eliminated in consolidation. The

accompanying condensed consolidated financial statements should be read in conjunction with the consolidated financial statements for

the year ended March 31, 2023, and notes thereto included in the Company’s annual report on Form 10-K, which was filed with the

SEC on June 21, 2023.

| Note 2. |

Liquidity and Financial Condition |

The Company reported a net loss of $1,484,000

and $1,017,000 for the three months ended September 30, 2023 and 2022, respectively, and $2,902,000 and $1,904,000 for the six months

ended September 30, 2023 and 2022, respectively. At September 30, 2023 and March 31, 2023, the Company’s accumulated deficit amounted

to $192,416,000 and $189,514,000, respectively. The Company had working capital of $8,277,000 and $10,081,000 as of September 30, 2023

and March 31, 2023, respectively. The cash balance at September 30, 2023 and March 31, 2023 was $2,137,000 and $3,820,000, respectively.

During the six months ended September 30, 2023 and 2022, net cash used in operating activities amounted to $1,446,000 and $3,363,000,

respectively.

Management believes that the Company has access

to additional capital resources through possible public or private equity offerings, debt financings, corporate collaborations or other

means; however, the Company cannot provide any assurance that other new financings will be available on commercially acceptable terms,

if needed. If the economic climate in the U.S. deteriorates, the Company’s ability to raise additional capital could be negatively

impacted. If the Company is unable to secure additional capital, it may be required to take additional measures to reduce costs in order

to conserve its cash in amounts sufficient to sustain operations and meet its obligations. These measures could cause significant delays

in the Company’s continued efforts to commercialize its products, which is critical to the realization of its business plan and

the future operations of the Company. These matters raise substantial doubt about the Company’s ability to continue as a going concern.

The accompanying condensed consolidated financial statements do not include any adjustments that may be necessary should the Company be

unable to continue as a going concern.

| Note 3. |

Summary of Significant Accounting Policies |

Use of Estimates

The preparation of condensed consolidated financial

statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent liabilities at the dates of the

condensed consolidated financial statements and the reported amounts of revenues and expenses during the reporting periods. Actual results

could differ from these estimates. Significant estimates and assumptions include reserves and write-downs related to receivables and inventories,

the valuation allowance relating to the Company’s deferred tax assets, valuation of equity and the estimated amortization periods

of upfront product licensing fees received from customers. Periodically, the Company evaluates and adjusts estimates accordingly.

Reclassification

During the three and six months ended September

30, 2023, the Company aligned its accounting policy and conformed its prior presentation of certain costs it views as research and development

efforts. These costs are now included in research and development, whereas they were previously included in cost of revenues. During the

three and six months ended September 30, 2022, the Company reclassified $200,000 and $400,000, respectively, from cost of revenues to

research and development. The reclassification in the prior periods increased research and development and decreased cost of revenues

by the same amount. The reclassification had no impact on total operating costs, earnings from operations, net earnings, earnings per

share or total equity.

Net Loss per Share

The following table provides the net loss for

each period along with the computation of basic and diluted net loss per share:

| Schedule of computation of earnings per share | |

| | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Six Months Ended September 30, | |

| (In thousands, except per share data) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Numerator: | |

| | |

| | |

| | |

| |

| Net loss | |

$ | (1,484 | ) | |

$ | (1,017 | ) | |

$ | (2,902 | ) | |

$ | (1,904 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Denominator: | |

| | | |

| | | |

| | | |

| | |

| Weighted-average number of common shares outstanding: basic and diluted | |

| 5,164 | | |

| 3,101 | | |

| 5,051 | | |

| 3,101 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share: basic and diluted | |

$ | (0.29 | ) | |

$ | (0.33 | ) | |

$ | (0.57 | ) | |

$ | (0.61 | ) |

The computation of basic loss per share for the three and six months

ended September 30, 2023, and 2022 excludes the potentially dilutive securities summarized in the table below because their inclusion

would be anti-dilutive.

| Schedule of anti-dilutive shares | |

| | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Six Months Ended September 30, | |

| (In thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Stock options | |

| 519 | | |

| 406 | | |

| 519 | | |

| 406 | |

| Warrants | |

| 103 | | |

| 108 | | |

| 103 | | |

| 108 | |

| Common stock units (1) | |

| 46 | | |

| 46 | | |

| 46 | | |

| 46 | |

| | |

| 668 | | |

| 560 | | |

| 668 | | |

| 560 | |

Revenue Recognition

The Company recognizes revenue in accordance with

Accounting Standards Codification (“ASC”), Topic 606 Revenue from Contracts with Customers (“Topic 606”). Revenue

is recognized when the Company transfers promised goods or services to the customer, in an amount that reflects the consideration which

the Company expects to receive in exchange for those goods or services. In determining the appropriate amount of revenue to be recognized

as the Company fulfills its obligations under the agreement, the Company performs the following steps: (i) identification of the

promised goods or services in the contract; (ii) determination of whether the promised goods or services are performance obligations,

including whether they are distinct in the context of the contract; (iii) measurement of the transaction price, including the constraint

on variable consideration; (iv) allocation of the transaction price to the performance obligations; and (v) recognition of revenue

when (or as) the Company satisfies each performance obligation. The Company only applies the five-step model to contracts when it is probable

that it will collect the consideration it is entitled to in exchange for the goods or services it transfers to the customer.

The Company derives the majority of its revenue

through sales of its products directly to end users and to distributors. The Company also sells products to a customer base, including

hospitals, medical centers, doctors, pharmacies, distributors and wholesalers. The Company has also entered into agreements to license

its technology and products.

The Company considers customer purchase orders,

which in some cases are governed by master sales agreements, to be the contracts with a customer. For each contract, the Company considers

the promise to transfer products, each of which are distinct, to be the identified performance obligations. In determining the transaction

price the Company evaluates whether the price is subject to refund or adjustment to determine the net consideration to which it expects

to be entitled.

For all of the Company’s sales to non-consignment

distribution channels, revenue is recognized when control of the product is transferred to the customer (i.e. when its performance obligation

is satisfied), which typically occurs when title passes to the customer upon shipment but could occur when the customer receives the product

based on the terms of the agreement with the customer. For product sales to its value-added resellers, non-stocking distributors and end-user

customers, the Company grants return privileges to its customers, and because the Company has a long history with its customers, the Company

is able to estimate the amount of product that will be returned. Sales incentives and other programs that the Company may make

available to these customers are considered to be a form of variable consideration, and the Company maintains estimated accruals and allowances

using the expected value method. With the movement of these sales to a full distributor model in fiscal year 2022, the Company no longer

provides these arrangements although the Company still receives some returns from the period prior to the year ended March 31, 2023.

The Company has entered into consignment arrangements,

in which goods are left in the possession of another party to sell. As products are sold from the customer to third parties, the Company

recognizes revenue based on a variable percentage of a fixed price. Revenue recognized varies depending on whether a patient is

covered by insurance or is not covered by insurance. In addition, the Company may incur a revenue deduction related to the use of the

Company’s rebate program.

Sales to stocking distributors are made under

terms with fixed pricing and limited rights of return (known as “stock rotation”) of the Company’s products held in

their inventory. Revenue from sales to distributors is recognized upon the transfer of control to the distributor.

The Company assessed the promised goods and services

in the technical support to Invekra for a ten-year period as being a distinct service that Invekra can benefit from on its own and as

separately identifiable from any other promises within the contract. Given that the distinct service is not substantially the same as

other goods and services within the Invekra contract, the Company accounted for the distinct service as a performance obligation.

Accounts Receivable

Trade accounts receivable are recorded net of

allowances for cash discounts for prompt payment, doubtful accounts, and sales returns. Estimates for cash discounts and sales returns

are based on analysis of contractual terms and historical trends.

The Company’s policy is to reserve for uncollectible

accounts based on its best estimate of probable credit losses in its existing accounts receivable. The Company periodically reviews its

accounts receivable to determine whether an allowance for doubtful accounts is necessary based on an analysis of past due accounts and

other factors that may indicate that the realization of an account may be in doubt. Other factors that the Company considers include its

existing contractual obligations, historical payment patterns of its customers and individual customer circumstances, an analysis of days

sales outstanding by customer and geographic region, and a review of the local economic environment and its potential impact on government

funding and reimbursement practices. Account balances deemed to be uncollectible are charged to the allowance after all means of collection

have been exhausted and the potential for recovery is considered remote. The Company did not deem it necessary to record an allowance

for doubtful accounts for probable credit losses at September 30, 2023 and March 31, 2023. Additionally, at September 30, 2023 and March

31, 2023 the Company has allowances of $24,000 and $16,000, respectively, related to potential discounts, returns, distributor fees and

rebates. The allowances are included in accounts receivable, net in the accompanying condensed consolidated balance sheets.

Inventories

Inventories are stated at the lower of cost, cost

being determined on a standard cost basis (which approximates actual cost on a first-in, first-out basis), or net realizable value.

Due to changing market conditions, estimated future

requirements, age of the inventories on hand and production of new products, the Company regularly reviews inventory quantities on hand

and records a provision to write down excess and obsolete inventory to its estimated net realizable value. The Company recorded a provision

to reduce the carrying amounts of inventories to their net realizable value in the amount of $280,000 and $236,000 at September 30, 2023

and March 31, 2023, respectively, which is included in cost of revenues on the Company’s accompanying condensed consolidated statements

of comprehensive loss.

Recent Accounting Standards

Accounting standards that have been issued or

proposed by the FASB, the SEC or other standard setting bodies that do not require adoption until a future date are not expected to have

a material impact on the consolidated financial statements upon adoption.

| Note 4. |

Condensed Consolidated Balance Sheet |

Inventories, net

Inventories, net consist of the following:

| Schedule of inventories | |

| | |

| |

| | |

September 30, | | |

March 31, | |

| | |

2023 | | |

2023 | |

| Raw materials | |

$ | 1,493,000 | | |

$ | 1,764,000 | |

| Finished goods | |

| 1,020,000 | | |

| 1,094,000 | |

| Inventories, net | |

$ | 2,513,000 | | |

$ | 2,858,000 | |

Leases

The Company's operating leases are comprised primarily

of facility leases. The Company did not have any finance leases as of September 30, 2023 and March 31, 2023. Balance sheet information

related to our leases is presented below:

| Schedule of lease information | |

| | |

| |

| | |

September 30, | | |

March 31, | |

| | |

2023 | | |

2023 | |

| Operating leases: | |

| | | |

| | |

| Operating lease right-of-use assets | |

$ | 350,000 | | |

$ | 418,000 | |

| Operating lease liabilities – current | |

| 216,000 | | |

| 256,000 | |

| Operating lease liabilities – non- current | |

| 134,000 | | |

| 162,000 | |

Other information related to leases is presented below:

| Six Months Ended September 30, 2023 | |

| |

| Operating lease cost | |

$ | 216,000 | |

| Other information: | |

| | |

| Operating cash flows from operating leases | |

| (79,000 | ) |

| Weighted-average remaining lease term – operating leases (in months) | |

| 19.3 | |

| Weighted-average discount rate – operating leases | |

| 6.00% | |

As of September 30, 2023, the annual minimum lease payments of our

operating lease liabilities were as follows:

| Schedule of minimum

operating lease liabilities |

|

|

|

| For Years Ending March 31, |

|

|

|

| 2024 (excluding the six months ended September 30, 2023) |

|

$ |

81,000 |

|

| 2025 |

|

|

144,000 |

|

| 2026 |

|

|

157,000 |

|

| 2027 |

|

|

9,000 |

|

| Total future minimum lease payments, undiscounted |

|

|

391,000 |

|

| Less: imputed interest |

|

|

(41,000 |

) |

| Present value of future minimum lease payments |

|

$ |

350,000 |

|

| Note 5. |

Commitments and Contingencies |

Legal Matters

The Company may be involved in legal matters arising

in the ordinary course of business including matters involving proprietary technology. While management believes that such matters are

currently insignificant, matters arising in the ordinary course of business for which the Company is or could become involved in litigation

may have a material adverse effect on its business and financial condition of comprehensive loss.

Employment Agreements

The Company has employment agreements in place

with two of its key executives. These executive employment agreements provide, among other things, for the payment of up to eighteen months

of severance compensation for terminations under certain circumstances.

Amendments

On June 16, 2023, we entered into an amended and

restated employment agreement with our Chief Executive Officer, Amy Trombly. The amended and restated agreement provides that, in the

event of termination upon change of control either without cause or for good reason, Ms. Trombly is entitled to receive, in addition to

the other benefits described therein, a lump sum severance equal to one and a half times her base salary and one and a half times her

target annual bonus. All other material terms of the amended and restated agreement remain unchanged from her prior employment agreement.

On June 16, 2023, we amended and restated our

employment agreement with Bruce Thornton, our Chief Operating Officer. Under the amended and restated agreement, Mr. Thornton will serve

as Executive Vice President and Chief Operating Officer of the Company. Mr. Thornton will no longer receive a monthly car allowance; however,

his base salary is adjusted to include such amount. The amended and restated agreement also provides that, in the event of termination

upon change of control either without cause or for good reason, Mr. Thornton is entitled to receive, in addition to the other benefits

described therein, to a lump sum severance equal to one and a half times his base salary and one and a half times his target annual bonus.

The agreement further provides that upon termination for any reason, Mr. Thornton’s outstanding and vested equity awards shall remain

exercisable for 18 months following termination. Either party may terminate the employment agreement for any reason upon at least 60 days

prior written notice. All other material terms of his amended and restated agreement remain unchanged from his prior employment agreement.

Bonus Grants

On June 16, 2023, the Compensation Committee of

the Board of Directors approved annual bonus awards of $162,500 for Ms. Trombly and $150,000 for Mr. Thornton.

Equity Awards

On June 16, 2023, the Compensation Committee of

the Board of Directors approved an equity award of 100,000 shares of the Company’s common stock to each of Ms. Trombly and Mr. Thornton,

to be issued to on June 30, 2023, at a valuation based on the five day weighted trailing average of the Company’s stock price on

the day of grant. In addition, the Compensation Committee also approved a one-time cash payment by the Company as reimbursement for estimated

taxes payable with respect to such equity awards. On September 22, 2023, the Company paid taxes related to the common stock issuance in

the amount of $149,000.

As of September 30, 2023, with respect to these

agreements, aggregated annual salaries was $586,000 and potential severance payments to these key executives was $1,300,000, if triggered.

Financing of Insurance Premiums

On February 1, 2022, the Company entered into

a note agreement for $748,000 with an interest rate of 4.68% per annum with final payment on January 1, 2023. This instrument was issued

in connection with financing insurance premiums. The note is payable in ten monthly installment payments of principal and interest of

$76,000, with the first installment beginning March 1, 2022.

On February 1, 2023, the Company entered into

a note agreement for $453,000 with an interest rate of 8.98% per annum with final payment on January 1, 2024. This instrument was issued

in connection with financing insurance premiums. The note is payable in eleven monthly installment payments of principal and interest

of $43,000, with the first installment beginning March 1, 2023.

| Note 7. |

Stockholders’ Equity |

Authorized Capital

The Company is authorized to issue up to 24,000,000

shares of common stock with a par value of $0.0001 per share and 714,286 shares of convertible preferred stock with a par value of $0.0001

per share.

| Note 8. |

Stock-Based Compensation |

Stock-based compensation expense is as follows:

For the three months ended September 30, 2023

and 2022, the Company incurred $130,000 and $113,000 of stock-based compensation expense, respectively, and for the six months ended September

30, 2023 and 2022, the Company incurred $307,000 and $327,000 of stock-based compensation expense, respectively. All stock-based compensation

incurred is included in selling, general and administrative expense in the accompanying condensed consolidated statements of comprehensive

loss.

At September 30, 2023, there were unrecognized

compensation costs of $379,000 related to stock options which are expected to be recognized over a weighted-average amortization period

of 1.04 years.

Stock options award activity is as follows:

| Schedule of options activity | |

| | |

| |

| | |

Number of

Shares | | |

Weighted-

Average

Exercise Price | |

| Outstanding at April 1, 2023 | |

| 565,000 | | |

$ | 8.84 | |

| Options granted | |

| 5,000 | | |

| 1.15 | |

| Options forfeited | |

| (46,000 | ) | |

| 34.30 | |

| Options expired | |

| (5,000 | ) | |

| 39.33 | |

| Outstanding at September 30, 2023 | |

| 519,000 | | |

$ | 6.25 | |

| Exercisable at September 30, 2023 | |

| 293,000 | | |

$ | 9.02 | |

The aggregate intrinsic value of stock options

of zero is calculated as the difference between the exercise price of the underlying stock options and the fair value of the Company’s

common stock, or $0.77 per share at September 30, 2023.

| Schedule of unvested restricted stock activity | |

| | |

| |

| | |

Number of Shares | | |

Weighted Average Award Date Fair Value per Share | |

| Unvested restricted stock awards outstanding at April 1, 2023 | |

| – | | |

$ | – | |

| Restricted stock awards granted | |

| 244,000 | | |

| 1.06 | |

| Restricted stock awards vested | |

| (244,000 | ) | |

| 1.06 | |

| Unvested restricted stock awards outstanding at September 30, 2023 | |

| – | | |

$ | – | |

The Company did not capitalize any cost associated

with stock-based compensation.

The Company issues new shares of common stock

upon exercise of stock-based awards.

At the end of each interim reporting period, the

Company determines the income tax provision by using an estimate of the annual effective tax rate, adjusted for discrete items occurring

in the quarter.

Our effective tax rate for the three and six months

ended September 30, 2023 was (12.61)% and (5.12)%, respectively. The Company’s effective tax rate for the three and six months ended

September 30, 2023 differed from the federal statutory tax rate of 21% primarily due to the valuation allowance recognized against deferred

tax assets in the U.S., and permanent tax adjustment of intercompany interest expense in Mexico and Netherlands.

Judgment is required in determining whether deferred

tax assets will be realized in full or in part. Management assesses the available positive and negative evidence on a jurisdictional basis

to estimate if deferred tax assets will be recognized and when it is more likely than not that all or some deferred tax assets will not

be realized, and a valuation allowance must be established. As of September 30, 2023, the Company continues to maintain a valuation allowance

in the U.S.

| Note 10. |

Revenue Disaggregation |

The Company generates revenues from products which

are sold into the human and animal healthcare markets and to multiple geographic regions.

The following table presents the Company’s

disaggregated revenues by revenue source:

| Schedule of disaggregated revenue by source | |

| | |

| | |

| | |

| |

| (In thousands) | |

Three Months Ended September 30, | | |

Six Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Human Care | |

$ | 2,075 | | |

$ | 2,447 | | |

$ | 4,825 | | |

$ | 4,615 | |

| Animal Care | |

| 489 | | |

| 737 | | |

| 1,067 | | |

| 1,523 | |

| Service and Royalty | |

| 167 | | |

| 147 | | |

| 266 | | |

| 1,176 | |

| | |

$ | 2,731 | | |

$ | 3,331 | | |

$ | 6,158 | | |

$ | 7,314 | |

The following table shows the Company’s

revenues by geographic region:

| Schedule of geographic sales | |

| | |

| | |

| | |

| |

| | |

Three Months Ended September 30, | | |

Six Months Ended September 30, | |

| (In thousands) | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| United States | |

$ | 590 | | |

$ | 973 | | |

$ | 1,396 | | |

$ | 1,842 | |

| Europe | |

| 1,201 | | |

| 1,170 | | |

| 2,271 | | |

| 2,012 | |

| Asia | |

| 346 | | |

| 518 | | |

| 1,208 | | |

| 1,438 | |

| Latin America | |

| 260 | | |

| 394 | | |

| 747 | | |

| 1,444 | |

| Rest of the World | |

| 334 | | |

| 276 | | |

| 536 | | |

| 578 | |

| Total | |

$ | 2,731 | | |

$ | 3,331 | | |

$ | 6,158 | | |

$ | 7,314 | |

The Company aligned the geographic regions reported

in the Asia and Rest of World segments in fiscal year 2022 to conform to the current year presentation. For the three months ended September

30, 2022, the Company reclassified $188,000 from Rest of World to Asia and for the six months ended September 30, 2022, the Company reclassified

$283,000 from Rest of World to Asia.

| Note 11. |

Significant Customer Concentrations |

For the three months ended September 30, 2023,

customer C represented 21%, customer A represented 13%, and customer B represented 10% of net revenue. For the three months ended September

30, 2022, customer A represented 20%, customer C represented 13% and customer B represented 12% of net revenue. For the six months ended

September 30, 2023, customer C represented 17%, customer B represented 12% and customer A represented 14% of net revenue. For the six

months ended September 30, 2022, customer B represented 20%, customer A represented 17% and customer C represented 10% of net revenue.

At September 30, 2023, customer D represented

20%, customer C represented 13% and customer A represented 11% of our net accounts receivable balance.

At September 30, 2022, customer A represented

35% and customer D represented 20% of our net accounts receivable balance.

| Note 12. |

Subsequent Events |

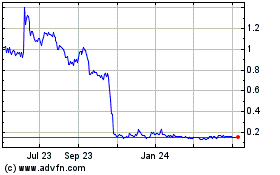

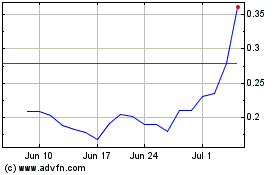

On October 26, 2023, the Company entered into

a placement agency agreement with Maxim Group LLC (“Maxim”), pursuant to which Maxim agreed to use its reasonable best efforts

to solicit offers to purchase up to an aggregate of 8,500,000 shares of the Company’s common stock, par value $0.0001 per share.

The Company agreed to pay Maxim a cash fee equal to 8.0% of the gross proceeds from the offering, plus reimbursement of up to $75,000

of legal fees and other expenses. Additionally, on October 26, 2023, the Company entered into a securities purchase agreement with the

purchasers party thereto for the sale and issuance of an aggregate of up to 8,500,000 shares of the Company’s common stock at a

public offering price of $0.20 per share.

The closing of the offering occurred on

October 30, 2023. In connection with the offering, the Company sold 8,500,000 shares of the Company’s common stock for

aggregate gross proceeds of $1,700,000 and estimated net proceeds of $1,414,000, after deducting placement agent fees and other

estimated offering expenses payable by the Company.

| Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion of our financial condition

and results of operations should be read in conjunction with the condensed consolidated financial statements and notes to those statements

included elsewhere in this Quarterly Report on Form 10-Q as of September 30, 2023 and our audited consolidated financial statements for

the year ended March 31, 2023 included in our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on June 21,

2023.

This report contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this report, the words “anticipate,”

“suggest,” “estimate,” “plan,” “aim,” “seek,” “project,” “continue,”

“ongoing,” “potential,” “expect,” “predict,” “believe,” “intend,”

“may,” “will,” “should,” “could,” “would,” “likely,” “proposal,”

and similar expressions are intended to identify forward-looking statements.

Forward-looking statements are subject to risks

and uncertainties that could cause our actual results to differ materially from those projected. These risks and uncertainties include,

but are not limited to the risks described in our Annual Report on Form 10-K including: our ability to become profitable; our dependence

on third-party distributors; certain tax impacts of inter-company loans between us and our Mexican subsidiary; the progress and timing

of our development programs and regulatory approvals for our products; the benefits and effectiveness of our products; the ability of

our products to meet existing or future regulatory standards; the progress and timing of clinical trials and physician studies; our expectations

and capabilities relating to the sales and marketing of our current products and our product candidates; our ability to compete with other

companies that are developing or selling products that are competitive with our products; the establishment of strategic partnerships

for the development or sale of products; the risk our research and development efforts do not lead to new products; the timing of commercializing

our products; our ability to penetrate markets through our sales force, distribution network, and strategic business partners to gain

a foothold in the market and generate attractive margins; the ability to attain specified revenue goals within a specified time frame,

if at all, or to reduce costs; the outcome of discussions with the U.S. Food and Drug Administration, or FDA, and other regulatory agencies;

the content and timing of submissions to, and decisions made by, the FDA and other regulatory agencies, including demonstrating to the

satisfaction of the FDA the safety and efficacy of our products; our ability to manufacture sufficient amounts of our products for commercialization

activities; our ability to protect our intellectual property and operate our business without infringing on the intellectual property

of others; our ability to continue to expand our intellectual property portfolio; the risk we may need to indemnify our distributors or

other third parties; risks attendant with conducting a significant portion of our business outside the United States; our ability to comply

with complex federal and state fraud and abuse laws, including state and federal anti-kickback laws; risks associated with changes to

health care laws; our ability to attract and retain qualified directors, officers and employees; our expectations relating to the concentration

of our revenue from international sales; our ability to expand to and commercialize products in markets outside the wound care market;

our ability to protect our information technology and infrastructure; and the impact of any future changes in accounting regulations or

practices in general with respect to public companies. These forward-looking statements speak only as of the date hereof. We expressly

disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein

to reflect any change in our expectations with regard thereto or any change in events, conditions or circumstances on which any such statement

is based, except as required by law.

Our Business

We are a global healthcare leader for developing

and producing stabilized hypochlorous acid, or HOCl, products for a wide range of applications, including wound care, eye, oral and nasal

care, dermatological conditions, podiatry, animal health care and non-toxic disinfectants. Our products reduce infections, scarring and

harmful inflammatory responses in a safe and effective manner. In-vitro and clinical studies of HOCl show it to have impressive antipruritic,

antimicrobial, antiviral and anti-inflammatory properties. Our stabilized HOCl immediately relieves itch and pain, kills pathogens and

breaks down biofilm, does not sting or irritate skin and oxygenates the cells in the area treated, assisting the body in its natural healing

process. We sell our products either directly or via partners in 55 countries worldwide.

Business Channels

Our core market differentiation is based on being

the leading developer and producer of stabilized hypochlorous acid, or HOCl, solutions. We have been in business for over 20 years, and

in that time, we have developed significant scientific knowledge of how best to develop and manufacture HOCl products, backed by decades

of studies and data collection. HOCl is known to be among the safest and most-effective ways to relieve itch, inflammation and burns while

stimulating natural healing through increased oxygenation and eliminating persistent microorganisms and biofilms.

We sell our products based on our HOCl technology

into many markets both in the U.S. and internationally. Our core strategy is to work with partners to market and distribute our products.

In some cases, we market and sell our own products.

Dermatology

We have developed unique, differentiated, prescription-strength

and safe dermatologic products that support paths to healing among various key dermatologic conditions. Our products are primarily targeted

at the treatment of redness and irritation, the management of scars, and symptoms of eczema/atopic dermatitis. We are strategically focused

on introducing innovative new products that are supported by human clinical data with applications that address specific dermatological

procedures currently in demand. In addition, we look for markets where we can provide effective product line extensions and pricing to

new product families.

In the United States, we partner with EMC Pharma,

LLC to sell our prescription dermatology products. Pursuant to our March 2021 agreement with EMC Pharma, we manufacture products for EMC

Pharma and EMC Pharma has the right to market, sell and distribute them to patients and customers for an initial term of five years, subject

to meeting minimum purchase and other requirements.

In September 2021, we launched a new over-the-counter

product, Regenacyn® Advanced Scar Gel, which is clinically proven to improve the overall appearance of scars while reducing

pain, itch, redness, and inflammation. On the same day, we launched Regenacyn® Plus, a prescription-strength scar gel which

is available as an office dispense product through physician offices.

In October 2022, we launched two new over-the-counter

dermatology products in the United States, Reliefacyn® Advanced Itch-Burn-Rash-Pain Relief Hydrogel for the alleviation

of red bumps, rashes, shallow skin fissures, peeling, and symptoms of eczema/atopic dermatitis, and Rejuvacyn® Advanced

Skin Repair Cooling Mist for management of minor skin irritations following cosmetic procedures as well as daily skin health and hydration.

In June 2022, the Natural Products Association

certified Rejuvacyn Advanced as a Natural Personal Care Product. Reliefacyn Advanced received the National Eczema Association Seal of

AcceptanceTM in 2023.

In January 2023, we launched a line of office

dispense products exclusively for skin care professionals, including two new prescription strength dermatology products, Reliefacyn® Plus

Advanced Itch-Burn-Rash-Pain Relief Hydrogel and Rejuvacyn® Plus Skin Repair Cooling Mist. These products, along with

Regenacyn® Plus Scar Gel, are marketed and sold directly to dermatology practices and medical spas.

In April 2023, we introduced a new pediatric dermatology

and wound care product for over-the-counter use, Pediacyn™ All Natural Skin Care & First Aid For Children.

Our consumer products are available through Amazon.com,

our online store, and third-party distributors.

We sell dermatology products in Europe and Asia

through distributors. In these international markets, we have a network of partners, ranging from country specific distributors to large

pharmaceutical companies to full-service sales and marketing companies. We work with our international partners to create products they

can market in their home country. Some products we develop and manufacture are custom label while others use branding we have already

developed. We have created or co-developed a wide range of products for international markets using our core HOCl technology.

First Aid and Wound Care

Our HOCl-based wound care products are intended

for the treatment of acute and chronic wounds as well as first- and second-degree burns, and as an intraoperative irrigation treatment.

They work by first removing foreign material and debris from the skin surface and moistening the skin, thereby improving wound healing.

Secondly, our HOCl products assist in the wound healing process by removing microorganisms. HOCl is an important constituent of our innate

immune system, formed and released by the macrophages during phagocytosis. Highly organized cell structures such as human tissue can tolerate

the action of our wound care solution while single-celled microorganisms cannot, making our products advantageous to other wound-irrigation

and antiseptic solutions. Due to its unique chemistry, our wound treatment solution is also much more stable than similar products on

the market and therefore maintains much higher levels of hypochlorous acid over its shelf life.

In the United States, we sell our wound care products

directly to hospitals, physicians, nurses, and other healthcare practitioners and indirectly through non-exclusive distribution arrangements.

In Europe, the Middle East and Asia, we sell our wound care products through a diverse network of distributors.

To respond to market demand for our HOCl technology-based

products, we launched our first direct to consumer over-the-counter product in the United States in February 2021. Microcyn®

OTC Wound and Skin Cleanser is formulated for home use without prescription to help manage and cleanse wounds, minor cuts, and burns,

including sunburns and other skin irritations. Microcyn OTC is available without prescription through Amazon.com, our online store, and

third-party distributors.

In March 2021, we received approval to market

and use our HOCl products as biocides under Article 95 of the European Biocidal Products Regulation in France, Germany and Portugal. The

approval applies to our products MucoClyns™ for human hygiene to be marketed and commercialized by us, MicrocynAH®

for animal heath marketed and commercialized through our partner, Petagon Limited, and MicroSafe for disinfectant use to be marketed and

commercialized through our partner, MicroSafe Group DMCC.

In June 2022, the Natural Products Association

certified Microcyn OTC as a Natural Personal Care Product in the United States.

In June 2023, we announced a new application of

our HOCl technology for intraoperative pulse lavage irrigation treatment, which can replace commonly used IV bags in a variety of surgical

procedures. The intraoperative pulse lavage container is designed to be used in combination with a pulse lavage irrigation device, or

flush gun, for abdominal, laparoscopic, orthopedic, and periprosthetic procedures. It is in trial use by hospitals in Europe, and we anticipate

commercial launch in the U.S. in 2024.

Eye Care

Our prescription product Acuicyn™ is an

antimicrobial prescription solution for the treatment of blepharitis and the daily hygiene of eyelids and lashes and helps manage red,

itchy, crusty and inflamed eyes. It is strong enough to kill the bacteria that causes discomfort, fast enough to provide near instant

relief, and gentle enough to use as often as needed. In the United States, our partner EMC Pharma sells Acuicyn through its distribution

network.

In September 2021, we launched Ocucyn®

Eyelid & Eyelash Cleanser, which is sold directly to consumers on Amazon.com, through our online store, and through third party distributors.

Ocucyn® Eyelid & Eyelash Cleanser, designed for everyday use, is a safe, gentle, and effective solution for good eyelid

and eyelash hygiene.

In international markets we rely on distribution

partners to sell our eye products. On May 19, 2020, we entered into an expanded license and distribution agreement with our existing partner,

Brill International S.L., for our Microdacyn60® Eye Care HOCl-based product. Under the license and distribution agreement,

Brill has the right to market and distribute our eye care product under the private label Ocudox™ in Italy, Germany, Spain, Portugal,

France, and the United Kingdom for a period of 10 years, subject to meeting annual minimum sales quantities. In return, Brill paid us

a one-time fee and the agreed upon supply prices. In parts of Asia, Dyamed Biotech markets our eye product under the private label Ocucyn.

Oral, Dental and Nasal Care

We sell a variety of oral, dental, and nasal products

around the world.

In late 2020, we launched a HOCl-based product

in the dental, head and neck markets called Endocyn®, a biocompatible root canal irrigant. In the U.S., we sell Endocyn

through U.S.-based distributors.

In international markets, our product Microdacyn60®

Oral Care treats mouth and throat infections and thrush. Microdacyn60 assists in reducing inflammation and pain, provides soothing cough

relief and does not contain any harmful chemicals. It does not stain teeth, is non-irritating, non-sensitizing, has no contraindications

and is ready for use with no mixing or dilution.

Our international nasal care product Sinudox™

based on our HOCl technology is an electrolyzed solution intended for nasal irrigation. Sinudox clears and cleans stuffy, runny noses

and blocked or inflamed sinuses by ancillary ingredients that may have a local antimicrobial effect. Sinudox is currently sold through

Amazon in Europe. In other parts of the world, we partner with distributors to sell Sinudox.

Podiatry

Our HOCl-based wound care products are also indicated

for the treatment of diabetic foot ulcers. In the United States, we sell our wound care products directly to podiatrists, as well as hospitals,

nurses, and other healthcare practitioners, and indirectly through non-exclusive distribution arrangements. In Europe, we sell our wound

care products for podiatric use through a diverse network of distributors.

On April 11, 2023, we launched Podiacyn™

Advanced Everyday Foot Care direct to consumers for over-the-counter use in the United States, intended for management of foot odors,

infections, and irritations, as well as daily foot health and hygiene. Podiacyn is available through Amazon.com, our online store, and

third-party distributors.

Animal Health Care

MicrocynAH® is an HOCl-based topical

product that cleans, debrides and treats a wide spectrum of animal wounds and infections. It is intended for the safe and rapid treatment

of a variety of animal afflictions including cuts, burns, lacerations, rashes, hot spots, rain rot, post-surgical sites, pink eye symptoms

and wounds to the outer ear.

For our animal health products sold in the U.S.

and Canada, we partner with Manna Pro Products, LLC. Manna Pro distributes non-prescription products to national pet-store retail chains