UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13E-3

(Amendment No. 3)

RULE 13E-3 TRANSACTION STATEMENT UNDER

SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

POLYMET MINING CORP.

Name of Subject Company (Issuer)

PolyMet Mining Corp.

Glencore AG

Glencore International AG

Glencore plc

(Names of Persons Filing Statement)

Common Shares, Without Par Value

(Title of Class of Securities)

731916102

(CUSIP Number of Class of Securities)

|

Mohit Rungta

PolyMet Mining Corp.

444 Cedar Street, Suite 2060,

St. Paul, MN 55101

Tel: (651) 389-4100

|

|

|

|

John Burton

Glencore AG

Baarermattstrasse 3

CH-6340 Baar

Switzerland

Tel: +41 41 709 2000

|

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

With copies to:

|

Denise C. Nawata

Farris LLP

PO Box 10026, Pacific

Centre South

25th Floor, 700 W Georgia Street

Vancouver, BC

Canada V7Y 1B3

Tel: (604) 684-9151

|

|

Joseph Walsh

Shona Smith

Troutman Pepper

Hamilton Sanders LLP

875 Third Avenue

New York, NY 10022

Tel: (212) 704-6000

|

|

Adam Taylor

McCarthy Tétrault LLP

Suite 5300

TD Bank Tower

Box Jericho, NY 11753

Tel: (416) 601-8014

|

Eoghan P. Keenan, Esq.

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, NY 10153

Tel: (212) 310-8000

|

This statement is filed in connection with (check the appropriate box):

| a. |

|

☐ |

|

The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| |

|

|

| b. |

|

☐ |

|

The filing of a registration statement under the Securities Act of 1933. |

| |

|

|

| c. |

|

☐ |

|

A tender offer. |

| |

|

|

| d. |

|

☒ |

|

None of the above. |

Check the following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☐

Check the following box if the filing is a final amendment reporting the results of the transaction: ☐

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR FAIRNESS OF THIS TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE DISCLOSURE IN THIS SCHEDULE 13E-3. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE

Introduction

This Amendment No. 3 to Schedule 13E-3 (together with the exhibits hereto, this "Final Amended Schedule 13E-3" or "Final Amended Transaction Statement"), which amends and supplements the Rule 13E-3 Transaction Statement on Schedule 13E-3 (as amended by Amendment No. 1 to Schedule 13E-3, filed with the U.S. Securities and Exchange Commission (the "SEC") on September 12, 2023 and Amendment No. 2 to Schedule 13E-3, filed with the SEC on October 2, 2023, together, the "Initial Schedule 13E-3"), together with the exhibits hereto is being filed with the SEC pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (together with the rules and regulations promulgated thereunder, the "Exchange Act"), jointly by the following persons (each, a "Filing Person" and collectively, the "Filing Persons"): by (i) PolyMet Mining Corp., a corporation existing under the laws of British Columbia, Canada ("PolyMet" or the "Company"), (ii) Glencore AG, a company organized under the laws of Switzerland ("Glencore"), (iii) Glencore International AG, a company organized under the laws of Switzerland and (iv) Glencore plc, a company organized under the laws of Jersey.

This Final Amended Transaction Statement relates to the Arrangement Agreement, dated as of July 16, 2023 by and between the Company and Glencore, pursuant to which, on November 7, 2023, Glencore acquired all of the issued and outstanding Shares of the Company that Glencore or its affiliates did not directly or indirectly own through a plan of arrangement (the "Plan of Arrangement") pursuant to the Business Corporations Act (British Columbia), and the Company became a wholly owned subsidiary of Glencore (the "Arrangement"). A copy of the Plan of Arrangement is included as Appendix B to the Management Proxy Circular, which is attached as Exhibit (a)(2)(i) hereto (the "Circular").

This Final Amended Schedule 13E-3 is being filed pursuant to Rule 13e-3(d)(3) under the Exchange Act to report the results of the transaction that is the subject of the Initial Schedule 13E-3.

Capitalized terms used but not expressly defined in this Final Amended Transaction Statement have the meanings ascribed to such terms in the Circular.

All information set forth in this Final Amended Transaction Statement should be read together with the information contained or incorporated by reference in the Initial Schedule 13E-3. All information contained in, or incorporated by reference to, this Final Amended Transaction Statement concerning each Filing Person has been supplied by such Filing Person.

All information contained in, or incorporated by reference into, this Final Amended Transaction Statement concerning each Filing Person has been supplied by such Filing Person.

Item 15. Additional Information

(c) Other Material Information. A special meeting of the Company's shareholders (the "Meeting") was held on November 1, 2023, to consider, and, if thought advisable, pass a special resolution approving the Arrangement in the form attached as Appendix A to the Circular (the "Arrangement Resolution"). At the Meeting, the Arrangement Resolution was approved by 98.58% of the votes cast by the Company's shareholders, voting together as a single class, as well as 81.89% of the votes cast by the Company's shareholders, excluding votes attached to the Shares beneficially owned by Glencore or its affiliates, as required to be excluded pursuant to Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions. On November 3, 2023, the Supreme Court of British Columbia issued a final order approving the Plan of Arrangement. The Arrangement was completed on November 7, 2023.

As a result of the Arrangement, the Shares will no longer be listed on the Toronto Stock Exchange and the NYSE American. The NYSE American has filed an application on Form 25 with the SEC to remove the Shares from listing on the NYSE American and withdraw registration of the Shares under Section 12(b) of the Exchange Act. The deregistration will become effective 90 days after the filing of Form 25 or such shorter period as may be determined by the SEC. The Company has also filed an application to have the Shares delisted from the Toronto Stock Exchange, and has filed an application to cease to be a reporting issuer under applicable Canadian securities laws. In addition, Glencore intends to cause the Company to file a certification and notice on Form 15 with the SEC to suspend its reporting obligations under U.S. securities laws, and to otherwise terminate the Company's public reporting requirements. The Company's reporting obligations under Section 12(g) of the Exchange Act will be suspended immediately as of the filing date of the Form 15 and will terminate once the deregistration becomes effective.

Item 16. Exhibits

The following exhibits are filed herewith:

| Exhibit No. |

Description |

| |

|

| (a)(2)(i) * |

Management Proxy Circular of PolyMet Mining Corp. dated October 2, 2023 |

| |

|

| (a)(2)(ii) * |

Form of Proxy Card |

| |

|

| (a)(2)(iii) * |

Voting Instruction Form |

| |

|

| (a)(2)(iv) * |

Letter of Transmittal |

| |

|

| (a)(2)(v) * |

Notice of Special Meeting of Shareholders of PolyMet Mining Corp. (incorporated herein by reference to the Circular) |

| |

|

| (a)(2)(vi) * |

Letter to Shareholders of PolyMet Mining Corp. (incorporated herein by reference to the Circular) |

| |

|

| (a)(5)(i) * |

Press Release of PolyMet Mining Corp. dated July 17, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on July 17, 2023) |

| (a)(5)(ii) * |

Press Release of PolyMet Mining Corp. dated September 28, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on September 28, 2023) |

| |

|

| (a)(5)(iii)* |

Notice to Canadian Securities Regulatory Authorities of Notice of Meeting and Record Date (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on September 12, 2023) |

| |

|

| (a)(5)(iv) |

Press Release of PolyMet Mining Corp. dated October 2, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on October 2, 2023) |

| |

|

| (a)(5)(v) |

Press Release of PolyMet Mining Corp. dated October 16, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on October 16, 2023) |

| |

|

| (a)(5)(vi) |

Press Release of PolyMet Mining Corp. dated October 27, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on October 27, 2023) |

| |

|

| (a)(5)(vii) |

Press Release of PolyMet Mining Corp. dated November 1, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on November 2, 2023) |

| |

|

| (a)(5)(viii) |

Press Release of PolyMet Mining Corp. dated November 3, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on November 3, 2023) |

| |

|

| (a)(5)(ix) |

Press Release of PolyMet Mining Corp. dated November 7, 2023 (incorporated herein by reference to Exhibit 99.1 to the report on Form 6-K furnished to the SEC on November 7, 2023) |

| |

|

| (c)(i) * |

Formal Valuation and Fairness Opinion of Maxit Capital LP (incorporated herein by reference to Appendix C to the Circular) |

| |

|

| (c)(ii) * |

Fairness Opinion of Paradigm Capital Inc. (incorporated herein by reference to Appendix D to the Circular) |

| |

|

| (c)(iii) * |

Special Committee Discussion Materials Provided by Maxit Capital LP to the Special Committee on June 13, 2023 |

| |

|

| (c)(iv) * |

Special Committee Discussion Materials Provided by Maxit Capital LP to the Special Committee on July 15, 2023 |

| |

|

| (c)(v) * |

Discussion Materials Provided by Paradigm Capital Inc. to the Board of Directors and the Special Committee on July 15, 2023 |

| |

|

| (d)(i) * |

Arrangement Agreement dated July 16, 2023, between PolyMet Mining Corp. and Glencore AG (incorporated herein by reference to Exhibit 99.2 to the report on Form 6-K furnished to the SEC on July 17, 2023) |

| (d)(ii) * |

Form of Support and Voting Agreement entered into severally by Glencore AG, on the one hand, and each of Jonathan Cherry, Patrick Keenan, Alan R. Hodnik, David Dreisinger, David J. Fermo, Roberto Huby and Stephen Rowland, on the other hand (incorporated herein by reference to Exhibit 99.3 to the report on Form 6-K furnished to the SEC on July 17, 2023) |

| |

|

| (d)(iii) * |

Letter addressed to Glencore AG on behalf of the Board of Directors of PolyMet Mining Corp., dated May 18, 2023 |

| |

|

| (d)(iv) * |

Letter addressed to the Board of Directors of PolyMet Mining Corp. on behalf of Glencore AG, dated May 24, 2023 |

| |

|

| (d)(v) * |

Letter addressed to the Board of Directors of PolyMet Mining Corp. on behalf of Glencore AG, dated June 30, 2023 |

| |

|

| (e)(i) * |

Amended and Restated Corporate Governance Agreement between Glencore AG and PolyMet Mining Corp. dated June 28, 2019 |

| |

|

| (e)(ii) * |

Investor Rights and Governance Agreement between Glencore AG and PolyMet Mining Corp. dated February 14, 2023 |

| |

|

| (f)(i) * |

Interim Order (incorporated herein by reference to Appendix E to the Circular) |

| |

|

| (f)(ii) * |

Part 8, Divisions 2 of the Business Corporations Act (British Columbia) - Rights of Dissenting Shareholders (incorporated herein by reference to Appendix G to the Circular) |

| |

|

| 107 * |

Filing Fee Table |

____________________________

* Previously filed

SIGNATURE

After due inquiry and to the best of each of the undersigned's knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated as of November 7, 2023

POLYMET MINING CORP.

By: /s/ Mohit Rungta

Name: Mohit Rungta

Title: Chief Financial Officer

GLENCORE AG

By: /s/ Carlos Perezagua

Name: Carlos Perezagua

Title: Director

By: /s/ Stephan Huber

Name: Stephan Huber

Title: Director

GLENCORE INTERNATIONAL AG

By: /s/ Peter Friedli

Name: Peter Friedli

Title: Director

By: /s/ John Burton

Name: John Burton

Title: Director

GLENCORE plc

By: /s/ John Burton

Name: John Burton

Title: Corporate Secretary

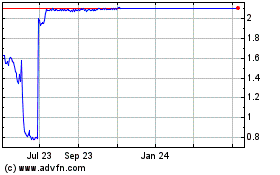

Polymet Mining (AMEX:PLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

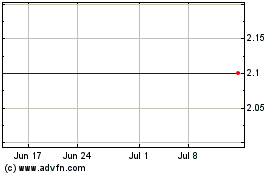

Polymet Mining (AMEX:PLM)

Historical Stock Chart

From Apr 2023 to Apr 2024