false

0001844862

0001844862

2023-11-07

2023-11-07

0001844862

us-gaap:CommonStockMember

2023-11-07

2023-11-07

0001844862

us-gaap:WarrantMember

2023-11-07

2023-11-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

November 7, 2023

Solid

Power, Inc.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-40284 |

|

86-1888095 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

|

486

S. Pierce Avenue, Suite E

Louisville, Colorado |

|

80027 |

| (Address of principal executive offices) |

|

(Zip code) |

(303) 219-0720

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, par value $0.0001 per share |

|

SLDP |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50 |

|

SLDPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§ 240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

Earnings Call Transcript

On November 7, 2023,

Solid Power, Inc. (the “Company,” “Solid Power,” “we,” or “our”)

hosted a conference call to discuss its financial and operating results for the quarter ended September 30, 2023. A transcript of

the conference call is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Exhibit 99.1 to this

Current Report on Form 8-K, the information set forth therein, and the information disclosed under this Item 7.01 is being furnished

and will not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise be subject to the liabilities of that section, nor will it be deemed to be incorporated by reference into

any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Forward Looking Statements

All statements other than

statements of present or historical fact contained herein or in Exhibit 99.1 to this Current Report on Form 8-K are “forward-looking

statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including Solid

Power’s or its management team’s expectations, objectives, beliefs, intentions or strategies regarding the future. When used

herein, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,”

“intend,” “estimate,” “expect,” “project,” “plan,” “outlook,”

“seek,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although

not all forward-looking statements contain such identifying words. These statements include our financial guidance for 2023, future financial

performance and our strategy, expansion plans, market opportunity, future operations, future operating results, estimated revenues, losses,

projected costs, prospects, and plans and objectives of management. These forward-looking statements are based on management’s current

expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future

events. Except as otherwise required by applicable law, Solid Power disclaims any duty to update any forward-looking statements, all of

which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. Readers are

cautioned not to put undue reliance on forward-looking statements and Solid Power cautions you that these forward-looking statements are

subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Solid

Power, including the following factors: (i) risks relating to the uncertainty of the success of our research and development efforts,

including our ability to achieve the technological objectives or results that our partners require, and to commercialize our technology

in advance of competing technologies; (ii) risks relating to the non-exclusive nature of our original equipment manufacturers and

joint development agreement relationships; (iii) our ability to negotiate and execute supply agreements with our partners on commercially

reasonable terms; (iv) rollout of our business plan and the timing of expected business milestones; (v) delays in the construction

and operation of production facilities; (vi) our ability to protect our intellectual property, including in jurisdictions outside

of the United States; (vii) broad market adoption of battery electric vehicles and other technologies where we are able to deploy

our cell technology and electrolyte material, if developed successfully; (viii) our success in retaining or recruiting, or changes

required in, our officers, key employees, including technicians and engineers, or directors; (ix) risks and potential disruptions

related to management and board of directors transitions; (x) changes in applicable laws or regulations; (xi) risks related

to technology systems and security breaches; (xii) the possibility that we may be adversely affected by other economic, business

or competitive factors, including supply chain interruptions, and may not be able to manage other risks and uncertainties; (xiii) risks

relating to our status as a research and development stage company with a history of financial losses, and an expectation to incur significant

expenses and continuing losses for the foreseeable future; (xiv) the termination or reduction of government clean energy and electric

vehicle incentives; and (xv) changes in domestic and foreign business, market, financial, political and legal conditions. Additional

information concerning these and other factors that may impact the operations and projections discussed herein or in Exhibit 99.1

to this Current Report on Form 8-K can be found in the “Risk Factors” sections of Solid Power’s Annual Report on

Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended March 31, 2023

and other documents filed by Solid Power from time to time with the Securities and Exchange Commission (the “SEC”),

all of which are available on the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties

that could cause actual events and results to differ materially from those contained in the forward-looking statements. Solid Power gives

no assurance that it will achieve its expectations.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

See the Exhibit index

below, which is incorporated herein by reference.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: November 9, 2023

| |

SOLID POWER, INC. |

| |

|

|

| |

|

|

| |

By: |

/s/ James Liebscher |

| |

|

Name: James Liebscher |

| |

|

Title: Chief Legal Officer and Secretary |

Exhibit 99.1

Solid Power, Inc.

Third Quarter 2023 Earnings Conference

Call

November 7, 2023 – 2:30pm

MT

Corporate Participants

Jennifer Almquist, Investor

Relations for Solid Power Inc.

John Van Scoter, President

and Chief Executive Officer

Kevin Paprzycki, Chief

Financial Officer and Treasurer

Conference Call Participants

Brian Dobson,

Chardan Capital Markets

Jeffrey Campbell,

Seaport Research Partners

Michael Shlisky,

D.A. Davidson

Vincent Anderson,

Stifel Nicolaus & Company

Operator

Greetings.

Welcome to the Solid Power, Inc. Third Quarter 2023 Financial Results and Business Update Call. Please note that this event

is being recorded. I will now turn the conference over to your host Jennifer Almquist, Investor Relations for Solid Power, Inc.

Thank you. You may begin.

Jennifer Almquist

Thank

you, Operator, and thank you, everyone, for joining us today. I’m joined on the call today by Solid Power’s President

and Chief Executive Officer, John Van Scoter and Chief Financial Officer, Kevin Paprzycki.

A

copy of today’s earnings release is available on the Investor Relations section of Solid Power’s website at ir.solidpowerbattery.com.

I’d

like to remind you that parts of our discussion today will include forward-looking statements as defined by US securities laws. These

forward-looking statements are based on management’s current expectations and assumptions about future events and are based on

currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Solid

Power disclaims any duty to update any forward-looking statements to reflect future events or circumstances. For a discussion of the

risks and uncertainties that could cause actual results to differ materially from those expressed in today’s forward-looking statements,

please see Solid Power’s most recent filings with the Securities and Exchange Commission, which can be found on the company’s

website at ir.solidpowerbattery.com.

1

Solid Power, Inc.

November 7, 2023, 2:30pm MT

With

that, let me turn it over to John Van Scoter.

John Van Scoter, President and Chief Executive

Officer, Solid Power, Inc.

Thank

you, Jen, and good afternoon, everyone. Thank you for joining the call today.

I’ll begin today with an important milestone

- our A-Sample EV Cell shipments and entrance into automotive qualification. I’ll then provide an update on our solid overall progress

and give early thoughts on 2024 priorities and goals. After that, I’ll hand the call off to Kevin for the financial review

and we’ll open up Q&A.

Over the last week or so, we shipped more than

80 of our EV cells to BMW to officially begin the automotive qualification process.

This is no small achievement. A year ago, we were

struggling with yield issues on our 20 Ah cells as we initially scaled up our roll-to-roll line production. Since then, the team has overcome

those obstacles and more, including a few significant supply chain and vendor quality issues on both the cell and powder production sides.

We’ve done this while completing SP2 construction, initiating powder production, and incorporating our new SP2 powder into cells.

I want to extend my gratitude to the team, and reiterate my appreciation for the strong team I’ve inherited.

Looking more closely at the EV cells we just shipped.

These EV cells meet BMW’s initial performance expectations, and represent our first, or A-1 cells for the automotive qualification

process. These A-1 cells are 60 Ah, have 40 layers, and are about 10 by 30 centimeters in size. Importantly, they were also produced on

our EV cell line using electrolyte from SP2.

We expect the A-1 cells are to be followed by

A-2 and A-3 cells, each with increased performance targets that we will collaborate with BMW to meet their expectations. We still have

a way to go to hit the increased performance targets for A-2 and A-3, but this is a great start. And we are now on a path to work with

our partners to hit those targets. We can’t provide details at this point, but if we continue to improve towards those A-2 and A-3

targets, we believe we will drive greater range, battery life and safety for the consumer, while driving down cost for the OEMs.

These cells are not only a key step towards the

commercialization of Solid Power’s technology, they are a key step for BMW’s demo car program as well. The cells are slated

for module and pack builds this year, and together we are targeting them to power a full-sized BMW EV in 2024.

Our ability to enter A Sample was bolstered by

the investments we’ve made in quality assurance equipment and processes. This includes the X-ray and CT Scan equipment that we acquired

and fully implemented into our processes earlier this year. It also includes some new, innovative screening techniques that the team developed,

which enabled us to identify and address problems more efficiently. Collectively, these processes helped us get into automotive qualification

and also give us confidence that the cells we have delivered will meet the targets laid out for us uniformly across all shipments, which

is critical for overall EV pack performance.

2

Solid Power, Inc.

November 7, 2023, 2:30pm MT

It’s also worth mentioning that these cells

came off our EV line at SP1, with Solid Power and BMW employees working side-by-side on their development. BMW’s efforts to accelerate

the development of our solid-state technology was a huge driver and we are grateful for their collaboration.

Now that we are successfully producing A-1 cells,

we have also separated our two lines with each running concurrently. Our EV Cell line is focused 100% on our A-sample cell production

for our partners, and our pilot, or development, line now fully dedicated to advancing our cell performance, including R&D on our

next gen cells.

During my travels this quarter, I got to

visit BMW’s battery development facility in Parsdorf, Germany. The facility is impressive, and the facilities and infrastructure

are progressing with their line to be built over the coming year. A substantial square footage will be dedicated to continued development

of Solid Power’s technologies, and staffed by BMW’s experienced battery engineers. Once complete, this line will expand development

activities of our solid-state technologies in 2 regions of the world.

In addition, we continue to progress with Ford

and SK On cell requirements, which in some respects are different than BMW’s.

On the electrolyte side, since we began production

of our electrolyte powder at SP2 in April, we have been diligently working to increase production volumes and efficiencies. The team has

done a great job. We have the final configuration of our production line in place and are now producing powder at sufficient volumes and

quality to use SP2 powder in the manufacture of our EV cells. Importantly, we’ve stopped producing powder at SP1 and begun to redeploy

our SP1 team and resources towards development of our next gen powders. We feel good about our capability to produce 1.25 metric tonnes

per month at SP2 by the end of this year.

As we’ve said previously, demonstrating production at this scale

is important as potential customers prefer to take product from large production runs. So far this year, we have provided SP2 electrolyte

samples to two potential customers, and are working towards providing samples to 4 more in the near future. We believe many EV OEMs and

Tier 1 battery producers have a sulfide-based, solid-state product in their future roadmap. The scale and high quality of the powder we

are now putting out puts us in an incredible position to be the leader in supplying them the electrolyte they will need.

Lastly, I want to take a moment to briefly

update you on the strategic priorities I outlined last quarter, as well as a couple more we’ve added to our list. We are still refining

our 2024 goals, but I feel these priorities will likely form the basis for what we want to achieve next year.

On last quarter’s earnings call, I

outlined three initiatives that I saw as immediate strategic priorities. Specifically: establishing a presence in Korea, increasing our

strategic supply chain capabilities, and elevating our external and investor communications.

First, establishing a presence in Korea. During

the quarter, we established a new legal subsidiary to do business there, secured and opened office space in Korea, and laid the groundwork

for collaboration with Korean National Labs and Universities.

3

Solid Power, Inc.

November 7, 2023, 2:30pm MT

Most importantly, we visited the peninsula over

an approximately 10-day period with some of my senior team. During this trip, we vetted options with our partners, suppliers and potential

customers and got very positive feedback on our plans. We evaluated our options and narrowed down to a few potential paths to further

expand our Korean presence. We feel good about our plan, and our ability to make progress over the next few months. Our plan should allow

us to accelerate building our team in Korea, and tapping into the world class battery talent pool that exists there. We look forward to

sharing more when we can.

Second, elevating our strategic supply chain activity.

During the quarter, we battled through the similar-grade material issues we have been facing. I think the team did a fantastic job ensuring

we kept development and production moving forward while working with our suppliers to address root causes. We also began the recruiting

process for the key supply chain leadership we need, and met with potential new suppliers in Korea for critical materials.

Lastly on supply chain, we successfully implemented

SAP on October 1st, going live with supply chain and accounting functions. We are excited about the tools this will provide. Our

team did a great job here keeping this project on time & under budget and I’d like to thank the many involved for the tireless &

successful efforts.

Third, elevating our external and investor communications

efforts. During Q3, we continued to meet with shareholders, but increased the amount of interactions significantly. We completed a positive

series of meetings in a non-deal roadshow, and are planning another in Q4. A few weeks ago, we posted a new investor deck which does a

good job summarizing Solid Power’s investment thesis. Also from a media perspective, we increased our PR efforts with social and

print media. We’ve done 3-4 interviews, with a great Denver Post article published and the rest on the way.

IR planning is well underway for 2024, with a

focus on increasing higher quality interactions and greater visibility. We are planning an investor/analyst event sometime in 2024 where

we expect to provide a comprehensive technical update on our cell and electrolyte progress, provide insight into our commercialization

timeline, and update our high-level financial projections.

Lastly on IR, one of the things we hear consistently

from investors is that they’d like to have more frequent updates. To be clear, we will only release news when we have meaningful

news to share. While our progress has been strong, we will not always have major news to share on a frequent or consistent schedule. When

we hit significant milestones or accomplish one of our goals, we will proudly release it. But world-changing development progress isn’t

always linear.

Shifting gears toward new priorities. In October, the senior team at

Solid Power spent a couple highly productive days working offsite on longer-term strategic plans and initiatives. Following those meetings,

we’ve added 2 additional priorities, which we’ll focus on in 2024.

The first is seeking at least one additional OEM

partner. A new OEM partner must be additive in terms of collaborative expertise and also fully aligned with our current partners’

objectives.

4

Solid Power, Inc.

November 7, 2023, 2:30pm MT

The second is accelerating our revenue timeline

to drive cash-generation opportunities. We expect any new revenues to be driven by electrolyte sales. Feedback from our current sampling

process continues to be positive.

Each of these new objectives demonstrates our

competitive urgency and a shift towards growth and technology commercialization.

Collectively all five of these priorities will

likely form our goals for the year. As we fully plan out these new priorities and set our goals and guidance for 2024, we’ll go

into them in more detail.

With that, I’ll hand it over to Kevin

to take you through our financial results. Kevin?

Kevin Paprzycki, CFO Solid Power Inc.

Thanks John. Good afternoon, everyone. I’ll

start off with an overview of our financial results, and then update our ‘23 outlook.

Overall,

solid operational performance has us tracking favorable to our ops and capex targets for the year, strengthening our solid

liquidity position.

Our third quarter ‘23 revenue of $6.4 million

was in line with our expectations, and again driven by strong execution on our development and government contracts.

Third quarter ‘23 operating expenses were

$27.9 million, up $9 ½ million from last year. This increase represents expanded efforts to build our EV cells, and increase our

electrolyte production. We expect these development-related investments to be slightly higher in the fourth quarter than they were in

the first three quarters of ’23.

Our third quarter ‘23 operating loss was

$21.5 million, and net loss was $15.1 million.

Touching

on our balance sheet and liquidity. During the third quarter, we invested $15.3 million in operations and $8.3 million in

capex. We ended the quarter with total liquidity of $422.3 million, consisting of cash, marketable securities, and long-term investments.

Looking

ahead to the rest of ‘23. Right now, we believe both our operational and capital spend will be slightly favorable to the

low end of our guidance range for the year. We continue to expect revenue in the range of $15 to $20 million, but we believe our

‘23 cash investments will come in slightly below the $70 million low end for operating, and the $50 million low end for capex.

I want to praise the ops teams here, as these

favorable reductions are driven by positive factors. On the operating side, our EV cell development and yields have been solid, meaning

we have needed to build fewer cells. This translates into less material and labor spend. On the capex side, the team has done a

great job optimizing processes and finding more cost-effective ways to structure our SP2 powder line. As a result, we have been able to

eliminate some of our planned equipment. There are also some investments where we can prudently wait to until ‘24 to make. Those

will get picked up when we give guidance for next year.

5

Solid Power, Inc.

November 7, 2023, 2:30pm MT

So, taking into account those favorable investment

spends, we now expect ending liquidity for ‘23 slightly above the high end of our guidance range which was $375 million.

Finishing up, at this point we have no real change

or update to our longer-term projections, although this great spend performance by our ops team helps strengthen our overall liquidity.

With our capital light business model, we are still sitting in a very solid position for the long term with the ability to run all the

way to the late 20’s with our current cash, and longer as we secure the financing or grant funding that we’re pursuing.

We plan to give financial guidance for ‘24 at year-end, with

longer-term high-level projections provided during our planned ‘24 IR event. With that, I’ll now turn the call

back to John.

John Van Scoter, President and Chief Executive

Officer, Solid Power, Inc.

Thanks, Kevin. Before we head to Q&A, I’d

like to reiterate that since I stepped into this role almost five months ago, I’ve been incredibly pleased with the Solid Power

team I’ve inherited.

One of Solid Power’s core values is to earn

credibility through execution. I believe the team here does that on a daily basis at all levels. In just a few months, I’ve

seen excellent execution in driving A-Sample cell deliveries and ramping high quality SP2 electrolyte production, despite battling through

technical and supply chain challenges.

Solid Power continues to execute on its technical,

customer, and financial targets. We are confident continuing to execute this way will drive long term shareholder value.

With that I will hand it over for Q&A.

Operator

Yes, thank you. We will now begin the Q&A

session. To ask a question, you may press star then 1 on your touch tone phone. If you are using a speakerphone, please pick up your handset

before pressing the keys. To withdraw your question, please press star then 2. At this time, we will pause momentarily to assemble the

roster.

And the first question comes from Mike Shlisky

from D.A. Davidson.

6

Solid Power, Inc.

November 7, 2023, 2:30pm MT

Michael Shlisky

Good afternoon and thanks for taking my questions.

So John, I think being in Korea sounds great. Glad you are making some headway there. Opening an office and getting things started.

And you already do have a presence kind of in Europe given where you're working with BMW. I was wondering if, or kind of, why don't you

have other plans for perhaps Japan or China or elsewhere for additional opportunities? Or is it going to be kind of one step at a time

here?

John Van Scoter

Yes. I think it is one step at a time. But my

vision for the Korean office is actually to operate throughout Asia. That's one of the beauties of planting the flag there initially.

I think we can do work in Japan and the rest of Asia from that location. But yes, I do think we're going to stepwise and just be

mindful of the costs associated with creating satellite offices, but balance that against the opportunity to support our partners and

develop supply chain relationships and procure world-class talent.

Michael Shlisky

Great thanks for that color. I wanted to turn

to the strike that's underway or just wrapping up here in the U.S. at the Big 3 automakers. There's some headlines to what's in the new

contracts that come out. We don't have to name any individual company, they all kind of seem somewhat similar. I guess if you -- are you

--have you gotten any feedback from any of your partners that there will be changes to the timeline or amount of investments in the EV

vehicles or in the battery facilities at this point?

John Van Scoter

Yes. We've been monitoring this very regularly

since all the headlines have come out from the various strikes and so forth. And plant pausing and the like. But honestly, we have not

seen any change in terms of the pull from our partners from around the globe. All of the push that they've had for specific timelines

and requests really haven't changed. So we're very pleased with that. It may just be the time horizon that they're looking at for the

commercialization that's driving that. But we're still under a lot of pressure to perform, to be in a position to have commercialized

technology by 2028.

Michael Shlisky

Great. I appreciate those comments. I’ll

pass it along. Thank you.

Operator

Thank you. And the next question comes from Vincent

Anderson with Stifel.

Vincent Anderson

Yes, thanks. So Toyota hasn't necessarily been

quiet about its sulfide technology, but I am curious if you noticed any shift recently in the conversations throughout the industry after

their announcement of working on raw material integration with Idemitsu. I would imagine it's a net positive to have the chemistry further

validated by these big market participants. But I'm wondering if it's translated yet into an uptick in interest or urgency from any of

your potential electrolyte customers that see that as a competitor?

7

Solid Power, Inc.

November 7, 2023, 2:30pm MT

John Van Scoter

Yes. We do see it as a net positive with major

players now backing sulfide-based all-solid-state batteries in their road map. We think that there's room for multiple winners. And we

think that given our position from ability to produce volume electrolyte now and our plans to grow that in the future that we're very

well positioned to participate with the players that are intending to be there with sulfide-based ASSBs.

Vincent Anderson

Perfect. Thanks. And then could you just refresh

my memory on if there's any tie between SP1 and SP2, with regard to some of the optimization you're doing around your electrolyte chemistry

-- in so far does SP2 accelerates that or optimizing the chemistry further was part of the step of moving to SP 2 at scale or are those

completely independent?

John Van Scoter

No, they are interrelated. As we've shifted all

of the electrolyte production to SP2 and shut down the SP1 production, it's allowed us to reconfigure the physical area in SP1 and also

have resources move around to support our next generation of powders there in SP1. And then we also are underway in construction for the

next-generation powder laboratory here at SP2. That is scheduled to be completed next summer. And so we'll go through another redistribution

of square footage lab capability and personnel when that facility is available in SP2, again, to focus on the next-generation electrolytes.

Vincent Anderson

Great. And then last one, specifically for you,

John, you've had a few months at Solid Power now. I'm just wondering what impression a fresh pair of eyes has found with regard to how

you see the balance of, call it, risk reward mainly on capital requirements of driving development and adoption of solid-state cells all

the way down to the OEM level versus maybe focusing on optimizing your chemistry, further broadening the commercial opportunities of the

electrolyte on more OEM agnostic basis and letting the market come to you and tell you exactly when and where to commit more capital.

John Van Scoter

So we're very customer-driven that we're finding

that our partners that we have right now are having different requirements and different approaches to ASSB development. And we're really

following our partners' requirements and collaborating with them to meet those requirements. That is kind of the landscape that we see

right now. I think it's appropriate given the nascent nature of the market based on my experience with early-stage technologies. And as

it matures, I think there's an opportunity to do more, call it, independent and more reusable development across multiple customers.

But right now, given a lot still has to be sorted in terms of performance, that is the nature that we're following right now with each

OEM.

8

Solid Power, Inc.

November 7, 2023, 2:30pm MT

Vincent Anderson

OK. That’s very helpful, I appreciate

it.

Operator

Thank you. And the next question comes from Jeffrey

Campbell with Seaport Research Partners.

Jeffrey Campbell

Hi. Good afternoon. A Sample cells typically are

tested for cell performance and cycle life and allow a manufacturer to make design and production decisions. Since yourselves already

meet BMW's initial performance expectations, what are the primary endpoints that the A-1 cells will be tested for?

John Van Scoter

Yes, we just shipped the cells. We, of course,

have characterization data on them going out, but we need a confirmation of BMW's testing. We need them to be integrated into packs or

into modules and then into packs. And so we're still a ways away from being able to comment really further on the performance. And I would

emphasize, yes, that we've met BMW's requirements for A-1, but those are primarily driven by the demo car. So there will be A-2 and A-3,

we expect that we will be working with BMW on for subsequent improvements as we go through the entire A Sample part of the process or

for A Sample qualification.

Jeffrey Campbell

Ok. Thank you. You mentioned in your prepared

remarks that another OEM relationship is a 2024 goal. Is it possible that, that partner might not be one of your current JV relationships?

John Van Scoter

Yes.

Jeffrey Campbell

Ok. Great. Thank you. Appreciate it.

9

Solid Power, Inc.

November 7, 2023, 2:30pm MT

Operator

Thank you. And once again, please press star then

1 if you would like to ask a question. And the next question comes from Brian Dobson with Chardan Capital.

Brian Dobson

Hi. Thanks very much for taking my question. So

wholesaling the electrolyte is likely a key area of opportunity. Would you speak to the competitive landscape in that segment? And also

what you see as your advantages moving forward?

John Van Scoter

I'm sorry, could you repeat the question, you

broke up. I didn't get the first part of it.

Brian Dobson

Yes. Sorry about that. So wholesaling the electrolyte

is a key area of potential opportunity in the future. Could you speak a little bit to the competitive landscape that you're seeing in

that segment and what your advantages might be?

John Van Scoter

Sure. Good question. We have taken an approach

to invest ahead of the aggregate demand that's in the marketplace. And I believe it's been a key part of the uptake that we have from

not only our current partners, but our potential future partners in that these are all very high-volume minded companies in very high-volume

spaces. And I think that really differentiates us from the other current providers that are providing electrolyte into the market.

Obviously, market windows close and we need to

continue to make investments to stay ahead of the demand. Right now, I think we look forward into 2024, we have a good balance to

what we see demand wise and what we can produce here at SP2. But we're constantly looking at that and actually have on the drawing board

SP3 plans right now underway to, again, stay ahead of that. In terms of competitors, I think that we're near the front of the pack

with regard to ability to produce high-quality, consistent production to the level that is required by the marketplace. There may be one

or two others that could do that today, but we're in a small set, I believe, relative to wholesaling electrolyte.

Brian Dobson

Yes. Very good. And then just turning to BMW,

if I could ask a follow-up question on that side. You mentioned that you've met the initial requirements and that you're currently making

adjustments for BMW's A-2 requirements. How long do you have to do that? And how far along are you in making those adjustments?

10

Solid Power, Inc.

November 7, 2023, 2:30pm MT

John Van Scoter

Yes. For clarification, A-2 is going to be a new

cell design. So it's more than just an adjustment and it could require some other chemistries all the way back to the electrolyte depending

on where we land. We literally are in the collaboration phase with them to define specifically what those requirements are going to be.

And based on those requirements, it will drive an overall time line. As we commented earlier in our remarks, we do plan to do an investor

event in 2024 and one of the things that we'll cover in that we expect will be more details around our A-2 timing and specifications.

Really not in a position to comment any further

on that right now. But it is underway. It's a cell design as well as potentially back into electrolyte chemistries.

Brian Dobson

Yes. Very good. Thanks very much.

Operator

Thank you. And again as a reminder please press

star then 1 if you would like to ask a question. All right. That does conclude the question-and-answer session as well as the call itself.

Thank you so much for attending today's presentation. You may now disconnect your lines.

11

Solid Power, Inc.

November 7, 2023, 2:30pm MT

v3.23.3

Cover

|

Nov. 07, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 07, 2023

|

| Entity File Number |

001-40284

|

| Entity Registrant Name |

Solid

Power, Inc.

|

| Entity Central Index Key |

0001844862

|

| Entity Tax Identification Number |

86-1888095

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

486

S. Pierce Avenue

|

| Entity Address, Address Line Two |

Suite E

|

| Entity Address, City or Town |

Louisville

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80027

|

| City Area Code |

303

|

| Local Phone Number |

219-0720

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

SLDP

|

| Security Exchange Name |

NASDAQ

|

| Warrant [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of common stock at an exercise price of $11.50

|

| Trading Symbol |

SLDPW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

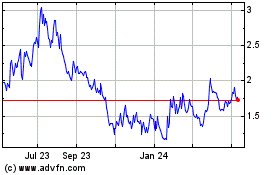

Solid Power (NASDAQ:SLDP)

Historical Stock Chart

From Apr 2024 to May 2024

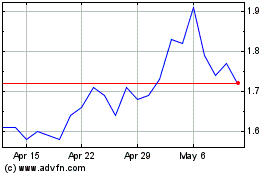

Solid Power (NASDAQ:SLDP)

Historical Stock Chart

From May 2023 to May 2024