0001117171

false

CN

0001117171

2023-11-09

2023-11-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported):

November 9, 2023

| CBAK ENERGY TECHNOLOGY, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-32898 |

|

86-0442833 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

| BAK Industrial Park, Meigui Street |

| Huayuankou Economic Zone |

| Dalian, China, 116450 |

| (Address, including zip code, of principal executive offices) |

| |

| (86)(411)-3918-5985 |

| (Registrant’s telephone number, including area code) |

| |

| |

| (Former name or former address, if changed since last report) |

Securities registered or to be registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value |

|

CBAT |

|

Nasdaq Capital Market |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. Results of Operations

and Financial Condition.

On November

9, 2023, CBAK Energy Technology, Inc. (the “Company”) released its unaudited results of operations for the third quarter ended

September 30, 2023. A copy of the press release issued by the Company concerning the foregoing results is furnished hereto as Exhibit

99.1.

The information

in Item 2.02 of this Current Report on Form 8-K and the exhibit attached hereto are intended to be “furnished” and shall not

be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the

liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. Except as shall be expressly set forth

by specific reference in such filing, the information contained herein and in the accompanying exhibit shall not be incorporated by reference

into any filing with the Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless

of any general incorporation language in such filing.

ITEM 9.01. Financial Statements

and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CBAK ENERGY TECHNOLOGY, INC. |

| |

|

|

| Date: November 9, 2023 |

By: |

/s/Jiewei Li |

| |

|

Jiewei Li |

| |

|

Chief Financial Officer |

2

Exhibit 99.1

CBAK Energy Reports Third Quarter 2023 Unaudited

Financial Results

DALIAN, China, November 9, 2023 /PRNewswire/ –

CBAK Energy Technology, Inc. (NASDAQ: CBAT) (“CBAK Energy,” or the “Company”) a leading lithium-ion battery manufacturer

and electric energy solution provider in China, today reported its unaudited financial results for the third quarter ended September 30,

2023.

Third Quarter of 2023 Financial Highlights

| ● | Net revenues from sales of batteries were

$44.3 million, an increase of 71.5% from $25.8 million in the same period of 2022. |

| ● | Net

revenues from batteries used in light electric vehicles were $1.11 million, an decrease

of 2.8% from $1.15 million in the same period of 2022. |

| ● | Net

revenues from batteries used in electric vehicles were $0.40 million, an increase of

19.5 times from $0.02 million in the same period of 2022. |

| ● | Net

revenues from uninterruptible supplies were $42.8 million, an increase of 73.5% from

$24.7 million in the same period of 2022. |

| ● | Gross

margin for the battery business was 26.4%, an increase of 17.7 percentage points from

8.7% in the same period of 2022. |

| ● | Net

income attributable to shareholders of CBAK Energy (after deducting the change in fair value

of warrants) was $6.3 million, compared to a net loss of $0.9 million in the same period

of 2022. |

Yunfei Li, Chairman and Chief Executive Officer

of the Company, commented, “Amid the slowdown in China’s battery industry and macro headwinds, we are pleased to deliver robust

growth in our primary battery business and achieve both operating and net income in the third quarter, further improving our profitability.

Looking ahead, we anticipate sustaining our solid financial and operating performance. This is supported by our significant order backlog,

which exceeds our production capacity. Notably, orders for the Dalian facility have been scheduled toward the end of 2024, and our Nanjing

facility is also overwhelmed. At the same time, we are continuing to improve production efficiency and expand production capacity, bolstering

our market-leading position and reinforcing our growth trajectory.”

Jiewei Li, Chief Financial Officer and Secretary

of the Board of the Company, added, “As the battery business returned to year over year growth in the third quarter, we also recorded

the ongoing improvements in gross margin and operating profit margin. This was underpinned by a sharp increase in the contribution of

our higher-margin battery business and a reduction in the cost of revenues as we further leveraged our technology to improve production

efficiency. Alongside a growing number of orders for our battery products, we will continue to find the right balance between growth and

profitability while investing in R&D and production capacity expansion to enhance our sustainable, long-term competitiveness.”

Third quarter of 2023 Business Highlights &

Recent Developments

| ● | In

September, CBAK Energy announced that its wholly-owned subsidiary, Nanjing CBAK reached an

agreement with BAK Battery to acquire, from BAK Battery, a 5% stake in BAK Power, an unrelated,

well-respected power battery R&D and manufacturing company. |

| ● | In

September, CBAK Energy announced that its wholly-owned subsidiary, Nanjing CBAK received

an order worth RMB33.58 million from Anker, one of the largest third-party accessories suppliers

globally for Apple Inc.’s products. |

Third quarter of 2023 Financial Results

Net revenues were $63.4 million, representing

an increase of 9.9% compared to $57.7 million in the same period of 2022. This increase was primarily attributable to growth in the Company’s

battery business.

Among these revenues, detailed revenues from our

battery business are:

| Battery Business | |

2022

Third

Quarter | | |

2023

Third

Quarter | | |

%

Change

YoY | |

| Net Revenues ($) | |

| 25,845,959 | | |

| 44,327,653 | | |

| 71.5 | |

| Gross Profits ($) | |

| 2,242,930 | | |

| 11,698,226 | | |

| 421.6 | |

| Gross Margin | |

| 8.7 | % | |

| 26.4 | % | |

| - | |

| Net Income ($) | |

| 1,064,317 | | |

| 7,770,711 | | |

| 630.1 | |

| Net Revenues from Battery Business on Applications ($) | |

| | | |

| | | |

| | |

| Electric Vehicles | |

| 19,688 | | |

| 402,863 | | |

| 1946.2 | |

| Light Electric Vehicles | |

| 1,146,370 | | |

| 1,114,107 | | |

| -2.8 | |

| Uninterruptable supplies | |

| 24,679,901 | | |

| 42,810,683 | | |

| 73.5 | |

| Total | |

| 25,845,959 | | |

| 44,327,653 | | |

| 71.5 | |

Cost of revenues was $51.2 million, representing

a decrease of 5.7% from $54.3 million in the same period of 2022. The decrease in the cost of revenues corresponds to the Company’s

higher gross profit from the batteries’ segment.

Gross profit was $12.2 million, representing

an increase of 254.0% from $3.5 million in the same period of 2022. Gross margin was 19.3%, compared to 6.0% in the same period of 2022.

Total operating expenses were $7.0 million,

representing an increase of 40.8% from $4.9 million in the same period of 2022.

| ● | Research and development expenses were

$2.6 million, an increase of 8.1% from $2.4 million in the same period of 2022. |

| ● | Sales and marketing expenses were $1.1

million, an increase of 33.8% from $0.8 million in the same period of 2022. |

| ● | General and administrative expenses were

$3.2 million, an increase of 73.7% from $1.9 million in the same period of 2022. |

| ● | Provision for doubtful accounts was $0.02

million, compared to a recovery of doubtful accounts of $0.1 million in the same period of 2022. |

Operating income amounted to $5.3 million,

compared to an operating loss of $1.5 million in the same period of 2022.

Finance expense, net amounted to $0.4 million,

compared to finance income, net of $0.7 million in the same period of 2022.

Change in fair value of warrants was $0.02

million, compared to $0.94 million in the same period of 2022. The change in fair value of the warrants liability is mainly due to the

share price movement.

Net income attributable to shareholders of

CBAK Energy was $6.3 million, compared to net loss attributable to shareholders of CBAK Energy of $290 in the same period of 2022.

Net income attributable to shareholders of

CBAK Energy (after deducting the change in fair value of warrants) was $6.3 million, compared to a net loss of $0.9 million in the

same period of 2022.

Basic and diluted income per share were

both $0.07, compared to $0.00 in the same period of 2022.

Conference Call

CBAK Energy’s management will host an earnings

conference call at 8:00 AM U.S. Eastern Time on Thursday, November 9, 2023 (9:00 PM Beijing/Hong Kong Time on November 9, 2023).

For participants who wish to join our call online,

please visit:

https://edge.media-server.com/mmc/p/imrz65fd

Participants who plan to ask questions during

the call will need to register at least 15 minutes prior to the scheduled call start time using the link provided below. Upon registration,

participants will receive the conference call access information, including dial-in numbers, a unique pin, and an email with detailed

instructions.

Participant Online Registration:

https://register.vevent.com/register/BI1f60f4340d574f159da65982159458e2

Once completing the registration, please dial-in

at least 10 minutes before the scheduled start time of the conference call and enter the personal pin as instructed to connect to the

call.

A replay of the conference call may be accessed

within seven days after the conclusion of the live call at the following website:

https://edge.media-server.com/mmc/p/imrz65fd

The earnings release and the link for the replay

are available at ir.cbak.com.cn.

About CBAK Energy

CBAK Energy Technology, Inc. (NASDAQ: CBAT) is

a leading high-tech enterprise in China engaged in the development, manufacturing, and sales of new energy high power lithium batteries

and raw materials for use in manufacturing high power lithium batteries. The applications of the Company’s products and solutions

include electric vehicles, light electric vehicles, electric tools, energy storage, uninterruptible power supply (UPS), and other high-power

applications. In January 2006, CBAK Energy became the first lithium battery manufacturer in China listed on the Nasdaq Stock Market. CBAK

Energy has multiple operating subsidiaries in Dalian, Nanjing and Shaoxing, as well as a large-scale R&D and production base in Dalian.

For more information, please visit ir.cbak.com.cn.

Safe Harbor Statement

This press release contains “forward-looking

statements” that involve substantial risks and uncertainties. All statements other than statements of historical facts contained

in this press release, including statements regarding our future results of operations and financial position, strategy and plans, and

our expectations for future operations, are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended and Section 21E of the Securities Exchange Act of 1934, as amended. We have attempted to identify forward-looking statements

by terminology including “anticipates,” “believes,” “can,” “continue,” “could,”

“estimates,” “expects,” “intends,” “may,” “plans,” “potential,”

“predicts,” “should,” or “will” or the negative of these terms or other comparable terminology. Our

actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking statements.

Any forward-looking statements contained in this

press release are only estimates or predictions of future events based on information currently available to our management and management’s

current beliefs about the potential outcome of future events. Whether these future events will occur as management anticipates, whether

we will achieve our business objectives, and whether our revenues, operating results, or financial condition will improve in future periods

are subject to numerous risks. There are a significant number of factors that could cause actual results to differ materially from statements

made in this press release, including: significant legal and operational risks associated with having substantially all of our business

operations in China, that the Chinese government may exercise significant oversight and discretion over the conduct of our business and

may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value of

our securities or could significantly limit or completely hinder our ability to offer or continue to offer securities to investors and

could cause the value of such securities to significantly decline or be worthless, the effects of the global Covid-19 pandemic or other

health epidemics, changes in domestic and foreign laws, regulations and taxes, the volatility of the securities markets; and other risks

including, but not limited to, the ability of the Company to meet its contractual obligations, the uncertain markets for the Company’s

products and business, macroeconomic, technological, regulatory, or other factors affecting the profitability of our products and solutions

that we discussed or referred to in the Company’s disclosure documents filed with the U.S. Securities and Exchange Commission (the

“SEC”) available on the SEC’s website at www.sec.gov, including the Company’s most recent Annual Report on Form

10-K as well as in our other reports filed or furnished from time to time with the SEC. You should read these factors and the other cautionary

statements made in this press release. If one or more of these factors materialize, or if any underlying assumptions prove incorrect,

our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or

implied by these forward-looking statements. The forward-looking statements included in this press release are made as of the date of

this press release and the Company undertakes no obligation to publicly update or revise any forward-looking statements, other than as

required by applicable law.

For further inquiries, please contact:

In China:

CBAK Energy Technology, Inc.

Investor Relations Department

Phone: +86-18675423231

Email: ir@cbak.com.cn

Piacente Financial Communications

Ms. Hui Fan

Tel: +86-10-6508-0677

Email: CBAK@thepiacentegroup.com

In the United States:

Piacente Financial Communications

Ms. Brandi Piacente

Tel: +1-212-481-2050

Email: CBAK@thepiacentegroup.com

CBAK Energy Technology, Inc. and Subsidiaries

Condensed consolidated Balance Sheets

As of December 31, 2022 and September 30,

2023

(Unaudited)

(In US$ except for number of shares)

| | |

December 31,

2022 | | |

September 30,

2023 | |

| | |

| | |

(Unaudited) | |

| Assets | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 6,519,212 | | |

$ | 3,176,249 | |

| Pledged deposits | |

| 30,836,864 | | |

| 42,511,872 | |

| Trade and bills receivable, net | |

| 27,413,575 | | |

| 45,564,242 | |

| Inventories | |

| 49,446,291 | | |

| 37,451,597 | |

| Prepayments and other receivable | |

| 5,915,080 | | |

| 7,266,257 | |

| Receivables from former subsidiary, net | |

| 5,518,052 | | |

| 323,973 | |

| Income tax recoverable | |

| 57,934 | | |

| - | |

| Total current assets | |

| 125,707,008 | | |

| 136,294,190 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 90,004,527 | | |

| 93,587,460 | |

| Construction in progress | |

| 9,954,202 | | |

| 35,605,326 | |

| Long-term investments, net | |

| 945,237 | | |

| 897,635 | |

| Prepaid land use rights | |

| 12,361,163 | | |

| 11,503,787 | |

| Intangible assets, net | |

| 1,309,058 | | |

| 936,062 | |

| Deposit paid for acquisition of long-term investments | |

| - | | |

| 3,669,851 | |

| Operating lease right-of-use assets, net | |

| 1,264,560 | | |

| 949,192 | |

| Deferred tax assets, net | |

| 2,486,979 | | |

| 3,397,566 | |

| Total assets | |

$ | 244,032,734 | | |

$ | 286,841,069 | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Trade and bills payable | |

$ | 67,491,435 | | |

$ | 88,176,563 | |

| Short-term bank borrowings | |

| 14,907,875 | | |

| 33,190,571 | |

| Other short-term loans | |

| 689,096 | | |

| 338,581 | |

| Accrued expenses and other payables | |

| 25,605,661 | | |

| 38,481,174 | |

| Payables to former subsidiaries, net | |

| 358,067 | | |

| 389,250 | |

| Deferred government grants, current | |

| 1,299,715 | | |

| 366,171 | |

| Product warranty provisions | |

| 26,215 | | |

| 23,285 | |

| Warrants liability | |

| 136,000 | | |

| - | |

| Operating lease liability, current | |

| 575,496 | | |

| 366,391 | |

| Finance lease liability, current | |

| 844,297 | | |

| - | |

| Total current liabilities | |

| 111,933,857 | | |

| 161,331,986 | |

| | |

| | | |

| | |

| Deferred government grants, non-current | |

| 5,577,020 | | |

| 5,022,216 | |

| Product warranty provisions | |

| 450,613 | | |

| 471,384 | |

| Operating lease liability, non-current | |

| 607,222 | | |

| 462,323 | |

| Accrued expenses and other payables, non-current | |

| 1,085,525 | | |

| - | |

| Total liabilities | |

| 119,654,237 | | |

| 167,287,909 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Shareholders’ equity | |

| | | |

| | |

| Common stock $0.001 par value; 500,000,000 authorized; 89,135,064 issued and 88,990,858 outstanding as of December 31, 2022 and 89,611,396 issued and 89,467,190 outstanding as of September 30, 2023 | |

| 89,135 | | |

| 89,611 | |

| Donated shares | |

| 14,101,689 | | |

| 14,101,689 | |

| Additional paid-in capital | |

| 246,240,998 | | |

| 247,200,355 | |

| Statutory reserves | |

| 1,230,511 | | |

| 1,230,511 | |

| Accumulated deficit | |

| (131,946,705 | ) | |

| (129,627,258 | ) |

| Accumulated other comprehensive loss | |

| (8,153,644 | ) | |

| (14,330,746 | ) |

| | |

| 121,561,984 | | |

| 118,664,162 | |

| Less: Treasury shares | |

| (4,066,610 | ) | |

| (4,066,610 | ) |

| Total shareholders’ equity | |

| 117,495,374 | | |

| 114,597,552 | |

| Non-controlling interests | |

| 6,883,123 | | |

| 4,955,608 | |

| Total equity | |

| 124,378,497 | | |

| 119,553,160 | |

| | |

| | | |

| | |

| Total liabilities and shareholder’s equity | |

$ | 244,032,734 | | |

$ | 286,841,069 | |

CBAK Energy Technology, Inc. and Subsidiaries

Condensed consolidated Statements of Operations

and Comprehensive Income (Loss)

For the three and nine months ended September

30, 2022 and 2023

(Unaudited)

(In US$ except for number of shares)

| | |

Three months ended

September 30, | | |

Nine months ended

September 30, | |

| | |

2022 | | |

2023 | | |

2022 | | |

2023 | |

| Net revenues | |

$ | 57,721,692 | | |

$ | 63,441,109 | | |

$ | 194,267,650 | | |

$ | 148,258,680 | |

| Cost of revenues | |

| (54,261,244 | ) | |

| (51,192,531 | ) | |

| (179,955,540 | ) | |

| (129,219,716 | ) |

| Gross profit | |

| 3,460,448 | | |

| 12,248,578 | | |

| 14,312,110 | | |

| 19,038,964 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development expenses | |

| (2,385,591 | ) | |

| (2,577,714 | ) | |

| (7,998,181 | ) | |

| (8,013,760 | ) |

| Sales and marketing expenses | |

| (834,501 | ) | |

| (1,116,377 | ) | |

| (2,361,839 | ) | |

| (2,800,969 | ) |

| General and administrative expenses | |

| (1,866,055 | ) | |

| (3,240,770 | ) | |

| (6,556,944 | ) | |

| (9,302,798 | ) |

| Recovery of (provision for) doubtful accounts | |

| 142,966 | | |

| (24,623 | ) | |

| (68,651 | ) | |

| (286,283 | ) |

| Total operating expenses | |

| (4,943,181 | ) | |

| (6,959,484 | ) | |

| (16,985,615 | ) | |

| (20,403,810 | ) |

| Operating (loss) income | |

| (1,482,733 | ) | |

| 5,289,094 | | |

| (2,673,505 | ) | |

| (1,364,846 | ) |

| Finance income (expenses), net | |

| 687,345 | | |

| (447,031 | ) | |

| 71,869 | | |

| (189,248 | ) |

| Other (expenses) income, net | |

| (991,352 | ) | |

| 601,654 | | |

| (1,165,094 | ) | |

| 1,022,907 | |

| Change in fair value of warrants | |

| 936,000 | | |

| 15,000 | | |

| 4,699,000 | | |

| 136,000 | |

| Income (loss) before income tax | |

| (850,740 | ) | |

| 5,458,717 | | |

| 932,270 | | |

| (395,187 | ) |

| Income tax credit (expenses) | |

| 2,012 | | |

| 305,431 | | |

| (84,230 | ) | |

| 1,015,626 | |

| Net (loss) income | |

| (848,728 | ) | |

| 5,764,148 | | |

| 848,040 | | |

| 620,439 | |

| Less: Net loss attributable to non-controlling interest | |

| 848,438 | | |

| 570,644 | | |

| 401,313 | | |

| 1,699,008 | |

| Net (loss) income attributable to CBAK Energy Technology, Inc. | |

$ | (290 | ) | |

$ | 6,334,792 | | |

$ | 1,249,353 | | |

$ | 2,319,447 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

| (848,728 | ) | |

| 5,764,148 | | |

| 848,040 | | |

| 620,439 | |

| Other comprehensive loss | |

| | | |

| | | |

| | | |

| | |

| – Foreign currency translation adjustment | |

| (8,925,745 | ) | |

| (515,279 | ) | |

| (15,620,472 | ) | |

| (6,405,609 | ) |

| Comprehensive (loss) income | |

| (9,774,473 | ) | |

| 5,248,869 | | |

| (14,772,432 | ) | |

| (5,785,170 | ) |

| Less: Comprehensive loss attributable to non-controlling interest | |

| 1,632,419 | | |

| 553,874 | | |

| 1,150,285 | | |

| 1,927,515 | |

| Comprehensive (loss) income attributable to CBAK Energy Technology, Inc. | |

$ | (8,142,054 | ) | |

$ | 5,802,743 | | |

$ | (13,622,147 | ) | |

$ | (3,857,655 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Income (loss) per share | |

| | | |

| | | |

| | | |

| | |

| – Basic | |

$ | (0.00 | )* | |

$ | 0.07 | | |

$ | 0.01 | | |

$ | 0.03 | |

| – Diluted | |

$ | (0.00 | )* | |

$ | 0.07 | | |

$ | 0.01 | | |

$ | 0.03 | |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average number of shares of common stock: | |

| | | |

| | | |

| | | |

| | |

| – Basic | |

| 88,996,692 | | |

| 89,473,026 | | |

| 88,900,977 | | |

| 89,171,988 | |

| – Diluted | |

| 88,996,692 | | |

| 89,904,319 | | |

| 88,923,265 | | |

| 89,582,401 | |

7

v3.23.3

Cover

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity File Number |

001-32898

|

| Entity Registrant Name |

CBAK ENERGY TECHNOLOGY, INC.

|

| Entity Central Index Key |

0001117171

|

| Entity Tax Identification Number |

86-0442833

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

BAK Industrial Park

|

| Entity Address, Address Line Two |

Meigui Street

|

| Entity Address, Address Line Three |

Huayuankou Economic Zone

|

| Entity Address, City or Town |

Dalian

|

| Entity Address, Country |

CN

|

| Entity Address, Postal Zip Code |

116450

|

| City Area Code |

86

|

| Local Phone Number |

3918-5985

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

CBAT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

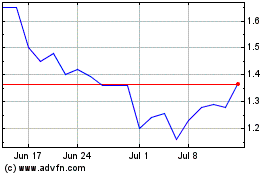

CBAK Energy Technology (NASDAQ:CBAT)

Historical Stock Chart

From Apr 2024 to May 2024

CBAK Energy Technology (NASDAQ:CBAT)

Historical Stock Chart

From May 2023 to May 2024