Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-254806

PROSPECTUS SUPPLEMENT

(To

Prospectus dated April 7, 2021)

1,410,256

shares of Common Stock

Warrants

to Purchase up to 1,410,256 shares of

Common Stock

We

are offering 1,410,256 shares of our common stock (the “Shares”), par value $0.0001 per share (the “Common Stock”),

and warrants to purchase up to 1,410,256 shares of Common Stock (the “Warrants”). The combined offering price for each Share

and accompanying Warrant is $0.78. The Warrants are exercisable immediately following the date of issuance and may be exercised for a

period of five years from the initial exercisability date at an exercise price of $0.78 per share. This prospectus supplement also relates

to the offering of the Common Stock issuable upon exercise of such Warrants.

Our

common stock is listed on The Nasdaq Capital Market under the symbol “ORGS.” There is no established trading market for

the Warrants and we do not expect a market to develop. We do not intend to apply for a listing for the Warrants on any securities

exchange or other national recognized trading system. Without an active trading market, the liquidity of the Warrants will be

limited. On November 7, 2023, the last reported sale price for our common stock on The Nasdaq Capital Market was $0.78

per share.

Investing

in our securities involves a high degree of risk. Before making an investment decision, you should carefully review and consider all

of the information set forth in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein

and therein, including the risks and uncertainties described under “Risk Factors” on page S-8 of this prospectus supplement,

on page 4 of the accompanying prospectus, and under similar headings in the documents incorporated by reference into this prospectus

supplement.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding shares of common stock held by non-affiliates,

or public float, was determined to be $24,365,156 based on 30,466,807 shares of common stock outstanding, of which 25,380,436

are held by non-affiliates, and the closing sale price of our shares of common stock on The Nasdaq Capital Market of $0.96 on

October 18, 2023, which is within 60 days of the date of this prospectus supplement. Upon any sale of shares of common stock under

this prospectus supplement pursuant to General Instruction I.B.6 of Form S-3, in no event will the aggregate market value of securities

sold by us or on our behalf pursuant to General Instruction I.B.6 of Form S-3 during the twelve calendar month period immediately prior

to, and including, the date of any such sale exceed one-third of the aggregate market value of our shares of common stock held by non-affiliates,

calculated in accordance with General Instruction I.B.6 of Form S-3. During the prior 12 calendar month period that ends on, and includes,

the date of this prospectus supplement (excluding this offering), we have not sold any of our securities pursuant to General Instruction

I.B.6 of Form S-3.

| | |

Per Share and Accompanying Warrant | | |

Total | |

| Offering price | |

$ | 0.78 | | |

$ | 1,099,999.68 | |

| Placement agent fees (7%) | |

$ | 0.0546 | | |

$ | 76,999.98 | |

| Proceeds, before expenses, to us | |

$ | 0.7254 | | |

$ | 1,022,999.70 | |

| (1)

|

We

have agreed to pay the Placement Agent (as defined below) a cash fee equal to 7.0% of the aggregate gross proceeds of this offering.

See “Underwriting” for additional information regarding the compensation payable to the underwriter. |

We

have engaged Titan Partners Group LLC, a division of American Capital Partners (the “Placement Agent”), to act as our placement

agent in connection with this offering. The Placement Agent is not purchasing or selling any of the securities offered pursuant to this

prospectus supplement and the accompanying prospectus and the Placement Agent is not required to arrange the purchase or sale of any

specific number of securities or dollar amount, but they have agreed to use their best efforts to arrange for the sale of all of the

securities.

Delivery

of the securities is expected to be made on or about November 9, 2023.

Sole Placement Agent

Titan

Partners Group

a division of American Capital Partners

The

date of this prospectus supplement is November 8, 2023

TABLE

OF CONTENTS

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of a registration statement that we filed with the Securities and Exchange Commission, or the SEC, utilizing a “shelf”

registration process and consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this

offering and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference

herein. The second part, the accompanying prospectus, provides more general information. Generally, when we refer to this prospectus,

we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this

prospectus supplement and the information contained in the accompanying prospectus or any document incorporated by reference therein

filed prior to the date of this prospectus supplement, you should rely on the information in this prospectus supplement; provided that

if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example,

a document incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies

or supersedes the earlier statement.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

We

have not, and the Placement Agent has not, authorized

anyone to provide any information other than that contained or incorporated by reference into this prospectus supplement, the accompanying

prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We do not, and the Placement

Agent does not, take any responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation

of an offer to purchase, the securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction to

or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. The information

contained in this prospectus supplement or the accompanying prospectus, or incorporated by reference herein or therein is accurate only

as of the respective dates thereof, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus

or of any sale of our common stock. It is important for you to read and consider all information contained in this prospectus supplement

and the accompanying prospectus, including the documents incorporated by reference herein and therein, in making your investment decision.

You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where

You Can Find More Information” and “Incorporation of Certain Information By Reference” in this prospectus supplement

and in the accompanying prospectus.

We

are offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted. The distribution

of this prospectus supplement and the accompanying prospectus and the offering of our securities in certain jurisdictions may be restricted

by law. Persons outside the United States who come into possession of this prospectus supplement and the accompanying prospectus must

inform themselves about, and observe any restrictions relating to, the offering of our securities and the distribution of this prospectus

supplement and the accompanying prospectus outside the United States. This prospectus supplement and the accompanying prospectus do not

constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by

this prospectus supplement and the accompanying prospectus by any person in any jurisdiction in which it is unlawful for such person

to make such an offer or solicitation.

Unless

the context otherwise indicates, references in this prospectus supplement to “Orgenesis,” “we,” “our,”

“us” and “the Company” refer, collectively, to Orgenesis Inc., a Nevada corporation and its subsidiaries.

CAUTIONARY

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying base prospectus and documents we have filed with the SEC that are incorporated by reference herein

and therein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities

Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, from time

to time we or our representatives have made or will make forward-looking statements in various other filings that we make with the SEC

or in other documents, including press releases or other similar announcements. The forward-looking statements involve substantial risks

and uncertainties. All statements, other than statements related to present facts or current conditions or of historical facts, contained

in this prospectus, including statements regarding our strategy, future operations, future financial position, future revenues, and projected

costs, prospects, plans and objectives of management, are forward-looking statements. Accordingly, these statements involve estimates,

assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,” “intend,”

“may,” “might,” “ongoing,” “plan,” “potential,” “predict,” “project,”

“should,” “target,” “will,” “would,” or the negative of these terms or other comparable

terminology are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying

words. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout our SEC reports,

and in particular those factors discussed under the heading “Risk Factors” in this prospectus supplement, the accompanying

base prospectus, any related free writing prospectus and in the other documents incorporated herein by reference, as may be updated from

time to time by our future filings under the Exchange Act.

You

should assume that the information appearing in this prospectus supplement, the accompanying base prospectus, any related free writing

prospectus and any document incorporated herein by reference is accurate as of its date only. Because the risk factors referred to above

could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our

behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as

of the date on which it is made. New factors emerge from time to time, and it is not possible for us to predict which factors will arise.

In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors,

may cause actual results to differ materially from those contained in any forward-looking statements. All written or oral forward-looking

statements attributable to us or any person acting on our behalf made after the date of this prospectus supplement are expressly qualified

in their entirety by the risk factors and cautionary statements contained in and incorporated by reference into this prospectus supplement

and the accompanying base prospectus. Unless legally required, we do not undertake any obligation to release publicly any revisions to

such forward-looking statements to reflect events or circumstances after the date of this prospectus supplement or to reflect the occurrence

of unanticipated events.

Actual

results may vary materially from the expectations contained herein due to various important factors, many of which are, and will be,

amplified by the COVID-19 pandemic, including (but not limited to) the following:

Corporate

and Financial

| ●

|

our

ability to generate revenue from the commercialization of our point-of-care cell therapy (“POC”) to reach patients and

to increase such revenues; |

| ●

|

our

ability to achieve profitability; |

| ●

|

our

ability to manage our research and development programs that are based on novel technologies; |

| ●

|

our

ability to grow the size and capabilities of our organization through further collaboration and strategic alliances to expand our

point-of-care cell therapy business; |

| ●

|

our

ability to control key elements relating to the development and commercialization of therapeutic product candidates with third parties; |

| ●

|

our

ability to manage potential disruptions as a result of the continued impact of the coronavirus outbreak; |

| ●

|

our

ability to manage the growth of our company; |

| ●

|

our

ability to attract and retain key scientific or management personnel and to expand our management team; |

| ●

|

the

accuracy of estimates regarding expenses, future revenue, capital requirements, profitability, and needs for additional financing;

and |

| ●

|

our

belief that our therapeutic related developments have competitive advantages and can compete favorably and profitably in the cell

and gene therapy industry. |

Cell

& Gene Therapy Business (“CGT”)

| ●

|

our

ability to adequately fund and scale our various collaboration, license, partnership and joint venture agreements for the development

of therapeutic products and technologies; |

| ●

|

our

ability to advance our therapeutic collaborations in terms of industrial development, clinical development, regulatory challenges,

commercial partners and manufacturing availability; |

| ●

|

our

ability to implement our POC strategy in order to further develop and advance autologous therapies to reach patients; |

| ●

|

expectations

regarding our ability to obtain and maintain existing intellectual property protection for our technologies and therapies; |

| ●

|

our

ability to commercialize products in light of the intellectual property rights of others; |

| ●

|

our

ability to obtain funding necessary to start and complete such clinical trials; |

| ●

|

our

ability to further our CGT development projects, either directly or through our JV partner agreements, and to fulfill our obligations

under such agreements; |

| ●

|

our

belief that our systems and therapies are as at least as safe and as effective as other options; |

| ●

|

the

outcome of certain legal proceedings that we become involved in; |

| ●

|

our

license agreements with other institutions; |

| ●

|

expenditures

not resulting in commercially successful products; |

| ●

|

our

dependence on the financial results of our POC business; |

| ●

|

our

ability to complete development, processing and then roll out Orgenesis Mobile Processing Units and Labs (“OMPULs”);

and |

| ●

|

our

ability to grow our POC business and to develop additional joint venture relationships in order to produce demonstrable revenues. |

| |

|

| |

Metalmark

Investment Risks |

| |

|

| ●

|

Octomera

(as defined below) may not receive the future payments pursuant to the Unit Purchase Agreement with MM OS Holdings, L.P. (“MM”),

an affiliate of Metalmark Capital Partners; |

| ●

|

MM

may force the sale of Octomera under certain conditions which may result in MM receiving a greater value than us and our shareholders; |

| ●

|

MM

assumed control of the Board of Managers of Octomera, which has limited our ability to control and direct the activities of Octomera.; |

| ●

|

MM

has the right to buy our units in Octomera upon the occurrence of certain events, which could result in us not holding any equity

in Octomera; |

| ●

|

we

may be forced to redeem all of the units of Octomera held by MM, which could require substantial cash outlay and would adversely

affect our financial position; and |

| ●

|

if

MM opts to exchange its Octomera units for shares of our common stock, we could potentially issue up to 5,106,596 shares of our common

stock to MM, which may result in significant dilution to our existing stockholders. |

These

statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks identified

under “Risk Factors” in this prospectus supplement, the accompanying base prospectus, our annual report on Form 10-K for

the fiscal year ended December 31, 2022, as filed with the SEC on March 22, 2023, and any additional risk factors identified in our periodic

reports since the date of such report. You are cautioned not to place undue reliance on forward-looking statements, which speak only

as of the date of this prospectus supplement.

PROSPECTUS

SUPPLEMENT SUMMARY

This

prospectus supplement summary highlights information contained elsewhere in this prospectus supplement, the accompanying base prospectus

and the documents incorporated by reference herein and therein. This summary does not contain all of the information that you should

consider before deciding to invest in our securities. You should read this entire prospectus supplement and the accompanying base prospectus

carefully, including the section entitled “Risk Factors” in this prospectus supplement and the accompanying base prospectus

and our financial statements and the related notes and the other information incorporated by reference into this prospectus supplement

and the accompanying base prospectus, before making an investment decision.

Our

Company

Overview

We

are a global biotech company working to unlock the potential of CGTs in an affordable and accessible format. CGTs can be centered on

autologous (using the patient’s own cells) or allogenic (using master banked donor cells) and are part of a class of medicines

referred to as advanced therapy medicinal products, or ATMPs. We are mostly focused on the development of autologous therapies that can

be manufactured under processes and systems that are developed for each therapy using a closed and automated approach that is validated

for compliant production near the patient for treatment of the patient at the point of care, or POCare. This approach has the potential

to overcome the limitations of traditional commercial manufacturing methods that do not translate well to commercial production of advanced

therapies due to their cost prohibitive nature and complex logistics to deliver such treatments to patients, ultimately limiting the

number of patients that can have access to, or can afford, these therapies.

To

achieve these goals, we have developed a collaborative worldwide network of research institutes and hospitals who are engaged in the

POCare model, or our POCare Network, and a pipeline of licensed POCare advanced therapies that can be processed and produced under such

closed and automated processes and systems, or POCare Therapies. We are developing our pipeline of advanced therapies and with the goal

of entering into out-licensing agreements for these therapies. Our cellular therapies, though defined as drug products, conceptually

differ from other drug modalities in that they are based on reprogramming of cells sourced from the patient or from a donor. In most

cases, they are individually produced per patient in a highly sterile and controlled environment, and their efficacy is optimized when

administered a short time following production as fresh product.

To

advance the execution of our goal of bringing such therapies to market, we have designed and built our POCare Platform - a scalable infrastructure

of technology and services that ensures a central quality system, replicability and standardization of infrastructure and equipment,

and centralized monitoring and data management. The platform is constructed on POCare Centers that serve as hubs that locally implement

our quality system, Good Manufacturing Practices, training procedures, quality control testing, incoming supply of materials and oversee

the actual production in the Orgenesis Mobile Processing Units & Labs, or OMPULs.

In

connection with the investment by an affiliate of Metalmark Capital Partners (“Metalmark” or “MM”) in November

2022, we separated our operations into two operating segments: the operations of Octomera LLC (the “Octomera” segment which

we have renamed to the “Octomera” segment following the change of name of Morgenesis LLC to Octomera LLC) and therapies related

activities (the “Therapies” segment). Prior to that, we conducted all our operations as one single segment. The Octomera

segment includes mainly POCare Services and includes the results of the subsidiaries transferred to Octomera and all of the operations

of Octomera LLC. The Therapies segment includes our therapeutic development operations.

On

June 30, 2023, in connection with an additional $1 million investment in Octomera, we and MM entered into Amendment No. 1 to the Second

Amended and Restated Limited Liability Company Agreement (the “LLC Agreement Amendment”) to change the name of Morgenesis

to “Octomera LLC” and to amend Octomera’s board composition. Pursuant to the LLC Agreement Amendment, the board of

managers of Octomera (the “Octomera Board”) will be comprised of five managers, two of which will be appointed by us, one

of which will be an industry expert appointed by MM, and two of which will be appointed by MM. As a result of the amendment to the composition

of the Octomera Board pursuant to the LLC Agreement Amendment described above, we deconsolidated Octomera from our consolidated financial

statements as of June 30, 2023 and recorded our equity interest in Octomera as an equity method investment.

In

addition, we and MM entered into various amendments to the Unit Purchase Agreement since June 30, 2023. Pursuant to such amendments,

we or MM, as the case may be, agreed to pay certain amounts in exchange for Class A Preferred Units of Octomera LLC to support the continued

expansion of Orgenesis’ POCare Services, all as detailed in the table below. In the case of MM investments, the investment amount

of the First Future Investment (as defined in the UPA) was reduced by the amount of the Subsequent Investment.

| Date | |

Investing party | |

Amendment # | |

Amount | | |

Class A Preferred units obtained | |

| August 22, 2023 | |

MM | |

3 | |

$ | 100,000 | | |

| 10,000 | |

| August 29, 2023 | |

Company | |

4 | |

$ | 543,000 | | |

| 54,310 | |

| September 6, 2023 | |

MM | |

5 | |

$ | 100,000 | | |

| 10,000 | |

| September 13, 2023 | |

MM | |

6 | |

$ | 150,000 | | |

| 15,000 | |

| September 28, 2023 | |

MM | |

7 | |

$ | 150,000 | | |

| 15,000 | |

| October 12, 2023 | |

Company | |

8 | |

$ | 117,000 | | |

| 11,700 | |

We

currently own approximately 75% of Octomera LLC.

Therapies

segment (POCare Therapies)

While

the biotech industry struggles to determine the best way to lower cost of goods and enable CGTs to scale, the scientific community continues

to advance and push the development of such therapies to new heights. Clinicians and researchers are excited by all the new tools (new

generations of industrial viruses, big data analysis for genetic and molecular data) and technologies (CRISPR, mRNA, etc.) available,

often at a low cost, to perform advanced research in small labs. Most new therapies arise from academic institutes or small spinouts

from such institutes. Though such research efforts may manage to progress into a clinical stage, utilizing lab based or hospital-based

production solutions they lack the resources to continue the development of such drugs to market approval.

Historically,

drug/therapeutic development has required investments of hundreds of millions of dollars to be successful. One significant cause for

the high cost is that each therapy often requires unique production facilities and technologies that must be subcontracted or built.

Further the cost of production during the clinical stage is extremely expensive, and the cost of the clinical trial itself is very high.

Given these financial restraints, researchers and institutes hope to out-license their therapeutic products to large biotech companies

or spin-out new companies and raise large fundraising rounds. However, in many cases they lack the resources and the capability to de-risk

their therapeutic candidates enough to be attractive for such fundings or partnership.

Our

POCare Network is an alternative to the traditional pathway of drug development. We collaborate with academic institutions and entities

that have been spun out from such institutions. We are in close contact with researchers who are experts in the field of the drug and

also partners with leading hospitals and research institutes. Based on such collaborations, we enter into in-licensing agreements with

relevant institutions for promising therapies with the aim of adapting them to a point-of-care setting through regional or strategic

biological partnerships. Based on the results of the collaboration, we are then able to out-license our own therapeutic developments,

as well as those therapies developed from in-licensing agreements to out-licensing partners at preferred geographical regions.

The

ability to produce these products at low cost allows for an expedited development process, and the partnership with hospitals around

the globe enables joint grants and lower cost of clinical development. The POCare Therapies division reviews many therapies available

for out licensing and select the ones which they believe have the highest market potential, can benefit the most from a point of care

approach and have the highest chance of clinical success. It assesses such issues by utilizing its global POCare Network and its internal

knowhow accumulated over a decade of involvement in the field.

The

goal of this in-licensing is to quickly adapt such therapies to a point-of-care approach through regional partnerships, and to out-license

the products for market approval in preferred geographical regions. This approach lowers overall development cost, through minimizing

pre-clinical development costs incurred by us, and through receiving of the additional funding from grants and/or payments by regional

partners.

Octomera

segment (mainly POCare Services)

Octomera

is responsible for most of our POCare services platform. The POCare Services platform is utilized by parties such as biotech companies

and hospitals for the supply of their products. Octomera’s services include adapting the process to the platform and supplying

the products, or POCare Services. These are services for third party companies and for CGTs that are not necessarily based on our POCare

Therapies. POCare services that we and our affiliated entities perform include:

| |

●

|

Process

development of therapies, process adaptation, and optimization inside the OMPULs, or “OMPULization”; |

| |

●

|

Adaptation

of automation and closed systems to serviced therapies; |

| |

●

|

Incorporation

of the serviced therapies compliant with GMP in the OMPULs that we design and built; |

| |

●

|

Tech

transfers and training of local teams for the serviced therapies at the POCare Centers; |

| |

●

|

Processing

and supply of the therapies and required supplies under GMP conditions within our POCare Network, including required quality control

testing; and |

| |

●

|

Contract

Research Organization services for clinical trials. |

The

POCare Services are performed in decentralized hubs that provide harmonized and standardized services to customers, or POCare Centers.

We are working to expand the number and scope of our POCare Centers with the intention of providing an efficient and scalable pathway

for CGT therapies to reach patients rapidly at lowered costs. Our POCare Services are designed to allow rapid capacity expansion while

integrating new technologies to bring together patients, doctors and industry partners with a goal of achieving standardized, regulated

clinical development and production of therapies.

Our

principal executive offices are located at 20271 Goldenrod Lane, Germantown, MD 20876, and our telephone number is (480) 659-6404. Our

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and all amendments to those reports are available

free of charge though our website (http://www.orgenesis.com) as soon as practicable after such material is electronically filed

with, or furnished to, the SEC. Except as otherwise stated in these documents, the information contained on our website or available

by hyperlink from our website does not constitute part of, and is not incorporated by reference into, this prospectus or the registration

statement of which it forms a part.

The

Offering

The

following is a brief summary of some of the terms of the offering and is qualified in its entirety by reference to the more detailed

information appearing elsewhere in this prospectus supplement and the accompanying base prospectus. For a more complete description of

the terms of our common stock, see “Description of Capital Stock” in the accompanying base prospectus.

| Common

Stock offered by us |

1,410,256

shares. |

| |

|

| Warrants

offered by us |

We

are also offering Warrants to purchase up to 1,410,256 shares of Common Stock. The exercise

price of each Warrant will be $0.78 per share. Each Warrant will be exercisable on the closing date of this offering. The Warrants

will expire five years from the initial exercisability date. This prospectus supplement also relates to the offering of

the Common Stock issuable upon exercise of such Warrants. See “Description of Securities We Are Offering” for a discussion

on the terms of the Warrants. |

| |

|

| Common

stock to be outstanding immediately after this offering |

31,877,063

shares (assuming no exercise of the Warrants). |

| Use

of proceeds |

We

expect to receive net proceeds from this offering of approximately $0.8 million, after deducting

the Placement Agent’s fees and estimated offering expenses payable by us.

We

intend to use the net proceeds of this offering for working capital and general corporate purposes. See “Use of Proceeds.” |

| |

|

| Risk

Factors |

Investing

in our securities involves a high degree of risk. You should carefully consider the information under “Risk Factors”

on page S-8 of this prospectus supplement and the accompanying base prospectus and the other information included or incorporated

by reference in this prospectus supplement and the accompanying base prospectus for a discussion of factors you should carefully

consider before deciding to invest in our securities. |

| |

|

| Nasdaq

Capital Market symbol |

Our

shares of common stock are traded on The Nasdaq Capital Market under the symbol “ORGS”. There is no established trading

market for the Warrants, and we do not expect a market to develop. We

do not intend to apply for a listing for the Warrants on any securities exchange

or other national recognized trading system. Without an active trading market, the liquidity of the Warrants will be limited. |

The

number of shares of our common stock expected to be outstanding immediately after this offering is based on shares of common stock outstanding

as of June 30, 2023, and excludes as of that date the following:

| |

●

|

3,510,767

shares of our common stock issuable upon the exercise of stock options outstanding as of June 30, 2023, at a weighted-average exercise

price of $4.22 per share; |

| |

|

|

| |

●

|

4,431,786

shares of our common stock issuable upon the exercise of warrants outstanding as of June 30, 2023, at a weighted-average exercise

price of $3.79 per share; |

| |

|

|

| |

●

|

10,425,469

shares of common stock issuable upon conversion of principal and accrued interest underlying outstanding convertible loans assuming

a weighted-average conversion price of $2.56 per share, assuming a conversion date of June 30, 2023; |

| |

|

|

| |

●

|

483,703

shares of common stock available for future issuance under our 2017 Equity Incentive Plan as of June 30, 2023; and |

| |

|

|

| |

●

|

170,308

shares of common stock available for future issuance under our Global Share Incentive Plan (2012) as of June 30, 2023. |

Unless

otherwise stated or the context requires otherwise, all information in this prospectus supplement assumes (i) (ii) no issuances or exercises of

any other outstanding shares, options, or warrants after June 30, 2023 and (iii) no exercise of the Warrants.

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before purchasing our common stock, you should read and consider carefully the following

risk factors, as well as the risks described under the section captioned “Risk Factors” in the accompanying base prospectus,

our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as filed with the SEC on March 22, 2023, and any subsequent

updates in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, all of which are incorporated herein by reference, and

as updated by any other document that we subsequently file with the SEC and that is incorporated by reference into this prospectus supplement

and the accompanying base prospectus, before investing in our securities. Each of these risk factors, either alone or taken together,

could adversely affect our business, operating results and financial condition, as well as adversely affect the value of an investment

in our common stock. There may be additional risks that we do not presently know of or that we currently believe are immaterial, which

could also impair our business and financial position. If any of the events described below were to occur, our financial condition, our

ability to access capital resources, our results of operations and/or our future growth prospects could be materially and adversely affected

and the market price of our common stock could decline. As a result, you could lose some or all of any investment you may make in our

common stock.

Risks

Related to this Offering and Our Common Stock

The

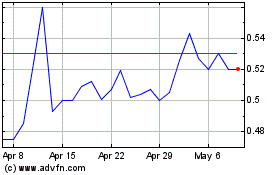

market price for our common stock has experienced significant price and volume volatility and is likely to continue to experience significant

volatility in the future, which may cause the value of any investment in our common stock to decline.

Our

stock price and the stock prices of companies similar to Orgenesis have been highly volatile. In addition, stock markets generally have

recently experienced volatility. Our stock price has experienced significant price and volume volatility for the past year, and our stock

price is likely to experience significant volatility in the future. The price of our common stock may decline and the value of any investment

in our common stock may be reduced regardless of our performance. Further, the daily trading volume of our common stock has historically

been relatively low. As a result of the historically low volume, our shareholders may be unable to sell significant quantities of common

stock in the public trading markets without a significant reduction in the price of our common stock. The trading price of our common

stock may be influenced by factors beyond our control, such as the volatility of the financial markets in general, including in reaction

to the ongoing COVID-19 pandemic, geopolitical conflicts such as the Russian invasion of Ukraine and the emerging military conflict in

Israel and Gaza, uncertainty surrounding the U.S. economy, conditions and trends in the markets we serve, changes in the estimation of

the future size and growth rate of our markets, publication of research reports and recommendations by financial analysts relating to

our business, the business of our competitors or the EV industry, changes in market valuation or earnings of competitors,

sales of our common stock by our principal shareholders, and the trading volume of our common stock. The historical market prices of

our common stock may not be indicative of future market prices and we may be unable to sustain or increase the value of our common stock.

Further, we have historically used equity incentive compensation as part of our overall compensation arrangements. The effectiveness

of equity incentive compensation in retaining key employees may be adversely impacted by volatility in our stock price. Significant declines

in our stock price may also interfere with our ability, if needed, to raise additional funds through equity financing or to finance strategic

transactions with our stock.

Any

inability or perceived inability of investors to realize a gain on an investment in our common stock could have an adverse effect on

our business, financial condition and results of operations by potentially limiting our ability to attract and retain qualified employees

and to raise capital. In addition, there may be increased risk of securities litigation following periods of fluctuations in our stock

price. Securities class action lawsuits are often brought against companies after periods of volatility in the market price of their

securities. These and other consequences of volatility in our stock price which could be exacerbated by macroeconomic conditions that

affect the market generally, or our industries in particular, could have the effect of diverting management’s attention and could

materially harm our business.

Purchasers

will experience immediate dilution in the book value per share of the common stock purchased in the offering.

The

price of our common stock to be sold in this offering is substantially higher than the net tangible book value per share of our common

stock. Therefore, if you purchase shares of our common stock in this offering you will pay a price per share that substantially exceeds

our net tangible book value per share after this offering. After giving effect to the sale of an aggregate of 1,410,256 shares

of our common stock and accompanying Warrants to purchase 1,410,256 shares of common stock at a price of $0.78 per share, and after deducting placement agent fees and estimated offering expenses payable by us, our as adjusted

net tangible book value as of June 30, 2023 would have been approximately $13.6 million, or approximately $0.46 per share.

This represents an immediate increase in as adjusted net tangible book value of approximately $0.02 per share to our existing

stockholders and an immediate dilution in as adjusted net tangible book value of approximately $0.32 per share to purchasers of

our common stock in this offering. The exercise of outstanding stock options and warrants, as well as the Warrants being offered in this

offering, will result in further dilution of your investment. See “Dilution” in this prospectus supplement for more information.

There

may be future sales of our common stock, which could adversely affect the market price of our common stock and dilute the value of the

common stock you purchase.

The

exercise of any options granted to executive officers and other employees under our equity compensation plans, the settlement of our

outstanding restricted stock units, the exercise of outstanding warrants and other issuances of our common stock could have an adverse

effect on the market price of the shares of our common stock. Other than the restrictions set forth in the section titled “Underwriting,”

we are not restricted from issuing additional shares of common stock, including any securities that are convertible into or exchangeable

for, or that represent the right to receive shares of common stock, provided that we are subject to the requirements of The Nasdaq Capital

Market. Sales of a substantial number of shares of our common stock in the public market or the perception that such sales might occur

could materially adversely affect the market price of the shares of our common stock. Because our decision to issue securities in any

future offering will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing

or nature of our future offerings. Accordingly, our shareholders bear the risk that our future offerings will reduce the market price

of our common stock and dilute their stock holdings in us.

A

large number of shares of common stock issued in this offering may be sold in the market following this offering, which may depress the

market price of our common stock.

We

are offering a significant number of shares of our common stock relative to the amount of our common stock currently outstanding. Additionally,

a large number of shares of common stock issued in this offering may be sold in the public market following this offering, which may

depress the market price of our common stock. If there are more shares of common stock offered for sale than buyers are willing to purchase,

then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of

common stock and sellers remain willing to sell the shares of common stock. The common stock issued in the offering will be freely tradable

without restriction or further registration under the Securities Act.

If

securities or industry research analysts cease publishing research or reports about our business or if they issue unfavorable commentary

or downgrade our common stock, the market price of our securities and trading volume could decline.

The

trading market for our securities relies in part on the research and reports that securities and industry analysists publish about us,

our industry and our business. We do not have any control over these analysts. The market price of our securities and trading volumes

could decline if one or more securities or industry analysts downgrade our securities, issue unfavorable commentary about us, our industry

or our business, cease to cover our company or fail to regularly publish reports about us, our industry or our business.

An

active trading market for our common stock may not develop or be sustained.

Although

our common stock is currently traded on The Nasdaq Capital Market, an active trading market for our common stock may not be maintained.

If an active market for our common stock is not maintained, it may be difficult for shareholders to sell shares of our common stock.

An inactive trading market may impair our ability to raise capital to continue to fund operations by selling shares and may impair our

ability to acquire other companies or technologies by using our shares as consideration.

Our

management will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Our

management will have broad discretion in the application of the net proceeds from this offering, and our stockholders will not have the

opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. The failure by our

management to apply these funds effectively could harm our business. See “Use of Proceeds” on page S-13 for a description

of our proposed use of proceeds from this offering.

We

have never paid cash dividends on its capital stock, and we do not anticipate paying dividends in the foreseeable future.

We

have never paid cash dividends on any of our capital stock and we currently intend to retain any future earnings to fund the growth of

our business. Any determination to pay dividends in the future will be at the discretion of our board of directors and will depend on

our financial condition, operating results, capital requirements, general business conditions and other factors that the board may deem

relevant. As a result, capital appreciation, if any, of our common stock will be the sole source of gain for the foreseeable future.

Risks

Related to Our Warrants

Issuance

of our common stock upon exercise of securities may depress the price of our common stock.

Upon

consummation of this offering, we will have 31,877,063 shares of common stock issued and outstanding; 3,510,767 shares

of our common stock issuable upon the exercise of stock options outstanding as of June 30, 2023, at a weighted-average exercise

price of $4.22 per share; 4,431,786 shares of our common stock issuable upon the exercise of Warrants outstanding as of

June 30, 2023, at a weighted-average exercise price of $3.79 per share; 10,425,469 shares of common stock issuable

upon conversion of principal and accrued interest underlying outstanding convertible loans assuming a weighted-average conversion

price of $2.56 per share, assuming a conversion date of June 30, 2023; 483,703 shares of common stock available for

future issuance under our 2017 Equity Incentive Plan as of June 30, 2023; and 170,308 shares of common stock available for

future issuance under our Global Share Incentive Plan (2012) as of June 30, 2023; and Warrants issued in this offering to

purchase shares of common stock at an exercise price of $0.78 per share. All Warrants and stock options are convertible, or

exercisable into, one share of common stock. The issuance of shares of our common stock upon the exercise of outstanding convertible

securities could result in substantial dilution to our shareholders, which may have a negative effect on the price of our common

stock.

There

is no public market for the Warrants being offered by us in this offering.

There

is no established public trading market for the Warrants, and we do not expect

a market to develop. In addition, we do not intend to apply to list the Warrants

on any national securities exchange or other nationally recognized trading system. Without an active market, the liquidity of the Warrants will be limited.

Holders

of the Warrants offered hereby will have no rights as shareholders with respect to shares of common stock underlying

the Warrants until such holders exercise their Warrants and acquire our common shares, except as otherwise provided

in the Warrants.

Until

holders of the Warrants acquire our shares of common stock upon exercise thereof, such holders will have no rights

with respect to the shares of common stock underlying such Warrants, except to the extent that holders of such

Warrants will have certain limited rights to participate in distributions or dividends paid on our shares of

common stock as set forth in the Warrants. Upon exercise of the Warrants, the holders

will be entitled to exercise the rights of a shareholder only as to matters for which the record date occurs after the exercise date.

Risks

Related to the Metalmark Investment

Octomera

may not receive the future payments pursuant to the Unit Purchase Agreement with MM OS Holdings, L.P. (“MM”), an affiliate

of Metalmark Capital Partners.

The

Unit Purchase Agreement, as amended, between us and MM (the “UPA”) requires MM to make up to two additional payments to Octomera

if certain specified Net Revenue targets (as defined in the UPA) are satisfied by Octomera during each of years 2022 and 2023, as described

in more detail below. For each of those fiscal years in which such specified Net Revenue targets are satisfied by Octomera, MM will be

obligated to pay an additional $10 million to Octomera shortly after the end of that fiscal year.

If

Octomera and its subsidiaries generate Net Revenue (as defined in the UPA) equal to or greater than $30,000,000 during the twelve month

period ending December 31, 2022 (the “First Milestone”) and/or equal to or greater than $50,000,000 during the twelve month

period ending December 31 2023 (the “Second Milestone”), then MM will pay up to $10,000,000 in cash in exchange for 1,000,000

additional Class A Units if the First Milestone is achieved and $10,000,000 in cash in exchange for 1,000,000 Class B Units Preferred

Units of Octomera (the “Class B Units”) if the Second Milestone is achieved. During 2023, MM has paid $6,500,000 in

exchange for 650,000 Class A Units. Notwithstanding the foregoing, if the First Milestone is not achieved, but Octomera and its subsidiaries

generate Net Revenue equal or greater to $13,000,000 for the three months ending March 31, 2023, then MM shall make the first $10,000,000

future investment for 1,000,000 Class A Units described above. At any time until the consummation of a Company IPO or Change of Control

(in each case, as defined in the LLC Agreement), MM may, in its sole discretion, elect to invest up to an additional $60,000,000 in Octomera

(any such investment, an “Optional Investment”) in exchange for certain Class C Preferred Units of Octomera (the “Class

C Units” and, together with the Class A Units and the Class B Units, the “Preferred Units”). $10,000,000 of such Optional

Investment shall be to purchase Class C-1 Preferred Units based on an enterprise value of $125,000,000, with such enterprise value adjusted

by any net debt as of such time; $25,000,000 of Optional Investment shall be to purchase Class C-2 Preferred Units based on an enterprise

value of $156,250,000, with such enterprise value adjusted by any net debt as of such time; and $25,000,000 of Optional Investment shall

be to purchase Class C-3 Preferred Units based on an enterprise value of $250,000,000, with such enterprise value adjusted by any net

debt as of such time. Further, if, during the twelve month period ending on December 31, 2023, Octomera and its subsidiaries generate

(i) Net Revenue (as defined in the UPA) equal to or greater than $70,000,000, (ii) Gross Profit (as defined in the UPA) equal to or greater

than $35,000,000 and (iii) EBITDA (as defined in the UPA) equal to or greater than $10,000,000, then MM shall make (or cause to be made)

a one-time cash payment of $10,000,000 to the Company upon such payment becoming final and binding pursuant to the UPA (the “Earnout

Payment”).

Accordingly,

if we do not meet the applicable Net Revenue, Gross Profit or EBITDA targets, Octomera will not be eligible to receive the future payments

from MM. Further, MM may choose not to make any of the Optional Investments. In addition, under certain circumstances, MM will obtain

the right to put to us (or, at our discretion, to Octomera if Octomera shall then have the funds available to consummate the transaction)

its shares in Octomera.

MM

may force the sale of Octomera under certain conditions which may result in MM receiving a greater value than us and our shareholders.

At

any time following the earliest to occur of (x) prior to the two year anniversary of the initial closing date under the UPA (the “Initial

Two Year Period”) or a Material Governance Event (as defined in the LLC Agreement), if MM and we approve a sale of Octomera or

(y) (i) after the Initial Two Year Period or (ii) after the occurrence of a Material Governance Event, if MM or the Octomera Board by

Supermajority Vote (as defined in the LLC Agreement) approves a Sale of Octomera (an “Approved Sale”), then, subject to notice,

MM or Octomera can require the members of Octomera to sell their units in Octomera (the “Drag Along Rights”) to the purchaser

in the Approved Sale. Notwithstanding the foregoing, we are entitled to advise Octomera and the Octomera Board of our election to be

a potential acquiror of Octomera. Notwithstanding the foregoing, if MM falls below 50% of its initial holdings in Octomera as specified

above, then it is no longer entitled to exercise the Drag Along Right. Notwithstanding the foregoing, prior to the three-year anniversary

of the initial closing date (the “Initial Three Year Period”), MM and Octomera will not be entitled to exercise the Drag

Along Right unless the valuation of Octomera reflected in the sale is equal to or greater than $300,000,000. If we breach our obligation

to effectuate an Approved Sale or otherwise the failure of an Approved Sale to be consummated is primarily attributable to our or our

affiliates, then (i) the Octomera Board shall be appointed as follows: (a) one manager shall be appointed by us, (b) the Industry Expert

Manager shall be appointed by MM and (c) three Managers shall be appointed by MM and (ii) MM will have the option to convert all of its

Preferred Units into such number of Common Units (as defined below) that represents (on a post-conversion basis) the Applicable Percentage

(as defined in the LLC Agreement) of all of the outstanding Common Units (including any Common Units to be issued to MM pursuant to this

provision).

While

we have the right of first refusal with respect to acquiring Octomera in its entirety, if MM elects to exercise such a right and if we

are not in the position to acquire Octomera, MM may cause the sale of Octomera to any third party on terms MM approves on an arm’s

length basis pursuant to the Drag Along Right, subject to the conditions set forth above. If this occurs, we are contractually obligated

to approve such a sale and execute any documents as required by MM. Based on this, there may be a situation where MM approves a sale

that is more valuable or beneficial to MM than to our company and our shareholders, and we will not be able to prevent such a transaction.

A sale of Octomera would have impacts to our POCare services business as conducted through Octomera and to our overall value as a whole.

MM

assumed control of the Board of Managers of our subsidiary, Octomera, which has limited our ability to control and direct the activities

of Octomera.

Pursuant

to Amendment No. 1 to the Second Amended and Restated Limited Liability Company Agreement, dated as of June 30, 2023, the board of managers

of Octomera (the “Octomera Board”) is comprised of five managers, two of which are appointed by the Company, one of which

is an industry expert appointed by MM, and two of which are appointed by MM.

In

addition, if (i) at any time there is a Material Underperformance Event (as defined in the LLC Agreement), (ii) at any time there is

a Material Governance Event, (iii) Octomera does not pay in full the aggregate Redemption Price (as defined in the LLC Agreement) to

redeem on any Redemption Date (as defined in the LLC Agreement) all Preferred Units to be redeemed on such Redemption Date, (iv) Octomera

or Orgenesis does not pay in full the aggregate price of the Put Option (as defined in the LLC Agreement), or (v) Orgenesis breaches

its obligation to effectuate an Approved Sale (as defined below) or otherwise the failure of an Approved Sale to be consummated is primarily

attributable to us or our affiliates, then the Octomera Board shall be appointed as follows: (a) one manager shall be appointed by us,

(b) the Industry Expert Manager shall be appointed by MM and (c) three Managers shall be appointed by MM.

Accordingly,

MM controls the Board of Directors of Octomera and is entitled to direct its activities and approve any transactions of Octomera, even

if such transactions provide greater value to MM than they do to us and our shareholders. This lack of control could significantly impact

our POCare service activities as conducted through Octomera and to our overall value as a whole.

MM

has the right to buy our units in Octomera upon the occurrence of certain events, which could result in us not holding any equity in

Octomera.

Upon

the occurrence of a Material Governance Event, MM is entitled, at its option, to put to us (or, at our discretion, to Octomera if we

or Octomera shall then have the funds available to consummate the transaction) its units or, alternatively, purchase from us its units

(such purchase right, being the “MM Call Option”). The purchase price for units of MM or us in Octomera under either the

put right or the MM Call Option shall be equal to the fair market value of such units as determined by a nationally recognized independent

accounting firm selected by MM in its sole discretion; provided, however, that in no event shall the Put Price with respect to Preferred

Units be less than $10.00 per Class A Preferred Unit plus the Class A PIK Yield (as defined below) (the “Class A Preferred Unit

Original Issue Price”), $10.00 per Class B Preferred Unit plus the Class B PIK Yield (as defined below) (the “Class B Preferred

Unit Original Issue Price”) or the applicable price per Class C Preferred Unit as set forth in the LLC Agreement (the “Class

C Preferred Unit Original Issue Price”), as applicable, to each Preferred Unit. In the event MM does exercise its right following

the occurrence of any such event, we shall cease to be an equity owner of Octomera and will no longer derive any benefits from this subsidiary

or its activities. This would also affect the POCare activities being conducted by us through Octomera and our overall value as a whole.

We

may be forced to redeem all of the units of Octomera held by MM, which could require substantial cash outlay and would adversely affect

our financial position.

Each

holder of Preferred Units has the right to require Octomera to redeem its Preferred Units if holders of at least 50% of the then outstanding

Preferred Units deliver written notice to Octomera (the “Redemption Request”) at any time after (i) the earlier of either

November 4, 2027 and (ii) receipt by Octomera of an offer for a Change of Control from a third party purchaser that is not an affiliate

of any unitholder at a valuation of no less than $300,000,000 which Octomera has not accepted and completed (the “Proposed Sale”).

In the event a Redemption Request is delivered at any time following November 4, 2027, the price per Preferred Unit at which Octomera

will redeem Preferred Units (the “Redemption Price”) will be equal to the applicable Preferred Liquidation Preference Amount

(as defined in the LLC Agreement) determined as if a Deemed Liquidation Event (as defined in the LLC Agreement) had occurred on the date

the Redemption Request is delivered and as determined by a nationally recognized independent accounting firm selected by MM in its sole

discretion.

Any

such redemption would require us to expend substantial cash resources and could have a material adverse affect on our financial position.

In addition, our cash reserves at the time of such redemption may be insufficient to satisfy such redemption, in which case we may not

be able to continue as a going concern if we are unable to support our operations or cannot otherwise raise the necessary funds to support

our operations.

If

MM opts to exchange its Octomera units for shares of our common stock, we could potentially issue up to 5,106,596 shares of our

common stock to MM, which may result in significant dilution to our existing stockholders.

The

LLC Agreement provides that MM is entitled, at any time, to convert its units in Octomera for our common stock (such exchange option

being the “Stock Exchange Option”). Under the Stock Exchange Option, MM is entitled, at any time prior to July 1, 2025, to

exchange its units in Octomera for our common stock (the “MM Exchange Right”). The amount of shares of common stock to be

received by MM upon exercise of the MM Exchange Right shall be equal to (i) the fair market value of MM’s units to be exchanged,

as determined by a nationally recognized independent accounting firm in the United States with experience in performing valuation services

selected by MM and us, divided by (ii) the average closing price per share of our common stock during the 30-day period ending on the

date on which MM provides an exchange notice to us (the “Exchange Price”); provided, that in no event shall (A) the Exchange

Price be less than a price per share that would result in us having an enterprise value of less than $200,000,000 and (B) the maximum

number of shares of our common stock to be issued pursuant to the MM Exchange Right exceed 5,106,596 shares of our common stock. If MM

opts to exchange its Octomera units for shares of our common stock, we could potentially issue up to 5,106,596 shares of our common stock

to MM. The common stock issuable to MM upon exchange of the Octomera units for our common stock could have a depressive effect on the

market price of our common stock by increasing the number of shares of common stock outstanding and the proportionate voting power of

the existing stockholders may be significantly diluted.

USE

OF PROCEEDS

We

estimate that the net proceeds we will receive from this offering will be approximately $0.8 million, after deducting the Placement Agent’s

fees and estimated offering expenses payable by us and excluding the proceeds, if any, from the subsequent exercise of the Warrants.

We

intend to use the net proceeds from this offering, including any net proceeds from the exercise of Warrants issued

in this offering, together with our existing cash and cash equivalents, for working capital and general corporate purposes, including

our therapy related activities. We have not yet determined the amount of net proceeds to be used specifically for any particular purpose

or the timing of these expenditures. Accordingly, our management will have significant discretion and flexibility in applying the net

proceeds from the sale of these securities.

Pending

the use of the net proceeds from this offering, we intend to invest the net proceeds in investment-grade, interest-bearing instruments,

certificates of deposit or direct or guaranteed obligations of the U.S.

DIVIDEND

POLICY

We

have never declared or paid any cash dividends on our common stock. We currently intend to retain earnings, if any, to finance the growth

and development of our business. We do not expect to pay any cash dividends on our common stock in the foreseeable future. Payment of

future dividends, if any, will be at the discretion of our board of directors and will depend on our financial condition, results of

operations, capital requirements, restrictions contained in current or future financing instruments, provisions of applicable law, and

other factors the board of directors deems relevant.

DILUTION

Dilution

in net tangible book value per share to new investors is the amount by which the effective offering price per share paid by the purchasers

of the Shares sold in this offering exceeds the as adjusted net tangible book value per share of common

stock after giving effect to the offering. We calculate net tangible book value per share by dividing our net tangible assets (tangible

assets less total liabilities) by the number of shares of our common stock issued and outstanding as of June 30, 2023.

Our

net tangible book value at June 30, 2023 was approximately $12.6 million, or $0.44 per share.

After

giving effect to the sale in this offering of 1,410,256 Shares and Warrants to purchase 1,410,256 shares of Common

Stock at a combined price of $0.78 per share and accompanying Warrant, and after deducting the placement agent’s

fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of June 30, 2023 would have been

approximately $13.6 million, or $0.46 per share. This represents an immediate increase in net tangible book value of $0.02

per share to existing stockholders and immediate dilution in net tangible book value of $0.32 per share to new investors in

this offering.

The

following table illustrates this dilution on a per share basis, assuming the holders of the Warrants offered

hereby do not exercise the Warrants:

| Offering

price per share | |

|

|

|

|

$ |

0.78 | |

| Net tangible book value per

share as of June 30, 2023 | |

$ |

0.44 |

|

|

|

| |

| Increase

in net tangible book value per share attributable to this offering | |

|

0.02 |

|

|

|

| |

| As adjusted net tangible book value per share

as of June 30, 2023, after giving effect to this offering | |

|

|

|

|

|

0.46 | |

| Dilution per share to

new investors purchasing securities in this offering | |

|

|

|

|

$ |

0.32 | |

The

foregoing tables and calculations (other than historical net tangible book value) are based on 28,466,807 shares of common stock outstanding

as of June 30, 2023, and excludes as of that date the following:

| |

● |

3,510,767

shares of our common stock issuable upon the exercise of stock options outstanding as of June 30, 2023, at a weighted-average exercise

price of $4.22 per share; |

| |

|

|

| |

● |

4,431,786

shares of our common stock issuable upon the exercise of warrants outstanding as of June 30, 2023, at a weighted-average exercise

price of $3.79 per share; |

| |

|

|

| |

● |

10,425,469

shares of common stock issuable upon conversion of principal and accrued interest underlying outstanding convertible loans assuming

a weighted-average conversion price of $2.56 per share, assuming a conversion date of June 30, 2023; |

| |

|

|

| |

● |

483,703

shares of common stock available for future issuance under our 2017 Equity Incentive Plan as of June 30, 2023; and |

| |

|

|

| |

● |

170,308

shares of common stock available for future issuance under our Global Share Incentive Plan (2012) as of June 30, 2023. |

Except

as otherwise indicated, all information in this prospectus supplement assumes no exercise or conversion of the outstanding options, convertible

loans or warrants. To the extent that any of these outstanding options, convertible loans or warrants are exercised or converted at prices

per share below the effective offering price per share in this offering or we issue additional shares under our equity incentive plans

at prices below the effective offering price per share in this offering, there will be further dilution to new investors.

In

addition, we may choose to raise additional capital due to market conditions or strategic considerations, even if we believe we have

sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity

or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

DESCRIPTION

OF SECURITIES WE ARE OFFERING

Common

Stock

The

material terms and provisions of our common stock and each other class of our securities which qualifies or limits our common stock are

described in the section entitled “Description of Capital Stock” beginning on page 7 of the accompanying prospectus and

the Description of Securities included as Exhibit 4.1 to our Annual Report on Form 10-K for the year ended December 31, 2022, filed with

the Securities and Exchange Commission on March 22, 2023.

Warrants

The following description is subject

in all respects to the provisions contained in the form of Warrant. You should review a copy of the form of Warrant, which will be filed

as an exhibit to our Current Report on Form 8-K being filed with the SEC in connection with this offering, for a complete description

of the terms and conditions of the Warrants.

The

Warrants will be exercisable immediately for a period of five years at an exercise price of $0.78 per share.

The

Warrants will be exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice and

by payment in full in immediately available funds for the number of shares of common stock purchased upon such exercise. If there is

no registration statement registering, or the prospectus contained therein is not available for the issuance of the shares underlying

the warrants, as an alternative to payment in immediately available funds, the holder may, in its sole discretion, elect to exercise

the Warrant through a cashless exercise, in which case the holder would receive upon such exercise the net number of shares of common

stock determined according to the formula set forth in the Warrant. No fractional shares of common stock will be issued in connection

with the exercise of a Warrant. In lieu of issuing fractional shares, we will pay the holder a cash adjustment in respect of such fraction

in an amount equal to the fraction multiplied by the exercise price of the Warrant or round up to the next whole share.

The

exercise price per whole share of our common stock purchasable upon the exercise of the Warrants is $0.78 per share of common

stock. The exercise price of the Warrants is subject to adjustment from time to time in the event of certain stock dividends and

distributions, stock splits, stock combinations, reclassifications or similar events affecting our common stock and also upon any distributions

for no consideration of assets, including cash, stock or other property, to all of our shareholders. The exercise price is also subject

to adjustment in the event of subsequent sales of our common stock (or securities convertible into or exercisable or exchangeable for

shares of common stock) at a purchase price (or conversion or exercise price, as applicable) less than the then-effective exercise price.

In the event of such a subsequent sale, the exercise price will be reduced to such lower price, subject to certain exceptions.

A

holder will not have the right to exercise any portion of the Warrants if the holder (together with its affiliates) would beneficially

own in excess of 4.99% (or, at the election of the purchaser, 9.99%) of the number of shares of our common stock outstanding immediately

after giving effect to the exercise.

We

do not plan on applying to list the Warrants on The Nasdaq Capital Market or any other national securities exchange or any other nationally

recognized trading system.

Subject

to applicable laws, the Warrants may be offered for sale, sold, transferred or assigned without our consent.

In

the event of a fundamental transaction, as described in the Warrants, and generally including, with certain exceptions,

any reclassification, reorganization or recapitalization of our shares of Common Stock, any sale, lease, license, assignment,

transfer, conveyance or other disposition of all or substantially all of our assets, our merger or consolidation with or into

another person, the acquisition of more than 50% of our outstanding shares of Common Stock, or any person or group becoming the beneficial

owner of 50% of the voting power represented by our outstanding shares of Common Stock, the holders of the Warrants will be

entitled to receive upon exercise thereof the kind and amount of securities, cash or other property that the holders

would have received had they exercised the Warrants immediately prior to such fundamental transaction. Additionally, as more

fully described in the Warrants, in the event of certain fundamental transactions, the holders of the Warrants will be entitled to receive

consideration in an amount equal to the Black Scholes Value (as defined in the Warrant) of the remaining unexercised portion of the Warrants

on the date of consummation of such fundamental transaction.

Except

as otherwise provided in the Warrants or by virtue of such holder’s ownership of shares of our common stock, the holder of a warrant

does not have the rights or privileges of a holder of our common stock, including any voting rights, until the holder exercises the warrant.

PLAN

OF DISTRIBUTION

Titan

Partners Group LLC, a division of American Capital Partners, LLC (“Titan”, or the “Placement Agent”) has agreed

to act as our exclusive Placement Agent in connection with this offering subject to the terms and conditions of the Placement Agency

Agreement, dated November 8, 2023. The Placement Agent is not purchasing or selling any of the securities offered by this prospectus supplement,

nor is it required to arrange the purchase or sale of any specific number or dollar amount of securities but has agreed to use its reasonable

best efforts to arrange for the sale of all of the securities offered hereby. In connection with the offering of the securities described

in this prospectus supplement, we have entered into a securities purchase agreement (the “SPA”) directly with an institutional

investor in connection with this offering for the sale of all of the securities offered hereby.

We

expect to deliver the shares of common stock and warrants being offered pursuant to this prospectus supplement on or about November 9,

2023.

Fees

and Expenses

We

have engaged Titan as our exclusive Placement Agent in connection with this offering. This offering is being conducted on a “best

efforts” basis and the Placement Agent has no obligation to buy any of the securities from us or to arrange for the purchase or

sale of any specific number or dollar amount of securities. We have agreed to pay the Placement Agent fees set forth in the table below.

| | |

Per Share of Common Stock and

Warrant | | |

Total | |

| Public Offering Price | |

$ | 0.78 | | |

$ | 1,099,999.68 | |

| Placement Agent Fees(1) | |

$ | 0.0546 | | |